Climate change policy in Canada today is fragmented and largely uncoordinated among governments. Many provinces, frustrated by the perception that Ottawa has not been proactive enough in setting national targets for greenhouse gas emissions reductions, have independently embarked on their own policies to reduce emissions. The resulting patchwork of measures illustrates the complexity of achieving coherent policy when both levels of government intervene in the same policy arena.

In this study, Tracy Snoddon and Randall Wigle examine climate change policy in Canada from the perspective of “environmental federalism.” Most other analyses on this issue have sidestepped the fact that Ottawa shares jurisdiction with the provinces, which means that both levels of government have access to any tax revenues that might be generated by emissions-reduction measures. This “inconvenient truth” of the Canadian federation, combined with the fact that greenhouse gas emissions are highly concentrated in specific provinces (notably Alberta and Saskatchewan), makes it all the more critical that we understand the interaction of federal and provincial policies, and how their effects vary regionally, in order to develop effective policy instruments.

The authors demonstrate that a national climate change policy using a market-based instrument (e.g., a carbon tax or tradable emissions permit system) would be much more cost-effective than the patchwork of federal and provincial programs that exists today. Their economic simulations show that provincial climate change policies to supplement national efforts are likely to have little effect on Canada’s overall greenhouse gas emissions and will come at a substantial economic cost. The main reason is that differences in the stringency of provincial policies simply change the provincial distribution of emissions rather than actually reducing them overall. Emissions-intensive economic activity is encouraged, where possible, to migrate to provinces with more lenient emissions standards.

Many observers suggest that it is wishful thinking to hope there could be a national climate change policy, because emissions-intensive provinces will vehemently resist efforts to be subject to the same requirements as other provinces. However, Snoddon and Wigle point out that the way revenues generated from market-based emissions-reduction instruments are allocated would have a dramatic effect on the net economic costs of reducing emissions across provinces. For example, if the revenues from a carbon tax (or from auction of emissions permits in a cap and trade system) were returned to the provinces in accordance with their initial shares of emissions, the net economic burden on emissions-intensive provinces could actually be modestly lower than that on most other regions of the country.

The authors propose an ambitious national policy that is much more cost-effective than the patchwork status quo, and offer a road map for implementing it. The centrepiece of their proposal is a federal carbon tax, initially set at $10 per tonne of CO2 equivalent, and rising gradually to about $35 by 2030. Such a tax could be implemented relatively quickly (unlike a system of tradable emissions permits) and, if necessary, without agreement from the provinces. However, Snoddon and Wigle stress that its political success hinges on convincing the provinces to drastically scale back their own climate change initiatives in favour of a more cost-effective national plan. They argue that Ottawa must negotiate formal agreements with the provinces for sharing any revenues generated from the proposed tax, rather than simply using them to reduce federal taxes or fund federal programs. Such revenue-sharing agreements would recognize that environmental protection is a shared federal-provincial responsibility, and that the provinces must be compensated for allowing Ottawa to set the parameters of Canadian climate change policy. Revenue sharing would also ensure that no province bears an undue economic burden for meeting national emissions-reduction targets.

Another advantage of a national carbon tax is that it could easily be integrated into a continental climate change policy regime in the event that the ambitious proposals now being considered in the United States are adopted. Even though the US seems to prefer a cap-and-trade system of emissions permits over a carbon tax, Snoddon and Wigle show that their proposal could coexist with such a system and, more importantly, could easily be converted into a cap-and-trade system should negotiations on a harmonized North American policy regime be successful.

In Canada the climate change policy environment is currently fragmented. Both the federal government and the provinces are implementing or proposing their own initiatives, often with little thought about how they will interact with those of other governments. While multiple governments operating in the same policy field is not a unique situation in Canada, in the case of climate change this approach can be costly and environmentally ineffective. At the same time, our policies are influenced by those south of the border. Just as the US abandonment of Kyoto under the Bush administration in 2001 made it difficult for Canada to adopt more stringent emissions reduction policies, recent climate initiatives supported by the Obama administration make it increasingly unlikely that Canada will be able to continue with the status quo.

If we are interested in adopting, or are required to adopt, a different approach, policy-makers will need information on the cost and effectiveness of different options. There have been a number of studies assessing the effects of different climate change policies for Canada, and these have yielded some valuable lessons. However, this body of research misses the mark in three important ways. First, most studies ignore the issue of burden sharing across provinces. The uneven distribution of natural resources and energy-intensive industries across provinces makes the issue of burden sharing paramount. Second, most studies ignore policies at the provincial level and focus instead on Canada-wide policies implemented by the federal government. But the fact is that Ottawa and the provinces share responsibility for the environment and jointly occupy the carbon revenue base. Provinces can and do implement their own climate change policies, but little is known about how these interact with federal initiatives. Finally, since joint occupancy and provincial policies are ignored, existing work offers little insight on how we might realistically move from the current patchwork approach to a more cost-effective greenhouse gas (GHG) reduction policy.

The key objective of this paper is to focus attention on regional burden sharing, joint occupancy and transitional arrangements as the critical obstacles to be addressed if we are to move climate change policy forward. If we fail to remove these obstacles, the status quo environment is likely to continue for some time.

We begin with an overview of the current policy environment, assessing developments at the federal and provincial levels as well as in the United States. The literature offers several valuable lessons about climate change policy. We review these, focusing on such matters as cost-effectiveness, revenue recycling, sectoral effects and issues of competitiveness. We also draw attention to important issues that have not received much attention, such as the interaction of federal and provincial policies. In the fourth section we propose an alternative climate change approach for Canada. The final section presents some concluding remarks.

Our proposal argues for the implementation of a Canada-wide carbon tax to reduce emissions. In this regard, it is not novel. The value-added of our proposal is that it attempts to address the frictions between the federal and provincial governments that have to date stymied effective policy. Our proposed regime would achieve real reductions and could over time be fully integrated with whatever policy is decided upon in the United States.

Revenue sharing is at the centre of our proposal, not so much as a mechanism for reducing other taxes (although that remains a possibility) as a kind of lubricant to ease the economic and political cost of implementing climate change policies and to overcome federal and provincial resistance. We argue that the federal government needs to retain a share of the revenues in order to reduce the political costs of imposing the tax. Provinces need a share, too; otherwise they will have no incentive to abandon their own climate change policies in favour of a more cost-effective national system.

In this section we provide a brief overview of climate change policies at the federal and provincial levels, as well as discussions of recent developments in the United States. We highlight the variety of policies in effect or under consideration at both levels of government as well as the lack of policy integration.

In 2007 the federal government announced its Turning the Corner plan (Government of Canada 2007).1 The plan promised a 20 percent reduction in emissions below 2006 levels by 2020, mandatory emissions intensity reduction targets for major industrial emitters, energy and fuel efficiency standards, air pollution measures, and a final regulatory framework by January 2010. With 2006 emissions estimated at 721 megatonnes CO2 equivalent (hereinafter denoted as Mt CO2e) and 2020 emissions forecast at 897 Mt CO2e, the federal government’s goal requires an annual reduction in emissions of 320 Mt by 2020.2

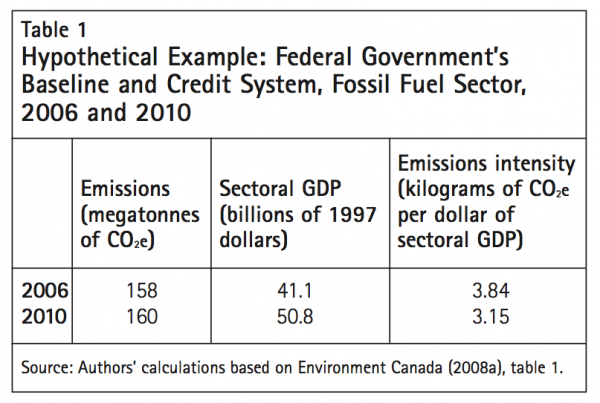

The proposed mandatory emissions-intensity reduction scheme, referred to as a baseline and credit system, covers the following sectors: electricity generation, pulp and paper, cement, oil and gas, and iron and steel. Baseline emissions intensities were set at 2006 levels, and proposed intensity-reduction targets require covered entities to reduce the rate at which they emit greenhouse gases (GHG) per unit of output below these baseline intensities. These targets are less stringent than absolute emissions caps, because it is possible in practice to satisfy emissions-intensity targets, even as aggregate emissions are growing. Intensity targets are thus no guarantee of absolute reductions in greenhouse gas emissions (see table 1 for a hypothetical example).

Consider the following illustration. The baseline emissions intensity for the fossil fuel industry for 2006 is 3.84 (measured in kilograms of CO2e per constant dollar of sector GDP) (Environment Canada 2008a, 7, table 1). The federal government’s proposal requires an 18 percent reduction in intensity from 2006 levels by 2010 for covered sectors. Assuming the target is applied to the sector’s average emissions intensity, firms must achieve an intensity of 3.15 by 2010. As illustrated by the hypothetical data presented in table 1, the sector can achieve the target while aggregate emissions increase. This possibility makes the achievement of emissions-reduction goals more uncertain.

The federal proposal outlines five avenues for meeting the intensity-reduction targets: abatement, emissions trading, contributions to a technology fund, offsets and the Kyoto Clean Development Mechanism.

Covered entities can undertake in-house abatement activities. If the rate of emissions per unit of output falls below the required intensity target, then the firm receives credits. Credits can be either sold to firms with higher-than-target emissions intensities or banked for future use. Suppose a firm in the fossil fuel sector (see table 1) reduces its emissions intensity below the required rate, to 3.12. This firm would then receive credits equal to 0.03, the difference between 3.15 and 3.12 multiplied by its output for that year.

Emissions trading allows firms with low costs of abatement to generate credits by reducing their intensity below the assigned target. Firms with costly abatement options may find it cheaper to buy credits than to pursue in-house abatement activities. The trading price for credits would be determined by demand and supply in the emissions-trading market.

Offsets or contributions to a technology fund are alternative ways of complying with regulations for reducing emissions intensity. Offsets are allowances granted to parties for emissions reductions achieved outside of the covered sectors. An example would be a farmer who changes his or her farming practices to increase carbon uptake in the soil. Covered emitters may purchase these offsets and apply them against their own reduction targets. One difficulty of this system is the determination of whether emissions reductions credited with offsets are in fact incremental. If the emissions reductions are not incremental (that is, they would have occurred anyway), then the offsets do not contribute toward the goal of reduced emissions.

Firms may alternatively satisfy part of their reduction target by contributing to a technology fund at a price of $15/tonne of CO2e. Funds are intended for investment in emissions-reducing technology. The federal proposal set limits on how much of a firm’s target can be satisfied using fund contributions, but these were set high for the first five years. For 2010, the federal proposal allowed a firm to satisfy up to 70 percent of its target using fund contributions. By 2015, fund contributions can account for no more than 40 percent of the target.

The technology fund option effectively caps the price of tradable permits at $15/tonne. If the price for a one-tonne emissions credit is $20, a firm can opt to satisfy its target by making a fund contribution at $15/tonne rather than pay the higher credit price. Since a significant share of a firm’s target can be achieved in this manner, permit trading will be limited and slow to develop. Moreover, the technology fund investments will take time to bear fruit with regard to emissions reduction, so few actual emissions reductions will be achieved in the first few years of operation from these compliance mechanisms.

Finally, firms may use the Kyoto Clean Development Mechanism (CDM). The CDM is intended to allow high-income countries with Kyoto Protocol targets to generate credits by funding emissions-reducing projects in developing countries. The motivation for the CDM is that both recipient and funding countries can benefit from the projects. The recipient will benefit from energy-saving or emissions-reduction projects, and the associated economic activity, whereas the funder can often reduce emissions more cheaply in the recipient country than at home. Emissions reductions in the recipient and funding countries are identical in terms of their impact on climate. The federal proposal allows Canadian firms to use CDM credits to satisfy up to 10 percent of their target.

A number of climate plans preceded the Turning the Corner plan. Action Plan 2000 was followed in 2002 by the Climate Change Plan for Canada, and in 2005 Project Green was released (Government of Canada 1998, 2002a,b, 2005). All proposals included some mix of regulatory measures, subsidies, a domestic emissions-trading scheme (limited in coverage and of the baseline and credit type) and voluntary measures. Rivers (forthcoming) provides a useful comparison of the various federal commitments, reduction targets and actual emissions.

With the election of Barack Obama as president of the United States in 2008, climate change is now solidly on the US agenda. As a result, the Canadian government is being forced to rethink its approach.

Recent media reports have outlined possible changes to its strategy, including plans to harmonize reduction targets, harmonize the implementation timetable, delay the introduction of targets and match US vehicle emissions standards (see, for example, Galloway 2009; Laghi and McCarthy 2009).

In Canada the federal government and the provinces not only share responsibility for the environment but also share the carbon tax base. So it is perhaps not surprising to see provinces introducing their own climate initiatives.

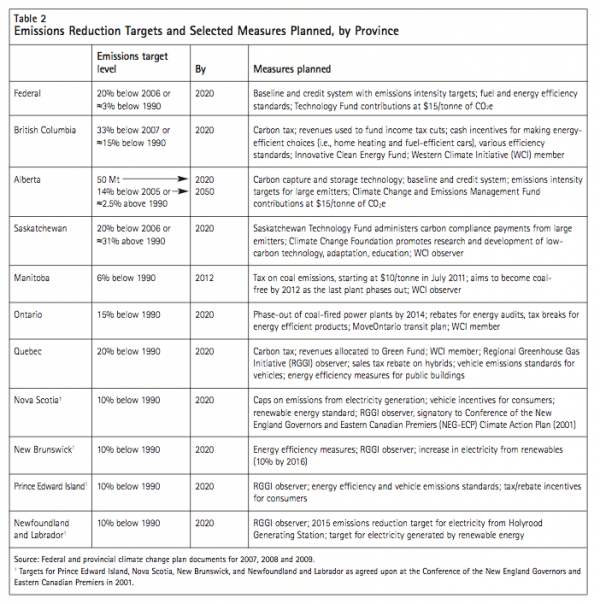

Table 2 provides an overview of emissions-reduction targets and selected measures by province, as specified in various government documents. The first observation from table 2 is that provincial emissions targets differ in terms of the base year chosen and the time frame for achieving the target. Deeper targets and smaller time frames call for more stringent policy instruments if the required emissions reductions are to be achieved.

A second observation is that provinces can be grouped according to whether they include some form of carbon pricing in their plan. Emissions-permit trading schemes and carbon taxes are market-based approaches that put a price on emissions.3 Contributions to a special fund at a set price per tonne of CO2e also put a price on emissions.

Currently, carbon taxes are levied in two provinces. Quebec introduced the Green Fund duty in its June 2006 climate plan. The tax varies by fuel, ranging from a low of about 0.5 cents per litre of propane to $8/tonne of coal. Quebec has earmarked revenues for its Green Fund (a technology fund). British Columbia imposed a carbon tax of $10/tonne in 2008, which is slated to increase gradually to $30/tonne in 2012. Unlike Quebec, British Columbia has adopted a 100 percent tax recycling option, using the carbon revenues to fund personal and business income-tax rate cuts. Manitoba recently introduced a plan that would impose a tax on emissions from coal production starting in July 2011.

A tradable emissions permit scheme is another approach to the pricing of carbon. The Western Climate Initiative (WCI) (which consists of British Columbia, Manitoba, Ontario and Quebec, along with seven US states) hopes to launch a market-based cap-and-trade system covering some 90 percent of emissions in the member provinces and states by 2015 (WCI 2009). British Columbia’s Greenhouse Gas Reduction (Cap and Trade) Act was introduced to pave the way for integration of a BC cap-and-trade system with the cap-and-trade systems of its regional partners (like the WCI). In 2008 Quebec and Ontario signed a deal to launch the Provincial and Territorial Greenhouse Gas Cap and Trade Agreement. Ontario recently released a discussion paper to generate comment on design and implementation issues (Ministry of the Environment 2009). Finally, several provinces are observers to the Regional Greenhouse Gas Initiative (RGGI), a consortium of 10 US mid-Atlantic states that propose to restrict the emissions of their electricity sectors using a cap-and-trade system.

Most of the cap-and-trade proposals, which are still under development, involve some auctioning of permits. A key component of any trading proposal is how it will be integrated with other trading regimes. The integration question is, however, a subject of ongoing research and debate.

Alberta and Saskatchewan have instead opted for a baseline and credit approach similar to the federal plan. While Saskatchewan’s plan has not yet been implemented, Alberta’s baseline and credit system was launched in 2007, with 2008 as the first year of compliance. Under the plan, large emitters (over 100,000 tonnes) were required to reduce emissions intensity by 12 percent in 2008. Emitters can also comply by purchasing Alberta offsets or by making contributions to an Alberta fund at a price of $15/tonne. Fund revenues are to be recycled back to industry to be used in the development of clean technologies or to help firms adopt cleaner production alternatives. A preliminary report indicates that a reduction of 6.5 Mt was achieved.4 This represents about 32.5 percent of the reduction target for 2010 of 20 Mt outlined by the Government of Alberta (2008).

As for the remainder of the provinces, their plans are heavily focused on energy and fuel efficiency standards; a variety of narrowly targeted measures, including tax rebates for the purchase of fuel-efficient hybrid vehicles; subsidies for energy-saving or carbon-free technologies; and public awareness programs to encourage Canadians to adopt environment-friendly habits in their daily lives.

In March 2009 Henry Waxman and Edward Markey (Democratic congressmen from California and Massachusetts, respectively) introduced the American Clean Energy and Security Act into Congress. While the passage of the Waxman-Markey Bill in its current form is far from assured (it has yet to be passed in the Senate), its proposals on greenhouse gas emissions suggest the general direction of US policy for the next decade. The Bill proposes an emissions-reduction target of 20 percent below 2005 levels by 2020 on covered sectors, which is projected to yield an economy-wide reduction of approximately 17 percent. The plan includes a hard cap on emissions in covered sectors, initially comprising the electricity sector, refiners, and the primary oil and gas sectors, with permit trading allowed among participants. The coverage of the scheme will be extended as time passes, so that eventually 85 percent of emissions will be covered. The Waxman-Markey Bill includes a number of measures intended to ease the burden in energy-intensive and trade-sensitive sectors. This includes output-based allocation of permits, as well as the possibility of GHG-based border adjustments for goods produced in countries without “similar” climate change policies. These measures are intended to address competitiveness concerns.5

Although the Waxman-Markey Bill proposes the eventual auctioning of most permits, in the early stages little revenue will be generated. A significant share of permits will be given free to the electricity sector to minimize cost increases for electricity. Other permits will be distributed to the heating oil and natural gas sectors and are to be used to reduce the impact on consumers. While the plan is to eventually switch to auctioning for most permits, even if the specifics of the Bill do not change there is ample scope for them to change before the Bill is adopted. Currently, the switch to auctioning is intended to take place after 2030.

The Bill also allows offsets, although it remains to be seen how restrictive the rules will be for granting them. The more offsets are allowed against a fixed cap, the lower will be the emissions reduction achieved in covered sectors. A possible response mechanism for very high or very low permit prices is also under discussion. Initially it was expected that the CO2e permit price would not be allowed to fall below approximately $25, but recent simulations of the plan suggest that the actual permit price would likely be closer to $15. The Bill proposes a number of subsidies and incentives aimed at various technologies; however, the details are likely to change before the Bill is adopted.6

One key element of the Waxman-Markey Bill is its stated intention to subsume initiatives at the state or regional levels. In other words, the federal cap-and-trade scheme would, in time, replace the schemes independently developed by states — including, notably, regional initiatives like the Western Climate Initiative. At this stage there seems to be ample goodwill on all sides in terms of effecting this transition, but the mechanics and conflicts of doing so remain daunting, even with the proposed 2012–17 time frame.

The Bill includes modest emissions targets starting in 2012. The harmonization of state and regional cap-and-trade schemes into a single system is intended to take place in the period 2012–17. Special transition measures designed to support and ease the transition to a lower-carbon economy are to be phased out by 2020. If this timetable is not followed and the transition period and/or measures are extended, the scope for uncertainty will increase and the uncertainty will spill over into Canada.

As mentioned, in the early stages the bulk of US permits would be given away gratis. The same is true in the Canadian federal proposal (with the exception of technology fund contributions). In both cases, the bulk of the limited revenues generated (by the limited auctioning of permits in the United States, or in Canada’s case by technology fund contributions) are earmarked for the easing of the transition to a lower-carbon economy. Consequently, the scope for mitigating the impact of carbon policy through personal or corporate income tax cuts is negligible in the near term.

The proposed US Bill has generated a great deal of interest in Canada, mainly because of key differences in the proposed emissions-trading regimes and in the stringency of the emissions-reduction targets — and the bilateral trade issues that may result.

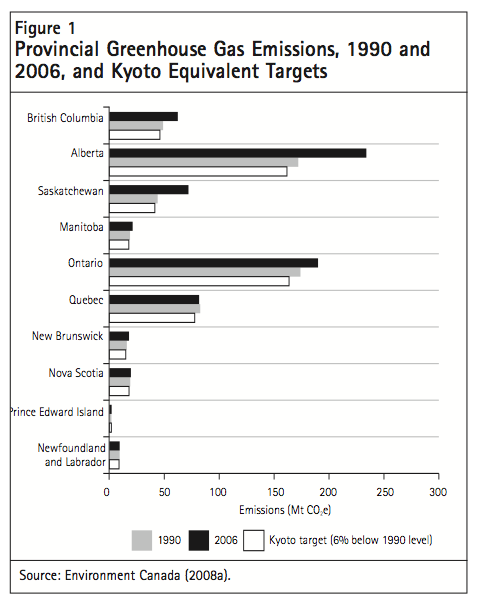

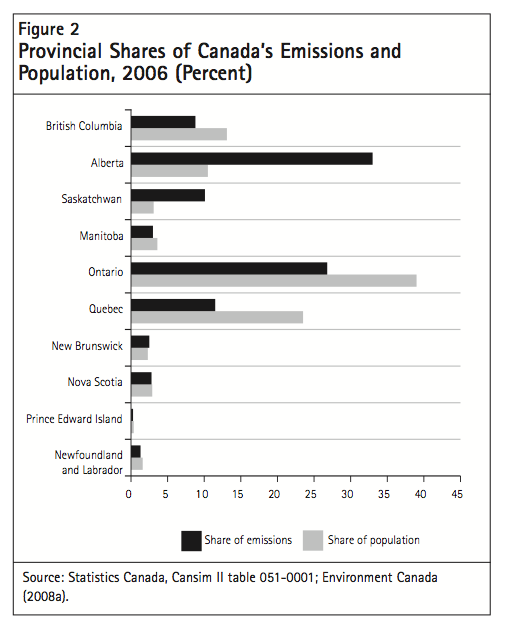

According to Environment Canada (2008a), Canada’s aggregate 2006 emissions were 22 percent higher than its 1990 emissions. Figure 1 shows Canada’s emissions broken down by province for 1990 and 2006. It also shows a “Kyoto” target for each province. Significant growth in emissions in Alberta and Saskatchewan, and to a lesser extent in Ontario and British Columbia, has contributed to the overall growth in Canada’s aggregate emissions.

The future emissions reduction costs implied in federal government documents are much lower than those of outside experts. The government’s Turning the Corner announcement of $1.5 billion for the Clean Air and Climate Change Trust Fund, with an associated 80 Mt (16 Mt annually from 2008 to 2012) in reductions, implies a cost per tonne of just under $20 (Environment Canada 2008b). A recent report by Canada’s Commissioner of the Environment and Sustainable Development criticizes these estimates, stating that the government’s analysis of emissions reductions attributable to the trust fund is flawed and unverifiable (see Auditor General of Canada 2008, 17). The Commissioner also argues that the government’s proposed regulatory framework, developed as part of the Turning the Corner plan, overestimates the expected emissions reductions and lacks transparency (Auditor General of Canada 2009, 58-66).

In contrast, using federal estimates of emissions reductions actually achieved and federal expenditures to date, Wigle (2005) finds a cost per tonne of around $200. He argues that this high cost can be attributed to the federal government’s heavy reliance on selected technology subsidies and voluntary measures rather than on carbon pricing. Considering that Canada’s emissions are roughly 200 Mt above the Kyoto target, a quick calculation suggests that the cost of using this approach is in the neighbourhood of $40 billion in today’s dollar terms. These estimates suggest that the emissions reductions achieved so far in Canada have been small and very costly.

Since most provincial plans set goals more than 10 years into the future and are relatively new, it is too early to tell whether existing measures will in fact achieve stated emissions-reduction targets. However, there have been several “stock-taking exercises” of provincial and federal climate change policies. Recent studies include Jaccard (2006), Jaccard and Rivers (2007), Demerse and Bramley (2008), Council of the Federation (2007) and Marshall (2008).

Key findings from these studies are that Canada has so far relied heavily on measures that are not particularly cost-effective or environmentally effective. In particular, there is little evidence to suggest that voluntary and education measures are effective ways of lowering emissions. Carbon pricing is frequently proposed in this literature, as it provides clear incentives for reducing emissions, but it is not yet a prominent feature in most federal and provincial plans. And existing measures, such as contributions to technology funds and provincial carbon taxes, set a low price on emissions. These studies highlight the lack of coordination between provincial and federal policies and the weak leadership of programs introduced at the federal level. Finally, the literature calls for better attempts to measure actual emissions reductions, track progress and measure success, since plans do not necessarily translate into real reductions.

Before going into the details of our proposal, we discuss some key barriers that are at the heart of the debate in Canada. These barriers include the aggregate welfare costs, sectoral costs, regional effects and competitiveness issues associated with climate change policies. Along with these barriers, we review some of the key lessons from the literature. Finally, we draw attention to some important barriers to the further development of climate policy in Canada for which the literature offers few lessons. These include issues arising from the joint occupancy of the carbon revenue base, the shared responsibility for the environment and transitional adjustment issues.

Under what conditions are the costs of achieving a given reduction in emissions minimized?

The accumulation of GHG and rising surface temperatures can trigger, and increase the frequency of, extreme weather events, all of which have serious negative consequences for the economy. In monetary terms, these consequences are referred to as damages. While damage depends on the total stock of gases, the additional damage from one more tonne of GHG emitted (the marginal damage cost) is the same regardless of where it is emitted. However, the costs of reducing emissions depend very much on where reductions occur.

For a cost-effective reduction in emissions, the total cost of abatement must be minimized. This is achieved if, at the target level of emissions, the marginal cost of abatement is the same across all emissions sources. The academic literature is heavily focused on two market-based instruments that are promising in this regard: a carbon tax and a cap-and-trade permit system. Other authors have emphasized the importance of market-based instruments. For instance, the main message of the popular 2007 book Hot Air, by Mark Jaccard, Jeffrey Simpson and Nic Rivers, is that effective climate policy must include a price on carbon.

These instruments work by imposing a monetary cost on emissions. Suppose a carbon tax of $10/tonne of CO2e is applied to all emissions. If firms do not reduce their emissions, they pay $10/tonne emitted. Firms that are able to reduce emissions at a lower cost than the tax thus have an incentive to do this, and will continue to reduce emissions until the additional cost of doing so equals the $10 tax. At this point, there is no further incentive to reduce emissions, as the additional cost would exceed the tax.

A cap-and-trade permit system creates a market (and a price) for emissions. Suppose a permit is required for each tonne of emissions. As long as the number of permits available for the year is lower than current emissions, aggregate emissions will fall. This is true regardless of how permits are distributed (that is, based on historical emissions, based on current output or auctioned).

Firms with low abatement cost opportunities have an incentive to undertake these activities. If they succeed in reducing emissions below their initial allowance, they can sell the surplus permits to firms that find it cheaper to purchase permits than to undertake in-house abatement activities. Market forces determine the price at which permits are traded.

Assuming all sources of emissions are covered by the tax or the permit system, emitters face the same emissions price and the same incentive to abate. This ensures that emissions reductions are achieved in a cost-effective manner. If all sources are not included and the carbon price differs by emissions source, the costs of achieving a given reduction target will increase. For a permit regime, the broader the coverage (that is, the larger the fraction of total emissions covered in the system), the closer the system comes to the lowest cost solution.

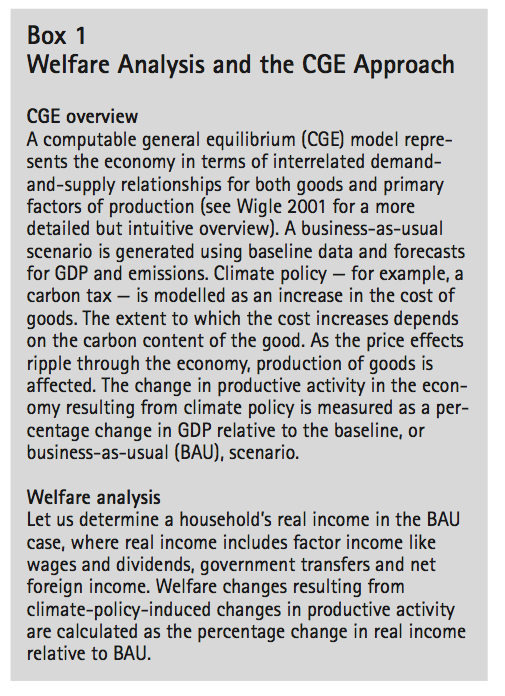

Both instruments have a direct effect on production costs and on the prices of energy-intensive goods. These price changes ripple through the economy, leading to changes in the prices of other goods and services, wages and the cost of capital. Since climate change policy has the potential to affect many prices in many sectors and regions, computable general equilibrium (CGE) models of the economy are often used to assess the aggregate cost of emissions reductions. These simulation models, representing the economy as a series of interrelated demand-and-supply relationships for goods and services and factors of production, examine the overall effect of these policy-induced price changes on sectoral and aggregate economic activity, aggregate and sectoral emissions, and households.

While some analyses focus on GDP effects, others focus on how policies affect welfare (see box 1 for the specifics of welfare analysis and the CGE approach). Changes in output (and the income generated by them) that result from climate change policy are captured by the GDP measure. However, climate change policy may also affect labour supply and the consumption of leisure (if labour supply is variable). The welfare measure can differ from the GDP effects because the income effects of these changes in leisure are included in the welfare measure. If labour supply is fixed, then GDP and welfare measures are identical.7

Research for Canada indicates that significant emissions reductions will be costly, with GDP losses in the range of 1 to 2 percent relative to business as usual (BAU) (see, for example, Ab Iorwerth et al. 2000; Wigle 2001; Dissou, MacLeod, and Souissi 2002).8 This amounts to roughly $500 to $1,000 in terms of current per-person GDP per year. Studies also show that more narrowly targeted instruments entail greater welfare costs.

Snoddon and Wigle (2007b) find that the welfare cost of achieving a Kyoto target is 0.59 percent if Canada participates in an international permit market (which covers all emissions), as compared to a cost of 1.91 percent if Canada achieves all of its target by reducing domestic emissions using a domestic carbon tax (or a cap-and-trade system). For a domestic cap-and-trade system, Wigle (2001) finds that the more narrowly targeted the regime, the more welfare costs rise. When all domestic emissions are covered, the welfare cost of achieving a Kyoto target is 1.1 percent relative to BAU. Narrowing the coverage to include first the more energy-intensive and then only the most energy-intensive sectors increases the welfare cost from 1.3 to 2.0 percent. Finally, if only the most energy-intensive sectors are exempt, the welfare cost increases significantly, to 7.5 percent.

Policies implemented by subnational governments will generally, if uncoordinated, increase the costs of reducing emissions. Research confirms that uncoordinated actions result in variations in the carbon price (and therefore the incentive to abate). Conrad and Schmidt (1998) look at the costs of achieving a 10 percent reduction in emissions in one year for 11 European Union countries, comparing an EU-wide carbon tax with a system whereby each country sets its own carbon tax. Tax rates are shown to vary considerably in the uncoordinated case, contributing to greater welfare losses. Similarly, the National Roundtable on the Environment and the Economy (2009b) reports that the carbon price is likely to be significantly lower if a Canada-wide carbon-pricing policy is adopted than if individual provinces act on their own to reduce emissions.

We know that uncoordinated action gives rise to carbon prices that differ across emissions sources; the costs of achieving a given reduction target could be lowered if the carbon price was uniform. We do not know just how costly uncoordinated action might be or what cost savings might result from eliminating differences in the incentive to abate across emissions sources. We return to this point below.

Welfare or GDP losses are sensitive to how revenues from a carbon tax or auctioned permits are used. Most taxes, such as personal and corporate income taxes, are distortionary. Efficiency gains due to a lowering of distorting taxes can partially offset the welfare losses associated with the imposition of a carbon tax or a permit regime.

The effects of tax recycling are nicely illustrated in a study by the National Roundtable on the Environment and the Economy (2009a). This study evaluates the effects of achieving two emissions-reduction targets (20 percent below 2006 levels by 2020 and 65 percent below 2006 levels by 2050) using a Canada-wide cap-and-trade permit system with full auctioning. By 2020, revenue recycling via a reduction in sales taxes leads to a small, 0.9 percent, increase in welfare relative to BAU. Recycling via corporate income and labour/payroll taxes leads to changes in welfare relative to BAU of -0.8 percent and -0.2 percent, respectively. In the long run (2050), however, welfare losses with sales tax recycling are much higher, at 4.4 percent, when compared to welfare costs of 2.0 and 3.2 percent with corporate and labour/payroll tax recycling, respectively.

Differences in the welfare costs associated with alternative tax recycling options relate partly to how tax cuts influence capital investment. Corporate income tax cuts serve to lower business costs and stimulate capital investment and growth, which help to counteract the higher costs associated with pricing emissions. By contrast, sales tax reductions have comparatively little impact on investment. Consequently, the distortionary costs of sales taxes tend to be lower than those for corporate income taxes. If the tax proceeds are used to lower the taxes with larger distortionary effects — corporate income taxes in particular — then these distortions are reduced and the overall welfare losses from reducing emissions are smaller.

The choice of whether to auction permits or freely distribute them affects the aggregate costs, since free distribution generates no revenues with which to lower distorting tax rates. Dissou (2006) illustrates this point using a CGE model for Canada. Emissions reductions achieved using a permit system with full auctioning and revenue recycling to reduce payroll taxes causes aggregate welfare to fall by 1.3 percent relative to BAU. In contrast, when permits are freely distributed based on a firm’s current output or historical emissions, welfare losses range from 2.1 to 2.9 percent.

Key lessons: A uniform incentive to abate for all emissions will ensure that emissions reductions are achieved at minimal cost; the greater the variation in the incentive to abate, the higher the costs. Use of a revenue-generating instrument can potentially lower the aggregate welfare costs associated with reducing emissions if revenues are recycled to reduce distorting tax rates.

Emissions reductions will affect sectors differently, depending on how energy intensive they are. Sectoral impacts are one of the key issues in the debate on how emissions-trading regimes should be designed.

Wigle (2001) examines the sectoral impacts (measured by changes in output relative to BAU) of using a domestic or international permit scheme. When the Kyoto target is achieved entirely through domestic emissions reductions, fossil-based electricity suffers the greatest change in production, -21 percent relative to BAU. Other hard-hit sectors are coal, petroleum and coal products, chemicals, resins and plastics, and natural gas, which undergo production changes in the range of -7 to -10 percent. For most other sectors, production changes are more modest, ranging from -3 to 3 percent. If international permit trading is allowed, the impacts are muted, falling in the range of approximately -3 to 3 percent.

Dissou (2006) shows that the choice of how permits are distributed in a domestic trading regime can ease the burden of energy-intensive sectors but at a somewhat higher aggregate welfare cost. Three allocation schemes are considered: full auctioning of permits with tax recycling, free distribution based on firms’ current output levels and free allocation based on firms’ historical emissions levels. The aggregate welfare costs are 1.3, 2.1 and 2.9 percent for full auctioning, output-based allocation and historical emissions-based allocation, respectively. Output effects

are most uneven, and most severe, for the auctioned permit scenario. In the coal and gas pipeline sectors, output falls by 26 and 21.5 percent, respectively, in the auctioned permit scenario. If permits are freely distributed based on output, output falls by 22 and 18 percent in coal and gas pipelines, respectively.

Key lessons: sectoral effects can be very uneven; policies can be modified to address uneven burden sharing; and modifications will involve a trade-off — a more even sharing of the burden across sectors but a higher aggregate welfare cost.

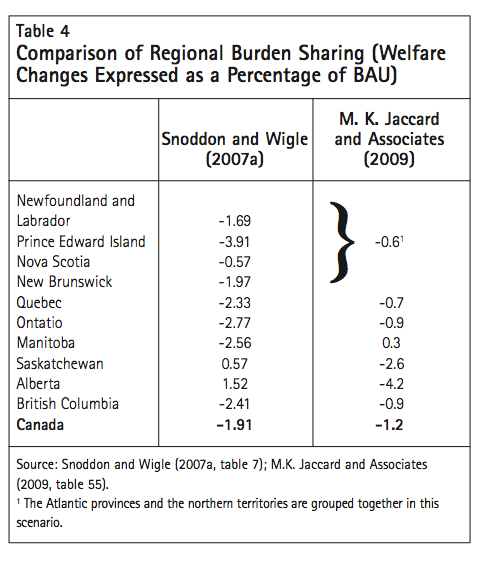

The regional burden is a significant factor in the implementation of climate change policies. This is especially true for Canada because its distribution of fossil fuels, energy-intensive sectors and emissions is geographically concentrated. The welfare burden may be particularly acute for Alberta and Saskatchewan given their disproportionate shares of emissions relative to population (see figure 2).

While almost all CGE analyses for Canada focus on the aggregate welfare or GDP effects of climate change policies and ignore how the burden is shared across provinces, a few studies concentrate on regional burdens. Snoddon and Wigle (2007b) consider the aggregate and provincial welfare and emissions effects of achieving Canada’s Kyoto target using either a federally implemented carbon tax or international permits.

The carbon tax experiment results in an aggregate welfare loss of 1.9 percent, as compared to a loss of just 0.6 percent in the case of international permit trading. The burden is fairly evenly distributed across provinces when international permit trading is used, with welfare changes ranging from -0.2 percent for Newfoundland and Labrador to -1.3 percent for Prince Edward Island. In fact, excluding Prince Edward Island (which appears to be an outlier), the largest welfare loss is 0.7 percent for Ontario.

Provincial welfare changes are significantly more uneven in the domestic carbon tax experiment, ranging from -3.9 percent for Prince Edward Island to +1.5 percent for Alberta. The carbon tax needed to ensure that domestic emissions reductions hit the target is $153/tonne of CO2e.

While Prince Edward Island is still the hardest-hit province, both Alberta and Saskatchewan actually experience welfare gains. This is largely because carbon tax revenues are returned to provinces in proportion to their initial emissions, illustrating that the burden need not predominantly fall on energy-intensive provinces.9

PEI is an outlier because even though its own emissions are small, it is a huge net importer of carbon-intensive products. So other provinces receive the carbon tax revenues, but the extra cost of these carbon-intensive imports increases the economic burden on PEI. Thus, it has little opportunity to abate and little to gain from trading in abatement services.

Alternative tax recycling options would, however, generate different results. If carbon tax revenues were instead used to lower federal personal income taxes, it is likely that Ontario (the source of over 40 percent of federal income tax revenues) would fare better than it would if revenues were returned in proportion to initial emissions. In contrast, Saskatchewan and Alberta, which contribute smaller shares to federal income tax revenues than to aggregate emissions, would not fare as well under this scenario.

In Snoddon and Wigle (2008), the focus is on regional welfare losses when the federal government opts for a mix of policies (including limited domestic emissions trading, technology subsidies, and building and vehicle standards) rather than for a single carbon-pricing approach to emissions reductions. The policy-mix experiment gives rise to a shortfall in federal revenues.10 Interestingly, the aggregate and provincial welfare burdens are influenced by how the revenue shortfall is financed. Provincial welfare losses are generally lower, but sometimes more unevenly distributed, when shortfalls are financed by increases in income taxes rather than consumption taxes at the federal level. This result reflects the fact that the income tax base is more unevenly distributed than the consumption tax base.

The Pembina Institute and the David Suzuki Foundation recently released a study (Bramley, Sadik and Marshall 2009) of aggregate and provincial welfare, GDP and emissions effects of implementing a mix of climate policies to achieve two alternative goals – 25 percent below 1990, and 20 percent below 2006 by 2020. The results are based on a technical study produced by M. K. Jaccard and Associates (2009).

Focusing on the 20 percent below 2006 target, the aggregate welfare loss from the climage change policies is 1.2 percent compared to BAU.11 Welfare changes for provinces range from a high of -4.2 percent in Alberta to a low of +0.3 percent in Manitoba. The main policy features include a Canada-wide cap-and-trade system with full auctioning (equivalent to a carbon tax). In this scenario, carbon-pricing revenues are disbursed as follows: about 36 percent to federal personal income tax reductions, 13 percent to international permit purchases, 22.3 percent to electricity and transit subsidies, 10 percent to households to compensate for higher energy costs, and about 1 percent for federal purchases of agricultural offsets; the remaining 18 percent is used to compensate for reductions in provincial revenues from various taxes. With the more stringent 25 percent below 1990 target, the aggregate welfare cost is 2.4 percent, with provincial welfare losses ranging from 7.8 percent in Alberta to 0.1 percent in Manitoba.

Because the policy mix is complex, it is difficult to distill from either Bramley, Sadik and Marshall (2009) or M.K. Jaccard and Associates (2009) whether the regional burden effects are driven by one or two key measures. However, the recycling of more than a third of the carbon revenues to lower federal personal income taxes partially explains the comparatively small losses in Ontario. Although the Bramley, Sadik and Marshall report (2009) claims to represent federal and provincial climate change policies, this is really not the case. Its approach, like most in the literature, assumes a national-level government to implement the Canada-wide carbon tax (or auctioned permit system), along with the other complementary policies. The underlying CGE model assumes a single national government to implement policies and distribute all carbon-pricing revenues.

Key lessons: provincial burdens can be quite uneven, even if aggregate costs are low; the distribution of carbon revenues can influence regional burdens in the same way that the unevenness in sectoral burdens depends on how initial emissions permits are allocated; complementary policies also play a role.

As noted above, carbon-pricing policies increase business costs. Canadian firms, competing in international markets with businesses that do not face similar cost increases, are at a disadvantage. The more internationally competitive the market, the more constrained the ability of Canadian firms to raise prices in response to increased costs.

Competitiveness was a serious concern when the US government abandoned the Kyoto Protocol in 2001. Klepper and Peterson (2002) discuss the effects of US withdrawal on the functioning of an international permit market, permit prices and the benefits from emissions reductions. Canada, in particular, was concerned about the withdrawal of its major trading partner. If Canada were to take serious action to reduce emissions and the United States did not, there could be serious implications for Canadian competitiveness and trade vis-à-vis its southern neighbour.

Harrison (2007) notes that the costs of divergence would be felt particularly by Canadian manufacturing, foreign direct investment, and the oil and gas export industry. Bramley, Sadik and Marshall (2009) and the M.K. Jaccard and Associates technical report (2009) show that the distribution of welfare losses across provinces and sectors is not particularly sensitive to whether the domestic carbon price is higher or the same in Canada as it is in OECD countries. Provincial GDP is, however, sensitive to the relative domestic carbon price. Concerns about competitiveness help to explain why Ottawa has avoided broad carbon pricing (by adopting narrow coverage in its proposed emissions-trading regimes, delaying implementation of its baseline and credit proposal, and setting a low price for technology fund contributions).

Today the situation is reversed, but the competitiveness concerns remain. The United States is implementing climate change policies and threatening to impose border measures on goods imported from countries with less stringent policies. Since US climate change policies increase business costs, US firms are at a disadvantage relative to imports from countries with less stringent policies. Border measures on imports address this disadvantage. If Canada is judged as failing to pursue reductions with the same stringency as the US its exporters may well be subject to such surcharges. More stringent emissions-reduction policies in Canada could exempt Canadian exporters from these US border adjustments, but higher compliance costs may reduce their competitiveness in other markets.

Key lessons: what goes on south of the border is a critical determinant of the form and substance of Canadian policies; Canada will face increasing pressure to move from its current approach to an alternative position with more effective policies for meeting emissions-reduction goals; and while stringent goals do not necessarily achieve emissions reductions, stringent policies do.

A summary of the political obstacles confronting the federal government when it comes to climate change policy is provided in Harrison (2007). Those most hurt by climate change policy (hard-hit sectors and provinces) will be relatively well informed and will have the greatest incentive to exert pressure on the federal government. Harrison notes that in general the public shows a high degree of support (but low levels of attention) for action on the environment (Harrison 2007, 94). As a result, relatively benign policies can be adopted — looks like action but achieves little in the way of emissions reductions. The resulting costs for interested parties are in effect quite low.

Voters generally dislike taxes. This is especially true for highly visible taxes, like a carbon tax. While there will be significant price increases if a permit-trading scheme equivalent to a carbon tax is imposed, voters may be less resistant to such a policy because its effects are less immediately transparent.

Key lesson: political optics are important; policies that are perceived as all cost and no benefit for the federal government or the provinces will not be implemented.

Most analyses of climate change policy in Canada focus on national, single-instrument policies implemented by the federal government. They implicitly assume that Ottawa can and does control all aspects of climate change policy and that provincial policies do not exist. Revenues are often recycled to lower federal taxes. If a permit scheme with free distribution of permits is considered, the federal government would determine now the permits are distributed. Permits are distributed by the federal government. This stylized approach may have several desirable features, but it is significantly at odds with the complex reality of a decentralized federalism like Canada’s. As a result, these experiments provide little insight into important issues concerning climate policy in a federation.

The provinces and Ottawa share responsibility for the environment, and jointly occupy the carbon tax base. These uniquely federal characteristics have contributed to Canada’s current patchwork approach. The provinces and the federal government have introduced or proposed their own climate initiatives, and have done so concurrently. Some provinces have carbon taxes but most do not; some provinces allow contributions to a fund, some have released cap-and-trade proposals, and some have introduced or proposed baseline and credit systems. There are several reasons for provinces to implement their own policies. A provincial government may act to satisfy voters, to influence the distribution of the burden in the province or to stake a claim on carbon-pricing revenues (now and, perhaps more importantly, in the future).

To our knowledge, Snoddon and Wigle (2007a) is the only work that examines Canadian climate change policies at both levels of government. This work highlights important issues relating to the interaction of federal and provincial climate change policies, particularly in terms of their effects on national and provincial welfare and emissions. Differences in provincial policies can cause ripples that are not contained within provincial borders, as factors and goods markets are linked by interprovincial trade and factor mobility. Another concern is emissions leakage, whereby emissions reductions in those provinces that have climate change policies are partially offset by emissions increases in provinces that do not.

In their stylized model, the federal government implements either a regulatory approach or a domestic emissions-trading scheme to reduce emissions while at the provincial level some but not all provinces may implement regulatory initiatives. British Columbia and Quebec are selected as the provinces to implement climate initiatives, since they were among the first in Canada to move on climate change policy.

Canada is required to achieve an emissions-reduction target roughly equal to the Kyoto target in all experiments. This allows a comparison of different approaches that achieve the same emissions target.12 In the event of a shortfall in domestic emissions reductions, the federal government buys permits on the world market at a price of $30 a tonne.

If the federal government opts for a domestic emissions-trading regime, it receives an allocation of permits equal to Canada’s target emissions. These permits are allocated to provinces in proportion to their baseline 2010 emissions and are sold at cost. Permit revenues are returned in a lump-sum fashion to households. Under the regulatory approach, the federal government introduces three measures. First, the average fuel efficiency for both the household and the transportation sectors must improve by 5 percent. This is modelled as a 5 percent reduction in fuel intensity. Second, the government grants subsidies for sequestration and afforestation activities sufficient to bring about a 10 Mt contribution to the target. The third measure is a renewable standard for electricity that requires a 6 percent increase in new renewable electricity generation.

The regulatory measures available to British Columbia and Quebec are similar to but more stringent than those of the federal government. Provincial fuel-efficiency targets require that the average vehicle fuel economy increase by 10 percent.13 The provincial renewable standard for electricity requires a 10 percent increase in new renewable electricity generation. British Columbia also uses subsidies for sequestration, assumed to achieve a 5 Mt contribution to emissions reductions.

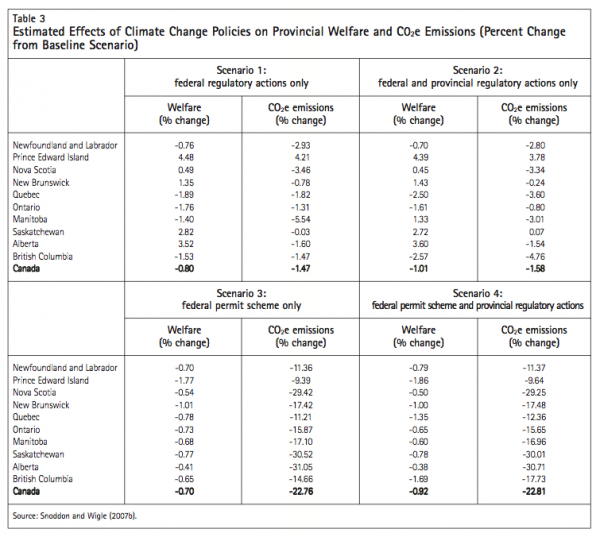

The simulations examine implementation by the federal government of either a permit-trading regime or its regulatory policies. They then consider what happens when the selected provinces add their regulatory measures. The results, expressed as the percentage difference from BAU levels, are summarized in table 3.

There are three main observations. First, domestic emissions reductions are greatest when the federal government uses permits. The regulatory measures, which do not harness the power of market incentives, reduce GHG emissions by only 2 percent, and at a higher cost in terms of reduced welfare. Since the selected policies are not sufficiently stringent to bring about the required reductions in emissions within Canada, international permit purchases close the gap and help keep aggregate costs low.

The second observation is that adding provincial actions to those of the federal government tends to increase the aggregate welfare cost while contributing marginally to domestic emissions reductions. For instance, adding provincial regulatory policies to the domestic emissions-trading regime increases aggregate welfare losses by 31 percent but generates less than 1 percent in additional domestic emissions reductions. When provincial actions are added to federal actions, emissions reductions (and welfare losses) are greater in British Columbia and Quebec. But for many of the other provinces, both welfare losses and emissions reductions are lower when provincial actions are added to federal actions. This result reflects the problem of emissions leakage.

To understand emissions leakage, consider the regulatory scenarios. Federal regulations on their own are relatively ineffective. To the extent that these measures do work, they tend to reduce the user price of fuels, thereby raising emissions of emitters that are not directly covered by the regulations. Leakage also occurs with provincial regulations. These regulations depress energy demand in the regulating province (over and above the effects of federal regulations, as provincial regulations are more stringent). This may cause energy prices in the rest of Canada to fall and emissions to rise. The problem of leakage can seriously reduce the effectiveness of policies implemented by lower levels of government.

The third observation is that provincial welfare losses are more uneven when the federal government uses the regulatory approach. More importantly, adding provincial regulatory measures to federal action tends to worsen the regional welfare distribution.

We also note that the addition of more stringent provincial action raises the aggregate welfare cost. Leakage is partially responsible for this result. Provincial regulations serve to drive a bigger wedge into the incentive to abate, as compared to the situation in provinces that do not act. Alberta and Saskatchewan both experience welfare gains when the federal government alone undertakes regulatory actions. These gains are partially explained by the sequestration and afforestation subsidies (over $650 million) paid mainly to these provinces to ensure that regulatory targets are achieved.

The analysis confirms the conclusion that market-oriented instruments (exemplified by the permit-trading scheme in scenario 3, table 3) are more cost-effective than regulatory measures and subsidies designed to increase fuel efficiency and encourage green technologies, discussed earlier in the paper.

More importantly, these results strongly support the view that, from a cost-effectiveness perspective, a market-based Canada-wide climate policy is preferable to the uncoordinated patchwork of federal and provincial initiatives that exists today. The interaction of federal and provincial policies alters the provincial distribution of GHG emissions and increases the cost to Canadians of achieving whatever emissions-reduction target is eventually agreed to.

Key lessons: aggregate costs will be higher when policies are uncoordinated; nonuniform provincial policies may also affect distribution of the burden across provinces; and emissions leakage can be a problem.

The literature provides useful information on alternative policy scenarios. However, the status quo environment on climate change policy is a long way from the single-instrument, national approach discussed extensively in the literature.

There has been little discussion of how the provinces might be convinced to vacate the carbon-pricing policy field and what they might demand in return. While the federal government could introduce its own emissions-trading system or carbon tax, it does not have the constitutional power to force the provinces to abandon their own policies. Developments in the United States may force Ottawa to act, but the issues internal to the federation will still need to be addressed. There is also the question of whether to act now or wait until US policies are firmly in place. Federal actions alone will not ensure that emissions reductions are cost-effective.

Key lesson: existing research provides little insight on how to get from the status quo to something else.

The status quo approach to addressing climate change in Canada is costly and ineffective. If we are required to find a better approach, how do we get from here to there and when do we make our move? While a unified carbon-pricing policy for North America may be desirable from a cost-effectiveness standpoint, the reality is that, despite recent initiatives in the United States, such a policy will take some time to formulate.

Yet there will be pressure for Canada to move on climate change policy. We argue that three critical obstacles need to be addressed if our current approach is to be successfully replaced with a more cost-effective and environmentally effective one. These obstacles are regional burden sharing, joint occupancy, and transitioning from the status quo to a new approach. Our proposal focuses on these obstacles.

The proposal’s key features are:

Under our proposal, the federal government introduces a broad-based federal carbon tax along the lines of that proposed in Mintz and Olewiler (2008) but with a lower rate of about $10/tonne CO2e in 2010. This rate is somewhat lower than British Columbia’s current carbon tax of $15 but higher than Quebec’s Green Fund duty. The federal carbon tax would rise steadily over time, hitting $20 in 2020 and about $35 in 2030.14 The basic idea is to keep the carbon tax slightly higher than the permit price in the United States.

Recent estimates suggest that even a modest tax could generate significant revenues. For instance, a tax of $20/tonne CO2e could generate about $10 billion.15 As abatement targets become tighter in the longer term, revenues would be greater as the carbon tax rises or as we transition to a cap-and-trade system with full auctioning.16 The tax could also be structured to adjust as negotiations proceed for a harmonized carbon-pricing policy for Canada and the United States.

A proposal for a federal carbon tax is not new. However, our approach introduces two novel and key features — federal-provincial revenue sharing and decentralized revenue recycling — as mechanisms to help move climate policy forward.

In the short term, our proposal has two advantages. First, a federal carbon tax can be introduced almost immediately (and, if necessary, without agreement by the provinces). The complexities of emissions-reduction certification and verification, which could delay action, can be avoided. Although the approach differs from the developing US cap-and-trade regime, a federal carbon tax would allow Canada to signal to the United States the stringency of its own emissions-reduction plans and avoid US border adjustments.

A second advantage is that a carbon tax generates revenues. A revenue pool creates a form of liquidity to address burden-sharing concerns immediately. For instance, the competitiveness impacts of a carbon tax on industries like cement and glass are a serious concern. One way to address this concern would be to earmark a declining share of carbon revenues for sector-specific research and development and energy-efficiency investments, with the share of carbon revenues available for recycling (and for reducing distorting taxes) increasing over time.

Formal revenue-sharing between Ottawa and the provinces is necessary to address the joint-occupancy problem. It provides the provinces with an incentive to vacate the carbon tax field (and to withdraw from regional/provincial cap-and-trade regimes) in exchange for a share of the revenues. Decentralized revenue recycling means provinces can use these revenues to pursue their own objectives.

Our proposal adheres to two important principles with respect to the design of a cost-effective and environmentally effective policy regime: broad coverage and incentives. A Canada-wide carbon tax can be implemented with broad coverage, ensuring that real emissions reductions are possible whatever target is adopted. The cost-effectiveness of these reductions depends on how quickly Ottawa and the provinces reach an agreement on revenue sharing and on dismantling existing provincial carbon-pricing policies. When provincial policies are dismantled, the incentive to abate will be equal across emissions sources.

The proposal addresses two important transitions. Canada needs to transition from its current fragmented approach to a uniform country-wide approach. And at some point in the future it will need to transition to a North American (or US) climate change regime. Substantial federal carbon revenues will help to bring the provinces to the bargaining table to negotiate shares. Without a share, provinces have little incentive to give up their existing policies. This inhibits the transition to a Canada-wide approach. It is unlikely that any proposal would be adopted in the absence of some such arrangement.

Revenue-sharing specifics include how to split the revenues between the federal government and the provinces, how to allocate the provincial share to provinces and how to adjust shares over time. The federal government needs to retain a share for its own purposes (revenue recycling, redistribution or subsidization). While there are clear efficiency advantages to the recycling of revenues to tax cuts — in particular, business income tax cuts — retaining a share may help Ottawa defray the political costs associated with imposing the tax.

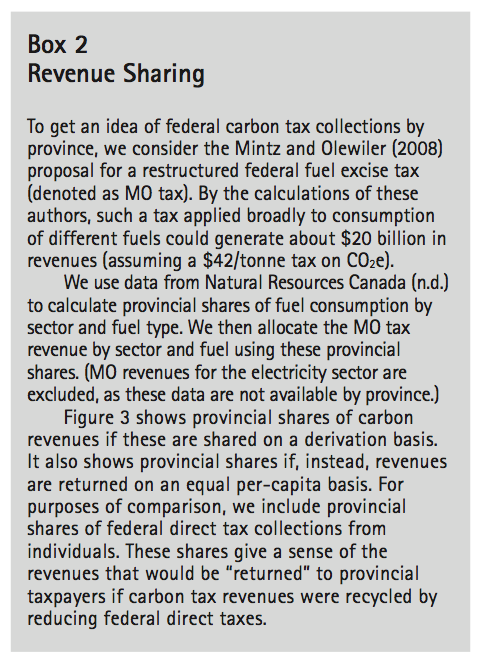

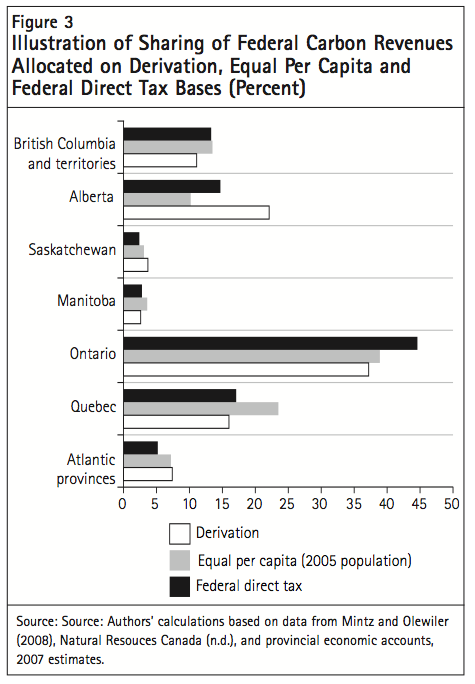

How the provincial share is allocated will be controversial. Carbon revenues could be disbursed on a derivation or per capita basis (see box 2 for an illustration of revenue sharing under alternative allocation rules). Alberta and Saskatchewan would receive greater shares using a derivation rule, where carbon tax revenues are returned in proportion to the amount of tax collected from the province. Larger provinces such as Ontario and Quebec would be better off with an equal per capita rule. The regional welfare burden in energy-intensive provinces like Alberta could be significantly decreased or increased depending on how carbon revenues are shared with provinces.17

Finally, the revenue-sharing agreement could include provisions for phasing out the carbon tax should an integrated North American climate change policy be adopted. If a North American cap-and-trade regime is adopted with full auctioning, the carbon tax revenue-sharing agreement could be replaced with an agreement on sharing auction revenues, although in principle an arrangement can apply to revenues from either a carbon tax or auctioned permits.

With revenue sharing, Ottawa and the provinces will have carbon revenues to allocate. In the short run, revenue recycling to reduce distorting taxes is one option, but some provinces and the federal government may choose to use these revenues to offset burdens in particular sectors and industries. For provinces, decentralized revenue recycling makes revenue sharing more attractive. In the longer term, recycling revenues to reduce distortionary taxes may become more important as targets are tightened and as pressures mount to keep aggregate costs low.

Our proposal also addresses a second transition issue — namely — the question of how to transition to a North American (or US) climate change regime. The integration of the Canadian and US economies will eventually require the integration of Canada’s policy regime with a US (or North American) regime in some way. That said, there is a good chance that a North American scheme will converge on a fully (or largely) auctioned cap-and-trade scheme. This could mean transitioning from a carbon tax to a cap-and-trade system in the longer run.

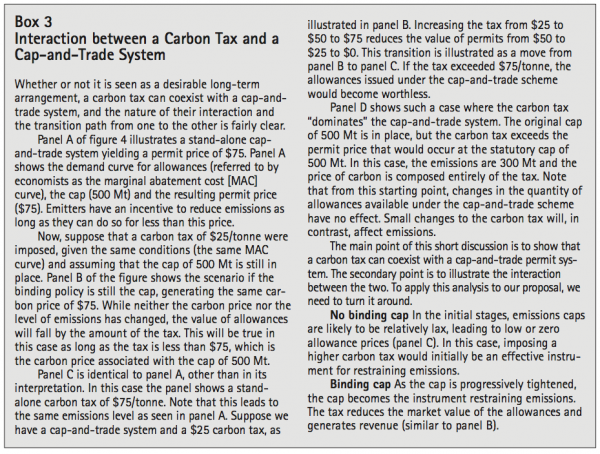

Integration with a North American policy regime does not, however, preclude a continuation of the federal carbon tax integrated with a US cap-and-trade, or even the coexistence of a Canada-wide carbon tax and a Canada-wide cap-and-trade (box 3 provides some specifics on how the system can transition from a carbon tax or tax plus cap to a full cap-and-trade system). Further, if the negotiation of a North American cap-and-trade system proves more difficult than anticipated, the carbon tax can stand in its stead, raising (if negotiations fail) or lowering (if negotiations are successful) the rate as appropriate.18

While our proposal has much to offer over a continuation of the status quo, some would advocate instead for a federally implemented cap-and-trade regime. In the static context, the two policies would be very similar (although the compliance costs are higher in the carbon tax case). There are, however, a number of considerations (in the short run and during the transition) that favour our proposal.

A carbon tax generates revenues in the short run. These revenues are essential to the shift from the status quo to a new approach. Revenues help to ease the transition to a lower-carbon economy. For the provinces, revenues provide an incentive to participate. By retaining a revenue share, the federal government has a discretionary tool for defraying some of the political costs it will incur.

Suppose instead a US-style cap-and-trade regime is adopted, with most permits being given away rather than auctioned over the near term. To finance interim measures aimed at easing the burden of adjustments for particular groups, existing distortionary tax rates will increase, as will the aggregate costs of emissions reductions. The carbon tax proposal avoids these increases and allows for the possibility of reduced distortionary taxes at either the federal or the provincial level. There is also no guarantee that the public will not resist increases in these other taxes, although we acknowledge that there may be less resistance than would be the case with a carbon tax.

A US-style cap-and-trade approach may meet with less resistance from industry. Instead of bargaining with provinces over revenue sharing, the federal government will be negotiating the allocation of permits and the timetable for transitioning to full auctioning. During the transition from free allocation to full auctioning, provinces may pressure the federal government for a revenue share.

Another concern is the time and complexity entailed in aligning a federal cap-and-trade system with existing regional initiatives and with the emerging US system. It is not a straightforward matter to outline the distribution and crediting of permits in an environment of multiple and possibly overlapping cap-and-trade systems.

Our proposal can be implemented almost immediately and with relative ease and, as shown in box 3, can be used to fill the gap as Canada makes the transition to an integrated North American climate regime.

Perhaps the greatest obstacle to the adoption of US-style cap-and-trade is that it is not at all clear how or why the provinces would agree to it. In the short run no revenues will be generated — only costs. To operate in a cost-effective manner, provinces would be asked to give up their own carbon-pricing policies and revenues. It is not obvious what they would get in return.

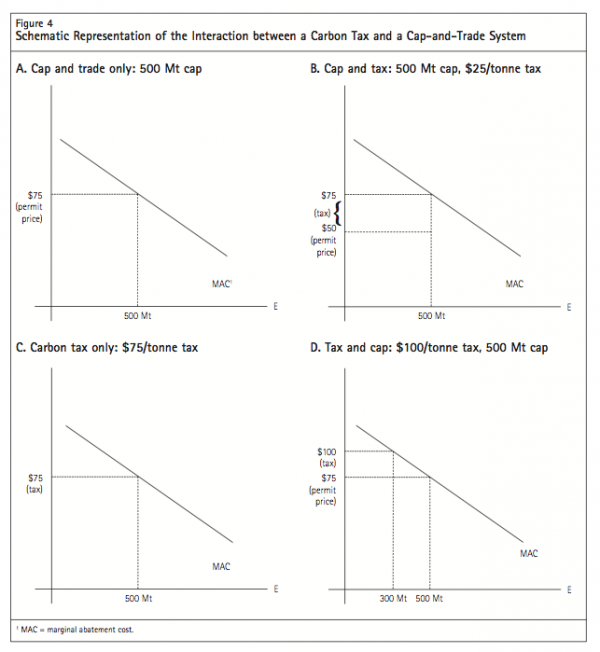

How would our proposal affect aggregate and regional welfare burdens? While there are no studies that include formal revenue sharing or that consider decentralized revenue recycling, we can get a general sense of the range of possibilities by considering some key results from Snoddon and Wigle (2007b) and M.K. Jaccard and Associates (2009). In the latter case, we focus on the results for the less aggressive target. Our observations should be viewed with some caution as the modeling approaches, the baseline and the underlying parameters differ in several important respects.

Both papers consider regional and aggregate welfare effects of climate change policies. These are summarized in table 4. In Snoddon and Wigle (2007b) the overall welfare effects are somewhat greater, as is the range of regional welfare effects. The regional distribution of the burden is, however, quite different in the two scenarios.

The Snoddon and Wigle (2007b) experiment can be interpreted as a special case in our proposal. A federal carbon tax is imposed, with 100 percent of the revenues returned to the provinces in proportion to initial emissions (approximating a derivation-sharing rule). The federal revenue share is zero, there are no federal adjustment measures to ease the burden, and the provinces simply give “green cheques” to households (revenues are returned to households in lump-sum form). In this experiment, carbon revenues are not used to lower distorting tax rates.

The M.K. Jaccard and Associates (2009) experiment could also be considered a special case in our proposal. A federal carbon tax (equivalent to a fully auctioned permit system) is implemented. The federal government’s revenue share is about 82 percent and the provincial share is 18 percent.19 The provincial share is distributed to the provinces in proportion to the reduction in provinces’ tax revenues induced by federal climate policies. About 36 percent of federal carbon tax revenues are used for federal personal income tax cuts. Various other measures are implemented at the federal level, such as compensation to households and subsidies to the electricity and transit sectors. About 10 percent of revenues go to international permit purchases (so not all emissions reductions are achieved domestically).

Key differences in how revenues are used in each of the experiments may help to explain the different patterns of regional burdens. Differences in the aggregate burden could reflect a number of factors, including the efficiency gains from recycling a portion of revenues to federal income tax cuts in M.K. Jaccard and Associates (2009). There are also important differences in the implicit federal-provincial split of revenues and the rule used to allocate revenues to provinces. Neither paper considers the impact of decentralized revenue recycling. This is clearly an area where more research would be useful.

While the experiments are not fully compatible, they do show that regional burdens are sensitive to how Ottawa and the provinces share carbon-pricing revenues. There are many possible revenue-sharing and decentralized-revenue-recycling scenarios. The welfare and emissions effects of these options for Canada and the provinces must be fully explored if climate change policy is to move forward.

The recent history of Canadian policy shows that failure to put a price on CO2e emissions is very costly, especially when the scope of non-price measures is limited to specific sectors or specific sets of emitters. Few real emissions reductions have been achieved. Existing and emerging policies overlap and there is no framework for integrating these different policies and instruments. Recent US climate initiatives put additional pressure on Canada to reduce emissions.

We propose a federal carbon tax with transition measures. With this proposal, Canada can achieve real emissions reductions almost immediately and in a more cost-effective manner. Canada can also signal the stringency of its climate change plans to the US government and, in so doing, avoid US border adjustments. Unlike a cap-and-trade system, where permits are distributed freely for a period of time (and hence offer nothing to the provinces in terms of revenue), our proposal generates revenues that can be used for addressing the burden-sharing concerns of industry, of individuals and of the provinces. Our proposal recognizes that the carbon tax field is shared by Ottawa and the provinces. Although the federal government is in the best position to implement a Canada-wide policy, provincial governments have already staked a claim. A move from the current patchwork environment to a Canada-wide approach will therefore require a carbon revenue-sharing agreement between the federal government and the provinces, with provinces free to determine how best to recycle their revenue shares.

Finally, our proposal recognizes that in the longer term Canada will need to integrate into a North American carbon-pricing regime. Our carbon tax can coexist with a US cap-and-trade system and, perhaps more importantly, can transition into a cap and trade should negotiations on a North American climate change regime prove successful.

The authors gratefully acknowledge the helpful comments of two anonymous referees and the research assistance provided by Griffen Carpenter.

Ab Iorwerth, A., P. Bagnoli, Y. Dissou, T. Peluso, and J. Rudin. 2000. “A Computable General Equilibrium Analysis of Greenhouse-Gas Reduction Paths and Scenarios.” In An Assessment of the Economic and Environmental Implications for Canada of the Kyoto Protocol, edited by Analysis and Modelling Group, National Climate Change Process. Ottawa: Natural Resources Canada.

Auditor General of Canada. 2008. December 2008 Report of the Commissioner of the Environment and Sustainable Development. Ottawa: Minister of Public Works and Government Services.

————. 2009. Spring 2009 Report of the Commissioner of the Environment and Sustainable Development. Ottawa: Minister of Public Works and Government Services.

Bramley, M., P. Sadik, and D. Marshall. 2009. Climate Leadership, Economic Prosperity: Final Report on an Economic Study of Greenhouse Gas Targets and Policies for Canada. Calgary and Vancouver: Pembina Institute; David Suzuki Foundation.

Conrad, K., and T. Schmidt. 1998. “Economic Effects of an Uncoordinated versus a Coordinated Carbon Dioxide Policy in the European Union: An Applied General Equilibrium Analysis.” Economic Systems Research 10 (2): 161-82.

Council of the Federation. 2007. Climate Change: Leading Practices by Provincial and Territorial Governments in Canada. Accessed June 3, 2009. www.councilofthe federation.ca/pdfs/CCInventoryAug3_EN.pdf

Demerse, C., and M. Bramley. 2008. Choosing Greenhouse Gas Emission Reduction Policies in Canada. Calgary: Pembina Institute.

Dissou, Y. 2006. “Efficiency and Sectoral Distributional Impacts of Output-Based Emissions Allowances in Canada.” Contributions to Economic Analysis and Policy 5 (1): 1506.

Dissou, Y., C. MacLeod, and M. Souissi. 2002. “Compliance Costs to the Kyoto Protocol and Market Structure in Canada: A Dynamic General Equilibrium Analysis.” Journal of Policy Modeling 24:751-79.

Environment Canada. 2008a. Canada’s Greenhouse Gas Emissions: Understanding the Trends, 1990-2006. Accessed November 27, 2009. https://www.ec.gc.ca/pdb/ghg/inventory_report/ 2008_trends/2008_trends_eng.cfm