The Canadian manufacturing sector is in the midst of an unprecedented economic crisis. Having endured nearly three years of declining output growth, it appears there are more hard times to come. While the recent weakness can be attributed to the deep US recession, Canadian manufacturers suffer from a longer-term competitiveness problem that, if not addressed, will continue long after the recession is over. This study examines the ways in which public policy can bolster manufacturing competitiveness in Canada.

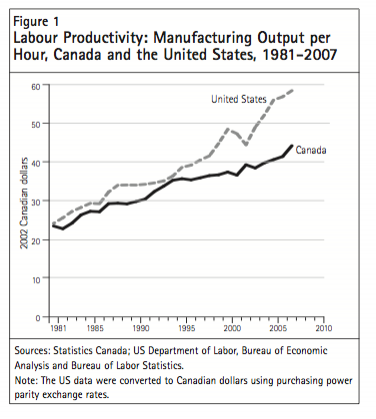

Labour productivity – which measures the market value of the output a worker can produce in one hour – is a fundamental indicator of the economic health of the manufacturing sector. Not only does it represent a “speed limit” for sustainable increases in workers’ wages and benefits, it is a key determinant of cost competitiveness. Labour productivity grew faster in Canada than in the United States in the years following the 1988 Canada-US Free Trade Agreement, nearly erasing the then-small productivity gap by the mid-1990s. However, following the North American Free Trade Agreement (NAFTA) the gap grew significantly, and it is now on the order of 25 percent in favour of the United States. That it has done so in the wake of NAFTA, which was intended in part to broaden market access, increase competitive pressures and stimulate productivity improvements, presents a conundrum for policy-makers.

An exhaustive review of the research literature by the authors reveals that the main explanation of Canada’s poor productivity performance is insufficient investment of all types. Relative to that of the United States, Canada’s economy is investment poor, yet investment is precisely the vehicle through which most productivity improvements flow. This could be in the form of machines embedded with new technologies that improve the efficiency of workers, computers and networking equipment that allow for reorganization of production processes, or public infrastructure that provides the very foundation on which firms can build their competitiveness. Canada suffers from significant weakness in all these areas; addressing them is critical to improving productivity growth.

Canadian manufacturers are less innovative than their US counterparts (both in terms of new product development and more efficient production processes), despite the fact that the overall R&D gap is narrowing.

Additional public investment in R&D over the past decade has not succeeded in improving business innovation in Canada. Innovative ideas for improving business efficiency and product design are not in short supply in Canada. However, to be exploited effectively, these ideas often require investment in equipment (particularly in information and communication technologies), and managerial know-how and risk-taking.

The empirical evidence examined here also decisively shows that the productivity benefits of technology imported by foreign firms that establish production facilities in Canada spill over to their Canadian counterparts – a winwin economic proposition. This might call for further loosening of foreign ownership limitations and a review of foreign direct investment criteria along the lines proposed by the Competition Policy Review Panel.

The authors conclude that the lack of demand for investment, innovation and skills in Canada needs to be acknowledged and better understood. Although the supply of factors that contribute to productivity growth in Canada is generally sufficient – for example, Canada invests heavily in R&D, and the skill level of its workers is high by international standards – the problem is a lack of demand for innovation, physical capital and highly skilled employees on the part of businesses. Reducing business taxes would increase incentives to invest in machinery and equipment, but if Canadian manufacturers are to live up to their productive potential, policy-makers will need a broader understanding of the barriers to an innovative and competitive market environment. These barriers include the role of regulatory policies, the ability and willingness of business managers to exploit the innovation opportunities of information technologies, and the relatively small size of Canada’s domestic market.

The Canadian manufacturing sector is in the midst of an unprecedented economic crisis, having endured nearly three years of declining output growth, with more hard times to come. While the recent weakness can be attributed to the faltering US economy, Canadian manufacturers suffer from a longer-term structural problem. Manufacturing productivity – which is a fundamental determinant of the sector’s competitiveness – has increased less than 10 percent in Canada since 2000, compared with 37 percent in the United States. Given that the United States is Canada’s largest trading partner, this trend bodes poorly for the manufacturing sector, even after the worst of the current economic slowdown is behind us.

This study examines the many interrelated factors affecting labour productivity in Canadian manufacturing. There is indeed a large productivity gap between Canada and the United States, which has widened considerably since the mid-1990s. That it has done so in the wake of the North American Free Trade Agreement (NAFTA), which was intended in part to broaden market access, increase competitive pressures and stimulate productivity improvements, presents a conundrum for policy-makers.

Why has this productivity gap not closed in the wake of continental free trade? A number of reasons have been suggested: (1) Canadian firms remain too small to exploit economies of scale fully; (2) investment in productive capital broadly conceived (including machinery and equipment, public infrastructure, information and communications technology, as well as foreign direct investment) might be insufficient; (3) Canadian manufacturers might not be innovative enough; and (4) the skill level of Canadian workers might be too low.

We survey the literature on these factors and explore their possible relationship to lagging productivity growth. All play at least some role in the productivity gap, but the most pressing issue to address is the low capital intensity of manufacturing firms. Investment in physical capital broadly defined – including private investment in machinery, structures and information technology as well as public investment in the infrastructure that undergirds these private investments – typically accounts for well over half of improvements in productivity growth. Canada performs poorly on all these measures, yet this could be addressed by fairly straightforward changes to tax, spending and regulatory policies.

Innovation is the second pillar of strong productivity; here, the evidence suggests that Canadians, while not lacking in new ideas, seem less able to reap economic benefits from them. “Innovation” too often is code for investment in research and development (R&D) spending, but it should be viewed more broadly. The Canada-US R&D gap has narrowed considerably over the past 15 years, but other factors that are complementary to R&D – such as technologies embodied in both domestic and foreign investment and the ability of information and communications technology (ICT) to reorganize production processes more efficiently – are critical to making sure that the economic benefits of innovation come to fruition.

A third important issue is the effective use of workers’ skills. While the Canadian workforce is one of the best educated in the world, a surprising number of Canadians say they feel overqualified for their job; at the same time, there exist pockets of labour shortages for certain skilled trades. In addition, a large body of evidence shows that immigrants have trouble finding jobs in their professional fields. Structural impediments to labour mobility – most notably, uncoordinated provincial professional accreditation procedures and the inability to assess immigrants’ work experience and credentials accurately – prevent these workers from easing the skilled-labour shortages that exist in some areas. These accreditation procedures need to be harmonized to exploit the full potential of Canada’s world-class labour force. There is also some evidence that the managerial and creative skills of Canadian workers might be substandard.

Labour productivity – which measures the market value of the output that a worker can produce in one hour – is a fundamental indicator of the economic health of the manufacturing sector. Figure 1 shows that Canada recently has underperformed, both compared to its own history and, more important, to the United States. Labour productivity grew faster in Canada than in the United States in the years following the 1988 Canada-US Free Trade Agreement (FTA), nearly erasing the small gap by the mid-1990s. However, following the 1994 NAFTA, which brought Mexico into the continental free trading zone and further reduced Canada-US trade barriers, the gap grew significantly. There was a slight reversal in the early 2000s, but the gap is still on the order of 25 percent in favour of the United States.

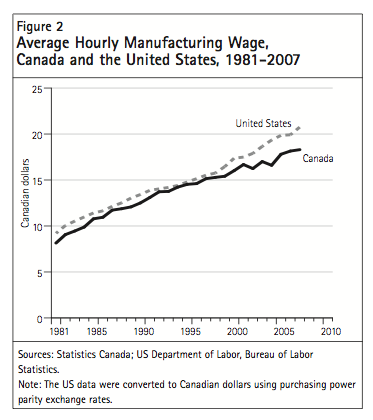

Why is this productivity gap of concern? There are several reasons, but perhaps the most important is that it means lower and more slowly growing manufacturing wages. Because labour productivity measures the “value” of what workers bring to a company, it sets an effective ceiling on potential increases in hourly compensation consistent with firm profitability. Figure 2 shows hourly manufacturing wages in Canada and the United States, and the patterns are similar to those in figure 1.1 The manufacturing sector has long prided itself on providing well-paid jobs, but in the midst of sluggish productivity growth, it is increasingly difficult for firms to do so.

A closely related issue is the importance of productivity to global competitiveness. The flip side of strong productivity growth is lower production costs, which improve the competitive posture of both exporters in foreign markets and domestic firms visà-vis imports in the domestic market. In addition, strong productivity is an important measure of market efficiency and thus is a factor in firms’ decisions about where to locate production facilities.

Economists long argued that labour productivity in Canadian manufacturing was relatively low because of market inefficiencies that persisted due to protective tariffs. Historically, the tariff system was a remnant of colonial days, with a preference for trade with other parts of the British Empire. One of the main predicted benefits of free trade with the United States was the gains in efficiency resulting from a rationalization of production as manufacturers were forced to adjust to competitive pressures without the shielding offered by this tariff wall. The gains from free trade, it was argued, would come from Canada’s shedding inefficient low-productivity jobs and reallocating them to more productive companies and industries. In addition, by increasing access to the US market, free trade was expected to create opportunities to expand Canadian production, thus allowing firms to reap productivity gains through greater economies of scale. Finally, continental free trade would enable large overseas firms (such as Japanese and European automakers) to locate production facilities in Canada to serve the entire North American market.

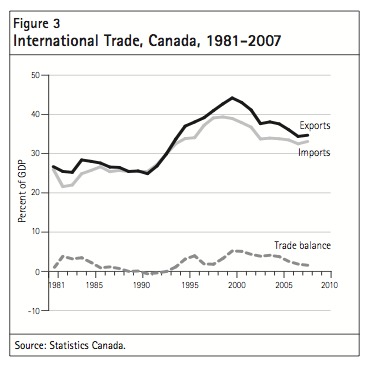

There is certainly no doubt that the Canada-US FTA and NAFTA increased Canadian international trade. Figure 3 shows that exports’ share of GDP, which had hovered in the 25 to 30-percent range throughout the 1980s, rose dramatically to a peak of 45 percent in 2000 before falling back somewhat in the wake of the 2001 US recession and, more recently, the appreciation of the Canadian dollar. Imports also increased, but to a slightly lesser extent, allowing Canada to run consistent trade surpluses.

Canadian trade has also become more concentrated in North American markets. In 1990, 69.2 percent of Canadian merchandise imports came from the United States; by 2007, 76.3 percent did so. With respect to exports, the concentration was even more dramatic, with US-bound exports peaking at 85.9 percent of the total in 1999 before falling back to 76.9 percent by 2007. Approximately 50 percent of Canadian exports to the United States are raw materials and energy products,2 while Canadian imports from the United States are concentrated in manufactured goods, including machinery and equipment.

On the more fundamental question of whether this increase in trade flows was accompanied by productivity improvements, the evidence is much more mixed. In a seminal paper, Trefler (2004) finds that productivity increased by 15 percent in the 10 years following the 1988 Canada-US FTA in those industries most affected by US imports and by 14 percent in export-intensive industries. It is of interest that these improvements primarily reflect the closure of inefficient plants and the growth of high-productivity plants, rather than improvements in economies of scale brought about by access to the large US market.

These productivity gains stalled, however, beginning in the mid-1990s. Canada’s “competitiveness” since then, in the form of continued strong export growth and consistent trade surpluses, has been made possible by a weak currency. From 1997 to 2004, the Canadian dollar typically fluctuated between 65 and 75 US cents, well below the 85 cents that is more consistent with economic fundamentals. By keeping export prices low in foreign markets and import prices high in domestic markets, the weak dollar allowed Canadian manufacturers to prosper even as productivity growth lagged. The rapid appreciation of the Canadian dollar since mid-2005 has been a rude awakening.

Some economists have argued that the competitive pressures of free trade would lead to lower employment, lower wages and a weaker manufacturing sector. One study demonstrates that the effect of domestic tariff reductions in the Canada-US FTA on employment varied dramatically depending on firms’ productive efficiency: less efficient firms reduced employment by 20.8 percent from 1988 to 1994, but highly efficient firms increased employment by 6.1 percent (LaRochelle-CoÌ‚teÌ 2007). This is consistent with the notion that liberalized trade encourages a redeployment of resources to higher-productivity uses and suggests that the FTA was successful in this regard. Analysis over a longer period by Wright and Holt (2007) shows conclusively that, in Canada, manufacturing employment increased considerably in the years following the implementation of NAFTA – in sharp contrast to a steady decline in the United States – and manufacturing’s share of the economy increased throughout the 1990s. With regard to wages, Canadian manufacturing pay, although it remains below US levels, continues to increase (see figure 2).

Free trade has provided numerous benefits to Canadian manufacturers, including modest productivity gains, but it has not solved the pro ductivity problem, for which a number of reasons have been suggested. What is the evidence for each of these possible causes, and to what degree might policy levers be effective in addressing them?

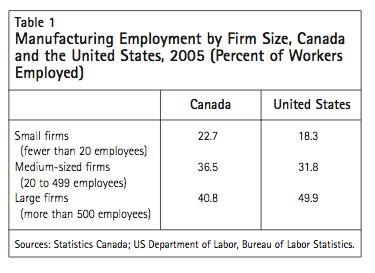

Elementary economics shows that, up to a point, bigger is better in terms of productivity. Larger plants can better exploit the efficiencies of mass production and have longer production runs to spread fixed costs over a larger amount of production, hence lowering unit costs relative to smaller plants. This is particularly true for the manufacturing sector: data show that firms with 100 or more employees are, on average, 80 percent more productive than those with fewer than 100 (Leung, Meh and Terajima 2008). Canada’s manufacturing sector is characterized by relatively more small and mediumsized firms than is that of the United States, but the difference is not as striking as the relative sizes of the respective economies might suggest. Table 1 shows that half of US manufacturing sector employees work for firms with 500 or more employees, compared with just over 40 percent in Canada. This suggests there is modest room for scale-driven productivity improvements in Canada (see Baldwin and Tang 2003; Sharpe 2003).

In theory, free trade should have caused average Canadian plant size to converge with that in the United States, because plants on both sides of the border could serve the same large continental market. The geographic, cultural and political reality is, however, that northsouth trade flows are far smaller than would be expected in a borderless world. Despite the absence of tariffs, the Canada-US border still serves as a real obstacle to full exploitation of the US market. Helliwell (1996) suggests that the “border effect” is very large: interprovincial trade is 20 times greater than trade between provinces and states of comparable population and geographic proximity. Brox (2001) finds, however, that NAFTA has resulted in the diversion of 6.2 percent of interprovincial trade to the United States, somewhat mitigating the border effect. More recent work by Vigfusson (2008) indicates that the border continues to present a marketing and regulatory, if not economic, barrier to US market access.

In the aggregate, there is considerable room for efficiency gains from expanding the scale of Canadian manufacturing operations. The simplest indicator of scale-related efficiency is the cost elasticity of production, which essentially measures the degree to which unit costs would change in the event of a given change in production. Brox (2006, 2007) finds strong positive economies of scale in Canadian manufacturing: a 10-percent increase in scale would actually lower unit production costs (and, in turn, boost productivity) by 2.5 percent.

Daly (1998) argues that the failure of the productivity gap to close following the Canada-US FTA was the result of the rapid growth in small and mediumsized manufacturing enterprises in Canada. He notes a similar increase in small US firms, but the increase was relatively greater in Canada. Noting the importance of export-led growth in Canadian manufacturing since 1989, Daly suggests that small Canadian-owned firms have benefited more from the increase in exports, but have not had the gains in labour productivity experienced by the larger foreign-owned firms in the sector.

Extending Daly’s analysis, Baldwin, Jarmin and Tang (2004) examine the trend in the importance of small producers in the Canadian and US manufacturing sectors from the early 1970s to the late 1990s. They find a common North American trend in changes in plant size: small plants in both countries increased their share of employment up to the 1990s, but this share has remained fairly constant since, in both countries. Over the entire period, small firms’ share of output increased less than their share of employment, implying falling relative labour productivity. The authors conclude that the similarity in the trends in the two countries suggests that the causes are similarities in the technological environment rather than country-specific factors. This suggests that differences in economies of scale are not the main explanation of the labour productivity gap. Further, Britton (1998) claims that industrial productivity gains resulting from trade agreements appear to come more from specialization within industries than from scale economies.

More recent analysis by Leung, Meh and Terajima (2008) offers a more nuanced view. They compile productivity and employment data for five classes of firm size in the United States and Canada over the period 1984-97. Applying the US firm size distribution to the Canadian productivity data allows them to isolate the productivity effect of differences in the distribution of firm size. They find that this factor accounted for just over 50 percent of the CanadianUS labour productivity gap in manufacturing as of 1997. The remainder is due to the fact that, with the exception of medium-sized firms (those with between 100 and 499 employees), all firm-size groups in Canada are less productive than their US counterparts. The authors add that firm size distributions in each country have not changed appreciably since 1997, which implies that this effect is likely not an important factor in the recent sharp divergence of Canada-US productivity trends.

Baldwin and Gu (2004) report that trade-led productivity growth is due not so much to plant size as to the degree to which it encourages product specialization, which allows for the exploitation of scale economies. The key point here is that, in multi-plant firms, product specialization allows each plant to concentrate on individual types of output. For example, under NAFTA, Canadian auto plants were assigned a unique product line, with other models being imported from US plants.

In a similar vein, Callen, Morel and Fader (2005) argue that process is more important than plant size in determining efficiency and average cost performance. They conclude that changes in management accounting and control procedures are required to gain maximum efficiency from advanced manufacturing practices such as just-in-time production. Their findings are based on analysis of the production of the same types of products, and thus cost reductions could be attributed to differences in process – for example, the use of just-in-time production versus conventional manufacturing processes. Research on just-in-time production by Brox and Fader (1997, 2002) reaches a similar conclusion.

It is clear from the available evidence that “bigger is better” when looking for productivity gains. Larger plant size is compatible with product specialization, better utilization of capital and specialization of labour through longer production runs. Moreover, average plant size is somewhat smaller in Canada than in the United States. Nonetheless, the growing importance of small and medium-sized manufacturing enterprises is not unique to Canada; the same basic trend is occurring in the United States, where smaller firms have acquired a larger share of the manufacturing sector. There is little evidence that differences in the scale of production are a major explanation for the widening productivity gap between Canada and the United States in recent years.

That being said, the fact remains that big firms are more productive than small ones, and Canada could enable incremental advances in firm productivity by addressing some of the obstacles that discourage companies from growing. Lack of market access is one such factor and, as we have seen, the border remains both a practical and a psychological obstacle to the US market for many Canadian manufacturers. Canada therefore should continue discussions with the United States about streamlining border administration to make it as efficient as possible while respecting legitimate concerns about security – see Hart (2007) for specific policy options.

In addition, some tax policies designed to encourage small business development have the perverse effect of discouraging such firms from expanding. For instance, the combined federal-provincial corporate tax rate averages 16.5 percent for businesses with incomes of less than $500,000, but jumps to 33.5 percent thereafter, which dulls the incentive to expand. The Harper government has committed to lowering the standard federal statutory corporate tax rate to 15 percent by 2012, which should reduce this disincentive.

Finally, competition policy, at times, has prevented mergers and acquisitions in the name of reducing market power in domestic markets. In a globalized economy, however, decisions on mergers and acquisitions must also take into account their potential effects on international competitiveness, including both the ability to reap gains from increasing plant scale and the potential for additional foreign direct investment.

Another critical determinant of a firm’s productivity is the capital equipment at its disposal: a worker can dig a trench faster with a bulldozer than with a shovel, and an accountant can manage the books more effectively with a state-of-the-art computer than with a calculator. The quantity and quality of physical capital available have a direct impact on labour productivity, and most long-run empirical analyses indicate that, in Canada and the United States, investment in physical capital is responsible for well over 50 percent of observed increases in labour productivity (Baldwin and Gu 2007; Jorgenson, Ho and Stiroh 2008). This section looks at the role of physical capital in the Canada-US productivity gap, with special focus on the importance of foreign direct investment (FDI), public infrastructure, and information and communications technology.

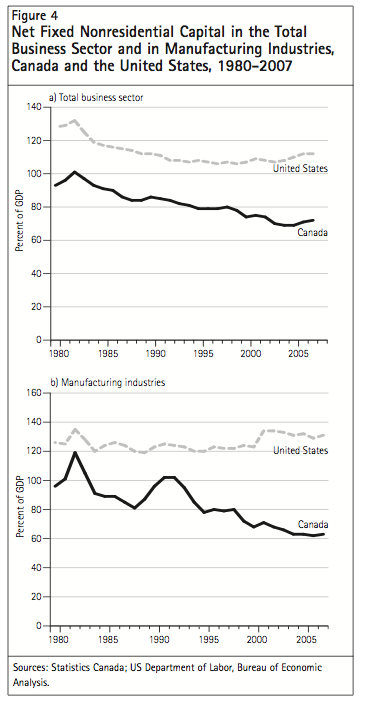

Compared to that of the United States, Canada’s is a capital-poor economy. As a percentage of gross domestic product (GDP), US businesses employ almost 50 percent more nonresidential physical capital than their Canadian counterparts, and the gap has not changed appreciably over the past 30 years (figure 4, panel a). Given a gap of this magnitude and the critical importance of physical capital, one might say that the Canadian economy is like an accountant trying to manage the books with a first-generation computer.

The story is much the same for the manufacturing sector, but here the gap between the two countries has widened even more dramatically in the past 15 years (figure 4, panel B).3 Despite the evidence of some rationalization following the implementation of NAFTA, Canadian manufacturing productivity has been hampered by relatively low capital spending on machinery and equipment (Brox 2008a). Another important contrast with the United States is that, in Canada, manufacturers are less capital intensive than are other sectors of the economy, which runs counter to intuition – in Canada, the capital-to-GDP ratio for manufacturers was 12 percent lower than for the economy as a whole in 2007, whereas in the United States it was 16 percent higher. One reason for this difference is Canada’s relatively lower labour costs (see figure 2), which lead to greater labour intensity. At least some of the responsibility might be traced to Canadian public policy, which generally has been directed at maintaining a high level of employment, rather than increasing wage rates – for example, government subsidies to business are often conditional on employment guarantees.

The stagnation of manufacturing wages in Canada in recent years could lead to further erosion of labour productivity, because it makes hiring more employees more attractive than investing in new equipment. In turn, this leaves the manufacturing sector even more capital poor, further reducing productivity (and the implied wage growth) in a vicious circle. It is important for policy-makers to realize that stimulating investment is a positive-sum game: improving productivity, profitability and wage growth provides the foundation for sustainable growth in both employment and earnings.

The more important factor in Canada’s investment deficit (and the reverse of low labour costs) is high capital costs. There are a number of reasons why capital costs have historically been high in Canada, but one of the most important is Canada’s high taxes on investment. Since 2001, the statutory federal corporate tax rate – essentially a tax on the business returns to capital – has been reduced from 28 percent to 19 percent currently, and is legislated to fall to 15 percent by 2012. An examination of recent Canadian corporate tax cuts reveals that a 10-percent reduction in corporate income taxes leads to a 7-percent increase in the capital stock – a potent lever for stimulating productivity growth (Parsons 2008). Studies of other countries yield similar positive effects (see, for example, Djankov et al. 2008; and Cummins, Hassett and Hubbard 1995).

It is important to note that manufacturers have been the primary beneficiaries of recent corporate tax relief. In their annual international comparison of effective tax rates on capital, Chen and Mintz (2008) calculate that the total federal-provincial effective marginal rate on Canadian manufacturers has fallen dramatically, from 37.1 percent in 2005 to 19.3 percent in 2008 (the corresponding numbers for the United States are 35.8 percent and 25.4 percent). Despite this relief, other taxes on capital exist at the provincial level: six provinces (Manitoba, Saskatchewan, New Brunswick, Nova Scotia, Quebec and Ontario) levy direct taxes on firms’ capital stocks, and four (Manitoba, Saskatchewan, British Columbia and Prince Edward Island) impose provincial sales taxes on machinery and equipment.4

In addition, the 2009 federal budget provides for a temporary acceleration of capital cost allowances for investments in manufacturing machinery and investment, such that the cost can be deducted over two years. Though the motivation for this is the cyclical economic downturn, lowering effective taxes on such investment is also sound long-run policy to improve competitiveness. Policy-makers should be open to the possibility of extending this measure if it proves effective at stimulating investment.

Another factor in the cost of investment is the Canadian-US dollar exchange rate. Since most machinery and equipment is imported from the United States, a weak Canadian dollar raises equipment costs. The recent appreciation of the Canadian dollar, therefore, provided a significant opportunity for manufacturers to narrow the investment gap (Brox 2008a) by lowering the cost of machinery imported from the United States. Indeed, Canadian investment in machinery and equipment per worker increased from 60 percent of the US level in 2001 to 85 percent in 2007.

Of particular importance to Canada’s capital stock are international direct investment flows. In a branchplant economy such as Canada’s, foreign direct investment (FDI) plays a particularly important role in the economy. FDI actually fell slightly from 30 percent of GDP in 1970 to 24 percent in 1998, but has since rebounded sharply – it was 33 percent in 2007.

One might ask why foreign investment is of special importance. Some argue that there is no substantive difference between foreign and domestic investment, and that foreign direct investment simply crowds out domestic investment. The evidence shows, however, that FDI is a critical vehicle through which technologies that would otherwise not be available in Canada are diffused through the economy. Moreover, as an analysis of manufacturing plant openings and closures over the period 1973-97 reveals, new foreign-owned plants are, on average, 12 percent more productive than domestically owned plants. The main reason for this productivity edge is that these plants are more capital intensive, more innovative, and more technologically advanced (Baldwin and Gu 2005, 2006a and 2006b).

Domestically owned plants benefit as well. Baldwin and Gu find important productivity spillovers from foreignto domestically controlled firms, the result of competitive pressures, the increased rate of technology transfer or adoption through the demonstration effect. As well, smaller and younger domestic plants capture larger spillover benefits than do older and larger plants. Tang and Rao (2001) report that foreign-controlled manufacturing firms spend proportionately less on R&D than their Canadian-owned counterparts, even though they are significantly more productive. This implies that they tend to import advanced technology from their parents, illustrating the important linkages between FDI and innovation.

Gholami, Lee and Heshmati (2006), in a study of the relationship among ICT investments, FDI and productivity growth in 23 major industrialized and emergingmarket economies, find that FDI is a more potent driver of labour productivity than is domestic investment. This confirms the notion that foreign companies bring new technologies into the host economy.

Although opponents of foreign ownership view it as a threat to the strength of Canadian-owned manufacturing firms, the empirical evidence clearly demonstrates the contrary. FDI, whether in the form of new entrants, acquisition of existing firms or additional investments by existing foreign-owned entities, increases labour productivity in the Canadian manufacturing sector – not only for the foreign companies making the investment, but for domestic manufacturers as well.

FDI, like its domestic counterpart, is sensitive to the corporate tax burden, so the policy measures discussed earlier are similarly important in attracting it. The report of the Advisory Panel on International Taxation (2008) concludes that, although Canada’s existing tax treatment of multinational corporations is both fair and competitive, several specific technical improvements could be made with regard to inbound investment. Other, more direct policy actions could be taken, however, to reduce barriers to FDI. In many sectors – most notably telecommunications, broadcasting and aviation – statutory ownership restrictions limit the degree to which foreign firms can operate in Canada, and research commissioned by the Competition Policy Review Panel suggests that these restrictions can be relaxed safely (McFetridge 2008). Canada is one of only two countries (Australia being the other) that subject foreign investment to screening as a matter of policy. Moreover, the review criteria used under the Investment Canada Act for this purpose seem too restrictive, in two ways. First, the threshold for subjecting foreign investment to review (now $295 million) is much too low. Second, the onus is currently on the foreign firm to show that the investment has net positive benefits to Canada. Given the overwhelming empirical evidence of FDI’s benefits, the onus should be on the government to show that the investment is contrary to the national interest. This would cement the underlying premise that, except in rare situations, foreign investment is beneficial to Canada.

Other important factors that affect the decision to locate facilities in Canada are the quality of infrastructure and the skill level of the labour force. As we shall see later, each of these factors is a significant contributor to productivity in its own right, and the degree to which they encourage foreign firms to invest in Canada only reinforces their importance.

In addition to private investment, public investment in roads, bridges, sewer systems and other facilities collectively known as “infrastructure” is of equal or greater importance to manufacturing cost-effectiveness and productivity. A large body of literature (reviewed in Brox 2008c) conclusively shows that investment in public infrastructure has positive effects on costeffectiveness, productivity and international competitiveness. A sustained 10-percent increase in infrastructure spending would increase manufacturing productivity in Canada by well over 5 percent. For purposes of comparison, the productivity return on a similar increase in private investment in machinery and equipment is on the order of 2.5 to 3 percent.5

Canada currently suffers from a serious infrastructure deficit. Whether measured as a percentage of GDP or per capita, infrastructure spending has drifted downward over the past several decades, and the drop accelerated in the 1990s – coincident with the widening Canada-US manufacturing productivity gap. These trends are not accidental. Over the same period, infrastructure investment declined 3.5 percent in dollar terms in Canada, while increasing by 24 percent in the United States.

Additional investment in public infrastructure is perhaps the most important factor in promoting labour productivity growth. However, the key is to undertake the appropriate types of investments. Although public infrastructure includes everything from port facilities to municipal parks and recreation facilities, it is roads, bridges, water treatment facilities and energy transmission systems that are most important in terms of manufacturing productivity. Many would also support investment in “green infrastructure,” such as wind and solar power; high-speed, low-emission public transit networks; and so on. These new forms of infrastructure might push the technological frontier and ultimately reshape and strengthen the productive posture of manufacturers, but they are not yet proven. In the near term, even though paving roads and rebuilding bridges might not have the appeal of other projects, they are essential to a strong manufacturing sector.

In the current economic circumstances, recent decisions by the federal and certain provincial governments to increase spending substantially (described in Brox 2008c) are a welcome development. In addition to strengthening productivity performance in the medium term, infrastructure projects provide shortterm fiscal stimulus by creating jobs. If well timed, they will help cushion the current economic downturn.

Information and communication technology is a special class of investment because it provides tools that allow companies to reorganize and streamline production processes. Whereas investment in more machinery allows workers to increase efficiency within a given organizational framework, ICT investment can increase the efficiency of the organizational framework itself, and in that sense it is revolutionary rather than evolutionary (Brynjolfsson and Hitt 2000).

Nobel-prize-winning economist Robert Solow (1987) once quipped: “You can see the computer age everywhere but in the productivity statistics” – indeed, early US studies (Brynjolfsson 1993; Triplett 1999; Gordon 2000) found that ICT investment had had little impact on labour productivity. More recent studies, however, have found significant productivity enhancements. For example, ICT investment leads to increases in labour productivity because firms make additional investments in business organization, workplace practices and human capital to exploit its capacity to streamline production processes. Although ICT investment has relatively little immediate effect, its contribution to productivity and output is as much as five times greater than that of non-ICT investments over a period of several years (Brynjolfsson and Hitt 2003) – reorganizing production processes takes time, and it is not surprising to see its beneficial effects build over time. Jorgenson, Ho and Stiroh (2008) find that ICT investment accounts for only 10 percent of total investment, but it has been responsible for nearly one-third of US productivity growth since 1995. Although productivity improvements initially were concentrated in the ICT-producing industries, the economic benefits have fanned out to the broader economy over the past ten years.

Similar results have been found for Canada, but the effects are considerably smaller (for a review of major Canadian studies, see Sharpe 2006). For instance, Colecchia and Schreyer (2002), in a study of nine OECD countries, find that ICT investment contributed, on average, between 0.3 and 0.9 of a percentage point per year to output growth over the period 1992-2000. The effect was nearly twice as large in the United States as in Canada (0.86 versus 0.47 of a percentage point).

A detailed study by Brox (2008b) focuses on the effect of investment in ICT on manufacturing production. All forms of investment serve to reduce unit manufacturing costs, but Brox estimates the rate of return on ICT capital to be approximately twice that on non-ICT capital. Even accounting for the fact that ICT depreciates more rapidly than other forms of investment, this rate is quite high. Furthermore, as Brox shows, ICT investment is distinctly different from other forms of investment in how it affects the organization of production.

Despite the overwhelming evidence of ICT’s strong productivity effects, Canada’s ICT investment gap with the United States has widened over the past 20 years (see figure 5). Part of this widening was due to the dot-com bubble in the United States in the late 1990s, but even since the crash, ICT investment intensity in manufacturing (as expressed as a percentage of manufacturing output) has been nearly twice as high in the United States as in Canada.

Sharpe (2005) offers several potential reasons for the persistence of this gap. One of the most important, as for investment in general, is high effective tax rates. He cites analysis by the C.D. Howe Institute that estimates the effective tax rate on ICT assets at 53.2 percent, compared with 35.2 percent for all investment assets, mainly because ICT equipment depreciates more rapidly than other forms of investment, and tax depreciation schedules do not take this into account. The United States has revised ICT depreciation schedules that more accurately reflect true service life, and Canadian tax policy could stimulate further ICT investment by making similar adjustments. Sharpe also suggests that Canadian managers might be more reluctant than their US counterparts to undertake the organizational changes and training needed to implement ICT effectively, which leads them to invest less in the technology.

In summary, of all forms of business investment, ICT has the greatest potential to enhance the productivity of Canadian manufacturers. It thus reinforces the more general need to reduce the tax burden on investment. In addition, bringing Canadian depreciation schedules more in line with actual service life would reduce the currently strong disincentive to invest in ICT. Because of the unique nature of ICT, policy-makers could even go one step further and subsidize ICT investment via preferential investment tax credits. The 2009 federal budget allows temporary “expensing” of investment in computers – meaning that the full cost of the investment can be deducted immediately rather than spread over a number of years – as a fiscal stimulus measure, but there are sound reasons to keep the after-tax cost of such investment low even after the recession is behind us.

Because of its potential to change how products are designed and manufactured, ICT investment is closely related to innovation. Indeed, one could argue that ICT investment is simply the tool that allows a firm to execute an innovative idea, whether a streamlined supply chain, enhanced customer service or a new product line. This suggests that successful diffusion of such technologies throughout the economy is critically dependent on the innovation environment.

The common perception of innovation focuses on technological improvements to products, such as GPS navigation systems for automobiles and ecologically friendly toilet flushing mechanisms. But innovation is much broader than product improvement and encompasses new processes that allow factors of production to be used more effectively in order to produce output at a lower overall cost. This involves direct production processes on the plant floor as well as improvements in supply chains and transportation facilities or procedures.

It is difficult to measure innovation directly, but one crude indicator is “total factor productivity,” which measures economic growth that cannot be accounted for by increases in capital, labour and raw materials – and hence, it is presumed, must be due to more efficient use of those factor inputs, improved quality of the inputs themselves or better-quality products.6 By this indicator, Canada’s manufacturing sector has lagged the US sector over the past ten years, with 9.9 percent cumulative growth for the former and 17.4 percent for the latter; the gap is even larger for the economy as a whole: 2.4 percent in Canada versus 12.9 percent in the United States.

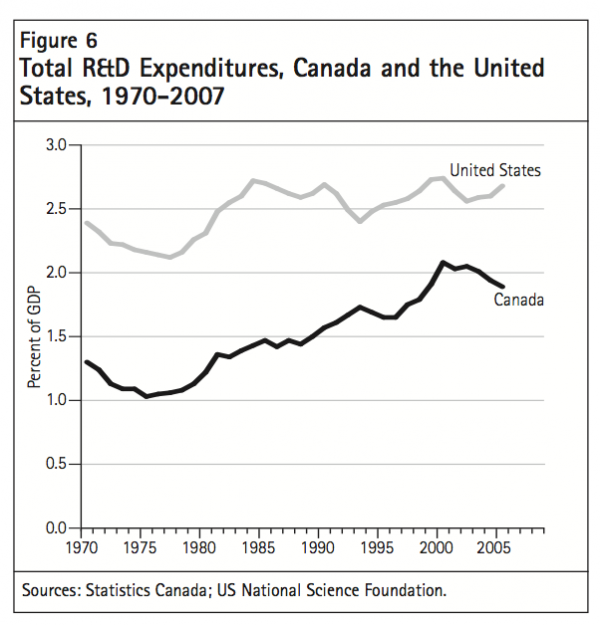

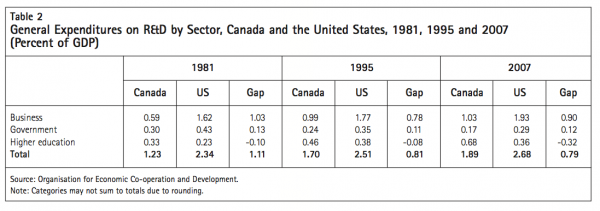

Investment in R&D activities is one important aspect of innovation. As figure 6 shows, expenditures on R&D as a percentage of GDP have been significantly higher in the United States than in Canada since 1970, although the gap has narrowed somewhat in recent years. Moreover, a closer look at the composition of R&D expenditures by sector of performance in the two countries over the past 25 years (see table 2) shows some considerable contrasts.

One difference is that the R&D gap is concentrated entirely in the business sector. Relative to GDP, university-performed research has doubled in Canada since 1981 and now exceeds that in the United States by a large margin. The gap in government-performed research is due entirely to the fact that more than half of US government-performed research is defencerelated, which has negligible effects on private-sector innovation.7 Much analytical research suggests that the business R&D gap is due more to structural differences between the Canadian and US economies than to poorly designed policies.

One study of the relative size and research intensity of numerous industries in Canada and the United States reveals some surprising trends (ab Aorwerth 2005). First, R&D intensity in research-intensive manufacturing sectors such as pharmaceuticals and ICT is considerably higher in Canada, but since these Canadian sectors are so much smaller than their US counterparts, their R&D is insufficient to close the gap. Second, research intensity in the large US automotive sector dwarfs that in Canada’s auto sector (15 percent of sales compared with less than 1 percent). This reflects the presence of US-owned auto makers and parts suppliers in Canada, whose R&D is typically performed south of the border. However, as noted earlier, the technologies generated by that US R&D are transferred to and used by their affiliates in Canada, benefiting both USand Canadian-owned firms. Except for the research-intensive sectors and the special case of automotive manufacturing, the business R&D gap between Canadian and US manufacturers is negligible.8

Yet Canada’s first-dollar R&D tax credit (which provides relief on all qualifying expenditures) is far more generous than the incremental credit in the United States (which applies only to R&D spending above a certain threshold determined by past R&D spending). Indeed, numerous empirical studies have suggested that Canada’s business R&D would be even lower in the absence of the tax credit.9 Nevertheless, it remains unclear why such a generous credit is needed to achieve merely passable levels of R&D intensity. McKenzie and Sershun (2005) present a compelling reason: generous tax treatment of the inputs to R&D is only one side of the story. Just as important to the decision to pursue R&D projects is the tax treatment of the eventual fruits of that R&D in production. The authors find that the tax treatment of capital (which embodies the innovations that R&D generates) has as large an effect on R&D spending as the tax treatment of R&D spending itself. High tax rates on capital take away much of the positive incentive for R&D that the tax credit gives, which reinforces the importance of lowering taxes on investment.

The growing importance of university research in Canada, if effectively transferred to industry, is also likely to have a positive impact on productivity. An examination of trends in Canadian manufacturing costs from 1961 to 2001 shows that increases in academic research are associated with decreases in unit costs (and, hence, increases in productivity), all other factors held constant, and that this relationship has strengthened over time (Brox 2007). Nonetheless, the effect is much smaller than that of other forms of investment. The cost elasticity of academic research is only -0.13, meaning that a 10-percent increase in university R&D funding would reduce manufacturing costs by only 1.3 percent, compared with 5 percent for infrastructure and 2.5 to 3 percent for private investment. This suggests that there is room for improvement in university-industry technology transfer.

In a detailed IRPP study of the issue, Niosi (2008) concludes that the relevance of academic research to business is limited, for several reasons. On the university side, academic researchers are more often motivated by the originality of research than by its usefulness to business. Furthermore, even if research does have commercial potential, the university infrastructure for identifying business opportunities (consisting primarily of technology transfer offices) is limited. On the business side, research partnerships with universities are dominated by very large firms; small and medium-sized firms have relatively little knowledge of, much less input into, university research directions. This is consistent with survey results showing that the abstract nature of university research and lack of information are among the factors businesses cite as barriers to successful partnerships (Bodell, Brox and Fader 2006).

Even though the Canada-US R&D gap might not be as worrying as many observers fear, the fact that a gap persists suggests that spending is only one piece of the innovation puzzle. R&D provides the ideas and experimental evidence to support them, but it takes smart investment, good management and a skilled work force to put them into productive action. Tang and Le (2007) capture these complexities by constructing an innovation index that includes the educational attainment of the labour force, investment in machinery and equipment, rates of patenting and R&D spending. They find that, although R&D alone has very weak positive effects on Canadian manufacturing productivity, their multidimensional index has strong productivity effects that build over time.

This clearly illustrates the interaction between the ability to create an innovation (via R&D spending and patenting) and the ability to put it into productive practice (via a highly skilled labour force that can effectively use the investment that so often embodies the innovation). These interrelationships are evident in work by Rao, Tang and Wang (2008), who examine the sources of the Canada-US gap in total factor productivity. They show that insufficient investment in machinery and equipment is by far the most important reason for Canada’s lagging performance, accounting for up to 90 percent of the shortfall. But the authors note that this “investment effect” hides more complex interactions among investment, R&D and workers’ skills.

There are also important interactions among R&D, innovation and ICT investment. The ICT-producing industries are the most research intensive in Canada’s manufacturing sector – R&D spending represents in excess of 25 percent of their sales. As noted earlier, however, it is the process innovations that information technologies allow, rather than the science-powering microchips themselves, that ultimately offer the most potential for broad-based productivity gains in the economy. Such process innovations require not only ICT investment, but also complementary investments in operations and supply chain management, as well as appropriate business management skills.

In many ways, Canada’s innovation problem is not an issue of science and technology per se but of economic incentives and rewards to entrepreneurship (McFetridge 2008). Canada has invested large sums of money in university research over the past ten years (largely by establishing Canada Research Chairs and increasing funding for research granting councils), and the tax treatment of business R&D is generous. The reason for Canadian businesses’ apparent inability to innovate as rapidly or effectively as their US counterparts might stem not from a lack of supply of innovative ideas and technologies, but from insufficient demand for their use. There are several potential reasons for this lack of demand, among the most important of which are relatively high taxes on investment and risk taking, low wages and regulatory barriers that dull competitive pressures.

A recurrent theme of the analysis is the need for a highly skilled workforce to reap the productivity benefits associated with innovation and investment. Productivity gains come from working more smartly, rather than from working more. “Human capital” – the educational attainment, work experience and problemsolving skills embedded in workers – is the vehicle by which the productive possibilities of innovation and investment are actually brought to fruition; see Rao, Tang and Wang (2002) for further discussion.

Evidence on the skill level of Canadian workers suggests that it is fairly high by international standards. Average years of schooling among the working-age population is nearly as high as in the United States (13.2 years versus 13.3 years in 2004) and has been rising in recent years. The percentage of the working-age population with university degrees is lower (22 percent versus 29 percent in 2004), but has also been rising relative to that in the United States (Riddell 2007). The large contrast with the United States is in the higher proportion of Canadian workers who have completed nonuniversity postsecondary courses, which includes vocational courses and other specialized technical training (34 percent versus 9 percent of US workers). The result is that 56 percent of Canadian workers have some form of formal education past high school compared with just 38 percent of US workers; the Canadian percentage is also more than twice the OECD average (Boothby and Drewes 2008).

Canadian workers’ apparent advantage in educational attainment, however, has not been fully reflected in the wage structure. In the United States, the “skills premium” – by which educational attainment beyond high school increases individuals’ earning profiles – increased substantially in the 1980s and 1990s as slower growth in the number of university graduates coincided with increasing demand for more highly skilled workers. By the end of the 1990s, the earnings of college-educated US men were, on average, more than 70 percent higher than those of high-school graduates; in the early 1980s, they had been less than 35 percent higher (Burbidge, Magee and Robb 2002). In Canada, the university skills premium has remained essentially steady in the range of 40 percent – though there is some evidence of a recent increase. The wage premium in Canada for postsecondary education other than university – which primarily consists of trade school training and certificates from colleges – is, however, much smaller than that for a university degree (Boothby and Drewes 2006).

The problem in Canada is not one of insufficient skills but of insufficient demand for them. Research by Brisebois, Orton and Saunders (2008) reveals a high proportion of Canadian workers who believe they are overqualified for their job – almost a quarter (23.7 percent) of the under-25 age group do so. The proportion declines sharply with age, to 11.5 percent for the 25-to-44 age group, although this is still the thirdhighest percentage in this age group in 17 countries the authors examine. They suggest that the relatively more common feeling of overqualification among Canadian workers is tied to a labour market that has an excess of relatively low-skilled, low-paying jobs despite strong economic growth over the past decade and an increasingly better educated workforce.

There is a close complementarity between skills and investment, which has been studied since the pioneering work of Griliches (1969). Essentially, the hypothesis holds that investment in equipment is associated with increasing demand for skilled labour, since the new equipment contains technologies that require greater skills to use effectively. While we are not aware of rigorous empirical analysis of this question for Canada with regard to investment generally, Yan (2006) finds that Canadian investment in ICT specifically has a strong positive effect on demand for skilled labour. This further reinforces the critical importance of investment as a productivity driver as well as a vehicle for taking advantage of underutilized workers’ skills.

Although there is considerable evidence of broadbased weakness in the demand for skilled labour, some pockets of skilled-labour shortages exist in manufacturing. There is considerable anecdotal and survey evidence of the difficulty of finding and training machinists, tool and die makers, electricians, welders and other “apprenticeable” occupations (Sharpe, Arsenault and Lapointe 2008). Labour market data are not detailed enough to quantify the magnitude of these shortages, but they clearly limit manufacturing’s ability to maximize productivity. Despite the shortages, completion rates for apprentice programs are low, information sharing among businesses, high schools and technical schools is inadequate and attractive job opportunities outside manufacturing draw job seekers away from apprenticeship-based careers.

Another large untapped pool of skills lies dormant in Canada’s recent immigrants, who will become an increasingly important source of labour force growth as the baby boomer generation retires (Gross 2004; Reitz 2005; Hum and Simpson 2007). On average, immigrants are better educated than the Canadianborn, but they often have trouble finding work in their field of expertise. Alboim, Finnie and Meng (2005) identify some of the institutional obstacles and constraints immigrants face, including the inadequate ability of Canadian employers to assess educational credentials and work experience acquired in the immigrant’s home country and the lack of bridge training and mentoring programs to provide immigrants with the Canadian education and experience many employers demand.

Some immigrants cannot find suitable work because their particular skills are not in demand. Under its current economic immigration policy, Canada seeks to admit well-educated immigrants regardless of their field of study or professional orientation, but it might be advisable to expand selection criteria to include projected labour market needs, as Australia has done (Hawthorne 2008). Since 1999, Australia has awarded bonus points to applicants in fields that suffer from labour shortages, and as a result the employment and earnings performance of recent immigrants in that country is far better than in Canada.

Canada could also make better use of immigrants’ skills if labour market flexibility within the country were improved – one could say that Canada needs an interprovincial labour mobility pact. A number of studes suggest that discordant regulations on accreditation and certification at the provincial level reduce Canadian labour market efficiency (see Harris and Lemieux 2005; Duina 2006). This is a particular challenge for immigrants: while the federal government is responsible for the selection of immigrants (except in Quebec), the provinces control entry into most trades and professions and administer immigrant adaptation and settlement programs. The federal government could address this disconnect if it provided a better clearing house for information on assessing immigrants’ credentials (see Alboim and MacIsaac 2007). Progress is being made: in January 2009, the Council of the Federation agreed in principle to endorse amendments to the Agreement on Internal Trade that permit any worker certified for an occupation by a regulatory authority of one province or territory to be recognized as qualified for that occupation by all others.

The determinants of labour productivity in Canadian manufacturing are complex and interrelated, but there are several themes that should help the development of policies to shore up manufacturing competitiveness.

Relative to that of the United States, Canada’s economy is investment poor, yet investment is precisely the vehicle through which most productivity improvements flow – whether in the form of machines embedded with new technologies that improve the efficiency of workers, computers and networking equipment that allow for reorganization of production processes, or public infrastructure that provides the very foundations on which firms can build their competitiveness. Canada suffers from significant weakness in all these areas; addressing them is critical to improving productivity growth.

Evidence suggests that, on a dollar-for-dollar basis, investment in the construction and maintenance of roads, bridges and other key public infrastructure is almost twice as effective as private investment at stimulating manufacturing productivity. Essentially, this is because we have allowed the state of this infrastructure to erode over the past several decades. Accelerating infrastructure investment would have the added advantage of serving as a fiscal stimulus that simultaneously would reinforce the longterm strength of the economy.

The particular importance of private investment is in machinery and equipment – especially information and communication technology. As with infrastructure, the Canada-US ICT gap among manufacturers is significantly larger than for private investment as a whole; as a result, Canadian firms have not been able to reap the sizable productivity gains seen in the United States. Such investment, moreover, has indirect effects that would enhance economic performance, including stimulating technological innovation and increasing demand for high-skilled and well-paying jobs. It thus should be singled out for specific tax relief – in the form of investment tax credits and accelerated depreciation schedules – beyond already-legislated reductions in statutory corporate tax rates. The 2009 federal budget includes temporary measures that allow accelerated writeoff of manufacturing processing equipment and expensing of investment in computers as part of its fiscal stimulus package, but there are compelling reasons to make such preferential tax treatment permanent. Just like infrastructure spending, such tax credits would provide an economic boost in the short term while rebuilding Canadian manufacturing’s competitive foundations in the medium and long term.

While difficult to measure accurately, Canada appears to lag the United States substantially in innovation, even though the R&D spending gap has narrowed considerably. Relative to the size of the economy, R&D performed by Canadian universities and government laboratories is on a par with that by their US counterparts, while the business R&D spending gap between the two countries is entirely concentrated in the Canadian automotive sector, whose source of innovation is the large amount of R&D conducted by US parent companies.

Additional public investment in R&D over the past decade has not succeeded in improving business innovation in Canada. Policy-makers thus should look elsewhere and take advantage of the strong symbiotic relationship among innovation, information technology and foreign direct investment. Innovative ideas for improving business efficiency and product design are not in short supply in Canada, but often require investment in equipment (both ICT and non-ICT) to be exploited effectively. Furthermore, empirical evidence decisively shows that the productivity benefits from technology imported by foreign firms that establish production facilities in Canada spill over to their Canadian counterparts – a win-win economic proposition. This might call for further loosening of foreign ownership limitations and a review of FDI criteria along the lines proposed by the Competition Policy Review Panel.

A second shortcoming of Canada’s innovation policy is its inability to connect the ideas generated in universities to their effective use in business. The small positive effect that academic research has on manufacturing productivity could be significantly enlarged if there were more information sharing between firms and university researchers about economically promising research directions.

Canada boasts one of the highest rates of postsecondary education attainment in the industrialized world, but the skills intensity of these universitytrained workers in manufacturing – measured by the proportion of hours they work – is much lower than in the United States. This is symptomatic of a tremendous amount of human capital going to waste. Since Canada’s relatively sluggish demand for highly

skilled manufacturing workers stems primarily from the capital investment gap between the two countries, increasing investment in equipment that embodies the latest technologies would increase the demand for the skilled labour to operate it, as well as the wages of Canadian workers.

The barriers that recent immigrants face in being able to use the skills they have brought with them from abroad also represent an ongoing challenge for policy-makers. Although the economy is in a cyclical recession right now, the coming retirement of the baby boomers means that immigrants will be critical to filling projected labour shortages in the years ahead. Policy reforms in this area should involve not just improving the process of credentials recognition but rethinking the role that current labour market needs should play in immigrant selection.

Although the supply of factors that contribute to productivity growth in Canada is generally sufficient – for example, Canada invests heavily in R&D and the skill level of its workers is high by international standards – the problem is a lack of demand for innovation, physical capital and highly skilled employees. Reducing business taxes would increase incentives to invest in machinery and equipment, which would spur demand for skilled workers and innovative production processes. If Canadian manufacturers are to live up to their productive potential, policy-makers will need a broader understanding of the barriers to an innovative and competitive market environment. These barriers include the role of regulatory policies, the ability and willingness of business managers to exploit the innovation opportunities of information technologies, and the relatively small size of Canada’s domestic market.

Advisory Panel on Canada’s System of International Taxation. 2008. Enhancing Canada’s International Tax Advantage: Final Report. Ottawa: Department of Finance. Accessed April 28, 2009. https://www.apcsit-gcrcfi.ca/07/index-eng.html.

ab Aorwerth, A. 2005. “Canada’s Low Business R&D Intensity: The Role of Industry Composition.” Working Paper 2005-03. Ottawa: Department of Finance.

Alboim, N., R. Finnie, and R. Meng. 2005. “The Discounting of Immigrants’ Skills in Canada: Evidence and Policy Recommendations.” IRPP Choices 11 (2).

Alboim, N., and E. McIsaac. 2007. “Making the Connections Ottawa’s Role in Immigrant Employment.” IRPP Choices 13 (3).

Baldwin, J.R., and W. Gu. 2004. “Trade Liberalization: Export-Market Participation, Productivity Growth, and Innovation.” Oxford Review of Economic Policy 20 (3): 372-92.

———–. 2005. “Global Links: Multinationals, Foreign Ownership and Productivity Growth in Canadian Manufacturing.” Cat. 11-622-MIE, no. 009. Ottawa: Statistics Canada.

————. 2006a. “The Impact of Trade on Plant Scale, Production-Run Length and Diversification.” Cat. 11F0027MIE no. 38. Ottawa: Statistics Canada.

————. 2006b. “Plant Turnover and Productivity Growth in Canadian Manufacturing.” Industrial and Corporate Change 5 (3): 417-65.

————. 2007. “Long-Term Productivity Growth in Canada and the United States.” Cat. no. 15-206-XWE. Ottawa: Statistics Canada.

Baldwin, J.R., R.S. Jarmin, and J. Tang. 2004. “Small North American Producers Give Ground in the 1990s.” Small Business Economics 23 (4): 349-61.

Baldwin, J.R., and J. Tang. 2003. “The Contribution of Small and Medium-Sized Producers to the Productivity Gap between the Manufacturing Sectors of Canada and the United States.” Presentation to the Canadian Economics Association Meetings, Ottawa, May.

Bodell, R., J.A. Brox, and C. Fader. 2006. “Canadian University Policies on Intellectual Property and the Rate of Technology Transfer.” In Structural Reform and the Transformation of Organisations and Businesses, edited by J.A. Brox, R.E. Caterall, and P. Koveos. Waterloo, ON: North Waterloo Academic Press.

Boothby, D., and T. Drewes. 2006. “Postsecondary Education in Canada: Returns to University, College and Trades Education.” Canadian Public Policy 32 (1): 1-21.

Brisebois, R., L. Orton, and R. Saunders. 2008. “Connecting Supply and Demand in Canada’s Youth Labour Market.” CPRN Research Report: Pathways to the Labour Market Series 8. Ottawa: Canadian Policy Research Networks.

Britton, J.N.H. 1998. “Is the Impact of the North American Trade Agreements Zero? The Canadian Case.” Canadian Journal of Regional Science 21 (2): 167-96.

Brox, J.A. 2001. “Changing Patterns of Regional and International Trade: The Case of Canada under NAFTA.” International Trade Journal 15 (4): 383-407.

————. 2006. “NAFTA, Infrastructure and the Canadian Automotive Sector.” Journal of Economic Asymmetries 3 (2): 23-42.

————. 2007. “Academic Research and Productivity in Canadian Manufacturing.” Industry and Higher Education 21 (2): 145-58.

————. 2008a. “A High Valued Canadian Dollar and Canadian Manufacturing: Disaster or Opportunity.” Presentation to the International Banking, Economics and Finance Association Summer Meeting and the 83rd Annual Meeting of the Western Economics Association International, Waikiki, HI, June 30-July 1.

————. 2008b. “Investment in Information and Communications Technology and Productivity in a Small Open Economy.” Presentation to the 35th Annual Conference of the Atlantic Canada Economics Association, Wolfville, NS, October 25.

————. 2008c. “Infrastructure Investment: The Foundation of Canadian Competitiveness.” IRPP Policy Matters 9 (2). Brox, J.A., and C.A. Fader. 1997. “Assessing the Impact of JIT

Using Economic Theory.” Journal of Operations Management 15: 371-88.

————. 2002. “The Set of Just-in-Time Management Strategies: An Assessment of Their Impact on Plant-Level Productivity and Input-Factor Substitutability Using Variable Cost Function Estimates.” International Journal of Production Research 40 (12): 2705-20.

Brynjolfsson, E. 1993. “The Productivity Paradox of Information Technology.” Communications of the ACM 36 (12): 67-77.

Brynjolfsson, E., and L.M. Hitt. 2000. “Beyond Computation: Information Technology, Organizational Transformation and Business Performance.” Journal of Economic Perspectives 14 (4): 23-48.

————. 2003. “Computing Productivity: Firm-Level Evidence.” Review of Economics and Statistics 85 (4): 793-808.

Burbidge, J.B., L. Magee, and A.L. Robb. 2002. “The Education Premium in Canada and the United States.” Canadian Public Policy 28 (2): 203-17.

Callen, J.L., M. Morel, and C. Fader. 2005. “Productivity Measurement and the Relationship between Plant Performance and JIT Intensity.” Contemporary Accounting Research 22 (2): 271-309.

Chakrabati, A.K., and C.L. Anyanwu. 1993. “Defense R&D, Technology, and Economic Performance: A Longitudinal Analysis of the U.S. Experience.” Engineering Management 40 (2): 136-45.

Chen, D., and J. Mintz. 2008. “Still a Wallflower: The 2008 Report on Canada’s International Tax Competitiveness.” C.D. Howe Institute e-Brief, September. Accessed April 28, 2009. https://www.cdhowe.org/pdf/ebrief_63.pdf.

Colecchia, A., and P. Schreyer. 2002. “ICT Investment and Economic Growth in the 1990s: Is the United States a Unique Case?” Review of Economic Dynamics 5: 408-42.

Cummins, J., K. Hassett, and G. Hubbard. 1995. “A Reconsideration of Investment Behavior Using Tax Reforms as Natural Experiments.” Brookings Papers on Economic Activity 52: 237-73.

Daly, D.J. 1998. “Canadian Research on the Production Effects of Free Trade: A Summary and Implications for Mexico.” North American Journal of Economics and Finance 9 (2): 147-67.

Djankov, S., T. Ganser, C. McLiesh, R. Ramalho, and A. Schleifer. 2008. “The Effect of Corporate Taxes on Investment and Entrepreneurship.” Paper presented at the American Enterprise Institute seminar “Assessing the Effects of Corporate Taxation,” March 17.

Duina, F. 2006. The Social Construction of Free Trade: The European Union, NAFTA, and Mercosur. Princeton, NJ: Princeton University Press.

Gholami, R., S.-Y.T. Lee, and A. Heshmati. 2006. “The Causal Relationship between Information and Communication Technology and Foreign Direct Investment.” World Economy 29 (1): 43-62.

Gordon, R.J. 2000. “Does the ”˜New Economy’ Measure Up to the Great Inventions of the Past?” Journal of Economic Perspectives 14 (4): 49-74.

Griliches, Z. 1969. “Capital-Skill Complementarity.” Review of Economics and Statistics 51 (4) 465-8.

Gross, D.M. 2004. “Impact of Immigrant Workers on a Regional Labour Market.” Applied Economics Letters 11 (7): 405-8.

Harris, R.G., and T. Lemieux, eds. 2005. Social and Labour Market Aspects of North American Linkages. Calgary: University of Calgary Press.

Hart, M. 2007. “Canadian Engagement in the Global Economy.” In A Canadian Priorities Agenda: Policy Choices to Improve Economic and Social Well-Being, edited by J. Leonard, C. Ragan, and F. St-Hilaire. Montreal: Institute for Research on Public Policy.

Hawthorne, L. 2008. “The Impact of Economic Selection Policy on Labour Market Outcomes for Degree-Qualified Immigrants in Canada and Australia.” IRPP Choices 14 (5).

Helliwell, J.F. 1996. “Do National Borders Matters for Quebec’s Trade?” Canadian Journal of Economics 29 (3): 507-22.

Hum, D., and W. Simpson. 2007. “The Legacy of Immigration: Labour Market Performance and Education in the Second Generation.” Applied Economics 39 (13-15): 1985-2009.

Jorgenson, D.W., M.S. Ho, and K.J. Stiroh. 2008. “A Retrospective Look at the U.S. Productivity Growth Resurgence.” Journal of Economic Perspectives 22 (1): 3-24.

Leung, D., C. Meh, and Y. Terajima. 2008. “Productivity in Canada: Does Firm Size Matter?” Bank of Canada Review (Autumn): 5-13.

LaRochelle-Côté, S. 2007. “Tariff Reduction and Employment in Canadian Manufacturing.” Canadian Journal of Economics 40 (3): 843-60.

Macdonald, R. 2008. “An Examination of Public Capital’s Role in Production.” Cat. 11F0027-MIE No. 050. Ottawa: Statistics Canada.

McFetridge, D.G. 2008. “The Role of Sectoral Ownership Restrictions.” Research document prepared for the Competition Policy Review Panel. Ottawa.

McKenzie, K., and N. Sershun. 2005. “Taxation and R&D: An Investigation of Push and Pull Effects.” IAPR Technical Paper, Institute for Advanced Policy Research, University of Calgary.

Niosi, J. 2008. “Connecting the Dots Between University Research and Industrial Innovation.” IRPP Choices 14 (14).

Parsons, M. 2008. “The Effect of Corporate Taxes on Canadian Investment: An Empirical Investigation.” Working Paper 2008-01. Ottawa: Department of Finance.

Parsons, M., and N. Phillips. 2007. “An Evaluation of the Federal Tax Credit for Scientific Research and Experimental Development.” Working Paper 2007-08. Ottawa: Department of Finance.

Rao, S., J. Tang, and W. Wang. 2002. “The Importance of Skills for Innovation and Productivity.” International Productivity Monitor 4 (spring): 15-26.

————. 2008. “What Explains the Canada-US Labour Productivity Gap?” Canadian Public Policy 34 (2): 163-92.

Reitz, J.G. 2005. “Tapping Immigrants’ Skills: New Directions for Canadian Immigration Policy in the Knowledge Economy.” IRPP Choices 11 (1).

Riddell, W.C. 2007. “Investing in Human Capital: Policy Priorities for Canada.” In A Canadian Priorities Agenda: Policy Choices to Improve Economic and Social Well-Being, edited by J. Leonard, C. Ragan, and F. St-Hilaire. Montreal: Institute for Research on Public Policy.

Sharpe, A. 2003. “Why Are Americans More Productive than Canadians?” International Productivity Monitor 6 (spring): 19-36.

————. 2005. “What Explains the Canadian-US ICT Investment Gap?” International Productivity Monitor 11 (fall): 21-38.

————. 2006. “The Relationship Between ICT Investment and Productivity in the Canadian Economy: A Review of the Evidence.” CSLS Research Report 2006-05.

Sharpe, A., J.-F. Arsenault, and S. Lapointe. 2008. “Apprenticeship Issues and Challenges Facing Canadian Manufacturing Industries.” CSLS Research Report 2008-2. Ottawa: Centre for the Study of Living Standards.

Solow, Robert M. 1987. “We’d Better Watch Out.” New York Times Book Review, July 12, 36.

Tang, J., and C.D. Le. 2007. “Multidimensional Innovation and Productivity.” Economics of Innovation and New Technology 16 (7-8): 501-16.

Tang, J., and S. Rao. 2001. “R&D Propensity and Productivity Performance of Foreign-Controlled Firms in Canada.” Working Paper 33. Ottawa: Industry Canada.

Trefler, D. 2004. “The Long and Short of the Canada-U.S. Free Trade Agreement.” American Economic Review 94 (4): 870-95.

Triplett, J.E. 1999. “The Solow Productivity Paradox: What Do Computers Do to Productivity?” Canadian Journal of Economics 32 (2): 309-34.

Vigfusson, R. 2008. “How Does the Border Affect Productivity? Evidence from American and Canadian Manufacturing Industries.” Review of Economics and Statistics 90 (1): 49-64.

Wright, C., and D. Holt. 2007. “Canada’s Free Trade Lessons for the World.” IRPP Policy Options 28 (9): 14-22.

Yan, B. 2006. “Demand for Skills in Canada: The Role of Foreign Outsourcing and Information-Communication Technology.” Canadian Journal of Economics 39 (1): 53-67.

James A. Brox is professor of economics at the University of Waterloo. He is the author of over one hundred articles, books, book chapters, monographs, and technical reports on various economic issues, usually with a strong policy focus. He has been chair of the economics department at the University of Waterloo (1996- 2005), president of the University of Waterloo Faculty Association (1984-86 and 1992-94), and associate dean of arts for computing (1989-90). He is currently president-elect of the International Banking, Economics, and Finance Association. He is an honorary life member of the Atlantic Canada Economics Association.

Jeremy Leonard is senior fellow at the Institute for Research on Public Policy. He has been affiliated with the IRPP in a variety of research capacities since 1994. He is the co-editor of A Canadian Priorities Agenda: Policy Choices to Improve Economic and Social Well-Being (IRPP 2007), and currently directs the Institute’s research activities on innovation and competitiveness. Prior to his association with the IRPP, he was a policy analyst with the Committee for Economic Development, based in Washington, DC, and an economist with the Manufacturers Alliance/MAPI in Arlington, Virginia. He holds an MA in economics summa cum laude from McGill University and a BA in philosophy from the University of Pennsylvania.

This publication was produced under the direction of France St-Hilaire, Vice-President, Research, IRPP. The manuscript was copy-edited by Barry Norris, proofreading was by Zofia Laubitz, production was by Chantal Létourneau, art direction was by Schumacher Design and printing was by AGL Graphiques.

Copyright belongs to IRPP. To order or request permission to reprint, contact:

IRPP

1470 Peel Street, Suite 200

Montreal, Quebec H3A 1T1

Telephone: 514-985-2461

Fax: 514-985-2559

E-mail: irpp@nullirpp.org