More than 60 percent of working Canadians currently don’t have a workplace pension. For those who do have one, it does not guarantee them retirement security. With employers increasingly opting for defined-contribution (DC) rather than defined-benefit (DB) pension plans, the burden of managing the risks associated with a pension – such as longevity and the market performance of assets – has shifted to the worker.

While this shift may have curtailed pension costs for businesses, as Robert Brown and Tyler Meredith argue, it has also left workers more vulnerable financially, since many do not have the wherewithal to plan effectively for retirement. In this study the authors explore ways to improve pension coverage and better manage risk for pension members, while also providing cost predictability for employers.

With respect to the policy reform proposals currently on the table, they find that although expanding the CPP/QPP would be worthwhile, it is unlikely to be undertaken in the current economic and political environment. Meanwhile, the pooled registered pension plan (PRPP), recently introduced by the federal government, lacks mandatory employer contributions and will do little to reduce risks for individuals.

The authors instead propose a voluntary pooled target-benefit pension plan (PTBPP). It would involve commingling assets across all participating workplaces to maximize scale efficiencies in investment and manage actuarial risk. Employers’ matching contributions would be mandatory but fixed, as in a DC plan. As with the PRPP, it would be available to individuals and the self-employed.

Most importantly, upon retirement, members could expect a benefit within a target range, depending on market performance. The authors suggest a minimum benchmark of 50 percent income replacement, requiring a slightly higher contribution rate than in many DC plans today.

While the target-benefit design would not eliminate the risk that benefits decrease due to market underperformance, the model proposed includes mechanisms to mitigate this risk. The plan would be managed by actuaries and investment managers, instead of by workers. To curtail administrative costs, the PTBPPs would be required to maintain a minimum pool of $10 billion, with management fees capped at 40 basis points, which would be considerably more cost-efficient than are most DC plans and RRSPs today (250 to 300 basis points).

In sum, for employers the proposed model would provide protection from pension cost volatility, and for employees it would offer more effective retirement saving through low administrative costs and reasonable retirement benefits. For many workers and employers this would be a vast improvement over their situation today.

Brown and Meredith conclude that the PTBPP could be implemented within the legislative framework recently created for PRPPs, but this would require concerted action by the provinces.

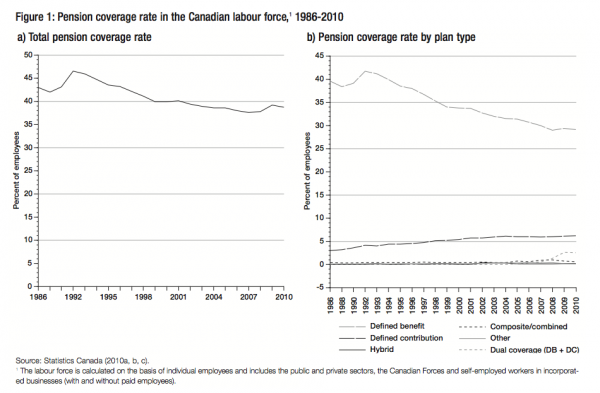

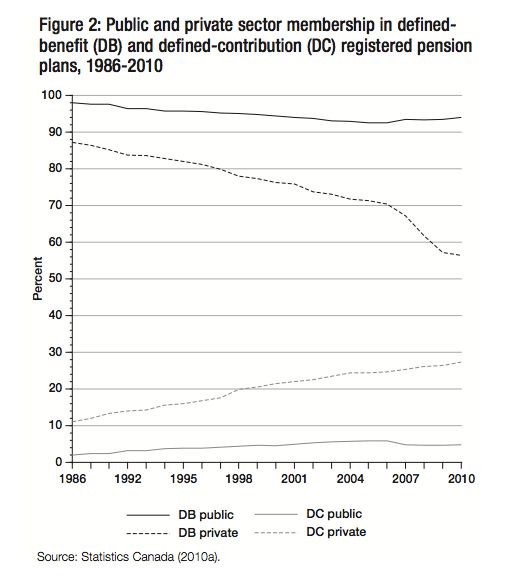

The world of employer-sponsored pension plans is evolving. While the traditional definedbenefit (DB) pension plan remains the primary model for occupational pensions — where they exist — DB pensions have been in a slow and persistent decline for more than two decades. This decline can be measured in different ways: (1) Between 1986 and 2010, the proportion of the Canadian labour force covered by DB pension plans shrank from 39 percent to 29 percent, while over the same period the number of employees covered by definedcontribution (DC) pension plans nearly tripled. (2) The share of registered pension plan members covered by a DB plan fell from 92 to 75 percent, while the proportion in a DC plan doubled from 7 to 16 percent (with the remaining 9 percent covered by hybrid and combined plans) (Statistics Canada 2010b,c).

These statistics tell us that there has been a notable shift away from DB pensions. In part, this is the result of the conversion of some plans to either a DC or group registered retirement savings plan (RRSP) model;1 the Vale Inco and RBC Group plans are some examples. However, the increasing popularity of DC and DC-like pensions is only part of the story. The growth of the labour force outside of industries in which DB coverage has been the prevalent model (Gougeon 2009) and the decline in workplace pension coverage overall have left many Canadian workers vulnerable amid worsening conditions for retirement saving (Canadian Institute of Actuaries 2007).

More pointedly, this new pension landscape raises important questions of equity. As in many other countries, in Canada the decline of DB pensions has been felt almost exclusively in the private sector. Among public sector workers, 86 percent have workplace pensions, of which 94 percent are DB. Yet only 25 percent of Canadian private sector workers have workplace pensions, and only 56 percent of those are DB (Statistics Canada 2011). The concern is that for middle-income Canadians, access to a stable, secure and adequate standard of living after retirement increasingly depends on where one is employed. Figures 1 and 2 illustrate these trends in pension coverage across the Canadian labour market.2

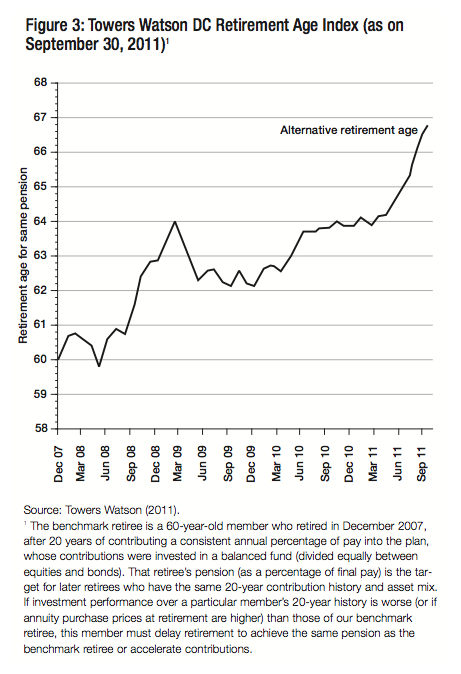

The decline in DB coverage, the growth of DC plans and the decrease in workplace pension coverage among newer cohorts of workers stem from decisions that many private sector employers have made to reduce their exposure to high and volatile pension costs and to shift a greater part of the burden of retirement saving onto employees. At the same time, the financial crisis of 2008-09 has clearly shown the pitfalls of saving for retirement in individual-directed DC accounts. The 2011 Towers Watson DC Retirement Age Index (figure 3) uses market performance to calculate the age at which an average middle-income worker paying into a DC plan can retire with sufficient asset value to pay for a life annuity guaranteeing an average rate of income replacement.3 According to the index, workers have had to increase their retirement savings by an equivalent of seven years just to balance off losses since the financial crisis of autumn 2008. For many, this means making a trade-off between taking early retirement and achieving the desired standard of living.

In response to these worrying trends, Canadian governments have been considering two very different, though not exclusive, approaches to reform: (1) expanding earnings-related public pension coverage through the Canada and Quebec Pension Plans (CPP/QPP), and (2) enhancing private pension plan coverage in the workplace. At the annual meeting of federal, provincial and territorial finance ministers in December 2010, the federal government unveiled the pooled registered pension plan (PRPP) as its preferred option for improving retirement savings. The provinces and territories have endorsed this plan, an option that clearly belongs to the second approach. Nevertheless, a number of provinces, notably Ontario (McFarland 2011), continue to press Ottawa for a “modest” expansion of the CPP.

In light of the pending implementation of PRPPs and ongoing concerns about the retirement income system, we take stock of the proposed reforms, assessing their potential to address the fundamental challenges that underlie the retirement and savings prospects of Canadians. After presenting the results of our assessment, we put forward an alternative proposal that we believe will provide greater retirement income security to more Canadians.

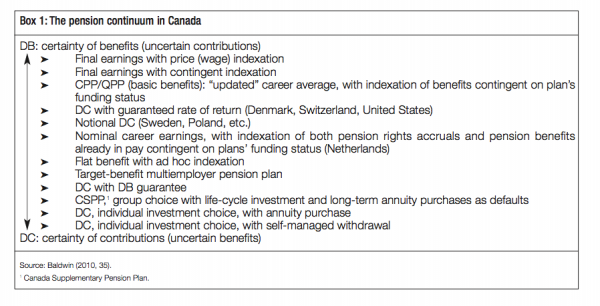

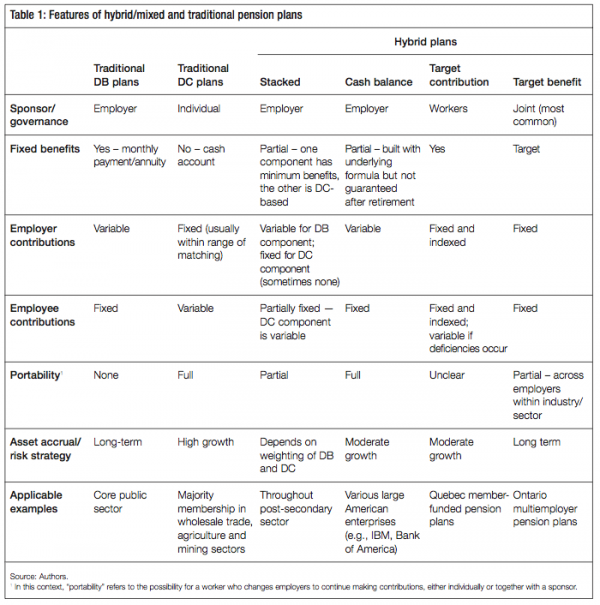

Before we analyze the details of the proposed reforms, it is important to outline the risks and other considerations inherent in different choices in pension design. Although many perceive the available options as being a binary choice between the DB and DC models, there is in fact a wide range of design choices and models along the spectrum, as box 1 illustrates.

Between the DB and DC plans is a series of plans that are referred to interchangeably as “hybrid” or “mixed” pension plans. In the aggregate, such plans represent a relatively small portion of pension membership in Canada — approximately 10 percent in 2010 (Statistics Canada 2010b). This should not, however, be interpreted as an absence of variation or experimentation in pension design.

Although few plans are explicitly designed to blend both DB and DC components into a “hybrid,” many plans classified as either one or the other differ at least marginally from the typical employer-based (DB) or employee-based (DC) models of risk sharing. In this respect, the notion that pensions are either purely DB or purely DC is not a useful framework for understanding current pension realities. This section attempts to disentangle some of these concepts and offer a clearer guide for analyzing pension design.

In a classic DB plan the benefit to be paid to workers upon retirement is defined in the plan. In this type of plan, the sponsor is legally responsible for funding the plan sufficiently to achieve the established benefit and ensuring any necessary changes in contributions, should circumstances require. This is not to say that plan sponsors take on these obligations forever

— in a union environment the process of collective bargaining often results in renegotiation

— but the pension’s management risks are carried by the plan sponsor who is, nominally, the investor. Among these risks are the following:

Even though the plan sponsor carries these risks, the company’s shareholders or its customers may ultimately bear the costs. Conversely, workers will argue that all of these risks are ultimately borne by the workers through their total compensation package. However, regardless of who ultimately pays the bill, it is the employer/plan sponsor who decides whether the plan is DB or DC, or whether there is a plan at all — although, in industries where unions are strong, this may be a debatable point.

In the early days of pension plans, sponsors were able to offer significant benefits at a relatively low cost. This was true because vesting periods were long, indexation of benefits to inflation was rare, and pension funding requirements allowed for the use of discount rates that reflected the full equity premium as well as a number of averaging mechanisms in determining the funding status. With the advent of various changes in provincial acts governing pension benefits in the early 1980s, vesting periods were shortened considerably.4 The high inflation rates of the late 1970s and early 1980s caused more workers to bargain for inflation protection. And while high rates of return on investments allowed plan sponsors to continue to promise large retirement benefits during the 1990s, three severe setbacks in financial markets in the past decade have resulted in significant actuarial deficits in a number of DB plans. These deficits have forced increases in contribution rates for members and have led a number of provinces to weaken the solvency regulations for pension plans (Archer 2011).

The latest round of changes to global accounting standards following the 2008 recession has further complicated the situation. Specifically, the introduction of “mark to market” valuation as of 2013 will eliminate the smoothing of pension costs based on future expected rates of return in favour of a present-day valuation. Employer financial statements will therefore become more volatile as pension deficiencies and surpluses are recorded in tandem with market performance.

Taken together with the general aging of the workforce and the rising ratio of retirees to contributors, these factors have made DB pensions more onerous for employers and shifted many of the contribution costs forward, closer to the present. Perhaps more importantly, recent turbulence in financial markets has increased the volatility of contribution rates significantly. It is no wonder that many private sector plan sponsors have decided that they can no longer afford the vagaries of the full DB pension promise.

We would be remiss to leave the impression that DB plans are without risk for plan members. A worker in a private sector single-employer pension plan (SEPP) ends up bearing the risk of insolvency of the plan sponsor if the insolvency occurs at a time when the liabilities of the plan are underfunded. Unlike workers covered by a multiemployer pension plan (MEPP) or a public service pension program, which theoretically collectivizes risk, SEPP members have no protection for the accrued value of their pension benefits.5 Once in bankruptcy, the plan and its members possess very limited rights as creditors against the remaining assets of the plan sponsor (see Davis 2011). The bankruptcies at Nortel and AbitibiBowater have shown that unless the government is willing to bail out the plans at full cost, DB pensions are far from being risk-free to the worker.

Other significant drawbacks of traditional DB plans are their limited portability and the method used to calculate termination benefits. For example, the financial cost to a worker leaving a fairly generous DB plan midway through his or her career could represent a loss of benefit accruals of as much as 45 percent relative to a continuing plan member with similar career earnings.6 This cost can serve as a significant deterrent to employment mobility and is increasingly problematic in a labour market where most individuals work for more than one employer over the course of their careers.

In a classic DC plan, it is the contribution that is defined.7 The level of retirement income that the defined contribution will produce is unknown and depends highly on the investment return (after management fees) that the DC fund can achieve. The plan sponsor has normally met all its requirements once it has made its contribution (assuming the plan requires a contribution from the sponsor).

With a DC plan, the worker in effect carries all the pension risks. If, for whatever reason, it becomes apparent that the plan’s funding is insufficient to meet retirement income objectives, it is up to the worker to supplement the funds in the account. And while many of the risks can be mitigated to a certain extent, the cost of mitigation can often be so high as to make it unadvisable.

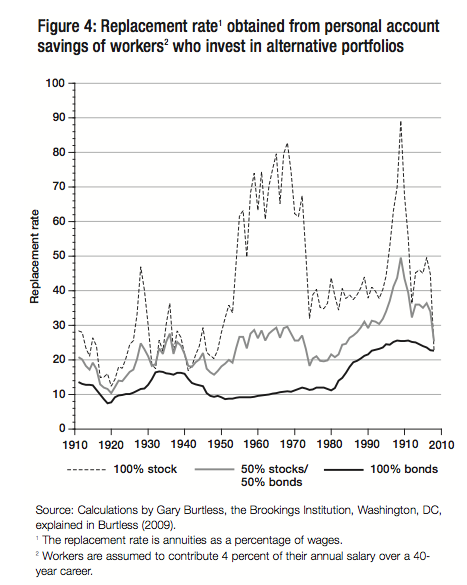

The investment risk, which is now the responsibility of the individual worker, is illustrated in figure 4. Clearly, the worker can decrease the portfolio risk by diversifying and choosing less volatile investments, such as government bonds. While it is true the volatility decreases markedly, so too do the earnings replacement rates.

Individuals can mitigate their DC investment risk in a number of ways. For instance, the employer/sponsor may suggest a default investment option as well as a number of other options rated according to risk exposure. Interestingly, the more options provided, the higher is the probability that a worker will choose the default option (Antolin, Payet, and Yermo 2010).

Alternatively, the worker can hire an investment adviser. Although this may reduce the investment risk, it certainly increases investment management costs. Individuals can easily lose 3 percentage points (300 basis points) of their gross rate of return to the investment adviser or fund manager (referred to as the management expense ratio, or MER).8 If funds earn in the neighbourhood of 5 percent per annum and inflation runs close to 2 percent (not unusual assumptions in the current environment), then such a worker is actually receiving a zero real rate of return. We discuss the significant impact of investment fees on pension outcomes below.

In addition, workers tend not to adjust their investment portfolio mix as they approach retirement. The literature tells us that one should move out of a strong equity portfolio to more of a bond portfolio as one nears retirement (Ambachtsheer 2010). This shift is actually seldom seen when individuals manage their own investments. Thus, many (or most) individual account holders lost 20 to 30 percent of their equity investment values between the summer of 2008 and the spring of 2009. Estimates published by the OECD (Antolin 2009) suggest that the market crash of 2008 may have led to a drop in earnings replacement ratios of almost 10 percentage points.9

The worker can also mitigate the longevity risk by buying an individual life annuity upon retirement. However, the purchaser bears both an interest-rate risk at the point in time the annuity is purchased (if higher interest rates become available later and the purchaser is locked into a low rate), as well as the cost risk of paying “full” price for the annuity if the purchaser’s health prospects are substandard relative to the high actuarial life expectancies assumed by insurers. Annuities can be a cost-effective method for protecting benefits, but not necessarily for all workers.

Finally, it is very difficult to get an annuity that provides true inflation protection. One can buy variable annuities whose payouts move with market values, but market values do not correlate well with inflation. Or one can buy an annuity where the annual payout increases according to a set (constant) inflation factor, but this is far from true inflation protection (and, of course, this feature greatly decreases the initial monthly payout).

While employer-sponsored DC plans remain more advantageous to workers than self-directed RRSP or tax-free savings account (TFSA) options, the risks are still considerable. The real problem, however, stems from the fact that few individuals are capable of assessing the risks involved and gauging the adjustments required to effectively plan for retirement (see Schwartz 2010). Moreover, given stagnant real wages, the inability to adjust to or compensate for market volatility leaves many vulnerable to insecure retirement futures. One cannot achieve a guaranteed level of retirement income simply through savings.

A growing number of individuals are now covered by a pension plan that is neither traditional DB nor traditional DC. While it is still a relatively small proportion of total registered pension plan coverage, as of 2010 more than 530,000 workers were covered by hybrid plans as classified by Statistics Canada. Growth in their membership has been nearly tenfold since 1986 (Statistics Canada 2010b). It is important to emphasize that these figures do not include a number of DB regulated plans that possess important elements of hybrid design, such as target-benefit plans. When these are included, as many as one million more workers could be added to the hybrid plan pool, representing a strong cross-section of the Canadian labour force.10 The pension plans of most Canadian universities, for example, are hybrids, with members participating in a DC plan that includes a guaranteed minimum defined benefit.

Generally, hybrid pensions come in one of four models, each with significantly different implications for employers and employees. Table 1 provides a brief overview of each. The universities example given above refers to a “stacked plan” wherein DB and DC components are said to sit one on top of the other. In 2010, approximately 95,000 Canadian workers participated in a stacked pension plan of some kind (Statistics Canada 2010b). The 2011 arbitration dispute between the Canadian Auto Workers (CAW) and Air Canada centred on the union’s proposal for a stacked pension plan. It would involve segregating the pension plan into two components: a DB base, built largely on the existing pension plan, with a cap placed on the employer’s contributions; and, on top of this, a DC fund into which the employer and employees would make matching contributions up to a set maximum (Burkett, Bauslaugh, and Mackenzie 2011). When a plan member retired, the combined value in these accounts would be brought together to create a single benefit payment.11 This type of plan does not fully immunize employers from the risks associated with pension coverage, although it ensures that benefits can be effectively capped and a portion of risks is shared with employees.

A second hybrid model, one that has gained prominence in the US, is the cash-balance (CB) pension plan. These plans have been particularly popular over the last several decades (although not in Canada, as we explain later) as a conversion vehicle for former DB plans. In a CB plan a principal lump sum “benefit” is paid into a hypothetical member account against which member contributions are “booked,” although the assets themselves remain pooled through the plan sponsor who bears the investment risk. For this reason, and due to the fact that the principal is calculated using an actuarial formula within the plan, CBs are notionally classified as DB. However, they operate much along the lines of a DC plan. No benefit is guaranteed upon retirement; workers receive only the market value of the account. Because the benefit is designated as a lump sum, a member may elect at retirement either to receive the lump sum or to annuitize the cash in his or her account as a monthly benefit.

As with some DB plans, part of the success of CBs is due to the use of the career-average salary as the benchmark for calculating benefits. Compared to the final-average-pay model common in DB plans, in which benefits are typically calculated as an average of the best three or five years of employment, the CB approach spreads contribution costs more evenly over the course of employment (Purcell 2004). While this does result in lower benefits for most plan members, it can also improve intergenerational equity, since younger workers are not as likely to be faced with contribution adjustments to support steep increases in pension costs for employees nearing retirement, as can happen with traditional DB plans. At the same time, for those who change employers several times over the course of a career, the portability of a fully accrued (front-loaded) lump-sum benefit can actually result in higher retirement income potential in the long run (Purcell 2004; United States 2005). These features have become more attractive as workers change jobs and employers more frequently.

Regulatory obstacles are a major reason why hybrid pensions have been lagging in Canada. At the crux of the matter are the traditional elements of DB and DC structures that are built into provisions of the federal Income Tax Act and into many provincial pension and benefit acts. Although the tax regime permits certain DB and DC features to coexist, it tends to hem pension design into either a DB or DC template. This rigidity creates significant administrative disincentives to innovation. As an example, in responding to the CAW proposal for a stacked pension plan, Air Canada strongly underscored the absence of a clear regulatory path for hybrids in its preference for a simple DC conversion (Burkett, Bauslaugh, and Mackenzie 2011).12

The current regulatory framework is outmoded from the point of view of plans that wish to operate along a fully integrated hybrid model. For example, the provisions of the Income Tax Act impose a DB regulatory framework on CB plans. This means that as CB benefits are transferred to a member upon retirement they can be neither more nor less than the amount prescribed within a traditional DB plan. Such provisions effectively nullify the advantages of predictable and reduced costs in the CB design in Canada.

In reality, the closest Canadian pension design has come to a hybrid plan is Quebec’s recently created member-funded pension plan (MFPP). The MFPP is for all intents and purposes a DB plan in which employer contributions are fixed as though they were defined contributions. Although it is the employer who formally invests the assets, the workers are solely responsible for topping up the fund where deficiencies exist, and they retain ownership of any surpluses. To ensure adequate stability in plan funding, contributions, but not benefits, are indexed to inflation. One may therefore think of the MFPP as a sort of “target contribution” pension plan offering minimum guaranteed benefit features. The MFPP is primarily targeted at private sector unionized workplaces, where conversion from DB to DC is a pressing concern. For this reason, several cycles of collective bargaining will have to pass before the model can be effectively evaluated.

A final type of hybrid plan, described in great detail throughout this study, is the targetbenefit (TB) plan. Plans of this sort provide defined benefits within an intended range but do not guarantee that the target will be achieved. This plan type is similar to the CB model in that the accrual and funding mechanisms integrate DB and DC approaches simultaneously. TB plans are substantively different from DB plans in that TB plans may automatically increase or reduce benefits in cases where actuarial projections fall outside the target benefit range. The unique features of individual TB plans make it difficult to classify these plans consistently. For example, Statistics Canada categorizes them, like many other hybrids, as DB plans, while the Income Tax Act treats many such plans as DC.13 Although they possess many features of DB plans, it is important to note that TB plans entail an everpresent risk of benefit reduction. This feature and their underlying funding mechanisms mean that TB plans are closer to the DC model of risk (Ontario Expert Commission on Pensions 2008, 69).

Multiemployer pension plans (MEPPs), which represent 34 percent of pension plan members in Ontario (Ontario Expert Commission on Pensions 2008) are an interesting example of the TB model.14 Traditional MEPPs have been dominant among private sector industries with high union density, where a worker could be employed by several different employers over the course of a year. (The construction industry is one example.) These plans are established by trust agreement and often use a governance model that includes representation from both employers and employees. Employers make a defined contribution to the pension fund that is meant to provide a targeted benefit at retirement. Critically, however, this benefit can be adjusted in line with the financial health of the plan.

Many provinces, led chiefly by Ontario, formally exempt traditional MEPPs established under collective or trust agreements from statutory requirements to maintain fixed benefit accruals (Shilton 2007, x).15 For this reason, Ontario excludes MEPPs from the province’s Pension Benefit Guarantee Fund, which insures a portion of DB pension benefits (Shilton, 2007, xiii). The benefits under a MEPP are therefore target benefits that carry an expectation but not a guarantee. MEPPs must make note of this uncertainty as to future benefit levels in their annual statements to members. Because of the underlying formula for calculating benefits and contributions in these plans, Ontario, like most other jurisdictions, regulates MEPPs as DB plans. MEPPs can best be described as TB plans with features of joint governance. Their prominence illustrates the important role that hybrid plan designs can play in pension reform.16

If asked to classify the CPP and QPP, many Canadians, and indeed a number of pension experts, would classify them as DB plans. But the benefit structure of these plans has been changed many times, and new proposals are still being debated and considered. Arguably the most significant changes to the CPP came in 1997 with the introduction of cuts in entitlements to future retirees of 9.3 percent, and a gradual increase in contribution rates from 6 percent to 9.9 percent of pensionable earnings by 2003. This new funding and benefit structure has restored the plan to a sound financial footing. According to the most recent report of the Chief Actuary, current contribution levels will be sufficient to fund obligations over the next 75 years (OSFI 2010). As for the QPP, further increases in contribution rates are now required as a result of funding shortfalls owing to lower rates of fertility, immigration and wage growth. QPP contribution rates are scheduled to increase to 10.8 percent by 2017 to restore sustainability (ReÌgie des rentes du QueÌbec 2011).

A key component of the 1997 reforms was the creation of an automatic balancing mechanism (ABM) for the CPP (a form of which is expected to be introduced to the QPP in the future), which triggers a review of contributions should actuarial reports find that the steady-state contribution rate of 9.9 percent is insufficient to ensure sustainability in the plan over the following 75-year period. Under the ABM, if the federal minister of finance is unable to make a recommendation that will achieve stability after consulting with the provincial finance ministers, the following would automatically occur:

Are the CPP and QPP in fact DB plans? Their contribution rates and benefit levels are well defined at any moment but never fully guaranteed. Thus, Canada’s own public pension system includes both target benefits and target contributions, a fact that should further highlight the relevance of alternative models to traditional DB and DC design.

Canada’s pension system, although relatively sturdy by international standards, faces a number of challenges that are accentuated by both an aging population and increasing instability in financial markets. Four challenges in particular speak to the significant vulnerability of middle-income Canadians in realizing a secure retirement, and must, in our view, be taken into consideration in assessing current and alternative reform proposals.

Although the optimal rate of income replacement for retirement remains an open question (Mintz 2009; Horner 2009; Wolfson 2011), it is generally accepted that a growing number of modestand middle-income working-age Canadians are not saving sufficiently to ensure that they will be able to maintain a comparable standard of living once they retire (Horner 2011; Wolfson 2011; Canadian Institute of Actuaries 2007). There are a number of reasons for this. Perhaps most importantly, the propensity to save has diminished significantly over the last several decades. The stagnation of real incomes since the 1980s, combined with increased volatility in financial markets, has made saving more difficult and less secure. Symptoms of this trend are flat real-dollar growth in RRSP contributions and increasing reliance on personal debt as a source of retirement funding (Robson 2010).

For the most part, this trend is a middle-class problem (LaRochelle-CoÌ‚teÌ, Myles, and Picot 2008; Wolfson 2011). Low-income Canadians can generally be assured of replacement rates of 70 to 80 percent, thanks to Canada’s strong foundation of universal and targeted retirement income programs: Old Age Security (OAS) and the Guaranteed Income Supplement (GIS), together known as Pillar 1 of Canada’s retirement income system; and the CPP/QPP, known as Pillar 2 (Mintz 2009).17

Closely related to changes in saving patterns are changes in pension coverage, as described earlier. It is important to underline that the decline in traditional DB plan coverage and the shift to DC plans means that Canadians must now make a greater effort to save. This effort has not materialized. The growth of employment in sectors of the economy where employersponsored pension coverage is relatively low has amplified this concern. Occupational pensions are an important vehicle for regularizing saving behaviour and providing a measure of predictability in retirement income. As indicated in figure 1, in 2010 slightly more than 60 percent of workers were not members of a registered pension plan, a phenomenon disproportionately evident in the private sector, where only 25 percent of employees were covered.

The absence of pension coverage is typically attributed to the high and uncertain financial cost of pensions for employers, although less significant factors are also present. These include employee preference for wages and benefits over pensions as a form of compensation, concerns over pensions’ portability, especially in industries without access to MEPPs, and, for owner-operated businesses, regulatory barriers that discourage pension participation. For these reasons it could be argued that, increasingly, single employers are not a suitable conduit for the delivery of pension benefits.

Those who find themselves in a self-directed DC pension plan face many of the same informational challenges as those who are entirely without occupational pension coverage. In these situations, deciding how much to save and selecting appropriate investment strategies in the hope of achieving a reasonable level of retirement income presupposes high financial literacy. There is a fair amount of empirical evidence to suggest that when given a range of choices, individuals will not always act rationally in planning for retirement (see Schwartz 2010). Younger workers, for example, may have a greater preference for immediate consumption and thus elect not to participate in voluntary pensions such as group RRSPs. DC plans will vary in terms of their default settings for matching contributions; if these are low, workers may not appreciate that they will have to set aside additional retirement savings. Finding the appropriate balance between voluntary and automatic enrolment requirements for a pension scheme is a critical point of debate.

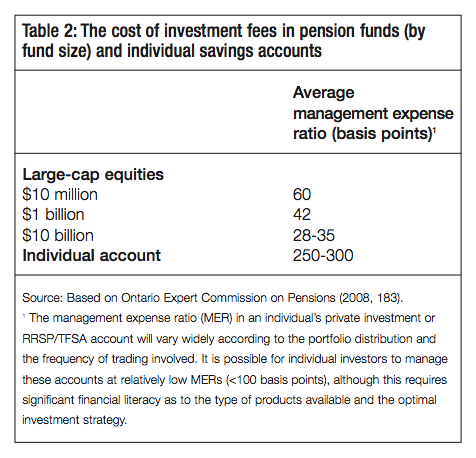

One of the most significant problems with an exclusively self-directed approach to retirement income security is the inability to benefit from the economies of scale and pooling of risk that come from being part of a large asset pool. While the design of the plan is important, size is also a key determinant of asset accumulation performance. Large asset pools, whether composed of an employment group in a DB/DC plan or commingled individual accounts, generate significant economies of scale. Not only are large funds able to achieve savings in administrative and management costs, but they also have investment opportunities, such as private placements, that are not available to smaller funds. The latter advantage may be realized only by very large asset pools (e.g., $10 billion or more) under certain conditions.18 Commingled plans, if they also pay out retirement income, enable pooling of mortality risk.

With a larger pool of participants in the actuarial sample, life expectancy can be predicted more accurately, giving less weight to outliers in health and age profile. This can lower large plans’ ongoing costs.

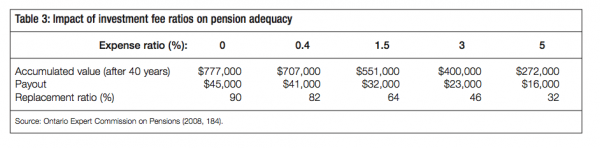

Some of the data compiled for the Ontario Expert Commission on Pensions (2008), reproduced in tables 2 and 3, have been particularly effective in focusing the debate on these issues. As table 2 indicates, plan size is a very important determinant of investment fees. While there is no one optimal level of capitalization, there is a significant difference in cost efficiency between plans above and below the $1-billion-asset threshold. Plans above this threshold have the advantages of broader investment opportunities and larger actuarial pools to minimize risk.

Table 3 shows the extent to which higher management expense ratios can severely reduce the accumulation of capital over the course of an individual’s working life and, as a result, his/her pension outcomes (both income level and replacement ratio). This analysis assumes consistent annual contributions of $10,000 over a worker’s 40-year career, with an average annual income of $50,000 (Ontario Expert Commission on Pensions 2008).19 The cumulative effect of lowand high-cost MERs is considerable. In this example, a worker whose pension was managed with an MER of only 40 basis points would receive upon retirement an annual pension benefit up to $9,000 greater than a peer with similar earnings and a similar contribution history whose pension plan had an MER of 150 basis points. This represents a difference of 18 percentage points in their respective income replacement rates.

Of the two reform proposals put forward by Canadian governments — pooled registered pension plans (PRPPs) and an expansion of the CPP/QPP — PRPPs have come the farthest and received the most attention. PRPPs are a positive development. In terms of the challenges described above and depending on the implementation details, they have the potential to provide a cost-effective vehicle for increasing pension coverage throughout the private sector, particularly among small and medium enterprises. They will also be available to self-employed individuals who had until now been excluded from participating in registered pension plans (Finance Canada 2010).

PRPPs are voluntary registered pension plans in which assets are commingled in one or more large pools in order to create economies of scale. Under the framework introduced by the federal government in the proposed Pooled Registered Pension Plans Act (Bill C-25), employers may enroll their employees, at which point the employees’ participation is automatic20 though not mandatory. Members may opt out within an initial registration period of 60 days. Individuals will also be able to join PRPPs on their own, even if their employer chooses not to participate. Assets contributed to the pool(s) would be managed like any large DB pension fund, that is, on a consolidated basis — for accounting purposes, assets would be booked to individual members, although funds would not be segregated into individual accounts.

This innovation could, if properly regulated, provide substantially lower MERs than are available to Canadians in conventional mutual funds or RRSP investments. It is important to remember that Bill C-25 is only an initial framework for implementing PRPPs in federally regulated sectors of the economy, which already have significant DB coverage. The provinces, which hold the constitutional power to regulate pension and labour standards, will have an important say in deciding how the proposed pension plan ultimately takes shape. Should they wish, provinces may negotiate with the federal government for more stringent requirements under their respective implementation agreements.

There are a number of reasons, however, to be critical of the PRPP as proposed in Bill C-25. First, and most importantly, employer contributions are entirely voluntary. This means that employers may automatically enroll their workforce without themselves being obliged to participate. Although cost predictability in pension management is a real concern for businesses of all sizes — and an impediment to coverage, especially within small and medium-sized workplaces — employer contributions are a cornerstone of all occupational pensions. To not require this element within the PRPP architecture suggests that the PRPP is more akin to a group RRSP than to a traditional DC pension. While its adoption may induce greater coverage across the labour force, it will not do much to provide greater financial security for those employees who already participate in group RRSPs. Without active employer contributions, employees will find in PRPPs nothing more than a potentially more efficient personal savings vehicle through greater pooling of assets and reduced investment fees.

Depending on how individual provinces decide to adapt or apply the legislation, PRPPs could also create new disparities among workers at the regional and/or sectoral level. Should some provinces wish to negotiate more stringent requirements for employer contributions or other features of the plans, PRPPs may become a source of labour-cost competition between employers in different parts of the country. Provinces less favourable to PRPPs as a reform option will need to carefully weigh how they proceed with their implementation.

From a regulatory standpoint it is also important to note that although participants are likely to see somewhat reduced MERs as a result of pooling, no maximum average fee has been instituted or contemplated for PRPPs. (This may change, however, with regulatory implementation.) Without this element can we expect MERs to fall substantially? The experience in Australia since default pension enrolment was instituted throughout the labour force in the late 1990s suggests otherwise. Although the asset value of pensions in Australia has grown rapidly since that country instituted the “MySuper” plan, management fees have not fallen to the same extent. Between 2002 and 2008 estimated overall management fees across Australia’s superannuation systems ranged between 120 and 137 basis points of total asset value. Although these fees are lower than the MERs encountered by Canadians with DC plans or group RRSPs (and below the average for individual accounts), they are still far above the benchmark for larger pension funds in Canada (see table 2). As Wilson Sy, a senior adviser to the Government of Australia’s Super System Review Committee, recently concluded: “Free-market competition under economic rationalist assumptions has not delivered the economic efficiency anticipated for Australian superannuation. Market competition was rendered ineffective due to complexity of products, and the bounded rationality of individuals” (2011, 58).

The recent skirmish between the Ontario Municipal Employees’ Retirement System (OMERS) and the financial services industry21 over which sector(s) should be authorized by the Superintendent of Financial Institutions to administer PRPPs is also an ominous sign for the future of this pension vehicle. OMERS contends that Canadian pension funds, given their large asset size ($1.1 trillion combined) and regulatory framework (they face lesser capital requirements than banks or insurance companies), are best placed to hold PRPP management costs below 100 basis points. Whether or not this is a valid argument, the debate reiterates that scale is a crucial factor for policy-makers to weigh in the implementation of PRPPs. Without sufficient competition among plan administrators and without access to institutions of sufficient size, investors may be denied the full potential that asset pooling offers for reducing the costs of retirement saving. Whether PRPPs, as currently designed, can provide the envisioned cost efficiency remains to be seen.

A second reform option has garnered interest among a number of provinces and organizations, such as the Canadian Labour Congress (CLC), CARP (formerly the Canadian Association of Retired Persons) and the Federal Superannuates National Association/National Association of Federal Retirees (FSNA). It involves the expansion of the CPP/QPP. Discussions of this option have waned since the announcement of the PRPP initiative in December 2010, although Finance Minister Jim Flaherty and many of his provincial counterparts have said that they remain tentatively interested in pursuing this plan once the PRPP is fully implemented. There is as yet no formal proposal to that effect; Ontario, which has been among the most consistent supporters of this course of action, has not specified the degree of expansion it might consider beyond something “modest.” Stakeholders and experts have proposed reforms ranging from increases in the replacement ratio of pensionable earnings (rising to either 50 percent or 70 percent from the current 25 percent), to straight increases in the year’s maximum pensionable earnings (YMPE) for all workers, to the creation of a newly targeted YMPE category for middle-income earners (see Baldwin 2010 and Horner 2011 for reference to specific proposals). Our objective here is not to reassess each of the proposed variants but rather to examine the relevance of CPP/QPP expansion as an instrument for addressing the four challenges in pension policy today.

The attraction of CPP/QPP expansion for policy-makers is its perceived ability to provide broad universal gains in retirement income adequacy. Although CPP/QPP benefits are, as previously described, target benefits rather than fixed defined benefits, the market performance of the Canada Pension Plan Investment Board (CPPIB) over the last decade has been considerably stronger than that of other investment vehicles.22 As well, the CPP under current rates of contribution has been deemed actuarially sound for the foreseeable future (OSFI 2010).

As a platform for increasing retirement income security among Canadians, particularly those in the lowto-modest-income category, the CPP/QPP is complicated by interactions with the means-testing features of OAS/GIS, the Pillar 1 programs of the retirement income system. For example, to double the replacement rate on pensionable earnings from 25 to 50 percent would require increasing CPP/QPP contribution rates from 9.9 to 14.9 percent of the YMPE ($48,300 in 2011). On the surface, this would represent only a 50 percent increase in contribution costs. However, with no adjustment to the clawback provisions in OAS/GIS, Canadians with low and modest incomes could see up to 50 percent of their top-up CPP/QPP benefit taxed back through these federal clawbacks, and as much as 100 percent when provincial clawbacks are factored in (e.g., Ontario Gains). Given that many of the individuals subject to these clawbacks are not those targeted by pension reform — they already have high income replacement rates — any proposal for CPP/QPP expansion needs to address this complex issue. Indeed, all pension reform proposals based on mandatory participation need to consider the effects of OAS/GIS clawbacks.23

Various solutions have been proposed to that effect, including (1) establishing a separate tier of pensionable earnings and benefits for those with incomes above the current YMPE, at current or increased rates of replacement (Baldwin 2010, 28); (2) significantly raising the year’s basic exemption (YBE) from its present level of $3,500, as suggested by Horner (2011); and (3) redistributing the pre-1996 legacy costs of the CPP/QPP (which represent 4 percentage points of the 9.9 percent contribution rate) across workers at all earnings levels (Horner 2011, 26). The first two options illustrate the extent of the challenge involved in increasing income replacement rates for modestand middle-income workers through the CPP/QPP without imposing on them onerous contribution rates. This is mostly due to the plan’s legacy costs which, in a sense, have become an impediment to reform. For example, extending current replacement rates to second-tier income as in the first option outlined above could be accomplished with an incremental contribution rate of 5 percent. The inordinate difference this would entail between contribution rates for tier 1 (9.9 percent) and tier 2 (5 percent) benefits would likely be difficult to explain and to defend. Only, perhaps, Horner’s proposal for an income-based smoothing of legacy costs would address this challenge.

In counteracting the problems associated with undersaving and limited financial capabilities, the CPP/QPP, as a mandatory public program, provides a highly effective tool for increasing pension coverage and adequacy across the labour force. That said, contrary to popular opinion, the CPPIB, which manages the fund’s investments, may not be the most cost-efficient pension administrator. Between 2002 and 2011 management expenses rose sharply, growing from 11 to 72 basis points (CPPIB 2011). Although the latter may still seem relatively low, some commentators have argued this cost profile is more or less comparable to that of private sector investment managers when factoring in regulatory burdens not carried by the CPPIB because of its arm’s-length relationship to government (Hurst 2010; Mohindra 2011).

Considering that the Canada Pension Plan Act also requires full prefunding of new benefits (section 113.1(4)(d)), any expansion would take as long as four decades to have a full impact. Although this funding provision is critical to the long-term solvency of the program, it means that any change in the CPP/QPP would not necessarily improve income adequacy for middleincome earners nearing retirement today, though it would certainly do so in the long term.

In addition, the fully funded tier of a reformed CPP/QPP would take on some of the disadvantages now experienced by private plans. For example, the new CPP/QPP tier, once mature, would also face the impact of volatile market returns, since it would have no pay-as-you-go component. Any reform based on the public pension plan would still require policy-makers to pay close attention to the cost structure.

One of the main reasons CPP/QPP expansion has fallen away from public debate in the last year and a half is the current state of uncertainty in the global economy. Due to its mandatory employer and employee participation and contributions based on earnings, many view the CPP/QPP funding mechanism as a payroll tax. As illustrated by the federal government’s recent decision to hold down mandatory increases in Employment Insurance premiums, there is concern in some quarters (see CFIB 2010) that increases in CPP/QPP payroll deductions could hamper employment growth in the short term in an otherwise weak and tentative economic recovery.24

A further difficulty for any proposal to expand the CPP/QPP is the need to amend the Canada Pension Plan Act, which requires the approval of at least seven provinces representing two-thirds of the country’s population. Any reform must also consider the established convention of maintaining parallelism between the CPP and QPP. So far six provinces have expressed interest in pursuing this route25 although, crucially, Quebec and Alberta have been resistant, citing the fragility of the Canadian economy as a reason for favouring voluntary DC approaches such as the PRPP (Coughlin & Associates 2011). Quebec, notably, must also increase QPP contribution rates in the next several years to address underfunding in the provincial plan, which means that further contribution increases are probably impossible at this time. On balance, expanding the CPP/QPP is far more complicated than it may appear in the public discourse.

At the moment, it remains an open question whether existing options will deliver needed reform in the Canadian pension landscape. The PRPP, while a potentially costefficient innovation, is very much a work in progress. Its design as a pure DC plan without mandatory employer contributions raises questions as to its ability to address the challenges of retirement income inadequacy, insufficient coverage and weak financial literacy. Meanwhile, discussions of expanding the CPP/QPP appear stalled. Although, if properly designed, this option could substantially improve income adequacy, coverage and administrative costs, and counteract the effects of weak financial literacy, it faces considerable resistance. Critics focus mainly on its mandatory nature and are concerned about the potential effect of payroll contribution increases on employment in the current weak economic recovery. The risk of imposing more saving than desired or necessary on certain groups is also an important consideration.

With the PRPP providing only a partial response and CPP reform not an option for the time being, are there other practical alternatives that could bring about substantive improvement in Canada’s retirement income system in the short term? There now appears to be general acceptance that neither a pure DB nor a pure DC plan is optimal for the future. Can an innovative pension plan design be found that would maximize the advantages of these two classic systems and still address the range of challenges we have outlined?

In an effort to find such a design, the following four government panels have reported in recent years with proposed changes to Canada’s retirement income system:

Although these reports differ in their detailed recommendations, each suggests new mechanisms to expand coverage, improve pension incomes and achieve more effective savings and pension options for Canadians. Keith Ambachtsheer has also presented his own plan in recent publications (2007; 2008).

Our proposal draws on many elements of the body of ideas put forward by the expert reports mentioned above. It attempts to distill from these various models a practical application of five key principles for reform that could be implemented in the current legislative and policy framework. It also builds on the real-world examples of Ontario’s traditional MEPPs and the pension model of the Teachers Insurance and Annuity Association in the US (see appendix 1).

To address ongoing pension and retirement income challenges properly, a new pension plan will need to satisfy certain basic principles:

We have incorporated our five principles in a model we refer to as the pooled target-benefit pension plan (PTBPP). Although it is similar in name to the PRPP, the PTBPP is a distinct concept with many important departures from the federal government’s proposal. In broad terms, our plan is a target-benefit pension that blends the pooling of risk found in traditional MEPPs with the cost predictability for employers of a DC plan. This hybrid design yields a pension vehicle in which participants gain a better expectation as to their retirement income than with the PRPP, greater portability across the labour market, professional third-party investment management, and a potentially more cost-efficient and effective saving vehicle.

It is important to note that our proposal entails some gains and losses for both employers and workers. This is consistent with the intent of the PTBPP to more effectively balance the allocation of costs and risks than current DB and DC pensions permit and to be acceptable to both sides.

This section describes each of the elements and key assumptions central to the proposal. The next section discusses how the model can best be implemented within current federal and provincial legislative frameworks.

Like the PRPP, this model is premised on the pooling of assets and risks on a comprehensive basis. This means that accounts would exist only notionally: assets would be booked by plan and participant, but would not be segregated per se. Funds would be invested and managed globally across the pool. By commingling assets to such a high degree, the plan would be able to leverage relatively low MERs and a collectivization of risk, which should provide for smoother actuarial costs. Pooling assets in this way, while mitigating some of the investment risk for individuals, would not eliminate it. A downturn in financial markets as significant as that of 2008-09 would still have a measurable negative impact on these funds.

Both employers and individual investors would be able to participate either by registering new plans or transferring existing assets (including RRSP accounts) to the pool(s).27 This would include access for self-employed individuals, as in the PRPP framework.28 For current singleemployer pension plans, particularly those of small and medium-sized enterprises with few members, participation in the PTBPP would provide the cost efficiency of larger pension funds. In this context, it is important to emphasize that having a pooled asset portfolio does not mean that all participant plans need to be identical. The participant plans could, as necessary, operate with differing contribution rates and target benefit ranges. Larger participating plans would have the possibility to define a portion of their investment portfolio within established parameters.

The plan itself is therefore a large umbrella under which a number of different plans and investments are commingled to realize efficiencies of scale. Provincial and federal regulators would also be able to make use of this vehicle to transfer in pensions that are “orphaned” as a result of windup or bankruptcy. While several provinces29 already have the power to designate a particular agency to “receive or hold” the assets of a registered pension plan under extenuating circumstances, by virtue of its design as a pooled entity the PTBPP would be an ideal host. This would ease administrative burdens during the transition process and provide greater protection of pension assets in provinces where such powers do not currently exist.

In general, this framework is consistent with the pooling features of the PRPP, with one key exception. To ensure that an efficient scale is reached, PTBPPs would be required to maintain a minimum portfolio of, say, $10 billion, a size generally considered large enough to generate significant cost efficiency (see table 3) and to allow for specialized investments (e.g., private placements). Although workplaces would be free to decide whether or not to join the plan, like the PRPP our model is premised on an employee auto-enrollment feature with a provision for opting out within 60 days. Many studies have shown that systems where participation is the default option and workers (and employers) must take action to opt out do produce significantly higher participation levels than systems in which participants must opt in (Ambachtsheer 2008).30 Once in the plan, members would have their contributions locked in over the course of their working lives, as is the case with PRPP. These provisions, in addition to the incentive provided by mandatory employer contributions (discussed below), are critical to ensuring that a critical mass of diverse participants is brought into the plan in order to minimize the problems resulting from selection bias.

Pooling provides a useful structure in which to mitigate some of the actuarial risks and management costs related to a pension fund, but it is not an end point. The effectiveness of a pension plan depends on a number of factors, including whether contributions are to come from both employers and employees, what rate of income replacement it provides, who is responsible for supplementing underperforming funds, and what policies exist with respect to management expenses.

For the plan sponsors (employers), the PTBPP would operate as a traditional DC plan. In this respect, contributions would be mandatory for both parties, but the employer’s contribution would be known and fixed within certain limits. The minimum contribution rate would be set according to the target benefit provided in the plan, with employee contributions being matched by the employer up to a set rate (which may vary by plan). As with most DC plans, employee contributions would be permitted above this level, within the limits of the Income Tax Act.31 The employer would not be responsible for any additional funding of the plan should asset values fall below the target range of benefits. Addressing any funding shortfall would either fall to the employees or be reconciled through a corresponding reduction in benefits, as explained further on. This framework would release existing DB sponsors from significant liabilities inherent in a classic DB plan and would provide important certainty of contribution costs for all sponsors.

One should not expect PTBPP plans to exist with low employer and employee contributions. As Mintz (2009) has suggested, DC plans with inadequate minimum contribution rates are an important cause of undersaving. The intent of the PTBPP is as much to improve income replacement as it is to achieve cost efficiency. It does not aim to reduce costs to allow lower rates of saving, but rather to generate higher rates of income replacement. What, then, is an appropriate contribution rate for participating plans?

Work by the Organisation for Economic Co-operation and Development (Antolin 2009) indicates that a contribution rate of 5 percent would provide an income replacement rate of 25.3 percent, while a contribution rate of 10 percent would double the rate to 50.7 percent (a 1 percentage point rate increase in contributions, therefore, raises the replacement rate by 5 percentage points, all things being equal).32 Although plans will differ according to the needs of plan sponsors and participants, minimum combined contribution rates would ideally be set at 10 percent. An income replacement rate of 50 percent from the plan would likely satisfy the needs of most workers when supplementary benefits from the OAS and CPP/QPP are factored in.33 At this level, for example, workers earning $50,000 on average over the course of their careers (slightly above the average wage) would receive a blended replacement rate of 88 percent in retirement, declining to 70 percent for those with career average earnings of $70,000.34 This would also leave room for individuals to take advantage of other more flexible forms of personal saving such as RRSPs and TFSAs.

According to the latest Capital Benchmark Report, the average combined employer and employee contribution rate to Canadian DC plans was 8.7 percent in 2009, having grown steadily over the previous three years (Great West Life 2010). Participation in the PTBPP would, therefore, require at least a modest increase in contribution rates for many sponsors.

Although some participants would also likely have to make additional contributions, the cost efficiency of their investments would be vastly superior to that of most mutual funds available in the marketplace.35 Much has been said already about the drain that management fees impose on capital accumulation. To address this concern, management fees would be capped at approximately 40 basis points after a pool has reached critical mass and an established start-up period has been completed. In suggesting a 40-basis-points cap, we note that British Columbia’s public sector pension plans (public service, colleges, teachers and municipal employees) run at a total expense ratio (investment management and pension administration) of 25 basis points (i.e., 0.25 percent) (Kennedy 2011). Thus, we believe that the 40-basis-point limit is fair and achievable. This requirement goes much farther than the current PRPP proposal, which expects funds to be operated at a “low cost” yet fails to enforce a particular limit on MERs. The MER cap would ensure that a plan’s assets grow efficiently over the course of a member’s working life. This would represent a material advancement for many investors.

The PTBPP entails a target-benefit structure whereby participants make contributions over the course of their careers with the purpose of receiving a retirement benefit within a preset range. The initial target benefit would be based on some agreed-upon earnings replacement objective; the required contribution rate would be set accordingly, again assuming 40 years of contributions. The actual benefit accrued would, of course, depend on the age of the participant at entry.36 For workers who contribute to their retirement savings solely through personal investments or as part of a traditional DC plan, having access to this type of plan would move their retirement income prospects beyond mere hope to a reasonable expectation (although not a guarantee) of a defined benefit.

After a target benefit range has been established and the plan set up, members would receive an update at least once annually as to the performance of their “account.” This would include an indication of the benefit, based on a recent snapshot of plan valuation, that can be expected upon normal retirement, expressed as projected monthly retirement income. In contrast to traditional DC plans, this would relieve members of the burden of extrapolating a notional retirement benefit from the present market value of their investment accounts. With this information, members can better place their pension benefits in the context of their overall retirement plan, and determine what, if any, need exists for supplementary personal savings.

Obviously, asset values will rise and fall with market performance, but this need not have a strong or immediate impact on the benefit schedule. This is now true with respect to Ontario’s traditional MEPPs, thanks to changes in solvency funding requirements. However, in an environment of prolonged low investment returns, such as today’s, participants must understand that their benefits are not guaranteed. If, over the medium term, asset values do not keep pace with the plan’s target benefit range, the plan’s trustees would address deficiencies by either mandating supplementary employee contributions or, as is the case with MEPPs, reducing benefits. Conversely, any “excess” returns above the target benefit schedule could be used to improve benefits for those still paying into the plan and to provide inflation protection for the payouts to those in retirement.

To help mitigate the risk of funding shortfalls, PTBPPs would use a more conservative method for calculating target benefits than is common in classical DB plans. One option is to calculate the income replacement on the basis of an employee’s career average pay rather than over his/her highest earning period. This approach is arguably more consistent with a target-benefit model, as it spreads pension costs more evenly across the working life and recognizes implicitly that the purpose of this type of pension plan is not to provide a maximum defined benefit upon retirement but rather a reasonable expectation of retirement income.

In addition to providing a contingency for shortfalls in investment performance, any pension plan must also accommodate potential risks arising from extended longevity of retirees and the effects on real benefits and related funding requirements of changes in the inflation rate over time.

The longevity risk can be addressed in either of two ways. First, the plan could purchase deferred life annuities for plan participants as they near retirement. This would start at a relatively early stage in a member’s working life (perhaps age 40). The proportion of an individual worker’s plan assets allocated to purchasing deferred annuities would then increase gradually to 100 percent as the worker nears retirement age — at which make point the retirement benefits become de facto “defined.” Not purchasing annuities all at once mitigates the interest rate risk. The group annuity market in Canada today is highly competitive and provides good value for this need (IFID 2012).37

Alternatively, the plan could elect to manage the payout of benefits itself. Like the Teachers Insurance and Annuity Association-College Retirement Equities Fund (TIAA-CREF) model (see appendix 1), the plan could be separated into two streams. Active (working) members would remain in one actuarial pool, while retirees would move into a group annuity program. This would require segregating assets between active and retired members, but the collectivization of investment risks would still be vastly superior to the risk workers bear in a typical DC plan. In either eventuality, participants are freed from managing these risks themselves.

Inflation is a major threat to any pension plan in which benefits are fully indexed to changes in the Consumer Price Index (CPI). Instead we propose a form of target indexation whereby the plan would guarantee only an annual inflation adjustment within a range slightly below the CPI. If actual rates of return exceed actuarial assumptions, the plan would allow for benefits improvement. The approach could be similar to that recently introduced by the Ontario Teachers’ Pension Plan (OTPP) whereby future benefit accruals (on or after January 1, 2010) are indexed at half the rate of the CPI, with the other portion conditional on the funding viability of the plan (Ontario Teachers’ Federation 2009). This is also consistent with the approach used in Quebec’s MFPP, British Columbia’s public sector pension plans and the Nova Scotia Teachers’ Pension Plan.

A final element of the PTBPP relates to the plan’s management and oversight functions. As compared to self-directed DC plans, where the individual bears the responsibility for investing funds, the plan would rely exclusively on professional, arm’s-length investment managers. These managers would be responsible for the day-to-day management of invested funds as well as for any annuities undertaken by the plan. Taking over these responsibilities from individual members will greatly improve the investment capabilities of the plan and provide a significant advantage for participating workers and small businesses. They no longer would be expected to manage their own assets and the associated investment and actuarial risks.

The plan would be overseen by a board of trustees with appropriate representation from each class of plan participants — active employees, individual account holders (this includes selfemployed members and those who have transferred in existing private assets) and retirees. Since employers do not bear any investment risk in the plan and have their contributions tied to a fixed standard, their participation is not warranted on the board. The board would maintain contact with the investment managers and make decisions with respect to investment policies and, whenever necessary, with respect to adjustments in the target benefit schedule. Rather than being represented directly by its own members, each voting group would nominate pension professionals to the board to act on its behalf. Models for this type of representation exist today, a prominent example being the OTPP. Nominees would be required to be fully independent of service providers, government and fund managers.

As with any commingled plan where benefits are expected or defined, the issue of whether to adjust benefits or to mandate supplementary employee contributions will cause friction between active and retired members and among generations of current contributors. Retirees will of course want to avoid any change in benefits, while current contributors will wish to maintain intergenerational equality in the funding of current and future liabilities. The problem could grow to a critical level if the participant classes disagree and are unable to make adjustments that take changing circumstances into account. Having a board of trustees consisting of investment and actuarial professionals to oversee the PTBPP addresses this risk partially, though not entirely. We therefore also propose that the plan undergo regular stress testing and long-term actuarial valuation. The model we propose would use moderately conservative actuarial assumptions that would discount future investment returns on the basis of lower-yielding benchmarks such as long-term government bonds (substantially lower than the expected rate of return in many DB plans today). An automatic balancing mechanism set out in the trust agreement (similar to that used by the CPP) would help ensure the plan’s long-term solvency. This would make it easier to increase employee contributions or reduce benefits in the event that the trustees are unable to agree on a course of action that is fair to the different generational cohorts of plan members.

Many current sponsors may see the loss of unilateral control over aspects of their pension plan’s management and funding as a disadvantage, but this concern is likely to be more than outweighed by the fact that sponsors would share no risk in the plan. In contrast, small-business employers may view this lesser role for the sponsor as a plus. Plan participants should see this model as an improvement over traditional employer-sponsored pension plans where participants often have little or no say in the running of the plan. The governance structure we have proposed is also a key departure from the PRPP model, in which participants have no representation.

We also wish to address a few issues regarding the implementation of the PTBPP. Obviously, in this new system, asset pools could not amount to several billions of dollars on day one of the plan. This is especially true if workplaces must opt in to the plan, as this model assumes. As mentioned earlier, potential administrators could be existing large pension plans, such as the OMERS and the OTPP, that could take on these new participants and manage the new assets at very low expense ratios, since these plans are not subject to the capital requirements imposed on banks and insurance companies. However, if the plan administrator were a bank or an insurance company with billions of dollars in existing assets, then the administrator could be expected to operate these new asset pools with cost levels close to those of the large pension plans even from day one. In any case, the cost levels would certainly improve relative to the status quo in workplace plans. Moreover, one would assume that these asset pools could exist as segregated funds with different capital requirements than those that apply to the assets of the financial institution itself.

Alternatively the plan’s assets could be managed by an arm’s-length, government-sponsored investment board similar to the CPPIB. Note that while the investment board might be sponsored by government, the latter would not exercise any control or influence (again, similar to the CPPIB). Moreover, taxpayers should not subsidize any administrative costs or be exposed to any plan risks.

The identity of the funds’ manager is not critical to the scheme, however. What is important is that total MERs should be equal to or less than 40 basis points and that the maximum expense fee should be mandated through legislation or regulation.

In no case would the plan sponsor control the investment of plan assets. This should avoid some of the investment governance issues now inherent in the MEPP model in Canada (see Ontario Expert Commission on Pensions 2008). Any existing plan (even existing individual RRSPs) could join the new asset pools. There would be no restrictions on entry.38 However, we would restrict the ability to move in and out of the funds so that the plans could benefit fully from asset commingling, long-term investment horizons and stability. For example, it would not be unfair to lock in assets in a given fund even through the retirement payout phase. Asset pools would be given five years from a fund’s creation to attain the desired critical mass (e.g., $10 billion). After that time, smaller pools would be forced to merge. Policy-makers may also wish to consider whether particular incentives might be needed to ensure that a minimum number of workplaces (especially those without pension coverage) are brought into such plans as they are established.

Putting such a system in place would require modest changes to the Income Tax Act and the provincial acts governing pension plans. But the amendments would be no more difficult than those needed to implement the proposed PRPPs at the provincial level. As is the case with the PRPP implementation now underway, a federal framework would be set up that provinces and territories could replicate with relative consistency. The PTBPP could even be achieved through (or built on) the PRPP framework if the provincial ministers of finance were willing, as a group, to negotiate more extensive requirements in their implementation of PRPP agreements with Ottawa. This would necessitate several major additions to the existing PRPP design, which ideally would be uniform across the country:

If these changes are considered too significant to achieve by way of the PRPP framework, or if a majority of provinces are unwilling to improve on the PRPP’s foundation — either of these is a likely scenario — then a separate framework would be required to enable the introduction of the PTBPP.

The Ontario government is considering introducing a new pension scheme that is similar to the PTBPP. In response to the proposal made by the Ontario Expert Commission on Pensions (2008) for a JGTBPP, Ontario is expected to introduce regulations allowing for such plans in unionized workplaces. This is quite different from our proposal, which is motivated by the need to improve the coverage and adequacy of pensions across the private sector as a whole, particularly in workplaces where pensions are not available today (mostly nonunionized). Also, unlike the JGTBPP proposal, which includes employers in plan governance in recognition of the role of collective bargaining within these plans, the PTBPP excludes employers from the plan’s board of trustees.

On balance, the PTBPP that we propose would provide better pension coverage, cost efficiency and retirement income security for plan members than would PRPPs or most current private group or individual plans. While the PTBPP would not solve all the challenges facing Canadians in securing their retirement incomes, it should yield a less costly savings vehicle than traditional DB plans and be more cost efficient than DC plans. For employers, the advantages are undeniable. The PTBPP model is more sustainable than a DB plan, and it limits risk much like a DC plan. Contribution costs may be slightly higher for employers under this model than under a typical DC or group RRSP plan, but employers would gain immense benefits for their employees. For their part, employees would still face pension risks under this plan, although the risks would now be collectivized in a more efficient and effective way than in a DC plan. For members of a DB plan facing the prospect of conversion to DC, the PTBPP would provide a better alternative to preserve future benefits.

Perhaps most importantly, for policy-makers the PTBPP is a timely proposal with the potential to address many of the limitations of the PRPP within the existing framework of Bill C-25. Given the uncertainty surrounding the future of pension reform in Canada, it should be viewed as a key step forward.

In attempting to find a middle ground in the pension reform debate, we suggested at the outset that any new plan design should satisfy five principles. How does the PTBPP stand up to this challenge?

Appropriate risk sharing can be achieved with the PTBPP, which is premised on the concept of large commingled asset pools. This pooling can significantly enhance plan efficiency and collectivize inflation, mortality and investment risks. Risk sharing of this kind attenuates the need for workers to possess sophisticated investment expertise.

The requirement that PTBPPs build asset pools of at least $10 billion within five years or merge with other plans enables these plans to take advantage of scale efficiencies and thus satisfies principle 2.

Again, through the pooling of plan assets, the PTBPP can achieve the collective advantages of scale. This is especially important if the fund also manages the benefit payout phase of the process. For example, although life expectancy is easier to predict for a large group than for any one individual, minimizing one type of risk, another risk remains if all individuals in the group experience improved life expectancy (as is the case today). This remaining risk can be mitigated in the marketplace through the purchase of group annuities or longevity bonds. (The latter would not be available to individual members.)

Under the PTBPP, workers gain more predictable benefits, while employers gain more predictable pension costs. For the majority of potential plan participants, these features should provide significant improvements over their current situation.