Cette étude porte sur la protection des prestations de retraite en cas d’insolvabilité du promoteur d’un régime de retraite. Les règlements actuels en matière de pensions n’assurent pas une pleine garantie aux adhérents de régimes à prestations déterminées, puisqu’ils autorisent la sous-capitalisation. En fait, selon l’auteur de l’étude Ronald Davis, ils favorisent souvent des pratiques d’investissement qui comportent des prises de risque discutables, tout en masquant certains des risques reportés sur les bilans des régimes.

Dans quelques cas ayant récemment défrayé la chronique, d’importants promoteurs sont devenus insolvables alors que l’actif de la caisse de retraite était insuffisant pour verser aux salariés et aux retraités leurs prestations acquises. Le législateur a réagi au problème en déposant des projets de loi visant à renforcer la priorité de paiement pour les réclamations faites par les adhérents contre le promoteur. L’auteur estime juridiquement fondé d’accorder une plus grande priorité aux cotisations patronales non versées, mais croit que celle-ci ne devrait pas s’étendre à la part restante du déficit d’une caisse de retraite (engendrée par une faible valeur de l’actif, par exemple, ou par un écart entre les taux d’inflation ou d’intérêt réels et projetés). Il juge donc qu’une réforme des lois en matière d’insolvabilité offre peu de chances d’améliorer la protection des prestations de retraite.

Une alternative est souvent mise de l’avant, soit un programme national de garantie qui assurerait les prestations contre l’insuffisance de l’actif des caisses de retraite en cas d’insolvabilité du promoteur du régime. Selon l’auteur, un tel programme, rigoureusement conçu, pourrait faire contrepoids aux règlements actuels en matière de capitalisation, dont la portée limitée est mal comprise par les adhérents. Toutefois, en plus de se heurter aux mêmes problèmes que tout régime d’assurance, la création d’un programme de garantie des prestations nécessiterait d’intenses négociations fédérales-provinciales, puisque les instruments de réglementation servant à gérer ces problèmes sont de compétence provinciale tandis que les risques financiers d’un programme national relèveraient sans doute du gouvernement fédéral.

Selon l’auteur, que les gouvernements souhaitent ou non créer un programme national de garantie des prestations de retraite, ils devraient au préalable modifier les règles de financement et de gouvernance des régimes de retraite de manière à rendre explicites certains risques inhérents aux régimes qui, actuellement, restent dissimulés aux intéressés. Ces modifications devraient, entre autres, promouvoir les régimes à prestation cible de manière à clarifier le « contrat de pension » des adhérents ; soutenir la gouvernance conjointe des régimes entre promoteurs et adhérents ; et permettre aux petits régimes de retraite de mettre à profit l’expertise et la structure de coûts des régimes plus importants. L’auteur suggère enfin de créer une commission royale d’enquête sur les régimes d’employeur pour susciter un dialogue au sujet de leur structure et de leur valeur entre les organismes de réglementation, les promoteurs de régimes, les adhérents et les retraités.

Employment-based pension plans, especially defined-benefit plans, are often characterized by experts and the media as “gold-plated” — the most secure part of Canada’s retirement income system beyond the existing public programs.1 Yet governments across Canada are either implementing or actively contemplating reforms to the legal regimes governing those employment-based pensions. Indeed, over the past few years, various commissions or panels of experts have issued reports and recommendations concerning reforms designed to strengthen them. The impetus for this activity is a growing realization of the impact of (1) definedbenefit pension promises on the financial health of businesses and the economy; (2) pension funding deficits on the adequacy of present and future retirement incomes; and (3) weak controls over conflicts of interest concerning plans’ investment policies that contribute to funding deficits and financial problems. The main focus of these reforms and commissions has been on defined-benefit pension plans, rather than on defined-contribution plans.

Employment-based pension plans originate in voluntary decisions by plan sponsors and members, but they receive significant public support through tax deferral. This financial support is based on the policy objective of ensuring adequate income for retirees by encouraging saving for retirement. Employment-based pension plans provide a significant proportion of retirement income to a large segment of the public.2 In addition, these plans have been integrated with other public policy initiatives that provide income for older citizens.3 The regulation of employment-based pensions, therefore, has important public policy implications.

According to the Report of the Ontario Expert Commission on Pensions (Arthurs 2008), employment-based pension coverage began declining in the 1970s from a high of 50 percent of the workforce to the current level of 38.5 percent. In Ontario, 2.2 million employees are covered and an additional 1.0 million retirees are receiving pensions. Defined-benefit pension plans provide approximately 80 percent of all employment-based pension coverage for Canadians (30-2).

Given the importance of employment-based pensions for Canadian workers, therefore, this study focuses on concerns surrounding the security of the defined-benefit pension promise in the event of employer insolvency. These concerns have been heightened by a number of recent high-profile cases, such as those of Nortel and AbitibiBowater, in which the pension plan sponsor became insolvent and the assets available were insufficient to pay promised pension benefits. As a partial response to such cases, private members’ bills have been brought before the House of Commons and the Senate to increase the priority of payment for claims against the employer by pension plan members for the shortfall in plan assets.4

To set the context for examining potential reforms to improve the security of the definedbenefit pension promise, I discuss the limitations of the pension promise, as currently constructed by pension regulation and the practice of pension professionals, by treating it as a guarantee backed by a claim on the sponsoring employer’s assets. I analyze the degree to which funding rules and professional practice support or undercut that guarantee, and specify the significant risks that remain to the pension promise because of asset allocation policies and the correlation between plan underfunding and employer insolvency risk.

I then examine the degree to which insolvency law supports the guarantee of pension benefits, especially that part of the guarantee provided by the sponsor’s nonpension assets when the sponsor becomes insolvent. While some recent amendments have increased access to the sponsor’s assets in cases of contribution arrears, insolvency law does not provide support for the largest component of risk to the pension promise — namely, the termination of the pension plan when there are insufficient assets to pay all the promised benefits, representing a “shortfall” in assets that remains after all contribution arrears have been accounted for.

Countries such as the United States and the United Kingdom have implemented pension benefit guarantee schemes that provide completely insured benefits, up to a specified maximum amount, when there is a shortfall in pension assets in the case of employer insolvency. The economic justification for such a policy choice is found in information problems in the labour market concerning pension promises, as well as in problems in designing adequate pension funding rules. The information problems stem from the fact that employees do not have sufficient information about the future risks that affect their pension security to value properly the pension benefits they have been promised in the context of their global compensation. Although pension regulation imposes duties to act in plan members’ best interests once the employer has made the contributions, those duties do not apply to the determination of the “price” (the proportion of total employee compensation used to fund the pension promise in the form of contributions). This “pricing” of the future benefit occurs as a negotiation on the terms of the employment contract, whereby the employee should assign less value to the pension promise as the risk of nonfulfillment increases, and instead demand more cash compensation. For employees, the effects of this incomplete information are magnified because, unlike other corporate stakeholders, who can diversify their risk by investing in other enterprises, employees have all their eggs in one basket, and face losing everything if their employer becomes insolvent and its pension plan is underfunded.

Funding defined-benefit pension plans requires a forecast of future events over the lifetime of a pension plan member. Any such forecast will inevitably be wrong, however, and if the actual events are more adverse than forecast, then the pension fund assets available to pay the pension benefits may be insufficient. Thus, pension funding rules require that the services of a professional actuary be used in making the forecast in order to calculate the amount to be contributed today. A pension benefit guarantee scheme is one means to share the risk that arises from the very nature of pension plans, which require a long-term commitment of resources to an uncertain future outcome.

Since any insurance program faces risks of moral hazard (where insured parties engage in riskier behaviour than they would without insurance) and adverse selection (where only high-risk parties buy insurance), I describe these risks and the regulatory tools available to control them. One reason Canada may face obstacles in implementing a national pension benefit guarantee scheme is that the regulatory tools to control the risks of moral hazard and adverse selection are under provincial jurisdiction, while presumably the fiscal risk of such a scheme — that is, if it were to be insufficiently funded — would rest with the federal government. Thus, implementation of such a guarantee scheme likely would require extensive federal-provincial negotiation.

Throughout the study, I pose a series of policy questions concerning funding rules, insolvency law and pension guarantees, and I offer some preliminary answers. These include a recommendation to consider, before implementing a national pension benefit guarantee scheme, complementary plan governance reforms such as promoting target-benefit plans in order to clarify the pension deal for plan members and retirees; furthering joint governance of employment-based pension plans; and allowing small pension plans to use larger plans’ expertise and cost structure. I also suggest convening a royal commission or some form of public inquiry to foster greater public debate and discussion than has so far taken place among regulators, plan sponsors, members and retirees.

Canada’s system of guarantees for employment-based pension plans is facing a crisis just when the largest age cohort in the population is beginning to retire. The defined-benefit pension guarantee system relies primarily on the sponsoring employer’s remaining solvent and guaranteeing its pension promises through a legal obligation to make up any shortfall in pension funding from its own assets. The efficacy of such a guarantee depends, however, on the degree to which it encourages the employer’s managers to make prudent decisions about setting aside the funds needed to pay the pension benefits and on the priority given to the payment of any pension fund shortfalls from the bankrupt employer’s assets in insolvency proceedings.5 One would expect managers to have strong incentives to avoid insolvency, and thus equally strong incentives to fund pension promises fully so that these liabilities would not likely be a cause of an employer’s insolvency. As well, since employment-based pension plans are regulated by provincial and federal law, such legislation would be expected to supplement and reinforce these incentives for full funding.

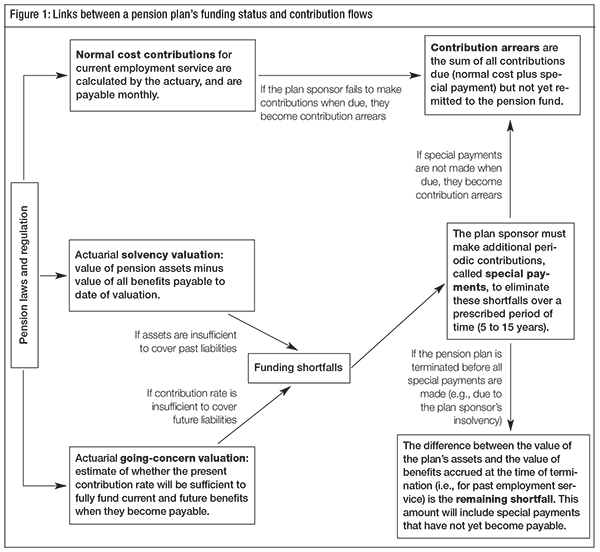

Over the past few years, however, major Canadian employers have faced multi-millionor multi-billion-dollar shortfalls in the funding of their pension plans at a time when their cash flow is insufficient to pay the additional special payment contributions required to bring their pension funds to full funding over a reasonable period of time (see the glossary and figure 1). These additional contribution obligations are triggered by law when an actuarial valuation discloses that the value of the assets in the pension fund has fallen below the amount needed to pay those benefits earned to the date of the valuation. The global financial crisis of 2007-09 led to an extreme drop in the value of pension assets just as employers faced major cash-flow challenges. The substantial pension deficits of such major corporations as Air Canada, Stelco, AbitibiBowater, Nortel and General Motors have been a significant factor in their entry into insolvency proceedings. In some cases, these substantial deficits existed well before the fall in the value of pension fund assets that occurred as a result of the global financial crisis.

The federal Office of the Superintendent of Financial Institutions (OSFI), which regulates more than 400 pension plans of employers whose business falls under federal jurisdiction,6 estimates that, as of June 2009, 79 percent of these plans were not fully funded. For 280 of those plans, the value of the assets was less than 90 percent of the cost of the pension promises owing. A graph accompanying the 2009 OSFI report shows that the weighted average solvency was below full funding for all the OSFI-regulated plans between December 2004 and June 2006 and returned to less than full funding again in early 2008 (OSFI 2009, 3).

In Ontario, the Financial Services Commission of Ontario has been conducting a risk-based monitoring of defined-benefit pension plans based on both actuarial data and funding data; more recently, it has also monitored plan investments. In its latest report on the funding of 1,539 defined-benefit plans in Ontario, the commission reported that the proportion of underfunded plans had increased to 79 percent in 2009 from 76 percent in 2008, while the median ratio of assets to liabilities had dropped from 91 percent in 2008 to 89 percent in 2009 (Financial Services Commission of Ontario 2010, 5). The total estimated shortfall for Ontario-regulated defined-benefit pension plans, if they were all to be terminated on their last valuation date, was $32.4 billion on a total of $170.1 billion in pension liabilities owed to plan members (22). The commission’s data show that Ontario pension plans’ median ratio of assets to liabilities has been below full funding since 2000 (11, 19-20).

The consequence of this funding shortfall is that regulations require employers that sponsor defined-benefit plans to make additional contributions called “special payments” to their pension fund in order to make up the shortfall and to increase the plan’s assets to an amount equal to its liabilities within five years.7 These payments can be quite large; for example, in Ontario, special payments in 2009 amounted to almost $2.8 billion, or 42 percent of all contributions to pension funds (Financial Services Commission of Ontario 2010, 29).

The threat these large special payments pose to the solvency of a sponsoring employer is clear, especially when the economic shock that led to the solvency deficit in the plan also has had a negative effect on the employer’s cash flow. If the employer becomes insolvent while the pension fund has insufficient assets to pay accrued benefits, and the pension plan is terminated as a result of the employer’s insolvency, plan members will suffer reductions in their promised benefits as a consequence. Thus, the limitation on the pension promise can be described as two separate — though potentially related — risks. First, there is the funding risk, in which the assets in the pension fund may not be adequate to fund the promised benefits. Second, there is the insolvency risk, in which the employer’s business assets, which serve as the ultimate guarantee of the pension promises, are subject to competing claims by other creditors in the employer’s insolvency. A fully funded plan need not worry about the risk of the employer’s insolvency, but a poorly funded plan may trigger the employer’s insolvency through its requirement for additional payments in order to be restored to full funding levels. Although legal regulation seeks to address both of these risks, Canada’s constitutional division of powers makes the process of policy formation with respect to such risks an area in which competing policy considerations must be balanced.

Defined-benefit pension plans can be funded in a number of different ways (see, for example, Davis and Sarra 2007, a research report prepared for the Ontario Expert Commission on Pensions). A report prepared for the Organisation for Economic Co-operation and Development (OECD) divides possible funding mechanisms for employer-sponsored pension plans into internal and external mechanisms (Gollier 2000, 232-6). One internal mechanism is “pay-as-you-go” funding, whereby the employer funds pension benefits as they become due from current revenues. Another internal mechanism is to set aside reserves in the employer’s accounts to pay future benefits. In both cases, however, the risk remains that there will be insufficient funds to pay benefits when they become due and that, in the event of sponsor insolvency, pension claimants may receive almost nothing if too few assets remain after other creditors with greater priority have had their claims paid.

External funding mechanisms avoid the latter risk by having the employer contribute amounts necessary to fund benefits earned each year to a third party, which holds and invests the contributions in order to fund future pension benefits. The third party may be a pension trust or an insurance company that has agreed to pay the promised benefits in return for specified premiums. With an external funding mechanism, employees and retirees no longer would face the loss of their entire pension benefits, as they would with internal funding, because the funds contributed by the employer would not be available to the employer’s creditors if the employer became insolvent. In Canada, pension regulation requires the use of external funding mechanisms through the establishment of a pension fund that is administered by a third-party custodian.8 Even this requirement does not eliminate all risk, however, as the funds held by the third party may not be sufficient to pay all the promised benefits.

The problem of the adequacy of pension funding can be illustrated by asking how much one must set aside now to fund a benefit of $100 per month for the rest of one’s life, beginning at age 65. To answer this question, one would need to know how long one will live after age 65 and how much the money set aside will earn if invested. The return earned by investing the initial amount will vary with the type of investment or asset held and with the cost of investing in that asset. Adding further parameters — such as a pension benefit calculated as a percentage of one’s final salary or career average earnings, which must be projected using hypotheses about one’s future earnings path — increases the complexity of the calculations.

Pension regulation relies on the actuarial profession to control the funding risk in calculating the contributions required to fund promised pension benefits. It does this through two requirements. First, it requires that the calculations of the contributions needed to fund the benefits earned each year (“normal cost contributions”) be carried out by an actuary using generally accepted actuarial practices (Davis and Sarra 2007, 17-18). Second, it requires that the actuary conduct two separate types of assessments of the adequacy of the fund every three years, using the assumption that the plan will terminate on the valuation date (a solvency valuation) and then using the assumption that the plan will continue for the foreseeable future (a going-concern valuation). If either actuarial assessment discloses that the assets are insufficient to pay the promised benefits, then the employer must make special payments to the pension fund, in addition to the normal cost contributions, sufficient to eliminate the shortfall in assets over a prescribed period — typically five years in the case of a shortfall disclosed by a solvency valuation, or fifteen years in the case of a going-concern valuation.

Thus, pension regulation addresses funding risk through the actuarial calculation of the normal cost contributions and through a second check of that calculation via a triennial actuarial valuation. Asset shortfalls may still arise, however, because of inherent uncertainty in actuaries’ calculations based on a forecast of future events. As I note in an earlier study,

Clearly, an actuary is in the business of forecasting. Even more clearly, given the number of variables involved, that forecast is primarily a product of the exercise of professional judgment and discretion. Therefore, there is almost invariably a difference between the actual rates of earnings, retirement, and life expectancy experienced by the pension plan and the estimates of those rates provided by the plan’s actuary when calculating the cost or the funded status of the plan. This exercise of professional discretion is the first source of insolvency risk for the pension plan’s members. Unless the actuary uses relatively conservative assumptions, the plan’s members face the risk that minute variations in actual experience will require large unexpected contributions from the plan sponsor and either the plan sponsor will not be able to make them due to its insolvent status or the size of the payments will drive the plan sponsor into insolvency proceedings. (Davis 2004, 33)

Moreover, uncertainty about future events is not the only source of potential asset shortfalls. Retroactive benefit increases may create a shortfall by giving future benefits to employees for past service, which immediately increases the plan’s liabilities beyond the ability of its assets to pay for them.

Dramatic shortfalls in assets also may result from the existence of a feedback loop — whereby a small disturbance is magnified and reflected over and over until the end result is a very large disturbance — between actuarial practice and investment in volatile equity. The loop begins with the actuarial practice of calculating the present cost of a future pension benefit. For example, to pay a benefit of $100 per month for life starting in ten years, suppose the actuary estimates that it will take a total of $60,000, based on average life expectancy. The actuary then estimates how much must be contributed today to earn a total of $60,000 in ten years, based on the anticipated rate of return, and including the effect of compound interest, from investing the pension contributions over that period.

In making the calculation, the actuary takes into account the type of investments the plan makes by using a rate of earnings that includes an “equity premium” intended to reflect the common understanding that, over the long run, the return on equity investments will be greater than that generated by “risk-free” fixed-income investments such as bonds. Thus, the greater the proportion of equities in the pension fund’s assets, the lower will be the initial pension contribution needed in the normal cost calculation the actuary performs. One report estimates that a pension plan that seeks to replace 50 percent of preretirement income by investing in fixed-income government bonds requires a contribution rate of 23.8 percent of salary (Hamilton 2009). The report also suggests, however, that:

Most of today’s retirement plans, defined benefit and defined contribution alike, try to make good pensions affordable by investing 50% to 70% of the fund in risky assets thought to offer higher rates of return in the long term, albeit with commensurately higher risks. The objective is typically to increase the rate of return on the pension fund by about 2% net of fees and to use some combination of risk management, patience, fluctuating contribution rates (defined contribution plans), fluctuating benefits (defined benefit plans) or both (hybrid pension plans) to deliver an acceptable compromise between affordability and stability. Increasing the expected rate of return by 2% reduces the steady state contribution rate by about 40%. (Hamilton 2009)

Critics of this practice focus on the bias toward equity investment created by the “equity premium,” arguing that there is no justification rooted in financial economics principles or research for using differing costs for a fixed obligation based on what form of investment one makes (see, for example, Bader and Gold 2003; Exley, Mehta, and Smith 2004; and Sutcliffe 2005). In their view, the practice of incorporating the equity premium into the cost calculations ignores the fact that the premium is the market price for the extra risk assumed by choosing equities over riskfree investments. The result is that the potential for a pension asset shortfall is increased by the proportion of equity assets in the pension fund. Despite this, in Ontario, the proportion of pension assets invested in equities has grown steadily, and at the end of 2008 stood at 60 percent (Financial Services Commission of Ontario 2009, 12-13), although the proportion declined slightly to 55 percent in 2009 (Financial Services Commission of Ontario 2010, 25-6).

Another critique of funding pension obligations through equity investments is that the volatility of such investments is a mismatch for the predictably increasing liability of a pension benefit. Because equity investment prices do not follow a predictable path, there is a real, albeit low, probability that they will generate a very large price decline just at the time when they must be sold to pay benefits (Bodie 1996, 90-1). A task force of the Canadian Institute of Actuaries to review the standards for pension funding in actuarial practice similarly concluded that 10 percent should be added to the contribution amount if the pension fund contained 50 percent equities, in order to account for the potential of an “unacceptable deterioration in the plan’s funded status” because of the high degree of asset-liability mismatch (Canadian Institute of Actuaries 2003, 9-10).

Although the Canadian Institute of Actuaries has not implemented the task force’s recommendation, the potential for equity investments to contribute to the rapid deterioration of plan funding has been recognized in at least one jurisdiction in Canada. In Quebec, as of the beginning of 2010, a pension plan must provide for adverse returns on equity investments by holding additional funds in reserve, over and above the amount required to pay for the plan’s outstanding liabilities (Supplemental Pension Plans Act, s. 128). The calculation of the amount of this reserve fund is based on the ratio of fixed-income assets to the total assets of the pension fund (Regulation Respecting Supplemental Pension Plans, s. 60.04).

Given the potential risks to pension fund balance sheets from equity investments, why have asset mixes weighted toward equities been almost universally adopted in pension funds? The most common justification is that investing in equities reduces the cost of paying for pension benefits. The reasoning behind this argument is that the actuarial calculation of the normal cost contributions factors in the potentially greater earnings of equities over fixed-income products, which reduces the cost of the benefits to the employer’s shareholders. However, this argument does not seem to fit easily into a regulatory regime that requires the employer to make special payments at some time in the future when the volatility of equity assets generates a shortfall in funding during the triennial actuarial valuation of solvency funding. When this happens, the shareholders bear the additional cost because of the transfer of additional assets from the corporation to the pension fund. If they were misled about the cost of the pension fund by the incorporation of the “equity premium” into the actuarial calculation of the cost of the benefits, the price of their shares may not reflect the risk they have assumed in the corporation’s pension fund (Laidler and Robson 2007, 3).

Critics of the actuarial practice of using the “equity premium” point out that, although pension funds investing in equities can increase the risk borne by their sponsors’ shareholders, the immediate recognition — through the corresponding reduction in the cost of funding the pension plan — of the potential but unrealized rewards for that higher risk introduces an unjustified bias in favour of equity. With other forms of increased risk, shareholders must wait to see whether or not the increased rewards are realized (see Bader and Gold 2003, 8; Ambachtsheer 2004, 4). Critics also point out that the interests of corporate managers may conflict with those of shareholders and plan members in that the immediate recognition of the not-yet-earned rewards of equity investments has an immediate effect on the compensation managers receive when it is based on the positive effect of such a pension investment policy on the corporation’s earnings (see, for example, Bader and Gold 2003, 8; Exley, Mehta, and Smith 2004, s.3; Sutcliffe 2005, 64). When coupled with the actuarial and pension accounting practices of smoothing variations in asset values and liabilities by spreading losses and gains over a number of years, which allows managers to anticipate future losses and to make their personal arrangements accordingly, the potential for earnings management through pension funds is apparent.

In a recent summary of the empirical research on the relationship between earnings management and the exercise of managerial discretion over the assumed rate of return, Martin Glaum concludes: “[M]anagers have scope for discretion when setting actuarial assumptions in pension accounting. Overall, the results…suggest that they exercise the discretion in opportunistic ways. The evidence…is consistent with managerial choices regarding pension accounting assumptions being influenced by funding consequences and related debt and dividend constraints, tax benefits, and companies’ efforts to smooth earnings” (2009, 293). Glaum notes that Bergstrasser, Desai, and Rauh (2006) “find evidence consistent with companies making more aggressive return assumptions in years before, and in years in which, they engage in merger and acquisition…transactions. Companies also appear to set higher expected rates of return on plan assets in periods in which seasoned equity offerings take place and in periods in which [chief executive officers] exercise stock options. The findings…moreover indicate that managers are more aggressive with return assumptions if their companies are close to failing to meet important earnings thresholds (positive earnings, previous years’ earnings, median industry earnings)” (Glaum 2009, 293).

Thus, the bias toward equity investments is enhanced by the ability of such investments to allow corporate officers to influence the corporation’s reported earnings to their advantage. Moreover, the professionals retained to advise pension fund administrators are also biased toward equities. As Exley, Mehta, and Smith point out (2004, s.2.2), the actuarial fees generated by equity investments are greater because of the increased likelihood of having to deal with surpluses or deficits and because there is more opportunity to be consulted by trustees, while Coleman, Esho, and Wong report (2005, 306) that equity investments give higher fees to professional advisors in choosing and monitoring investment managers.

One last point to be made about the investment policy is that, while the corporation’s shareholders may bear the initial risk of the investment policy through special payments, the ultimate incidence may fall on the active employees and/or all the plan members, depending on the circumstances. Even as the employer makes the special payments to extinguish the funding shortfall from its current assets, it could recover these payments indirectly from its active employees by reducing future increases in their cash compensation (Ambachtsheer 2004, 2; Pesando 2008, 6-7). As well, if the employer becomes insolvent, employees will have their benefits reduced if there is a shortfall in pension assets; in contrast, while shareholders will lose their investment in the firm, they are able to diversify their investments to mitigate this risk. Employees have no such option; instead, they lose both their means of livelihood and a significant proportion of their retirement savings.

The policy issues that arise from choosing to invest in equities thus directly challenge the riskbearing model that is the basis of Canada’s pension funding regulation. As Keith Ambachtsheer argues, “The greater the asset shortfall, and/or the greater the liability/asset mismatch, the riskier the pension contract becomes. It follows directly from this conclusion that funding policy and investment policy in [defined-benefit] plans are intimately linked. Both have a direct impact on the riskiness of pension contracts. Further, more risk exposure from one source can be offset by less risk exposure from the other, and vice-versa” (2007, 208).

In short, the risk that is carried on pension fund balance sheets has not been articulated and allocated clearly in defined-benefit pension plans. As a result, plan members believe, reasonably, that current regulatory arrangements are designed to guarantee full funding with current contribution rates (Ambachtsheer 2007, 11). Accepting that this guarantee, in fact, does not exist is thus the starting point for a discussion about what changes should be implemented. Options could include improving pension regulation, addressing the risks through the insolvency law regime, and implementing some form of pension benefit insurance. But there will be no incentive to start a dialogue about reform unless all involved agree that the current system does not offer a guarantee to those involved.

Clearly, the first type of insolvency risk mitigation is the funding risk regulation regime discussed above. By seeking to ensure that all promised benefits are fully funded and that the assets to pay those benefits are held by third parties beyond the reach of the employer’s creditors, pension regulation tries to ensure that pension benefits accrued to the date of the employer’s insolvency will not be adversely affected. As we have seen, however, the funding regime has some weaknesses, and there certainly have been a number of instances where large corporate employers had a significant shortfall in their pension funding even as they were unable to meet their debts to their creditors.9 In other cases, employers have failed to make both normal cost and special payment contributions when they became due for a period leading up to their insolvency.10

The risk to pension plan members’ benefits, therefore, once an employer becomes insolvent is that the employer’s assets cannot be used to make up any shortfall in funding. The reason is that, in an insolvency proceeding, the employer’s other creditors also make claims on those assets and, by definition, the employer has insufficient assets to pay all such claims in full. To the extent that all the claims have the same priority for payment, all will have to suffer some loss in the value of their claim. Thus, the insolvency law issue that determines the dimensions of the loss suffered by pension plan members is the extent to which they can claim priority over other creditors for payment in full from the insolvent employer’s assets. While various provincial pension law statutes purport to give such a priority to contribution arrears, these statutes have proved ineffective because of the constitutional paramountcy of the scheme of priorities set out in federal insolvency legislation.

Canada’s constitutional division of powers assigns to the federal Parliament exclusive power to legislate respecting bankruptcy and insolvency (Constitution Act, 1867, s.91 21). Thus, provincial pension legislation may not interfere with the operation of the federal insolvency scheme, and to the extent that it does, it is of no force and effect.

Pension legislation deals with the failure to remit contributions when due by declaring that the employer is “deemed” to hold all such contribution arrears in trust for the pension fund and by giving the pension administrator a statutory lien over all the employer’s assets for the amount of contributions owing (see, for example, Ontario’s Pension Benefits Act, 57(4)-(5)). In addition, such legislation requires payment of any remaining shortfall in the assets — that is, any shortfall that has not yet been made up with “special payment” contributions — when the pension plan is terminated (Pension Benefits Act, s.75(1)(b)). No statutory deemed trust is applicable, however, to the remaining shortfall (see figure 1).11

Insolvency legislation, for its part, makes all assets of the debtor subject to distribution among the creditors. However, any property held in trust by the debtor is not available for distribution to the debtor’s creditors. Courts have held that “deemed trusts” created by provincial legislation are not trusts under federal insolvency legislation because to find otherwise would be a constitutionally impermissible rearrangement of the scheme for distribution in federal legislation by provincial legislation. As a result, the courts have held that deemed trusts created by provincial pension legislation have no effect in an employer’s bankruptcy and, accordingly, the claims for pension shortfalls have the priority assigned to them by federal insolvency legislation.12

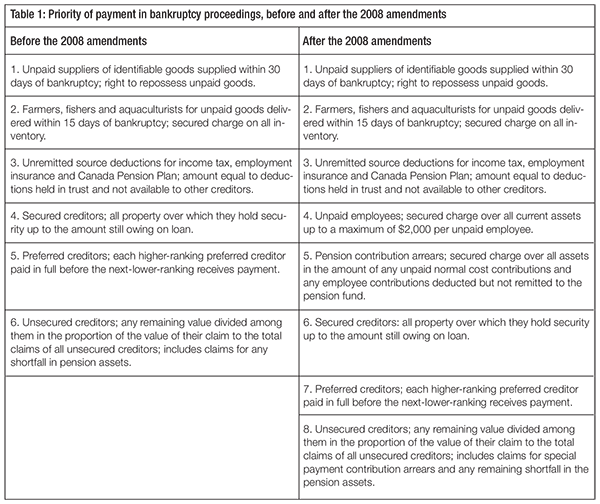

Until recently, all pension shortfall claims were treated as unsecured claims and accorded last priority, having to share with other unsecured creditors in whatever assets were left after secured creditors and higher-priority preferred creditors had their claims paid in full (Baird and Davis 2007, 80-2). As of July 2008, however, amendments to insolvency legislation were implemented that increase the priority of some pension claims in insolvency proceedings (see table 1).13 Now, any arrears of normal cost contributions or amounts deducted for employee contributions become a statutory secured charge on all the employer’s assets as of the date of the bankruptcy or receivership order. The pension contribution arrears secured charge is fifth in priority for payment and is entitled to payment before any other lowerranking secured charge.14

While this increased priority enhances the potential for recovery of the normal cost contribution arrears, any arrears for special payments required to extinguish a previously existing shortfall of pension assets remain as an unsecured charge, as does the claim for the shortfall itself. Thus, it is likely that the increased priority granted to arrears of normal cost contributions will provide complete relief only where there is no pre-existing shortfall of assets. Where such a shortfall exists, plan members likely will face a termination of the pension plan and a reduction of their accrued benefits, which may include a reduction of pension benefits to retirees or their surviving spouses.

To summarize, the approach to guaranteeing the pension promise is twofold. First, efforts have been made to ensure that adequate assets are set aside to fund the promise without risk that those assets could be subject to the employer’s creditors’ claims. This strategy, however, entails uncertainty about future events that affect the cost of benefits, as well as the risk of a significant degree of mismatch between investments and future pension liabilities.

Second, to address these problems, legislation requires the employer to contribute additional sums to the pension fund to extinguish any shortfall that is discovered through periodic comparisons of the assets and liabilities. However, there is still a significant period (of up to eight years) during which a pension fund may not have sufficient assets to pay the promised benefits. If the shortfall occurs shortly after the last actuarial valuation, it will not be recognized officially until the next actuarial valuation in three years’ time. Then, the employer must make additional special payments to make up the shortfall, but has a fiveyear period in which to do so (in the case of a solvency valuation shortfall). Thus, if the pension plan is terminated during the period between valuations or before the shortfall has been made up with the required special payments, there may be insufficient assets to pay the promised benefits.

This period will be of no concern as long as the employer remains solvent and able to make both normal cost contributions and special payments during that time. If the employer becomes insolvent, however, then pension plan members face an almost certain reduction in their promised benefits. The reason is that insolvency legislation — while granting priority status to claims for arrears of normal cost payments — still requires that any arrears of special payments plus any remaining shortfall in the assets be among the last claims paid out of what remains of the employer’s assets after all higher-ranking creditors have had their claims satisfied. Thus, a pension guarantee that is based on the employer’s assets serving as the backstop to the pension promise has certain limits. It is in this context that possible options to address weaknesses in the pension regulatory regime for providing benefit security should be assessed.

The security of promised pension benefits could be increased in a number of different ways. One option would be to give pension claims additional priority in payment over that granted to other claims through amendments to the existing scheme of distribution in the insolvency legislation; indeed, recent amendments increasing the priority of normal cost contribution arrears have whetted the appetite for such change among some policy-makers and legislators. Another option would be to set up a pension benefit guarantee scheme, which would operate similarly to an insurance policy, with plan sponsors required to pay premiums that would then be used to pay claims by plan members in the event that there were insufficient assets in the pension fund to pay promised benefits and the employer became insolvent and unable to fulfill its guarantee. Both of these options, however, would have problematic effects that would need to be taken into account and addressed before either was implemented.

One option for addressing the shortfall in pension assets is to mimic recent insolvency legislation amendments by increasing the priority for special payments arrears and for any shortfall remaining after all contribution arrears have been satisfied. However, while the policy justification for increasing the priority for special payments arrears would echo those for the increased priority for normal cost arrears, different policy considerations would apply to increasing the priority for any remaining shortfall.

In a recent article comparing the insolvency law treatment of pension claims and pension guarantee regimes in Canada, the United States and the United Kingdom, I suggested the following policy rationale:

Pension legislation in all three countries requires regular contributions be made to both defined contribution and defined benefit plans. Any contribution arrears will thus likely involve a deliberate decision by the employer to postpone or avoid remitting the contributions in order to use the funds to keep the business going. Such an action amounts to a preference in favour of the non-pension plan creditors that is contrary to the statutory [legal] obligations of the employer. Thus, granting contribution arrears claims a preference in the claims over remaining assets [in a case of insolvency] can be seen as an attempt to recognize that the non-payment may have been the result of preferences granted to other creditors while committing an offence. To the extent that insolvency law can serve to provide appropriate incentives to financially distressed employers and their creditors to comply with statutory obligations, granting a post-insolvency preference for those statutory obligations can provide such incentives. (Davis 2009, 145)

This rationale is consistent with those in other areas of insolvency law that try to discourage distressed debtors from attempting to prefer some creditors over others through risk-shifting strategies, such as voidable preferences (see Duggan and Telfer 2007). Additional policy justifications for priority treatment of contribution arrears include: (1) the likelihood that assets are available in an insolvency because of the low order of magnitude of contribution arrears — which are significantly smaller than the remaining shortfall in the pension fund in almost all cases; and (2) support for pension benefit guarantee schemes in the United States and the United Kingdom (Davis 2009, 145).

Similar rationales would apply to amending insolvency legislation to include special payment arrears in the statutory secured charge for pension contribution arrears. While there would be no difference in the deliberate and illegal behaviour involved in a decision to delay remitting special payments as opposed to normal cost contributions, there would be a difference in the size of the contribution involved and, accordingly, in the size of the preference granted to the employer’s other creditors in the period prior to insolvency. Another difference, of course, is that the obligation to make the special payment in the first place would have arisen because of the effects of exogenous economic forces on the value of assets and liabilities, not because the employer deliberately decided to underfund its pension promise.

Different policy considerations would apply, however, in the case for increasing the priority of the claim for the entire remaining shortfall after all contribution arrears have been remitted, for two main reasons. First, a shortfall in a defined-benefit plan can arise without any wrongdoing or statutorily prescribed fault on the part of the employer, and to that extent it does not represent a preference for other creditors. As I have noted elsewhere,

In a defined benefit plan, a solvency deficiency can arise when one or more of the variables on which an actuary has based his calculation of the amount of contributions vary adversely when compared to the assumptions used by the actuary. Recent examples of such adverse variations involved lower than assumed long-term interest rates and investment returns. Clearly, providing there was no improper [illegal] behaviour involved in the choice of assumptions for the calculations or the valuation of the plan, there is no element of deliberate choice to underfund by the employer. (Davis 2009, 146)

Second, the magnitude of the pension shortfall might make it less likely that the employer’s assets could satisfy the claim in many insolvency proceedings.

The effect of an increased priority on a plan sponsor’s credit should also be considered, especially given the volatility of pension shortfalls, which make any credit-granting decision uncertain because of the unknown dimensions and probability of the credit risk involved in a defined-benefit pension fund. When a financial institution considers granting credit to a business, it tries to assess the risk that the loan will not be repaid in full. The degree and probability of that risk will determine whether, how much and at what interest rate the loan will be made. While normal cost pension contributions typically are a known cost of the business that will increase only as the workforce expands, a pension shortfall is the result of a complex interplay of internal and external economic forces that yield unpredictable results. If a shortfall were given priority over the secured claims of financial institutions in insolvency proceedings, these institutions would have to charge higher interest and would tend to lend smaller amounts to firms with defined-benefit pension plans in order to protect themselves from the unpredictable risk that giving priority in payment to a pension shortfall would create to their security. Fiona Stewart (2007, 22) cites this concern as being behind the decision not to change priorities for pension claims in insolvency proceedings in UK pensions legislation.

Thus, the option of changing priorities under insolvency law to address the problem of a pension fund shortfall lacks a compelling policy rationale. Instead, two other options might be considered. One is to institute a national pension benefit guarantee scheme, funded by premiums charged to employers with defined-benefit pension plans. Another option is to implement stricter funding and asset-liability mismatch rules to address some of the remaining risks that are amenable to regulatory control. Neither of these options is mutually exclusive — stricter funding and measures to control asset-liability mismatch risk could enhance the viability of the pension guarantee scheme option.

To this point, the discussion about insolvency regulation has dealt with shortfalls in the context of a liquidation proceeding in which the employer’s operations have ceased and its assets have been taken over by a trustee in bankruptcy or a receiver.15 There are also restructuring proceedings in which the insolvent employer remains in control of the business under the protection of a court order that prevents creditors from seeking to collect on pre-insolvency debts pending a negotiated compromise arrangement acceptable to creditors.16 Recent amendments to the insolvency legislation require that any such arrangement must include full payment of all normal cost contribution arrears immediately, although a different arrangement may be negotiated with the plan members and pension regulator. However, arrears of special payments and any remaining balance of the shortfall in plan assets are subject to negotiation with the employer, and the amount and timing of the payment of these amounts will be part of the arrangement submitted to creditors for their approval at the end of the process. If the process is not successful, then the bankruptcy liquidation process described above will commence.

While an employer is not obligated to continue a pension plan, terminating a plan with a funding shortfall in a restructuring proceeding may not be the preferred course, particularly if the shortfall is large enough that the pension plan becomes one of the largest creditors and thus is able to dictate the terms of the arrangement through its voting power. In such a case, the preferred course might be to negotiate a compromise on future benefits and perhaps an employee contribution in order to reduce the financial burden after the employer leaves court protection. Thus, the full burden of the shortfall would be felt by other creditors if the pension plan were terminated during the restructuring proceeding, although terminations of plans with shortfalls are rare. As a result, care should be taken to ensure that a pension guarantee scheme does not encourage the “shedding” of pension obligations during a restructuring.

In a report for the Ontario Expert Commission on Pensions, Norma Nielson summarizes the potential policy options for dealing with the risk that pension assets will be insufficient to fund promised benefits in private, employer-based pensions as (1) doing nothing in advance; (2) relying on private market mechanisms; or (3) implementing a government-based mechanism such as a guarantee scheme (Nielson 2007, 2). She suggests that some form of pooling or insurance of the risk would be an effective response to its no-fault nature, the likelihood that the employer’s assets are insufficient to pay the more severe instances of a shortfall in assets, and the inability of employees to diversify this risk without moving from one employer to another (Nielson 2007, 7-8).

The arguments for and against a form of guarantee scheme for pension benefits when the sponsoring employer is insolvent and the pension fund faces a shortfall have been clearly and succinctly developed by both Nielson (2007) and Stewart (2007). Support for such a guarantee scheme is provided by the market failures inherent in the relationship between employer and employee. For one, workers are unable to assess the employer’s bankruptcy risk over their entire working life when bargaining over the wages they will defer in the form of pension contributions (Stewart 2007, 5). In addition, once the wage-pension trade-off bargain has been made, the employer is free to alter its bankruptcy risk because employment contracts — unlike, for example, bondholders’ covenants — do not impose any constraints on management decisions that might increase that risk (Howse and Trebilcock 1993, 756-7). This problem of information asymmetry in the labour market is compounded by the fact that the risk of a pension shortfall is not one that is diversifiable because it arises only on the insolvency of the employer, when the worker loses both present and future income (Nielson 2007, 8).

The argument against implementing a guarantee scheme is that it would face the same challenges as all insurance arrangements do — namely, moral hazard and adverse selection. The moral hazard of insurance is that the guarantee against financial loss increases the incentive to engage in riskier behaviour with respect to the insured activity. As Stewart notes, “Such behaviour may include raising benefits to unsupportable levels, cutting their own contribution rates, or pursuing a risky investment strategy” (2007, 6). Adverse selection may stem from premiums whose price does not reflect the actual insolvency risk of an individual employer. This leads to more solvent employers subsidizing weaker ones through premium increases and eventually to the more solvent employers finding a way (perhaps by changing to a definedcontribution pension plan) to quit the insurance pool, leaving behind only the financially distressed employers (Nielson 2007, 21; Stewart 2007, 6-7).

The regulatory instruments that are available to face these two challenges are strict control of funding and investment policy, exclusion of certain benefits from coverage and an appropriate premium structure that reflects the insolvency risk of individual employers. One of the most problematic factors is the premium structure. If properly designed to fully reflect an employer’s insolvency risk, premiums might be so expensive as to push weaker firms into bankruptcy or cause employers to terminate their defined-benefit plans in response (Stewart 2007, 22). Thus, the insurance premiums for a guarantee scheme might have the same effect on financially distressed employers as special payments are having now under the current funding regime. Stewart suggests that the reason fully adjusted premiums would be so expensive is that insuring pension benefits involves systemic risk because employer insolvencies are highly correlated with plan underfunding, as the economic conditions that underlie an insolvency likely would also drive down asset prices (2007, 7-8). Nielson suggests that only governments could absorb the “tremendous swings” that accompany systemic risks attached to pension benefit guarantee schemes (2007, 57). Stewart suggests that the choice to implement a pension guarantee scheme ultimately would be driven by political considerations of the implicit government guarantees that the pension regulatory regime was sufficiently robust to ensure full funding of defined-benefit pensions (2007, 8-9). If that implicit guarantee failed to provide full funding in high-profile insolvencies, political pressure might lead a government to implement some form of pension benefit guarantee scheme.

In considering whether or not to set up some form of pension guarantee scheme, the question arises as to whether this option ought to be the first response to the failure of the current regulatory system to provide consistent levels of full funding. If analysis of the funding rules discloses fundamental weaknesses and conflicts of interest in the regulatory regime, it might be preferable to address those issues before considering a pension guarantee, with its exacerbation of the moral hazard problems inherent in the process of receiving and investing “other people’s money” (Brandeis 1914). As discussed above in the context of the asset allocation decisions for pension fund investments, where the interests of plan beneficiaries and those who invest on their behalf diverge, adequate regulation must be in place to counteract the incentives generated by the possibility of reaping personal rewards for risking other people’s money. To the extent that a funding shortfall is the result of regulatory inadequacy in this area, adding insurance to the mix would only increase the potential for moral hazard. In a study of the asset allocations of private sector pension funds between 1998 and 2004, Crossley and Jametti find that plans whose benefits were insured under Ontario’s Pension Benefit Guarantee Fund had over 5 percent more assets allocated to equity than plans whose benefits were not insured, which the authors suggest is significant evidence of the moral hazard problems that pension insurance can create (2008, 9).

In addition to the moral hazard issue, however, it is important to recognize that the premium structure of any guarantee scheme is subject to the same stresses and demands as are actuarial estimates for a sponsoring employer. The guarantee scheme premium is intended to reflect the shortfall risk in the pension fund that is a result of the actuarial estimates of contribution levels. At the same time, the scheme is also subject to the risks formerly borne by plan members and retirees — namely, that a shortfall in the value of the plan’s assets in relation to its pension liabilities coincides with the employer’s insolvency to produce a shortfall in the funding available to pay accrued benefits.

In order to establish a premium that enables the insurance fund to cover a shortfall, the guaranteeing organization must assess both the employer’s insolvency risk and the risk of a shortfall in the pension fund’s assets, as well as any correlation between these two risks. The difficulty of designing a premium structure that both reflects these risks and is viable for plan sponsors is set out in the consultation documents of the United Kingdom’s Pension Protection Fund (PPF) concerning the redesign of its pension guarantee levy. These include the recognition by the PPF that it was not collecting sufficient levies — that is, levies that reflect their contribution to the PPF’s long-term risks — from pension plans that had current strong funding and low insolvency risk (Pension Protection Fund 2008, 3).

A consultation by the PPF on its proposed new levy formula led to the formation of a steering group that has proposed a complex formula designed to (1) address the calculation of longterm risk; (2) reduce the procyclical effect of having higher levies at the same time as firms become financially weaker because of deteriorating economic factors; and (3) enhance the predictability of future levies based on funding levels and firm insolvency risk. The suggested formula would replace the annual assessment of insolvency risk with one based on average risks and would assess funding levels based on a smoothing technique for both assets and liabilities. The steering group report recognizes that any premium or levy formula represents a compromise among fairness, predictability and the need to meet the guarantee fund’s requirement to have sufficient funds to support the guaranteed benefits (Pension Protection Fund 2010, 4.1.4). However, to the extent that any compromise added to the cross-subsidization of weak firms by strong firms, it would also add to the adverse selection problem for the guarantee fund. In addition, if averaging and smoothing techniques were adopted, any shortfall resulting from an underestimation of risk in these techniques would have to be borne by the taxpayers or subsidized by surviving pension plan sponsors. Either result would undermine the political acceptability of any pension guarantee scheme, as well as its ability to perform its function.

For pension funds, governance matters. The two main issues in pension fund governance are conflicts of interest and access to financial skill and expertise. I discussed some aspects of conflicts of interest above; however, access to financial skill and expertise can also involve conflicts of interest between the profit incentives of expert investment management organizations and the desire of pension fund beneficiaries to obtain the best return on their investments.

These conflicts of interest between investors and investment managers can be seen in research comparing the performance of the mutual fund industry — where individuals contract with mutual fund professionals to manage their money — to that of pension fund investments. Studies comparing Canadian and US mutual fund and pension fund performance controlling for size, investment style and risk find that mutual funds significantly underperform benchmark returns, while pension fund returns are very close to those of a benchmark portfolio.17 This different performance is attributed to the much higher cost structure of mutual funds, rather than to differences in investment ability: it costs individual investors more to obtain the same investment management services as pension funds. Ambachtsheer and Bauer (2007) suggest that individual investors face a large information asymmetry in their contacts with investment management firms, which makes them susceptible to paying too high a price for the investment products they purchase. To obtain better results than individual investors, however, pension fund managers must be able to resist the selling pressure of external investment managers. This requires both independence from the for-profit service provider and sufficient financial knowledge to assess the relationship between price and value in the services being offered.

A recent study of the pension system in Australia offers an illustration of the need for independence. There, the management of pension assets is carried out by industry funds, public sector funds and corporate funds, which are managed by nonprofit boards of trustees, and by retail funds, which are managed by for-profit trustee corporations that are part of financial conglomerates (Sy 2008, 33). The Australian Prudential Regulation Authority, which regulates pension funds in that country, reports that, over the period from 1996 to 2006, nonprofit superannuation funds with assets of over AU$100 million outperformed retail funds of the same size when comparing their net return on assets: “Over the decade, $1,000 invested in the average public sector fund rose to $2,109, compared to $2,087 for a corporate fund, $1,888 for an industry fund, $1,687 for an [eligible rollover fund] and $1,650 for a retail fund” (Australian Prudential Regulatory Authority 2007, 14). This finding was predictable in light of an earlier analysis of Australian pension return on assets data for the seven years ending in 2002. The authors of that study found that nonprofit funds had higher risk-adjusted returns than for-profit funds and that for-profit funds had a significantly higher expense ratio than nonprofit funds (Coleman, Esho, and Wong 2005, 302).

Sy reports that the governance structures of for-profit retail funds in Australia have little independence from the investment management organizations that sponsor them. More than 60 percent of the directors of retail funds — including directors who are also full-time employees of the funds — have one or more associations with service providers, often through full-time employment by those providers. In the retail superannuation industry, more than 80 percent of the assets are invested in funds that are part of a financial conglomerate. Typically, these retail funds conduct the investment management functions within the conglomerate, and contract with external service providers only for noninvestment services such as administration or custodial services. Even these services are provided by related companies in 39 percent of the retail funds (Sy 2008, 34).

Thus, despite the undoubted financial expertise of the retail fund sector of Australia’s pension plans, the returns to their plan members are lower than those in sectors where nonprofit plans governed by boards of trustees chosen from employers and plan members serve on a part-time basis. Although these nonprofit plan trustees may not have the same level of financial expertise as the directors of retail fund plans, they appear to be able to obtain sufficient expertise through contractual arrangements to obtain comparable returns without the high cost structure associated with the retail sector.

A study of US public pension plans assesses the effects of the composition of the board of trustees on investment performance, plan funding status and asset allocation over the fiveyear period ending in 2005 (Harper 2008).18 The study measures whether the number of trustees who were independent of plan members and the government employer (independent trustees), elected or appointed from the plan’s members (member trustees) or served as trustees because they held a particular position in the government (ex officio trustees) made a significant difference in important attributes of a sample of public pension plans with more than US$200 million in assets. While the study finds no relationship between the composition of the board of trustees and investment performance, it does reveal a relationship between composition and the funded status and asset allocations of the funds. Pension funds whose board composition was largely independent and member trustees allocated a smaller portion of their investments to equity than plans with smaller percentages of such trustees, while levels of plan funding were higher for funds whose boards had a greater number of member and ex officio trustees (Harper 2008, 18-19). Thus, trustee composition can have a significant effect on the security of the pension promise, with respect to such factors as the level of risk in the plan’s asset allocation and the funding level of the plan.

Unlike in the Australian retail pension fund sector, however, the trustee composition of US public pension plans does not appear to have an effect on investment performance, perhaps because trustees of US public plans do not have conflicts of interest concerning the profit earned by their funds’ investment advisors. Therefore, US pension funds’ investment management costs should reflect an arm’s-length bargain irrespective of the composition of the board of trustees. Where conflicts between trustee interests do exist in US public pension funds, however, over issues such as the proportion of riskier investments and the level of funding, board composition seems to affect the resulting decision-making.

The differences between the US and Australian cases highlight the importance of a governance structure that counteracts conflicts through the use of decision-makers who are able to negotiate at arm’s length with profit-seeking service providers, as well as the need to ensure that the composition of a pension plan’s governing body reflects the interests of all its stakeholders in decision-making. A pension fund that lacks a governance structure that addresses both the conflicts between management and plan members and shareholders over asset allocation and funding policy and those between plan members and for-profit service providers imposes an otherwise avoidable risk on a pension guarantee scheme. Ambachtsheer and Bauer (2007) calculate that the high management costs typical of mutual funds can reduce the amount available for pension payments by 22 percent over a 40-year period of saving the same amount each year for retirement.

Thus, a strong pension fund governance regime that ensures independent decision-making and the ability to assess the relationship between the value and price of financial services can reduce the amount and frequency of claims on a pension guarantee scheme. In Canada, however, any national pension benefit guarantee scheme faces the barrier of the constitutional division of legislative power, which makes it difficult for a national insurer to control factors that might increase the moral hazard of such a scheme.

Unlike the United Kingdom, which has a unitary legislature, or the United States, where insolvency and employee relations fall under the legislative authority of Congress, Canada assigns exclusive legislative authority over employment to the various provincial legislatures. As I summarize in an earlier publication,

Thus, while the ultimate impact of pension plan solvency deficiencies manifest themselves in insolvency proceedings; the federal government has no direct legislative access to the mandatory pension benefit insurance remedy. Any nationwide implementation of such a remedy would require extensive negotiations with provincial governments, especially in light of the potentially large fiscal impact of such a scheme on provincial budgets resulting from solvency deficiencies guaranteed by a provincial pension benefit insurance scheme. (Davis 2009, 147)

Previous attempts to use federal legislation to implement a nationwide mandatory unemployment insurance scheme on the grounds that the matter was one of “national concern” were rejected by the courts as constitutionally invalid.19 But even if the courts were to accept Parliament’s power to legislate in this area, or if some form of fiscal arrangement with the provinces could be agreed upon, the power to control the moral hazard risks of such a national program would remain in the hands of provincial legislatures, not the federal Parliament.

The provinces control the regulation of required contributions, the funding requirements rules for benefit increases and the required periods to amortize any funding shortfalls. As I have suggested elsewhere, “It would make no sense for the federal government to offer a form of fiscal guarantee of a national pension benefit guarantee plan while lacking the legislative tools to control the hazards in the insurance scheme it has agreed to fund” (Davis 2009, 148). The temptation for some provincial governments to alter these rules in response to financial distress by major provincial employers might prove too great, given that at least part of the cost of any changes would be borne at the national level. Indeed, a number of jurisdictions have already implemented changes that would increase the moral hazard risks for any national pension guarantee scheme, as I outline next.

In the first decade of the twenty-first century, a number of economic shocks battered the ability of pension funds to meet their obligations. Equity markets saw steep declines in asset values, such as those that accompanied the end of the dot-com bubble in 2000 and the global financial crisis of 2007-09. As well, the decline of long-term interest rates between 2000 and 2002 led to a sharp increase in defined-benefit pension liabilities and a deterioration in the funded status of defined-benefit pension plans by almost 30 percent (Ambachtsheer 2004, 1).

Pension funds value their liabilities by referring to the cost of purchasing an annuity from an insurance company for the amount of the benefits promised on retirement.20 The insurance company, in turn, prices the annuity using the long-term interest rate as the assumed rate of return on its investments that is needed to pay the annuity. If long-term interest rates are low, the insurance company must assume a low rate of return and thus would need to invest more money in order to generate the same level of benefits for the annuity. In such a case, the insurance company needs to price annuities higher, which increases the value of pension liabilities over what would obtain in an environment of high interest rates. Such negative changes in pension fund balance sheets, in turn, threaten the solvency of a company if the increased contributions required by the shortfall disclosed in the triennial solvency valuation hit at the same time as a downturn of its business. Governments have responded with a number of regulatory changes that appear almost to be at cross-purposes — taking steps to provide relief to financially stressed businesses through regulatory changes that decrease the security of pension benefits, while increasing the security of pension benefits through regulatory changes to funding requirements.

Extending the deficit payment period

In the cases of Air Canada and Stelco, pension liabilities and demands for increased contributions while business income was reduced led these companies into insolvency proceedings where they sought to restructure their debts, including their pension obligations. Both were eventually able to restructure their pension liabilities by obtaining an extension to ten years of the five-year statutory period for extinguishing a solvency shortfall. Subsequently, a number of jurisdictions decided to give employers the option of extending the period over which they must make solvency payments from five to ten years. This change considerably reduces the annual amount of each payment, thus easing the financial pressure on the employer at a time of lower income.21 Of course, this option also doubles the time period during which the pension fund has a shortfall in assets, thus increasing the risk that the employer will become insolvent while the plan still has a funding deficit.

“Smoothing” in response to volatility

To cushion an employer from sharp variations in the values of assets or liabilities in a pension plan, with respect to both its contribution obligations and its accounting balance sheets, actuarial practice has incorporated a technique called “smoothing” (Ambachtsheer 2004, 3). This practice has been criticized because it deprives stakeholders of an opportunity to appreciate the true dimensions of asset-liability mismatch risk in pension fund investment and asset allocation policy, and to determine whether or not that risk is consistent with stakeholders’ understanding of the pension contract (Bader and Gold 2003, 9).

The federal government has implemented an extension of smoothing to the calculation of solvency deficiencies or shortfalls in defined-benefit pension plans (Regulation Amending Certain Regulations under the Pension Benefits Standards Act, 1985, (2010)SOR/2010/149). Until July 1, 2010, actuaries calculated the solvency status of a plan every three years by comparing the value of the assets in the pension fund to that of its liabilities on the date of the valuation. If the value of the liabilities was greater than that of the assets, there was a solvency deficiency, usually expressed as the ratio between assets and liabilities. Thus, a ratio of .8 meant that the value of the assets was 80 percent of the liabilities and, if the plan was terminated with that ratio, members and retirees could expect a 20 percent reduction in their benefits. Employers were required to make special payments sufficient to raise the solvency ratio to 1 (that is, 100 percent) over the following five years, based on the funded status of the plan every three years.

Recent amendments, however, now permit actuaries to “average” solvency deficiency ratios over the previous three years in the calculation of a plan’s minimum funding requirements (Pension Benefits Standards Act Regulations, 1985, 9(8)). Solvency valuations now must be conducted every year, but the amount of the special payments required is determined by the average of the current solvency ratio and that of the previous two years. This change could lead to a plan’s never being fully funded, as the average-of-ratios calculation might generate special payments that never quite extinguish the existing liability. For example, if the ratios for three years are 1, .9 and .8, the average ratio would be .9, and special payments would be calculated to raise the ratio to 1 over the next five years. The following year, the ratios for three years could be .9, .8 and .82, while the average ratio would be .84, and, again, special payments would be calculated to raise the ratio to 1 over the next five years, and so on.

The implicit assumption behind this reform of pension funding rules is that the volatility of equity values is not a random event; rather, equity values will revert to some everincreasing average value over time. This assumption is revealed in a Department of Finance news release on the new standard, which states that the new policy “will mitigate the effects of short-term fluctuations in the value of plan assets and liabilities on solvency funding requirements” (Canada 2009). This belief justifies a reduction in payments to extinguish a pension fund shortfall because it is only an “aberration,” or temporary departure from the “true” or “normal” value of the equity investment, which will correct itself with the passage of time.

Critics claim, however, that there is no empirical or theoretical evidence to justify such an assumption (see, for example, Bader and Gold 2003, 9; Sutcliffe 2005, 64-7). As Henry Hu points out in a prescient article, whether equity returns follow an ever-increasing trajectory with only temporary aberrations or are truly random and whether investing over longer time horizons allows an investor to capture the “average” returns are hotly contested in both financial economics and the investment industry (2000, 823-36). The problem occurs not when individuals or investment managers defer to these beliefs in their investment decisions, but when governments and regulators promote a particular belief, either expressly or implicitly. Given the contested nature of the belief being promoted, a decision to use it as a basis for policy-making deserves some public debate before it is put in place.

Strengthening federal funding rules