L’organisation de la production mondiale s’est profondément transformée au cours des dernières décennies. La baisse des coûts de communication et de transport et la levée d’autres barrières commerciales ont incité nombre d’entreprises à fractionner leurs chaînes d’approvisionnement et à répartir leurs activités entre plusieurs pays, formant ce qu’on appelle des chaînes de valeur mondiales (CVM).

Ari Van Assche décrit dans cette étude la structure et l’étendue des CVM, puis se demande si elles nécessitent de repenser l’ensemble de notre politique commerciale. Car à certains égards, avance-t-il, les CVM marquent simplement le passage naturel du « commerce de biens » au

« commerce de tâches » englobant la spécialisation et les avantages comparatifs propres à la théorie classique du commerce. Elles signifient toutefois qu’il entre dans les exportations d’un pays donné un contenu en importations de plus en plus considérable, un phénomène qui bouscule les idées reçues sur le rapport entre commerce et compétitivité.

L’une des conséquences des CVM est qu’elles pourraient fausser lourdement les mesures ser- vant à évaluer la compétitivité internationale à partir des exportations. L’auteur estime ainsi que le solide avantage concurrentiel en produits de haute technologie que détiendrait la Chine n’est qu’un mirage statistique, puisque la majeure partie du contenu de ces exporta- tions est fabriquée dans les pays industrialisés.

De plus, les importations au sein des CVM ne sont plus nécessairement synonymes de concur- rence étrangère. Au contraire. Dans un contexte de réseaux mondiaux de production, les com- posants importés sont souvent largement complémentaires aux tâches nationales et peuvent donc dénoter la capacité concurrentielle du secteur intérieur. C’est le cas du secteur de l’avia- tion, où les importations peuvent refléter la forte demande intérieure de composants plutôt que la concurrence d’avionneurs étrangers.

Pour renforcer la compétitivité du Canada dans cet environnement en réseau, nos décideurs doivent en priorité attirer et conserver des activités à très forte valeur ajoutée tout en permet- tant la délocalisation d’autres tâches là où elles seront fortement rentabilisées. Mais les activi- tés à forte valeur ajoutée étant aussi soumises à une concurrence internationale croissante, les décideurs doivent également assurer à notre pays de tirer pleinement profit de sa participation aux CVM en rajustant, au-delà des stratégies commerciales, les politiques en matière de capital humain et d’innovation.

Dans son commentaire, Todd Evans, directeur de recherche à Exportation et Développement Canada, examine comment les investissements transfrontaliers et les ventes des sociétés affi- liées à l’étranger s’insèrent dans cette conception élargie de la politique commerciale. Ces acti- vités en rapide expansion sont en effet cruciales pour soutenir les réseaux commerciaux et les CVM des entreprises canadiennes.

The organization of international production has changed fundamentally in the past few decades. Thanks to reductions in the costs of communication and transportation and decreases in other obstacles to trade, many firms have sliced up their supply chains and have dispersed their production activities throughout multiple countries. At the same time, they have outsourced large portions of their supply-chain activities to external firms. As a result, the production process of consumer goods now involves many firms that are located in various countries around the world, giving rise to global value chains (GVCs).

The extent of GVCs has been well documented for a number of textiles and electronics products. In The Travels of a T-Shirt in the Global Economy, Pietra Rivoli (2005) traced the supply chain of a T-shirt she bought in Florida and found that it extended across two continents. The T-shirt’s key input, cotton, was grown and made in Texas. The T-shirt was then manufactured in China, and the final product was sent back to the United States for consumption. The value chains of electronics products are even more spread out. Ali- Yrkkö et al. (2011), Dedrick, Kraemer, and Linden (2010) and Kraemer, Linden, and Dedrick (2011) have painstakingly reconstructed the supply chains of the Nokia N95 Smartphone, the Apple iPhone and the Apple iPod, respectively – and have shown that the GVC for each of these products extends across three continents: Asia, Europe and North America.

One implication of the rise of GVCs is that international trade has become increasingly dominated by trade in tasks (within GVCs) instead of trade in goods (Grossman and Rossi-Hansberg 2008). In other words, countries no longer predominantly trade goods that have been produced entirely in the exporting country. Rather, an increasing share of international trade is in parts and components that make up multicountry value chains (i.e., task trade). Currently, trade in intermediate inputs accounts for roughly two-thirds of international trade (Johnson and Noguera 2012). In addition, countries rely more and more on imported inputs to produce their exports. For instance, by using input-output tables for 1990 for 14 countries, Hummels, Ishii, and Yi (2001) estimated that, on average, imported content accounted for nearly 21 percent of the exports’ value. Using more recent data, Miroudot and Ragoussis (2009) estimated that the average import content of exports rose for OECD countries from 26 percent in 1995 to 31 percent in 2005. In Canada, by contrast, the import content of exports fell from 31 percent in 2005 to 26 percent in 2008.

The rise of GVCs has captured the attention of policy-makers in Canada and abroad. The Office of the Chief Economist at Foreign Affairs and International Trade Canada (DFAIT) lists “global value chains” as one of its three main research themes, along with “North America and NAFTA” and “Emerging Markets.” Furthermore, in May 2011, the World Trade Organization (WTO) launched the Made in the World Initiative, with the aim of advancing dialogue between international experts concerning the concept, methodology and impact of GVCs. For many policy-makers, however, the policy implications of the rise of GVCs remain unclear. Some scholars seem to suggest that increasing trade in tasks is business as usual. Mankiw and Swagel (2006), for example, argue that offshoring “fits comfortably within the intellectual framework of comparative advantage built on the insights of Adam Smith and David Ricardo.” Other scholars claim, on the contrary, that the rise of GVCs is a new industrial revolution (Blinder 2006) and that a new paradigm is needed, which puts task trade at centre stage (Grossman and Rossi-Hansberg 2008).

In this study, I aim to shed new light on this debate by critically reviewing the emerging literature about GVCs. I will attempt to show that the disagreement among scholars is less profound than it appears. Traditional trade theories go far in explaining the logic and drivers of trade within GVCs (with the exception that trade now takes place at the more granular task level instead of at the goods level). In this sense the rise of GVCs is actually business as usual. At the same time, however, I will show that refocusing attention from trade in goods to trade in tasks requires a bigger leap than policy-makers might expect and can therefore be considered a paradigm shift. The leap is larger because many concepts and statistics that we rely on to measure international competitiveness and to frame trade and competition policy are based on assumptions that run counter to task trade. I will highlight a number of the problems related to this fact and will then discuss the policy implications of rising GVCs.

I have structured the paper as follows. First, I will discuss the main drivers of the rise in GVCs. This is followed by an analysis of how this has led to a boom in task trade. I then show how insights from traditional trade theories allow us to explain the logic and drivers of task trade in a relatively straightforward way. I will then apply these theoretical insights by analyzing the distinct roles that China and Canada play in GVCs. I will discuss how trade in tasks runs counter to some key concepts and statistics that we commonly rely on as we try to understand a country’s international competitiveness. Before concluding, I will analyze the implications of the rise in GVCs for Canadian trade and competition policy-makers.

While in the past the production chain of goods was largely concentrated within a single country and in the hands of a single company, corporations are now increasingly fragmenting their production chain by dispersing it throughout multiple countries and companies. As a result, a rising share of international trade within GVCs consists of trade in tasks.

Trade economists believe that companies decide to fragment their production processes internationally as a result of five forces related to globalization: (1) improvements in information and communications technology, (2) reductions in transportation costs, (3) trade liberalization, (4) investment liberalization and (5) economic liberalization in developing countries. I discuss these factors in turn.

The emergence of e-mail, the Internet and common communications protocols, as well as the increased availability of high-capacity computing power, has made it easier for firms to fragment their production processes and manage geographically separated tasks (Sturgeon 2002; Van Assche 2008; Gangnes and Van Assche 2011). Currently, many companies rely on sophisticated computer-aided design (CAD) technologies and B2B systems to share codified information between geographically separated locations. These technologies allow them to perform tasks in geographically dispersed locations with limited risk of miscommunication and with a relatively modest cost of monitoring (Leamer and Storper 2001; Autor, Levy, and Murnane 2003; Levy and Murnane 2004; Blinder 2006). Indeed, Fort (2011) estimates that US companies that use CAD technology to coordinate shipments have fragmented their international production processes more extensively than have companies without CAD technology.

A second driver of the rise in task trade is the substantial decline in transportation costs during the post-Second World War period (Hummels 2007). This means that it is now less expensive to disperse production activities throughout multiple countries. The decline in costs has been most dramatic for air shipping, since the invention of the jet engine and other innovations have decimated the cost of air shipping per ton-kilometre since the 1950s. Expressed in 2000 US dollars, the price fell from $3.87 per ton-kilometre in 1955 to under $0.30 in 2004 (Hummels 2007). Containerization has also reduced the costs of shipping by water, even though the declines in this case have been less extensive.

Such reductions in transportation costs have led to a magnified reduction in the cost of conducting trade in tasks (Yi 2003). Since products manufactured through trade in tasks (through GVCs) often cross borders multiple times before they reach the final consumer, they also give rise to transportation costs multiple times. A Japanese semiconductor, for example, may first trigger a transportation cost when it is sent to China for assembly into a computer, and it may then trigger an additional transportation cost when the computer is sent on to Canada. If transportation costs go down worldwide, the cost of trading is reduced multiple times, leading to a magnification effect.

Trade liberalization has further fuelled the international fragmentation process. Since the end of the Kennedy Round of the GATT in 1967, tariffs have fallen rapidly – especially for manufactured goods (Bridgeman 2012). From 1950 to 2010, average US import tariffs have dropped from 6.0 percent to less than 1 percent, and between 1960 and 1995 (Hummels 2007), average worldwide import tariffs dropped from 8.6 percent to 3.2 percent. As in the case of transportation costs, a reduction in tariffs leads to a magnified reduction in the cost of task trade, since products cross borders multiple times (Yi 2003; Bridgeman 2012).

Investment liberalization has also contributed to the rise of GVCs by making it easier for firms to disperse production activities across borders through foreign direct investment (FDI). In the past 20 years, a number of multilateral agreements have relaxed restrictions on FDI. The Agreement on Trade-Related Investment Measures (TRIMs), for example, bars WTO members from applying TRIMs that violate national treatment of trade and that lead to quantitative trade restrictions.1 Furthermore, the General Agreement on Trade in Services (GATS) limits barriers to foreign direct investment in services. Most investment liberalization, nonetheless, has taken place at the bilateral level (Tobin and Busch 2010). In recent years, the world has witnessed an extraordinary proliferation of bilateral investment treaties (BITs), with the number of BITs rising from 385 in 1990 to 2,807 in 2010 (UNCTAD 2011). These BITs generally cover a wide range of investment-related measures, including services trade, intellectual property rights protection and competition policy.

The economic liberalization of China in the 1980s and the fall of the Iron Curtain in the 1990s have increased the attractiveness of fragmenting international production by suddenly making available a large population of cheap and skilled workers to multinational firms. Hillberry (2011) has found evidence that, after controlling for per capita income and size, transition economies export a disproportionate volume of intermediate inputs.

While such widespread trade in tasks is a new phenomenon, the forces driving companies’ choices of where to locate tasks is largely similar to those driving international trade in goods. At the heart of location decisions in GVCs lies the tension between comparative advantage and agglomeration forces (Amiti 2005; Baldwin and Venables 2011). On the one hand, comparative advantage forces induce firms to establish value-chain tasks in the location that has the lowest production costs. On the other hand, this effect is moderated by the benefits of agglomerating adjacent value-chain stages (locating them close to each other), including reduced transportation costs, increased timeliness and fewer coordination problems.

Traditional comparative advantage forces can drive firms to slice up their value chains and extend them into multiple countries. This mechanism can be understood easily in the context of a framework developed by Jones and Kierzkowski (1990). Suppose that tasks within a value chain are geographically separable and have varying factor intensities, with some tasks requiring relatively more capital (capital-intensive tasks) and other tasks needing relatively more labour (labour-intensive tasks). As long as trade and communication costs are sufficiently low, firms in labour-scarce developed countries will have the incentive to relocate their labour-intensive tasks to labour-abundant developing countries while keeping the capital/knowledge-intensive tasks at home. In that case, comparative advantage forces will lead to trade in tasks, where the labour-abundant country exports labour-intensive tasks and the capital-abundant country exports capital/knowledge-intensive tasks.

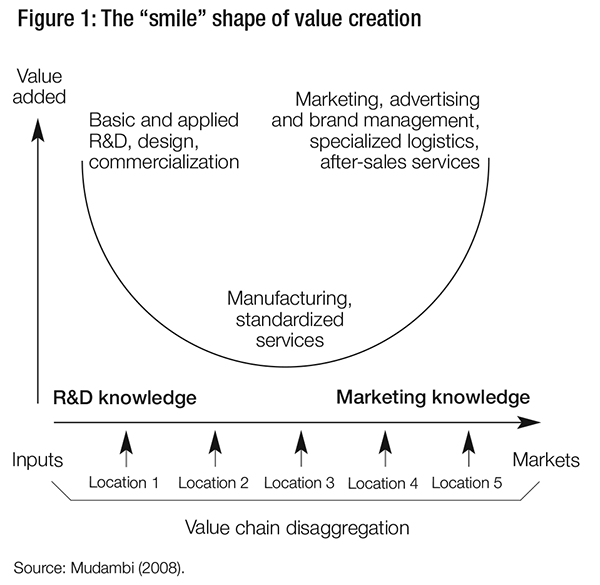

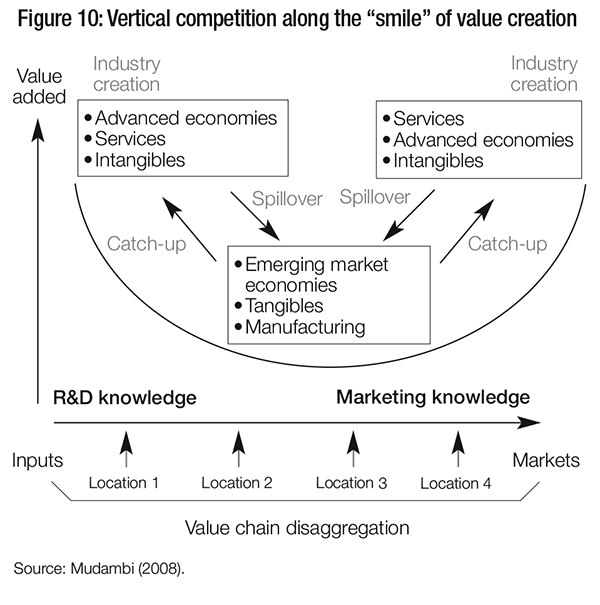

While data on task trade are difficult to come by, the empirical evidence seems to square well with the results of the Jones and Kierzkowski framework (1990). A value chain for a product consists of a number of interlinked tasks extending from upstream R&D, to manufacturing in the middle of the chain and then to downstream marketing. Generally, the upstream stage, R&D, and the downstream stage – marketing – are found to be knowledge-intensive, since they require significant creativity and innovation (Mudambi 2008; Jensen and Pedersen 2011). As a result, the framework suggests that R&D and marketing should be located in human-capital-intensive developed countries. In contrast, the manufacturing stages in the middle of the chain are more standardized, repetitive and labour-intensive activities that require less skills development and should therefore be relocated to developing countries.

This is precisely what scholars find in the electronics industry. Dedrick, Kraemer, and Linden (2010), Kraemer, Linden, and Dedrick (2011) and Ali- Yrkkö et al. (2011) have observed that in the production of the Apple iPhone, the Apple iPod and the Nokia N95 Smartphone, upstream R&D and downstream marketing are kept in Europe and the United States. Conversely, manufacturing activities in the middle of the chain are located in various developing economies, primarily in East Asia. As I demonstrate later in this study, Canada’s and China’s task trade patterns are also in line with the Jones-Kierzkowski framework.

In recent years, scholars have pinpointed other sources of comparative advantage for task trade, which tend to further strengthen developed countries’ hold on the knowledge-intensive activities, R&D and marketing. Focusing on the fact that GVCs often involve multiple companies that sign contracts with each other, one stream of literature has analyzed whether the quality of a country’s judiciary system can act as a source of comparative advantage. Acemoglu, Antràs, and Helpman (2007) argue that this should be the case: tasks that require more complex contracts (e.g., knowledge-intensive tasks like R&D and marketing) are more cheaply conducted in countries that have well-functioning contractual institutions. The empirical evidence is consistent with this. Costinot (2009) provides empirical evidence that countries with better contracting institutions indeed have a comparative advantage in more complex sectors. Similarly, Levchenko (2007) and Nunn (2007) provide evidence that countries with better legal systems export more in contract-intensive sectors than do countries with less sophisticated legal systems.

Another stream of literature has focused on the quality of a country’s transportation infrastructure as a source of comparative advantage (WTO and IDE-JETRO 2011). A location with a better transportation infrastructure, it is argued, is able to link with other value-chain stages more rapidly and efficiently, thus making it especially attractive as a location for time-sensitive tasks. Gamberoni, Lanz, and Piermartini (2010) have indeed found evidence that a location’s ability to export on time is at least as important a source of comparative advantage as the costs of labour, capital and other inputs in the export of intermediate goods.

The comparative advantage of developed countries in knowledge-intensive activities is a source of envy for many developing countries, since these activities are also the tasks that create the highest value-added within GVCs. That is, these tasks are responsible for creating the largest share of a final product’s value (Mudambi 2008; Dedrick, Kraemer, and Linden 2010). Furthermore, they provide firms with the largest profit margins (Shin, Kraemer, and Dedrick 2012). Mudambi (2008) has built on this fact to highlight that value creation in GVCs generally takes on a smiley shape, with value primarily created at the extremes of the smile (see figure 1). As I discuss below, the desire of countries to move into higher-value-added activities at the extremes of the smile shape of value creation has important implications for both trade and competition policy.

Offshoring to China and India has received massive attention, and as a result, it is often assumed that task trade takes place primarily between countries with disparate technological capabilities and dissimilar factor endowments. However, this is not the case (Grossman and Rossi-Hansberg 2012). Indeed, evidence suggests that most trade in tasks is actually transacted between developed countries. The WTO and IDE-JETRO (2011, 84-6) show that intra-EU and EU-North American trade account for the largest proportion of trade in intermediate manufacturing goods. Similarly, Amiti and Wei (2005) document that most US trade in services is offshored to other developed countries, such as Canada.

Once again, we do not need to develop a fundamentally new theory to explain the rise of task trade between similar countries. Indeed, Krugman’s New Trade Theory (1979) provides all the necessary elements to understand task trade between similar countries. Suppose that tasks are differentiated and their production exhibits increasing returns to scale2 in their production. In that case, in line with the mechanisms of the New Trade Theory, similar countries may specialize in different varieties of the same task. This would mean that GVCs may extend into similar countries, giving rise to trade in differentiated tasks. Alternatively, task trade between similar countries can emerge if there are external increasing returns to scale at the task level since it can also induce similar tasks to agglomerate in the same country (Grossman and Rossi-Hansberg 2012).3

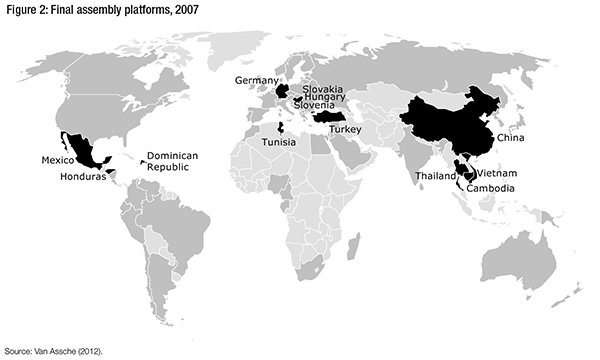

As in the case of trade in goods, the spatial distribution of tasks within GVCs seems to be far less dispersed than would be expected in a globalized, or “flat,” world. In a recent survey of Canadian firms, managers identified distance to producers as the most important obstacle to offshoring production (Boileau and Sydor 2011). Furthermore, most trade in intermediate goods is conducted intraregionally (Athukorala and Yamashita 2006; Curran and Zignago 2011), suggesting that sequential manufacturing stages in the value chain are located in proximity to each other. Van Assche (2012) also finds that final assembly platforms (i.e., countries that specialize in the assembly of imported inputs for export purposes) are generally labour-abundant countries located in the vicinity of large consumer markets (see figure 2). This evidence suggests that most value chains are regional, rather than being global.

The most obvious reason why spatial linkages matter is this: despite improvements in transportation technology, transportation costs remain economically important. This is especially true of products with a high weight-to-value ratio (Harrigan 2010). Hummels (2007) estimates that for the median individual shipment in US imports in 2004, exporters paid US$9 in transportation costs for every US$1 they paid in tariff duties. For major Latin American countries, transportation costs were two to four times higher than for the United States. The non-negligible size of transportation costs is especially important for task trade. As we have seen above, since GVCs often require the same component to be shipped multiple times before final consumption, task trade is more sensitive to trade costs (including transportation costs) than regular trade (Yi 2003; Gangnes, Ma, and Van Assche 2011).4

An additional reason why spatial linkages matter within GVCs is that timeliness has gained importance in supply chains. Harrigan and Venables (2006) show that the adoption of just-intime production techniques (associated with improvements in information and communication technology) should pressure firms to relocate their production of time-sensitive components closer to home. Using proprietary retail data, Evans and Harrigan (2005) have found evidence that American retailers have started to source their time-sensitive textile products closer to home.

A third reason why GVCs are regional instead of global is that regulatory differences in various countries continue to make it difficult for firms to operate GVCs smoothly across borders. Domestic regulations governing the movement of capital, foreign ownership, intellectual property rights and competition policy, to mention just a few, can differ vastly from country to country. This lack of regulatory harmonization continues to be a major impediment to firms that might want to geographically disperse their GVCs.

As I have shown, no new theoretical model is needed to think systematically about trade in tasks. Insights from the Old Trade Theory (comparative advantage) and the New Trade Theory (economies of scale and product differentiation) go far in explaining the logic and drivers of trade within GVCs. The only exception is that trade now takes place at the more granular task level, rather than at the goods level. Spatial linkages remain important in GVCs (as they do in traditional trade theories), and this makes most value chains regional instead of being global.

While task trade is governed by traditional comparative advantage forces, the resulting production and trade patterns across countries are different than before. In this section, I demonstrate these differences by investigating the roles that China and Canada play in GVCs.

The case of China is pertinent for Canadian policy-makers for a number of reasons.5 First, China is a developing country and should therefore play a different role in GVCs than Canada. This is indeed the case, with China specializing in labour-intensive assembly activities and Canada specializing in more capital-/knowledge-intensive activities such as component production and R&D. Second, due to China’s extraordinary exports rise in recent decades, the country is never far from the radar screen of Canadian policy-makers. Third, unique data from China’s Customs Statistics have provided scholars with unprecedented insights into the structure of GVCs and the role of China within that structure.

Detailed data from China Customs Statistics provide a useful tool to evaluate why firms integrate China into their GVCs (Ma, Van Assche, and Hong 2009; Ma and Van Assche 2010). Unlike trade data from other countries, the Chinese data distinguish between trade that occurs under its processing-trade regime and other “regular” trade. This distinction is important, since processing-trade data provide key insights into China’s role in GVCs that other data cannot provide. Under the processing-trade regime, firms located in China are granted duty exemptions on imported inputs as long as they are used solely for export purposes. Since firms under this regime cannot sell their products on the Chinese market, the only incentive that firms have for using this regime is to take advantage of China’s low wages. As a result, the data allow analysts to investigate the determinants of offshoring to China. Furthermore, for each Chinese processing location, the dataset provides information on the source country of foreign inputs used by its processing plants, as well as the destination country of the processed goods. This attribute allows a spatial mapping of trade flows to be generated between three sequential nodes of GVCs: the production location of processing inputs, the processing location in China and the consumption location of processed goods.

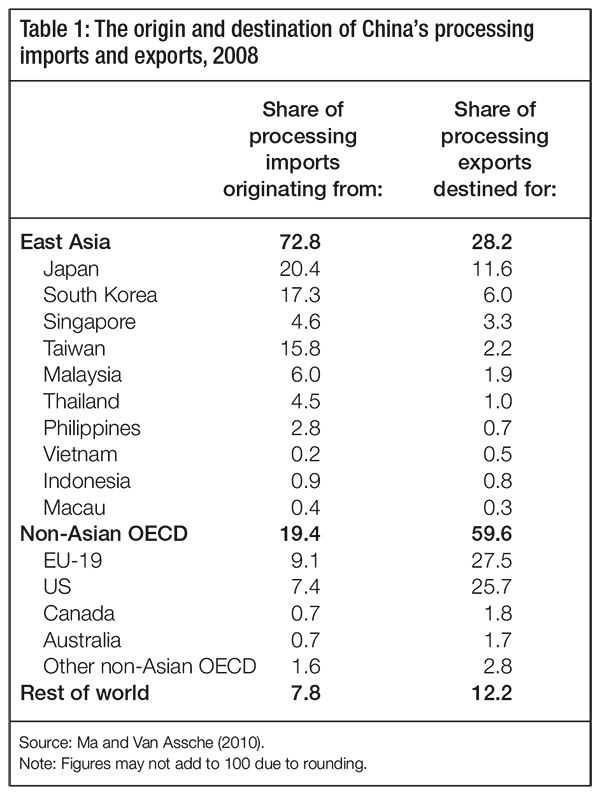

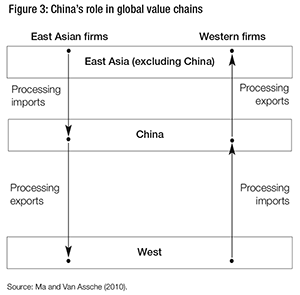

The data show two interesting spatial patterns in China’s processing trade. First, China’s processing trade clearly depicts a triangular trade pattern (see table 1). Specifically, foreign processing inputs are predominantly imported from China’s wealthier East Asian neighbours, while processed final goods are largely exported to Western markets.

Once the processing-trade data are disaggregated to the provincial level, however, the triangular trade pattern becomes inconsistent across processing locations. In a cross-section of 29 Chinese provinces, the average distance travelled by processing imports is negatively correlated to the average distance travelled by processing exports for most years in the period 1988-2008. In other words, whereas many provinces in China do exhibit the triangular trade pattern observed in table 1, other provinces exhibit the opposite pattern. They import their processing inputs from far away and export their processed final goods to neighbouring destinations.

Ma and Van Assche (2010) show econometrically that these spatial patterns result from the interaction of comparative advantage forces and spatial linkages in GVCs. Even before China entered the international scene, its wealthier East Asian neighbours (such as Japan, South Korea and Taiwan) were already key manufacturers of products consumed in the West. In the 1980s, however, rising labour costs were threatening to undermine East Asian firms’ competitive edge, and many chose to offshore their labour-intensive final assembly to China. China’s low labour costs and export promotion policies undoubtedly played a role in their decision, but China’s proximity to East Asian suppliers created the additional benefit that offshoring to the country added few distance-related trade costs. These offshoring decisions can explain the emergence of the triangular trade pattern observed in table 1.6 Instead of directly exporting their final goods to Western markets, East Asian firms now send their inputs to processing plants in China and then export their goods to the large Western market after assembly.

Western firms also take into account the interaction between comparative advantage forces and spatial linkages when offshoring their labour-intensive final assembly activities to China. Most Western firms that process goods in China sell their final goods in East Asia. This is because, in this situation, offshoring to China leads to only limited extra distance-related trade costs because of China’s proximity to East Asian markets. As is illustrated in figure 3, these Western firms exhibit a triangular trade pattern that is opposite to the one shown in table 1. They import their inputs from the West and export their processed goods to nearby East Asian markets.

The existence of such a two-way triangular trade pattern provides a plausible explanation for the negative correlation between import distance and export distance that is observed in China’s processing-trade data. Ma and Van Assche (2010) provide further empirical evidence of this. If China’s processing trade is dominated by two-way triangular trade, one should find that East Asian firms are attracted primarily by China’s proximity to East Asian suppliers. This proximity can be measured using import distance (i.e., the average distance from where processing inputs are imported). Conversely, Western firms should be attracted primarily by China’s vicinity to East Asian markets, which can be measured with export distance. In a panel regression across 29 Chinese provinces during 1988-2008, Ma and Van Assche (2010) found evidence of this. Processing exports to non-Asian OECD countries are more sensitive to import distance and less sensitive to export distance than those destined for East Asian countries.

In sum, China has become a prominent final assembly platform for East Asian GVCs, and its attractiveness as an assembly location is driven not only by low labour costs. Its geographic proximity to its East Asian neighbours also provides it with privileged access to the region’s upstream suppliers and downstream markets.

Determining Canada’s role in GVCs is less straightforward, since no databases similar to that of China’s processing-trade regime exist. Nonetheless, one can still gain insights into Canada’s position in GVCs by using international trade data to analyze the stages at which the country imports and exports goods and services.

The use of international trade statistics to classify traded goods according to their position in GVCs was pioneered by Yeats (2001) and Ng and Yeats (2001). They created two categories for international trade: intermediate goods trade and final goods trade. Countries specialized in upstream stages of production, they argued, should specialize in exports of intermediate goods. Conversely, countries specialized in final goods assembly should specialize in imports of intermediate goods and exports of final goods. Subsequent studies have relied on the less arbitrary United Nations’ Broad Economic Categories (BEC) classification to distinguish between intermediate and final goods (e.g., Lemoine and Ünal-Kesenci 2004; Zebregs 2004; Gangnes and Van Assche 2010). More recently, Goldfarb and Beckman (2007) and Goldfarb and Chu (2008) from the Conference Board of Canada have categorized Canada’s trade into three groups: primary, partly finished inputs and finished goods.

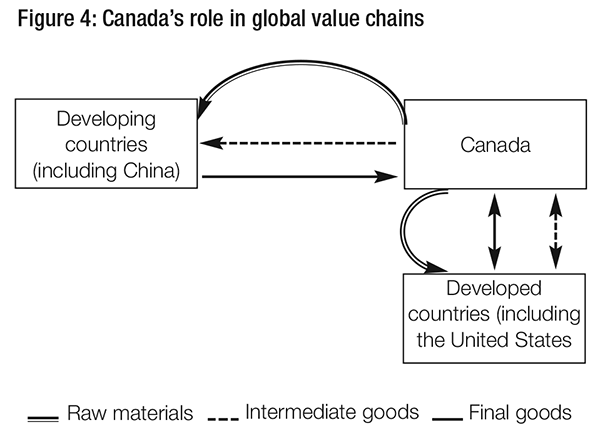

From our discussion in the section headed “Organization and Rationale for Global Value Chains” (above), it would be reasonable to expect that Canada’s trade patterns would resemble those depicted in figure 4. First, since Canada has a large advantage in natural resources, the country should be a net exporter of primary goods to both developed and developing countries. Second, since Canada is a developed country, it should have a comparative advantage in the production of capital-/knowledge-intensive intermediate goods and a comparative disadvantage in the labour-intensive assembly of final goods. Finally, Canada’s task trade with developed countries (and especially with the United States) should be largely between similar tasks with differentiated varieties (e.g., two-way trade of car engines).

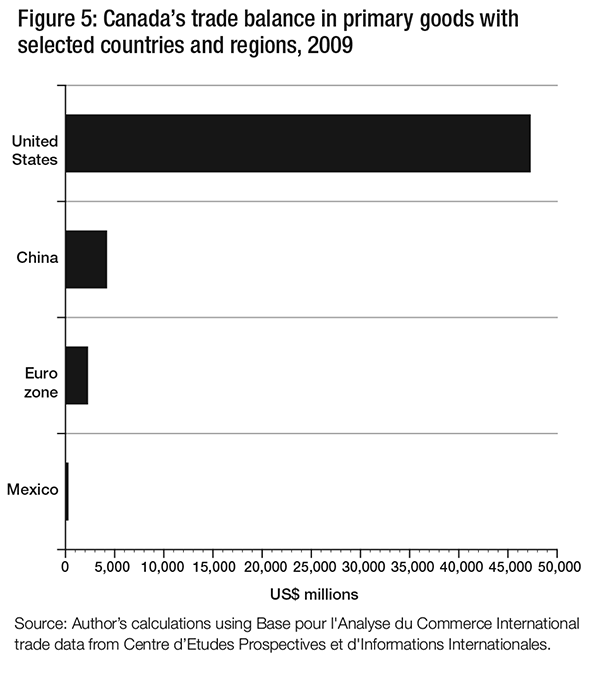

Indeed, Canada’s trade closely follows the patterns depicted in figure 4. First, as is shown in figure 5, Canada is a net exporter of primary goods to both developed countries (the United States and the European Union) and developing countries (China and Mexico).

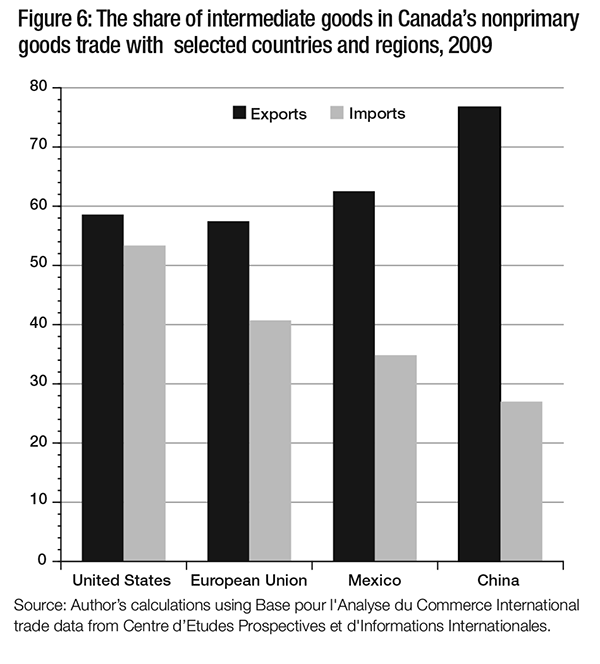

Second, for nonprimary goods, Canada disproportionately exports intermediate goods to China and Mexico, while it primarily imports final goods from these developing countries. As is shown in figure 6, in 2009, intermediate goods accounted for 62.5 percent and 76.7 percent of Canada’s nonprimary exports to Mexico and China, respectively. Conversely, final goods accounted for 65.2 percent and 73.0 percent of Canada’s nonprimary imports from Mexico and China. These results are in line with Goldfarb and Beckman’s (2007) findings that Canada’s exports to developing countries are more intensive in intermediate goods than its exports to the rest of the world, while its imports from developing countries are more intensive in final goods.

Third, Canada also seems to be specialized in knowledge-intensive R&D services when compared to the rest of the world. Boileau and Sydor (2011) show evidence that Canada is also a net exporter of R&D services. Using the Survey of Innovation and Business Strategies, they have found that a greater proportion of firms inshored R&D activities than offshored them.7 They infer from this that Canada is likely to export more inshored R&D services abroad than they import offshored R&D services.

Finally, Canada’s exports to developed countries (and especially to the United States) are highly similar in composition to its imports from these countries. As is shown in figure 6, more than 60 percent of both Canada’s exports to the US and its imports from the US are intermediate goods, buttressing the argument that the two countries trade similar tasks.8 Likewise, the composition of Canada-EU imports and exports is more similar than is the composition of its trades with developing countries.

In sum, excluding primary goods, Canada is specialized in the upstream value-chain stages of R&D activities and intermediate goods production while offshoring final assembly activities to developing countries such as China and Mexico. In addition, Canada and the United States are highly integrated into the same GVCs.

While no new paradigm is needed to think systematically about “trade in tasks,” thinking about “trade in tasks” is a paradigm shift on its own. A number of beliefs about trade that are deeply ingrained into our thinking are not valid in a world of GVCs. A key assumption that underlies traditional models of trade (Old Trade Theory, New Trade Theory …) and much of our thinking about trade is that firms produce their entire output in their home country and within their firm boundaries. This assumption leads to a number of erroneous conclusions. First, it leads to the premise that exports are made in the exporting country. Second, this assumption implies that exports reflect a country’s international competitiveness, while imports signal foreign competition. Third, it entails that trade policy has a symmetric impact on all domestic firms. Fourth, this perspective implies that competition in the international marketplace is mainly horizontal between multinational firms that sell similar products.

The ensuing discussion will demonstrate that these assumptions about international trade are not valid. First, exports are not necessarily made in the exporting country. Second, exportbased measures of international competitiveness are unreliable. Third, imports do not necessarily reflect foreign competition. Fourth, trade policy can have highly asymmetric effects on Canadian firms, with some winning and others losing. Fifth, international competition is increasingly vertical between actors within the same GVC.

In a GVC world, exports are not necessarily produced by the exporting country: they may also reflect production activities that have occurred in the countries from which inputs have been imported. Koopman, Wang, and Wei (2008) have demonstrated that this is the case for China’s processing exports. Combining Chinese trade data with an input-output table for China, they have estimated that, in 2006, the domestic content share of processing exports was only 18.1 percent, implying that the value of imported processing inputs accounted for 81.9 percent of the processing-export value. Since the domestic content share of nonprocessing exports is a much higher 88.7 percent, they found that only 50 percent of China’s export value was truly made in China.

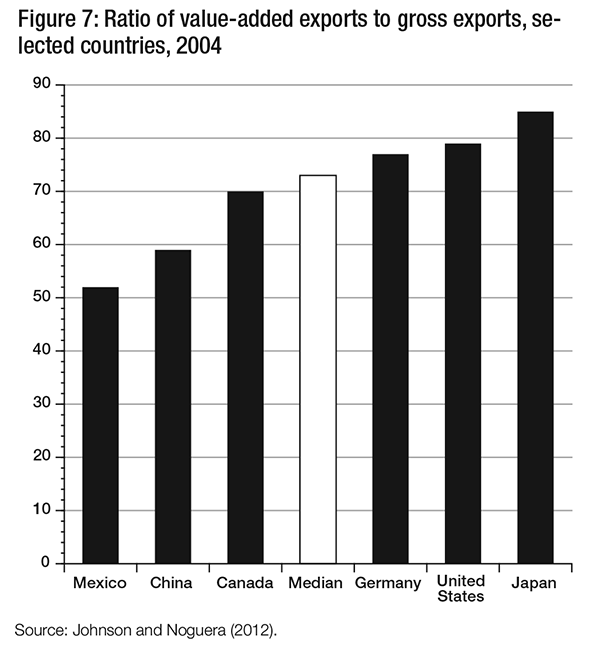

More recently, Johnson and Noguera (2012) have estimated the domestic content share of exports for a large number of countries. As shown in figure 7, Canada produces only 70 percent of its exports value at home, which is substantially less than is the case for Germany, the United States and Japan. This lower figure for Canada reflects two things. First, Canada’s economy is relatively small compared to those of Germany and the United States, and larger economies logically rely more on domestically produced inputs. Second, value chains that extend across the US-Canada border are prevalent not only in the automobile sector (Sturgeon, Van Biesebroeck, and Gereffi 2009), but also in many other industries. As can be expected, final assembly platforms such as China and Mexico create less than 60 percent of their exports value themselves, since they rely heavily on imported inputs.

Scholars and policy-makers often rely on export statistics to evaluate a country’s international competitiveness in specific industries. One of the preferred measures of international competitiveness is the revealed comparative advantage (RCA) index (Siggel 2006). The RCA index is calculated as the ratio of the share of a given industry in a country’s exports to the share of the same industry in world total exports. An export RCA value that exceeds unity implies that a country has a greater-than-average share of exports in that industry, thus suggesting that it has a revealed comparative advantage. Conversely, if the export RCA is smaller than unity, it implies that the country has a revealed comparative disadvantage.

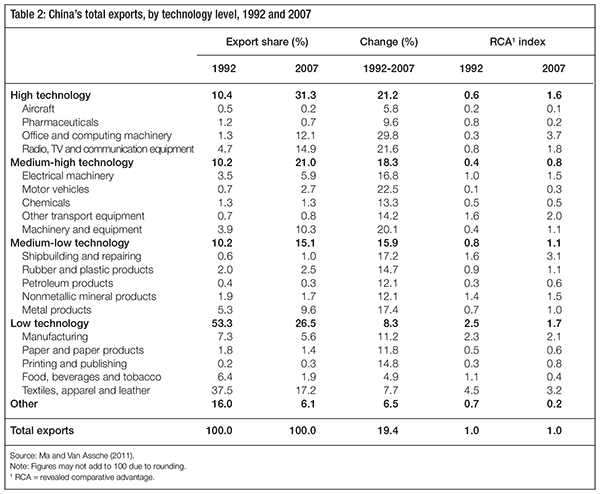

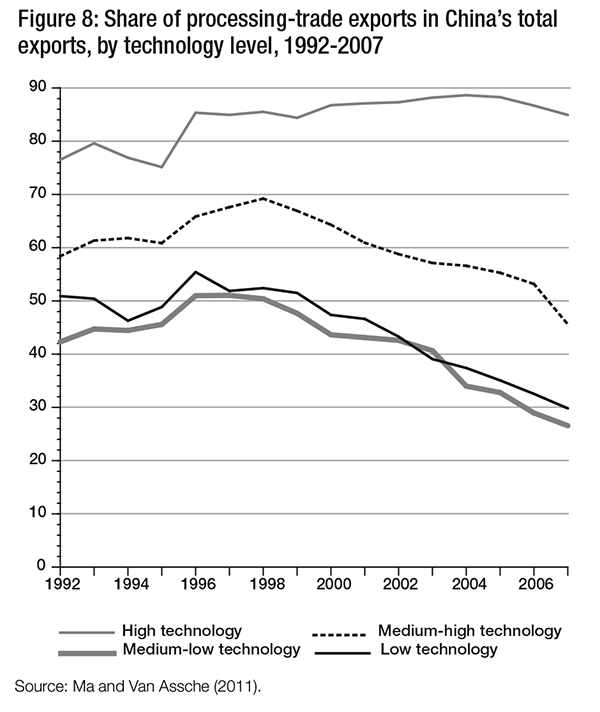

If exports are not made entirely in the exporting country, such export-based measures of international competitiveness can be severely biased. To demonstrate this, consider the following exercise conducted by Ma and Van Assche (2011). When using RCA indices to analyze China’s trade, the evidence seems abundant that China is becoming highly competitive in high-technology industries. Table 2 disaggregates China’s exports by technology category to analyze its changing export specialization patterns between 1992 and 2007. In 1992 China’s export composition was consistent with its status as a developing country. Low-technology exports accounted for 53 percent of its exports, and the nation had a revealed comparative advantage (RCA > 1) only in low-technology exports. Between 1992 and 2007, however, China’s exports composition changed quite dramatically. During this period exports growth has been particularly strong in the higher-technology categories. As a result, China in 2007 not only kept its revealed comparative advantage in low-technology exports, but also developed a revealed comparative advantage in medium-low technology exports and high-technology exports. Only in medium-high technology exports did China have a revealed comparative disadvantage.

Ma and Van Assche (2011), however, show that this perceived technological upgrading trajectory of China’s exports is largely a statistical mirage. China’s exports growth has been concentrated in the higher-technology sectors, but these are precisely the sectors in which China’s domestic content share is small. As shown in figure 8, 85 percent of China’s high-technology exports in 2007 were in the processing-trade regime, for which the domestic content share was less than 20 percent. In comparison, for the lower-technology categories, less than 50 percent of the exports were under the processingtrade regime, implying that a larger share of the export value was made in China. As a result, the rising sophistication of China’s exports may not reflect the growing sophistication of production activities in China, but rather the rising technology level of the imported inputs embodied in China’s exports.

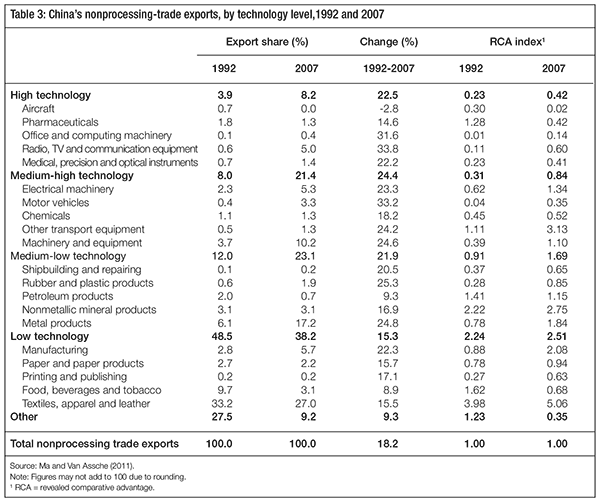

To obtain a more accurate measure of China’s technological upgrading trajectory, Ma and Van Assche (2011) examined the changing composition of China’s nonprocessing exports, for which the domestic content share is almost 90 percent. The data in table 3 suggest that China’s export specialization pattern – once adjusted for processing trade – is in line with its economic development. In both 1992 and 2007, China had a revealed comparative advantage (RCA > 1) only in the two lowest technology categories. These numbers run counter to the suggestion that China’s international competitiveness is rapidly shifting from low-technology to high-technology products.

In sum, if the domestic content share of exports is low, export-based measures of international competitiveness can become severely biased. In the case of China it gives the incorrect impression that China is rapidly gaining international competitiveness in high-technology sectors.

A third myth is that imports reflect foreign competition. In a GVC world, imported tasks are often highly complementary to domestic tasks and may therefore signal a competitive strength in the domestic sector. To understand this more fully, consider the following two examples.

The supply chain of Bombardier’s C Series airplanes spans from Canada (design, assembly and testing) to China (fuselage), the United Kingdom (wing structures and winglets), Italy (tailplanes), Germany (landing gear) and the United States (engine parts and other components). If demand for Bombardier’s C Series planes rises, this will increase demand for Canadian-based activities, but it will also increase imports of foreign-made components. It is clear that in that case the rise in imports is not due to a rise in foreign competition, but rather due to the complementarities between Canadian-based and foreign-based activities within the same GVC.

In addition, a Canadian firm’s decision to offshore a task abroad and import it back to Canada does not necessarily reflect an increase in foreign competition. Indeed, Grossman and RossiHansberg (2008) argue that this can strengthen domestic tasks by creating a positive productivity effect. The intuition is the following. When some of the tasks performed by a certain type of labour can more readily be performed abroad, the Canadian firms that gain the most from offshoring them are the ones that use this type of labour intensively in the production process. The augmented profitability of these firms gives them an incentive to expand relative to other firms that rely most heavily on other types of labour, which, in turn, enhances their labour demand. Some of this increased labour demand falls on local demand, generating an effect similar to a technological process that increases the productivity of a certain type of local task.

Such a positive productivity effect related to offshoring is found to lie at the heart of Germany’s superior export competitiveness in recent years (Marin 2010). Starting in the late 1990s, many German firms have offshored parts of their production process to Eastern Europe, Russia and the Ukraine. The lower wages in these countries, in turn, have allowed German firms to reduce their unit labour costs.9 As a consequence, offshoring to Eastern Europe has made German firms leaner and more efficient, helping them to win export market shares.

In sum, in a GVC world, policy-makers cannot look at imports and exports from the traditional mercantilist standpoint, viewing exports as good and imports as threats to the domestic economy.

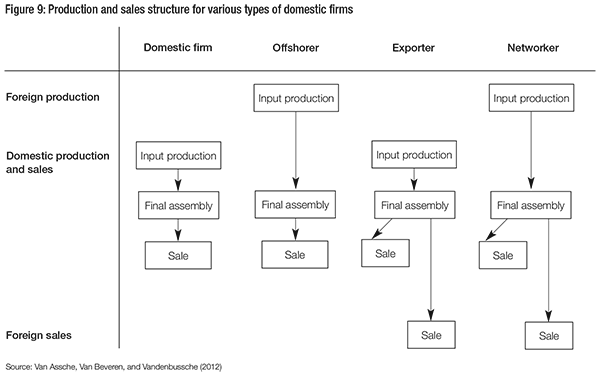

A fourth implication of conventional ways of thinking about trade competitiveness is that Canadian firms are no longer symmetrically affected by trade policy. To see this, consider figure 9, which depicts four types of Canadian firms, all of which operate in the same industry. domestic firms and exporters have concentrated their entire production in Canada, while offshorers and networkers rely on imported inputs from an offshoring country such as China to produce their products. Suppose now that Canada introduces an antidumping measure against imported inputs from China. In that case, as Van Assche, Van Beveren and Vandenbussche (2012) demonstrate, offshorers and networkers will lose market share, since their production cost goes up, while domestic firms and exporters will gain market share due to reduced competition. It is clear that in this case, Canadian firms will have opposing interests with regard to upholding the antidumping measure: domestic firms and exporters will lobby to uphold the measure, while offshorers and networkers will lobby against it.

Such a divisive scenario recently played out in 2006, when the European Union decided to introduce antidumping measures against Chinese and Vietnamese leather shoes. The launch of countervailing duties marked deep divisions between Europe’s manufacturing South and its retail-heavy North. While Italian and Spanish shoe manufacturers with more localized value chains welcomed the measure, large Scandinavian and British shoe companies such as Adidas, Ecco and Hush Puppies, which were working within global value chains, vehemently opposed the decision.

Another type of trade policy that can have asymmetric effects on Canadian firms is rules of origin (ROOs). Governments originally introduced ROOs in free trade agreements (FTAs) because the implementation of multiple tariff rates opens the door to tariff evasion.10 The ROOs, however, may have an asymmetric effect on the performance of Canadian firms. To see this, consider once again figure 9. Suppose that an FTA requires that input production take place within the FTA in order to receive a tariff rate of 0 percent on intra-FTA trade. In that case, Exporters are clearly better off, since all of their production happens at home (so their production costs are unaffected by the ROO) and they benefit from a zero tariff on their exports within the FTA. Conversely, the impact for Networkers is ambiguous. On the one hand, like Exporters, they do not have to pay tariffs on their exports within the FTA. On the other hand, the ROO may require them to switch from lower-cost suppliers outside the FTA to higher-cost suppliers within it. The result, then, is an asymmetric impact on firms, depending on whether they are Exporters or Networkers. This asymmetric impact of ROOs on firms once again implies that they may have varying preferences related to the form and implementation of FTAs.

Both examples demonstrate that Offshorers and Networkers – which operate within GVCs – have different trade policy preferences than traditional firms (Domestic firms and Exporters). They are not only interested in trade policies that improve their access to foreign markets; they will also lobby for reductions in import tariffs. Furthermore, in order to streamline their GVCs, they may lobby for deeper integration that aims to harmonize regulation and competition policy across countries (Antràs and Staiger 2011). In line with this, Orefice and Rocha (2011) indeed find empirical evidence that countries that trade tasks heavily with each other are more likely to form preferential trade agreements with deep integration.

While the impact of trade protection is asymmetric for firms, it should be noted that the effect remains symmetric for specific domestic tasks. In both examples above, trade policy effectively provides protection to domestic input producers by requiring some firms that produced their inputs offshore to switch their production to Home. As we shall see in the following subsection, this can become a powerful, yet dangerous, policy tool for trying to attract and keep high-value-added activities in a country.

If exports are produced entirely by national firms in their home country, then competition on the international market is entirely horizontal between firms in the same sector that compete for the same pool of customers. Bombardier competes against Embraer, Nike competes against Adidas. In a GVC world, however, a new type of international competition emerges that is vertical in nature (Ma and Van Assche 2011). Specifically, international players within the same GVC may vertically compete with each other to capture the more profitable (highervalue-added) activities and therefore to claim a larger share of profits from their joint output.

The importance of vertical competition within GVCs can be seen from the “smile” shape of value creation in figure 10. Firms generally locate R&D and marketing (the more capital-/knowledge-intensive activities) in developed countries, while they locate the labour-intensive manufacturing activities in developing countries (leading to spillovers). R&D and marketing have higher levels of value-added, however. So firms in developing countries, which are stuck in the middle of the value chain, have strong incentives to acquire the resources and competencies that will enable them to upgrade to higher-value-added activities and catch up with the developed world (Gereffi, Humphrey, and Sturgeon 2005; Mudambi 2008). Firms from China, India, Brazil and Mexico, for example, may try to move downstream by developing their own brands and marketing expertise. The Taiwanese electronics company Asustek, for example, started out as a contract manufacturer before making headway selling products under its own ASUS brand. Similarly, contract manufacturing firms from Taiwan or South Korea may try to move upstream by developing the necessary skills to design portions of the products they manufacture. Hon Hai (also known as Foxconn), for instance, started off as a simple assembler for GVCs and moved up the value chain to take on increasingly complex design responsibilities in the production of goods such as the Apple iPad.

Trade policy can play an intrinsic role in countries’ efforts to upgrade to higher-value-added activities, even though policy changes need to be approached with caution. As we have seen in “Trade policy may affect Canadian firms asymmetrically” (above), antidumping measures and ROOs both end up protecting domestic suppliers, even if the impact on downstream firms is asymmetric. Based on this, governments may have the incentive to introduce such trade policy measures to keep the production of high-value-added inputs in their country. It is important to stress, however, that such policies may backfire, as they could cause a country to be shut out of GVCs altogether. Specifically, if multinational firms feel they are facing too many constraints in conducting a specific task in a country (such as having to adhere to local content requirements), they may simply decide to move all GVC activities elsewhere.

Beyond a shift in thinking from trade in goods to trade in tasks, the rise of GVCs has two important implications for Canadian policy-makers. First, policy-makers should ramp up efforts to collect new data needed to determine Canada’s role in GVCs. Second, policy-makers should advocate for new trade and competition policies that will allow Canada to strengthen its role in GVCs.

A problem that policy-makers face in creating adequate policy responses to the rise in GVCs is the lack of data concerning GVCs (Ma and Van Assche 2010). To map GVCs, the following information is needed: the number of countries involved in the production process of a specific good, the value-added created in each country and the sequential supply-chain linkages between production activities. This information is hard to come by, however, with traditional data sources, such as firm-level data and international trade data providing incomplete information.

Some studies have attempted to capture the organization of GVCs by using firm-level data concerning the geographic distribution of multinational activities (e.g., Defever 2012; Hanson, Mataloni, and Slaughter 2005). However, this approach gives an incomplete and potentially biased picture of the organization of GVCs. With many multinationals outsourcing a large portion of their GVC activities (such as manufacturing) to external firms, data on GVCs should capture both intrafirm and arm’s-length linkages within GVCs.

As discussed under “Canada’s role in GVCs” (above) other scholars have relied on highly disaggregated product codes and descriptions in international trade statistics to classify each traded good according to its main use. Yeats (2001) and Ng and Yeats (2001), for example, have categorized intermediate goods as those products whose descriptions include the words “parts” or “components.” Lemoine and Ünal-Kesenci (2004) and Zebregs (2004) have used the United Nation’s BEC classification to distinguish between intermediate and final goods. While this approach has been useful in determining the positions of countries within GVCs, it has two important shortcomings. First, classifying goods according to their product codes is somewhat arbitrary, since product descriptions provide insufficient information to identify a product’s main use (Hummels, Ishii, and Yi 2001). Indeed, some goods, such as semiconductors, can be used both as a final good by consumers and as an intermediate good by electronics manufacturers. Second, even if traded goods were correctly classified as intermediate or final goods, international trade data do not identify the sector in which intermediate goods are used. They also do not indicate whether an intermediate good is processed for domestic consumption or used for export purposes. This makes it difficult to accurately link a trade flow with other trade flows within the same GVC.

Recently, a number of studies have combined international trade data with input-output (IO) table data to trace the organization of GVCs. The advantage of IO data is that it defines intermediate inputs by their use (i.e., in which industry the inputs are put to use and what share of the industry’s output is exported). As a result, the flow of imported inputs can be linked to the flow of exported goods within the same GVC and the valueadded created in each country can be estimated (de Backer and Yamano 2007; Erumban et al. 2011; Johnson and Noguera 2012). However, this approach has two shortcomings. First, it relies on the questionable proportionality assumption,11 which affects the reliability of the model’s results (Feenstra et al. 2010). (More collaboration among countries is needed to improve the quality of the international IO tables.) Second, IO tables remain highly aggregated, making it difficult to gain firm-level insights.

Policy-makers are starting to become aware of the urgency of collecting data that capture GVC activities (Feenstra et al. 2010). Since early 2009, the OECD and WTO have been collaborating to advance the issue of measuring trade in value-added. And in May of 2011, the WTO launched the Made in the World Initiative, with the aim of advancing dialogue between international experts on the concept, methodology and impact of GVCs on trade policy, and also on development in general. It is in the interests of Canadian policy-makers to be deeply involved in these international initiatives.

DFAIT, Industry Canada and Statistics Canada have already shown international leadership in the promotion of GVC analysis through the financing of leading-edge research on GVCs and through collecting new statistics on trade by business function. Their recent Survey of Innovation and Business Strategy has become one of the few available data sources that provide useful statistical information on Canadian firms’ involvement in GVCs (Boileau and Sydor 2011). These initiatives will provide researchers and policymakers with a better quantitative picture of GVCs and a way to assess the role played by any particular domestic establishment, firm or industry in a GVC. These efforts should continue in the future.12

To improve Canada’s competitiveness, policy-makers should establish a policy environment that will attract and retain the highest-valued activities to Canada while allowing other tasks to be moved to where they can be conducted most efficiently (Ma, Mudambi, and Van Assche 2012). Implementation of the following recommendations would help Canada create such a policy environment.

This includes not only the enhancement of Canada’s educational system, but also the fostering twenty-first century (OECD 2007). In this respect, several policy areas are of particular importance:

The following two hypothetical examples demonstrate how industryand firm-level policies do not necessarily lead to the attraction and retention of high-value-added activities in Canada:

Without efficient trade linkages, foreign companies will not be willing to integrate Canadianbased tasks into their GVCs. Similarly, Canadian companies will have a hard time building GVCs, thus reducing their competitiveness. To strengthen the competitiveness of Canadian tasks, it is important to focus on the reduction of barriers not only on the export side, but also on the import side. The federal government’s commitment to eliminating all remaining tariffs on manufacturing inputs and machinery and equipment used for manufacturing by 2015 has, in this respect, been an important policy decision.

Linkages with upstream and downstream parties can be streamlined through two additional channels:

The core theme underlying the recommendations presented here is that high-value-added activities are subject to increasing competition between countries, and policy-makers must realize that allowing Canada to fully benefit from the economic potential of participation in global value chains will require policy adjustments along a number of dimensions that transcend trade policy.

Acemoglu, D., P. Antràs, and E. Helpman. 2007. “Contracts and Technology Adoption.” The American Economic Review 97: 916-43.

Ali-Yrkkö, J., P. Rouvinen, T. Seppälä, and P. Ylä-Anttila. 2011. “Who Captures Value in Global Supply Chains? Case Nokia N95 Smartphone.” Journal of International Competitiveness and Trade 11: 263-78.

Amiti, M. 2005. “Location of Vertically Linked Industries: Agglomeration versus Comparative Advantage.” European Economic Review 49 (4): 809-32.

Amiti, M., and S.-J. Wei. 2005. “Fear of Service Outsourcing: Is it Justified?” Economic Policy 20 (42): 307-47.

Antràs, P., and R. Staiger. 2011. “Offshoring and the Role of Trade Agreements.” American Economic Review, forthcoming.

Athukorala, P., and N. Yamashita. 2006. “Production Fragmentation and Trade Integration.” North American Journal of Economics and Finance 17 (3): 233-56.

Autor, D., F. Levy, and R. Murnane. 2003. “The Skill Content of Recent Technological Change: An Empirical Exploration.” Quarterly Journal of Economics 118 (4): 1279-1333.

Baldwin, R., and A. Venables. 2011. “Relocating the Value Chain: Offshoring and Agglomeration in the Global Economy.” NBER Working Paper 16611.

Blinder, A. 2006. “Offshoring: The Next Industrial Revolution?” Foreign Affairs 85 (2): 113-28.

Boileau, D., and A. Sydor. 2011. “Global Value Chains in Canada.” In Trade Policy Research Special Edition: Global Value Chains — Impacts and Implications, edited by A. Sydor. Ottawa: Department of Foreign Affairs and International Trade, 157-78.

Bridgeman, B. 2012. “The Rise of Vertical Specialization Trade.” Journal of International Economics 86 (1): 133-40.

Costinot, A. 2009. “On the Origins of Comparative Advantage.” Journal of International Economics 77: 255-64.

Curran, L., and S. Zignago. 2011. “Intermediate Products and the Regionalization of Trade.” Multinational Business Review 19 (1): 6-25.

de Backer, K., and N. Yamano. 2007. ”The Measurement of Globalisation Using International Input-Output Tables.” OECD STI Working Papers 2007/8. OECD, Directorate for Science, Technology and Industry. Paris: Organisation for Economic Co-operation and Development.

Dedrick, J., K. Kraemer, and G. Linden. 2010. “Who Profits from Innovation in Global Value Chains? A Study of the iPod and Notebook PCs.” Industrial and Corporate Change 19 (1): 81-116.

Defever, F. 2012. “The Spatial Organization of Multinational Firms.” Canadian Journal of Economics, forthcoming.

DFAIT (see Foreign Affairs and International Trade Canada). Erumban, A., R. Goumaa, B. Losa, R. Stehrer, U. Temurshoev, M. Timmer, and G. De Vries. 2011. “The World Input-Output Database (WIOD): Construction, Challenges and Applications.” Paper presented to World Bank workshop, The Fragmentation of Global Production and Trade in Value Added,” June 9-10, 2011.

Evans, C., and J. Harrigan. 2005. “Distance, Time, and Specialization: Lean Retailing in General Equilibrium.” American Economic Review 95 (1): 292-313.

Feenstra, R., R. Lipsey, L. Branstetter, F. Foley, J. Harrigan, B. Jensen, L. Kletzer, C. Mann, P. Schott, and G. Wright. 2010. “Report on the State of Available Data for the Study of International Trade and Foreign Direct Investment.” NBER Working Paper 16254.

Foreign Affairs and International Trade Canada, Industry Canada, and Statistics Canada. 2011. “Profile on Global Value Chains: Key Findings from the Survey of Innovation and Business Strategy 2009.” Ottawa: Industry Canada. Accessed May 22, 2012. https://www.ic.gc.ca/eic/site/ eas-aes.nsf/eng/ra02126.html

Fort, T. 2011. “Breaking Up Is Hard To Do: Why Firms Fragment Production across Locations.” University of Maryland, Department of Economics. Accessed May 22, 2012. https://econweb.umd.edu/~fort/research.html

Gamberoni, E., R. Lanz, and R. Piermartini. 2010. “Timeliness and Contract Enforceability in Intermediate Goods Trade.” World Trade Organization Staff Working Paper ERSD-2010-14.

Gangnes, B., A. Ma, and A. Van Assche. 2011. “China’s Exports in a World of Increasing Oil Prices.” Multinational Business Review 19 (2): 133-51.

Gangnes, B., and A. Van Assche. 2010. “China and the Future of Asian Technology Trade.” In The Future of Asian Trade and Growth: Economic Development with the Emergence of China, edited by L. Yueh. London: Routledge, 351-77.

——————. 2011. “Product Modularity and the Rise of Global Value Chains: Insights from the Electronics Industry.” CIRANO Scientific Paper 2011s-64.

Gaulier, G., F. Lemoine, and D. Ünal-Kesenci. 2007. “China’s Integration in East Asia: Production Sharing, FDI & High- Technology Trade.” Economic Change and Restructuring 40: 27-63.

Gereffi, G., J. Humphrey, and T. Sturgeon. 2005. “The Governance of Global Value Chains.” Review of International Political Economy 12 (1): 78-104.

Goldfarb, D., and K. Beckman. 2007. Canada’s Changing Role in Global Supply Chains. Ottawa: Conference Board of Canada.

Goldfarb, D., and D. Chu. 2008. Stuck in Neutral: Canada’s Engagement in Regional and Global Supply Chains. Ottawa: Conference Board of Canada.

Grossman, G., and E. Rossi-Hansberg. 2008. “Trading Tasks: A Simple Theory of Offshoring.” American Economic Review 98 (5): 1978-97.

Grossman, G., and E. Rossi-Hansberg. 2012. “Task Trade between Similar Countries.” Econometrica 80 (2): 593-629.

Haddad, M. 2007. “Trade Integration in East Asia: The Role of China and Production Networks.” World Bank Policy Research Working Paper 4160.

Hanson, G., R. Mataloni, and M. Slaughter. 2005. “Vertical Production Networks in Multinational Firms.” Review of Economics and Statistics 87 (4): 664-78.

Harrigan, J. 2010. ”Airplanes and Comparative Advantage.” Journal of International Economics 82: 181-194.

Harrigan, J., and A. Venables. 2006. “Timeliness and Agglomeration.” Journal of Urban Economics 59: 300-16.

Hillberry, R. 2011. “Causes of International Production Fragmentation: Some Evidence.” In Trade Policy Research Special Edition: Global Value Chains — Impacts and Implications, edited by A. Sydor. Ottawa: Department of Foreign Affairs and International Trade, 77-102.

Hummels, D. 2007. “Transportation Costs and International Trade in the Second Era of Globalization.” Journal of Economic Perspectives 21 (3): 131-54.

Hummels, D., I. Ishii, and K.-M. Yi. 2001. “The Nature and Growth of Vertical Specialization in World Trade.” Journal of International Economics 54 (1): 75-96.

Jensen, P., and T. Pedersen. 2011. “The Economic Geography of Offshoring: The Fit between Activities and Local Context.” Journal of Management Studies 48 (2): 352-72.

Johnson, R., and G. Noguera. 2012. “Accounting for Intermediates: Production Sharing and Trade in Value Added.” Journal of International Economics 86 (2): 224-36.

Jones, R., and H. Kierzkowski. 1990. “The Role of Services in Production and International Trade: A Theoretical Framework. In The Political Economy of International Trade: Essays in Honor of Robert E. Baldwin, edited by R. Jones and Oxford: Blackwell.

Koopman, R., Z. Wang, and S.-J. Wei. 2008. “How Much of Chinese Exports Is Really Made in China? Assessing Domestic Value-Added When Processing Trade Is Pervasive.” NBER Working Paper 14109.

Kraemer, K., G. Linden, and J. Dedrick. 2011. “Capturing Value in Global Production Networks: Apple’s iPhone and iPad.” Mimeo.

Krugman, P. 1979. “Increasing Returns, Monopolistic Competition, and International Trade.” Journal of International Economics 9 (4): 469-79.

Leamer, E., and M. Storper. 2001. “The Economic Geography of the Internet Age.” Journal of International Business Studies 32 (4): 641-65.

Lemoine, F., and Ünal-Kesenci, D. 2004. “Assembly Trade and Technology Transfer.” World Development 32 (5): 829-50.

Levchenko, A. 2007. “Institutional Quality and International Trade.” Review of Economic Studies 74 (3): 791-819.

Levy, F., and R. Murnane. 2004. The New Division of Labor: How Computers Are Creating the Next Job Market. Princeton, NJ: Princeton University Press.

Ma, A., R. Mudambi, and A. Van Assche. 2012. “The Extent of Catch Up in Emerging Market Economies: A Global Value Chains Approach.” Mimeo.

Ma, A., and A. Van Assche. 2010. “The Role of Trade Costs in Global Production Networks: Evidence from China’s Processing Trade Regime.” World Bank Policy Research Working Paper 5490.

Ma, A., and A. Van Assche. 2011. “China’s Role in Global Production Networks.” In Trade Policy Research Special Edition: Global Value Chains — Impacts and Implications, edit- ed by A. Sydor. Ottawa: Department of Foreign Affairs and International Trade, 127-56.

Ma, A., A. Van Assche, and C. Hong. 2009. “Global Production Networks and China’s Processing Trade.” Journal of Asian Economics 20 (6): 640-54.

Mankiw, G., and P. Swagel. 2006. “The Politics and Economics of Offshore Outsourcing.” Journal of Monetary Economics 53 (5): 1027-56.

Marin, D. 2010. “Germany’s Supercompetitiveness: A Helping Hand from Eastern Europe.” Voxeu, June 20. Accessed May 22, 2012. https://www.voxeu.org/index.php?q=node/5212

Miroudot, S., and A. Ragoussis. 2009. “Vertical Trade, Trade Costs and FDI.” OECD Trade Policy Working Paper 89.

Mudambi, R. 2008. “Location, Control and Innovation in Knowledge-Intensive Industries.” Journal of Economic Geography 8 (5): 699-725.

Ng, F., and A. Yeats. 2001. “Production Sharing in East Asia: Who Does What for Whom, and Why?” In Global Production and Trade in East Asia, edited by L. Cheng and H. Kierzkowski. Boston: Kluwer Academic Publishers.

Nunn, N. 2007. “Relationship-Specificity, Incomplete Contracts and the Pattern of Trade.” Quarterly Journal of Economics 122 (2): 569-600.

OECD (see Organisation for Economic Co-operation and Development). Organisation for Economic Co-operation and Development. 2007. “Moving Up the (Global) Value Chain.” OECD Policy Brief, March. 2007.

Orefice, G., and N. Rocha. 2011. “Deep Integration and Production Networks: An Empirical Analysis.” WTO Staff Working Paper ERSD-2011-11.

Puzzello, L. 2012. “A Proportionality Assumption and Measurement Biases in the Factor Content of Trade.” Journal of International Economics 87 (1): 105-11.

Reich, R., T. Hixon, and R. Kimball. 1990. “Who Is Us? (The Changing American Corporation).” Harvard Business Review 68 (1) : 53-64.

Rivoli, P. 2005. The Travels of a T-Shirt in the Global Economy: An Economist Examines the Markets, Power, and Politics of World Trade. Hoboken: John Wiley & Sons.

Rubin, J. 2009. Why Your World Is Going to Get a Whole Lot Smaller: Oil and the End of Globalization. Toronto: Random House.

Rubin, J., and B. Tal. 2008. “Will Soaring Transport Costs Reverse Globalization?” CIBC World Markets StrategEcon, May, 4-7.

Shin, N., K. Kraemer, and J. Dedrick. 2012. “Value Capture in the Global Electronics Industry: Empirical Evidence for the ‘Smiling Curve’ Concept.” Industry and Innovation 18 (2): 89-107.

Siggel, E. 2006. “International Competitiveness and Comparative Advantage: A Survey and a Proposal for Measurement.” Journal of Industry, Competition and Trade 6 (2): 137-59.

Sturgeon, T. 2002. “Modular Production Networks: A New American Model of Industrial Organization.” Industrial and Corporate Change 11 (3): 451-96.

Sturgeon, T., J. Van Biesebroeck, and G. Gereffi. 2009. “The North American Automotive Value Chain: Canada’s Role and Prospects.” International Journal of Technological Learning, Innovation and Development 2 (1/2): 25-51.

Tobin, J., and M. Busch. 2010. “A BIT Is Better Than a Lot: Bilateral Investment Treaties and Preferential Trade Agreements.” World Politics 62 (1): 1-42.

UNCTAD (see United Nations Conference on Trade and Development). United Nations Conference on Trade and Development. 2011. World Investment Report 2011. Geneva: UNCTAD.

Van Assche, A. 2008. “Modularity and the Organization of International Production.” Japan and the World Economy 20 (3): 353-68.

Van Assche, A. 2012. “Cuáles países se convierten en plataformas de ensamble final?” In Redes globales y regionales de produc- cion, edited by I. Minian and E. Davalos. Mexico City: Instituto de Investigaciones Economicas-CISAN-UNAM.

Van Assche, A., I. Van Beveren, and H. Vandenbussche. 2012. “Who Gains from Import Protection? Evidence from Belgian Firms.” Mimeo.

Winkler, D., and W. Milberg. 2009. “Errors from the ‘Proportionality Assumption’ in the Measurement of Offshoring: Application to German Labor Demand.” Schwartz Center for Economic Policy Analysis Working Paper 2009-12.

World Trade Organization and Institute of Developing Economies-Japan External Trade Organization. 2011. Trade Patterns and Global Value Chains in East Asia: From Trade in Goods to Trade in Tasks. Geneva: World Trade Organization.

WTO and IDE-JETRO (see World Trade Organization and Institute of Developing Economies-Japan External Trade Organization).

Yeats, A. 2001. “Just How Big Is Production Sharing?” In Fragmentation: New Production Patterns in the World Economy, edited by S. Arndt and H. Kierzkowski. Oxford: Oxford University Press, 108-43.

Yi, K.-M. 2003. “Can Vertical Specialization Explain the Growth of World Trade?” Journal of Political Economy 111 (1): 52-102.

Yoshida, Y., and H. Ito. 2006. “How Do the Asian Economies Compete with Japan in the US Market? Is China Exceptional? A Triangular Trade Approach.” Asia Pacific Business Review 12 (3): 285-307.

Zebregs, H. 2004. “Intra-Regional Trade in Emerging Asia.” IMF Policy Discussion Paper PDP04/01.

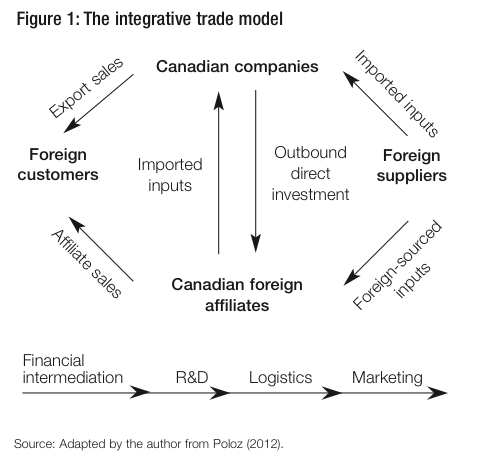

Trade policy in Canada tends to be focused primarily on growing exports.1 To be sure, some policy-makers and analysts still tend to equate “trade” with exports – arguably, an outdated and somewhat mercantilist view of international commerce. Trade liberalization, combined with lower transportation and communication costs, has allowed companies to rationalize production on a global scale so that exporting has become just one element within a closely knit network of trade activities. Canadian exporters now operate within a broader business framework that expands the traditional export model to include direct investment abroad, the integration of imported inputs into exports and the establishment of foreign affiliates. This “integrative trade” framework is supported through an underlying infrastructure of support services, including financial intermediation, R&D, logistics and marketing (see figure 1). The development and operation of global value chains (GVCs) constitute a core element of integrative trade.

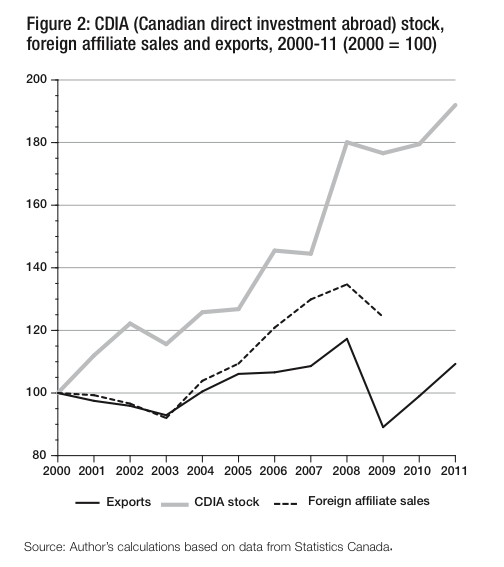

The various elements shown in figure 1 all represent significant levels of activity for Canadian companies. In 2011, for example, Canadian exports of goods and services amounted to more than C$500 billion. Outbound direct investment flows were C$45 billion, which pushed Canadian direct investment abroad (CDIA) stock to C$684 billion. Foreign affiliate sales (FAS) amounted to C$456 billion in 2009 (latest year available), exceeding exports from Canada for the first time.2 Imported inputs used in the production of exports are estimated at C$140 billion, while business spending on R&D came in at C$16 billion. Canada’s stock of outward foreign investment also generates significant profits for Canadian companies. In 2011, Canadian companies earned C$43 billion in income from their foreign direct investments, providing a significant source of funds to finance new investments and growth – in Canada and abroad.

As Van Assche argues, Canadian trade and competition policies would prove more effective if they were broadened to address additional facets of international trade. In particular, Van Assche focuses on the role of GVCs in international trade and puts forth a number of recommendations as to how trade and competition policy could better reflect the growing prevalence of GVCs. In his study, Van Assche addresses the trade side of the equation very well. This commentary will therefore focus on the role of outward investment and foreign affiliates in supporting Canadian companies’ international trade networks and value chains.

The building and maintenance of GVCs requires cross-border investment by companies operating in the value chain. So CDIA is needed to establish foreign manufacturing operations and also to build procurement and distribution networks. The establishment of a foreign affiliate through CDIA is often the first step for a company expanding outside Canada. In addition to serving local markets, foreign affiliates are used to secure access to cost-efficient inputs, labour and resources in other countries, thereby increasing Canadian firms’ productivity and profitability. Empirical research suggests that Canadian companies with a larger international footprint are more productive, have lower cost structures and are more competitive. Understanding the role of CDIA and foreign affiliates provides important insight into Canada’s international trade and also has implications for trade and competition policy.

International investment has become a key element in the growth strategy of Canadian companies. However, much misunderstanding has arisen about the benefits associated with outbound investment. The negative perception associated with outbound investment and offshoring (i.e., exporting jobs and capital) stems partially from the rationalization of some Canadian industries in the late 1980s and early 1990s – namely, labour-intensive manufacturing of textiles, clothing, furniture, consumer appliances and other consumer goods. This was a global phenomenon, and to remain competitive, Canadian companies were compelled to reduce costs through the transfer of production to offshore sites. In fact, many of the companies that used outbound investment to restructure their operations have survived to grow into successful Canadian firms with much of their design and higher-value-added manufacturing remaining in Canada. By contrast, many of the firms that did not adapt in this way are no longer in business.

In recent years the motivation behind CDIA has expanded beyond simple cost-cutting. Canadian businesses still use outbound investment to improve cost efficiencies, but CDIA is also critical in protecting their market share, tapping into global supply chains, growing their businesses and accessing new technology and resources (e.g., skilled labour and raw materials). An Export Development Canada (EDC) survey of Canadian exporters carried out in March 2010 found that 66 percent of respondents used CDIA mainly to increase foreign sales (EDC 2010). Growing their market share was cited by 58 percent of survey respondents, while improving service to existing foreign customers was cited by 45 percent of companies. In addition, 40 percent of the survey participants reported using foreign investment to improve their competitiveness within existing GVCs, and 27 percent noted that they invest in a foreign market to become part of a new global or regional supply chain. Another EDC survey of Canadian companies carried out in May 2011 (EDC 2011) examined growth characteristics of Canadian exporters and found a strong positive correlation between participation in a GVC and company sales growth.