Christian Lammert met en cause la thèse répandue d’une mondialisation qui nivellerait par le bas les régimes fiscaux des nations. Il observe au contraire une hausse continue des taux d’imposition et des recettes fiscales. Comparant entre elles les statistiques de l’OCDE, du Canada, des États-Unis, de la Suède et de l’Allemagne, il soutient en effet que depuis 1965, l’augmentation globale des recettes fiscales des gouvernements provient essentiellement des hausses de l’impôt sur le revenu des particuliers et des cotisations de sécurité sociale.

Taxation and tax policy reform appears on the political agenda in most advanced welfare states in Europe and North America. Of course studies of taxation and tax policy are nothing new and have existed ever since people have paid taxes. The current work is situated in the context of the future of the welfare state and the reinforced international economic and political integration referred to as “globalization.” The purpose of this paper is to analyze how globalization is affecting tax policy in advanced welfare states. In comparing the evolution of tax policy in Canada with those in the United States, Germany and Sweden from 1960 to 1995, I will try to review the conventional antiglobalization thesis, i.e., that globalization leads to a “race to the bottom” in revenue and expenditures policies, or as others have called it, a “beggar the neighbour policy” (Tanzi and Bovenberg 1990, 187).

There are at least four major functions of fiscal policy and taxation in the modern economy (Boskin 1978, 2). First, they direct the financing of government expenditures; second, they redistribute income of citizens; third, they serve to encourage or discourage certain activities; and fourth, they stabilize the overall economy. These functions of taxation are very important for the legitimacy and balance of modern welfare states. If we follow the conventional antiglobalization thesis, these functions are endangered under the present processes of reinforced international economic and financial integration. As well, the increased mobility of capital across national borders is alleged to put pressure on governments to decrease the overall tax burden and therefore to cut aggregate expenditures, especially on welfare. Governments are also forced by capital mobility to shift the tax mix away from progressive and relatively mobile direct (high income and capital) taxes towards more regressive and immobile indirect (consumption and labour) taxes (Sinn 1990; CERP 1993; Steinmo 1996; Andersson et al. 1998; Schulze and Ursprung 1999). They also enter into a tax competition to attract global capital, which is supposed to lead to a race to the bottom in corporation tax rates and finally to a fiscal crisis of the state (Scharpf 1997, 531; Frey 1990, 8). Following this frame of thought, the race to the bottom supposedly ends only when the tax rate on mobile factors has fallen to zero (Sinn 1992; Strange 1996). This results in a lowering and growing convergence of national tax rates and overall tax and expenditure burden profiles (Hobson 2003, 39; Andrews 1994; Moses 1994).

Proponents of this thesis argue that economic performance – output, price stability, and income – is significantly determined by the willingness of the owners of capital to continue to invest in productive activities. This argument stresses that the political role of investment in market-oriented democracies is crucial for state policy-makers, because of the nature of democratic politics and institutions. In this view, good economic performance is necessary for the continued popular approval and re-election of incumbents (Swank 1998). Indeed, in the late 1980s and at the beginning of the 1990s, a wave of tax reforms swept through the Western world, mainly effecting income taxes. Starting with the Tax Reform Act of 1986 in the USA, tax reform legislation was instituted between 1986 and 1991 in nearly all OECD countries that lowered top marginal rates on personal income tax. Many states also reduced their corporate tax rates during this period, but all governments accompanied these reforms with efforts to expand their tax base and to close many common tax loopholes. A frequent explanation for the near simultaneity of these changes is that economic integration forced governments to reform their tax systems in response to reforms in other countries (Lee and McKenzie 1989; Steinmo 1993).

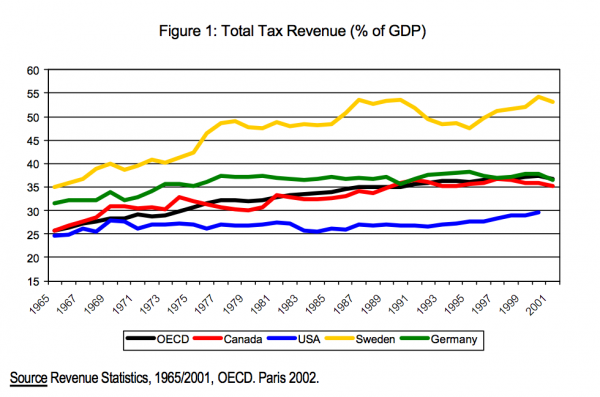

A closer empirical look at the evolution of tax revenues and tax system changes in advanced welfare states from 1960 to 2001 reveals a complete different picture. Figure 1 presents the evolution of total tax revenues as percentage of GDP from 1965 to 2001. As the data show, not only is there no decline in tax revenues in this period, but there is a moderate to high increase. Sweden is at the top and the USA at the bottom of the countries analyzed, and Canada and Germany are in the middle, near the OECD average. What is striking about this evolution is the degree to which tax revenues have increased in an era of intensifying capital mobility. There seems to be a positive rather than negative relationship between antiglobalization sentiment and tax revenues in advanced welfare states, a conclusion that stands contrary to the conventional globalization thesis.

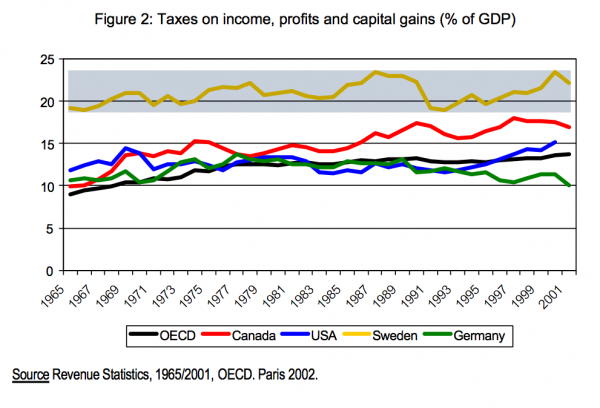

What about the second thesis, namely that globalization leads to a decrease of direct taxes and a shifting of the tax burden from direct to indirect taxes? Figure 2 measures the evolution of taxes on income and profits as a percentage of GDP; the outcome is comparable to that in figure 1. Again, there are no signs of decreasing tax revenues from income and profits since 1975. While tax revenues from income and profits remain steady in Sweden, there is a moderate increase in Canada and the USA and a moderate decrease in Germany. There seems to be no correlation between capital mobility and tax revenues from income and profits.

In contrast with Canada’s position on total tax revenues, in the case of tax revenues on income and profits Canada is clearly above the OECD average, at least it has been since the beginning of the 1980s, although it still has lower revenues than Sweden. USA and Germany are located largely beneath the OECD average, taking into account an increase in tax revenues in the USA in the mid -1990s that puts them just above the OECD average.

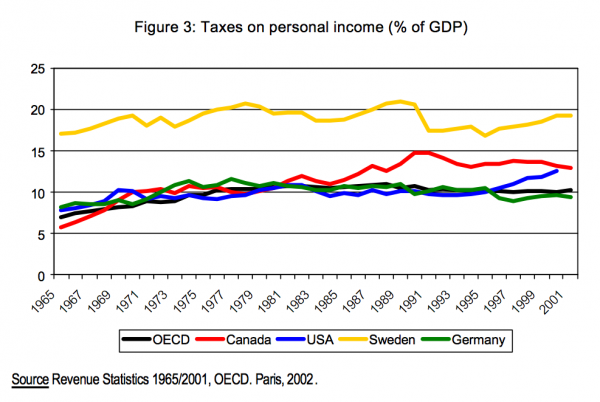

A similar picture can be drawn from the evolution of revenues from personal income taxes. As we can see in figure 3, there is again no clear sign of a decrease in tax revenues from personal income. In stark contrast with the conventional antiglobalization thesis, we find a moderate increase in tax revenues from personal income in all countries.

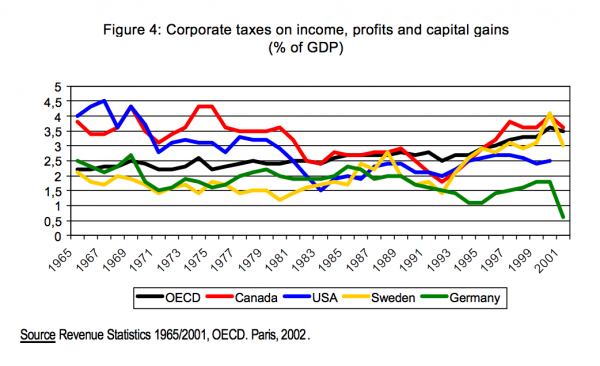

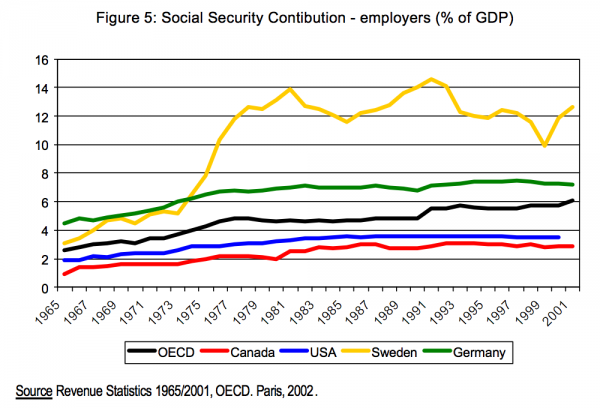

Again, Sweden is at the top of the ranking and the United States at the bottom. A slightly different picture is shown in figure 4. Here we see declining corporate tax revenues in the USA and Canada, especially in the 1980s, but growing revenues from this tax base again in the 1990s. In Sweden, tax revenues have been increasing since the beginning of the 1990s. In Germany, revenues from corporate taxation have declined since 1990. While these data appear to undermine the conventional antiglobalization thesis, we need to address two problems in regard to corporate income tax. The first is political: The decision of a corporation to invest in a specific country is based not just on tax rates, but also on other aspects like infrastructure, the educational system and social conditions. The second is economic and financial: The starting point for measuring actual taxes paid by corporations is corporation income taxes, which are a direct cost of doing business. However, corporate income taxes are not the only taxes businesses pay, and they are not necessarily the most costly. There are other taxes, such as payroll taxes and particular contributions to social security. The evolution of the later tax is shown in figure 5. (For a detailed discussion of average corporate tax rates, see Stewart and Webb 2003; Mendoza et al. 1994; Carey and Tchilingurian 2000.) Here we see a clear increase in social security contributions by employers since 1965: a moderate increase in Canada, USA and Germany and a sharp increase in Sweden, although revenues from social security contributions have begun to decline in Sweden since 1990.

As we can see, there is no empirical support for the notion that globalization forces governments to reduce direct taxes. Contrary to the conventional proposition that high capital mobility forces governments to cut back direct taxes, the data show that overall increases in government taxation since the 1965 have mainly been produced by increases in direct and personal income taxes and social security contributions (Hobson 2003, 43; Tanzi and Schuhknecht 2000, 58-59).

As Hobson (2003, 44) has shown, there are also no data to support the shifting tax base thesis. Capital tax burdens have risen considerably and consistently since the 1970s (see also Swank 1998; Ganghof 2001). Labour taxes remained far lower than capital tax increases throughout that period. Hobson concludes that “at a time when global capital flows are at highest point, we see a substitution of capital taxes for labour taxes which, of course, is precisely the inverse scenario to that of conventional expectations” (2003, 45).

To sum up, what are the empirical findings with respect to conventional predictions on the impact of globalization on the fiscal situation of modern welfare states? The main prediction was of a growing convergence in national tax regimes and tax rates, because all countries are caught in tax competition and a “beggar the neighbour” policy to attract foreign capital. Strikingly, in all tax categories, except corporate income tax, there are still major differences between national tax regimes and no signs of convergence as a result of enhanced international economic and fiscal integration. Peter Garret seems to be right when he concludes that “the conventional wisdom is too simple and considerably overdrawn” (1995, 682). What should we say about the relationship between globalization and tax policy reform in the OECD countries in the 1980s and 1990s? (for detailed discussion of this issue see Sandford 1993 and Hale 2002). As there is no direct correlation, there may well be some mediating factors that have an impact on the influence of globalization on tax policy reform.

After taking a closer look at some central features of the Canadian tax system relative to those in advanced welfare states, we find the Canadian tax system emerging as a series of compromises between competing political and ideological priorities that are embedded in Canadian political life. There are a few important elements in the Canadian tax system that help to place it in comparative perspective (for a detailed analysis of tax policy in Canada, see Hale 2002). Canada’s tax rates on personal income are relatively high and take effect at modest income levels compared with those of Canada’s main trading partners. Corporate tax rates are competitive and favour the growth of manufacturing resources and small business sources, but the rates for most service industries are high (Hale 2002, 15). Capital gains taxes are levied on the sale of most shares and other investments on the death of their owners, but there are no estate or inheritance taxes. Sales tax levels are high, especially compared with those in the USA. They mainly pay for Canada’s higher per capita public spending. During the late 1990s there was a significant increase in payroll taxes, mainly to restore the Canadian Pension Plan to financial solvency. In addition, there are relatively generous incentives for retirement, and more recently, for education savings. This goes hand in hand with a growing number of income transfer programs that are administered through the tax system.

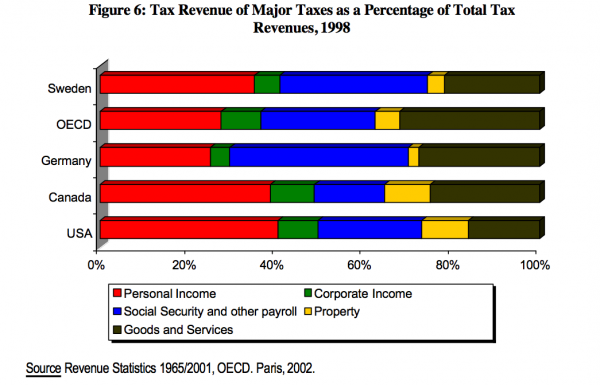

What can we conclude about the tax systems in the four countries we have analyzed? As we can see in figure 6, personal income taxes are high as a proportion of total tax revenues in Canada and the USA. Sweden and Germany have the lowest share of personal income taxes. Germany has the highest proportion of social security contributions, just a few points ahead of Sweden and Canada, with the USA at the bottom of this ranking. In the case of corporate income taxation, it is highest in Canada and the United States, followed by Sweden and Germany. This analysis indicates not just different tax burdens (tax-to-GDP ratio), but different tax regime structures (tax-to-total-taxes ratio).

In looking at the differences between the four countries in this sample, even without taking into account the broader picture of the OECD countries, we come to the same conclusion (Wagschal 2001, 134). We can distinguish at least three different tax regimes or approaches to taxation:

How can we best characterize the different worlds of taxation? Primarily, there is the territorial aspect. The spatial connection of the different worlds of taxation refers to the “families of nations” concept (Castles 1993). The worlds of taxation are also strongly related to partisan politics, in other words, the party composition of governments (Garrett 1998; Esping-Anderson 1990). Tax rates and the tax system structures are both connected to party preferences. Analogous to the different worlds of taxation is the ideological dominance of the various parties in government. So Garrett’s suggestion in the broader context of globalization and domestic politics in industrial countries (1998) is trumped by the findings regarding the different tax regimes: Partisan politics do matter.

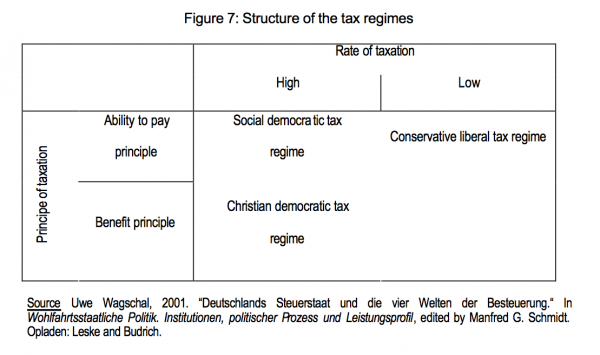

Uwe Wagschal (2001, 137) points out another interesting factor that has a bearing on the various tax regimes: religion. The social democratic and the liberal conservative tax regimes are mostly in protestant countries, and the Christian democratic regimes are in Catholic countries. It appears therefore that religion is important not only to society but also to the party system (Lipset and Rokkan 1967), welfare regime structures, (Kersbergen 1995; Castles 2000), and tax rates and tax system structures. In Europe religious teachings are transformed into politics by party systems, and religion has a lasting effect on values and moral beliefs. In terms of the tax systems, this is manifested in two principles of taxation: the “ability to pay” principle, dominant in Protestant countries, and the “benefit principle,” which prevails in Catholic countries. Tax regimes can thus be differentiated according to two criteria: the level of taxation and the operating taxation principle (see figure 7).

We can therefore describe the three worlds of taxation as follows. The conservative-liberal tax regime is characterized by a high proportion of direct taxes (individual, corporate, wealth). Social security contributions and tax rates on consumption are relatively low. In contrast, in the Christian democratic tax regime there is a broader concept of taxation, with, typically, many different taxes. Direct taxes are not as essential to total tax revenues as they are in liberal regimes, but social security contributions do make up a big part of government revenues. There is a high tax burden on labour in Christian democratic tax regimes. In social democratic tax regimes, high total tax revenues are mainly composed of high income taxes and above average taxes on consumption. Social security contributions are relatively low (Wagschal 2001, 140).

In comparing the three tax regimes we find other determinants that shaped tax policy in addition to globalization, especially in the 1980s and 1990s. Party politics is a key factor accounting for differences, especially to explain the structure and complexity of tax systems. There is, not surprisingly, a negative correlation between conservative parties and total tax revenues, on the one hand, and a positive correlation between left-wing parties and total tax revenues, on the other; so parties do matter (Wagschal 2001, 144). Thus the interests of the parties are manifested in tax policies: left-wing parties go for a redistribution of income to fight poverty, while conservative parties focus on wealth creation, price stability, market economy and low taxes (Klingeman et. al. 1994). Party politics also have an impact on the actual structure of the tax system. For example, in the Christian democratic taxation world, a high percentage of tax revenues are accounted for by social security contributions. Therefore, this is an instance where families are favouredin the tax system (for other effects of party politics on taxation, see Garrett 1998, 87). There are many case studies (Webber and Wildavsky 1986; Schick 1993; Steinmo 1995; Wildavsky and Caiden 1997) and comparative studies (Castles 1998) that focus on the tax preferences of parties and that confirm the strong correlation between partisan politics and tax policy. Political swings from the Left to the Right appear to have been a principle cause of tax reforms starting in the late 1980s. In the mid- to late-1980s, conservative parties controlled the governments of many OECD counties: there was Christian democratic and conservative dominance in Germany and Great Britain, the Mulroney government in Canada from 1984 to 1993, and Republican control of the Senate through 1986 and the presidency through 1992 in the USA.

From a social perspective tax policy is mainly a function of the balance of power between different interest groups and their positions in the political system. The degree of corporatism, union density and the frequency of strikes are important indicators in this regard. The influence of corporatism on tax policy has been shown in some comparative and quantitative studies (Steinmo and Tolbert 1998; Garrett 1998) Simply put, the more hegemonic the corporatist model, the higher the tax levels. Wagschal (2001, 146) summarizes the corporatist argument correctly when he says that in government, left-wing parties deal with strong labour unions better than do conservative ones. On the other side, when unions are weak, it is easier for conservative parties to advance their economic policies.

Strongly linked to the corporatism argument is another important perspective on the pace and depth of the neoliberal tax model: the structure of productivity-oriented co-operation. Countries may be classified according to the extent of national co-ordination through economy-wide bargaining among relatively centralized national employer and union associations (Soskice 1999; Huber and Stephens 2001). Nations vary according to the degree of sectoral co-ordination of the economy, and this aspect is vitally important for tax policy. As Hall and Gingerich (2001) have argued, elements of national economic models are functionally interdependent. Comprehensive reforms in one area of the model have significant implications for the performance of other aspects of the model. As Soskice (1999) argues, business, labour and the state have a critical interest in preserving existing elements of economic models. Employers in sectorally co-ordinated market economies will not embrace significant neoliberal reforms when the reforms cause undue uncertainty. In fact, support among German employers for maintaining basic elements of the generous welfare state was arguably rooted in business’s interests in promoting long-term stability in labour and industrial relations (Swank 2002). Duane Swank says correctly that “Generally, the greater the national or sector coordination of the economy, the higher the cost…to policy makers from emulation of market- conforming tax policy reforms; benefits from maintenance of extant tax structures or incremental reforms to it…will also be higher in coordinated market economies” (2002, 17). With respect to tax policy, the integration of labour into the bargaining process is related to higher social welfare expenditures and a greater emphasis on the politics of redistribution (Garrett and Lange 1985). In countries where business and labour interests are highly integrated into the governmental decision process, as is the case in Sweden and Germany, tax policy is made with the consent of labour and business interests. Such a structure provides an environment conducive to respective elites bargaining with governmental officials over economic goals and social welfare policy. On the other hand, in countries where interests are organized into many groups that are narrow in focus and outside the decision making process, policy-makers must respond to a much wider spectrum of demands and interests. In this context, policy choices tend to be more piecemeal and have shorter time horizons (Steinmo and Tolbert 1998, 169).

The impact of political institutions on state policy in general and tax policy in particular should also be considered (Weaver and Rockman 1993). In particular, the so called “veto players” (Tsebelis 1995, 1999) have considerable influence on tax revenues (Castles 1998) and tax policy reform (Hallerberg and Basinger 1999; Ganghof 1999). As several studies show (Huber et al. 1993; Schmidt 1996), veto players slow down tax policy reforms. The more checks and balances in the political system, the lower the tax revenues. This may be a function of the reform capacity of the political system in general. Socio -economic factors are also important for tax policy. There is an especially strong correlation between tax policy and two socio- economic factors (Wagschal 2001, 143; Swank 1998): The first is the percentage of retired taxpayers in a society: the higher it is, the higher the tax revenues. The second is the rate of economic growth: the higher it is, the lower the tax rates. Neoconservatives turn this argument around, suggesting that lower tax rates lead to more economic growth in the long run. What is important is the policy inheritance. From this perspective, tax policy is often a policy of nondecision, because the political costs of tax reform are much higher for politicians than the political benefits.

The empirical data and theoretical models clearly show that globalization is one relatively minor factor among many that explain tax policy reforms. And even that limited influence is mediated by domestic political systems, institutions and constellations of actors. As the data has shown, the conventional globalization thesis of a race to the bottom is not borne out. Tax rates and tax revenues are still increasing, despite the ongoing trend toward international trade integration. Countervailing pressures like the high cost of welfare programs, different parties in government, strong labour unions, and institutional veto players counteract the pressure of globalization on tax policy.

As for the future of taxation in Canada, it is more likely to be one of gradual evolution than radical change. Although the data don’t show any downward pressure on tax rates and tax revenues comparatively speaking, there are at least four key factors in Canada that are likely to put pressure on future tax rates, although regional political dynamics and the workings of fiscal federalism suggest that tax reductions will be a higher priority in some provinces than others (Hale 2002). First, neoliberalism will continue to shape fiscal and tax policy, including the role of the tax system in delivering social policies and programs in most parts of Canada. Second, governments that seek to define their own economic and social priorities rather than simply react to events beyond their borders will have to exercise centralized control over budgetary policies and spending levels if they hope to foster the economic growth needed to finance social services in the context of Canada’s changing demographics. Third, the ability of governments to combine the promotion of economic growth and higher living standards will be closely linked to their ability to develop a workable division of responsibilities among federal and provincial governments and with other national governments. Finally, the diffusion of new technologies will continue to transform national and regional economies while giving individuals greater opportunity to avoid government and tax regulations that run contrary to their perceived interests and values. This discussion of determinants that shape tax policy reform has shown that successful management of fiscal and tax policy requires a capacity to set priorities; adapt to changing circumstances; and build a consensus that enables competing economic, social, regional and ideological interests to identify their own well-being in the broader political and economic environment. Tax policy is shaped by many political, economic and social determinants. As Geoffrey Hale correctly concludes, “it should not be surprising if the tax system stubbornly refuses to confirm either economic theories or political ideologies, but reflects past decisions and the policy tradeoffs of the political process” (2002, 71). The notion of tax policy being driven by globalization and forces associated with globalization (both positive and negative) is simply not borne by the facts.

Andersson, K., V. Kanniainen, J.Sodersten, and P.B. Sorensen. 1998. “Financing the Nordic Welfare States in an Integrating Europe.” In Tax Policy in the Nordic Countries, edited by Peter B. Sorenson. Houndsville: Macmillan.

Andrews, D. 1994. “Capital Mobility and State Autonomy.” International Studies Quarterly 38, no. 2: 193- 218.

Boskin, Michael J. 1978. Federal Tax Reform. Myth and Realities. San Francisco: Institute for Contemporary Studies.

Carey, David, and Harry Tschilingurian. 2000. “Average Effective Tax Rates on Capital, Labour and Consumption.” OECD Economic Working Paper no. 258. Paris: OECD.

Castles, Francis G., ed. 1993. Families of Nations. Patterns of Public Policy in Western Europe . Aldershot: Dartmouth.

Castles, Francis G. 1998. Comparative Public Policy: Patterns of Post-war Transformation. Cheltenham: Edward Elgar.

Castles, Francis G. 2000. “The Dog that Didn’t Bark: Economic Development and the Post-war Welfare State.” In Welfare State Futures, edited by Stephan Leibfried. Cambridge: Cambridge University Press.

CERP. 1993. “Making Sense of Subsidarity: How Much Centralization for Europe?” Monitoring European Integration. CERP: Brussels.

Esping-Andersen, Gøsta. 1990. The Three Worlds of Welfare Capitalism. Princeton, NJ: Princeton University Press.

Frey, Bruno. 1990. “Intergovernmental Tax Competition” In Influence of Tax Differentials on National Taxation. Proceedings of the 7th Munich Symposium on International Taxation. Kluwer Law International.

Ganghof, Steffen. 1999. “Adjusting National Tax Policy to Economic Internationalization. Strategies and Outcomes.” In Welfare and Work in the Open Economy , edited by Fritz W. Scharpf and Vivian Schmidt. Oxford: Oxford University Press.

Ganghof, Steffen. 2001. “Global Markets, National Tax Systems, and Domestic Politics: Rebalancing Efficiency and Equity in Open States’ Income Taxation.” MPIfG Discussion Papers 01/9. Köln.

Garrett, Geoffrey. 1995. “Capital Mobility, Trade and the Domestic Politics of Economic Policy.” International Organisation 49, no. 4: 657-87.

Garrett, Geoffrey. 1998. Partisan Politics in the Global Economy . Cambridge: Cambridge University Press.

Garrett, Geoffrey, and Peter Lange. 1985. “The Politics of Growth.” Journal of Politics 47, 792-827

Hale, Geoffrey. 2002. The Politics of Taxation in Canada. Peterborough: Broadview Press.

Hall, Peter, and Daniel Gingerich. 2001. “Varieties of Capitalism and Institutional Complementarities in the Macroeconomy.” Paper presented to the American Political Science Association, August 30- September 1, San Francisco.

Hallerberg, Mark, and Scott Basinger. 1999. “Globalization and Tax Reform. An Updated Case for the Importance of Veto Players.” Politische Vierteljahresschrift 40: 618-627.

Hobson, John M. 2003. “Disappearing Taxes of the ‘Race to the Middle’? Fiscal Policy in the OECD.” In States in the Global Economy: Bringing Domestic Institutions Back In, edited by Linda Weiss. Cambridge: Cambridge University Press.

Huber, Evelyn, Charles Ragin, and John D, Stephens. 1993. “Social Democracy, Christian Democracy, Constitutional Structure, and the Welfare State.” American Journal of Sociology 99, no. 3: 711-749.

Huber, Evelyn, and John D. Stephens. 2001. “Welfare State and Production Regimes in an Era of Retrenchment.” In The New Politics of the Welfare State, edited by Paul Pierson. Oxford: Oxford University Press.

Kersbergen, Kees van. 1995. Social Capitalism. A Study of Christian Democracy and the Welfare State. New York: Routledge.

Klingemannn, Hans Dieter, Richard Hofferbert, and Ian Budge. 1994. Parties, Policies and Democracy. Boulder: Westview Press.

Lee, D.R., and R.B. McKenzie. 1989. “The International Political Economy of Declining Tax Rates.” National Tax Journal 42, no. 2: 79-83.

Lipset, Seymour M., and Stein Rokkan. 1967. “Cleavage Structures, Party Systems, and Voter Alignments.” In Party Systems and Voter Alignments: Cross-national Perspectives , edited by Seymour M. Lipset and Stein Rokkan. New York: The Free Press.

Mendoza, Enrique, Assaf Razin, and Linda L. Tesar. 1994. “Effective Tax Rates in Macroeconomics: Cross Country Estimates of Tax Rates on Factor Incomes and Consumption.” National Bureau of Economic Research Working Paper no. 4864. Cambridge.

Moses, J. 1994. “Abdication from National Policy Autonomy: What’s Left to Leave? – Comment/Reply.” Politics and Society 22, no. 2: 125-164.

Sandford, Cedric. 1993. Successful Tax Reform. Lessons from an Analysis of Tax Reform in Six Countries. Bath: Fiscal Publications.

Scharpf, Fritz W. 1997. “Introduction: the Problem-Solving Capacity of Multi-level-Government.” Journal of European Public Policy 4, no. 4: 520-538.

Schick, Allen. 1993. “Governments versus Budget Deficits.” In Do Institutions Matter? Government Capabilities in the United States and Abroad, edited by Kent Weaver and Bert A. Rockman. Washington D.C.: Brookings Institution Press.

Schultze, Günther, and Heinrich Ursprung. 1999. “Globalisierung contra Nationalstaat?“ In Nationaler Staat und internationale Wirtschaft, edited by Andreas Bausch and Thomas Plümper. Baden-Baden: Nomos.

Schmidt, Manfred G. 1996. “When Parties Matter: A Rieview of the Possibilities and Limits of Partisan Influence on Public Policy.” European Journal of Political Research 30: 155-183.

Sinn, Hans Werner. 1990. “Tax Harmonization and Tax Competition.“ European Economic Review 34: 489- 504.

Sinn, Hans-Werner. 1992, „The Case of European Tax Harmonization.” Tax Harmonization and Fiscal Liberalization in Europe, edited by G. Winkler. New York: St. Martin’s.

Soskice, David. 1999. “Divergent Production Regimes : Coordinated and Uncoordinated Market Economies in the 1980s and 1990s.” In Continuity and Change in Contemporary Capitalism, edited by Herbert Kitschelt et al. Cambridge: Cambridge University Press.

Steinmo, Sven. 1993. Taxation and Democracy. New Haven: Yale University Press.

—-. 1995. “Why is Government So Small in America? In Governance 8, no. 3: 303-334.

—-. 1996. ”The New Political Economy of Taxation.” Centre for Western European Studies Working Papers 19. Berkeley.

Steinmo, Sven, and Caroline Tolberg. 1998. “Do Institutions Really Matter? Taxation in Industrialized Democracies.” Comparative Political Studies 31, no. 2: 165-187.

Stewart, Kenneth G., and Michael C. Webb. 2003. “Capital Taxation, Globalization, and International Tax Competetion.” Department of Economics Working Paper EWP0301. University of Victoria

Strange, Susan. 1996. The Retreat of the State. The Diffusion of Power in World Economy . Cambridge: Cambridge University Press.

Swank, Duane. 1998. “Funding the Welfare State: Globalization and the Taxation of Business in Advanced Market Economies.” Political Studies 46, no. 4: 671-692.

—-. 2002.”The Tranformation of Tax Policy in an Era of Internationalization: An Assesment of a Conditional Diffusion Model.” Paper prepared for the Annual Meeting of the American Political Association, Boston, August 29 -September 1.

Tanzi, Vito, and A., Land Bovenberg. 1990. “Is There a Need for Harmonizing Capital Income Taxes within EC Countries?” In Reforming capital income taxation, edited by Horst Siebert. Tübingen: Mohr.

Tanzi, Vito, and Ludger Schuknecht. 2000. Public Spending in the Twentieth Century. Cambridge: Cambridge University Press.

Tsebelis, George. 1995. “Decision making in Political Systems : Veto-Players in Presidentialism, Parliamentarism, Multicameralism and Multipartyism.” British Journal of Political Science 25: 289- 325.

—-. 1999. “Veto Players and Law Production in Parliamentary Democracies: An empirical analysis.” American Political Science Review 93: 591-608.

Wagschal, Uwe. 2001. “Deutschlands Steuerstaat und die vier Welten der Besteuerung“ In Wohlfahrtsstaatliche Politik. Institutionen, politischer Prozess und Leistungsprofil , edited by Manfred G. Schmidt. Opladen: Leske and Budrich.

Weaver, Kent, and Bert Rockman, ed. 1993. Do Institutions Really Matter? Government Capabilities in the United States and Abroad . Washington D.C. : Brookings Institutions Press.

Webber, Carolyn, and Aaron Wildavsky. 1986. A History of Taxation and Expenditure in the Western World. New York: Simon and Schuster.

Wildavsky, Aaron, and Naomi Caiden. 1997. The New Politics of the Budgetary Process. New York: Addison, Wesley, Longman.