Someshwar Rao and Stephen Tapp | 4 mai 2015

It’s not every day that the Prime Minister of India stops by. The last official visit to Canada was over 40 years ago. And so it is hoped that the arrival of Narendra Modi in Canada will send a strong signal that the leaders of both countries are committed to deepening their relationship.

In fact, this relationship has provided decidedly mixed signals in recent years. There have been plenty of promising developments: an initial investment deal; a nuclear cooperation agreement; negotiations on a trade deal the Comprehensive Economic Partnership Agreement (CEPA); opening new trade offices in India; and creating a high-level CEO forum, among others. Both governments have set ambitious goals with clear timelines to grow this relationship. Canada’s government has even identified priority sectors, which include energy, agriculture, infrastructure and education.

But despite all the promise and potential, tangible results have been hard to come by. Alas, that previously concluded but never ratified investment deal was subsequently reopened, and despite much effort, the ambitious government targets will not be met. CEPA talks didn’t wrap up in 2013; instead they’ve slowly plodded along, with nine rounds held over five years and it’s unlikely that two-way trade will come close to reaching the $15-billion target set for 2015 (notwithstanding possible underreporting in official bilateral trade data).

Perhaps these disappointments will be forgotten. The election last year of a new majority government in India of the Bharatiya Janata Party, led by Prime Minister Modi -offers an important chance to refresh this relationship. India is now undertaking several economic reforms (including those to improve the business climate and attract foreign investment) and is taking a more active role in its foreign policy.

Negotiating the CEPA was long complicated by what appeared to be different levels of ambition by the two sides, with Canada seeming to want a more open and inclusive deal. India may finally be more serious about getting to a deal, but that too brings complications, as it’s shown a new willingness to assert its preferences even when they run counter to a global consensus or require forging a new path outside of traditional multilateral institutions.

Last year India’s new government prevented the implementation of a previously agreed upon multilateral trade facilitation agreement (TFA) at the World Trade Organization (WTO), due to concerns about restrictions on India’s food subsidies to its poor. (The TFA was ultimately salvaged, but only after considerable negotiating efforts and much existential angst at the WTO.)

India is also busy developing new institutions that will give it a far greater voice than in traditional venues. It -recently became the second-largest shareholder in the Chinese-led Asian Infrastructure Investment Bank and, along with the rest of the BRICS countries (Brazil, Russia, China and South Africa), is creating the New Development Bank an organization that will also lend money for infrastructure projects as well as in international crises. Both of these organizations are widely seen as attempts by India and the world’s leading emerging markets to create alternatives to the traditional Western-led Bretton Woods institutions, the International Monetary Fund and the World Bank.

The Indian prime minister’s visit and these considerations raise an important strategic question for Canada: with several other trade negotiations ongoing for both sides, should Canada focus its resources on concluding a trade deal with India? Recall that Canada is already involved in the higher–profile 12-country Trans-Pacific Partnership (TPP) and bilateral talks with Japan, among others; and India is in talks with several other Asian countries as part of the Regional Comprehensive Economic Partnership as well as with the European Union, among others.

We think that India merits being a priority international market for Canada over the long term and that concluding the CEPA trade deal with India could be a much-needed spark for a stronger economic relationship. At the same time, we identify several significant obstacles in important areas such as foreign investment and temporary labour mobility that must be overcome in order to conclude a truly comprehensive trade deal. The crux of the challenge for the negotiators and politicians involved in these decisions is that the very same areas that offer the largest potential long-term gains (namely investment and services) also bring with them difficult political considerations that will make a good deal hard for both sides to finalize.

There is a compelling case for Canada to remain at the negotiating table with India, even if this deal cannot be concluded as quickly or as comprehensively as some might like.

India should be an important component of a longer-term strategy to diversify Canada’s economic links with the rest of the world. That enduring desire to diversify goes back decades some may recall discussions in the 1970s when Canada sought a third option for its trade and investment beyond traditional American and British markets.

Today, Canadian trade pundits are often heard pushing for more Canadian involvement in faster-growing emerging markets. They lament the fact that we are missing out because we are so heavily tied to the US. Some diversification has occurred over the past decade through exports, but also by leveraging outward foreign investment as well as sales by Canadian foreign affiliates but these developments are not always as self–evident or as quick as many would like.

Improving Canadian engagement with India is a long-term project that requires a long-term perspective and sustained effort. Indeed, the economic growth outlook for India over the coming decades is among the most favourable in the world and according to OECD projections, even better than that of other high flyers like China and Brazil. Moreover, while growth has recently slowed throughout much of the world (advanced and emerging markets alike), in India growth is accelerating.

Several factors underpin the optimism for India’s long-run growth trajectory: a large potential domestic market; a demographic dividend as its young population enters the labour force; a world-class information and communications technology (ICT) services sector that includes a large pool of skilled engineers; significant room for continued urbanization and industrialization (agriculture accounts for almost half of Indian employment versus only 2 percent in Canada); and the potential to narrow the large gaps in productivity, income, technology and business practices relative to the global frontier.

Even if we shouldn’t place too much faith in long-term economic forecasts, the current starting point demonstrates the remarkable rise of India over the past two decades. In 2014, its economy was the 10th largest in the world measured at market exchange rates, and an impressive 3rd largest based on purchasing power parity exchange rates, behind the US and China (PPP adjusts for price differences across countries in buying similar goods and services). By way of comparison, India’s economy is already larger than Canada’s, which is in 11th and 15th place, respectively, in these global rankings.

Much of this reflects the simple fact that India is a huge country, the second most populous in the world, with Indians outnumbering Canadians by a factor of 36 to 1. Due to the large diaspora of Indian immigrants in Canada, there is scope to leverage the strong social ties and connections with the 1.2 million Canadians who have East Indian origins (representing 3.5 percent of our population). India is the second-largest source country for foreign students studying in Canada. And the widespread use of English as a common language in the two countries facilitates communication and business dealings, as does having similar legal systems based on British common law. More generally, political institutions in India are democratic, unlike those of some other fast-growth emerging markets.

Also supportive of an Indian focus for Canada are estimates that suggest significant untapped potential to expand Canada-India trade flows. Analysis from Canada’s Department of Foreign Affairs, Trade and Development finds that among high-growth trading partners with whom Canada does not have a trade deal, India is the largest under-performer relative to its model predictions. Importantly, this same model -suggests that Canada is already overtrading with China, based on observable factors that influence trade patterns.

But India’s long-term economic outlook is not entirely sanguine. Many of its potential strengths could become serious weaknesses if they aren’t properly managed. For instance, the demographic dividend that could be a huge boon also means that the Indian labour market needs to create millions of jobs in the formal sector in order to avoid increased unemployment and forgone potential output. This in turn, requires a stronger education system, which is currently failing to provide many students with an adequate education in some regions of the country. Similarly, while -urbanization could greatly improve India’s productivity, it will require accompanying infrastructure on a massive scale and much better social programs.

Impressive GDP numbers can also mask the fact that per capita income in India is very low roughly only one-tenth of Canadian levels and extreme poverty remains a huge challenge. The World Bank estimates that in 2012, roughly one-quarter of the Indian population was living on only US$1.25 (using PPP at 2005 international prices) and more than half lived on only $2 a day.

India scores badly on cross-country business climate indicators, such as the World Bank’s ease of doing business measures. Improving the business environment in India requires combating corruption, enhancing the country’s infrastructure and sharpening the performance of the government bureaucracy.

Another issue is that in India less than one-third of all working-age women participate in the labour force (whereas more than three-quarters do in Canada). Broader economic participation and opportunities for women were ranked a dismal 124th out of 136 countries by the World Economic Forum in a 2013 survey. This is a factor that has thus far restrained Indian growth, but it might well be a major source of India’s future growth if significant progress can be made to put women on equal footing with men in Indian society and its economy.

In the future, much as in the past, opening up to international trade and investment will likely be an important contributor to India’s growth. Before 1991, India was largely a closed economy with inward-looking policies, often referred to as the licence raj. International trade was subject to steep import tariffs, licences, quotas and export taxes. Foreign direct investment (FDI) was highly restricted.

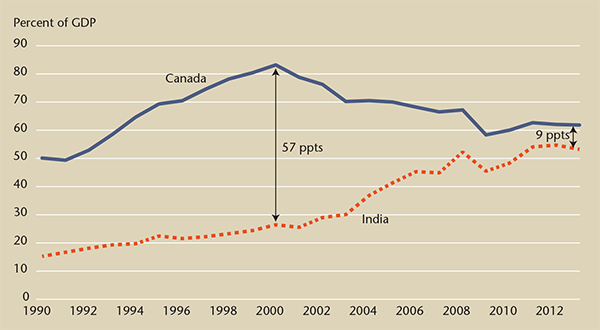

In recent decades, India has reduced its barriers to trade and FDI and become more open to the world. Since the year 2000, India’s overall trade as a share of its economy has increased significantly and closed much of the gap relative to Canada, which was a much more open and trade-intensive economy (figure 1).

Figure 1. Trade as a share of gdp, india and canada, 1990-2013. Source: World Bank Development Indicators. Note: ppts = percentage points.

India’s trade gains were driven largely by services ICT services exports and other commercial services. In 2013, India became the world’s 6th-largest exporter of commercial services, well ahead of Canada in 17th spot.

Much like India’s trade with the rest of the world, India’s trade with Canada has also grown quickly in recent decades but from a very low starting point. From 1990 to 2014, total two-way Canada-India merchandise trade grew at an average annual rate of 10.7 percent in nominal terms, and it now stands at over $6 billion per year (table 1).

Canada’s exports to India are currently disproportionately from Saskatchewan (related to vegetable products, such as pulses, lentils and peas, along with chemicals and fertilizers such as potash) and the Northwest Territories (precious stones). In the other direction, India’s top exports to Canada include chemicals, precious stones, iron and steel, and apparel and accessories.

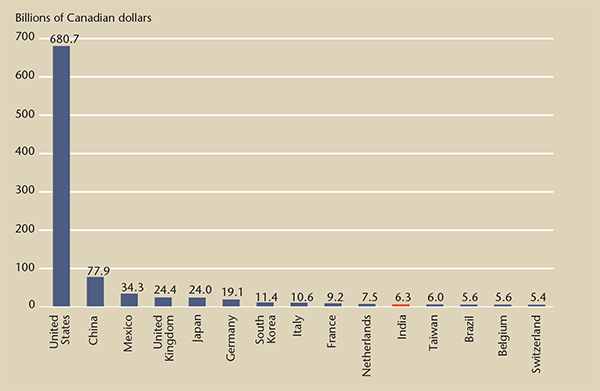

While the growth story is impressive, is it important to keep things in context by looking at levels relative to the rest of Canada’s merchandise trade (figure 2). None of the Canada-India linkages reported in table 1 represents more than 0.7 percent of Canada’s total. The outward investment from Canada to India has been remarkably weak in the officially reported statistics, ranking as only our 35th-largest investment destination in the world. Bilateral services trade is also currently quite low. Where such obvious weakness exists, the CEPA talks are but one way to improve the situation.

Figure 2. Canada’s bilateral merchandise trade with its top 15 trading partners, 2014. Source: Department of Foreign Affairs, Trade and Development.

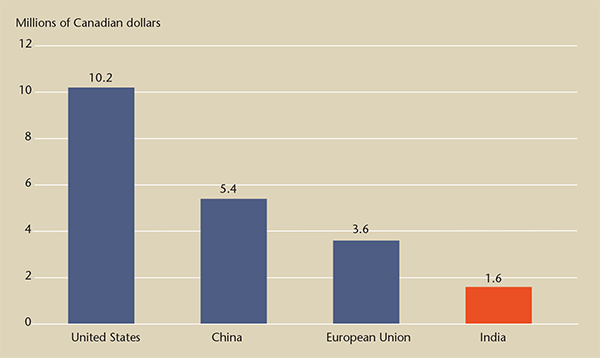

Perhaps one reason for our weak trade numbers to India is that the composition of Canada’s trade with India is different than that with the rest of the world. In 2013, over 1,500 Canadian enterprises exported to India. An impressive number, but these exports are far more likely to come from small and medium-sized enterprises (firms with fewer than 500 employees) in Canada, a fact that helps explain the much smaller average value shipped per exporter to India (figure 3). For Canada’s exports to the US, Europe and even China, big firms account for a much larger share of total trade.

Figure 3. average canadian exports to various destinations, 2013. Source: Authors’ calculations based on Statistics Canada, Trade by Enterprise Characteristics: Exporters in Canada, 2013 provisional estimates. Note: Value exported per Canadian exporting enterprise.

Consider a scenario where the Modi-Harper visit reinvigorates the CEPA talks: assuming that a deal can ultimately be reached, what might be the impacts? Both countries’ governments have estimated these impacts using a trade model. The estimated GDP gains for each country are relatively large and roughly equivalent (for Canada, an increase of about 0.4 to 1.0 percent of GDP, and our back-of-the-envelope estimates suggest that this is reasonable).

We expect that the biggest gains for Canada are likely to be had in services and foreign investment. From a sectoral perspective, Canadian service industries such as insurance, banking, telecoms and other commercial services (engineering, health, education and perhaps even tourism) stand to benefit considerably from a CEPA. In goods trade, Canada’s natural resources and resource-based industries (agriculture and related products, energy, fertilizers and precious stones) as well as durable goods manufacturers (autos and aircraft and associated parts) could be the biggest potential winners.

For a regional perspective, if existing trade patterns persisted, then Saskatchewan and the Northwest Territories would enjoy the largest relative benefits. At the same time, by removing barriers to the Canadian market, the CEPA would increase competition from Indian firms. Adjustment challenges would be expected, particularly in business services (computer, software ICT, outsourcing, call centres) and in lower–wage, labour-intensive manufacturing industries (e.g., textiles and apparel as well as steel). The overall net impacts would not necessarily be negative even for these sectors, as innovative firms in these areas stand to gain as well as do those Canadian businesses that would use Indian products and services as a production input, and Canadian consumers, who could potentially enjoy lower prices and increased product variety. Of course, it is extremely difficult to forecast precisely where the largest gains may be from any trade deal, as new products and services not yet traded often account for the lion’s share of gains.

What are the broader strategic considerations of the CEPA for Canadian foreign policy?

If a trade deal with India is concluded, expect something far less ambitious and much more limited in breadth and depth than Canada’s deal with the European Union.

For Canada, the CEPA would represent only its second trade deal in the Asia-Pacific region after the recent South Korean deal and importantly, its first with a BRICS emerging market country. Taken together with the North American Free Trade Agreement, the Canada-EU deal (Atlantic links), and a potential Trans-Pacific Partnership (Pacific links), the CEPA would mean that the vast majority of Canada’s trade would have specific trade preferences.

In that scenario, the major missing piece of the puzzle would be improved Canadian engagement with China, where there is some renewed momentum with a recent investment deal. A joint Canada-China complementarities study was released in 2012, but formal trade talks have not been launched. Recently, however, the two countries have agreed to establish a panel of experts to examine next steps in the Canada-China trade policy relationship.

The CEPA could also give Canada a chance to secure first-mover advantage in the Indian market over the US and European Union. For these reasons, even acknowledging the difficulties and likely long time horizon to finalize CEPA negotiations, these talks should be an important priority for Canada’s overall longer-term trade strategy.

Of course, one of the difficulties in getting a Canada-India deal relates to politics and attaining broader public support. While Canadians typically support trade deals, polls find less public support for trade deals with Asian countries, where there are likely bigger concerns about competing with lower-wage countries. For instance, a 2014 poll by the Asia Pacific Foundation of Canada found that only 38 percent of Canadian respondents supported a Canadian trade deal with India versus 46 percent who opposed it. By contrast, support for a Canadian trade deal with the European Union was much stronger, at 67 percent.

Canadian policy-makers and the public need to adopt a long-term horizon to grow this trade relationship, and expectations should be set realistically. If we do get a trade deal with India, it will probably not be as comprehensive as some would like in the near term. But perhaps a limited deal would be better than no deal at all, as it can always be expanded incrementally over time if both sides are happy with the results. It has been and will continue to be a long process to engage governments and do business in India, but the potential rewards can be large, and Canada should do what it can to avoid missing out on a rising India.

Someshwar Rao is the president of S. Rao Consulting Inc. and an IRPP research fellow. Stephen Tapp is a research director at the IRPP. This article draws on their forthcoming IRPP Study The Potential to Grow Canada-India Economic Linkages: Oversold or Overlooked?