*This study is also available in French.

The emergence of digital information and the Internet represents a major innovation which has revolutionized the telecommunications industry, as well as business practices and the lives of citizens in general. In addition, the introduction of competition into the industry has magnified the impact of innovations and made the industry more complex. A true Schumpeterian wave of innovation has taken place – a phenomenon that occurs only a few times in a century.

The Internet revolution gave rise to a broad movement of unlimited optimism. Financial agents encouraged unsustainable economic forecasts, thus contributing to the development of a speculative bubble that led to overinvestment in the telecom sector, among other repercussions. These excesses have raised a number of issues. Could this outcome have been avoided, at least in part, through better management of macroeconomic policy? The regulation of the financial sector, corporate governance rules and bankruptcy laws have also been singled out as possible factors. The debate on these issues is ongoing. This paper attempts mainly to establish whether, if telecommunications regulation were better adapted to the new circumstances of the industry with regard to both the technology and the competitive environment, this could have limited the scope of the excesses that took place.

The period of accelerated expansion of the telecommunications industry was marked by the entry of new firms that built transmission networks based on Internet technology. This technological advance, combined with the excess capacity that resulted from overinvestment, contributed to significant price reductions in long-distance and Internet services. The period was also marked by numerous financial transactions. The exmonopolists formed alliances in order to better face competition, purchase new companies to access the new technology more quickly and offer their customers one-stop access to all communications services. New entrants also made acquisitions – of exmonopolists, in particular – to increase traffic on their networks. Some companies adopted the convergence strategy by trying to combine content, transmission and online transactions.

These transactions encouraged the companies to go into debt, but they did not result in the anticipated synergy, while price reductions affected revenues. Thus the difficulties of the telecom sector are not due solely to the extravagant optimism of the players but also to poor choices of business models. The end of the boom in the industry forced several companies to go bankrupt. Others struggled to survive, in particular by selling assets to dismantle conglomerates based on the convergence or one-stop approach. The bursting of the bubble resulted in a considerable loss of financial wealth, large layoffs and the abandonment of a number of investment projects.

At the same time, the innovation wave had very positive effects on the organization of society, the productivity of businesses and employee compensation as the Internet quickly became a means of communications and a locus for trading goods and services in the economy. Telecom users benefited from substantial reductions in prices and from a proliferation of new services.

Could the waste of resources in the telecom industry have been prevented? Given network economics, I believe the regulatory agencies, by issuing operating permits, could have promoted the principle of network capacity sharing – a well-known principle in that industry – in order to avoid the enormous duplication that took place. Actors in financial markets would have objected to this type of intervention, arguing that market forces are a preferable medium for ensuring resource allocation.

To better prepare for the future, telecommunications companies are refocusing on their traditional mission and are becoming highly efficient carriers in a highly competitive market. Others seek to occupy a specialized niche in the business services market. Finally, another avenue is that of the broker offering its customers a solutions package in partnership with other firms.

In Canada, greater competition and network economics did not generate optimal results – that is, a situation where the interests of customers and telco shareholders converge. It remains to be seen whether a relatively small long-distance market such as Canada’s can sustain several cost-effective competitors over the medium term. In the local market, the introduction of competition proved to be a complicated process and did not have the anticipated results. In my opinion, true competition in this market will be in the technological realm. Wireless communications and cable distribution can, thanks to new technical advances, truly compete with the landlines of the exmonopolists.

Finally, by contributing to the demise of the notion of long-distance services, new business models based on IP communications will challenge the exmonopolists as well as the regulators in their efforts to set rules governing new technological discoveries.

The past decade has witnessed a major socioeconomic phenomenon. The digitalization of information, the bandwidth revolution associated with the use of fibre optics to transmit that information and the emergence of the Internet are major innovations that have transformed the telecommunications industry as well as business practices and the lives of citizens in general. In addition, the introduction of competition in the telecommunications sector in America and Europe has magnified the impact of innovations on the industry and made it more complex.1 There has been a true Schumpeterian wave of innovations, such as are seen only a few times in a century.

Schumpeter argued that long waves of innovations both create and destroy wealth.2 The net long-term impact is positive because innovation remains the foundation of broad social changes and of the productivity gains that improve living standards in the economy. These gains, however, are achieved in the aftermath of major upheavals, both economic and social, that can go on for decades. New firms, as well as already-existing ones, benefit from the wave of innovations and adopt the new technologies, while others disappear because they are unable to adjust to new market conditions and become obsolete. Market adjustments also contribute to the disappearance of certain occupations, and some workers may find themselves unemployed as a result. It may be noted that, following a major innovation such as the advent of electricity, it often takes decades for firms to adjust to the opportunities offered by the new technology and for citizens, in turn, to benefit from it.

At the same time, according to F. Hayek, the Austrian economist and Nobel prize winner, in a period of strong economic growth it is difficult for central banks to determine the cost of capital (the “natural” interest rate) that will permit an efficient resource allocation in the economy. If the cost is too low, there is a risk that investment demand will become excessive. Unrealistic expectations about the future profits associated with the new technologies generated by the wave of innovations can, if they occur when interest rates are too low, and even if there is no inflation, give rise to financial flows that will push stock market values to unsustainable levels.3 High share values then encourage firms to increase indebtedness and thus contribute to greater speculative activity in financial markets.

To some extent, this is what happened with the advent of electricity in the 1890s. The companies that adopted the new technology saw the value of their shares increase substantially. When it became clear that profits would only show up over the longer term, there was an abrupt adjustment in the stock market.4 This scenario more or less repeated itself between 1995 and 2001 in the telecommunications (“telecom”) industry, despite all the knowledge accumulated in the past century about the operation of markets, control measures and the regulations aimed at ensuring the proper functioning of financial markets, and despite the broad dissemination of information compared with the situation a hundred years earlier. Innovation and the ready availability of credit can lead to excesses that are costly for the economy.

The bandwidth and Internet revolution gave rise to a wave of unbounded optimism encouraged by a variety of gurus, management consultants and financial analysts. It was believed that demand for bandwidth would increase almost indefinitely, reflecting new business practices and a rapid transformation of society. Financial actors encouraged and supported these unsustainable predictions, thus contributing to a speculative bubble that resulted in, among other things, overinvestment in telecommunications and eventually led to a major crisis in this industry.

The telecom industry is currently undergoing a painful process of restructuring and consolidation. In the United States, no fewer than 50 telecommunications companies (“telcos”) have had to seek protection under bankruptcy law. Corporations formed by merger are disposing of assets or have already done so. It will be some time before the overcapacity can be absorbed and the industry can start showing positive results again.

Could this outcome have been avoided, at least in part, though better management of overall macroeconomic policy, more stringent regulation of the financial sector and a stricter governance regime for companies with shareholders that deal with financial markets? Had the regulatory regime governing the telecom sector been better adapted to the new technological and competitive environment, could it have limited the scope of these excesses?

In the case of monetary policy, the current debate is centred on whether central banks should take account of changes in the value of assets (such as stock market shares) in their decision-making process. In the United States, the Federal Reserve has defended its interest rate policy,5 which had been criticized on the grounds that stock market speculation and the impact of the drastic correction that followed could have been avoided in part through a pre-emptive rise in the cost of capital.6 That issue was also considered in Canada at a time when stock market shares were rising rapidly.7 Hayek’s theory suggests that overinvestment occurred because the cost of capital was too low. Throughout the expansion period, however, productivity gains ensured that there was no inflationary push, so that the Federal Reserve, in particular, felt it was justified in leaving rates unchanged. The debate in ongoing, and no consensus has emerged.

Just as important are issues of financial market regulation and corporate governance. The speculative bubble received some stimulus from the actions of financial analysts, brokers, bankers and a few corporate executives who played fast and easy with the principles of ethics or engaged in outright fraud. Some aspects of these issues will be discussed below in the context of the telecommunications industry. But there is also a more fundamental debate on whether the adoption of stricter rules or a more stringent enforcement of existing regulations might have prevented stock market speculation or might at least have limited its scope. This is an ongoing issue,8 which has given rise to a reinforcement of the financial market regulatory system. While this paper will not discuss the question of governance regulations properly speaking or of governance itself, it will nonetheless refer to the lack of ethics displayed by some players in the telecommunications industry and its consequences for the industry.

Bankruptcy laws add another dimension to the management of the legal framework within which corporations operate. These laws have a significant impact on the present and future behaviour of the telecom industry in North America. It will be seen later on that in an industry where there is significant overcapacity, the use of legal provisions allowing a corporation to restructure and reduce its debt can represent a threat to competitors who honour their commitments to their creditors and their shareholders.

Finally, we must also ask whether some regulatory provisions applying to the telecom industry might have made it possible to reduce the scope of the speculative bubble. If guidelines had been put into place by regulators when telecommunications services were opened to competition and regulatory barriers in data transmission industries removed, would this have helped to lessen the chaotic growth of the industry? In particular, could the sharing of networks, combined with the preservation of competition in Canada and the United States, have led to better resource allocation, as has been suggested previously?9 One may also ask whether the approach adopted by the Canadian Radio-television and Telecommunications Commission (CRTC) in opening the door to competition helped the Canadian telecom sector to avoid a debacle similar to that observed south of the border.

With the digital revolution and the emergence of the Internet, gurus such as G. Gilder, N. Negroponte and, in Canada, D. Tapscott announced the beginning of the bandwidth revolution.10 They argued that the electronic exchange of information would transform the lives of citizens and how they communicate and deal with companies and governments, as well as how goods and services are traded in the economy. The few Internet companies that had appeared on the market (the “dot-coms”) would lead the way of the future with respect to new ways of doing business. All the companies active in the data transmission sector, from equipment suppliers to software and telecom service providers, now constituted the “new economy.” Some gurus and financial analysts promoted the “new management paradigms” of the “new economy,” aimed at guiding the decisions of corporate managers and investors in this new environment.

The new models were based on future unlimited demand for bandwidth. All of the economic transformations associated with the Internet would generate a continuously growing demand for the transmission of information on a worldwide scale. Gilder was a notable advocate of this prediction in a “Newsletter” aimed at corporate executives and investors, as well as in his book Telecosm,11 seen as the bible of the new age of communications. Some believed that this prediction was already becoming a reality, making it easier to understand why the so-called new paradigms were so readily adopted:

Other management concepts also emerged, including that of “Internet time.” The use of e-commerce was expected to result in a radical and very quick transformation of business practices, enabling companies to achieve in three months what took a year before they began using the Internet. According to telecom corporate managers, the design of products and their acceptance by customers would take but a fraction of the time traditionally needed to carry out these marketing activities.

In addition, the dot-coms, with Amazon and Yahoo! at the forefront, were expected to replace the companies of the “old economy,” enabling consumers to make transactions much more cheaply and quickly, and eventually resulting in faster growth in productivity and living standards. An enormous increase was anticipated in both business-to-consumer (B2C) and business-to-business (B2B) e-commerce. Consumer survey firms and consultants began to revise their estimates of the importance of e-commerce on a monthly basis, and there were predictions that it would reach trillions of dollars by 2004.12

To these prophecies must be added the falsification of data on Internet traffic and on the financial performance of some corporations. From November 1993 (when the Mosaic browser was launched) until it turned over the network to the private sector in April 1995, the National Science Foundation found that instead of doubling every year, traffic was doubling every three months. After management of the Internet was transferred to the private sector, some analysts extrapolated forecasts from those findings, even though it was clear that this rate of increase could not be sustained. Whereas the industry had assumed that Internet traffic would continue to double every three months, in fact it has doubled every year since 1997. That mythical rate of growth nevertheless served as the basis for predictions regarding all types of telecommunications traffic.13

The exaggerated figures on Internet traffic contributed to maintaining the speculative bubble in the telecom industry. In addition, a few financial analysts embellished the performance figures of some corporations in order to stimulate stock market transactions, while others recommended buying shares of companies they knew were facing financial difficulties.14 Eventually, WorldCom-MCI, which owned UUNet, America’s largest service provider, acknowledged that it had falsified its data on Internet traffic growth in order to maintain the value of its shares on the stock market.15 Several brokerages agreed to pay substantial fines in order to reach out-of-court settlements in proceedings that had been filed against them by the US government. All of these developments reflected the environment in which the telcos operated during the Internet boom.

Finally, an innovation wave — especially if it is encouraged by financial markets — is often accompanied by an entrepreneurial wave. The creation of new Internet companies, the entry of new players into telecommunications and the development of many new services was all evidence of the entrepreneurial vitality generated by the wave of innovations. Managers of traditional telephone companies were setting up new telecommunications firms. Engineers and computer experts were leaving well-established employers to start their own businesses. The appeal of stock options at a time when markets were reaching record levels also contributed to the entrepreneurial wave. Venture-capital firms supported the creation of high-tech companies by providing expert know-how and fresh capital.

As part of these developments, fibre optic networks were built by new entrants into the industry — and, in their determination to compete, by the exmonopolists as well — each firm trying, from one year to the next, to make its network more innovative, to extend it further and to give it greater capacity than those of its rivals. In the race for incremental innovation, equipment suppliers sold fibres with ever-increasing capacity. Nortel’s multiplex technology made it possible to transmit several wavelengths in a single fibre, thus raising network capacity to very high levels. Carriers’ capital costs were growing at spectacular rates — 34 percent at annual compound rates between 1996 and 2000 — in several different areas (optical networks, routers, wireless, etc.).16 Capital spending, another indicator of the investment surge, accounted for 15 percent of US GDP on a trend basis. In the late 1990s and early 2000s, that share grew to 33 percent, clear evidence of a Schumpeterian wave of innovation.17

Toward the end of the innovation period (around 1999), however, the telcos began to express concerns about bottlenecks and equipment shortages, despite all the networks that had been put into place. This was truly the peak of the speculative bubble. Major equipment suppliers such as Nortel and Cisco had difficulty meeting the demand and were forced to adopt a form of rationing toward their customers, who then started overstating their equipment requirements in order to ensure they could obtain the products they believed they needed to meet their own market demand.

At the same time, the new entrants, who had poured into their own networks the funds they had secured in financial markets and who had low revenues, began to experience cash-flow difficulties. Suppliers such as Nortel aggressively financed these customers’ equipment purchases. In the race to innovate, companies like Nortel and Cisco, which were at the core of the Internet revolution, also acquired several high-tech firms which in their view offered promising products in this area. These acquisitions were made at a time when all the dot-coms were substantially overvalued.

The incumbent telcos, many of which had formerly been in a monopoly position, were now facing a complex environment. First, the introduction of competition into the long-distance market forced them to deal not only with resellers but also with newcomers who invested in equipment. In the United States, for example, AT&T faced competitors such as MCI, Sprint and WorldCom; in Canada, Bell and Telus had to contend with Call-Net and Unitel (acquired by AT&T Canada), as well as a large number of resellers. Second, thanks to runaway financial markets, a new breed of actor appeared, the “bandwidth barons” — firms such as Qwest, Global Crossing, Level 3 and GTS in the United States and 360Network in Canada. Unburdened by the past, these newcomers immediately adopted the new technologies to build their networks. At the same time, the exmonopolists had to open up their networks to Internet service providers. The incumbents had to offer local Internet service — an obligation the new entrants were not subject to — and also had to open up that part of their network to potential rivals once competition was allowed in local markets.

In the face of these developments in innovation and in the competitive environment, the traditional companies used a variety of strategies. In addition to investing in their own networks to upgrade them and increase their capacity, they also adopted a piggyback strategy by buying out service providers. As well, firms such as Bell in Canada and AT&T in the United States adopted a one-stop service strategy (see below). The companies acquired new assets in order to compete in several markets at once. WorldCom, born of the merger of various telcos, also adopted the onestop approach by integrating both vertically and horizontally. When it acquired UUnet and MCI, WorldCom became the largest ISP in North America and a major player in the long-distance market. However, a move to buy Sprint in order to establish a presence in the wireless market was rejected by US competition authorities. These growth strategies based on acquisitions are discussed in greater detail below.

The wave of transformations was accompanied by another major development in the telecom market. The exmonopolists, who until then had been very active in research and development — often through subsidiaries (as in the case of Nortel in relation to Bell) or laboratories (as in the case of Bell Labs in relation to AT&T) — virtually left the field of R&D, while equipment suppliers like Nortel, Lucent and Cisco experienced vertiginous growth thanks to technological advances and the support of financial institutions.18 In Canada, getting rid of Nortel was a strategy that gave Bell an opportunity to improve its cash-flow position while creating value for shareholders. Having become network operators and service providers, the exmonopolists no longer had much control over the pace of innovation. It should be pointed out that by abandoning their foothold in R&D, the telcos helped to lower obstacles to entry into the industry, since all new entrants now had access to the most up-to-date technology offered by equipment suppliers.19 Thus the telcos can be said to have contributed to greater competition in the industry.

In addition to making acquisitions, telcos also formed alliances with others, especially abroad: AT&T partnered with British Telecom; Sprint was part of Global One, a vast partnership that included France Telecom and Deutsche Telekom and whose goal was to offer a full range of end-to-end telecommunications services to large multinationals.

New entrants associated with the “bandwidth barons” relied primarily on the deployment of large-scale fibre optics systems to obtain funds in financial markets, but they also strove to develop a client base and attract traffic to their networks. For a few years, Qwest was a model in that regard, as well as a beacon for investors. The company negotiated partnership agreements with several other firms and made a few strategic acquisitions in the United States and elsewhere, particularly in Europe. With the intensifying activity in mergers and acquisitions that took place in the late 1990s, Qwest was able to acquire USWest, a local exchange telco, in competition with Global Crossing.

The merger was based on a promising business model that combined new technologies with traditional networks and entrepreneurial culture with monopoly culture — a model which, by being anchored in customer services, was to provide a stable revenue source. Due to the overvaluation of its capitalization caused by speculation in the market, however, Qwest had to borrow to complete these acquisitions and as a consequence faced significant debt-service costs later on.

A similar approach was followed by Global Crossing when it bought Frontier, a small local service telco. Global Crossing was seen by Gilder as the model of the future for telecommunications firms, along with a Canadian counterpart, 360Network.

The large European national monopolies and Japan’s NTT tried to transform themselves into global players offering their customers one-stop shopping by making acquisitions, building new networks and taking part in the activities of foreign operators.20 In addition, the European companies assumed that the growing demand in telecommunications would spur a comparable increase in mobile communications. Thus more than 100 billion euros (the equivalent of Ireland’s annual GDP) was spent in acquiring licences for 3G mobile networks.

The first signs that the speculative bubble was about to burst appeared in 2000 with the collapse of a number of Internet companies. These firms had been expected to overtake the companies that were typical of the “old economy,” but they now faced a cash-flow crisis and several of them went bankrupt. Unrealistic predictions about e-commerce, exaggerated claims about advertising revenues and Web site “hits,” a poor choice of business models and a severe underestimation of real-life problems, such as the supply and delivery of goods to customers, were the main factors that led to the spectacular failure of many dot-coms.21 This turning point was the first clear indication that there was no common ground between growth predictions and the reality of e-commerce.

Warnings issued by Nortel in the fall of 2000 about its sales and profits signalled the beginning of a rapid drop in the value of its shares. This was followed by the collapse of financial markets (debt and equity) in 2001, which had a severe impact on the telecom industry.

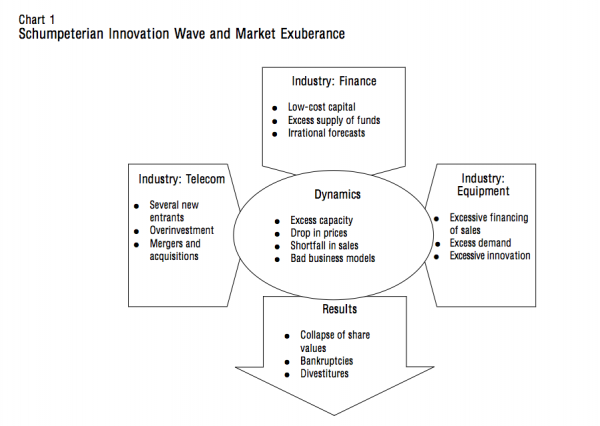

All the players in the telecommunications industry and the financial sector soon realized that a wide gap had developed between the supply and demand of bandwidth, on the one hand, and the services associated with it, on the other.22 The problem was not that individual companies were installing too much fibre, but that too many companies were trying to build nearly identical networks at the same time. In the United States, more than a dozen nationwide backend networks were built; a similar scenario developed in western Europe.23 The downside of Schumpeter-style innovation waves is described in chart 1, which summarizes the real-life and financial dynamics of the firestorm that engulfed the telecom industry.

Chart 1 shows that high levels of bandwidth overcapacity led to a number of consequences for the telecom industry and for financial markets.

Today, carriers operate in a new environment which requires them to delay the deployment of new-generation technologies, to lower their costs and to draw greater value from their existing networks. Equipment suppliers have been forced to revise their product design and marketing strategies. For example, they must now offer equipment that bridges the gap between carriers’ traditional networks and the new technologies.

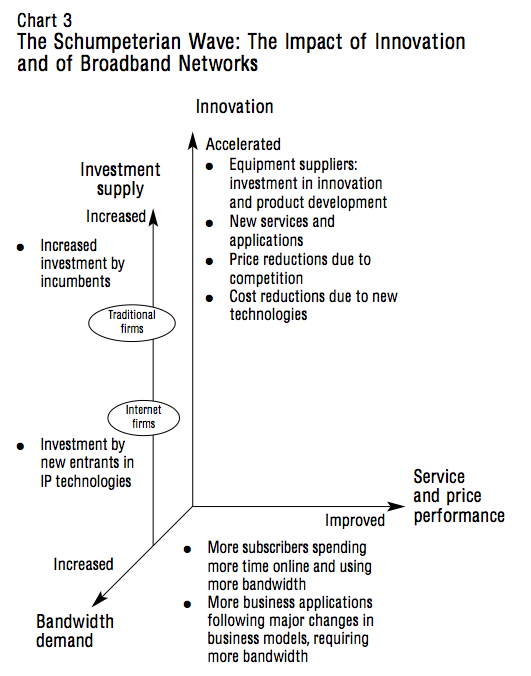

The shareholders and creditors of telcos have suffered the consequences of the debacle that hit the industry. The inefficient resource allocation that characterized the Internet boom caused significant losses in the economy, since the money invested could have been used to more profitable ends. At the same time, however, the innovation wave had positive effects for those who sought the new services offered on the market. It also helped to increase productivity gains in the economy30 and to lower the costs of products and services sold in the marketplace. Consumers benefited from lower prices, and workers who were able to obtain wage increases without creating inflationary pressures were the winners of the technological boom.31 Chart 3 shows the positive effects of a Schumpeterian innovation wave.

The users of telecom services benefited from several new services and from a significant decrease in bandwidth prices. For example, while Internet access was seen as a high-value-added product in the mid-1990s, under the impact of competition and the diffusion of Internet technology it quickly became a low-cost service within easy reach of households and businesses. An Internet subscriber can communicate with someone located in any region of the world without having to pay long-distance charges. And whereas the creation of a Web site was formerly seen as the preserve of large corporations, it is available today to small businesses and individuals.

One of the major repercussions of the Internet revolution has been the transformation of business models throughout the economy. Electronic data transmission among companies through private networks had already been a reality for some time and had begun to have an impact on the business models of large multinational corporations.32 The dot-coms helped to spread awareness of e-commerce among various economic agents. New companies created profitable business models from scratch based on electronic data transmission.

The example of the computer manufacturer Dell remains the classic reference in this regard. The company deals with its worldwide clientele from its Web site and forwards electronic orders to its network of subcontractors for the parts needed to meet customers’ needs. The product is delivered to the customer and much of the after-sale service is provided from the company’s Web site. In addition, Dell collects various types of information on its customers in order to become familiar with their needs and to design future products based on those needs. This model enables the company to achieve a high level of productivity, to minimize transaction costs and the cost of interacting with other suppliers along the value chain and to provide personalized services to its customers.

In varying degrees and in different ways, traditional firms of all sizes have adopted this business model, made accessible by Internet technology and its public network. This has been reflected in, among other things, lower prices for a variety of goods and services, faster marketing of new, more efficient products and an improved relationship between customers and sellers. These are important gains for all economic agents.

Indeed, this transformation of the economy is far from over. Thanks to competition and to the growing availability of Internet technology, in particular wireless services, the digital revolution that is taking place through telecom networks will, in the medium term, continue to change the way business is done, including in the public sector (and including, eventually, the health and education sectors) and will thus be a source of improvements in living standards. Major innovations evolve in ways that are difficult to predict and are spread over several decades before their full impact is felt. A major mistake made by the analysts of the digital revolution was to believe that ways of doing things in the economy and in society in general would change quickly and uninterruptedly.

Last, the so-called new management paradigms have disappeared from financial analyses and there has been a return to traditional profitability benchmarks used to assess investment performance. The distinction between “old” and “new” economy, which led to errors in forecasts, in investment decisions and in the choice of business models,33 has practically vanished from the vocabulary of analysts.

In addition to overinvestment in carrier capacity, the choice of business models also contributed to the transformation and difficulties of the telecommunications sector. Many of the numerous mergers that took place in the industry did not generate the expected results. Today, companies must dismantle conglomerates that were built up during the Internet boom because their strategies relied on business models based on vertical and horizontal integration and because a good number of these models eventually failed.

In a competitive regime, the one-stop strategy is aimed at enabling the company to establish a major presence or even a dominant position in the market. This strategy is inspired both by the monopolistic culture of traditional telcos, which are used to offering all services on the market, and by the bundling of services as a marketing strategy designed to maximize the number of subscribers to an information distribution network. As the exmonopolists still had an important client base, substantial financial resources and a large asset portfolio, they saw in this approach an ideal strategy to meet the growing competition.

In contrast with this approach, which is based on the firm owning all the assets that delineate its field of operation, is the broker, or syndication, approach. This strategy consists in offering customers a full range of services while not owning any infrastructure — or owning only some key assets, such as a telecommunications network — and using the services of several suppliers who own other telecom assets. A broker must have in-depth knowledge of telecommunications in order to meet the needs of customers adequately and to be able to manage an entire network of service providers. In the context of the fragmentation and specialization of the computer market, that is the model that IBM adopted recently when it created its Global Services consulting service, in which specialists determine the best solutions for customers, including products from suppliers other than IBM. The company does not have to be a leader in all market niches but instead focuses on its vast knowledge of computer technology. IBM is now listening to its customers in a market where it has lost the near-monopoly it once held.

In the past, traditional telephone companies were used to operating in a world where they controlled the infrastructure supporting the services they offered.34 When the market is undergoing an expansion in capacity and in the supply of services, this strategy requires the acquisition of numerous assets. AT&T and WorldCom in the United States, and BCE in Canada, adopted this strategy. For newcomers, an acquisition strategy was seen as a means of quickly establishing a client base so as to increase the use of the networks they were putting into place. This was the direction chosen by Qwest and AOL.

The so-called convergence approach is nothing more than the traditional vertical-integration strategy.35 At the end of expansion periods, when companies have substantial liquidity, one often sees a significant push to acquire assets aimed at creating vertical or horizontal integration. And yet, vertical integration as a business strategy has not had much success in the past.36 A recent worldwide survey by McKinsey has shown that over the period 1990-97, few mergers realized the goals they were meant to achieve.37 The results indicate that only 12 percent of merged firms succeeded in improving their bottom line. Mergers in high-tech industries have fared no better.

One of the factors behind these findings is the fact that the success of a merger is not determined by costs or hypothetical economies of scale, scope or network but rather by the growth in revenues of the merged entity. When corporate managers’ predictions regarding the new company’s performance fail to materialize, the value of its shares begins to decline. The cost reduction measures taken by management to remedy the situation tend to hinder the new firm and to prevent its growth. The problems created by merging different corporate cultures tend to complicate the situation even further, eventually leading to the disposal of assets and, at the very least, a partial dismantling of the conglomerate. As a consequence, shareholders are often the victims of unrealized promises made at the time of the acquisition.

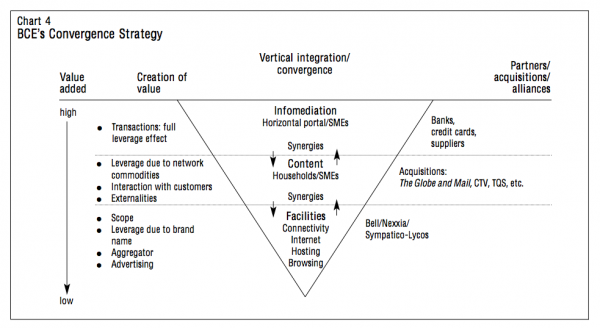

Overview: The BCE strategy was patterned after models based both on the ownership of data transmission assets by the provider of one-stop services and on the “convergence” among transmission capacity, electronic data processing and content. Appendix 1 summarizes the main elements of this strategy, which included the creation of new subsidiaries, the acquisition of companies and the formation of partnerships. “Connectivity, commerce and content” were the catchwords used to describe the strategy behind the conglomerate built by BCE’s management. The strategy relied on the synergies among the different assets making up the conglomerate, with the latter’s profitability expected to exceed the combined profits of its components. For example, through Bell Actimedia’s Sympatico portal, BCE hoped to convince customers to subscribe to The Globe and Mail and to watch various programs on the CTV network. With the conglomerate, Bell was to become a “pivotal” presence in the communications market.

The outcome of the BCE strategy is in accord with the findings of the McKinsey study on mergers referred to earlier. The synergies achieved between the components of the conglomerate were not up to expectations. As was the case generally in the industry, the portal’s pulling power and the results of cross-marketing efforts focused on products offered on the Internet were less than anticipated. In addition, the costly purchase of Teleglobe was an ill-advised acquisition. Investors were harshly critical of BCE’s strategy.

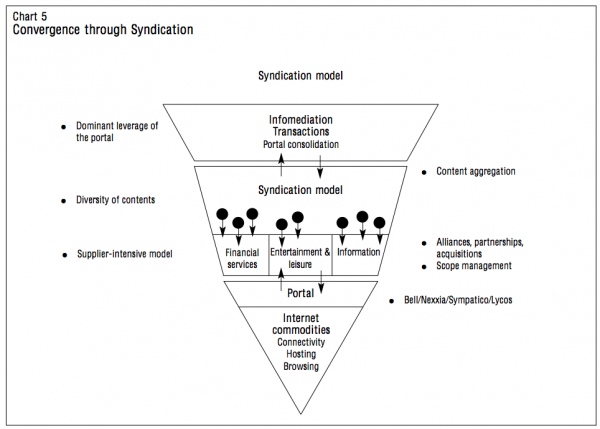

Convergence — acquisition or syndication: The BCE example serves to illustrate the convergence strategy in chart 4, which describes the situation of communications companies that have adopted the so-called transmission and content convergence strategy.

The object of convergence strategy is to enable a firm selling communications services to climb the value-added ladder in order to achieve a higher return on assets. In this model, the combination of connectivity and content is aimed at attracting an evergrowing number of customers and persuading them to make multiple e-transactions. The company thus becomes a sort of cyber-broker able to offer a broad selection of goods and services needed by customers.38

In chart 4, the lower part of the triangle illustrates BCE’s position before its major acquisitions. The company owned a network (which, among other things, was equipped with Nexxia, a high-speed data transmission facility) and offered Internet services to businesses and households through Sympatico-Lycos. The company wanted to offer higher-value-added products because competition had resulted in Internet access and other products (such as search engines and content hosting) becoming low-profitability services. That is why BCE adopted a strategy aimed at pushing it toward the top of the triangle, where higher-value-added activities are found. They included infomediation activities that were designed to enable BCE, along with its partners (such as banks, for financial services, as well as various suppliers of goods and services), to become a super-broker offering its customers a broad range of transactions. To achieve this goal, it was necessary to offer content that would attract more customers willing to pay to access that content. This larger customer base was also expected to attract more advertisers. The better known the portal and the greater its ability to capture Internet traffic, the more it would attract customers by reducing transaction and search costs and the more it would tend to become a major player in the market. This is a network effect similar to that used for Windows by Microsoft, a company that succeeded in dominating the market. This is also what was meant by the “leverage effect of a brand,” as exemplified by Bell, in this case. This concept was at the core of the convergence strategy.

The content attraction effect was not as powerful as had been anticipated, however, and the infomediation function became fragmented on the web; e-commerce success was achieved instead by specialized sites such as eBay and Amazon. While it is still possible for a general infomediation function to develop on the Web, it will take several generations of Net users before it can become profitable.

BCE found itself with assets that did not generate the value that had been anticipated when they were acquired. That is why the new management recently decided to sell those assets. The costs associated with the transactions and with the losses on the value of the assets could have been avoided, at least in part, if the company had adopted the syndication strategy illustrated in chart 5.

The syndication strategy does not rely on buying content assets, but rather on forming alliances or partnerships with various content providers without investing in the partner firms, except possibly in a few firms whose products are deemed essential to the success of the strategy. Before any agreements are signed, potential suppliers can be made to compete so as to generate the best quality/price ratios. The company can thus secure a broad range of content geared to the anticipated needs of its clientele. There is always the possibility of adding new suppliers or terminating some agreements when market needs change. The leading partner must be able to monitor market changes efficiently, as well as to negotiate with several suppliers and manage several agreements simultaneously. The complexity of these activities imposes costs that must be assumed, but the syndication strategy is far more flexible and less binding financially than the vertical-integration approach.39

It is a strategy that is well known in the information sector. An information transmission company — a newspaper, for example — must seek that information from many sources. It may own some suppliers who are deemed essential, but in general it will tend instead to conclude agreements with several subcontractors. Among Internet companies, the online broker E*TRADE, for example, has adopted the syndication approach by using the services of several providers of financial data and analysis. eBay, a profitable Internet company, uses the services of several upstream access providers as well as those of several downstream companies responsible for delivering and insuring the goods traded on its Web site and for offering secure payment facilities and debt-collection services when required. eBay recently acquired PayPal, a company it deemed essential to the conduct of its business. In other areas, it operates through agreements with several subcontractors and partners. Had BCE followed a similar strategy, it would probably have better protected shareholder value.40 BCE’s difficulties stem, not only from excess capacity in the industry and from the drop in the price of services such as long distance, but also from its choice of growth strategy.

This analysis also applies to AOL/Time Warner and Vivendi, which were the main proponents of the convergence strategy. In AOL’s case, not only did the hoped-for synergies not materialize, but there was also a problem stemming from the well-documented conflict between different corporate cultures — a problem

that is not unexpected in mergers, even the perception of which can sometimes have a substantial impact. The tensions between the two originating organizations also contributed to the failure of the transaction.41 In Quebec, the purchase of Vidéotron by Quebecor was a form of reverse integration, in which the content provider acquired the carrier. Quebecor and the Caisse de dépôt et placement might well have been able to largely avoid writing off assets if they had given priority to the value of Quebecor’s content by simply negotiating its presence on several portals. There was no significant need from a content perspective for Quebecor to own transmission infrastructures in order to achieve that goal, although there may have been other reasons to do so.

In addition to the excessive growth in transmission capacity encouraged by the bandwidth “prophets,” poor business model choices intensified the collapse of the telecommunications industry. As many other corporate managers did in past economic booms when financial markets were very favourable, industry leaders thought that acquisitions were a promising avenue for ensuring longer-term profit growth. These leaders now look like apprentice sorcerers, with current managers often forced to dismantle the empires built by their predecessors in order to avoid the worst. The shareholders and creditors of telcos were the losers of this venture into one-stop services and convergence.

The magnitude of the innovation wave in Canada was not comparable to that seen in the United States. When the 1990-91 recession ended, Canada was faced with a considerable budgetary deficit and the burden of public debt weighed heavily on the economy. Tax increases intended to reduce the deficit dampened consumption growth significantly and the borrowing requirements of governments generated pressures on financial markets. Thus from 1992 to 1998 average GDP growth in Canada (2.9 percent) was notably lower than in the United States, where GDP grew at an average of about 3.5 percent. When the deficits subsided and the debt was lowered, Canadian growth began to accelerate in 1998-99 when the speculative bubble was already blowing itself out. Canada avoided the recession that occurred in the United States when the bubble burst. The collapse of the dot-coms, the spectacular bankruptcies of firms of the new economy, especially Enron, and the debacle in the telecom industry pulled the American economy into recession in 2001.

The reversal experienced by the Canadian telecom sector was not as spectacular. A few companies, such as AT&T Canada, 360Network and Teleglobe, a Bell subsidiary, sought bankruptcy protection, and Nortel underwent major restructuring. While this contributed to a slowdown of the economy in 2001, it did not have the impact that the collapse of the dot-coms and of large corporations such as WorldCom had on the American economy.

In the telecommunications sector, the CRTC’s approach to increased competition did not lead to the dismantling of the largest conglomerates such as Bell and Telus, contrary to what happened with AT&T in the United States in 1984. Had Canada followed the example of its southern neighbour, Bell’s local service would have become separate from its long-distance service. Instead, the exmonopolists were able to keep the part of their operations that was related to local call, and thus maintained their control over the last kilometre that the signal had to cross in order to reach customers. Greater competition first occurred in long-distance services, and the members of Stentor, an organization comprising all telcos that occupied a monopoly position, had to open their networks to new entrants into the market. The elimination of regulatory barriers between telephone services and cable distribution (the result of the CRTC’s landmark decision 94-19) then opened the door to competition between these two sectors of information transmission. Today, cable companies offer Internet access and data transmission services and can provide telephone services, and telephone companies are able to offer broadcasting services.

The introduction of a competitive regime into the market for local and long-distance services was a complex process, heavily laden with regulations. The exmonopolists had to distribute their costs and their assets so as to set access rates for their networks. The restructuring of rates for local markets made it possible to reduce cross-subsidization in favour of the residential market, without eliminating it entirely. In addition to paying for network access, the competitors of the former members of Stentor had to contribute to the cross-subsidization associated with the local residential service. Adding to the complexity of the situation is the fact that new entrants into the local market are entitled to a “portable subsidy” paid with their contributions so as to offset the difference between costs and rates in this market. In short, the CRTC interpreted its mandate as giving it the power to redistribute income in the telecom market. All of these elements add complexity to the operation of the market and have been the source of ongoing tensions between the new players and the exmonopolists.

The CRTC’s approach, called “forbearance” when competition reaches adequate levels, led to the development of a competitive environment in the Canadian long-distance market.42 Several companies did enter the long-distance market, but they were mostly re-sellers; only a small number of newcomers developed true networks across the country.43 With a few exceptions, such as Fonorola, infrastructure investment was done mainly by companies associated with US firms like Sprint and AT&T (which acquired Unitel).

Given the small size of its market and the dominant position held by companies such as Bell and Telus, Canada has not seen a large wave of new entrants, in contrast to what took place in the United States, where new companies spread fibre optics networks across the country. Only 360Network can be considered a Canadian “bandwidth baron.” With spread of the Internet, several ISPs made their appearance in Canada, and some, such as iStar, had a brief success on financial markets. The larger telcos and cable companies have contributed to the consolidation of the Canadian market, which does not have an ISP comparable to AOL that could concentrate Internet traffic and seriously challenge them.

The elimination of regulatory barriers between telecom services and cable distribution wrought by the CRTC’s landmark decision 94-19 did not, however, have all the outcomes that had been anticipated. Cable companies offer Internet access and data transmission services, but they have not, as many had predicted, overtaken the telecommunications market.

The level of competition reached in the long-distance market was sufficient to convince the CRTC to withdraw and let market forces determine prices. The former members of Stentor lost significant market share when rates began declining precipitously. By 1999, approximately 25 percent of sales in the long-distance market were made by the competitors of the exmonopolists.44 Lower prices had a negative impact on the profitability of the former Stentor members, and they had to work hard to preserve the value of their capitalization. The BCE strategy, analysed above, and the drop in prices in the telecom market penalized the company’s shareholders. However, the presence of the former Stentor members in the local market and the virtual absence of competitors in this market segment (see below) have given the exmonopolists a steady revenue flow that has enabled them to stabilize their financial situation. By comparison, in the United States the companies competing in the long-distance market have not had this stable source of income and as a result have been hit even harder by price wars.

New entrants into the Canadian long-distance market have found it very difficult to achieve profitability, as the example of AT&T Canada shows all too well. Thanks to the intervention of the federal government, the American company first acquired Unitel, which had already lost half a billion dollars, and was allowed to hold 49 percent of the Canadian firm. Unable to become truly profitable, however, AT&T

Canada divested itself of the residential sector (taken over by Primus) to concentrate on the lucrative business sector. Then, in October 2002, the company declared bankruptcy and the American parent decided to withdraw from its subsidiary. Having rid itself of its debt burden, AT&T Canada changed its name to Allstream; it is too early to say whether the company will succeed in becoming profitable.45 New entrants into the long-distance market have always maintained that the network access fees granted to the exmonopolists by the CRTC are too high for new firms to be profitable in that market. The difficult issues surrounding the profitability of the competitors of Bell and Telus and network access fees will be discussed later on.

As in the United States, Canadian consumers — households and businesses — have been the big winners in the increased competition and the technological boom. Thanks to competitive forces, they have benefited from lower prices for long-distance services and Internet access. They have also been the beneficiaries of the new services offered in the market. And thanks, among other things, to the cable distribution networks, Canadians now enjoy the benefits of competitive supply in high-speed Internet access.

The industry must now deal with the situation resulting from the speculative excesses of recent years and meet the needs of a customer base whose goals are anchored in economic reality. On the demand side, the entire economy is pursuing the move toward digitalization, but at a realistic pace and subject to cost and efficiency requirements. E-commerce will continue to make progress but it will reach levels substantially lower than those predicted a few years or even just a few months ago. On the supply side, it has been estimated that the industry operates at about 40 percent of capacity46 and that excess capacity will only be eliminated in 2006.

The industry is also threatened by factors associated with bankruptcy law. When companies seek bankruptcy protection against their creditors, their transmission capacity does not disappear. If they are able to come to an agreement with their creditors, they are then able to return to the market with a lighter debt load, while competitors that did not go bankrupt must continue to bear the cost of servicing their own debt. In Canada, for example, 360Networks, AT&T Canada and Teleglobe reached such agreements with their creditors. In addition, investors can buy out bankrupt companies at prices that are much lower than the cost of setting up high-speed transmission networks. A few carriers have already been acquired at prices that represented only a fraction of their past value.47

These developments highlight the competitive asymmetry that could emerge in the telecom market. To increase their client base, companies that were bought at cut-rate prices or that were able to rid themselves of their debt burden are now in a position to launch a new price war that could be fatal to competitors that had succeeded in surviving difficult market conditions. Indebted companies such as Verizon, Qwest or AT&T in the United States could, in turn, be forced to take refuge behind the protection of bankruptcy laws. One could then talk about a domino effect — a situation that some analysts had predicted48 and that would reinforce the dangerous trend toward lower prices caused by overcapacity, with damaging effects on investors in the telecom industry. The wealth-destroying process caused by past excesses could go on for some time before the industry returns to stability.

Given the overcapacity and the economics of networks — which require that fixed infrastructure costs be amortized over the largest possible number of customers — the move toward consolidation that began with the bankruptcy of several carriers is expected to continue for some time. In the United States, the exmonopolists in local markets (the “regional Bell operating companies,” or RBOCs), in particular, find themselves in a generally better financial situation than other carriers and are in a position to buy at deep-discounted prices long-distance companies that are just coming out of bankruptcy or that are struggling to avoid falling into it. In resisting efforts to open up the local market to competition (see the analysis below), the RBOCs have already achieved a major consolidation of this segment of the market by acquiring several smaller firms. That is how SBC Communications, for example, has become a new giant in the world of telcos.

Recently, some states forced the RBOCs to lower their wholesale local rates in order to stimulate competition. AT&T took advantage of these decisions to secure a presence in local markets in eight states, and WorldCom, currently under chapter 13 of US bankruptcy law, offers local services in 33 states.49 If competition continues to grow in local markets, it is conceivable that the RBOCs, which have the right to be in the long-distance market, will be allowed to buy a carrier.50 The US market would then look more like its Canadian counterpart, with some firms present in both local and long-distance markets. If a giant such as SBC Communications or Verizon51 bought at cut-rate prices another giant currently under bankruptcy protection (WorldCom, for example), the new company would be in a position to make better use of network economics and provide a more stable flow of income. This type of consolidation would lead to a telecom market with oligopolistic characteristics.

Consolidation also takes place when new competitors enter the market with the cash flow and expertise needed to offer specialized services. Thus Integrated Device Technology (IDT), a systems integrator, acquired Winstar, a bankrupt carrier, for a fraction of its book value ($42 million) and may be in a position to acquire at bargain prices other companies in bankruptcy or in financial trouble.

Following the fall from grace of the convergence and one-stop concepts, the business models that are expected to dominate are those requiring companies to specialize more. Recent trends in market consolidation suggest that three models will prevail in coming years. A first model is that of telcos that have refocused on their traditional mission and will, in a competitive environment, become highly efficient, highly reliable, low-cost carriers offering platforms that are capable of combining various technologies available in the market. The refocusing strategy currently pursued by Bell Canada can be seen as going in that direction.

A second model comprises firms occupying a specialized niche, such as broadband services, in particular for the international exchange of complex data between companies or other organizations. By consolidating broadband networks and using its computer expertise, a company like IDT could be moving toward this model. AT&T Canada, renamed Allstream after coming out of bankruptcy, sold its residential services to Primus and now specializes in business services.

Finally, the third model, described earlier, is that of the broker offering its clients a solutions package in partnership with other firms. This model encompasses, for example, telcos that divest themselves of their carrier business to concentrate on the supply of value-added services. The new AT&T management in the United States appears to be going in that direction. AT&T sold a number of assets associated with the one-stop model and wants to withdraw from the residential market in order to focus on business services. In December 2002, AT&T, IBM and Intel agreed to create a joint venture called Cometa Networks, offering businesses an integrated network for wireless Internet access (Wi-Fi) in airports, office buildings and other public places. Thus AT&T and its partners have developed a value-added package for businesses that must remain in Web contact with their managers when they are travelling.

Within a few years, the profile of the telecommunications sector will have transformed itself. After the wild years of the Internet boom, the industry will be more closely anchored in market realities and more focused on efficiency criteria.

The introduction of competition in telecom markets was a major element in the innovation wave that took place during the 1990s. Had the telcos maintained their monopoly position, they would have controlled the pace at which new technologies could be introduced into the market. To recoup the historical costs of their networks, they would have been tempted to slow down their equipment upgrades. As a result, equipment suppliers would have had less incentive to market products that are made ever more efficient through a whole series of incremental innovations. Moreover, had the regulatory system that set service rates on the basis of cost plus a fair and equitable return been maintained, prices would not have undergone the rapid downward trend that has been seen in the last decade. The degree of penetration of Internet technology throughout the economy would be substantially less than it is today. This can be seen, for example, in the hesitation of some European countries in allowing competition in telecom markets, which delayed the conversion of their economies to digital technology and reduced their competitiveness.52 Thus competition was a major contributing factor in the technological boom.

In the long-distance market, however, competition and network economics did not achieve optimal results — that is, a situation in which the interests of consumers and shareholders converge. In local markets, the introduction of competition turned out to be a complicated process and did not generate the expected outcomes.

The enhancement of competition in long-distance and local markets assumes that regulatory agencies set the rates that new entrants must pay to access the networks of the exmonopolists. This is one of the major problems surrounding increased competition. When an innovation wave is in full swing, rate-setting is even more complicated because the new technology based on IP data transmission is substantially less costly than the technology associated with the networks inherited from the past.

In theory, network access costs should reflect the prices that would obtain in a competitive environment. But if the regulator allows an exmonopolist to claim its historical costs, new entrants do not pay only the marginal cost of the service received but must also assume a part of the cost of depreciation related to all investments already made by the monopolist. In a competitive market, historical depreciation is irrelevant since prices are determined by current supply and demand conditions. In the United States, the response given to this problem by the Federal Communications Commission in 1996, when it opened local markets to competition, was to use an approach based on the costs of the most recent technology to set access rates without reference to monopolists’ historical costs.53 There was an outcry among the RBOCs, and they launched a legal challenge, which they won in part.54 One of the arguments put forth by the exmonopolists was that they had invested in good faith and that their shareholders should not be the victims of increased competition.55 This is a complicated issue which illustrates another economic dimension of networks.56 A network in which a carrier has invested substantial amounts of money cannot simply be discarded without penalizing shareholders who invested in the company on the basis of the information available at the time.

In Canada, the CRTC attempted to follow an intermediate course in this regard by allowing the exmonopolists to recoup a substantial portion of their historical costs and by using long-term incremental costs as a basis to set access rates. Understandably, this approach to rate-setting has led to pressures on the part of new entrants, who argue that they are being forced to pay for historical costs that do not contribute to their profits. To this difficult issue is added the fact that the CRTC, by maintaining cross-subsidization in favour of residential subscribers as an income-redistributing measure, does not promote an efficient functioning of the telecommunications market. Rate restructuring should have led to the elimination of cross-subsidization and the CRTC should have let the federal government take care of the matter of income redistribution. If the government believes telecom services should be made affordable to all, it may be appropriate to grant a tax credit (similar to the GST tax credit) to low-income taxpayers as a means of offsetting the higher rates. This way, new entrants would not be forced to contribute to a fund intended to cross-subsidize the local market. This would result in the elimination of at least one source of tension in the telecommunications market.

Companies such as CallNet Enterprises and AT&T Canada have always maintained that the access rates to the Telus and Bell networks are too high to be profitable for new entrants. AT&T Canada challenged the CRTC’s most recent decision, which set a ceiling for residential rates until 2006 and lowered network access rates by 15 percent in May 2002. This reduction was far less than what AT&T had requested, but the Cabinet supported the CRTC’s decision.57 On the other hand, the CRTC deemed that competition in the long-distance market was declining and that Bell, Aliant, Telus, MTS and Saskatel had not honoured some of its decisions regarding competitors’ access to their networks. There were also confrontations between cable companies and telcos, in particular with regard to the provision of television services.

Although 10 years have passed since competition was allowed into the telecommunications sector, there remains much tension between the various players in the Canadian market, and it is still very difficult for new entrants to become profitable. Competition has had a number of beneficial effects for users, but for shareholders the impact has been less positive. While in the United States, major competitors of the exmonopolist AT&T, such as MCI or Sprint, were able to achieve profitability in the long-distance market before the Internet boom,58 in Canada network economics and the limited size of the market may have played a part in the outcome. Moreover, the exmonopolists, by being present in both local and long-distance markets, may enjoy some benefits in terms of rate-setting and business strategies. The CRTC has adopted a number of regulations designed to prevent them from shutting out rivals through predatory pricing policies. Nonetheless, Stentor’s former members are able to take advantage of bundling opportunities that are not available to new entrants. Indeed, the tensions that have marked the television market are related to the cross-subsidization that Bell is allegedly able to make among its bundled service packages.

In conclusion, one may ask whether the way that competition has been introduced into the telecom industry in a market as small as Canada’s is such as to enable several competitors to be cost-effective over the long term. The Canadian experience is not conclusive at this point, and it raises a number of issues that will be discussed in more general terms in the concluding section. It is to be hoped that telecommunications, an innovative sector that is absolutely essential to the proper functioning and competitiveness of the economy, will not follow the example of commercial aviation, where it has become very difficult to be profitable and where one major airline after another is seeking bankruptcy protection to ensure its survival over the medium term. This model leads to a drying-up of the investment capital needed to promote technological progress, especially in the context of the current limits on foreign investment. On the other hand, as shown above, competition has been a determining factor in the innovation wave of the last decade. For the Canadian market, the approach that would serve the interests of both consumers and shareholders has yet to be defined.

Finally, increased competition in the local telephone market in the United States and Canada has had relatively little effect. In Canada, the former monopolists still occupy approximately 98 percent of this market.59 The wholesale access rates set by the CRTC do not encourage resellers to try their luck in local markets. Instead, the CRTC’s approach is focused on encouraging potential competitors to invest in equipment so they can offer services at the local level. This strategy is not very promising, however: except in high-density business sectors in downtown areas, it is not cost-effective to have competing networks in the local market. Under those conditions, competitors will apply a skimming strategy whereby they will offer specific services in the lucrative market of large or medium-size businesses; as a result, the market shares of new entrants will remain very small. This was the strategy adopted by MetroNet (later purchased by AT&T Canada) when it decided to enter the local market.

In local markets, the answer is not in having several networks compete, but in encouraging competition at the technological level.60 Cable companies offer high-speed Internet access and can also offer Internet telephone communications. An example is Vidéotron’s Internet communications project in partnership with Cisco, which could have been brought about through a merger with Rogers Communications but was abandoned when Vidéotron was bought by Quebecor. Had the project gone ahead, a true competitive regime might have developed between different technologies in the local market. Strong competition among wireless service providers already offers consumers a choice. Further progress in this area, with the eventual deployment of 3G or even 4G technology, would make it possible to bypass the local infrastructures of the exmonopolists.

To be cost-effective, an investment project in costly infrastructures must assume a high rate of network utilization. When a company deploys a communications network, it seeks to secure the highest traffic volume possible for that network. The marginal cost associated with gaining additional customers is negligible, but the average cost is a function of infrastructure utilization rates. With compression techniques increasing the capacity of optic fibres and Internet technology, it is more necessary than ever to secure the highest traffic possible in order to make the infrastructures cost-effective. In the context of a Schumpeterian innovation wave and a market that is completely open to competition, economic agents tend to overestimate investment requirements considerably. Waves of excessive optimism of the scope described earlier have been seen a few times in economic history. In addition to the case of electricity in the 1890s mentioned above, a similar phenomenon was observed with the unregulated construction of railways as part of the conquest of the American West in the 19th century. The development of competing networks brought about a series of bankruptcies, which led the American government to regulate the railway industry in the following century.61

During the Internet innovation wave, it became clear that a trend toward overinvestment was developing, especially when the bandwidth barons appeared on the market. The chairman of the Federal Reserve cautioned investors about this display of “irrational exuberance,” but his attempts at moral suasion were not enough to temper investors’ extravagant optimism. In fact, financial markets had no interest in slowing down the wave of irrationality that gripped investors when the first public offerings and corporate stock and debt issues reached their peak. Moreover, financial analysts and brokers did not hesitate to promote securities which they well knew had no value.62 As mentioned earlier, the question whether the Federal Reserve should have raised its benchmark rate to calm this speculative wave remains open.

Given the demands of network economics and the extravagant behaviour of financial markets, I believe the regulatory agencies could, by issuing licences for the operation of telecommunications networks, have controlled the deployment of new networks so as to prevent the waste of resources and the erosion of shareholders’ capital. After all, the telcos had long been familiar with the principle of infrastructure sharing. In an industry where network economics play a fundamental role in ensuring returns on investment, various forms of co-ownership and “condominium” sharing of satellites, underwater cables and other types of infrastructure have long been in use.63 In particular, the major international carriers have often shared infrastructure costs to avoid building costly duplicate networks. When a new network free of the depreciation costs of past investments is established, it should clearly be easier for carriers to reach an agreement on sharing costs and capacity. This is the approach adopted by a number of public institutions in Canada in recent years.64 When hearings were held on the granting of operating licences to companies wishing to invest in a network or part of a network, the regulatory agencies could have applied the principle of capacity sharing to the deployment of fibre optics networks in North America. This approach does not imply that regulators are better informed than private investors about market conditions. The agencies could have requested the companies to submit their investment plans — and the information on which the plans were based — and could have discussed with them the possibility of sharing infrastructures. The result would have been a better organization of the information on the investment intentions of various competitors in the market, laying the groundwork for analysing investor expectations under a different light. In particular, such an exercise could have highlighted the overestimation of demand during the high-speculation period when each carrier believed it could secure significant market share. In addition, carriers investing in a shared network could have agreed to make it available to third parties for a fee. The rules set by regulators to control network access could then have been used to set a rate schedule enabling other firms to access the new network at a competitive price. Again, infrastructure costs could have been avoided.

Overall, this approach would have made it possible to increase the cost effectiveness of projects by avoiding the waste of resources. In the process, the investment boom would probably have been less extreme and investors’ interests could have been protected. From the point of view of consumers’ interests, there was no need to have this huge excess capacity in order to lower prices and facilitate the emergence of several new types of services on the market. For reasons mentioned earlier, however, this type of intervention in the telecommunications market when the Internet wave was at its peak would have been poorly received by the financial community, which would have argued in favour of a free marketplace to ensure an efficient allocation of resources. Moreover, some players in the telecom industry have a reputation for not giving in easily to this type of cooperation:65 as seen earlier, in the culture of the industry companies prefer to own the assets that are the source of the services they offer. However, the extravagance displayed during the last innovation boom and the ongoing tendency to consolidate should facilitate a change of attitude in the future on the part of carriers. In Canada, for example, following the acquisition of Clearnet by Telus, the latter reached an agreement with Bell Mobility on sharing infrastructures for their wireless services.

While the impact of the most recent Schumpeterian wave is still being assessed, technological advances and the emergence of new telcos pose new challenges to existing firms and regulators. And while the financial difficulties of the telcos has slowed down the pace of innovation, there has been talk for some time now of voice transmission on the Internet, and companies such as Cisco Systems have invested significant amounts in the development of this technology. Recently, the US company Vonage began offering, for a low, flat monthly fee, Internet telephone service in which the notion of long distance ceases to exist: subscribers can call anywhere in the United States and Canada as long as they have a high-speed Internet connection.66 Thus Vonage is at the forefront of a new wave of innovations in the industry. In Canada, Primus recently announced that it plans to offer a similar service; Bell Canada, in partnership with Cisco, also intends to enter the Internet telephone market. The Vonage business model will challenge both the exmonopolists, whose networks are threatened by this technology, and the regulatory agencies, which will have to define rules applying to the new service.67 This process is already under way, as telcos in both the United States and Canada have asked the agencies to hold hearings on the subject of Internet telephone service.

The speedy implementation of WiFi technology through the deployment of “hot spots” allowing high-speed Internet access in both countries constitutes another competitive threat in local markets. There is a risk, however, that this technology will soon become obsolete because companies such as ArrayCom, IPWireless, Navini and others are currently developing 4G technology, a high-speed wireless technology for Internet access that circumvents the weak point of WiFi technology — namely, the short range of the “hot spots.”68 The new technology makes it possible to adopt a leapfrogging strategy that eschews 3G technology and to develop a nationwide wireless network for high-speed Internet access, whereas the shortcomings of WiFi make it practically impossible to deploy a nationwide network. That is the route that a company like Nextel intends to take to provide high-speed wireless services. This technology poses another major challenge to the networks of the exmonopolists. Technological advances are in the process of achieving what complex regulations were not really able to do — namely, introducing a truly competitive regime in local markets. Clearly, technological innovations will continue to transform the telecom industry in the future.

Over the past decade, the telecommunications sector has experienced a Schumpeterian innovation wave. This phenomenon had a positive impact on social organization and on business productivity once the Internet quickly became a means of communicating, disseminating information and trading goods and services. Telecom users have been the beneficiaries of a substantial drop in prices and a proliferation of new services.