(This study has been translated into French.)

As Canada’s population ages, a growing number of frail seniors will require long-term care services to help them perform daily activities such as eating, dressing or bathing. Ensuring that adequate care is accessible to every Canadian who needs it should be a national priority.

Currently, the financing of long-term care is a patchwork. Access to long-term care and its cost to individuals vary depending on the region where they live and whether they are still at home or in a residential facility. How will governments address the anticipated increase in long-term care needs in the next two decades and beyond? Because there is little information about the level of public funding currently available, let alone future funding, Canadians are not in a position to make informed decisions on how to plan for their care needs in the future.

This IRPP study examines which financing schemes are most likely to ensure universal coverage of long-term care services in an equitable and efficient way, and what should be the role of governments in that regard. Based on a review of the economics literature and empirical evidence available from other countries, Michel Grignon and Nicole F. Bernier analyze the pros and cons of available options for financing long-term care: private savings, private insurance and universal public insurance.

The authors find that relying on private savings is not an efficient way for individuals to provide for their potential future care needs, as they are likely to save too much or too little. While the risk of becoming dependent on formal care for an extended period of time is concentrated among a relatively small segment of the population, for some that risk can reach catastrophic levels in financial terms (for example, needing extensive care for over five years).

Long-term care thus warrants some form of insurance, either private or public. Private longterm care insurance, by its nature, is subject to significant market failures. As a result, taking this option would require heavy government regulation and large subsidies. Because of their effect on individuals’ decisions and behaviour regarding long-term care insurance, last-resort options, such as obtaining care in public hospitals, would also have to be curtailed. Moreover, individuals would still end up paying more for coverage than they would if they contributed to a public insurance plan.

The authors recommend that governments adopt a universal public insurance plan that provides full coverage based on a standard evaluation of care needs. This would reduce uncertainty for aging Canadians and be more equitable. It would also be more consistent with the “aging at home” approach, which is favoured by seniors and increasingly promoted by governments.

The number of Canadian seniors is expected to grow significantly over the next decades, reflecting the postwar baby boom, better health among older Canadians, and better prospects of survival for patients suffering from chronic conditions. In 2036 an estimated 10 to 11 million Canadians will be aged 65 and older — more than double the 2009 figure of 4.7 million — and their numbers will continue to rise to some 12 to 15 million by 2061. While the vast majority of seniors live independently, in any given year about 14 percent depend on others to assist them with activities of daily living such as eating, dressing and bathing,1 and the number of dependent seniors is expected to triple over the next 50 years (Statistics Canada 2010).2 Ensuring that we can provide adequate long-term care to Canada’s aging population should be a priority.

Informal caregivers (mostly dependent seniors’ partners and, to a lesser extent, their children) currently provide the bulk of seniors’ care — 66 to 84 percent of it — free of charge.3 While it is likely that this will continue to be the case in future years, a growing number of Canadians will also require long-term care services provided by paid workers and professionals (Goda, Golberstein, and Grabowski 2010). How will Canadian governments address this anticipated increase in long-term care needs? Will they pay for these costs out of their budgets or will they leave all or part of the financial burden to those needing care and their families? And if governments choose the second option, how will individuals cope with this burden?

Since little information is available on current or future public funding, Canadians are not in a position to make informed decisions as they plan financially for their long-term care needs, for example, by saving or by purchasing insurance. Currently, most formal care services provided outside hospitals are not covered under the Canada Health Act and are not very accessible. Therefore long-term care costs are largely shared by the individuals who require care and their provincial or territorial governments.

The financing of long-term care is a patchwork. While long-term care is publicly subsidized in most provinces, there is also a user-pay component for both residential and home-based long-term care. Out-of-pocket expenses are usually income-tested and vary considerably across the country. For institutional care (in a residential care facility), in 2008 maximum annual charges for standard accommodation for nonmarried seniors were $12,157 in Quebec, compared with $33,600 in Newfoundland (Fernandes and Spencer 2010).4 For home care, the current allocation of costs between public and private purses is not known, but in the late 1990s, 25 percent of nursing care and support services provided at home were being paid out-of-pocket at an estimated average cost of $15,000 per year per patient (Coyte 2000). As a result, access to a defined bundle of services is not uniform (McGregor and Ronald 2011).

Clearly, Canadians face financial risks that vary depending on the region where they live and whether they reside at home or in a facility. In addition, while existing programs provide public funding for some care services in nursing homes, they often don’t cover adequately the care services required by dependent seniors who remain in their own homes, even though staying at home is a cheaper option preferred by the vast majority of Canadians. The existing arrangements result in inequities among Canadian citizens and are inefficient. In this context, it is worth exploring how access to long-term care can be made universal in Canada.

Any universal funding scheme, whether private or public, must satisfy several, potentially contradictory, objectives: efficiency (no resources wasted and providing what individuals demand), equity (care provided according to need and ability to pay), respect for beneficiaries, sense of solidarity within society (no disincentive for families to care for relatives) and intergenerational fairness (Wittenberg, Sandhu, and Knapp 2002).

In this study, we address the following questions: What are pros and cons of various options for financing formal long-term care in Canada? How will decisions in that regard affect public and private spending, equity and value for money? What can federal, provincial and territorial governments do to support financing schemes that will provide accessible care in an equitable, cost-minimizing and quality-maximizing way? To answer these questions, we review economic theory and empirical evidence on the effects of such schemes in several countries. Japan, the Republic of Korea, Singapore, the United Kingdom and the United States, as well as most continental European countries, have debated and experimented with various options for at least 20 years. We will focus especially on the US experience, as most of the research evidence comes from there.

In the first section, we briefly describe the basic characteristics of long-term care. In the sections that follow, we analyze the potential and limitations of the three main options available for financing long-term care: private savings, private insurance and public insurance. These options are not necessarily mutually exclusive, but depending on their specific modalities and how they are combined, they would have very different equity and efficiency consequences (Wittenberg, Sandhu, and Knapp 2002; Glendinning et al. 2004). In the final section, we make recommendations adapted to the Canadian context.

People who need long-term care might depend on others to assist them with instrumental activities of daily living such as preparing meals, performing housework, taking medications and doing errands. They might also need assistance with basic activities of daily living such as eating, dressing and bathing. Some people need assistance with both categories of activity. Long-term care differs from acute or rehabilitation care in that it tends to be required for an extended period of time.

Long-term care can be formal or informal, depending on whether it is provided by paid professionals or workers or free of charge by a spouse, relatives or friends. Formal care can be provided to dependent patients who live either in nursing homes or in the community (that is, in their own home or that of their caregiver), but informal care is provided mostly in the community.

Long-term care consists only of downstream services to assist with instrumental activities of daily living or basic activities of daily living. Downstream services are provided for the most part by caregivers (such as spouses or adult children) or by semiskilled, unregistered care providers. By contrast, upstream services are for acute or rehabilitation care, and are aimed at either healing individuals or stabilizing their health condition (for example, diabetes). A dependent patient will typically need a combination of downstream and upstream services. However, a long-term care insurance plan would cover mostly the downstream portion, together with out-of-hospital professional services (such as home nursing) that are not already provided under the Canada Health Act.

The Canadian Labour Force Survey identified 57,000 formal home care workers for 2001, but only 14,000 of them were registered workers (such as registered nurses, licensed practical nurses or social workers). Hollander (2004) finds that, in British Columbia, only 10 percent of formal home care services are professional services. All the same, unregistered workers also need skills to provide long-term care. Their services substitute for what patients cannot do by themselves on a daily basis because of physical and other limitations. For instance, the skills required involve being able to provide personal care to patients with limitations, engaging in a relationship with them and having a respectful attitude.

Individuals cannot easily be classified as being either independent of or dependent on care from others, since dependence is best measured on a continuum. People can range from being perfectly autonomous to being in need of constant assistance. And not all individuals with limitations actually require assistance from others. When individuals do need assistance to perform instrumental activities of living, they are most often only mildly dependant in that they require relatively inexpensive services from low-skilled workers, who help periodically with tasks such as running errands and house cleaning (Gilmour and Park 2006). When individuals need assistance in performing basic activities of living, their dependence is usually severe, and they are in daily need of costly nursing services from skilled workers. This is where most of the financial burden for long-term care occurs. How should Canadians and governments prepare for the risk that they will need expensive care in the context of an aging society?

From the perspective of individuals, there are two ways to plan financially for the costs associated with long-term care. One is to save money and the other is to take out an insurance policy. In the first scenario — private savings — individuals save money starting at an early adult age to prepare for the possibility of, say, having to spend five years in a nursing home (Barr 2009). If no public coverage is available, and assuming that one year in a nursing home costs $60,000, this option would require individuals to save approximately $300,000 during their working years. This would amount to the equivalent of $7,500 per year over a 40-year period.5 For married couples, the amount of savings required would be the same, since it is unlikely that both spouses would need long-term care for five years. Each spouse would therefore need to save a total of about $150,000, or a sum equivalent to $3,750 a year per person. There are two main instruments that could be used to support private savings: medical savings accounts and reverse mortgages.

Governments could create designated registered savings plans with tax exemptions on condition that the money saved is actually used for long-term care services.6 As with Canada’s Registered Retirement Savings Plan (RRSP), tax exemptions could be offered at the front end: the portion of income saved in the medical savings account (MSA) would not be taxed, but withdrawals from the account to pay for long-term care services would be taxed. Alternatively, as with the Tax Free Savings Account (TFSA), the portion of income saved in an MSA would be taxed, while the income generated by the fund would be exempted. MSAs have been in place in Singapore since 1984 (known as Medisave), although the scheme is used mostly to pay for acute-health-care services (Lim 1998).

The reverse mortgage, which is also known as equity release in the UK and as viager in France, is another option. There are many variants, but the basic principle is that individuals sell their houses but stay in them afterward until they are institutionalized or until their death. Instead of saving in a separate savings account for long-term care, individuals pay the mortgage on their house during their working years and later sell their asset back at a discounted price in exchange for receiving periodic payments over time from the buyer in order to secure a flow of income. The discount on the selling price depends on the length of time the seller is expected to stay in the house and thus depends on the seller’s age and gender and the actual value of the house. In the UK, the Royal Commission on Long Term Care (1999) simulated the annual income generated by equity release for a variety of cases. The most favourable cases for the seller were that of a male aged 79 and living alone, who could generate 4 percent of the house’s value per year, and that of a male aged 87 and living alone, who could generate 12 percent of the value of the house. If this also applied to Canada, and considering that the median value of a house in Canada is roughly $200,000 (Statistics Canada 2006, 7), a reverse mortgage could be expected to yield, in the most favourable cases, an annual income of about $8,000 for a 79-year-old male living alone and about $24,000 for a similar male aged 87 (Royal Commission on Long Term Care 1999, vol. 2, chap. 9).

As instruments of private savings, medical savings accounts and reverse mortgages require relatively little public intervention, but governments may nevertheless opt to create tax incentives designed to promote saving by individuals and to regulate financial products offered on the private market. In the case of reverse mortgages, a government agency may also play the role of a risk-neutral buyer. That is, it may pay upfront for the cost of longterm care and then be reimbursed (partially or totally) by selling the house when the beneficiary dies (Collins 2007; Hirsh 2006).

In no country are private savings the only source of funding for long-term care, not even in the United States or Singapore, two countries notable for their strong reliance on individual savings and market competition in health care. In the US, a federal plan funded through Medicaid and administered by individual states covers catastrophic expenses for long-term care. In Singapore, a voluntary, government-backed insurance scheme, ElderShield, has covered the cost of chronic disability among the elderly since 2003. It was extended five years later to cover periods in excess of five years and amounts in excess of $300 per month for long-term care.7 Such programs exist simply because private savings are not adequate instruments to ensure universal coverage of long-term care costs, as they present two substantial risks. First, some individuals will need long-term care services in excess of what their savings can support. Second, if every married individual saved $150,000 over their lifetime to cover the possibility of having to spend five years in a nursing home, a majority of individuals would end up having saved too much, simply because the risk of becoming dependent for a long period of time is concentrated in a subgroup of the population. An estimated 31 percent of people turning 65 in 2005 will not need any long-term care before they die (Kemper, Komisar and Alexcih 2005). From an individual’s perspective, it is not efficient to forgo $3,750 a year of consumption (or investment in housing or education) only to leave a large bequest at the time of death.

As for the reverse mortgage more specifically, this method is used in some countries (e.g., in France) by some individuals — mostly those in income-poor and asset-rich occupations, such as farming. However, the reverse mortgage is not widely used as a public instrument to help fund long-term care in any country. The Royal Commission on Long Term Care (1999) noted that in the UK few dependent elderly people actually had a house of sufficient value that they could sell to cover the cost of the formal care services they needed. With average home care costs estimated at $15,000 per year in Canada (Coyte 2000), there is no reason to believe that the Canadian situation is any different.

As can be seen, relying on private savings alone is an insufficient and inefficient way to fund long-term care. Given the type of risk and the uncertainty associated with dependence and the future availability of informal care, some form of insurance is also needed8 as it has many advantages over individual savings.

Individuals opting for long-term care insurance contribute to a risk pool. When they require care services, a multidisciplinary assessment team conducts a standardized evaluation of their condition on a regular basis to determine the range and quantity of services they are to receive (which will be funded by the pool). Whenever beneficiaries want more or better-quality services than those insured by the pool, they pay the difference out-ofpocket. If the lifetime risk of dependence is, say, 20 percent, the insurance option will, in principle, cost only 20 percent of what is needed for the MSA option — that is, $750 per year for a married individual, rather than $3,750. But this amount is likely an underestimate, since the insurance scheme would require additional revenue to cover administrative costs (e.g., to pay the assessment team).

The ideal pool for long-term care insurance is composed of individuals who contribute to the scheme from the beginning of their working life and who do not claim any benefit for decades. As we know, the typical 30-year-old contributor is unlikely to claim benefits for longterm care in the next 40 years, although the risk that a few may have to do so sooner does exist. The long time lapse between beginning contributions and claiming benefits is similar to that found in pension plans and life insurance, but it is distinct from acute-health-care insurance, in which contributors do typically claim benefits at any age.

It is difficult to imagine that most young adults would spontaneously start paying premiums for long-term care insurance unless they had to, and later entry is a more realistic assumption if contributing to the plan is not mandatory. Meier (1999) shows that costs to individuals are equivalent whether they start contributing to the insurance pool at age 30 or enter the pool later in life, in which case they pay higher premiums. She argues that, because individuals can acquire better information as the years pass with regard to the kind of long-term care they might need, it is more rational for them to enter the pool after reaching age 50, as most individuals do who purchase long-term care insurance where it is offered. However, from an insurance perspective, it would not work if most people chose to enter the pool after age 70, even if the older individuals paid correspondingly higher premiums. This is because there would be too small a proportion of lucky individuals (those not needing long-term care) from whom income could be transferred.

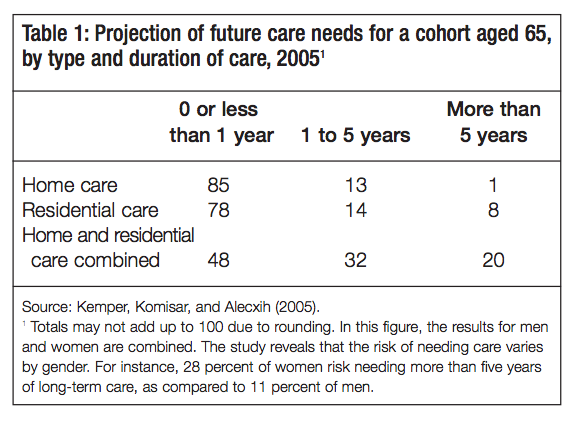

Risk-pooling makes sense because of the concentrated risk of long-term care. While the unit cost for services is high, the probability that contributors will claim benefits over an extended period of time is limited. As shown in table 1, individuals aged 65 in 2005 had a one-in-five chance of becoming dependent on formal care for more than five years later in life.9 That said, females are more likely than males to require long-term care. According to Brown and Finkelstein (2008), for instance, the probability that a woman aged 65 will spend at least three years in a nursing home over the course of her remaining years of life is 9.7 percent, as compared to a probability of only 3.4 percent for men.10 Based on Kemper, Komisar and Alecxih (2005), it is possible to roughly estimate the distribution of the financial burden for those needing long-term care.11 Let us assume that the cost of a year in a nursing home is $65,000, that home care costs $15,000 a year, and that residential care and home care are used in the same proportions. Then the average cost per claimant will be about $40,000 per year.12 The distribution of direct costs would look like this: 48 percent of those who turned 65 in 2005 would on average need six months of care over their remaining years of life, costing $20,000; 32 percent of them would need three years, costing $120,000; and 20 percent of them would need five years, costing over $200,000.13

Public intervention under the insurance option can take several forms. Governments can make the premiums tax-free to attract middle-class individuals. They can also provide means-tested subsidies (vouchers) to improve the affordability of insurance premiums for low-income individuals. In addition, they can make participation in an insurance plan mandatory. But more important, governments can choose between relying on the private insurance market or creating a public scheme.

Data from the OECD indicate that private long-term care insurance is not widespread in wealthy countries (OECD 2010).14 Less than 1 percent of Canadians have a long-term care insurance policy (Baker). Even in the US, where there is a longstanding culture of private insurance and market competition in health care, private long-term care insurance has failed to make a real dent in the market so far. In the early 2000s, only 10 percent of Americans had purchased an insurance policy, and private insurance accounted for only an estimated 2 to 4 percent of longterm care costs (United States 2004; Tumlinson, Aguiar, and O’Malley Watts 2009). If insurance is better than individual savings for financing long-term care, why is private insurance not more popular? The economics literature refers to this question as the “long-term care insurance puzzle,” and provides three types of explanations: behaviour, affordability and market failures. Whether one of these explanations is more significant than the others is not trivial, because determining the importance of each explanation will help define the policy orientation.

One behavioural explanation for low take-up of private long-term care insurance is the lack of information. Relying on incorrect information, individuals often assume that long-term care is publicly covered. Surveys in England (Parker and Clarke 1998; Deeming and Keen 2003) and in the European Union (Walker 1993, 1996) indicate that individuals believe that long-term care is a public responsibility and that, as citizens, they pay or have paid for coverage through their taxes. In the US, while seniors’ health care is covered by Medicare, Americans may not realize that this program does not provide for long-term care, as suggested by Brown, Coe and Finkelstein (2006). This false impression may be reinforced by the fact that Medicaid does cover catastrophic long-term care expenditures.15 There is no reason to believe that Canadians do not share similar misconceptions. The Canada Health Act does not cover long-term care, but provinces and territories pay some of the cost of nursing homes and offer some publicly funded home care services, so that some Canadians may be under the false impression that public programs will fully cover their long-term care.

If lack of information, or false information, is the main cause of the low take-up of private long-term care insurance, governments could undertake to better inform the population to make sure individual decisions are based on correct information. Private insurance companies could launch advertising campaigns to convince consumers of the need to buy private longterm care insurance.

A second behavioural explanation is the “low-probability illusion.” Individuals tend to exaggerate events with high probability and low stakes, and to dismiss events with low probability and high stakes. For instance, individuals will more readily buy insurance to cover their visits to a doctor than to cover the possibility that their material possessions will be completely destroyed by an earthquake. This explanation does not apply to long-term care insurance. As we have seen, there is a 20 percent risk that people aged 65 will be dependent on long-term care for over five years during their remaining life, and there is a 32 percent risk that they will need long-term care for a period of one to five years. The higher risks are concentrated, but they cannot be dismissed as negligible, and it would therefore be expected that a greater number of individuals would buy long-term care insurance.

A third behavioural explanation is “risk denial.” Individuals know the probability that they will need long-term care, they know the associated financial risk, and they also know that it is desirable to buy coverage. Yet they believe that they will not personally need long-term care in the future. But why would an individual who buys acute-health-care insurance not buy longterm care insurance as well? Why would the very same individual deny risk in one case but not in the other? The answer is that it is easier for individuals to deny a health risk that could occur 20 or 30 years from now than to deny a risk that could happen anytime, for example, a stroke. It is not risk denial among individuals, but rather the long-term nature of long-term care insurance that better explains low take-up.

Lack of affordability is cited in the literature as the main reason for low take-up of long-term care insurance.16 Individuals may want to buy insurance but do not, simply because they first have to satisfy more pressing needs such as paying for food, shelter or clothing, and when that is done, nothing is left to spend on long-term care insurance. Technically, insurance is deemed unaffordable if its cost, added to the cost of the minimum standard basket of goods and services, exceeds one’s income17 (Bundorf and Pauly 2006; Kim 2009). A convenient value for the cost of the minimum standard basket is the national poverty line: if subtracting the cost of a standard long-term care insurance policy from an individual’s income does not bring that individual under the poverty line, long-term care insurance is deemed affordable (Kim 2009). Using such a definition of the minimum basket, Kim calculates that 75 percent of Americans could afford a basic long-term care insurance policy (covering three years of nursing home care with a 90-day waiting period and a maximum of $100 per day), and that 60 percent of them could afford a still more generous policy (unlimited coverage of nursing home or home care with a 90-day waiting period and a maximum of $150 per day). This indicates that lack of affordability is not the reason why most individuals do not buy long-term care insurance. It also indicates that, to make insurance affordable to all Americans, governments would need to subsidize premiums for basic coverage for a quarter of the population. Even then, individuals would not be fully covered and would be left with no protection after three years. If they were to ensure full protection, that is, coverage for an unlimited period of time with daily maximum amounts that better reflect the actual care costs, governments would need to subsidize 40 percent of individuals.

Calculations based on this definition of affordability depend heavily on the cost of insurance and the standard level of coverage. Insurance premiums vary substantially with the subscriber’s age, ranging from $1,512 per year at age 40 to $4,515 at age 75, for three years of coverage, including a maximum of $150 per day, a waiting period of 90 days and 5 percent compound inflation protection (Tumlinson, Aguiar, and O’Malley Watts 2009). As a result, buying basic coverage may be affordable when an individual starts contributing at age 40 but not when contributions begin at age 75.

An alternative definition of affordability is that the value of the insurance premium needs to be inferior to a share (say, 5 or 10 percent) of an individual’s total income. Those who need to spend more than that share will not only sacrifice their most basic needs, they will also frustrate their desire for a socially acceptable consumption basket and will forgo leisure activities that are deemed socially necessary. Such a definition raises the threshold and predicts less affordability than the previous one. In their 1994 study, Wiener, Hixon Illston, and Hanley assumed that long-term care insurance is not affordable for individuals who need to spend more than 5 percent of their income to buy it. Based on this rather extreme assumption, they predict that private long-term care insurance would be unaffordable for 70 percent of the US population.

As we can see, these two definitions of affordability yield very different results: between 25 percent (Kim 2009) and 70 percent (Wiener, Hixon Illston, and Hanley 1994) of individuals cannot afford any long-term care insurance. The results also have extremely different policy implications. If affordability is an issue for only 25 percent of the population, the obvious public intervention is redistribution — that is, make the rich pay higher premiums to subsidize the poor. But if as many as 70 percent of individuals cannot afford private insurance, no such subsidization can take place. In this case, the only practical intervention is to lower the average cost of long-term care insurance. Even the very stringent definition of affordability suggested by Wiener, Hixon Illston, and Hanley (1994)18 fails to explain why only 10 percent of Americans buy long-term care insurance, while 30 percent could afford it. This suggests that factors other than affordability are at play. Cohen, Kumar, and Wallack (1993) compared insurance purchasers with nonpurchasers, and their results confirm this: they found that purchasers and nonpurchasers have the exact same distribution of income and liquid assets.

A more compelling explanation as to why individuals do not buy long-term care insurance is that the price of insurance is too high relative to the value they derive from it. The problem is not the affordability of insurance but the fact that it is overpriced: individuals could afford it but do not buy it simply because the satisfaction they derive from being insured is lower than what they are being charged. Private long-term care insurance is overpriced because insurers need to charge high loading fees (amounts in excess of the expected loss) to cover not only the administrative costs of insurance, but also a variety of factors particular to long-term care insurance that lead to market failures. These market failures are described below.19

Moral hazard occurs when individuals who bought insurance against a given risk behave differently than they would have without insurance by, for instance, using more services than needed. To compensate for the additional costs due to behavioural changes among the insured, insurers set higher premiums, such that the price for insurance may then exceed what individuals are willing to pay.

Moral hazard has been documented for acute-health-care insurance but does not apply well to long-term care insurance, for two reasons. First, for acute health care, one doctor assesses the needs of a patient and provides the treatment accordingly. As health professionals, doctors’ main incentive is to provide high-quality care, as opposed to the most cost-effective care; as such, they are prone to overestimate their patients’ needs. But for long-term care, the assessment team sent by the insurance company is not directly involved in the provision of care and has no incentive to inflate diagnostics or payouts for insured individuals.

Second, dependent individuals prefer informal care over formal care, and they also prefer formal home care over formal residential care. The more expensive services are not perceived to yield higher quality; they are, instead, a last-resort option. Being insured does not therefore provide an incentive for the dependent person to use more expensive forms of care services. That said, it is conceivable that the children and other relatives of dependent individuals would not want to provide care to them if they were insured, simply because there is an alternative that can spare them the time and effort of doing so (Pauly 1990). But this does not seem to be the case. Grabowski and Gruber (2007) show that, in the US, individuals do not increase their consumption when they have to pay less out-of-pocket to obtain long-term care services and that demand for nursing home care is not sensitive to price. In addition, Pezzin, Kemper, and Reschovsky (1996) show that, when a generous public program of home care is offered, the elderly are more likely to stay in their own homes, rather than live with their children or in a nursing home. Their results indicate that dependent individuals use the resources at their disposal, whenever available, primarily opting for the cheaper option — which is to stay in their own homes. Overall, then, the empirical evidence suggests that moral hazard is not a major issue for private long-term care insurance.

Adverse selection can be described schematically as follows. Within the population, one group has a higher risk of living in a given situation (e.g., in a state of dependence) than another group. Individuals do know to a certain extent which group they belong to (whether they are a high insurance risk), but insurers do not. Insurers are not in a position to identify individual levels of risk and to adjust their premiums accordingly. They can calculate premiums only for the average level of risk in the pool of individuals selecting their plan, such that lower-risk individuals have to pay more than their own actuarial premium. Some of the lower-risk individuals will then consider the insurance overpriced and leave the pool. When they do, the average level of risk in the pool increases and premiums must be raised for the remaining insured parties. Because low-risk individuals tend to opt out in greater proportion, the average level of risk in the risk pool is higher than it is for the population as a whole, and the price of insurance is higher on average than it would be if insurers could calculate risk-adjusted premiums. Insurers might try to address adverse selection by administering medical questionnaires and screening or by offering alternative plans to low-risk individuals, but this would increase their administrative costs.

In the case of long-term care insurance, individuals are likely to have information about their risk of becoming dependent that is not fully available to insurers (for instance, they might know about their own health-related behaviour or whether their parents and other relatives suffered from diseases with a genetic component). In addition, insurers are not always in a position to make them reveal this information. Individuals thus not only know more than insurers about their personal risk, but they actually use that privileged information in deciding whether or not to purchase an insurance policy. Oster et al. (2009) studied a population at risk of developing Huntington disease. This condition typically starts developing between age 30 and 50 and involves a degenerative process lasting some 20 years, leading to disability and death. It is therefore a high risk for long-term care insurers. The authors showed that whereas take-up of long-term care insurance is 10 percent in the general population aged 50 and over, it is 25 percent among those with a parent who had Huntington disease and who therefore have a 50 percent chance of carrying the gene.20 In a nutshell, there is a strong possibility of adverse selection in long-term care insurance.

Two recent studies seem to contradict the adverse selection thesis, as they found no correlation between the purchase of a policy and individual awareness of risk of becoming dependent (Finkelstein and McGarry 2006; Cutler, Finkelstein, and McGarry 2008). But according to these studies, the reason for this is not that adverse selection does not exist, but rather that it is offset by propitious selection. Risk-averse individuals tend not only to buy more long-term care insurance than other individuals, but they also tend to take better care of their health. Risk-averse females are more likely to have Pap smears and mammograms, and risk-averse males are more likely to have prostate tests than are their non-riskaverse counterparts. Both groups are also more likely to take flu shots and to have their cholesterol levels monitored (Finkelstein and McGarry 2006), and to abstain from smoking or drinking alcohol (Cutler, Finkelstein, and McGarry 2008). As a result, even if risk-averse individuals represent a higher-than-average risk of dependence at age 65 and are more likely to purchase insurance (as predicted by adverse selection), such individuals are also likely to take better care of their health than others and will eventually become a lower risk later on. This is how adverse selection is offset by propitious selection.

In a nutshell, causes other than adverse selection help explain the low take-up of long-term care insurance in the US market, since it is offset in part by propitious selection. Oster et al. (2009) suggest that in the coming years progress in genetic testing will yield more private information and lead to even more adverse selection. Adverse selection could then become widespread enough to no longer be offset by propitious selection.

Long-term-care insurance requires a financial commitment over a long period of time. With some exceptions, policies are typically purchased several years before benefits are claimed, and a number of policies are terminated before any benefits are claimed. Policy lapses have been documented by three sources in the US, which is the only market for long-term care insurance from which useful observations can be derived. The Society of Actuaries (2002) found that 12 percent of policies are dropped in the first year, followed by a dropout rate of 6 to 8 percent in subsequent years. Only twothirds of policies are kept over five years, and only half of policies are kept after ten years. Finkelstein, McGarry, and Sufi (2005) used a retrospective question from the Health and Retirement Survey among respondents who had bought long-term care coverage. Of 3,649 respondents, 987 (27 percent) had dropped a policy over the course of five years. McNamara and Lee (2004) used the same survey to find out how many people who had held a long-term care insurance policy in 1996 still held one (not necessarily the same policy) two years later: 442 of the 700 who had policies in 1996 still had coverage in 1998, yielding a 37 percent lapse rate over two years. While the extent of the phenomenon is not fully understood, it is well established that keeping a long-term care insurance policy for five years or more is a financial challenge for approximately one-third of individuals who purchase one and that the attrition rate does not abate after five years.

Lapses are wasteful for individuals, because premiums are never redeemed and insurance policies therefore have no surrender value. But why do individuals buy insurance and then drop it in such large numbers? Finkelstein, McGarry, and Sufi (2005) show that those who drop their policies are less likely to use a nursing home later in life than those who keep their policies. This suggests that some individuals buy insurance when they are relatively young, fearing that they might be at risk of becoming dependent. They keep the policy for a few years but stop paying premiums when the information they gain about themselves as they age allows them to conclude that their personal risk of becoming dependant is low.

The main consequence of insurance policy lapses by those who perceive they are at lower risk is that they lead to what is called “reclassification risk,” or “premium risk,” for those remaining in the pool. Because of the frequent lapses in premium payments, insurers cannot offer any protection against reclassification risk (and higher premiums) to those who are insured. Contracts do not usually guarantee that premiums will remain the same in the future if the contract-holder’s health status (or risk of dependence) changes and the probability of joining the high-risk category in later years of life is substantial. According to Finkelstein, McGarry, and Sufi (2005), 33 percent of those aged 75 years old and over are high-risk and ineligible to buy long-term care insurance.

The reclassification risk defeats the very purpose of insurance, which is to reduce uncertainty. People who become high-risk over the years will face hefty premiums, even if they are already covered. Purchasing a policy at age 65 clearly does not make much sense if the uncertainty related to the probability of becoming a higher risk later in life is not covered. Reclassification is a standard failure of private markets in long-term care insurance, although the economics literature does not provide evidence as to whether individuals do opt out as a result of reclassification.

The cost of one unit (one hour) of formal care is expected to increase steadily from year to year in the future. Future costs represent a systemic risk for long-term care insurance in particular because of the time lapse between premium collection and payout time. As discussed in more detail in the appendix, long-term care is labour-intensive, and the cost of labour in wealthy countries tends to increase faster than GDP, which puts pressure on long-term care costs. Longterm care also relies on technology, and its projected cost depends on technological progress. Even though some technological innovations provide substitutes for human labour, most of them complement it. That is, they make it possible to perform something new or different. Innovations thus tend to multiply the equipment, electronic devices and costs required for each dependent patient. Moreover, they generally require better-skilled, more specialized human resources. Whereas technology can improve the quality of long-term care and make it more efficient, its progress also pushes up the average cost of long-term care for a dependent patient.

In a standard insurance situation (e.g., medical insurance), total payout for a risk pool is relatively predictable: only some individuals will need to draw from the pool in a given year. The law of large numbers and cross-section variations within a risk pool are such that the insurer is in a position to redistribute the random consequences of a known risk when a risk pool gets large enough. In the case of long-term care insurance, the insurer faces an additional systemic risk, as total payout for claimants will depend on the unknown cost of long-term care in future years for a given cohort.21 As a result, the insurer is not in a position to redistribute the random consequences of a known risk.

One solution is to pool across cohorts. If there is risk variance across cohorts, insurers could diversify the risk by pooling them such that they would subsidize each other. The risk faced by the insurer would then decrease directly in proportion to the number of pooled cohorts. Unfortunately, this would hold only if risks were independent across the cohorts: if some cost more and others cost less, pooling them would reduce total variance. But if all future cohorts tended to cost more per dependent individual than the present cohort, pooling them would not solve the problem of variance over time. Research by Cutler (1996) using data on the average cost per day reimbursed by Medicare in the US,22 together with various medical-care price indexes, showed steady increases in the average cost of formal care from year to year. As a result, insurers are not able to reduce the risk by pooling across cohorts and enrolling individuals of various ages in the same pool.23

In order to minimize the systemic risk of long-term care insurance, insurers will want to either restrict benefits or charge high premiums. In the first case, they may want to replace the standard coverage of treatment — as is typical in health care insurance, for instance — with fixed cash indemnities that are the same irrespective of the actual cost of care. In practical terms, when they become dependent, the insured receive a lump sum of money as opposed to coverage for the care costs they actually incur. The insured — not the insurer — then bears the systemic risk of longterm care cost increases. Cash indemnities may be based on long-term care costs that seem reasonable at the time the insurance is purchased, but with the escalation of care costs over the years, the indemnities may be considerably less than the average cost of care when the insured makes a claim.

In the second case, insurers may want to charge loading fees that exceed their expected loss. Cutler (1996) found that loading fees represent about 50 percent of the actuarial premium for long-term care insurance policies,24 as compared to 25 to 30 percent, on average, for acutemedical-care insurance policies. Again, potential buyers might avoid such insurance, because they would consider the premiums to be too high.

To sum up, the systemic risk inherent in the long-term care insurance market is clearly the most plausible and most satisfactory explanation reviewed so far. Insurance take-up is low mainly because insurers do not cover the full financial risk of long-term care, or they do so only at a price so high that insurance becomes overpriced and potential buyers are not interested.

A rival explanation challenges the systemic risk thesis. It is based on the observation that not all contracts are overpriced; that insurers do, in some instances, offer generous coverage; and that purchasers typically choose to buy very restrictive policies (Brown and Finkelstein 2007).25 The vast majority of Americans do not buy private long-term care insurance, and the minority who do are unwilling to purchase generous coverage, but this situation is not primarily a result of systemic risk. It stems from the fact that private insurance has been “crowded out” by the availability of public coverage for catastrophic expenditures. The argument is that, with the presence of a means-tested public scheme, individuals commonly assume that a Good Samaritan (the government) will come to their rescue if they need formal care, and as a result, they have little incentive to purchase private long-term care insurance. In the United States, almost two-thirds of long-term care expenditures are publicly covered. While Medicaid is the main mechanism for providing care, Medicare also plays a marginal role in public coverage. The two institutional characteristics of Medicaid are that (1) it pays for long-term care only when beneficiaries have spent down their assets and (2) it tops up benefits received from any other source whenever such benefits are insufficient to cover the costs incurred by beneficiaries.

The following scenario illustrates how Medicaid operates. Beneficiary A receives an annual indemnity payment of $35,000 from his/her private insurance to help cover the costs of a nursing home, which amount to $50,000. A’s assets are $26,000, well above Medicaid’s threshold of $2,000.26 In the first year, A will therefore need to spend $15,000 to pay for the nursing home in addition to what he/she receives from the insurance, and Medicaid will not pay anything. Medicaid will not begin payments until the following year, and then only after A has spent the remaining $9,000 of his/her assets (above the $2,000 threshold). Policy-holders know that, had they not subscribed to private insurance, they would have had to spend their assets down to $2,000 from the very first year but that Medicaid would have paid the remaining $26,000 (the $50,000 annual cost of the nursing home minus the $24,000 paid by the insured) for that year and everything afterwards. In such a case, Medicaid effectively taxes private insurance benefits at a rate of 100 percent. Similarly, for those with no assets but with an income of $25,000 a year, the insurance benefit, together with the insured’s income, will more than cover the full cost of the nursing home, and Medicaid will not pay anything. Again, Medicaid is effectively taxing the private insurance benefit of the insured at a rate of 100 percent.

Brown and Finkelstein (2008) developed a model in which a rational 65-year-old individual makes consumption/savings choices for his/her remaining years of life, taking into account the fact that a public catastrophic insurance plan will pay for any necessary long-term care if his/her income is below a defined level. The authors show that the existence of a public catastrophic insurance plan gives rise to a significant opportunity cost for such an individual. If the individual is not privately insured, he/she will simply have to spend down his/her assets before enjoying free coverage from Medicaid. But if the individual has paid for private insurance, he/she will have to forgo the benefit of free coverage. This may be enough of an incentive for individuals not to purchase private insurance, a phenomenon known as the “crowding-out” effect.

This opportunity cost effectively increases the cost of buying private insurance for individuals. Together with other market failures (systemic risk and insurance policy lapses), crowding-out clearly helps explain why only 10 percent of Americans are willing to pay for private insurance. Such behaviour, while rational, is detrimental to individuals’ welfare. In the absence of a Good Samaritan, more Americans would indeed purchase private insurance and would be better off, as they would be able to keep their assets, which is not possible under Medicaid.

Brown and Finkelstein (2008) simulate a situation where the problems of loading fees due to systemic risk and to risk-averse insurers are resolved and the only problem remaining is the Good Samaritan plan. Their simulation indicates that in such a case the demand for long-term care insurance would increase to almost 40 percent. Another simulation, removing market failures and the Good Samaritan plan, indicates that the market share of private insurance would reach 100 percent. In other words, when there is no public program of last resort to cover catastrophic expenditures, all individuals are willing to buy insurance.27 It is obvious, then, that the crowding-out effect due to the presence of a Good Samaritan plan explains a substantial part of the low take-up of private long-term care insurance in the US.

Brown, Coe, and Finkelstein (2006) use the variation in Medicaid’s asset thresholds for couples, which ranged between $16,824 and $84,120 across American states in the year 2000, to show that a $10,000 decrease in the threshold would increase the proportion of couples with long-term care insurance by only 1.1 percentage points (from 10.3 to 11.4 percent). In addition, if all states were to use the most stringent threshold, $16,824, the proportion of couples buying private insurance would increase to only 13 percent. Clearly, even significant decreases in the thresholds yield only modest results.

Let’s sum up the main explanations for the low take-up of private long-term care insurance. We have seen that a fundamental characteristic of long-term care insurance is the lapse of time between premium collection and payouts. This time lapse entails a systemic risk that private insurers cannot spread across cohorts, so they compensate by restricting coverage and by charging high loading fees. This, in turn, makes private insurance policies overpriced and unattractive. Research also shows that individuals do not buy private insurance even though they would be better off with it, largely because it is subject to a very high implicit tax rate due to public coverage of catastrophic long-term care costs. This indicates that programs of last resort cannot coexist with a private insurance market. Consequently, we are left with two options for longterm care insurance: a regulated private insurance market without public programs of last resort (that is, without a Good Samaritan plan), and social insurance.

The first option — a private, regulated insurance market with no public program of last resort — would require governments to correct the many significant market failures that we have described above. They would need to impose mandatory coverage, to ensure that all individuals contributed to a pool from early on, and that they continued to do so throughout their adult life. In addition, governments would need to subsidize those who could not afford premiums, in order to ensure that no one was left without coverage. They could do this partly by redirecting budgets currently allocated to existing public programs for long-term care services. However, given the very large number of individuals who would require a subsidy, governments would also need to raise new taxes or secure other sources of revenue. As private insurers would likely want to exclude high-risk individuals because of their health status, governments would also need to make it mandatory for insurers to accept anyone who wanted to purchase a policy. Finally, government legislation could also forbid prescreening and the use of acute care services as criteria to set premiums; and it could regulate private insurers to set uniform premiums based on a limited list of observable characteristics, such as age, gender and geographic area. While a regulated private market would require that governments significantly alter the rules of the private market to correct failures, doing so would also restrict the ability of insurers to compete and to offer better quality services at lower costs.

In addition, this option would require that governments terminate existing public programs for long-term care. If applied to Canada, it would entail abolishing the three alternatives to private long-term care insurance: the needs-based funding and services currently offered by provincial and territorial governments for residential care and home care services; public funding for services offered by voluntary/third-sector agencies (Meals on Wheels, home help services, etc.); and public hospital care, Canada’s program of last-resort for individuals who require care services. Needless to say, most Canadians would consider this option an extremely radical departure from the current state of affairs. Given the radical adjustments required and the inefficient outcomes of a regulated private insurance market, the second option — social insurance — is the preferred option.

Social insurance, by definition, addresses the main market failures associated with private longterm care insurance such as reclassification risk, systemic risk and crowding-out. A single-payer, universal public insurance plan would eliminate the reclassification risk and ensure that the pool of insured is sufficiently large to effectively distribute the systemic risk among them. Such a plan would also involve lower transaction costs and loading fees, so contributors would pay less for coverage than they would under private insurance. Overall, social insurance would be a more cost-effective option than private insurance.

The possible establishment of a public insurance scheme for long-term care in Canada raises five core issues for public debate: (1) Should the scheme be financed out of general revenues or through an earmarked fund? (2) Should it be open-ended or should it have a fixed envelope? (3) How should revenues be collected and on what basis (income, consumption, flat-rate premium, risk-adjusted or not)? (4) Should it provide full or partial coverage? (5) Should it be pay-as-you-go (PAYGO) or funded? Although the economics literature does not always provide answers specific to the case of long-term care insurance, classical treatises on taxation and public insurance are applicable.

A public insurance scheme can be financed either through general revenues (as in the case of the Old Age Security program) or through a segregated fund in the public accounts (as in the case of the Canada Pension Plan/Quebec Pension Plan). The second option entails governments collecting earmarked contributions, allocating the revenues generated to a dedicated fund and spending the accumulated sums only for purposes specified in the plan. Mainstream economists have argued that taxpayers respond more favourably to earmarked contributions (Musgrave 1959; Buchanan 1963; Goetz 1968; Browning 1975), because this way they are assured that their contributions are allocated to public coverage of a given risk and will not be used for other purposes that they may find questionable (e.g., supporting welfare recipients or financing wars). According to this view, earmarked taxes or levies are better protected against political changes and do not affect work incentives as much as general tax increases. The main drawback, as McCleary (1991) pointed out, is that segregated funds increase the risk of resource misallocation. In a situation where there is a surplus in the earmarked fund at a time of a deficit in the general budget, the author argues, the government would need to borrow money, at a cost, whereas if the scheme was financed through general tax revenues, it could use some of the surplus instead, at no cost.

In an open-ended scheme, the government pays as much as is needed to cover the cost of claims and increases the contribution rate to make up for any deficit. By contrast, in a fixed budget, spending cannot exceed the amount of contributed funds, irrespective of the cost of benefits claimed. With this kind of funding, the services covered may need to be rationed or costs may need to be reduced. Wiener, Hixon Illston, and Hanley (1994) suggest rationing through partial coverage: when demand exceeds the prebudgeted fund, more copayments are left to the patient. The rationale for a fixed-budget insurance scheme is to minimize the variability of the insurer’s liability. Such a scheme would cover a risk in the future, as it is seen today, without projecting any price increases (inflation), additional costs due to technological innovations or increases in dependency probabilities. This may make sense in a private market, where insurers cannot cover systemic risk (Cutler 1996). But it is inappropriate for a public insurer, whose main raison d’eÌ‚tre is precisely to be neutral with regard to systemic risks and to ensure that everyone obtains sufficient coverage of future care costs. If the insurance scheme is to be a public one, it should be open-ended.

The literature on taxation and public finance emphasizes three principles to help determine the basis for, and forms of, revenue collection for a social insurance scheme: ability to pay, expected benefit, and behavioural neutrality. The first two principles are about fairness and help determine who ought to contribute and how much. The third is about efficiency and helps determine which form of revenue collection (premium, sales tax, income tax, payroll tax, estate tax or tax on bequests) will minimize behaviour distortions and help avoid negative welfare impacts.

The two fairness principles, ability to pay and expected benefit, coincide in some social insurance schemes that provide income transfers. With the Canada and Quebec Pension Plans, for instance, everyone contributes a share of their income and receives a fraction of it at retirement. But in the case of in-kind transfers such as for health care and long-term care services, these two principles have a different logic: the ability-to-pay principle requires that contributions be proportional to income, while the expected-benefit principle requires that those who will benefit the most from the services provided contribute more to their funding.

An extreme application of the expected-benefit principle would be a risk-adjusted tax, but it is generally accepted that risks that are not under the control of the individual should not be included in the tax base. For instance, even though women are more likely to need formal long-term care, few economists, if any, would argue that their contributions should be higher. There is less agreement as to whether individuals presenting risk factors such as obesity should pay higher contributions. At the other end of the spectrum would be a flat premium (or poll tax) whereby everyone would contribute a fixed amount independent of risk or ability to pay. This solution raises issues of equity and affordability, as the poorest individuals would not be able to make a contribution without jeopardizing their consumption of essential goods and services.

Wiener, Hixon Illston, and Hanley (1994) propose yet another application of the benefit principle to long-term care insurance. Because long-term care insurance protects an individual’s assets, the authors have suggested that such a scheme be financed through a tax on the value of assets bequeathed after death. Their idea, however, relies on two wrong assumptions: (1) individuals want to, and do, leave assets behind (Hurd [1987] showed that this is not generally the case) and (2) long-term care insurance does not benefit individuals with no assets. In addition, a tax on housing or capital gains at death is not neutral: just as a tax on income can discourage individuals from working, a tax on housing or capital gains can deter individuals from saving and investing.

Taxation causes changes in behaviour among individuals who may seek to avoid it by working shorter hours, retiring younger, saving and investing less, and consuming differently than they would have otherwise. This is why economists (since Musgrave 1959) tend to favour sales taxes, which are more behaviourally neutral than taxes on earnings or on capital gains. And while sales taxes are less linked to ability to pay than are income or capital taxes, they are still preferable in that respect to a flat-tax premium. Indeed, wealthier individuals consume more in absolute value, albeit less as a share of their income (McIntyre et al. 2003).

Partial coverage means that dependent individuals needing long-term care services would be faced with copayments or deductibles. A long-term care insurance scheme that provided partial coverage with deductibles (called back-end coverage) would cover stays exceeding a fixed duration (say, over one year) or services associated with needs above a certain basic level (Garber 1995). The standard justification for back-end coverage is to discourage individuals from making insurance claims for sums of money that are of lower value than the costs of administering such claims. In the case of long-term care, back-end coverage could be justified as a way to discourage claimants with minimal needs or those who need long-term care for only a short period of time. While having needs assessed by a multidisciplinary assessment team (composed of professionals such as doctors, nurses, social workers, psychologists and physiotherapists) entails high administrative costs, these remain small relative to the cost of long-term care services. However, individuals do not know in advance how much care they will need and for how long they will need it. Therefore, deductibles do not make sense for public long-term care insurance.

An insurance scheme with copayments would provide only partial, front-end coverage and exclude catastrophic expenditures. It would likely cover a portion of the costs for the first years in a nursing home, up to a maximum, and provide no coverage for additional costs or time in long-term care. Copayments are usually applied to prevent overuse but result in substantial welfare loss. For instance, they do not reduce uncertainty, as individuals remain vulnerable to catastrophic expenditures. Copayments are thus not a suitable option for public long-term care insurance, especially since moral hazard is either limited or unlikely to occur. In addition, partial coverage with copayments leads to inefficient utilization of care services. Indeed, when selecting providers and treatment options, patients buying individual services are likely at a disadvantage in comparison to insurers that buy bulk services. In addition, with more limited information about their possible care options, patients might not be in a position to use welfare-enhancing alternatives such as continuing-care retirement or life-care communities, which could reduce total costs in the long run (Garber 1995).

In a funded plan, contribution levels are calculated in such a way that the funds will be sufficient to cover liabilities, given assumptions about interest rates. In a PAYGO plan, the value of the fund in a given year is used to cover expenditures of that same year. If future needs are greater than current needs, the contribution rate is raised. This is certainly the issue that has generated the most debate in the economics literature, which tends to favour a funded plan. There are four arguments or principles that favour a funded plan: greater intergenerational equity, better sustainability, reduced uncertainty and increased savings rate. Each of these is reviewed and discussed below.

First, a funded plan is deemed equitable in the context of an aging population in that each generation pays for its own costs as opposed to having smaller, younger generations pay for larger, older ones. It starts from the observation that, within the PAYGO scheme, baby boomers reaped the economic and financial benefit of having raised fewer children and are now transferring to a smaller generation the cost of supporting them in old age (Lassila and Valkonen 2004).

There are two objections to the intergenerational equity argument. First, a long-term care scheme does not benefit only elderly dependent people. It also benefits their children, who are then spared some of the burden of providing informal care. However, this is not a very compelling argument since, as described above, informal care is usually provided when possible, even when financial coverage for formal care is also available. Second, as suggested by Muellbauer (1992), assessing intergenerational fairness cannot be restricted to transfers or payments for health and long-term care. If economic growth continues at the same pace as in the past (approximately 1.5 percent per year for real GDP per capita), younger generations will be substantially richer (over their lifetime) than were their predecessors, and there is therefore no compelling reason why each generation should contribute an amount equal to the value of the benefits it receives in an age-related insurance scheme. The same argument holds for longer life expectancy: younger generations will enjoy longer lives, and fairness could require that they contribute to older cohorts’ well-being as well. Baldini and Beltrametti (2006) suggest a different way to address intergenerational equity concerns. They argue that any PAYGO scheme will generate a windfall profit for the first generations of beneficiaries, since they can claim benefits without having contributed at all. A purely equitable plan would take 85 years to phase in, which would not be very efficient. Based on (certainly extreme) recent Italian demography (very rapid aging of the population and low fertility rates), the authors show that imposing a 30 percent copayment rate over the first 20 years (the proceeds of which would be set aside in a fund) would be sufficient to spread the initial windfall profit across generations.

A variant of a funded public scheme was proposed and rejected in the US in the 1980s. According to this proposal, an extension of Medicare was to be financed through a flat-rate tax applied to the elderly population, in order to provide some nursing home care (Medicare Catastrophic Coverage Act 1988). Even though the leadership of the American Association of Retired Persons (AARP) was in favour of the tax and the Medicare extension (Garber 1995), the backlash came from middle-class seniors, who were to pay a surtax to subsidize those too poor to pay the flat rate.

Finally, it should be noted that a fully funded insurance scheme would prevent the public insurer from pooling cohorts, therefore bringing us back to the problem of systemic market failure of long-term care insurance described above. This means that funding should be partial at most: the risk of systemic increases in the cost of long-term care should be spread across cohorts PAYGO, while the demographic risk linked to changing sizes of cohorts should be actuarial at the cohort level (Cadette 1998).

Demographic change is such that governments must ensure that insurance plans can be financially sustained over time, especially since baby boomers will massively claim benefits at a time when, due to cohort sizes, there will be fewer contributors left (Auerbach, Gokhale, and Kotlikoff 1991, 1992). The MeÌnard Commission predicted that in Quebec, due to the province’s demographics, contributions to a PAYGO public insurance scheme for long-term care would have to increase 40-fold between 2000 and 2050, from $20 to $800 per individual aged 20 and older (MeÌnard 2005, 88). A PAYGO system thus raises concerns of sustainability.

A funded plan is more sustainable than a PAYGO scheme: surplus money would be collected now for later use and the fund surplus would help smooth the increase in the amounts needed to pay for long-term care in the future. Calculations for the Spanish population made by Costa-Font and Patxot (2004) indicate that perfect smoothing (a fully funded plan) would require doubling the contributions paid today (thus allowing the contribution rate to remain constant over time). In Canada, this would amount to increasing the contribution to a long-term care insurance plan if it existed today from 1.4 percent of GDP to 2.8 percent, half of it being spent for current needs and the other half being saved in a fund to cover future liabilities.

This being said, a fully funded plan is not warranted from an economic perspective. Barro (1979) showed that the opportunity cost of a tax grows faster than the tax rate itself: a rate of 2 percent is more than twice as onerous as a rate of 1 percent. As a result, a constant rate of taxation of 2 percent over 20 years is preferable to 1 percent for 10 years followed by 3 percent for the next 10 years. Barro also makes it clear that the most important issue is not equalizing marginal tax rates across generations (that is, ensuring that all generations pay the same marginal tax, irrespective of their income levels), but equalizing the marginal cost of the tax for all periods (so that it would require a similar effort by each generation, taking their relative income level into account). To put it another way, if future generations are expected to be wealthier than current ones, the same marginal tax rate applied to a future generation with higher incomes would be less of a burden than when applied to the current generation. Ensuring the sustainability of the fund in an equitable manner therefore depends on factors other than simply equating tax rates across generations. How much higher the future tax rate may be remains an empirical question, but perfect smoothing (i.e., through a fully funded plan) is nevertheless not warranted from an economic perspective.

PAYGO schemes create uncertainty because individuals must take into account a complex demographic environment in order to predict how much they may need to contribute to the insurance scheme in the future. Risk-averse individuals want protection against that uncertainty. However, a fully funded plan is not necessary to reduce uncertainty (Cadette 1998). It is argued that a funding mechanism with permanent rules, based on information concerning future age distributions, could do just that by decreasing exposure to systemic risk (Lassila and Valkonen 2004).

The increased savings rate argument contends that a PAYGO scheme is pure spending, while a funded plan can increase the savings rate in the economy. According to this view, accumulated surpluses would increase the savings rate, which would in turn yield a higher GDP growth rate and make long-term care more affordable in the future (Saving 2000). Two conditions need to be met for this to work. First, the fund must be protected from being used for anything other than future long-term care (e.g., to offset the budget deficit on other programs). Second, funds must be used to buy private bonds, as opposed to government bonds. Government bonds would indeed create future liabilities, and their redemption would negatively affect public finances. A fund invested in government bonds would generate an increase in tax rates in the future and would then be no different from a PAYGO scheme. Even if these conditions were met, it is not certain that a fully funded plan would increase aggregate savings. If households had perfect foresight, they would anticipate the rise in taxes in the PAYGO scheme to cover future generations, and save today to prepare for those future tax increases. There is still some dispute concerning whether or not households are that rational and able to predict the future. Assuming they are not, the savings rate would increase if long-term care was funded, rather than being paid for through a PAYGO scheme.

As Miyazawa, Moudoukoutas, and Yagi (2000) show, this argument is equivalent to the one developed by Aaron (1966), known as the Aaron-Samuelson model, according to which funded solutions are better in economies where the interest rate is greater than the sum of the population growth rate and the productivity growth rate, but only in such economies. Much of the literature recommending moving away from PAYGO schemes in general (for pensions, for instance) dates from the 1990s, when these conditions held, and a common view arose that funded plans are better. But the coming four decades will be characterized by an aging population and lower rates of return on capital. Therefore, funded solutions cannot be expected to offer the same advantages as they have in the past.

Miyazawa, Moudoukoutas, and Yagi add to the Aaron-Samuelson model a specific feature of long-term care insurance. In the Aaron-Samuelson model, individuals can only consume or save, but Miyazawa and colleagues argue that, when individuals are still young, they can also invest in their health capital. Investment in health capital by young individuals decreases the risk of becoming dependent. If all members of a generation did invest in their health capital when young, insurers would experience increases in the rate of return on premiums and individuals would reap the benefits of their investment in the form of lower insurance premiums later on. However, individuals would have no incentive to invest in their health capital if their only motivation was to reduce their insurance premiums later in life, because such an investment would not financially benefit them personally as much as it would their risk pool (in the form of lower premiums). Investors would reap only a portion of the financial benefits from their personal investments because the benefits would be redistributed within the group, and it is unlikely that everyone else in the pool would have made the same investment.

Miyazawa, Moudoukoutas, and Yagi then add another assumption: time in the first period can be allocated to labour or investment in health, and all health investment comes from time (i.e., time taken for physical activity, for sleep, for preparing healthy meals, etc.). A PAYGO scheme imposes a tax in the first period; this decreases the rate of return on labour and makes investment in health more attractive than a funded scheme.

This model is theoretical, and it relies on many assumptions. Therefore, its conclusion — that PAYGO schemes are better than funded ones from both a macroeconomic management and an individual welfare perspective — must be viewed with caution. However, the model introduces the very important notion that a transfer attached to long-term care is not simply an income transfer from the young to the old or from the healthy to the sick. A transfer attached to long-term care is also a productive expenditure aimed at producing health.

This argument is similar to one of Muellbauer’s (1992) objections to the generational accounting framework. According to Muellbauer, if public spending is not just pure consumption but also entails an investment motive, the condition of actuarial intertemporal budget constraint may not hold. What we therefore need to know is the relative benefit derived from the growth in GDP generated by (1) investing one dollar in the general economy by raising the savings rate (Saving 2000) and (2) investing the same dollar specifically in the long-term care industry. Investments in long-term care can yield positive returns in the future, either through improvements in health or in our systemic ability to produce long-term care at a lower cost in the future. The first point (return on investment in long-term care in terms of better health) has to do with the preventive aspect of long-term care: does it slow down the process of failing health and disability? The second (return of investment in improved productivity) has to do with the effect of insurance on technical innovation in long-term care: do we observe in long-term care what is now documented in acute care — that insurance funding generates R&D and supports innovation?