With multilateral trade negotiations stalled, a sluggish recovery in the US and resurgent growth in emerging markets such as India and China, the strategic question of whether to focus Canadian trade policy on deepening trade ties within North America or more actively seek markets elsewhere has become more pressing. Some argue that geography and size mean that the lion’s share of trade benefits will inevitably come from the United States, while others note that a continental focus ignores three-quarters of the global economy (much of it growing faster than North America) at its peril. Despite the claims of both sides, there is relatively little empirical evidence on which to judge them.

This study attempts to fill this void by comparing the economic benefits of implementing a North American customs union with those of increasing Canada’s share of trade with Europe and/or large emerging economies. Unlike more traditional analyses of diversification, Patrick Georges and Marcel Mérette’s study examines the potential effect of demographic trends in particular countries on Canada’s terms of trade, and shows that this effect is large enough to warrant consideration in trade policy development.

The benefits of deepening continental integration via a customs union (which would eliminate costly rules of origin and lower the cost of intermediate goods) are relatively small. Negotiating a customs union in the mid-1990s as part of replacing or upgrading NAFTA would have increased Canadian GDP by about 1 percent (about $15 billion in today’s dollars) per year. But if we were to do so today, the benefits would be less than half as large, mainly because multilateral tariff reductions agreed to in the 1990s have reduced the benefits of NAFTA preferences.

The economic benefits of diversification are potentially larger than those of deepening North American integration, so long as partners are selected carefully. Canada should build up trade links with nations with relatively young populations to take advantage of demographically driven improvements in its terms of trade as well as strong economic growth in those nations. Diversifying 10 percentage points of Canada’s trade from the United States to India, for example, would boost domestic consumption per capita by almost 5 percent in 2050 relative to its baseline level. Trade diversification to the European Union, on the other hand, could actually reduce consumption relative to the status quo.

The tough question is, of course, how to diversify trade. Georges and Mérette see this as a long-term proposition by which cultural ties, trust and networks can pave the way for trade missions and eventual preferential trade agreements.

As observed by Head (2007), Canada’s debate on trade policy typically centres on two questions, one strategic and one tactical. The strategic question is whether Canada should diversify its trade pattern away from the United States, or whether it should pursue deeper continental integration. The tactical question is how we should conduct our chosen strategy. Strategic and tactical questions are clearly nested. For example, Canada could engage more with the rest of the world through multilateral trade negotiations, formal preferential trade agreements (PTAs) with selected countries, ad hoc trade promotion (e.g., Team Canada missions) or a unilateral decision to reduce or eliminate trade barriers (Helliwell 2002; Dobson 2006; Head 2007). Canada could pursue deeper integration with the United States by reducing the burden of crossing the border, harmonizing regulatory procedures and standards, negotiating a common external tariff and customs union, simplifying NAFTA rules of origin, liberalizing the remaining restrictions on US direct investment in Canada and the movement of labour, and negotiating agreements to curb US trade remedy laws (e.g., Dobson 2002; Harris 2003; Goldfarb 2003; Hart 2007; Mandel-Campbell 2008; Georges 2010).

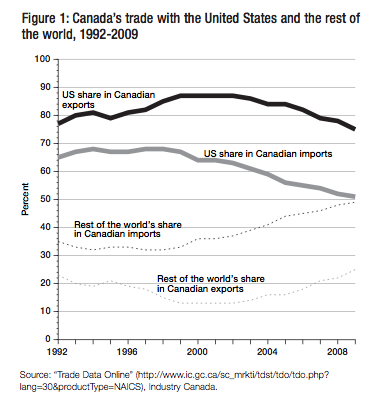

Figure 1 provides a convenient starting point for the strategic trade policy debate in Canada by illustrating trade with the United States as a share of total Canadian trade. The United States is Canada’s largest trading partner both as an export market and as a supplier. The strategic positions on Canadian trade policy are easily foreseen from this figure. On the one hand, some advocate an almost exclusive focus on the United States. For example, Hart (2007) claims that “more than ever, the two-way movement of goods and services across the Canada-US border is Canada’s economic lifeline” (429). He says, “Engagement with our southern neighbour is the indispensable foundation of any Canadian policy to maximize benefits from international trade and investments” (418-19). On the other hand, some politicians and commentators argue, often during US recessions, that the Canadian economy is too exposed to the US business cycle, that there is risk involved in having so many eggs in the American basket, and that alternative markets must be developed in order to diversify away from the US economy. This argument, which unsurprisingly gained favour at the start of the 2008-09 US recession, is far from new; there have been attempts to reduce Canada’s trade dependence on the United States by seeking closer economic links elsewhere. For example, in 1957, Prime Minister John Diefenbaker announced that Canada would shift 15 percent of its trade from the United States to Great Britain. In the 1970s, the Trudeau government searched for closer economic links with the European Community. Both initiatives failed to achieve their goals.

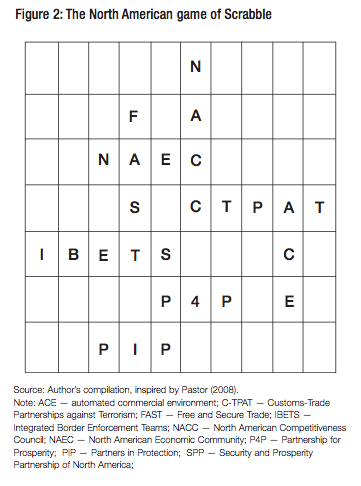

Many participants in this strategic debate about whether or not to diversify trade away from the United States typically dismiss, even mock, the proposals of others while predicting huge potential gains from their favoured option, without providing much in the way of empirical evidence. Indeed, empirical evidence is rare and, when it exists, it does not necessarily corroborate these claims. For example, much has been written about how deeper integration will further reduce the cost of cross-border trade and should theoretically increase access to North American markets and spur economic growth in Canada. But there are virtually no quantitative studies of how much incremental economic benefit would result from additional integration. Pastor (2008, 94) ironically refers to the “North American game of Scrabble” which, since 2001, has consisted of the leaders of Canada, Mexico and the United States meeting periodically to “spell new acronyms that purport to be initiatives,” and then promptly discarding them. (See figure 2 for some of these initiatives.) He notes that if one measures progress by examining the growth in trade, the reduction in wait times at the borders and the public support for integration, all of these initiatives have failed miserably. What is lacking, in Pastor’s view, is a North American vision “based on the simple premise that each country benefits from its neighbors’ success and each is diminished by their problems or setbacks.” Such a vision stimulates “a new consciousness, a new way of thinking about one’s neighbors and about the continental agenda [so that] Americans, Canadians, and Mexicans can be nationals and North American at the same time.” This vision of North America, according to Pastor, could evolve from a customs union and a common team of customs and border guards at the continental perimeters, thereby eliminating the costly and cumbersome rule-of-origin regulations and allowing all legitimate goods to move seamlessly across the borders. To do this, the three governments would need to negotiate a common external tariff.

Given the size and proximity of the United States, bilateral issues will always be on the Canadian policy agenda. However, as Head (2007, 446) points out, the important issue with respect to the strategic question and the best allocation of trade “negotiation resources” concerns our effort on the margin: “Would the allocation of more resources to deeper integration with the U.S. generate larger marginal net benefits than a similar resource allocation directed at broader integration with the rest of the world?” In his opinion, Canada cannot maximize its benefits from international trade by disengaging from the three-quarters of the global economy that is outside the United States. Helliwell (2002) also believes that, if faced with a choice between a globally oriented policy and one that has its primary focus on continuing efforts to harmonize policies with those in the United States, the decision is obvious, given that North America’s share of the global economy is destined to shrink. In response to this strategic perspective, the tactical approaches to trade policy in the past decade have been thinly spread among multilateral trade negotiations at the World Trade Organization (WTO), non-US bilateral or regional trade negotiations, and Team Canada missions to promote trade and investment across the world. But claims regarding the benefits of such efforts to diversify trade away from the United States are seldom backed by rigorous empirical analysis.

This study attempts to fill this void by estimating the economic benefits of implementing a North American customs union and comparing them to the benefits of increasing Canada’s share of trade with Europe and/or large emerging economies. Unlike more traditional analyses of trade diversification, our work examines the potential role of demographic changes on Canada’s terms of trade and shows that they are large enough to warrant consideration in the development of trade policy.1

Before we embark on the empirical analysis, it will be useful to provide the basic theoretical underpinnings of the major strategic options for Canada’s trade policy and their potential impact on trade diversification. Broadly speaking, there are three options: reduce trade barriers across a wide spectrum of countries (multilateral); deepen the existing North American Free Trade Agreement (NAFTA); and reduce trade barriers with a selected group of countries to encourage diversification away from the United States.

Perhaps the biggest single driver of trade in the post-World War Two period has been the steady drop in tariff rates negotiated through the General Agreements on Tariffs and Trade (GATT) and its successor, the WTO. These multilateral negotiations to reduce trade barriers across a wide spectrum of countries remain, in theory, the best way for Canada (and all other trading nations) to maximize the gains from trade.2 Furthermore, they remain a good tactic for a country to use to diversify its trading partners, as these negotiations can be viewed as a way to counter the trade-diverting effects created by PTAs, including NAFTA.

PTAs, which include regional and bilateral free trade agreements such as NAFTA and customs unions such as the first incarnation of the European Union in the 1960s, seek to reduce or eliminate trade barriers across member countries but to maintain them for nonmembers. The views on these PTAs have evolved throughout the twentieth century. During the 1930s, some nations used foreign trade to try to increase their power, by making other nations more economically dependent on them. Hirschman (1945) gives the following example:

Country B may have a comparative advantage in the production of a certain commodity with respect to country A, but not with respect to countries C, D, E, etc. If by some preferential treatment, A induced B to produce this commodity for export, A becomes B’s only market, and the dependence of B upon A may well be worth to A the economic cost involved in not buying in the cheapest market. (31-2)

The establishment of the most favoured nation (MFN) clause in the GATT, and then the WTO, which automatically extends to every member country the lowest tariff extended to any member, was meant to curb the ability of the more powerful market to create political dependence on its trade concessions. As stated by Heidrich and Tussie (2010), in adopting nondiscrimination as a pillar, the GATT system was viewed as a means of eroding trade dependence on imperial powers, while at the same time protecting the interests of smaller nations by curbing the ability of the more powerful countries to threaten suspension of trade preferences.

According to Bhagwati (2008), PTAs since World War II have not been motivated by these sordid views of the past, but instead reflect a deep misunderstanding of the critical difference between regional or bilateral trade preferences and genuine nondiscriminatory trade liberalization embodied in the WTO. For Bhagwati, “the current tide of [PTAs] has been the result of politicians mistakenly, and in an uncoordinated fashion, pursuing free trade agreements because they think (erroneously) that they are pursuing a free trade agenda” (11). When a PTA is formed and trade barriers are eliminated among members, the result is, of course, freer trade. But if the external barriers are left unchanged by the member countries, then the handicap suffered by nonmembers in the markets of the member countries increases.3 So PTAs are fundamentally discriminatory, which leads Bhagwati to suggest that in the current pandemic of preferential agreements we should more appropriately call the MFN tariff at the WTO the “least favoured nation” tariff!

Bhagwati believes that the cure for the PTA pandemic is to progressively reduce the MFN tariffs to zero, which would effectively eliminate the preferences in PTAs, and therefore make them worthless. Georges (2010) has shown that eliminating MFN tariffs multilaterally would permanently increase Canada’s real GDP by at least 1 percent (and probably considerably more).

All this suggests that Canada should not neglect the importance of multilateral rounds of negotiation at the WTO. Continued multilateral trade liberalization would increase trade between industrialized nations (including Canada) and emerging economies, given that the former generally have much lower MFN tariffs than the latter. Therefore, multilateral tariff reductions would obviate the need for PTAs between Canada and emerging economies to spur diversification.

However, given the structural impasse at the Doha Round, this tactic may prove difficult, if not impossible. The problem is the lack of political will and lobbying support. First, Hart (2007, 414) points out that Canada has found itself largely on the sidelines of the WTO negotiations, unable to contribute constructively, in part because Canadian politicians of all stripes, “convinced of the political weight of Canada’s farm lobby,…insisted that Canada make every effort to bring down trade barriers and subsidies on Canada’s exports, but not at the expense of supply management and the monopoly marketing of wheat and barley.” Second, as Bhagwati (2008, 87) puts it, “lobbies provide the foot soldiers in the battles to open trade.” To paraphrase him, lobbying money you spend on opening up the Indian market via a bilateral deal will, if successful, get the Indian market opened to you. But if you spend that same money in Geneva, opening up the Indian market on a multilateral basis, the benefits to you will be diluted by “free riders” from other countries who have not spent any money in support of this goal. Thus, the money is better spent on bilateral agreements.

NAFTA eliminated tariffs for continental trade, but each member country retains its individual trade and external tariff policies with respect to nonmember states. This gives an incentive for firms from nonmembers to export their goods to the member country with the lowest external tariffs and then transship to the final destination to take advantage of NAFTA’s preferential treatment. To avoid such “trade deflection,” NAFTA (and indeed all FTAs) have rules of origin which are designed to restrict the benefits of the preferential tariff treatment to products manufactured wholly or substantially within the PTA area. This assures that goods that are simply being transshipped or undergoing only minor transformations in a member country will not be deemed as originating in that country and will not receive preferential treatment when reexported to another member country.

Whereas an FTA requires preferential rules of origin to prevent trade deflection, a customs union does not. The core elements of a customs union are negotiation of a common external tariff with respect to nonmembers, a revenue-sharing agreement for the customs duties collected at the external border and harmonized external trade policies. Harmonizing external trade barriers with respect to nonmembers eliminates the incentive for trade deflection and transshipment, thus making rules of origin unnecessary: movements of goods within a customs union are not based on their “originating status” but on the principle of “free circulation.”4

Rules of origin are complex and costly to comply with. In NAFTA, there are three tests of origin: the change in tariff classification test (used most frequently), the value content test and the specific production process test.5 Chapter 4 and annex 401 of NAFTA contain about 200 pages dealing with rules of origin and the interpretation of these rules as they apply to particular products. Many studies have shown that rules of origin, while they eliminate trade deflection, also distort trade flows and reduce efficiencies in the production process. For example, NAFTA rules of origin encourage firms to substitute intermediate goods (that is, parts and components required to produce a finished product) originating in the zone for less expensive non-originating materials in order to obtain preferential trade treatment (see, among others, Krishna 2005; Georges 2008a). This implies that NAFTA rules of origin as currently designed may hinder North American firms from taking full advantage of the global production chains. Eliminating rules of origin would thus serve to encourage geographic diversification of supply chains.

A related problem with rules of origin is that fragmentation of supply chains magnifies the complexity of assigning origin to a single country, since many goods use primary factors owned by residents of countries other than that in which the good or stage is produced (a phenomenon associated primarily with foreign direct investment and, to a lesser extent, the international movement of labour). In such a case, the origin of traded goods becomes ambiguous, as it is split between factors owned by residents of a series of countries (Lloyd 1993).

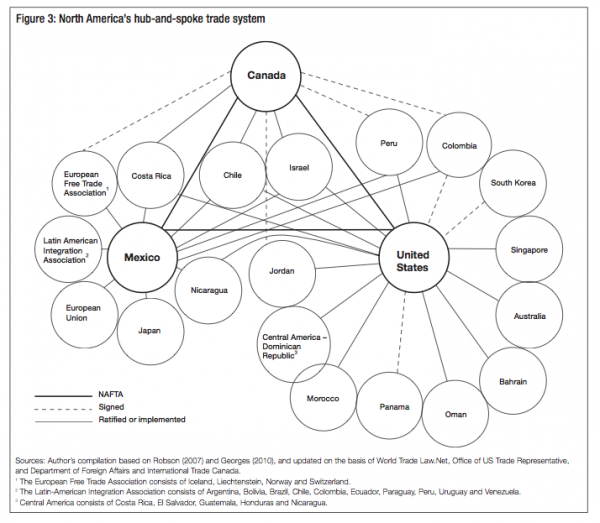

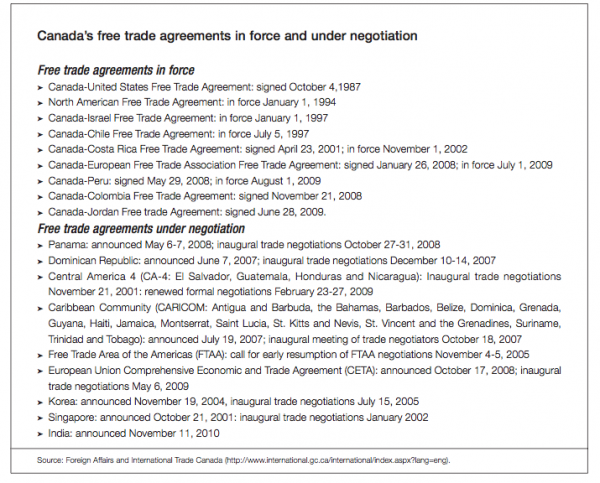

A later section of this study will evaluate numerically the effects of, and potential gains from, switching to a customs union with the United States that would also liberalize NAFTA rules of origin. But is the option technically or politically feasible? The first important technical challenge with the negotiation of a North American customs union involves harmonizing trade policy. This would not only require selecting a common external tariff or liberalizing NAFTA rules of origin, however. As claimed by Meilke, Rude, and Zahniser (2008), one of the thorniest issues would be the many different FTAs that North American countries have negotiated separately (see figure 3). A full North American customs union could require the eventual reconciliation of the rules of origin used in each FTA (excluding NAFTA, of course, as NAFTA preferential rules of origin would, in theory, no longer exist) in a process similar to the 1997 pan-European “diagonal cumulation” system implemented by the European Union. Research along the lines of Augier, Gasiorek, and LaiTong (2005) on cumulating rules of origin, and of Cornejo and Harris (2007) on a general origin regime as an indispensable minimum to effectively interconnect existing FTAs, should therefore be pursued and encouraged to better gauge the technical challenge of doing this reconciliation.

The second consideration is that moving to a customs union would make rules of origin redundant only if the rules’ objective was truly to eliminate trade deflection. But that interpretation, however common, is somewhat inconsistent with the observation that the United States is the NAFTA member that insisted on strict rules of origin, whereas it is also the member with the lowest MFN tariffs. Trade deflection would therefore benefit the United States, not Mexico or Canada, in terms of tariff revenues. This suggests that the real reason for having rules of origin in NAFTA (and in any FTA, for that matter) might be rent-seeking activities by interest groups instead of a genuine concern with trade deflection. Indeed, cross-border and intranational coalitions of industries backing duty-free access in exchange for strict rules of origin were probably the leading factor behind the success of FTA negotiations in the 1980s and 1990s (Destler 2006).6 The logical implication seems to be that these groups will inevitably lobby against rulesof-origin liberalization and, therefore, against any agenda for a North American customs union. This argument against the political feasibility of a customs union may be overstated, however, as the political economy supporting strict rules of origin has been eroding and will continue to erode because of the new international supply chains. For example, according to Baldwin (2009, 40), “it may be the case that ROOs [rules of origin] are saving industry jobs, but whose? As unbundling and spatial dispersion of upstream manufacturing proceeds, the nationalistic argument for ROOs tends to get blurred. Moreover, if unbundling results in a multiplication of firms, it will make political organization more difficult.”

According to Helliwell (2002, 86), “North America is destined, through the joint forces of demography and [technological] catch-up, to be a smaller and smaller share of the world economy. To focus emphasis on the smaller part of the global pie may seem attractive during booming times in the United States economy, but would be a short-sighted strategy.” Although Helliwell’s thesis is far-reaching and not limited to trade relations, we will illustrate the discourse that this notion typically generates in the context of trade policy.

First, trade diversification should not be understood in terms of additional net jobs that Canada’s trade with non-North American partners might generate. Businessmen and politicians tend to think that an increase in Canadian exports to faster-growing markets will increase employment. However, what might be common sense for particular companies is not necessarily true for a country as a whole (Krugman 1996), in this case because there is an eventual limit to how low the unemployment rate can go without creating unacceptable inflation. If Canada’s economy were to experience a large surge in exports to, say, China and India, the Bank of Canada would eventually need to offset the expansionary effect of the exports by raising interest rates, and an increase in export-related jobs would be more or less matched by a loss of jobs in interest-rate-sensitive sectors of the economy.

Second, trade diversification away from the United States is often construed as an insurance policy for Canada and Canadian exporters against US recessions. In other words, trade diversification would reduce the risk of having all of one’s eggs in the same basket and therefore reduce the volatility of the incomes of Canadian exporters. Clearly, this view requires that recessions in the rest of the world be unsynchronized with those in the United States – if all markets are subject to the same business cycles, then there may be little benefit to diversification in this regard. More fundamentally, welfare gains in standard trade models are derived from specialization in production and trade flows, not from diversification per se. So, the cost of greater income risk must be set against the benefit of specialization. In other words, there might be a trade-off between the gains from specialization derived from deep integration with the United States and the income volatility that the lack of market diversification affords. Goldfarb (2006) has analyzed this portfolio-type argument that the status quo delivers volatility. She argues that “over the past decade, Canadian exports to the U.S. have been less volatile on average than have exports to most other regions. Where they have been more volatile, they have been accompanied by significant trade growth. Shifting exports away from the U.S. over the past decade would have increased volatility and decreased trade growth, making Canada worse off, assuming all else was equal” (18). In the same vein, Beaulieu and Emery (2006, 269) argue that “incomes from trade can be expected to be high and low depending on demand for Canada’s exports, but total income over time will presumably be maximized by Canada specializing in its comparative advantage and exporting to the highest price buyer…This will mean that we remain highly dependent on the U.S. market and subject to considerable income risk and income volatility.” For them, income-smoothing tools (employment insurance, personal savings) and institutions (the Canadian Wheat Board and other price and revenue stabilization funds) are the proper instruments for addressing these issues of volatility in economic markets as a more direct alternative to a strategy of diversifying export markets.

Export diversification is often dismissed from another angle by questioning the ability of governments to change trade patterns. For example, Goldfarb (2006, 2) claims that “individuals, rather than governments, determine economy-wide trade patterns,” which would in part explain why past efforts by governments to change trade patterns have failed. Taken at face value, this argument seems, in a slightly cavalier way, to dispose of 60 years of research on trade creation and diversion effects due to (government-negotiated) FTAs, and possibly to underestimate the current Canadian concerns with respect to (government-imposed) border security measures post-9/11. However, as Goldfarb rightly points out, “for now, businesses continue to solidify their economic links in the U.S., while growing them at a faster rate outside of the U.S. as opportunities arise and relative risks fall” (26). And indeed, businesses take advantage of these opportunities. For example, Cadot et al. (2010) have shown that since the early 2000s OECD markets have been diversifying their sources of supplies geographically, and that this recent trend of import diversification is broadly consistent with a quality search model where buyers screen foreign suppliers (and hence countries) for quality before deciding which suppliers should be included in cross-country supply chains. As noted earlier, figure 1 also shows a clear trend toward increased import diversification for Canada since 1998.

This might suggest that import – rather than export – diversification, is a relevant, even if neglected, issue, and that the Canadian government should bend with the wind of marketdriven import diversification.7 Consistent with Beaulieu and Emery (2006), the natural policy approach seems to let Canada specialize in its comparative advantage while freely importing from the lowest cost/price producers. This, of course, is also consistent with our viewpoint that further multilateral negotiations at the WTO remain important, as does further liberalization of (NAFTA) rules of origin, with the aim of giving Canadian firms full advantage of global supply chains. This also is consistent with a government-led intensification of trade flows to and from emerging markets, implemented through selected FTAs, which would enable Canada to import more intensively from low-cost sources as well as providing larger export markets.

As noted previously, all FTAs have rules of origin designed to restrict the benefits of the preferential tariff treatment to products originating in the member countries. Being the gatekeepers of preferential trade, rules of origin also eliminate trade deflection by ensuring that goods that are simply being transshipped through a member country or undergoing only minor transformations there will not be deemed to originate in that country, and will not receive preferential treatment when re-exported to another member country.

However, rules of origin are also costly, and to gauge these costs, the econometric literature has constructed an index of the “restrictiveness” of rules of origin as an independent variable in order to estimate their economic impact on bilateral trade flows, preferential tariff utilization rates and investment flows.8 On the basis of these studies, it is now generally acknowledged that in some instances firms have decided to pay the MFN tariff rather than to incur the cost of complying with rules of origin, automatically cancelling the potential trade-creating benefits of FTAs. Also, the diversity of rules of origin across FTAs has severely limited interregional trade flows, and the restrictiveness of some rules of origin is beyond the levels that would be justified to prevent trade deflection.9

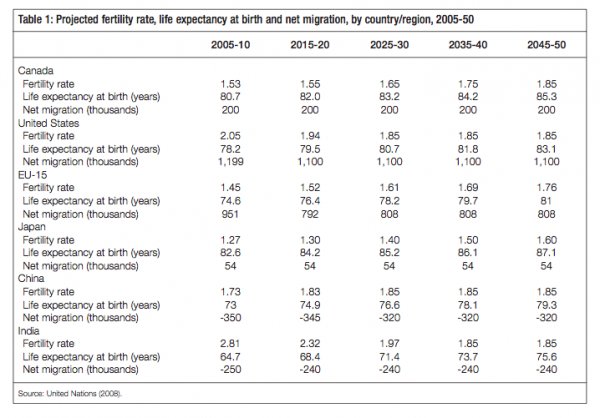

Whereas an FTA requires preferential rules of origin to prevent trade deflection, a customs union does not. Hence, some economists have suggested transforming NAFTA into a customs union (e.g., Kunimoto and Sawchuk 2005; Ghosh and Rao 2005; Pastor 2008; Georges 2008b, 2010). Gauging the economic impact of converting NAFTA into a customs union requires estimating the joint effect of adopting a common external tariff and eliminating rules of origin, which can (roughly) be decomposed into two effects: (1) the pure effect derived from the adoption of a common external tariff, and (2) the pure effect derived from the elimination of rules of origin. Given that the two joint policies imply complex interconnections between the use of raw materials, intermediate goods and value added, Georges (2008b) proposes a general equilibrium framework to gauge the impact of moving from NAFTA to a customs union that also eliminates rules of origin. The approach uses a multicountry, multisector, dynamic general equilibrium model in which the world economy consists of seven countries/regions divided into two groups: NAFTA countries (Canada, the United States and Mexico) and non-NAFTA countries (Mercosur – which consists of Brazil, Argentina, Paraguay and Uruguay; the rest of Latin America; Europe; and the rest of the world). Each country has eight sectors of production: agriculture, natural resources, food processing, textiles and clothing, manufacturing, technology products, automotive products, and services).

We set the common external tariff to the existing US external tariff (currently the lowest, on average, of the three NAFTA members), on the assumption of limited Canadian negotiation power on this score.10 With regard to the costs of rules of origin, the modelling approach is based on the fact that they act as an implicit tax to NAFTA firms for the use of non-originating intermediate goods, but as an implicit subsidy for the use of capital, labour and intermediate goods purchased within NAFTA (see Georges 2008a for a mathematical approach to this problem and Georges 2010 for a graphical presentation). Therefore, the main impact of removing rules of origin is to reallocate efficiently the demand for factors of production in each sector of the NAFTA countries, lowering NAFTA firms’ demand for capital, labour and NAFTA intermediate goods, but increasing the demand for non-NAFTA intermediate goods. The efficient reallocation of factors of production within NAFTA will also lower the unit cost of production in every sector of the NAFTA countries.11

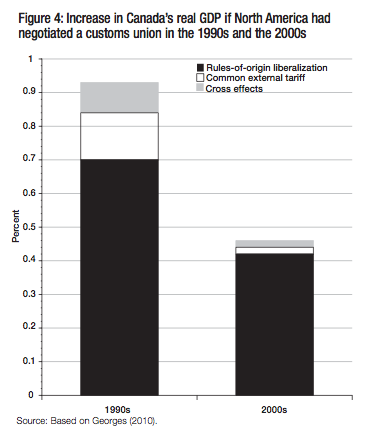

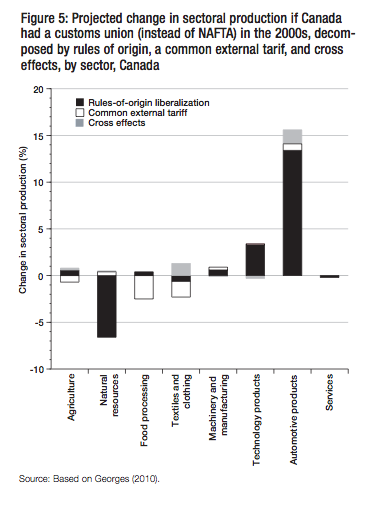

Using this modelling approach, we compare two counterfactual scenarios: (1) negotiation of a North American customs union in the mid-1990s (replacing NAFTA); (2) negotiation of such a customs union in the early 2000s. Figure 4 shows the results of the simulations and decomposes the sources of the gains into those due to the common external tariff, those due to eliminating rules of origin, and those due to a cross effect of both factors.12

The first observation is that the benefits of a customs union tend to decrease over time. The benefits would have been much larger had a customs union been negotiated as part of replacing or upgrading NAFTA in the mid-1990s. This would have led to a permanent increase of nearly 1 percent of Canadian GDP (about $15 billion per year in today’s dollars). If we had waited a decade to negotiate such an agreement, the benefits would have been only about half as large. The likely reason why potential benefits have declined since the 1990s is that multi-lateral tariff reductions agreed to in 1994 during the Uruguay Round (which were gradually implemented over the following decade) have reduced the relative advantage of NAFTA (i.e., MFN) tariff preferences. As a result, it became more common for North American firms to pay non-NAFTA tariffs for intracontinental exports rather than bearing the costs of complying with rules of origin. This pattern provides empirical confirmation of the notion that PTAs lose their value with declines in MFN tariffs agreed during multilateral rounds (Bhagwati 2008), as discussed earlier. The second important point is that elimination of rules of origin matters to Canada more than a common external tariff. Figure 4 shows that elimination of rules of origin accounts for the vast bulk of economic benefits. Therefore, the main motivation for advocating a North American customs union should be rules-oforigin liberalization and not the establishment of a common external tariff.

In terms of effects on specific sectors, negotiating a customs union would have had the strongest impacts on the natural resources, automotive products and technology products sectors (figure 5). Recalling that the removal of NAFTA rules of origin eliminates the implicit subsidy on North American intermediate goods and lowers the costs of final goods, then, sectors of production should be negatively affected by this shock when their production is used as intermediate goods, and positively affected when their production is for final uses. All sectors of the economy use natural resources intensively as an intermediate good. Therefore, the removal of rules of origin induces strong substitution of nonNAFTA resources, which has a negative impact on the Canadian resources sector (-6.6 percent in figure 5). The automobile and technology products sectors intensively use intermediate goods, and they gain from rules-of-origin liberalization (+13.4 percent and +3.3 percent), as they are in position to buy cheaper intermediate goods from the rest of the world, which improves their efficiency (see Georges 2010 for further details).13

In conclusion, the idea that a North American customs union and elimination of rules of origin hold large aggregate economic benefits for Canada is not borne out by quantitative analysis. The economic effects are positive, but they have decreased over time, and will continue to decrease to the extent that multilateral tariffs continue to fall. We estimate that negotiating a customs union with the United States and Mexico would increase Canadian output by about 0.5 percent annually, or $7 billion in today’s dollars.

As noted earlier, arguments in favour of diversifying trade away from the United States to other parts of the world are not new. Some of them, such as the notion that diversification would reduce the volatility of Canada’s trade flows, are not supported by recent data on economic volatility (Goldfarb 2006). Others, such as the notion that Canada should seek to spur trade ties to fast-growing emerging markets, are actually being borne out to varying degrees as a result of market forces. For example, Canadian exports to countries outside the OECD increased from 8 percent in 2004 to 15 percent in 2009, while the US share decreased from 84 percent to 74 percent. Here we examine a demographic argument in favour of trade diversification.

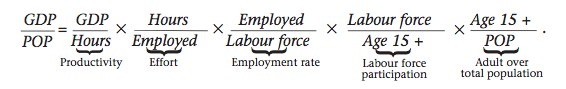

A typical framework (see, for example, Foot 2007) used to discuss the impact of population aging on GDP per capita decomposes this ratio into five terms – productivity, effort, employment rate, labour force participation and the ratio of adults to total population:

The literature generally suggests that population aging might tend to reduce the first four ratios to the extent that older workers are less productive, they choose to work fewer hours, they are discriminated against owing to their age, or they decide to retire early and leave the labour force entirely. It is thus generally thought that aging societies are at risk of economic slowdown relative to more youthful nations. Trade fits into this framework indirectly at best, to the extent that international trade tends to enhance productivity (see LoÌpez 2005 for a survey of the trade-productivity literature).

However, the impact of trade flows can be more clearly understood if we look at how the terms of trade affect the relationship between real gross domestic income and real gross domestic product. In a closed economy (with no tax), these quantities are identical, because the price index for produced goods is the same as the price index for purchased goods. But in the presence of international trade, the price indices for produced and consumed goods need not be the same, and variations in the ratio (known as the terms of trade) can have a strong impact on consumption (and therefore economic well-being), as illustrated in the following equation:

where real consumption (per capita) is defined as real disposable income minus real private saving, and the term of trade is given by the ratio of PQ (the price of the domestically produced goods) over PCON (the consumer price index defined as a weighted average of the price of the domestically produced goods and the foreign produced goods). An example is Canada’s experience in the 2000s. Thanks to a commodities boom that increased the prices paid for Canada’s raw materials exports (combined with relatively stable consumer prices), Canada’s terms of trade improved dramatically. From 2003 to 2008, Canada’s real gross domestic product grew by 2.5 percent annually, but real gross domestic income increased by 3.9 percent annually. The “extra” purchasing power was due to improvements in the terms of trade.

While the impact of demographic change on GDP per capita is well understood, it is also true that global demographic shifts can have marked effects on the terms of trade. As a nation’s population ages, the supply of the goods it produces falls while their prices increase, hence improving its terms of trade relative to younger nations. Clearly, a relatively closed economy could not benefit from improvement in terms of trade. But an open economy with some market power, such as Canada, could potentially mitigate the adverse economic impact of an aging domestic population by selecting younger (and faster-growing) trade partners. This would result in stronger downward pressures on Canada’s consumer price index (as consumers and firms import more from countries with relatively falling producer prices – owing to their young population and fast growth), thus improving further its terms of trade. (Note that some degree of specialization and thus market power in production is essential for the terms of trade effects we describe here.14)

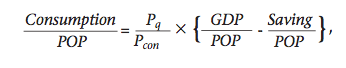

To examine this demographic dimension of trade diversification, we draw on work by Georges, MeÌrette, and Seçkin (2009), which uses a multicountry overlapping-generations model that is fully described in MeÌrette and Georges (2010). The model economy is made up of seven regions. North America is disaggregated into the United States and Canada, to distinguish the impacts of aging on a relatively closed economy from those on an open economy. Europe is aggregated into one region: the EU-15.15 Asia is disaggregated into three countries: Japan, a developed country with an already aging population; and China and India, emerging countries with very different demographic projections. The rest of the world is aggregated into one residual “region.” International trade is modelled by assuming that each region in the model produces a single good that is an imperfect substitute for the good produced in any other region. Therefore, households in each region consume a basket of all the goods produced in all regions of the world.

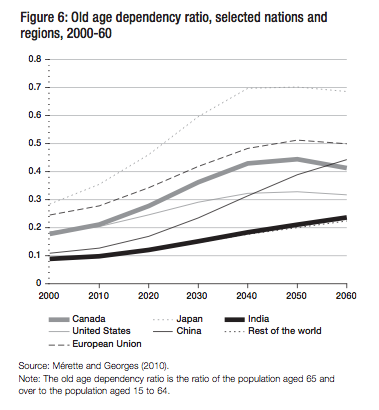

Population aging results from a combination of factors, the most important of which are rising life expectancy and declining fertility rates. Table 1 provides the assumptions behind the “medium variant scenario” of the United Nations demographic projections in each region of the world, including the effects of international migration. The demographic assumptions contained in table 1 can be used to project the impact on the old age dependency ratio (population aged 65 and over as a ratio of the population aged 15 to 64) as given in figure 6, for each region of the world, over the period 2000-60. As can be seen, Japan is by far the fastest aging country, with the elderly dependency ratio rising from 28 percent in 2000 to 70 percent by 2040. The EU-15 has the second-highest ratio, followed by Canada, whose elderly dependency ratio is expected to rise from 18 percent in 2000 to about 43 percent in 2040. In contrast, the United States has a more moderate increase in the elderly dependency ratio, which is projected to move from 19 percent in 2000 to 32 percent in 2040, in part because it has a much higher total fertility rate than most industrialized countries. The Chinese elderly dependency ratio follows a quite different pattern than that in the other regions. In 2000, China had one of the lowest ratios (about 10 percent). However, the drastic fall in the fertility rate starting in the 1979 as a result of the one-child policy, combined with net out-migration will lead to a sharp increase in the dependency ratio over the next several decades, reaching 30 percent in 2040 and continuing to rise. Finally, India has a relatively young population, and its elderly dependency ratio is expected to rise only modestly from 10 percent in 2000 to less than 20 percent in 2040.

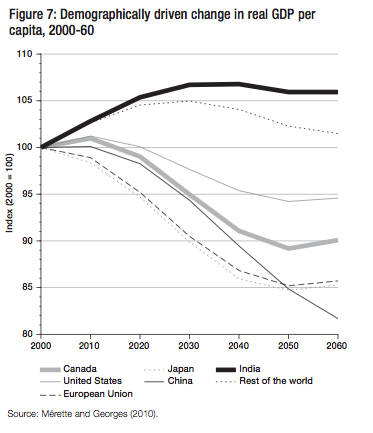

As noted earlier, population aging will lead to a reduction in labour force growth, which will put downward pressure on GDP growth. Figure 7 illustrates the impact of population aging in our multicountry model on real GDP per capita through 2060, abstracting from technical progress (that is, total factor productivity growth). For ease of comparison across regions, variables are normalized to 100 in 2000. As expected, among all regions, Japan and the EU-15 are the most negatively affected by population aging, with an earlier and sharper decline than the others in real GDP per capita. Aging has already begun to exert a negative effect on real GDP per capita in both Japan and the EU-15, although this effect has been delayed somewhat in other regions. Population aging in Japan and the EU-15 is projected to reduce real GDP per capita by about 15 percent between 2000 and 2050. Soon, North America will also be negatively affected by aging. Demographically driven real GDP per capita for Canada and the United States peaks in 2010, but population aging will lead to declines thereafter. The impact of aging on Canada is much more pronounced, with a fall of 11 percent between 2000 and 2050 as opposed to 6 percent for the United States over the same period. Looking at the other side of the aging spectrum, India has a relatively young population and strongly benefits from the demographic changes as its real GDP per capita increases until 2030 and then stabilizes thereafter at that level. Finally, the impact of aging in China is stunning. The Chinese economy has an abundant workforce at the turn of the twenty-first century, and this has supported real GDP per capita until now. Soon, however, as the demographic shock in China resulting from the one-child policy starts to kick in, the labour supply falls dramatically and contributes to lower real GDP per capita. By 2050, the fall in real GDP per capita (of close to 15 percent with respect to 2000) is similar to the one Japan is likely to experience.

It is important to recall that technical progress and innovation, which contribute to long-term growth in GDP, have been excluded from these forecasts, and in that sense the figures reaffirm the need for aging societies to adopt policies to accelerate productivity growth. In Canada, for instance, these projections imply that total factor productivity growth must increase by at least 13 percent over the next 40 years just to prevent GDP per capita from declining, let alone continuing to grow at rates to which Canadians are accustomed.

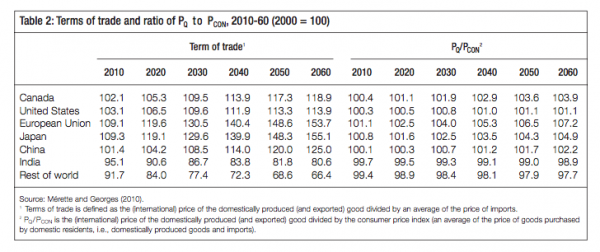

Although the demographically driven downward pressure on GDP per capita will contribute to lower consumption per capita, globalization through international trade can help offset some of this through favourable terms of trade effects. To the extent that population aging reduces the relative supply of a country’s good with respect to that in other regions, the relative price of its good will increase, and “older” countries should see an improvement in their terms of trade. Table 2 illustrates this by showing the projected terms of trade for the seven regions included in our model, and confirms that the fastest-aging nations have the largest increases in their terms of trade. An improvement in the terms of trade means that countries can import more than before for a given amount of exports, thus allowing domestic real consumption to increase.

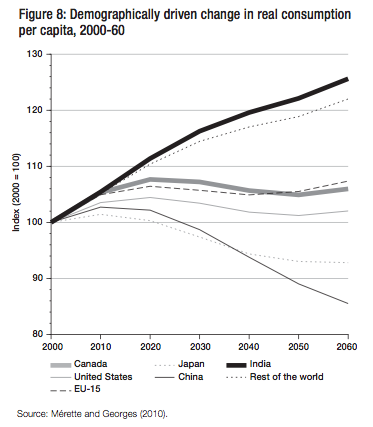

Figure 8 shows projected changes in per capita real consumption driven by demographic change (and the resultant changes in terms of trade) for the seven regions, and the patterns are quite different from those for per capita GDP. Real consumption per capita in Japan tends to fall because of the strong fall in GDP per capita shown in figure 7. Although Japan does see strong aging-related improvement in its terms of trade, the economic benefits are negligible because international trade is a relatively small share of its economy. In contrast, the more open economies of Canada and the EU-15 strongly benefit from the terms of trade appreciation.

Indeed, for Canada this effect offsets the negative effect of aging on GDP per capita shown in figure 7, allowing real consumption per capita to increase until 2020, after which it declines until 2050 by roughly 3 percent. While the United States outperforms Canada in terms of demographically driven GDP per capita, Canada’s per capita consumption does not fall below its 2010 level for most of the twenty-first century, whereas the United States remains below its 2010 level for most of the following decades. This reflects the fact that Canada has a more open economy and its terms of trade are likely to improve more. Because Canada’s consumption per capita will move in the opposite direction to GDP per capita until 2020, the Canadian economy will experience an “enriching decay,” that is, the improvement in the terms of trade is large enough to outweigh the negative impact of aging on domestic economic growth. This situation is the opposite of the famous “immiserizing growth” scenario described by Bhagwati (1958).

India gets a strong boost in real consumption per capita, despite deterioration in its terms of trade, as a result of a strong positive GDP per capita effect. This effect is itself stimulated by capital deepening in India, as its advantageous demographic position increases the productivity of capital and attracts foreign investment (MeÌrette and Georges 2010). The case of China is again striking, especially when observing the diametrically opposite directions taken by China and India’s real consumption paths from 2000 on. For China, both GDP and terms of trade effects contribute to reinforce the negative impact on real consumption per capita. Indeed, the timing of the one-child policy makes the Chinese economy a (still) relatively young country with respect to OECD countries but also an old one with respect to India and other parts of the world. Being caught between younger and older countries, the Chinese economy does not benefit from terms of trade appreciation occurring in the older, more open OECD countries, nor does it strongly benefit from capital deepening through net foreign capital inflows (MeÌrette and Georges 2010).

The foregoing projections have assumed that Canada pursues no explicit policies to diversify trade away from the United States. However, by examining alternative scenarios in which trade shares are modified from their baseline values, we can estimate the effect of trade diversification away from the United States on Canada’s real consumption per capita.

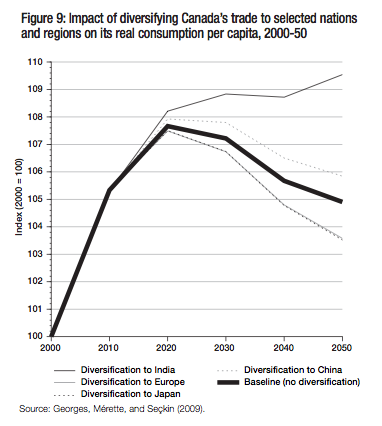

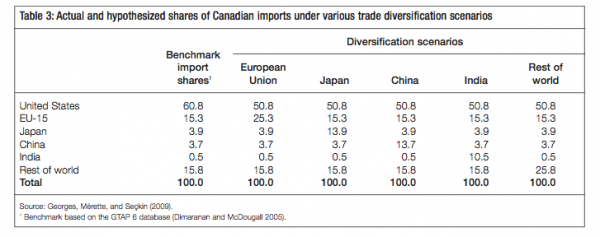

Figure 9 shows how Canada would gain or lose in terms of real consumption per capita if it diversified its trade away from the United States in favour of specific trade partners. For these experiments, we reduced the US share in total Canadian imports by 10 percentage points, a 2.5 percentage point increment every decade for 40 years, while successively increasing the share of other partners (see table 3 for details on alternative scenarios).

Our results indicate that, relative to the baseline case of unchanged US trade dependence, Canadians would benefit from a diversification scheme with India – the improvement in terms of trade would be large enough to boost Canadian consumption per capita by almost 4 percent relative to 2010 – and to a lower degree with China. In sharp contrast, a diversification scheme with the EU-15 or with Japan would actually reduce real consumption per capita slightly. For example, if Canadian firms and consumers increased the share of Indian goods in their imports by 10 percentage points, this would offset the negative impact of aging by propping up the real consumption per capita along a slowly upward-sloping path above its 2020 level. Therefore, between 2020 and 2050, real consumption per capita in Canada would increase by about 1.9 percent instead of falling by 2.8 percent, and would stand at roughly 4.7 percent above its baseline level in 2050. Diversifying to the EU-15 instead of India would cost Canadians roughly 6 percent of real consumption per capita by 2050.

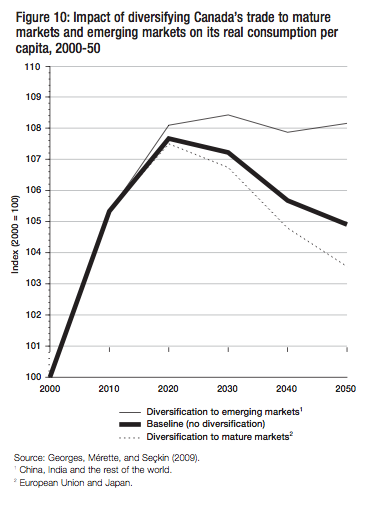

Figure 10 shows the results for diversification schemes to mature industrialized economies and emerging economies. In the mature markets, the shares of Japanese and EU-15 goods each increase by 5 percentage points in total Canadian imports, while the US share falls by 10 percentage points. The emerging markets diversification scheme represents a weighted average of the previous diversification schemes to China, India and the rest of the world – the 10 percentage point share increase is spread equally between the three regions. The rest of the world is a composite of all remaining countries/regions of the world, such as Russia, Africa, Brazil and South America, Oceania, the Arab countries, Turkey and the Central Asian countries. Figure 10 illustrates that, according to our simulations, emerging-market diversification schemes may prop up Canadian real consumption per capita, whereas mature-market diversification schemes would amplify the expected burden associated with population aging in Canada. The broad strategic choice of diversifying to mature markets instead of emerging markets would cost Canadians roughly 5 percent of real consumption per capita by 2050.

We need to be very explicit about what our modelling exercise does and does not do. Our focus has been on the impact on real consumption of an exogenous change in trade shares that would diversify our trade pattern away from the United States, and not on the mechanism that might lead to a change in these shares. The size, composition and direction of trade flows result from the decisions of millions of private producers and consumers. Government policy may have an influence on these decisions, but bringing about a large and rapid shift of trade shares might require strong policy measures.16 When Prime Minister Diefenbaker announced in 1957 that Canada would switch 15 percent of its trade from the United States to Great Britain, his plan would have required a doubling of UK exports to Canada, a willingness by Canadians to shun the many desirable goods they were buying from the United States while substituting less desirable goods from the United Kingdom, and the capacity of UK customers to double the value of their Canadian purchases (Hart 2002). Diefenbaker’s policy was blurred by nostalgia for Canada’s historic ties to Britain and by a lack of appreciation of commercial realities. Bearing his example in mind, we stress the importance of supplementing our analysis with studies of policies and institutions, such as bilateral trade agreements, that might be used to bring about endogenous changes in trade shares.

A related but more subtle caveat asks whether we should even consider changing the baseline shares of the model. These trade shares are presumably already optimally chosen on the basis of the exogenous variables and parameters in the model. If we change the shares, we change consumer preferences so that we cannot make meaningful comparisons.17 But are these baseline shares truly optimal? Existing trade shares reflect all sorts of distortions in the economy, and the presence of social capital (trust, networks) or its lack may still prevent Canada from establishing deep economic ties with India, China or Brazil, even if these ties are desirable.

Another caveat is the reliance of our model on a trade structure that assumes some degree of imperfect substitution between goods of different geographical origins, so that the law of one price does not hold. This assumption has been crucial in the economic literature (Helpman and Krugman 1985) in explaining some robust features of international trade, such as substantial two-way trade in “similar” products (intrasectoral trade) between countries. However, it also implies that each country has market power (and thus faces a downward-sloping export demand curve), so that quantity adjustment by producers to diverse shocks is somewhat muted by the lack of direct competition between regional producers, while terms of trade effects are greater as larger price changes are necessary to clear markets.18 This assumption could be relaxed in future multisectoral analyses, depending on the nature of the goods (i.e., differentiated manufactured goods versus homogeneous primary goods that would follow the law of one price).

We believe that the bilateral and regional trade agreements, which have proliferated in recent years – a phenomenon referred to as the “spaghetti bowl” of PTAs – are termites in the trading system that undermines true multilateral free trade (Bhagwati 2008). These agreements have become a way for the United States and the European Union to impose all sorts of “trade-unrelated” issues, cynically called “trade-related” issues in treaties. These include intellectual property protection, domestic environmental issues and labour standards, the last two presented as if they were altruistic measures aimed at benefiting foreign workers, even when they mask self-interest and new forms of protectionism. Multilateral trade liberalization negotiations at the WTO, which avoid quests for preferential access, remain the best strategy for countries seeking to take advantage of the international specialization of labour.19 They permit countries to diversify trade partners by eliminating or mitigating trade preferences and their distortions. In consequence, the WTO model should be embraced by those in Canada who advocate trade diversification away from the United States.

Given the political impasse at the WTO, Canadian policy-makers would be wise to consider second-best strategic options. This study has examined two possibilities: enhancing and deepening continental trade by negotiating a North American customs union, and attempting to diversify trade away from the United States to other regions of the world. The main benefit of a continental customs union would be the elimination of NAFTA rules of origin, which would reduce compliance costs and eliminate implicit subsidies and taxes on North American and foreign raw materials, intermediate goods and value added. Canadian firms could thus purchase intermediate goods where they are the cheapest, lowering production costs and enhancing competitiveness, which would induce further exports elsewhere in the world. Hence, paradoxically, deepening continental integration via a Canada-US customs union is another strategic direction, one that could also contribute to diversification of trade away from North America. If Canada is in search of a policy measure that might reconcile opponents and proponents of increased regionalism, this might be the one. Trade resources could be allocated away from the failed acronymic initiatives of the 1990s and 2000s (shown in figure 1) in order to pursue this option. However, our quantitative analysis shows that the long-term economic benefits are small – about 0.5 percent of GDP annually ($7 billion in current dollars) – and will continue to get smaller to the extent that MFN tariffs continue to fall.

With regard to the second strategic option, the economic benefits of diversifying trade away from the United States appear potentially larger than those of deepening North American integration, so long as trading partners are selected carefully. To date, however, Canada has adopted a scattershot approach, as shown in the box. As a general rule, Canada should negotiate agreements with relatively youthful nations (such as India, Brazil and, to a lesser extent, China) to take advantage of demographically driven improvements in its terms of trade as well as strong economic growth in these nations. Trade diversification to India, for example, would increase Canadian real per capita consumption by 2050 by nearly 5 percent relative to the scenario with no diversification. A more general effort to diversify trade to emerging markets outside North America and the EU-15 would result in a 3 percent increase in per capita consumption. From a demographic perspective, it would be unwise for Canada to try to diversify trade to Japan and Europe, notwithstanding the current government’s intention to move ahead with negotiations for a comprehensive economic and trade agreement with the European Union. Our simulations show that this would actually reduce real consumption per capita relative to the scenario with no diversification. Canadian trade policy-makers might well reconsider the wisdom of pursuing these talks at the expense of other trade negotiations.

Although the growth potential of China has attracted much attention, an analysis that takes into account demographic factors shows that India is an even more promising market in the twenty-first century. It may achieve its potential if it pursues its efforts to integrate the world economy through liberalization of both trade and capital flows, while accelerating the movement of its workforce out of agriculture and into the unskilled-labour-intensive industry of the “organized” sector (Panagariya 2006).

Factors other than demographics clearly go into making a country an attractive trading partner for Canada. The most important of these are innovation and productivity, which serve not only to spur faster economic growth in our potential export markets, but also allow the fruits of foreign innovation to spill over to Canadian firms via foreign direct investment. Indeed, one of the great advantages of having such close trade ties to the United States is privileged access to the many innovations that originate there. While forecasts of global innovation are beyond the scope of this study, it is clear that China and India are both striving to transform their economies into innovation leaders, and their efforts only strengthen the argument for developing deeper Canadian trade ties with them. Their transformation into innovation leaders would also reinforce the favourable terms of trade effects.

The tough question is, of course, how to diversify trade. As noted earlier, trade patterns are the result of millions of individual decisions made in the context of an existing set of tariffs and preferences. Past efforts to significantly change Canada’s trade patterns largely failed to meet their goals. Policy-makers must see this diversification strategy as a long-term proposition by which cultural and nonbusiness ties, trust and networks can pave the way for trade missions and an eventual preferential trade agreement with countries such as India, Brazil and China. India is a promising candidate, because in addition to India’s advantageous demographics and other circumstances, Canada’s large Indian diaspora has already helped build cultural ties between the two nations, which also share a history as former possessions of Great Britain. As Dobson (2006, 20) suggests, India’s demography and economic momentum argue for greater Canadian policy attention; she argues that “an FTA negotiation would send a powerful signal of commitment…to Canadian businesses interested in penetrating the Indian market and using India as a platform for Asian operations.” The key point here is that the positive influence of export lobbying would offset the negative lobbying of the import-competing interests and could thus accelerate negotiations. The United States is India’s obvious strategic priority in the Western hemisphere, but a recent analysis of the feasibility of a comprehensive USIndia bilateral FTA concluded that neither country was ready for such an agreement (Bery, Bosworth, and Panagariya 2005). The recent announcement of trade negotiations between Canada and India is a significant strategic signal of India’s potential importance to the North American economies and will serve Indian interests beyond the Canadian market.

By engaging in the three-quarters of the economy outside the US, as Head (2007) puts it, Canada has the opportunity to broaden the trade-driven growth that is essential to its economic well-being while continuing to reap the benefits of its geographic and economic proximity to the United States.

Acemoglu, D., and J. Ventura. 2002. “The World Income Distribution.” Quarterly Journal of Economics 117: 659-94.

Armington, P.S. 1969. “A Theory of Demand for Products Distinguished by Place of Production.” IMF Staff Papers 16: 159-76.

Augier, P., M. Gasiorek, and C. Lai-Tong. 2005. “The Impact of Rules of Origin on Trade Flows.” Economic Policy 20 (43): 567-624.

Baldwin, R. 2009. “Integration of the North American Economy and New-Paradigm Globalization.” Working paper 049, Policy Research Initiative, Government of Canada.

Beaulieu, E., and H. Emery. 2006. “Stay the Course or Find a New Path? Canada’s Reliance on the U.S. as an Export Market.” In Nafta @10, edited by J. Curtis and A. Sydor. Ottawa: Foreign Affairs and International Trade Canada.

Bery, S., B. Bosworth, and A. Panagariya. 2005. The India Policy Forum 2004. Washington, DC: The Brookings Institution.

Bhagwati, J. 1958. “Immiserizing Growth: A Geometrical Note.” Review of Economic Studies 25 (3): 201-5.

——————. 2008. Termites in the Trading Systems – How Preferential Agreements Undermine Free Trade. Oxford: Oxford University Press.

Bhagwati, J., and V.K. Ramaswami. 1963. “Domestic Distortions, Tariffs, and the Theory of Optimum Subsidy.” Journal of Political Economy 71 (1): 44-50.

Cadot, O., C. Carrère, M. Kukenova, and V. Stauss-Kahn. 2010. “OECD Imports: Diversification and Quality Search.” Policy Research working paper WPS 5285, World Bank.

Cadot, O., A. Estevadeordal, and A. Suwa-Eisenmann. 2006. “Rules of Origin as Export Subsidies.” In The Origin of Goods: Rules of Origin in Regional Trade Agreements, edited by O. Cadot, A. Estevadeordal, A. Suwa-Eisenmann, and T. Verdier. Oxford: Oxford University Press.

Carrère, C., and J. de Melo. 2004. “Are Differential Rules of Origin Equally Costly? Estimates from NAFTA.” Discussion paper series no. 4437, CEPR.

Cornejo, R., and J. Harris. 2007. “Convergence in the Rules of Origin Spaghetti Bowl: A Methodological Proposal.” Working paper no. 34, INTAL-INT, Inter-American Development Bank.

Destler, I.M. 2006. “Rules of Origin and US Trade Policy.” In The Origin of Goods: Rules of Origin in Regional Trade Agreements, edited by O. Cadot, A. Estevadeordal, A. Suwa-Eisenmann, and T. Verdier. Oxford: Oxford University Press.

Dimaranan, B., and R. McDougall, eds. 2005. Global Trade, Assistance, and Production: The GTAP 6 Data Base. West Lafayette, IN: Center for Global Trade Analysis, Purdue University.

Dobson, W. 2002. “Shaping the Future of the North American Economic Space: A Framework for Action.” Commentary no. 162, The Border Papers, C.D. Howe Institute.

——————. 2006. “The Indian Elephant Sheds Its Past: The Implications for Canada.” Commentary no. 235, C.D. Howe Institute.

Estevadeordal, A. 2000. “Negotiating Preferential Market Access: The Case of the North American Free Trade Agreement.” Journal of World Trade 34 (1): 141-66.

Estevadeordal, A., J.E. López-Córdova, and K. Suominen. 2008. “How Do Rules of Origin Affect Investment Flows? Some Hypotheses and the Case of Mexico.” In Gatekeepers of Global Commerce: Rules of Origin and International Economic Integration, edited by A. Estevadeordal and K. Suominen. Washington, DC: Inter-American Development Bank.

Estevadeordal, A., and K. Suominen. 2008. “What Are the Trade Effects of Rules of Origin?” In Gatekeepers of Global Commerce: Rules of Origin and International Economic Integration, edited by A. Estevadeordal and K. Suominen. Washington, DC: Inter-American Development Bank.

Foot, D.K. 2007. “Some Economic and Social Consequences of Population Aging.” In A Canadian Priorities Agenda: Policy Choices to Improve Economic and Social Well-Being, edited by J. Leonard, C. Ragan, and F. St-Hilaire. Montreal: Institute for Research on Public Policy.

Georges, P. 2008a. “Liberalizing NAFTA Rules of Origin: A Dynamic CGE Analysis.” Review of International Economics 16 (4): 672-86.

——————. 2008b. “Toward a North American Customs Union: Rules of Origin Liberalization Matters More Than a Common External Tariff for Canada.” North American Journal of Economics and Finance 19: 304-18.

——————. 2010. “Dispensing with NAFTA Rules of Origin? Some Policy Options.” The World Economy 33 (11): 1606-37.

Georges, P., M. Mérette, and A. Seçkin. 2009. “Should Canada Diversify Its Trade Pattern? An Overlapping-Generations CGE Analysis of Trade and Ageing.” Working paper 2009- 06, University of Ottawa.

Ghosh, M., and S. Rao. 2005. “A Canada-U.S. Customs Union: Potential Economic Impacts in NAFTA Countries.” Journal of Policy Modeling 27: 805-27.

Goldfarb, D. 2003. “The Road to a Canada-U.S. Customs Union: Step-by-Step or in a Single Bound?” Commentary no. 184, The Border Papers, C.D. Howe Institute.

——————. 2006. “Too Many Eggs in One Basket? Evaluating Canada’s Need to Diversify Trade.” Commentary no. 236, C.D. Howe Institute.

Harris, R. 2003. North American Linkage: Opportunities and Challenges for Canada. Calgary: Calgary University Press.

Hart, M. 2002. A Trading Nation: Canadian Trade Policy from Colonialism to Globalization. Vancouver: UBC Press.

——————. 2007. “Canadian Engagement in the Global Economy.” In A Canadian Priorities Agenda: Policy Choices to Improve Economic and Social Well-Being, edited by J. Leonard, C. Ragan, and F. St-Hilaire. Montreal: Institute for Research on Public Policy.

Head, K. 2007. “Engage the United States, Forget the Rest?” In A Canadian Priorities Agenda: Policy Choices to Improve Economic and Social Well-Being, edited by J. Leonard, C. Ragan, and F. St-Hilaire. Montreal: Institute for Research on Public Policy.

Heidrich, P., and D. Tussie. 2010. “Regional Trade Agreements and the WTO: The Gyrating Wheels of Interdependence.” In Redesigning the World Trade Organization for the Twenty- First Century, edited by D. P. Steger. Waterloo and Ottawa: CIGI, IDRC and Wilfrid Laurier University Press.

Helliwell, J. 2002. Globalization and Well-Being. Vancouver: UBC Press.

Helpman, E., and P. Krugman. 1985. Market Structure and Foreign Trade. Cambridge, MA: MIT Press.

Hirschman, A.O. 1945. National Power and the Structure of Foreign Trade. 1969. Reprint, Berkeley and Los Angeles: University of California Press.

Krishna, K. 2005. “Understanding Rules of Origin.” Working paper no. 11150, NBER.

Krugman, P.R. 1993. “What Do Undergrads Need to Know About Trade?” AEA Papers and Proceedings, American Economic Review (May): 23-6.

——————. 1996. “A Country is Not a Company.” Harvard Business Review (January-February): 40-50.

Kunimoto, R., and G. Sawchuk. 2005. “NAFTA Rules of Origin.” Discussion paper, Policy Research Initiative, Government of Canada.

Lloyd, P.J. 1993. “A Tariff Substitute for Rules of Origin in Free Trade Areas.” The World Economy 16: 699-712.

——————. 2002. “Country of Origin in the Global Economy.” World Trade Review 1 (2): 171-85.

Lloyd P.J., and X.G. Zhang. 2006. “The Armington Model.” Staff working paper, Productivity Commission, Melbourne.

López, R.A. 2005. “Trade and Growth: Reconciling the Macroeconomic and Microeconomic Evidence.” Journal of Economic Surveys 19 (4): 623-48.

Mandel-Campbell, A. 2008. “Foreign Investment Review Regimes: How Canada Stacks Up.” The Conference Board of Canada Report on Trade, Investment Policy and International Cooperation (April).

Meilke, K., J. Rude, and S. Zahniser. 2008. “Is NAFTA Plus’ an Option in the North American Agrifood Sector?” The World Economy 31: 925-46.

Mérette, M., and P. Georges. 2010. “Demographic Changes and the Gains from Globalisation: An Analysis of Ageing, Capital Flows, and International Trade.” Global Economy Journal, 10 (3), article 3.

Panagariya, A. 2006. “Transforming India.” Paper presented at the conference “India: An Emerging Giant,” October 13-15, Columbia University, New York.

Pastor, R. 2008. “The Future of North America: Replacing a Bad Neighbor Policy.” Foreign Affairs 87 (4): 84-98.

Robson, W.B.P. 2007. “Stuck on a Spoke: Proliferating Bilateral Trade Deals Are a Dangerous Game for Canada.” C.D. Howe Institute e-Brief (August).

United Nations Population Division. 2008. “World Population Prospects: The 2006 Revision.” https://esa.un.org.unpp.

Viner, J. 1950. The Customs Union Issue. New York: Carnegie Endowment for International Peace.

Zhang X.G. 2006. “Armington Elasticities and Terms of Trade Effects in Global CGE Models.” Staff working paper, Productivity Commission, Melbourne.

Patrick Georges and Marcel Mérette’s study of Canada’s strategic trade policy options in this era of slow US growth, rapid growth in many overseas markets and almost stalled global trade talks should reopen the debate on an important component of Canada’s economic future. This debate, or versions of it, seems to occur whenever we are hit by an external “shock” such as the repeal of the Corn Laws in 1846, the Smoot-Hawley Tariff Act of 1930, the “Nixon Shock” of 1971 and its aftermath, or the Great Recession of 2008/09. This debate occurs because involvement in the international economy has always been a key element of Canada’s experience, due to its colonial heritage, its location next to the world’s largest and most innovative economy, a large surplus of natural and food resources that are in demand around the world, and a relatively small population. And in most years, trade has contributed to Canada’s economic growth and the per capita income of its residents. Yet all this is changing. Exports and imports are increasingly fragmented into intermediate or component goods and services that are part of local or global value chains and not necessarily bought or sold as final end-products. Frequently companies will choose to establish themselves abroad through investment (creating a foreign affiliate) rather than exporting or importing from a home base, which often means individuals from the home country have to go abroad to provide know-how, after-sales service or market intelligence.

Increasingly, services are becoming the predominant international activity – research and development (R&D), transportation, and the creation or implementation of new ideas and management techniques – reflecting changes that have already taken form in the domestic economy. The operation of the international financial system – exchange rate levels and, importantly, exchange rate volatility – is becoming ever more important in determining what is traded internationally and by whom. This unpredictable activity increasingly and profoundly affects the cost of trading across borders. Additional provisions for security, ranging from more physical inspections to expensive electronic measures to verify shipments, are also increasing the cost of trade, magnifying the “home bias” of firm and company networks, and offsetting the often alluded to traditional benefits of trade.

In the broader context, power is shifting steadily from the USA and Europe to parts of Asia, Latin America and Africa, which are geographically and at times culturally and legally distant from Canada and have mostly large, young populations, as Georges and Mérette highlight.

The authors state or allude to some of these changes in context or in detail. While at times their focus is too hypothetical (for example, their ill-defined Canada-US customs union could be construed as a straw-man) or too focused on one dynamic, long-term factor (demographics), their study brings to our attention the fact that the trade world is changing, and that the wider discussion and debate about choices should also change. The changes affecting and influencing Canada will require the attention of politicians and policy-makers in various ways. The standard model of a free trade agreement like the North American Free Trade Agreement will have to be broadened and adjusted to reflect the realities of how trade actually is conducted in today’s world. Governments will have to place more emphasis on policies affecting firms, especially at home; for example, assisting them in overcoming information asymmetries in foreign markets; tax policies; financing and hedging costs to overcome volatility in exchange rates; regulatory alignment with respect to food, health, and product safety standards; and licensing requirements concerning highly technical products or professional competencies. In addition, emerging issues like climate change, and social considerations as they intersect with trade, will have to be researched, debated, and integrated into the world’s economic regime so that it appropriately reflects the importance of these issues and the perceptions and interests of emerging economic powers and less advantaged peoples. More studies like this one will thus be needed as Canadians sort out domestically and internationally how to face the world in the first few decades of the 21st century. As always, the ultimate objective of all our efforts is to enhance our prosperity and well-being in a peaceful, predictable and more equitable world. Trade with a broader focus, with the old and new instruments and based on the tried-and-tested principles of nondiscrimination, transparency and a careful balance between the domestic social contract and international needs and opportunities, will help us achieve these objectives.

John M. Curtis is a distinguished fellow at the Centre for International Governance Innovation (CIGI). He was the first chief economist at the Department of Foreign Affairs and International Trade. He was also senior policy adviser and coordinator, trade and economic policy, and director of trade and economic analysis with that department. He also participated in the Canada-US free trade negotiations and the Uruguay Round of multilateral trade negotiations.

This publication was published as part of the Competitiveness, Productivity and Economic Growth research pro- gram under the direction of Jeremy Leonard. The manuscript was copy-edited by Cy Strom, proofreading was by Zofia Laubitz, editorial coordination was by Francesca Worrall, production was by Chantal Létourneau, art direction was by Schumacher Design and printing was by AGL Graphiques.

Patrick Georges joined the University of Ottawa’s Graduate School of Public and International Affairs in 2006, Prior to this, he taught at the University of British Columbia (Sauder School of Business) and worked as a senior economist for the federal government, including in the Department of Finance and the Department of Human Resources and Skills Development. His research deals with international trade and finance, population aging, fiscal policy and public debt management, and financial and real options pricing theory. He uses general equilibrium mod- elling and other simulation models as tools to improve understanding of the economic impacts of alternative pub- lic policies.

Marcel Mérette became professor at the Department of Economics of the University of Ottawa in 1999 after four years as economist at Finance Canada. From 2005 to February 2010, he was vice-dean, research, and since then he has been the dean of the Faculty of Social Sciences. In the last 15 years, he has developed many computable overlapping generations models to publish papers on the economic impact of aging populations.

To cite this document:

Georges, Patrick, and Marcel Mérette. 2010. Canada’s Strategic Trade Policy Options: Deeper Continental Integration or Diversification? IRPP Study, No. 11. Montreal: Institute for Research on Public Policy.