Beneath the veneer of Canada’s stellar economic performance in the 2000s lies the conundrum of slow productivity growth. Most of Canada’s economic strength over the past 10 years has been due to strong labour force growth and sharp increases in prices for Canada’s natural resources. But as IRPP Research Fellow Someshwar Rao shows in this study, neither of these can sustain the growth capacity of the Canadian economy in the future. Economic growth will increasingly depend on productivity – the ability to create more economic value by working smarter.

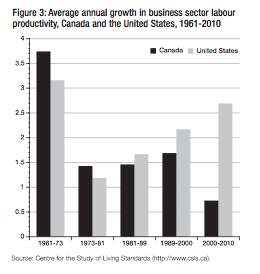

However, labour productivity growth in Canada has slowed to an average of just 0.7 percent per year in the 2000s, less than half the rate in the 1990s and far below the 2.7 percent annual growth in the United States. The productivity slowdown in manufacturing industries is even larger. This has ominous implications for income growth as well as international competitiveness.

In his broad review of the determinants of productivity growth Rao finds that there are three main challenges in Canada. First, while innovation and the adoption of technologies are by far the most important direct drivers of productivity, Canada remains a laggard compared with other industrialized nations in this area, due to insufficient investment in research and development (R&D) and the equipment that embodies new technologies.

A second important factor is the relatively large number of small and medium-sized enterprises in Canada. Because of their small size, these firms are unable to benefit from production techniques that require a certain minimum scale to be profitable, hampering their ability to grow.

Finally, competition and firm dynamics within industries are critically important for spurring innovation and productivity. But Rao maintains that there is not enough “creative destruction” – the process of inefficient firms shutting down and more productive ones taking their place, which accounts for a large share of productivity growth.

Rao recommends a multipronged policy approach. The Canadian government should reorient its R&D programs in favour of direct grants rather than the current scientific research and experimental development tax credit. It should look for new ways to connect the major actors in the innovation ecosystem (business, academia and governments) with one another to facilitate exchange of knowledge.

But direct support for innovation is necessary but not sufficient for productivity growth. Policy-makers must also ensure that competitive pressures on industry are robust, so that companies have incentives to innovate. Policies to liberalize trade and investment in fast-growing emerging markets and reduce the barriers to Canada-US trade as well as to entry in protected industries are equally important for boosting productivity.

The Canadian economy has outperformed those of the other G7 countries since 2000 by many headline measures. Between 1999 and 2009, it grew at an average annual rate of 2.1 percent, compared with 1.8 percent in the United States. Similarly, growth in per capita gross national income in Canada exceeded that in the US over the same period: 35.2 percent versus 27.9 percent. Canada is also expected to be a growth leader among the G7 countries in 2011 and 2012.

Lower government budget deficits and debt levels in relation to GDP, lower debt levels of households and businesses, low and stable inflation, a sound financial sector and an abundance of natural resource and human capital endowments bode well for the near-term prosperity of Canadians.

Yet many well-informed and influential Canadians have expressed serious concerns about the economic prospects for Canada further into the future because of its dismal productivity performance (Carney 2010; TD Economics 2010; Lynch 2010; Mulroney 2010). Between 2000 and 2010, growth in labour productivity (real GDP per hour worked) in the Canadian business sector averaged just 0.7 percent annually, less than half of the pace between 1981 and 2000. In contrast, labour productivity growth in the US business sector accelerated significantly after 2000, averaging 2.7 percent. Canada has also lost significant ground in productivity to other major developed economies as well as to emerging economies such as China, India, South Korea and Brazil.

The conundrum is that slow productivity growth has not only been a fact of Canadian life for the past three decades and continues to worsen, but it has also been impervious to numerous policy initiatives intended to improve it.

The main objective of this study is to examine the magnitude and the nature of Canada’s productivity challenges, summarize what is known about their potential causes and offer some policy directions to address them. The following are some of the specific questions I hope to address:

I draw upon the vast amount of existing productivity research in Canada and elsewhere to provide answers to these questions. However, it is not my intention to present a comprehensive literature review; there are already a number of very good ones (Dion 2007; Dion and Fay 2008; TD Economics 2005). Rather, the goal of this study is to synthesize the relevant findings of existing research into a policy-oriented and forward-looking presentation.

The study identifies two fundamental (and related) productivity problems in Canada: a sharp slowdown in productivity growth since 2000 and a large and widening Canada-US productivity gap. If these challenges are not addressed effectively and quickly, they will harm Canada’s longer-term economic growth and international competitiveness and threaten the living standards and the quality of life of Canadians. Therefore, the productivity issues should be at the front and centre of all future public debates and policy discussions in Canada.

The study also shows that medium-term prospects for raising productivity and narrowing the Canada-US gap are not promising because of emerging new factors, such as weak domestic and foreign demand, high resource prices and the strong Canadian dollar.

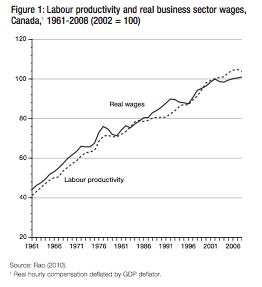

Productivity is the most important source of sustained growth in individual and national real income and living standards. Over long periods, labour productivity growth is the main driver of growth in real wages and real incomes. For instance, from 1961 to 2008, labour productivity growth in the Canadian business sector averaged 2.0 percent per year, while real wages grew at the rate of 1.8 percent per year. They generally move in lockstep over time (figure 1). Similarly, labour productivity and real GDP per capita across the countries of the Organisation for Economic Co-operation and Development (OECD) are also highly positively correlated.

For the purposes of this study, “labour productivity,” defined as the value of output per hour worked, will be used interchangeably with the more generic term “productivity.” When other types of productivity are discussed (for example, multifactor productivity), they will be referred to by their specific names.

Productivity and quality of life also go hand in hand, because higher real incomes lead to higher government revenues without increasing tax rates, thus allowing Canadian governments to finance more investments in health, education and environment and boost spending on social programs. According to Trefler (2007), closing only two-thirds of the Canada-US productivity gap and of the per capita real income gap would generate an additional $69 billon annually in government revenue, which could be used to increase spending, reduce taxes or further reduce the federal debt.

Labour productivity (whether measured as absolute levels or as growth rates) and the UN Human Development Index (HDI) – a weighted index of three important dimensions of quality of life (life expectancy, knowledge and education, and material standard of living) – are highly positively correlated across OECD countries, reinforcing the notion that high productivity growth enables investments in other activities that improve well-being. The Western European countries, especially Nordic countries, enjoy high levels of productivity as well as high quality of life, as measured by the HDI (Rao 2010). Labour productivity is also positively correlated across OECD countries with other measures of economic well-being.

The relationship between productivity, human capital and physical capital is a virtuous circle. Stronger productivity implies growing real wages and better business profitability. Strong wages encourage the acquisition of the necessary education and skills to access them, and increasing profits provide additional resources to reinvest in a business. Each of these actions contributes to further productivity growth. By the same token, weak productivity growth such as Canada has experienced will reduce returns to productive investments and discourage the accumulation of physical and human capital in a vicious circle. In short, productivity growth and factor accumulation are interrelated over time.

In view of Canada’s relatively good macroeconomic performance since 2000, despite dismal productivity growth (as well as its achievement in escaping the worst of the Great Recession), one could argue that the importance of productivity growth to economic well-being is exaggerated. But it is important to caution that Canada’s economic strength since 2000 has depended on strong employment growth and big improvements in Canada’s terms of trade resulting from large increases in real commodity prices worldwide. The latter effect was particularly pronounced and more than offset the negative impact of decelerating productivity growth (MacDonald 2008; Coulombe 2011).

However, going forward, the contribution from these two sources to real income growth is expected to decline dramatically, because of the expected slowdown in labour force growth and the low probability of a repeat in the 2010s of the more than tripling of commodity prices in the 2000s.

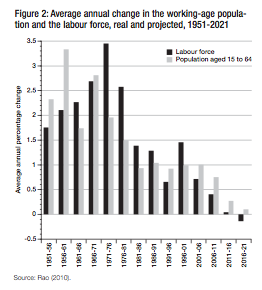

Canada’s labour force is expected to grow at an average rate of less than 0.5 percent per year between 2011 and 2016, and is actually expected to register a slight decline thereafter (figure 2). In addition, the share of elderly persons in the Canadian population is expected to rise steadily, increasing the need to strengthen social safety nets. Therefore, future improvements in real incomes and quality of life in Canada have to come mostly, if not entirely, from productivity improvements.

It is important to note that a small difference in productivity growth would make a big difference to per capita real income levels over the medium to longer term. For instance, if Canada’s business sector’s labour productivity growth averages 0.7 percent per year over the next 15 years (the same pace as from 2000 to 2010), Canada’s per capita real income in 2025 would be $52,960 (in 2010 dollars); but if labour productivity growth averages 1.7 percent per year, per capita real income would be $61,422 – more than 15 percent higher. For a family of four, this would translate into an increase in annual inflation-adjusted income of almost $34,000.

A second major reason productivity is important is to ensure the cost-competitive position of Canadian companies in increasingly global markets for goods and services. The competitiveness challenge has two dimensions: selling into the US market (for which exchange rate is a big factor) and facing import competition from emerging economies, especially the BRIC countries (Brazil, Russia, India and China). Therefore, a relatively strong business sector productivity performance is essential to meet the growing competitive challenge from the US, China, Brazil and India effectively.

Given that about 40 percent of Canada’s exports are manufactured goods, cost competitiveness in the manufacturing sector is especially important. Between 2000 and 2008, unit labour costs in Canada’s manufacturing sector increased 58 percent faster than in American manufacturing. About half of this deterioration in relative costs was due to the appreciation of the Canadian dollar, but the other half was due to slower productivity growth in Canada relative to the US.

The Canadian dollar is expected to remain at par with or above the US dollar over the medium term, because of continuing strong demand for resources and resource-based products from fast-growing emerging economies, such as China and India, and a US currency that is generally weak against all major currencies. Hence, to ease the growing competitive challenges from US manufacturers, Canada needs to significantly improve its relative productivity performance.

But competitive challenges do not emanate solely from the United States. Increased import penetration from emerging economies such as China, Mexico, Brazil and India (either directly or indirectly via the US) can no longer be ignored. The competition for Canada from these countries is especially strong in manufacturing and service industries with low to medium wages and productivity, such as textiles, clothing, furniture, auto parts, small appliances and electrical products, and information technology services. However, they are moving aggressively up the value chain to challenge the developed nations across all economic sectors, and Canada must act decisively to do what it takes to stay a step ahead of them.

In this section, we will examine Canada’s productivity record in some detail. We will first look briefly at economy-wide trends and then examine differences across industry sectors in more detail to better understand where the productivity problems are most severe. This section, especially the industry analysis, draws heavily on a recent paper by Tang, Rao, and Li (2010).

Canada’s labour productivity growth in the business sector (the 85 percent of the total economy for which reliable data are available) has slowed sharply since 1973 (a pattern seen in all industrialized countries) and has trailed that of the United States since 1981 (figure 3). In the 1990s’ economic expansion, especially in the second half, Canadian labour productivity growth accelerated, averaging 1.7 percent per year, although faster growth south of the border widened the gap. Since 2000, however, labour productivity growth has averaged only 0.7 percent, compared with 2.4 percent in the US.

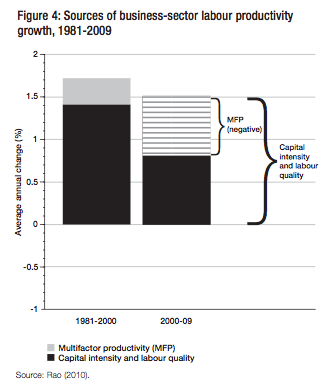

To better understand the proximate sources of the post-2000 slowdown in Canada’s aggregate labour productivity growth, it is useful to separate the trend into two components: the part due to increases in capital intensity and quality of labour and the part due to changes in the efficiency with which inputs are used in production (commonly referred to as multifactor productivity, or MFP). Figure 4 shows the contribution of each of these components to total labour productivity growth in the 1981-2000 and 2000-09 periods. The contribution of increasing capital intensity and labour quality was about the same in each, adding roughly 1.8 percentage points to average productivity growth. The large difference is in MFP. From 1981 to 2000, MFP growth was positive on average, thus increasing average annual productivity growth to 1.7 percent. However, MFP growth turned negative in the 2000s, and offset part of the contribution of increasing capital intensity and labour quality to productivity growth. As a result, total productivity growth from 2000 to 2009 was only 0.8 percent, significantly lower than in the earlier period.

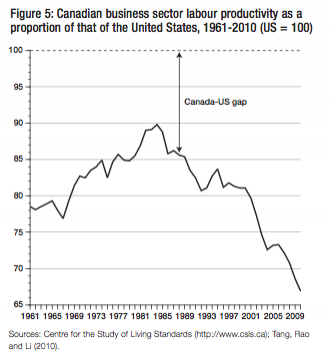

Labour productivity in the Canadian business sector grew, on average, at a faster pace than in the US prior to 1984, narrowing the Canada-US gap from 22 percent in 1961 to just over 10 percent in 1984. But, as mentioned before, Canada’s labour productivity growth has lagged behind that of the US in the past three decades, resulting in productivity divergence between the two countries. The Canada-US labour productivity gap increased from just over 10 percent in 1984 to just over 33 percent in 2010, the greatest difference in the last 50 years (figure 5).

While Canada-US comparisons are most pertinent from the perspective of cost competitiveness, Canada’s performance is also poor relative to that of a broader group of countries. According to OECD calculations, Canada ranked 26th among 33 OECD countries and 6th among the G7 in average annual productivity growth in the 2000s. While the rankings are a slight improvement relative to the performance of prior decades, they nonetheless confirm the gravity of Canada’s productivity problem.

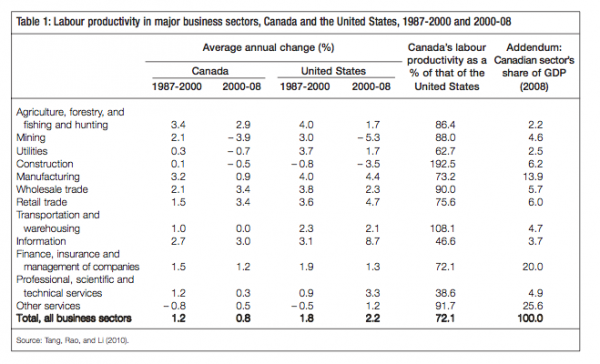

The deterioration of Canada’s aggregate productivity growth is well documented and understood, but the combined data mask considerable variation across sectors of the economy. Differences in sectoral performance can be seen in table 1, which shows productivity growth rates for 1987-2000 and 2000-08, as well as comparisons of productivity levels in the 12 major sectors between the US economy and the Canadian economy.1 For the Canadian and American economies as a whole, business sector productivity declined by equal amounts, thus preserving the one-percentage-point advantage in favour of the United States.

In Canada, average labour productivity growth decelerated in the 2000s for all major economic sectors except wholesale and retail trade and information industries (a group that includes activities such as publishing, broadcasting and telecommunications services). These sectors benefited from quantum leaps in information technology, which improved the efficiency of distribution and vastly decreased the cost of data transmission. Despite these improvements, Canada’s productivity level in information industries was still less than 50 percent that of the US as of 2007.

Some sectors actually registered declines in productivity. Mining is a case in point, where productivity went down by an average of 3.9 percent annually from 2000 to 2008. A drop in productivity can be brought on by sudden increases in demand that make it profitable for firms to use less cost-effective production techniques to meet that demand. The commodities boom that began in the mid-2000s is an example: recent research by Sharpe and Thomson (2010) and Rao (2010) suggests that increased use of low-grade mines and oil wells, driven by large increases in real output prices of these industries, was largely responsible for the productivity growth slowdown in these industries. However, the mining sector accounts for just 4.6 percent of total GDP, and its productivity level was a relatively high 88 percent of that of its US counterpart. Thus the effect of productivity declines in mining is minimal with respect to both national living standards and sectoral competitiveness. The substantial declines in labour and MFP growth rates in Canadian mining (including oil and gas) and utility industries were very similar to the reductions in growth rates in their US counterpart industries.

A relatively large sector that experienced a sharp decline in productivity in the 2000s is manufacturing, which accounts for 13.9 percent of Canadian GDP and is highly exposed to competition from the US. Productivity growth did not lag too far behind that of the US in 1987-2000 (3.2 percent annual average versus 4 percent), but in the 2000s Canada’s growth collapsed to 0.9 percent annually. The US manufacturing sector, in sharp contrast, boosted its productivity growth slightly. As a result, the productive capacity of Canadian manufacturers worsened considerably throughout the 2000s, falling to 73.2 percent of the US level in 2007.

Multifactor productivity (not shown in table 1) shows broadly similar trends across major economic sectors: declines in all but wholesale and retail trade and information industries. For the manufacturing sector, the decline in average MFP growth in the 2000s accounted for almost four-fifths of the total decline in productivity. The small remaining decline was due to a drop in capital intensity of production, which indicates that Canada’s problems in manufacturing are primarily due not to insufficient investment per se, but rather to the inability of companies to use inputs as efficiently and cost-effectively as their American counterparts. It also counters the conventional wisdom that Canadian manufacturing is significantly less capital intensive than manufacturing in the US.2

As noted earlier, a large proportion of Canada’s exports is made up of manufactured goods, and domestic manufacturers face stiff competition from American firms as well as those located in lower-cost emerging markets. For this reason, manufacturing productivity is particularly important for economic success.

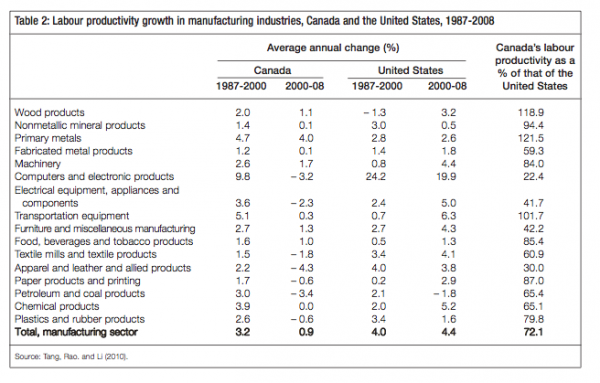

Table 2 shows detailed data for the 16 major manufacturing industries for Canada and the United States. All 16 Canadian groups experienced a significant labour productivity growth slowdown between 2000 and 2008, compared with the prior period. In sharp contrast, 9 of 16 US industry groups saw productivity growth accelerate.

Moreover, seven industries in Canada saw productivity growth turn into decline after 2000: computers and electronic products; electrical equipment, appliances and components; textile mills and textile products; apparel, leather and allied products; paper products and printing; petroleum and coal products; and plastics and rubber products. While the relative sizes of these industries vary considerably, they account together for almost one-quarter of total manufacturing. One industry of considerable concern is computers and electronic products. This is the epicentre of the infrastructure for the knowledge economy and a source of much innovation that has applications throughout the rest of the economy. In the US (where the industry’s share of manufacturing is almost four times that of its Canadian counterpart), productivity has been growing at double-digit rates. As a result, Canada’s output per hour worked in this industry is only 22.4 percent of the US level.

Even among several large industries that managed to maintain positive productivity growth in the 2000s, the deceleration since the 1987-2000 period is worrying. Average productivity growth in transportation equipment has dropped from 5.1 percent in 1987-2000 to nearly zero since then, whereas in the US the trends are the opposite. The sector enjoyed a strong productivity advantage over its US counterpart before 2000, so much so that transportation equipment producers remain competitive in the sense that productivity levels were still slightly higher than those of their US counterparts as of 2007. The chemicals industry (which includes fertilizers and pharmaceuticals as well as traditional industrial chemicals) also saw a sharp growth slowdown, from 3.9 percent to zero. This turnabout has left the industry at a considerable competitive disadvantage to its US counterpart, since productivity levels are only 65.1 percent of those in the US.

Some industries have fared relatively well on the productivity front. Industries that manufacture many raw materials (wood products, nonmetallic minerals and primary metals) have productivity levels that are near or above those in the US and have seen relatively modest growth slowdowns since 2000. This record is consistent with the thesis that Canada’s comparative advantage in competitiveness lies at the lower end of value chains (Expert Panel on Business Innovation in Canada 2009). Industries that transform these raw materials into intermediate and finished products (such as fabricated metals and electrical equipment and appliances) have had relatively poor growth rates and productivity levels relative to those of comparable American firms.

One large industry farther up the value chain that has performed fairly well is food, beverage and tobacco products, which constitutes just over 15 percent of Canadian manufacturing output. While its productivity growth over 1987-2008 has been modest, it is not materially different from that in the US, and it is competitive with respect to US industryspecific productivity levels.

The productivity diagnosis is clear and essentially undisputed: productivity growth has slowed considerably since 2000, with the largest declines occurring in mining and manufacturing industries. As a result of this broad slowdown, the Canada-US business sector labour productivity gap reached 30 percent in 2010, its highest level in at least 50 years. The slowdown in Canada’s labour productivity growth and the widening of the Canada-US business sector labour productivity gap were almost entirely due to the slowdown in MFP growth, both in relation to the US and in comparison with its own past. Insufficient capital investment, broadly speaking, is not the proximate cause Canada’s of productivity problems, though gaps in certain kinds of investment that are linked to innovation, discussed in the following section, have played a role.

As noted earlier, labour productivity growth is the fundamental longer-term determinant of improvements in real incomes and quality of life, because of the limits to contributions from growth in employment, the average number of hours worked per person and improvements in the terms of trade.

Therefore, to develop effective policies for improving the living standards and quality of life of Canadians, we need to understand better the key drivers of labour productivity growth. In this section, I will set out what the research literature tells us about what causes productivity growth and how Canada is faring on each factor in order to have a better sense of where public policies to improve productivity will be most cost-effective.

It is important to keep in mind that productivity growth is the outcome of complex interactions of the activities and actions of millions of business enterprises with their employees, competitors, clients and suppliers, creditors, educational institutions and governments, which makes it difficult to disentangle and identify strengths and weaknesses.

Nonetheless, at the industry level, productivity growth is influenced by six major factors: investment in physical capital, particularly information and communications technologies; innovation and the adoption and diffusion of new and state-of the-art technologies; investment in human capital; gains in productive efficiency from economies of scale and scope; intraindustry shifts in resources; and interindustry shifts in resources.

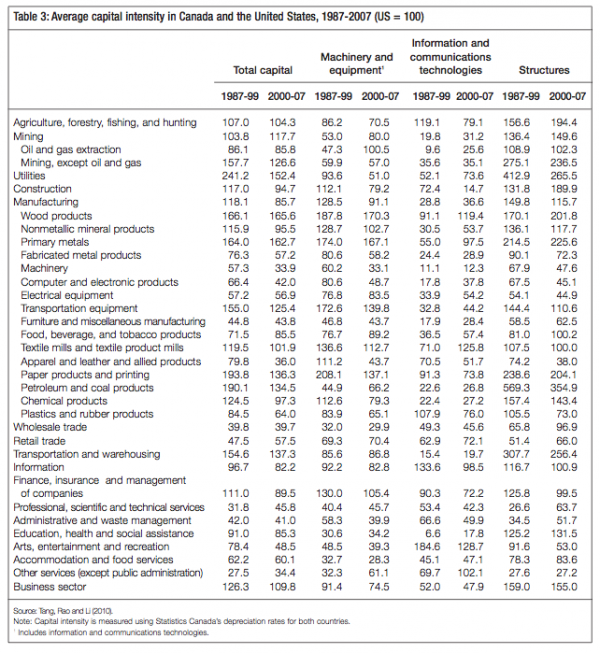

Perhaps surprisingly, the analysis in the preceding section indicates that the post-2000 productivity slowdown in Canada is not due to inadequate physical investment at an aggregate level (“capital deepening,” in the language of productivity research). Table 3 shows that the Canadian business sector taken as a whole is actually slightly more capital intensive than its United States counterpart (109.3 percent of the US level on average from 2000-07). The Canadian manufacturing sector’s capital intensity averaged 85.7 percent of that of its US counterpart in 2000-07, down significantly from 1987-99.

However, the composition of the capital stock in Canada is much more heavily tilted toward structures: the factories, warehouses, offices and other buildings necessary to run a business. Most economic sectors in Canada, particularly in goods-producing industries, are more structure intensive than their US counterparts, many significantly so.

But a large body of research shows that investment in machinery and equipment (M&E), particularly information and communications technologies (ICTs), rather than structures, is one of the most important drivers of productivity, because it is the vehicle through which innovations are put to use as well as a strong complement to human capital accumulation and research and development (R&D) spending in the innovation adoption process (Jorgenson and Stiroh 2000; Rao, Tang, and Wang 2008; OECD 2003; van der Wiel and van Leeuwen 2004; Fuss and Waverman 2005). A glance at table 3 shows glaring gaps in Canada: in its investment in M&E, the business sector of the Canadian economy was only three-quarters as capital intensive as the US in 2000-07, down from over 90 percent during 1987-99. The gap in investment in ICTs was much larger, at about 50 percent in both periods.

Table 3 also reveals that the Canadian manufacturing sector is even less ICT intensive than the economy as a whole: ICT capital intensity was just 36.6 percent of the US level in the post-2000 period, though that was a slight improvement from 1987-99. In addition, gaps in M&E capital (including ICTs), R&D and human capital (university education) are significantly positively correlated with the Canada-US labour productivity gaps. These results suggest that these three interdependent factors explain a large part of the Canada-US business sector productivity gap and its widening over time.

According to a recent report by the Conference Board of Canada (2011), Canada’s investment in M&E as a share of GDP remains one of the lowest among 16 peer countries. Canada’s average M&E investment share in GDP was the second lowest in the 1970s, 1980s and 1990s (only France had a poorer record). In the 2000s, Canada improved to 11th among the 16 countries, but this rise was due to lower investment shares in other countries rather than an increasing investment share in Canada. Furthermore, although ICTs’ share in M&E investment in Canada has increased significantly over time, it was significantly lower in Canada than in the US.

It is important to realize that the data in table 3 include only privately funded physical capital investment and exclude government investments in highways, sewers, airports and seaports, power generation and transmission, communication networks and the myriad of other long lived assets commonly referred to as infrastructure. Such facilities form the foundation that supports economic activity.

Public infrastructure is a strong complement to the private sector investments in productivity enhancing assets and hence is essential to maximize the productivity payoff from private sector investments in innovation and innovation adoption.

Empirical research done in Canada, the US and elsewhere shows a significant positive impact of investments in public infrastructure on productivity growth (Brox, 2008). A recent Statistics Canada study by Gu and MacDonald (2009) suggests that public infrastructure spending could provide a 17 percent rate of return. Their estimates also show that the growth in public infrastructure capital accounted for half of the total business sector MFP growth in Canada from 1962 to 2006.

Given the public-good nature of these infrastructure facilities, their provision, delivery and maintenance has been the responsibility of various levels of governments in all countries. However, in view of growing fiscal constraints on the public sector, new instruments and partnerships (including the provision of infrastructure by the private sector) are being used.

The available empirical research strongly suggests that innovation and technology adoption are by far the most important ingredients for improving the efficiency with which production inputs are organized and used as well as for the development of new higher-value products (both of which result in faster MFP). But innovation is a complex process that depends on factors as diverse as R&D, investments in state-of-the-art machinery and equipment, competitive pressures related to trade and investment, linkages with other countries, the quality of management and the availability of venture capital. To complicate matters further, all these factors are interrelated.3

Innovation activities include R&D spending by the business sector, R&D performed by universities and governments, imports of R&D services, licensing and purchasing of unembedded technology, technological training, engineering and consulting services and industrial design.

R&D spending by the business sector is a major input in the innovation process. It is the most important factor for creating new products and processes and for absorbing new technologies (OECD 2004; Bernstein 2002; Pages 2010). Hence R&D spending by business is the most important determinant of innovation and innovation adoption. Research done at the OECD (2004) suggests that a 10 percent increase in business sector real R&D spending would eventually translate into a 1.5 percent increase in MFP and GDP. However, R&D spending impacts MFP after a 5-to-10-year time lag (Hall, Mairesse, and Mohnen 2009).

Because much knowledge generated by R&D ultimately ends up in the public domain (either by design or by reverse engineering, plant visits and other efforts to learn from the knowledge of others), there are significant productivity spillovers from R&D throughout the economy and the social rate of return on R&D exceeds the private rate of return. R&D by universities and governments complements private sector R&D. Innovations from the university and government research could be commercialized by the business sector and reap the full productivity benefits, thereby increasing the private and social rates of return on business R&D. Consequently, strong government involvement and financial support by government for the business sector and universities are essential for undertaking optimum levels of R&D in an economy.4

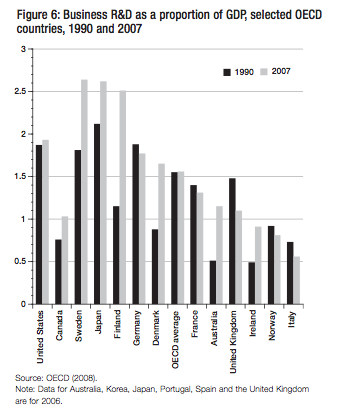

Canadian businesses invest less in R&D than companies in most other OECD countries. There is a substantial R&D intensity gap vis-à-vis the US business sector; however, the gap narrowed somewhat between 1990 and 2007 (figure 6). Available research suggests that differences in industrial structure have accounted for about one-third of the Canada-US business sector R&D gap. Foreign ownership does not seem to have played a role.

The manufacturing sector performs over half of the business sector R&D in Canada. But Canada ranked 10th among 12 developed OECD economies in 2006 in its R&Dto-GDP ratio in manufacturing. The intensity of manufacturing sector R&D in Canada was less than half of the US level in 2005. Only 5 of 14 manufacturing industries were more R&D intensive than their US counterparts. Moreover, these five industries represented only about 15 percent of manufacturing value added in Canada (Rao 2010).

Small open economies, such as Canada’s, benefit much more from R&D done in other OECD economies, especially the US, than from domestic R&D spending for increasing innovation (Coe and Helpman 1995; Bernstein 2002; Acharya and Keller 2007). Strong international trade and investment linkages facilitate knowledge and technology transfer and contribute a great deal to innovation adoption in Canada. Of course, to maximize the productivity benefits from foreign R&D, a certain amount of domestic R&D is essential.

Intense competition within and between industries increases incentives to innovate and adopt new technologies quickly, and to raise productivity. However, the relationship between these variables is expected to be nonlinear, because very high levels of competition could drastically reduce the profit margins of firms and hold back innovation and technology adoption. Research done at the OECD and elsewhere does support the thesis that the relationship between innovation and competition intensity traces an inverted U-shape; however, it is unclear what side of this curve Canadian firms are on.

The measurement of competition intensity is not straightforward, because of several conceptual and measurement difficulties (Aghion et al. 2005; Ahn 2002). Recent Industry Canada research suggests that there is a high degree of competition intensity in Canadian manufacturing and service industries, and Canada outperforms the US in many industries. However, it is important to note that competition intensity is endogenous. It is influenced by a host of factors such as competition policy, product and labour market regulations, trade and foreign investment policies, and tax and subsidy policies.

A high degree of trade openness and intraindustry shifting of resources in the Canadian manufacturing sector suggests vigorous competition in most Canadian manufacturing industries. On the other hand, foreign ownership restrictions in many key service industries might be constraining competition in these industries.

An important impediment to the entry of new innovative firms and their growth is the lack of financing. The main source of financing for innovative start-ups is equity capital provided by venture capitalists. The research done in the US and at the OECD finds that venture capital activity in an industry significantly increases its patenting, a good measure of innovation outcome (OECD 2004; Expert Panel on Business Innovation in Canada 2009; Lynch 2010).

Improvements in human capital, as measured by education level and work experience of the labour force, increase productivity and the labour market participation of individuals. Much of the available literature measures the productivity effects through private returns on education and experience by correlating wages with the education and experience levels of individuals.

Results from growth accounting research show that improvements in labour quality, measured by changes in educational attainment and experience, accounted for 25 percent, on average, of business sector labour productivity growth in Canada from 1981 to 2009. Similar estimates are obtained for the US (Baldwin and Gu 2009; Jorgenson, Ho, and Stiroh 2008). It is important to note these estimates of productivity impacts do not capture the productivity spillovers from human capital accumulation.

The Canadian workforce is well educated by international standards. The proportion of the population aged 25-64 with post-secondary degrees, at 49 percent in 2008, is the highest among OECD countries. However, Canada differs from the United States in that half of of these degrees are from colleges and vocational schools. If we limit the analysis to university graduates, Canada lags behind the US by a considerable margin: the proportion of the working-age population with university degrees in Canada was 25 percent in 2008, compared with 32 percent in the US.

This difference is important with respect to productivity, because research by Rao, Tang, and Wang (2002, 2008) strongly suggests that productivity elasticity from university education is significantly greater than from other types of post-secondary education. It also indicates that university education is a strong complement to R&D and M&E in the production process. This is consistent with work by Boothby and Drewes (2006) that shows the wage premium for workers with nonuniversity post-secondary degrees is only one-quarter to one-third of that for holders of university degrees.

University-educated workforces and researchers are central to the undertaking of innovation activities and the adoption of new technologies, the two key drivers of productivity growth.

Although Canada has a higher proportion of population aged 25-64 with university degrees than many OECD countries, we have a 31 percent gap with the US. Similarly, the proportion of researchers in total employment is higher than the OECD average, but Canada has a large gap (30 to 50 percent) vis-à-vis the US, Japan and Nordic countries (Ryan 2010).

Firm-based productivity research across many countries shows a strong positive correlation between the firm size and labour productivity, indicating the importance of scale and scope of operations for productive efficiency. Large firms enjoy greater productivity benefits from longer production runs and lower per-unit fixed costs than their smaller counterparts. Moreover, because of this structural productivity disadvantage, small and medium-size enterprises (SMEs) tend to invest less in innovation and physical and human capital, and and they tend to have less diverse product markets. These dynamics further exacerbate their productivity and competitiveness problems over time, creating a vicious cycle of lower size, lower productivity, lower trade and investment orientation and fewer investments in productivity-enhancing assets (Baldwin, Jarmin, and Tang 2004; Rao and Ahmad 1996; Pages 2010; Leung, Cesaire, and Yaz 2008).

In 2002, over 99 percent of manufacturing firms in Canada had fewer than 100 employees, the same percentage as in the US. However, their share of manufacturing employment was 79 percent, and their share of value added was 67 percent. In the US, the shares were 70 percent and 58 percent, respectively.

The difference in the average firm size between manufacturing firms in Canada and in the US is largely due to the much larger average number of employees at firms with 500 or more employees in the US. In short, Canada does not have as many large firms as the US, and the large firms in the US are much larger than those in Canada.

Research by Almon and Tang (2011a) shows that large manufacturing plants (those with over 1,000 employees) in Canada are as productive as their large US counterparts. On the other hand, their analysis suggests that the difference in productivity between plants with fewer than 1,000 employees in the two countries accounted for over two-thirds of the Canada-US manufacturing labour productivity gap in 2002. Differences in plant size in the two countries explained 20 percent of the manufacturing productivity gap.

A recent paper by Tang (2011) suggests that the contribution of the differences in the industrial structure to the Canada-US manufacturing sector labour productivity gap increased from 9 percent in 2002 to 20 percent in 2007, while the contribution of the plant size effect to the productivity gap declined from about 27 percent to over 8 percent in 2007.

Leung, Cesaire, and Yaz (2008) extended the relationship between firm size and productivity in the Canada-US context to nonmanufacturing industries. They found a significant positive relationship between firm size and labour productivity and MFP. The relationship is stronger in the manufacturing sector than in nonmanufacturing industries. The authors’ estimates show that the differences in employment distribution across firm size categories in the two countries accounted for approximately 21 percent of the Canada-US gap in labour productivity (expressed as sales per employee) at the aggregate level and for 48 percent of the gap at the manufacturing level.

In short, the available empirical research indicates that differences in economies of scale account for a significant part of the Canada-US business sector labour productivity gap. But, from the existing research, it is difficult to say how much the changes in the firm size distribution in the two countries contributed to the widening of the business sector productivity gap since 1981, especially after 2000.

Improvements in resource reallocation across firms within industries can contribute significantly to improvements in the productivity performance of individual industries, and thus improve the economy’s aggregate productivity performance. Industries are in constant flux: low-productivity firms close, high-productivity firms enter the market, and existing firms can shift resources internally from low-productivity activities to high-productivity activities. Such dynamics are often referred to as “creative destruction,” in reference to Joseph Schumpeter’s observation that the entry of creative and innovative firms will eventually destroy those low-productivity firms that are unable to cope with the new competition. Microeconomic productivity research done in Canada, the US, Europe and Latin America shows that firm dynamics are an important determinant of intraindustry shifts in productive resources and productivity growth (Bartelsman and Doms 2000; Bartelsman, Haltiwanger, and Scarpetta 2008; Verhoeven 2004; Baldwin and Gu 2011).

For example, firm dynamics made a major contribution to productivity growth in Finland over the past 35 years or so. They explain about one-third of the overall productivity growth in Finnish manufacturing since 1975 (Maliranta, Rouvinen, and Yla-Anttila 2010).

Research by Baldwin and Gu (2006, 2011), Chan, Gu, and Tang (2010) and Chan, Tang, and Gu (2011) shows that firm dynamics contributes from one-third to as much as three-quarters of labour productivity growth in Canada’s manufacturing and retail trade sectors. I suspect that it is also important for productivity growth in other industries.

Did the slowdown in firm dynamics contribute to the decline in labour productivity growth in the manufacturing sector? Recent research by Baldwin, Gu, and Yan (2011) indicates that it did not do so, and research results for the transportation equipment industry by Chan, Tang, and Gu (2011) are similar. However, the results for the electronics and electrical products industry indicate that the slowdown in firm dynamics was responsible for about one-third of the post-2000 productivity growth slowdown in that industry (Chan, Gu, and Tang 2010).

We do not know whether differences in firm dynamics in the two countries explain some of the Canada-US business sector labour productivity gap or its widening over time. New comparative research on firm dynamics in Canada and the US, although very data intensive, would be extremely useful in getting further insights into the productivity dynamics in the two countries.

All other things remaining constant, shifts in capital and labour from low-productivity (level as well as growth) industries to high-productivity (level and growth) industries would raise the overall productivity performance of an economy, and vice versa. In the first half of the 20th century, the declining share of agriculture as an employer and the rising shares of industry and services contributed significantly to raising overall labour productivity growth in Canada and other OECD countries (Nadeau and Rao 2002; Sharpe 2010; Hirshhorn 2011).

Recent papers by Sharpe and Thomson (2010), Hirshhorn (2011), Baldwin and Gu (2009) and Rao, Sharpe, and Smith (2005) examined how increased shifts in labour input from manufacturing to mining, especially oil and gas, and service industries, affected the slowdown of business sector labour productivity growth. The results vary from a small negative contribution to a small positive contribution.

Research by Rao and Lempriere (1992), Nadeau and Rao (2002) and Almon and Tang (2011a) indicates that the difference in industrial structure between Canada and the US has not contributed in any significant way to the Canada-US productivity gap, either in manufacturing or in the economy as a whole over the past 20 years. This is because the relative productivity advantage of the US in high-tech manufacturing and service industries is more or less offset by Canada’s relative advantage in resource and resource-based manufacturing industries.

However, a recent paper by Almon and Tang (2011b) suggests that interindustry shifts in labour input might actually have contributed somewhat to the narrowing of the Canada-US business sector labour productivity gap after 2000, because of a significant increase in the importance of the mining industry (which has a high level of productivity) in the Canadian economy. But at the same time, interindustry shifts seem to have widened the Canada-US labour productivity gap in manufacturing.

In summary, investments in physical and human capital, innovation and technology adoption, economies of scale and scope and intraand interindustry shifts in productive resources all play roles (albeit to varying degrees) in the determination of a country’s productivity growth path. Since they are all highly interrelated, it is difficult to disentangle completely their individual contributions to overall productivity growth. For instance, increased investment in information and communications technologies can both cut unit production costs directly and stimulate additional innovations that lead to increasing investment in R&D. An example is the dramatic increase in the computerization of the activities of the retail trade sector in the US and Canada over the last 20 years, especially for purposes of distribution, timely delivery and inventory control. It resulted in a huge reduction in unit production costs for the firms that were the leaders in the application of ICTs, such as Walmart, and increased their market shares, resulting in a significant increase in their R&D, creating a virtuous cycle of innovation and low production costs. Available empirical research also suggests that ICTs and R&D are complements in the production process.

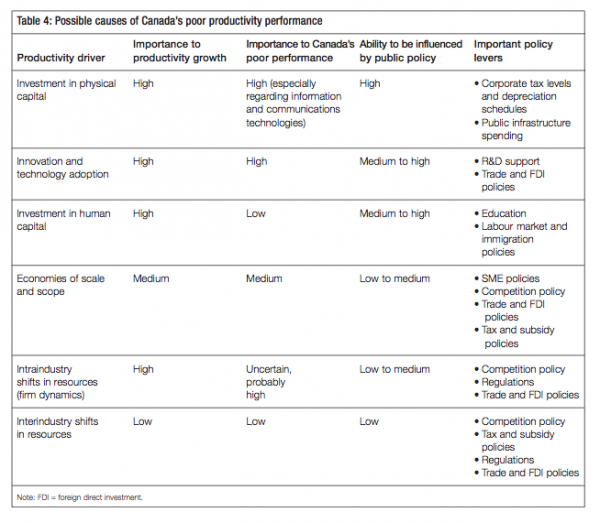

Despite these complexities, table 4 synthesizes the qualitative and quantitative discussion in this section by assessing the importance of the six major drivers of productivity growth, their importance in Canada’s poor performance and the ability of public policy to influence them, as well as the potential policy levers that can be used to address them.

Of most relevance to policy-makers are those factors that are highly important to Canada’s poor productivity performance and on which public policies can have a direct impact. Based on the voluminous research reviewed in this section, investment in information and communication technologies and in innovation and technology adoption should be the main proximate targets for encouragement, and they will be a central focus of the more detailed policy discussion later in the study.

Another important factor in spurring productivity is the process of firm dynamics, by which unprofitable firms and plants close down and are replaced by newer, more productive ones. The empirical research from other countries shows that such “churning” is important, because it is the process by which new productivity-enhancing investments and innovation are deployed. However, the Canadian research shows mixed results: for the manufacturing sector as a whole, this factor was not an important contributor to the productivity growth slowdown, but it was a significant factor in the specific manufacturing industries that have been studied (electronic products and electrical equipment).

Economies of scale and scope and interindustry resource shifts are of lesser quantitative importance than the factors just mentioned, but are nonetheless significant. It was noted earlier that about 20 percent of the Canada-US productivity gap can be attributed to differences in firm size, and that very large Canadian firms are as productive as their American counterparts. But scale and scope economies depend on market size, which is difficult to influence directly through public policy actions. Public policy can indirectly attempt to help companies grow by using trade and investment policies to enlarge potential markets and provide opportunities for smaller firms to grow.

Shifting of resources from one industry to another is a process largely determined by market forces and over which public policies also have only a marginal influence. For instance, high demand for natural resources, rather than government policy, has enlarged Canada’s mining sector relative to other sectors of the economy in recent years, and it would be difficult and counterproductive to attempt to interfere with the sectoral allocation of production resources in the name of increasing aggregate productivity. By the same token, however, governments should avoid artificially supporting low-productivity industries via targeted subsidies and instead adopt policies that keep industry barriers to entry low and expand potential markets for high-productivity activities, while letting market forces determine the most suitable allocation of economic activity across sectors.

The important roles of competition and international linkages as framework conditions for many aspects of productivity growth are evident in table 4: policies to increase trade and foreign direct investment (FDI) linkages and encourage competition have tangible effects on four of the six productivity drivers listed there. They are important because they operate on the demand side rather than the supply side of productivity improvement. Policy tools that encourage productivity-enhancing activities – such as innovation and investment via tax credits, low corporate tax rates, R&D grants and other methods to lower the cost of those activities – work exclusively on the supply side. But companies do not decide to invest in equipment and innovation based solely on the cost of doing so; they also must be compelled by pressure on the demand side, whether it be the entry of a new competitor in their market, a desire to sell in new geographic markets or the exigencies of their existing customers. Competition policy and international trade and investment linkages, working together, have a direct effect on the demand for higher productivity and are as much a part of productivity policies as the more traditional tools of tax policy and direct grants.

Before examining the policy implications of research findings in detail, it is important to identify potential new challenges for raising the speed limit of the Canadian economy that were perhaps not so prominent in the past. There are a number of adverse trends that will likely impede Canada’s productivity growth.

An acceleration of the slowdown in labour force growth in Canada and other OECD countries; the growing competitive challenges from large fast-growing emerging economies, such as China, Brazil and India; and the large government deficits and debt levels in the US and European countries are likely to keep the growth in domestic as well as external demand for Canadian products and services from the US and other OECD countries very weak in the future.

However, the large emerging economies, such as China, India, Brazil and Indonesia, are expected to continue to grow at a healthy pace, because of their favourable demographics, big improvements in physical and human capital and a huge potential to catch up to advanced countries’ per capita income levels. As a result, the global demand for natural resources and resource-based products should remain high. In view of Canada’s strong comparative advantage in these industries, the vigorous growth in emerging economies could partially offset the slowdown in demand for Canadian products and services from the US and other advanced economies. But, given that the extraction of natural resources is becoming increasingly difficult and expensive, the increased shift in productive resources from manufacturing and service industries to resources and resource-based industries could damage the aggregate productivity growth and would increase the environmental challenges in Canada.

Growth in demand and growth in output are generally positively correlated. Productivity growth tends to be strong in periods of strong growth in domestic and foreign demand, and weak during periods of slow growth in demand (Verdoorn’s Law). In addition, a prolonged period of slow growth in domestic and foreign demand could also adversely impact the fundamental determinants of productivity growth, discussed in the previous section, creating a vicious cycle of low productivity, low economic growth and weak demand, similar to Japan’s experience over the past 15 years.

A related problem is the effect of a sluggish recovery on the obsolescence of skills and capital equipment. Canada’s economic growth is expected to average less than 2.5 percent in 2011 and 2012. Consequently, the unemployment rate is expected to remain above 7 percent in the medium term. More important, the average duration of unemployment and underemployment is expected to stay high over the next five years. These developments could increase obsolescence of the skills of the workforce. Similarly, the expected slowdown in domestic and external demand for Canada’s products and services, the large interindustry shifts in productive resources and rapid technological changes could also reduce the productivity of existing physical capital.

The demand for resources and resource-based products is expected to remain strong in the future because of the rapid economic growth in large emerging economies, especially China and India. This is likely to keep real commodity prices and the Canadian dollar high. In addition, the US dollar is expected to stay generally weak vis-à-vis all major currencies because of huge government deficits and debt, and the large trade deficit in the US.

The strong currency has two opposing potential effects on productivity. The first is a reduction in the cost of acquiring machinery and equipment. Canadian firms purchase a large share of such investment goods from the US, so a strong Canadian dollar lowers their price. All else being equal, this should stimulate additional investment, which is an important driver of productivity.

However, all else is not equal. A strong Canadian dollar also reduces demand for exports, which become more expensive to foreign purchasers. This reduces the profitability of exportoriented Canadian firms (of which there are many), thus reducing availability of investable resources. In addition, because productivity tends to be procyclical, the reduction in demand has a direct adverse impact on short-term productivity trends.

Which one of these possible effects dominates is an empirical question, and Ng and Souare (2011) demonstrate that the positive impact of a real exchange rate appreciation, by lowering the cost of M&E investment demand in Canadian industries, is almost completely offset by the negative effect of the exchange rate appreciation on demand for that investment, due to the loss of foreign sales. Thus, on balance, a high dollar likely spells productivity challenges as much as it does opportunities.

Technological progress is increasingly becoming skills-biased (Autor, Katz, and Krueger 1998; Machin, Ryan, and Van Reenen 1998; Pierrard and Sneessens 2002; Mehta and Mohr 2010). Consequently, the availability of highly skilled employees is crucial for innovation and technology adoption, a key driver of productivity growth.

In view of the expected slowdown in labour force growth in Canada and other OECD countries and increasing competition for highly skilled people worldwide, including in the large fast-growing emerging economies, Canada is likely to face a growing shortage of skilled workers in the future. Such a development would severely constrain the ability of Canadian businesses to innovate and to quickly adopt new and state-of-the art technologies, thereby reducing productivity growth. There is, however, a small silver lining to the coming skilled-labour shortage. The slowdown in labour force growth in Canada will raise the price of labour relative to the cost of capital, thus increasing the capital-labour ratio and labour productivity growth.

Canada has two serious productivity problems: slow growth in productivity; and a large and widening gap with the United States, our largest and most dominant trading partner. Canada needs to start acting now to address these two major challenges, because we know that the economic forces that have driven income growth over the past decade – strong labour force growth and rapidly rising commodity prices – will start to level off and possibly even decline in the decade or two to come. In addition, the Canadian manufacturing sector has shrunk dramatically in terms of both output and employment, and the only way for it to turn itself around in the face of a strong dollar and intense competitive pressures from around the world is to improve its productivity.

Productivity is the outcome of complex interactions of decisions and activities of the private sector: the millions of Canadian business enterprises, domestic and foreign customers, suppliers, creditors, competitors, employees, universities and governments. It is primarily determined by the private sector’s investments in employee skills development, physical capital, and innovation and technology adoption, and by the size and pace of economic adjustment by businesses to rapidly changing market conditions.

To highlight the urgent importance of addressing the productivity challenges, Canada needs to make the productivity issue the central focus of all public debates and policy discussions. Another policy suggestion is to evaluate and disseminate widely the productivity impacts (both direct and indirect) of all government policies and programs, especially new initiatives.

There is no magic bullet or quick fix to Canada’s productivity problems, and governments should be careful to focus on those areas where there is a strong economic rationale for intervention and where the research evidence indicates that payoffs are high. The following policy measures meet both those criteria.

One important policy decision has already been taken that strengthens the productive potential of Canadian firms: the steady reduction in statutory corporate tax rates over the past 12 years. Canada’s federal corporate tax rate is now significantly lower than those of the US and most other countries. This increases resources available for investment, and several studies have shown that businesses have indeed responded to tax changes by investing more than they would have otherwise (Parsons 2008). Corporate tax policy could be made even more effective if the depreciation rates for investment in machinery and equipment were updated regularly to reflect more rapid obsolescence, particularly with regard to ICT equipment.

Canada provides one of the most generous programs of R&D support to the private sector among OECD countries. But unlike most OECD countries, Canada relies very heavily on indirect tax-based R&D support to Canadian enterprises rather than direct grants. The Scientific Research and Experimental Development (SR&ED) tax credit is generous in its amount (20 percent credit for large firms, 35 percent for small firms), its base (the credit applies to all qualified spending, not just above a certain threshold) and its definition of qualifying expenses (fairly broad compared with other countries). Despite this generosity, business R&D intensity here is significantly lower than in most major developed nations.

Tilting the balance of government support for business R&D toward direct grants would improve business R&D performance. A Department of Finance assessment of the SR&ED tax credit concluded that it provides modest net economic benefits, but also conceded that “direct assistance in the form of grants appears likely to leverage more research than tax credits” (Parsons and Phillips 2007, 33). But, more important, grants would allow governments to assess the extent to which those funds actually result in productivity enhancement. The SR&ED tax credit has no such accountability mechanism, and there have been recent concerns about abuse and fraudulent claims (McKenna 2011).

In addition, governments must do a better job of improving interface and collaboration between the three important actors in the Canadian innovation system (the business sector, universities and governments) in order to improve the synergies between them and raise the overall productivity benefits of R&D spending to Canada. Niosi (2008) points out that the fruits of the large investments that the federal government makes in university research do not always reach businesses, in part because the latter are neither involved sufficiently in decision-making on government grant approvals nor connected to universities via formal partnerships or informal networks. Such linkages could also raise overall business sector R&D intensity (Expert Panel on Business Innovation in Canada 2009; Lynch 2010).

Canada could significantly raise the overall productivity benefits from its innovation and innovation adoption efforts by targeting industries and sectors with significant positive productivity spillovers on other industries and sectors, such as biotechnology, aerospace, autos and ICT.

As noted earlier, an increase in foreign direct investment flows would address many factors behind Canada’s productivity conundrum by expanding exports as well as imports; it would also improve capital formation and competitive intensity and stimulate development and adoption of innovations (Rao, Souare, and Wang 2010). Expansion of both exports and imports would improve productivity by increasing the benefits from specialization and scale and scope economies, raising competition intensity and enhancing knowledge and technology transfers.

In order to attract more of the North-America-bound FDI to Canada and retain existing investments, Canada needs to clarify and streamline its foreign investment rules and regulations. In addition, Canada should remove the foreign ownership restrictions in key service industries, especially in network industries, such as telecommunications, air transport and financial services. It is also important to note that interprovincial barriers to trade and investment reduce Canada’s attractiveness for foreign firms (because they make it difficult to serve nation-wide markets) and should be eliminated.

Despite growth in emerging markets for Canadian products and services, the US is and always will be Canada’s dominant trading partner for the foreseeable future. The Canada-US Free Trade Agreement and NAFTA have brought large economic benefits to both countries and, as Trefler (2004) documents, large productivity gains for Canada.

But further steps can be taken. Reduction of nontariff barriers to trade, such as differences in regulations and food and health safety standards, through harmonization would significantly stimulate the commercial relations between the two countries and increase competitive pressures to boost productivity. Harmonization of Canadian and US tariffs vis-à-vis third countries through a customs union would also provide significant economic benefits to both countries (Ghosh and Rao 2005), although recent work by Georges and MeÌrette (2010) indicates that the magnitude of those benefits may have declined somewhat because of multilateral tariff reductions in the 1990s.

Large emerging economies have been growing at a much faster rate than Canada, the US and Western European economies. This divergence in growth rates will continue, if not accelerate, in the future. According to the latest analysis by Goldman Sachs (2009), the economies of China and India will rank first and third in level of real GDP, respectively, by 2050. Similarly, the economies of Brazil, South Africa and Indonesia are also expected to grow at a much faster pace than the OECD economies, because of the large differences in demographics and economic development.

Despite its weak commercial linkages with emerging economies, Canada’s trade and investment flows with them increased significantly because of their relatively faster economic growth. By improving access to these fast-growing economies, Canada could increase its trade and investment opportunities a great deal, strengthen its supply chain linkages with these economies and improve its productivity performance. To significantly improve access to these markets and strengthen its commercial linkages with the fast-growing economies, Canada needs to negotiate and sign comprehensive free trade agreements with them, similar to the one currently being negotiated with India.

Development and maintenance of a high-quality transportation and telecommunications infrastructure is perhaps one of the most important core roles of government, particularly in a vast, sparsely populated country such as Canada. It is crucial for the efficient functioning of product, capital and labour markets, it underpins private investment and it improves the productivity dynamics in Canadian industries. These networks are also critical for reducing trade costs as well as improving service delivery for Canadian exporters and importers.

Given that the need for expansion and repair of existing infrastructure has been widely documented, Canadian governments should move beyond the short-term “action plan” designed to combat the recent recession and significantly boost resources devoted to improving transportation and communication networks over the next several years. Of particular importance are initiatives to assure low-cost reliable broadband availability across the country. As noted earlier, Canadian businesses lag behind the US and other major OECD countries in investment in ICT equipment. Further public investment in broadband will help encourage businesses to narrow this gap.

Despite more than two decades of rigorous empirical research on the determinants of productivity in Canada, there is still much that we do not know. Based on my synthesis of productivity drivers and the available research on Canada’s productivity challenges, I will outline here some of the key knowledge gaps and future research priorities.

The main objective of this study has been to provide a synthesis of Canada’s productivity challenges, examine their possible causes and explore some of the policy and research implications of the findings.

The analysis shows that Canada has two serious productivity problems: weak productivity growth and a large and widening business sector productivity gap vis-à-vis the United States, its largest trading partner. Canada has also been losing ground to other OECD countries. The problems are broad-based across all Canadian industries, but are particularly acute in the manufacturing sector and are likely to remain, if not increase, in the future.

Inadequate private sector investments in innovation and technology adoption and the slow and weak adjustment of physical and human capital to rapidly changing market conditions seem to be largely responsible for Canada’s productivity problems.

In the past decade, despite the serious productivity challenges, the Canadian economy performed well relative to other OECD countries in terms of economic growth and real income improvements, thanks to stronger employment growth and large gains in trade. However, Canada will not be able to rely on these sources for future real income gains because of the marked slowdown in labour force growth and the difficulty of continuously improving its terms of trade. Moreover, the aging of Canada’s population and the growing competitive challenges from the US and emerging economies will increase the need for strong productivity growth in the future. Given the urgent need to address these productivity challenges, Canada should make them the central focus of all public debates and policy discussions surrounding the economy.

Future productivity improvements will be predominantly determined by the private sector’s investments in innovation and technology adoption and by the size and pace of economic adjustment in Canadian industries to changes in the economic environment. Nevertheless, government policies have a critical role to play in creating an environment in which firms have incentives to make the investments necessary to boost productivity growth to rates that are sufficient to secure the income growth and level of government services that Canadians have come to expect, and indeed deserve.

Acharya, R.C., and S. Coulombe. 2006. “Research and Development Composition and Labour Productivity in 16 OECD Countries.” Industry Canada Working Paper 2006-02.

Acharya, R.C., and W. Keller. 2007. “The Evolution of the World’s Technology Frontier, 1973-2002.” Industry Canada Working Paper 2007-03.

Aghion, P., N. Bloom, R. Blundell, R. Griffith, and P. Howitt. 2005. “Competition and Innovation: An Inverted-U Relationship.” Quarterly Journal of Economics 120 (2): 701-28.

Ahn, S. 2002. “Competition, Innovation and Productivity Growth: A Review of Theory and Evidence.” OECD Economics Working Paper 317.

Almon, M.J., and J. Tang. 2011a. “Do Very Large Producers Contribute to the Canada-U.S. Productivity Gap?: Evidence from Manufacturing.” Industry Canada (mimeo), October. Industry Canada Economic Research and Analysis Working Paper Series.

—————–. 2011b. “Industry Structure Change and Economic Growth: A Canada-U.S. Comparison.” Industry Canada. Presented at 45th Annual Canadian Economics Association Conference, June 4, Ottawa.

Anderson, R.D., and N. Gallini. 1998. Competition Policy and Intellectual Property Rights in the Knowledge-Based Economy. Calgary: University of Calgary Press.

Autor, D.H., L.F. Katz, and A.B. Krueger. 1998. “Computing Inequality: Have Computers Changed the Labour Market?” Quarterly Journal of Economics 118: 1169-213.

Baldwin, J.R., and W. Gu. 2006. “Plant Turnover and Productivity Growth in Canadian Manufacturing.” Industrial and Corporate Change 15 (3): 417-65.

—————–. 2009. Productivity Performance in Canada, 1961 to 2008: An Update on Long-Term Trends. Canadian Productivity Review, no. 25. Ottawa: Statistics Canada.

—————–. 2011. “Firm Dynamics and Productivity Growth: A Comparison of the Retail Trade and Manufacturing Sectors.” Industrial and Corporate Change 20 (2): 367-95.

Baldwin, J.R., W. Gu, and B. Yan. 2011. “Accounting for Slower Productivity Growth in the Canadian Manufacturing Sector after 2000: Evidence from Micro Data.” Presented at the annual meeting of the Canadian Economics Association, June 2-5, University of Ottawa.

Baldwin, J.R., R.S. Jarmin, and J. Tang. 2004. “Small North American Producers Give Ground in the 1990s.” Small Business Economics 23 (4): 349-61.

Bartelsman, E.J., and M. Doms. 2000. “Understanding Productivity: Lessons from Longitudinal Microdata.” Journal of Economic Literature 38 (3): 569-94.

Bartelsman, E.J., J.C. Haltiwanger, and S. Scarpetta. 2008. “Cross-Country Differences in Productivity: The Role of Allocative Efficiency.” University of Maryland.

Bernstein, J. 2002. “A Tour of Innovation and Productivity: Measurement, Determinants and Policy.” In Productivity Issues in Canada, edited by S. Rao and A. Sharpe. Calgary: University of Calgary Press.

Bloom, N. 2010. “Management and Productivity in Canada: What Does the Evidence Say?” Industry Canada Economic Research and Analysis Working Paper Series.

Boothby, D., and T. Drewes. 2006. “Post-Secondary Education in Canada: Returns to University, College and Trades Education.” Canadian Public Policy 32 (1): 1-21.

Brox, J.A. 2008. “Infrastructure Investment: The Foundation of Canadian Competitiveness.” IRPP Policy Matters 9 (2).

Carney, M. 2010. “The Virtue of Productivity in a Wicked World.” Remarks to the Ottawa Economics Association, March.

Chan, K., W. Gu, and J. Tang. 2010. “Industry Mix, Plant Turnover and Productivity Growth: A Case Study of the Electronic and Electrical Product Manufacturing Industry.” Presented at the annual meeting of Economics Association of Canada, May 28-30, Université Laval, Quebec City.

Chan, K., J. Tang, and W. Gu. 2011. “Industry Mix, Plant Turnover and Productivity Growth: A Case Study of the Transportation Equipment Industry in Canada.” International Productivity Monitor 21 (Spring): 24-47.

Coe, D.T., and E. Helpman. 1995. “International R&D Spillovers.” European Economic Review 39 (5): 859-87.

Conference Board of Canada. 2011. “Why Is M&E Investment Important to Labour Productivity?” Accessed November 8, 2011. https://www.conferenceboard.ca/hcp/hot-topics/investProd.aspx#anchor2

Coulombe, S. 2011. “Lagging Behind: Productivity and the Good Fortune of Canadian Provinces.” C.D. Howe Institute Commentary, No. 331, June.

Dion, R. 2007. “Interpreting Canada’s Productivity Performance in the Past Decade: Lessons from Recent Research.” Bank of Canada Review (Summer).

Dion, R., and R. Fay. 2008. Understanding Productivity: A Review of Recent Technical Research. Discussion paper. Ottawa: Bank of Canada.

Donselaar, P., H. Erken, and L. Klemp. 2004. “R&D and Innovation: Drivers of Productivity Growth.” In Fostering Productivity: Patterns, Determinants and Policy Implications, edited by G. Gelauff, L. Klomp, S. Raes, and T. Roelandt. Amsterdam: Elsevier.

Expert Panel on Business Innovation in Canada. 2009. Innovation and Business Strategy: Why Canada Falls Short. Ottawa: Council of Canadian Academies.

Fuss, M., and L. Waverman. 2005. “Canada’s Productivity Dilemma: The Role of Computers and Telecom.” Appendix E, Bell Canada’s Submission to the Telecommunications Policy Review Panel, Ottawa.

Georges, P., and M. Mérette. 2010. Canada’s Strategic Trade Policy Options: Deeper Continental Integration or Diversification? IRPP Study 11. Montreal: Institute for Research on Public Policy.

Ghosh, M., and S. Rao. 2005. “A Canada – U.S. Customs Union: Potential Economic Impacts in NAFTA Countries.” Journal of Policy Modelling 27: 805-27.

Goldman Sachs. 2009. “The Long-Term Outlook for the BRICS and N-11 Post Crisis.” Global Economics Paper 192. Accessed November 8, 2011. https://www2.goldmansachs. com/our-thinking/brics/brics-reports-pdfs/long-term-outlook.pdf

Gu, W., and R. MacDonald. 2009. “The Impact of Public Infrastructure on Canadian Multifactor Productivity Estimates.” The Canadian Productivity Review 21, Statistics Canada cat. 15-206-XWE2008021. Accessed November 8, 2011. https://www.statcan.gc.ca/bsolc/olc-cel/olc-cel? catno=15-206-XWE2008021&lang=eng

Hall, B.H., J. Mairesse, and P. Mohnen. 2009. “Measuring the Returns to R&D.” NBER Working Paper 15622.

Harris, R.G. 2002. “Determinants of Canadian Productivity Growth: Issues and Prospects.” In Productivity Issues in Canada, edited by S. Rao and A. Sharpe. Calgary: University of Calgary Press.

Hirshhorn, R. 2011. “Impacts of Structural Changes in the Canadian Economy.” Industry Canada Economic Research and Analysis Working Paper Series.

Jorgenson, D.W., M.S. Ho, and K.J. Stiroh. 2008. “A Retrospective Look at the U.S. Productivity Resurgence.” Journal of Economic Perspectives 22 (1): 3-24.

Jorgenson, D.W., and K.J. Stiroh. 2000. “Raising the Speed Limit: U.S. Economic Growth in the Information Age.” Brookings Papers on Economic Activity 1: 125-235.

Leung, D., M. Cesaire, and T. Yaz. 2008. “Firm Size and Productivity.” Bank of Canada Working Paper 2008-45.

Lynch, K. 2010. “Making Innovation Make Sense.” Paper presented at the “Innovation Next” conference, Public Policy Forum, Toronto, May 27.

MacDonald, R. 2008. The Terms of Trade and Domestic Spending. Insights on the Canadian Economy, no. 18. Ottawa: Statistics Canada.

Machin, S., A. Ryan, and J. Van Reenen. 1998. “Technology and Changes in Skills Structure: Evidence from Seven OECD Countries.” Quarterly Journal of Economics 113 (4): 1215-44.

Maliranta, M., P. Rouvinen, and P. Yla-Anttila. 2010. “Finland’s Path to the Global Productivity Frontier through Creative Destruction.” International Productivity Monitor 20 (Fall): 68-84.

McKenna, B. 2011. “Flawed R&D Scheme Costs Taxpayers Billions.” Globe and Mail, March 12.

Mehta, A., and B.A. Mohr. 2010. “Rising College Premiums in Mexico: Skill Biased Technical Change or Structural Transformation?” Paper presented at the Seventh Midwest International Economic Development Conference, April 16-17, University of Minnesota.