Les mesures de protection des investisseurs prévues au chapitre 11 de l’ALÉNA continuent de faire l’objet de vifs débats. Le Chapitre vise à créer un environnement sûr et prévisible, propice à la libre circulation des investissements en Amérique du Nord, ce qui, en retour, permet de réaliser des gains économiques substantiels. Les critiques prétendent toutefois que le chapitre 11 comporte de graves lacunes. L’une des lacunes les plus souvent évoquées est que le Chapitre favorise les intérêts des sociétés aux dépens des enjeux publics plus importants et qu’il mine la capacité des gouvernements d’adopter des mesures légitimes pour protéger l’environnement et la santé publique. Dernièrement, les parties à l’ALÉNA ont publié une déclaration pour préciser le sens d’une disposition clé du Chapitre et elles étudient la possibilité d’apporter d’autres précisions ainsi que certaines réformes.

Il est donc pertinent à ce moment d’évaluer le bien-fondé des différentes allégations formulées contre le chapitre 11 et d’examiner les réactions stratégiques appropriées. Dans ce numéro, nous donnons la parole à deux des principaux commentateurs du chapitre 11 au Canada, Mme Julie Soloway et M. Chris Tollefson. Nous leur avons demandé de s’exprimer sur les critiques du Chapitre et de faire part de leurs réflexions sur la possibilité de clarifications ou de réformes.

Mme Soloway soutient que l’allégation voulant que le chapitre 11 ait miné la réglementation environnementale est grandement exagérée. Elle est d’avis que la jurisprudence aux termes du Chapitre ne reflète pas du tout les pires scénarios prévus par certains critiques du Chapitre. Elle affirme que le Chapitre n’a sapé aucun règlement environnemental légitime en vigueur, pas plus qu’il n’est susceptible de refroidir le désir des législateurs de réglementer dans l’intérêt public. Mme Soloway estime que les tribunaux ont rendu des décisions favorables aux investisseurs étrangers seulement dans les cas les plus flagrants de conduite injuste ou discriminatoire de la part d’un gouvernement.

Bien que Mme Soloway convienne de l’existence d’une certaine incohérence dans l’interprétation des dispositions légales de l’ALÉNA, comme celles concernant la norme minimale de traitement (article 1105) et l’expropriation (article 1110), elle soutient que les tribunaux ont appliqué le Chapitre de façon prudente et responsable, dans l’esprit des objectifs pour lesquels il a été créé. En fait, la cause Metalclad est le seul cas dans lequel un tribunal a rendu une décision confirmant l’expropriation aux termes du Chapitre.

Mme Soloway fait toutefois remarquer que le régime actuel du Chapitre est peut-être « mûr pour une réforme » sur le plan de la procédure. Soulignant l’écart croissant entre le processus prévu au chapitre 11 et la transparence accrue des processus de règlement des différends prévus dans d’autres accords commerciaux, elle laisse entendre que l’adoption d’un ensemble cohérent de règles pour régir la présentation de mémoires d’amicus pourrait renforcer la perception de légitimité du processus prévu au chapitre 11, en contribuant à une plus grande reconnaissance des différents enjeux publics dans ces instances. Elle précise toutefois qu’il faudrait veiller à ce que ces règles garantissent que la présentation de tels mémoires facilitent le processus plutôt que de le freiner en le rendant inutilement lourd pour les parties à un litige. Elle suggère de se pencher sur la possibilité de créer un organe d’appel permanent pour assurer une application plus cohérente des règles et se prémunir contre les décisions discutables de la part des tribunaux. En revanche, elle s’oppose à une plus grande clarification des dispositions de fond de l’ALÉNA pour le moment en faisant remarquer qu’une telle entreprise est loin d’être simple, car il serait difficile d’éliminer toute incertitude sans miner gravement la protection des investisseurs.

Compte tenu des négociations en cours de la Zone de libre-échange des Amériques et des autres accords à l’étude sur le commerce et les investissements, M. Tollefson soutient, pour sa part, que le Canada doit intervenir fermement, tant dans le cadre de l’ALÉNA que dans d’autres instances, pour s’assurer que les droits des investisseurs ne compromettent pas de façon injustifiée le droit des gouvernements de réglementer dans l’intérêt public.

À l’instar de Mme Soloway, il soutient que la mise en œuvre de réformes de la procédure pour accroître la transparence du régime du chapitre 11 et faciliter la participation des citoyens s’impose. En revanche, il affirme, contrairement à Mme Soloway, que les craintes que le régime pourrait empêcher les législateurs de promulguer des règlements légitimes et non discriminatoires pour protéger l’environnement ou la santé publique ne sont pas injustifiées. Il est d’avis que l’absence d’une disposition, analogue à l’article XX de l’Accord général sur les tarifs douaniers et le commerce, qui permettrait de façon explicite aux gouvernements parties à l’ALÉNA de justifier ces règlements lorsqu’ils sont contestés par des investisseurs, est une grave lacune du Chapitre.

Tollefson soutient par ailleurs que le pouvoir discrétionnaire que le Chapitre confère aux tribunaux est vague et trop général et qu’il mène parfois à des interprétations légales boiteuses et inappropriées en plus de permettre aux tribunaux de faire fi de témoignages et d’arguments légaux pertinents en l’absence de toute supervision ou responsabilité judiciaire véritable. Il conclut en offrant une analyse détaillée de la décision controversée rendue dans la cause Metalclad qui, à son avis, illustre de façon non équivoque la nécessité d’apporter des précisions au chapitre 11 tant sur le plan de la procédure que du fond.

The North American Free Trade Agreement (NAFTA) created an institutional environment which fosters economic integration between Canada, Mexico and the United States. Since NAFTA has come into force, there has been substantial growth in trilateral trade and investment among Canada, Mexico and the United States.1 The importance of both inward and outward Foreign Direct Investment (FDI) for Canada is well known. FDI in Canada is responsible for 30 percent of all Canadian jobs and 75 percent of its manufacturing exports.2 More than one-half of Canadian outward FDI goes to the United States and the United States is Canada’s largest source of inward FDI. Increased investor protection is one reason that Canadian and US direct investments in Mexico have boomed, from an annual flow of US$5.7 billion in 1994 to US$19.9 billion in 2001.3 In general, a more predictable environment for investors will lead to increased investment.4

NAFTA’s goals for integration, however, are relatively modest compared to many other regional trade agreements. The parties to NAFTA did not contemplate the creation of an EU-style arrangement that provides for political and social integration. Rather, the NAFTA attempts to provide for economic integration between the three countries while, at the same time, preserving political autonomy and decision-making power in each country. Similarly, the NAFTA and its institutions were not designed to manage social welfare issues. As one commentator noted, “NAFTA was not designed with the intention to manage social welfare conditions. To the extent that the NAFTA has failed to address those conditions, this failure was built into its institutions.”5

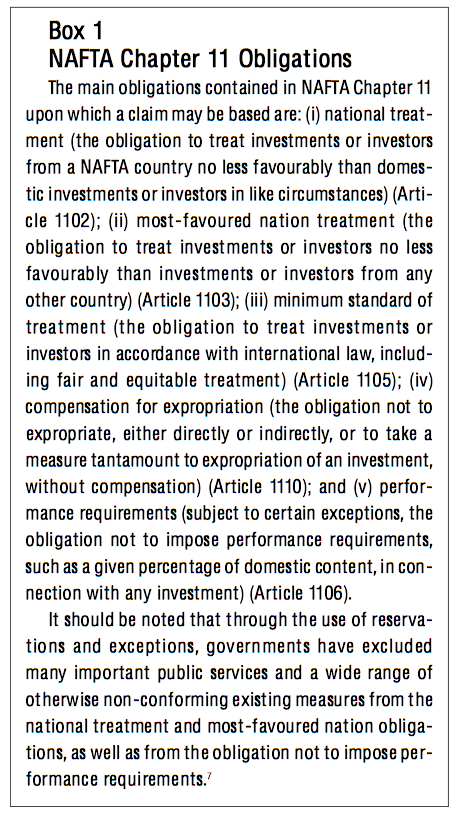

The rules of NAFTA’s Chapter 11 ideally create a secure and predictable framework for the unencumbered flow of investment within North America, which, in turn, allows for substantial economic gains. Simply put, Chapter 11 provides for certain obligations that define how a NAFTA government must treat an investment or an investor from another NAFTA country (see Box 1). If any one of them adopts a “measure” which breaches an obligation contained in Chapter 11, that investor may initiate a dispute-settlement proceeding directly against a NAFTA government.6

Despite the economic growth that these rules are designed to encourage, their desirability in the context of an integrated North American marketplace is being seriously challenged, primarily because of the perceived effects that these rules are having, or could have, on public regulation. This paper evaluates the claim that Chapter 11 has undermined environmental regulation in North America and concludes that, for the most part, the concern has been overstated. To date, NAFTA Chapter 11 has not threatened the progress of environmental regulation in North America. This paper also concludes that certain changes to the NAFTA Chapter 11 process may be warranted, however, to take account of some of the weaknesses of the current institutional architecture.

The rules found in Chapter 11 are by no means novel in international economic law. The key legal principles are largely grounded in customary international law, as codified in a myriad of existing Bilateral Investment Treaties (BITs). In this way, NAFTA is not a “radically new departure from prevailing practice with respect to investment protection.”8 There are over 2000 BITs currently in existence worldwide; Canada has no less than 21 Foreign Investment Protection Agreements (FIPAs — the equivalent of a BIT) currently in force.

BITs historically have been negotiated between developed and developing countries, and because of the inequality between the negotiating parties, many BITs were intrinsically asymmetrical.9 While, for example, US investors had significant foreign investment in Bangladesh, the same was not true for Bangladesh investors in the United States. Thus, traditionally, BITs were a function of an economic relationship characterized by an investor and a recipient of that investment where the negotiating power was almost always tilted in favour of the investor state. Moreover, BITs were generally based on developed country concerns regarding legal fairness and access to justice. Investor-state dispute settlement provisions were a feature of BITs because, once an investment was expropriated (whether for a legitimate public purpose or not) an investor generally had no standing in the courts of the host country and would have to persuade its own government to pursue a claim, thereby removing the decision of whether to initiate a claim from the party whose interests are directly at stake and basing that decision on broader political considerations.10

The application of this model to two countries with highly developed, mixed economies (i.e. Canada-United States) is new, and has resulted in some unanticipated consequences. More specifically, the nature of the disputes under NAFTA has differed from traditional challenges under BITs in terms of the type of measure challenged. The application of rules governing, for example, expropriation and the minimum standard of treatment have not generally been used to challenge regulatory measures adopted by a developed country with a comprehensive regulatory environment.

The United States sought to have a core set of principles imported from the BITs into the Canada-US Free Trade Agreement (FTA) and ultimately into NAFTA. Compliance with these rules required significant adjustments to Mexican foreign investment rules. The United States was adamant that expropriation provisions be included in NAFTA in order to protect US investors in Mexico from the possibility of expropriation of US-owned assets without compensation or recourse to impartial dispute settlement. This was a reaction on the part of the United States to the fact that Latin American countries had historically included a “Calvo” clause in their constitutions. Named after a 19th century Argentine diplomat, these clauses limit foreign investors to domestic remedies in the case of a dispute.11 Other developing countries had also confiscated US-owned property in the past without compensation. It is interesting to note that the inclusion of these ‘boilerplate’ provisions did not draw special attention during the NAFTA negotiations. What the parties failed to anticipate — or what was unknown at the time — were the implications of these provisions between countries with highly developed regulatory regimes.12

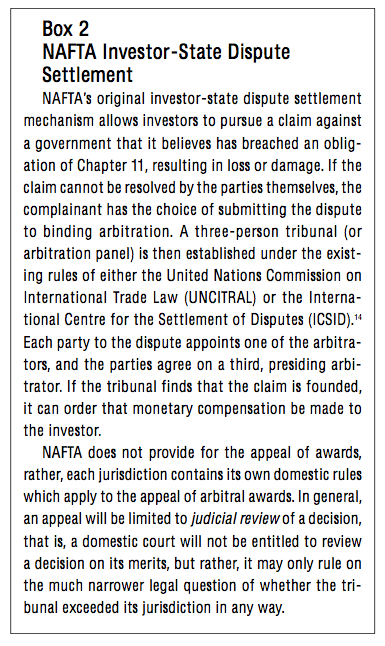

Even though significant changes were required by the NAFTA parties, they were seen as vital in securing the protection that NAFTA offered from unfettered parochial political interests (see Box 2). In the case of Canada, because of its size, Canada has “traditionally been at the forefront of countries ready, willing and able to undertake international commitments as the price of limiting the capacity of larger countries to impose arbitrary and unwanted restraints on Canadian trade, economic and other interests.”13

Empowering a private investor to directly challenge a host government depoliticizes in principle the dispute settlement process by removing it from the realm of state-to-state diplomatic relations. Under Chapter 11, a foreign investor has the comfort of knowing that a dispute concerning a foreign investment would be heard and adjudicated based on legal rules rather than political negotiations over a variety of matters not related to the investment in question. It is not hard to see why an investor would feel more confident in making a substantial investment in the context of this framework.

However, as the Chapter 11 jurisprudence has begun to emerge, a number of shortcomings have been revealed, calling into question the ongoing viability of its rules in supporting and sustaining cross-border investment. Thus, while these rules do encourage investment and economic integration, many have posed the question: at what cost? If, ultimately economic integration leads to a social disintegration, it is neither desirable nor sustainable.15

The concerns surrounding Chapter 11 take place as part of a broader set of concerns about the costs of globalization, that is, increased global economic integration, and increased environmental concern and activism on the part of non-governmental organizations (NGOs). The pace at which economic integration has taken place, facilitated in part by trade liberalization arrangements, has led to widespread anxiety among citizens who fear the loss of control over the factors that govern their lives.16 This fear has fixated onto both the legal and procedural provisions of Chapter 11.

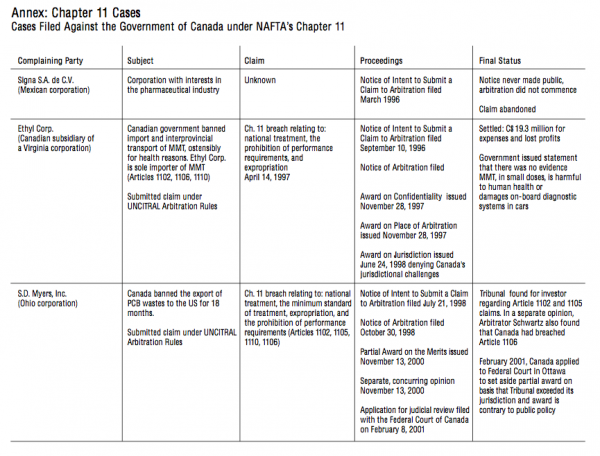

The first NAFTA Chapter 11 case to generate widespread controversy was the Ethyl case, where a US investor in Canada, Ethyl Corporation, challenged a Canadian ban on the international trade of the fuel additive MMT, ostensibly imposed for the purpose of protecting public health. While the case was settled for around C$19 million and resulted in the federal government retracting the trade ban on MMT before a decision was reached by the Tribunal, the case became a lightning rod for widespread opposition to Chapter 11, sowing the seeds for controversy in later cases. The critique centred around several issues:

First, and most likely foremost, the simple fact that a private investor could call into question a government’s measure ostensibly protecting the public’s health and welfare or the environment was objectionable to a wide range of civil society actors, who viewed this situation as a prime example of NAFTA favouring corporate interests over the broader public concerns.

Second, the legal obligations provided for in Chapter 11 came under attack from a substantive perspective. These rules were not viewed as neutral investment protection, rather they were viewed as inherently biased against environmental, health or safety regulations. Most prominent among the substantive concerns were the expropriation provisions and the uncertainty surrounding the concept of regulatory expropriation. Absent a direct takeover of foreign-owned property, what lesser interference could amount to a compensable expropriation? Would it be enough for a government action merely to affect the benefits of a foreign investment, or did the effect have to be so severe as to render the investment inoperable? And, even if a measure did put a foreign investor out of business, what if the measure addressed serious consumer or health concerns? Most critically, what would this mean for the future of environmental regulation in North America?

Not surprisingly, no immediate clear answers emerged. As the Chapter 11 jurisprudence began to develop, other concerns about the operation of investment protection rules emerged from the NGO community. NGOs have alleged that NAFTA panels’ broad interpretations of the national treatment obligation (Article 1102) and the minimum standard of treatment obligation (Article 1105) went far beyond the generally accepted interpretations of these concepts in international law.17 Critics argued that the uncertainty in how these rules would be interpreted would result in a “regulatory chill” whereby governments would cease to enact public health and safety measures for fear of a NAFTA challenge.

A third major area of concern arose from the process under which challenges were brought and disputes were heard. The NAFTA Chapter 11 process is, for the most part, private and does not provide a formalized mechanism for public access.18 In this way, it is argued that NAFTA was deficient, given that such arbitrations involved the interpretation of issues which define the relationship of foreign investor rights to domestic public measures. By not providing an adequate framework for public participation, critics argue that Chapter 11 created a “democratic deficit.”

Central to the view that Chapter 11 was inappropriate to arbitrate issues of public policy is the question of process transparency. While Ostry “only partly in jest” describes the word transparency “as the most opaque in the trade policy lexicon,” transparency, in particular, remains one of the key concerns among critics of a liberalized investment regime.19

In addition, critics argue that Chapter 11 does not provide for adequate participation in the arbitral process, for example, through the submission of briefs or other relevant information to the panel as a “friend of the court” (amicus curiae). Critics view this as especially important as ad hoc arbitrators may not have “sufficiently broad expertise to adjudicate issues outside of traditional trade law, with implications that transcend trade, entailing public policy analysis, and assessment of complex environmental and health issues.”20

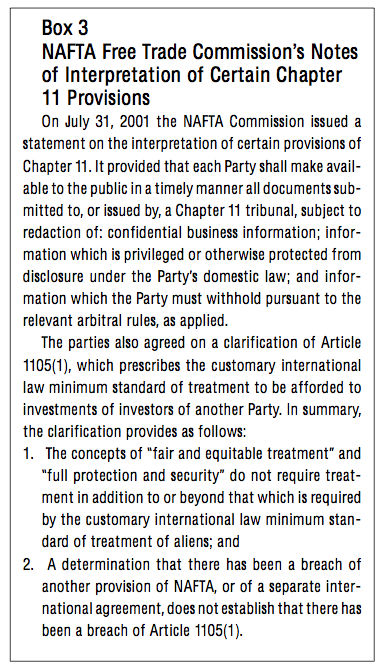

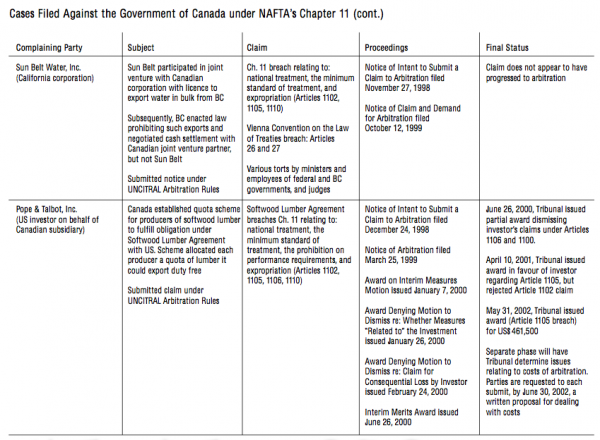

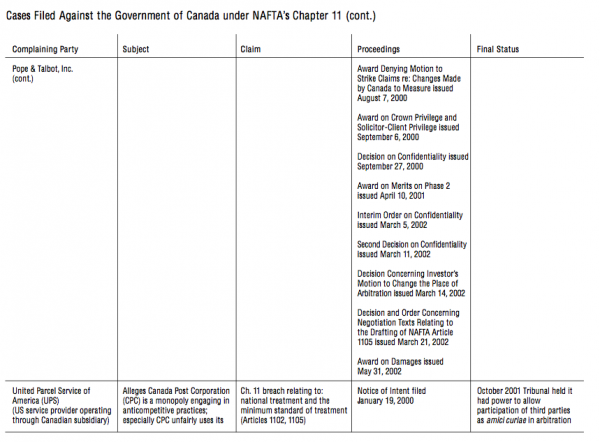

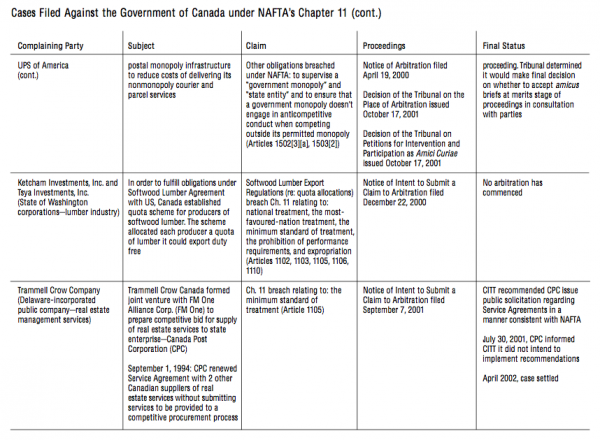

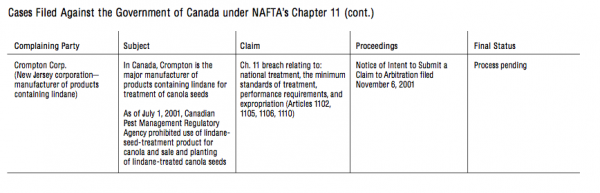

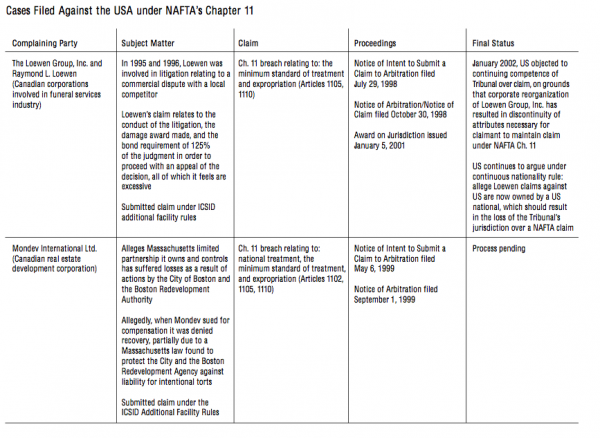

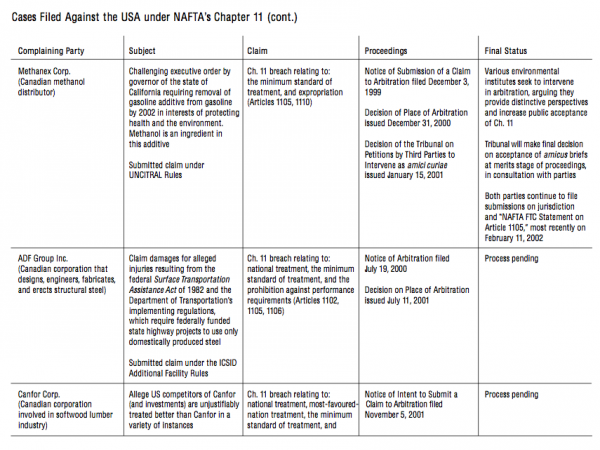

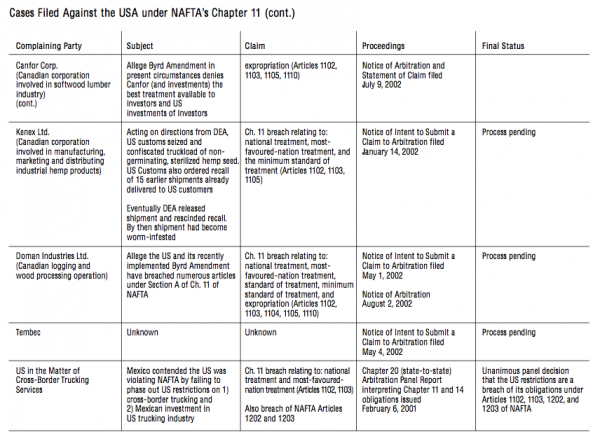

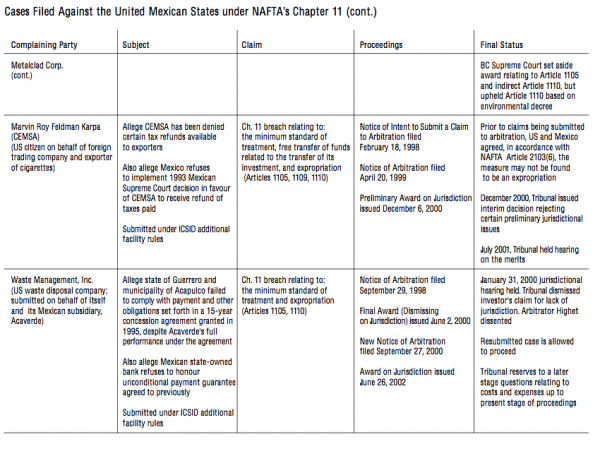

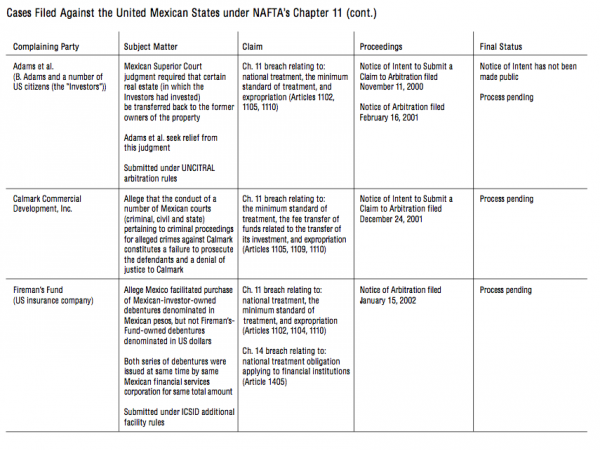

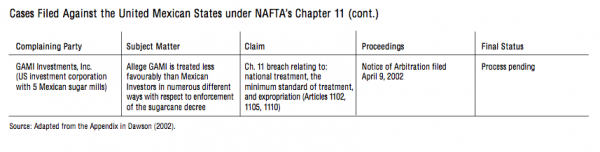

Some people may argue that such concerns are overblown and that the jurisprudence is still in its infancy. In NAFTA’s eight-year history as of September 2002, there have been some twenty-seven Chapter 11 complaints, only five of which have led to actual decisions. Other cases remain pending or have been settled or withdrawn.21 Yet, in response to the NAFTA critique outlined above, changes are being made as a result of intense political pressure being put on the NAFTA governments. On July 31, 2001, the NAFTA Commission, made up of the three signatory governments, issued an interpretive statement22 (see Box 3 on p. 11) as part of an ongoing clarification exercise, designed to “give future tribunals clearer and more specific understanding of Chapter 11’s obligations, as originally intended by the drafters.”23 In this regard, the Canadian Minister of International Trade, Pierre Pettigrew, stated that the NAFTA Commission is “seeking to clarify some of the provisions…such as expropriation disciplines, to ensure they properly reflect the original intent of the NAFTA Parties in the dispute settlement process.”24 Ongoing consultations with expert groups (including representatives from NGOs) are currently underway to further the clarification process.

It is thus timely to evaluate (i) the veracity of the diverse claims against NAFTA Chapter 11, and (ii) the appropriate policy responses. In undertaking this exercise, we should ask: what is the problem we are trying to cure, and what is the best way to solve it? This means stepping back from reactionary or “worst case” scenarios, and taking a realistic look at the rulings of the cases to date, on the basis of their facts and rendered decisions.

The following section examines the five cases where a NAFTA Tribunal has issued a final determination. It also examines the Methanex case, where there has been an award on jurisdiction only. While many more cases have been filed and/or settled, the focus of this section is to try and identify patterns from actual decisions, in order to “set the record straight” and challenge some of the myths surrounding NAFTA.

In this regard, there is a vital distinction to be made between the arguments of a claimant and the decision of a Tribunal. Although there have been some sweeping and surprising challenges brought by certain investors, this does not mean that these challenges are valid. As an expert recently stated, “The media and some commentators often confuse what is alleged to have occurred and what will be found by a Tribunal.”25 For example, investors have lost more often on the issue of expropriation than they have won. In fact, to date there has been only one successful expropriation claim under Chapter 11.26

That said, it should surprise no one if claimants continue to push at the edges of international law in order to obtain compensation. What is important is that any analysis of possible NAFTA reform be based on actual decisions, rather than the claims of investors.

There are nevertheless limits to the value of analyzing the jurisprudence because, under international law, Chapter 11 decisions do not establish precedents (stare decisis, in legal terms). A NAFTA arbitral tribunal’s ruling is not binding on subsequent tribunals.27 In one recent case, a NAFTA arbitral tribunal declined to follow a prior ruling, noting that the previous case was not “… a persuasive precedent on this matter and [this Tribunal] will not be bound by it.”28 That said, panels will still consider the relevance of the decisions of past NAFTA and other trade tribunals.29 Thus, while not binding, the case law is an important element guiding all concerned parties.

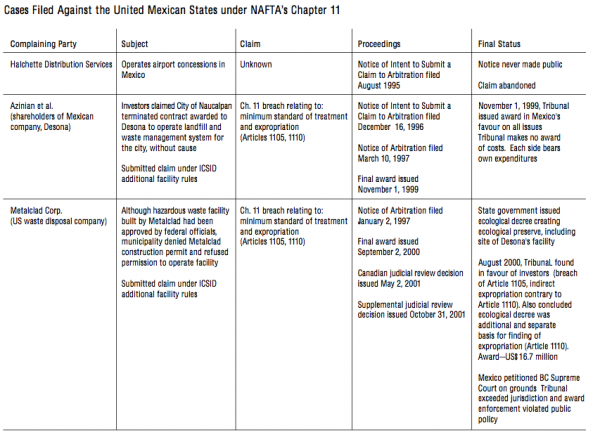

In March 1997, Mr. Azinian and two other American nationals, who were shareholders of Desechos Sólidos de Naucalpan S.A. de C.V. (Desona), a Mexican corporation, filed a Chapter 11 Notice of Arbitration against the Mexican government seeking damages of US$14 million. In November 1993, Desona had entered into a concession contract with the City Council of the Municipality of Naucalpan, Mexico, for the collection of solid waste from the city. A few months later, the Municipality complained about a number of irregularities in the implementation of the concession contract and in March 1994, it cancelled the contract for non-performance by Desona. Three levels of Mexican courts confirmed the legality of the contract’s annulment under Mexican law.

Azinian argued unsuccessfully before a Chapter 11 Tribunal that the actions taken by the Municipality had resulted in a violation of both the obligation to provide the minimum standard of treatment under international law and the expropriation provisions of NAFTA.30 In rejecting the claim, the Tribunal noted that the claimants’ fundamental complaint was that they were the victims of a breach of the concession contract. This was not by itself sufficient to support a claim under NAFTA. The Tribunal noted that NAFTA does not “allow investors to seek international arbitration for mere contractual breaches.”31 Rather, a successful claim under Chapter 11 must be grounded in the breach of a specific treaty obligation.

Analyzing the claim that the annulment of the contract resulted in an expropriation of Desona’s contractual rights (Article 1110), the Tribunal stated that because the Mexican courts found that the Municipality’s decision to “nullify the Concession Contract was consistent with the Mexican law governing the validity of public-service concessions, the question [was] whether the Mexican courts’ decisions themselves breached Mexico’s obligations under Chapter Eleven.”32 The claimants, however, had not alleged that the prior court rulings had violated any NAFTA provisions. Accordingly, if the Mexican courts found the contract to be invalid, and no objection was raised to those courts’ decisions, there was by definition no contract to be expropriated.33 The Tribunal stated as follows:

To put it another way, a foreign investor entitled in principle to protection under NAFTA may enter into contractual relations with a public authority, and may suffer a breach by that authority, and still not be in a position to state a claim under NAFTA. It is a fact of life everywhere that individuals may be dis- appointed in their dealings with public authorities, and disappointed yet again when national courts reject their complaints… NAFTA was not intended to provide foreign investors with blanket protection from this kind of disappointment, and nothing in its terms so provides.34

The Tribunal also rejected the argument that the breach of the concession contract violated the minimum standard of treatment provision (Article 1105) and stated that “if there was no violation of Article 1110, there was none of Article 1105 either.”35 The meaning of this statement is not clear; however, the Tribunal may have intended to assert, as the S.D. Myers Tribunal would later do (see below), that a violation of another provision of Chapter 11 automatically results in a violation of the minimum standard of treatment provision.

This case illustrates that the Tribunal did not view itself as a “court of appeal” for an investor disappointed with the outcome of a domestic court ruling. Rather, the Tribunal showed a high degree of deference for the domestic process by refusing to substitute its ruling for that of a Mexican court. The Tribunal limited the scope of a claim for expropriation by stating that NAFTA was not intended to protect against disappointments in dealings with public authorities. In no way has this decision expanded any of NAFTA’s substantive provisions beyond the scope of those provisions in international law.

In September 1998, a US-based investor, Waste Management, filed a Notice of Arbitration against Mexico. The claim arose from a 15-year concession contract granted by the state of Guerrero and the municipality of Acapulco to Acaverde, the Mexican subsidiary of Waste Management.

Under the concession, Acaverde was required to clean the streets, collect and dispose of all solid waste in the area, and build a solid-waste landfill. In return, Acaverde would receive monthly payments from Acapulco. Waste Management contended that it provided the services agreed to for about two years, but it only received payment equivalent to five months of services rendered. Waste Management claimed that Acaverde’s concession rights were unlawfully transferred to a third party. Waste Management also claimed that the Mexican public authorities did not accord its investment (Acaverde) treatment in accordance with international law, including fair and equitable treatment. In addition, the investor contended that the acts of the Mexican authorities constituted measures “tantamount to expropriation because the investor was deprived of the income from its investment; and because the Mexican authorities’ disregard of its rights effectively extinguished Acaverde’s viability as an enterprise.”

In June 2000, the Tribunal delivered an award, based not on these issues, but on a jurisdictional question raised by the government of Mexico. Under Article 1121 of Chapter 11, a complainant must abandon its right to initiate or continue other legal action in any other legal forum with respect to the issue before a NAFTA tribunal. This is done in the form of a written waiver submitted by the investor to the Tribunal, acknowledging that it is not pursuing the same claim concurrently before any other court or tribunal. Mexico contended, and the Tribunal accepted, that the waiver submitted by the investor did not comply with Article 1121, since concurrent domestic legal action had been pursued in violation of the waiver agreement. Accordingly, the Tribunal found that it lacked jurisdiction to hear the case.

In March 1999, Pope & Talbot, Inc., a US investor, claimed that Canada’s allotment of export quotas under the United States-Canada Softwood Lumber Agreement (1996)36 (SLA) discriminated against Pope & Talbot’s Canadian subsidiary, thereby violating the national treatment, minimum standard of treatment, performance requirements and expropriation provisions of Chapter 11.37 The SLA imposed quotas on duty-free softwood exports (export duties were charged above the quota limit) from the four major producing provinces in Canada (referred to as the “covered” provinces — British Columbia, Alberta, Ontario and Quebec)38 Pope & Talbot claimed damages of between US$85 and US$135 million.

Canada contended that since this issue concerned trade in goods, it did not fall within the scope of Chapter 11. Canada argued that the term “investment dispute” applied only to disputes about measures “primarily aimed at” investors of another party or investments of those investors. Canada also argued that if it is possible to categorize a measure as relating to trade in goods, the measure cannot be seen as relating to investors or investments, and the dispute over the measure cannot be considered an “investment dispute.” Softwood lumber is a “good”; therefore, the dispute relates to trade in a good and should have been brought under the NAFTA’s state-to-state dispute settlement provisions.

In a preliminary award, the Tribunal addressed the interrelationship between NAFTA’s Chapter 11 and Chapter 3 (trade in goods), stating “there is no provision to the express effect that investment and trade in goods are to be treated as wholly divorced from each other.”39 The Tribunal rejected the idea that a “measure aimed at trade in goods ipso facto cannot be addressed as well under Chapter 11.”40

Pope & Talbot claimed that the export quotas violated the national treatment obligation because they imposed different treatment on softwood lumber producers from the covered provinces, which had to pay a permit fee in order to export to the US, and exporters from the noncovered provinces, which did not.

The Tribunal rejected this argument and ruled that the measure, on its face, did not distinguish between foreign-owned and domestic companies,41 and did not otherwise unduly undermine the investment liberalizing objectives of NAFTA.42 The Tribunal determined that Canada’s differential treatment of lumber producers from covered and non-covered provinces, existing and new producers, holders of different levels of quotas under the Agreement, did not violate Canada’s obligations under Chapter 11 in the absence of discrimination between similarly situated foreign and domestic investors. The Tribunal also found that, in establishing different categories of producers, Canada was not motivated by discriminatory protectionist concerns.

Pope & Talbot also claimed that Canada breached its duty to treat investors in a fair and equitable manner (Article 1105) in its allocation of quotas. The Tribunal found that, under Chapter 11, foreign investors are entitled to the international law minimum plus the fairness elements.43 Based on this standard of analysis, the Tribunal found that actions of officials in the Softwood Lumber Division (SLD) of the Canadian Department of Foreign Affairs and International Trade (DFAIT) violated the minimum standard of treatment.44 After the Chapter 11 complaint was initiated, certain Canadian government officials had insisted on a “verification review” of Pope & Talbot’s records in support of its export quota allocation in earlier years. Specifically, by ordering Pope & Talbot to transport all of its corporate and accounting records located at the company’s head office in Portland, Oregon to Canada, it violated the obligation to provide fair and equitable treatment under Chapter 11. In doing so, the Tribunal characterized the actions of the SLD as imperious, based on naked assertions of authority and designed to bludgeon the company into compliance.45

In this regard, it should be noted that verifications are routinely conducted in international trade matters, and particularly in customs valuation, anti-dumping and countervailing duty cases, where they generally take place at the venue where the company’s records are located. Indeed, since a verification is essentially a form of “audit,” it would have made little sense to conduct such an exercise anywhere else. The SLD’s insistence that the company transfer several truckloads of records to Canada was not only highly unusual to anyone familiar with the administration of international trade laws and counter-productive to the goal of a verification review, it was also highly oppressive to the company. The Tribunal concluded that the investor was “being subjected to threats, denied its reasonable requests for pertinent information, required to incur unnecessary expenses and disruption in meeting SLD’s requests for information, forced to expend legal fees and probably suffer a loss of reputation in government circles.”46 Taken together with the tenor of SLD’s communications with the investor, and the less than forthright reports to the Minister regarding the situation between the investor and SLD, the Tribunal ruled that the verification episode amounted to a denial of fair and equitable treatment contrary to Article 1105.

The claimants also argued that, by reducing Pope & Talbot’s quota of lumber that could be exported to the US without paying a fee, Canada’s export control regime had deprived the investment of its ordinary ability to sell its product to its traditional and natural market, constituting an expropriation. At the outset of its analysis of Article 1110, the Tribunal noted that the “investment’s access to the US market is a property interest subject to protection.”47 It also noted that, contrary to Canada’s assertions, under certain circumstances regulation may indeed result in expropriation; a blanket exception for regulatory measures would create a gaping loophole in international protections against expropriation.48 The Tribunal went even further, stating that an expropriation may include “non-discriminatory regulation that might be said to fall within the police powers.”49

The Tribunal, however, found that there had not been an expropriation of property in this particular case. The ruling established that, in order to determine “whether a particular interference with business activities amounts to expropriation, the test is whether that interference is sufficiently restrictive to support a conclusion that the property had been ‘taken’ from its owner.”50 In Pope & Talbot’s case there was no such interference inasmuch as Pope & Talbot remained in control of its investment, continued to direct the day-to-day operations, was free of government interference with officers and employees, and continued to export substantial quantities of softwood lumber to the US and to earn substantial profits on those sales.51

A second ruling dealing with damages and with the NAFTA Commission’s interpretive statement of Article 1105 (see Box 3), referred to above, was delivered on May 31, 2002.52 Canada had contended that, although the Tribunal had already ruled on the matter of Article 1105 in April 2001, the interpretive statement was binding on the Tribunal and, therefore, it should reconsider its findings in light of it.

At the beginning of its analysis, the Tribunal focused on answering the question of whether the NAFTA Free Trade Commission’s interpretation was in fact an interpretation or an amendment. Since the interpretation had been issued in July 2001, many commentators had considered whether future NAFTA tribunals would find that it was within their powers to question the nature of a Commission’s action. In the Tribunal’s view, it was within its power to consider this question and it could not simply “accept that whatever the Commission has stated to be an interpretation is one for the purposes of Article 1131(2).”53

Analyzing the history of Article 1105, the Tribunal determined that there was no reference to customary international law in any of the draft versions of Article 1105. According to the Tribunal, one cannot conceive that NAFTA negotiators would not have known that, “as it is made clear in Article 38 of the Statute of the ICJ [International Court of Justice], international law is a broader concept than customary international law, which is only one of its components.”54 In light of this, the Tribunal noted that if it were to determine whether the Commission’s action is an interpretation or an amendment, it would choose the latter.55 The Tribunal, however, chose not to make such determination. After analyzing the question, the Tribunal decided to proceed assuming that the Commission’s action was an interpretation.

The next step was then to determine whether the Tribunal’s award of April 2001 was incompatible with the Interpretation.56 Such incompatibility, in the Tribunal’s view, would exist only if it were determined that the “concept behind the fairness elements under customary international law is different from those elements under ordinary standards applied in NAFTA countries.”57 In order to rule on this matter, the Tribunal had to determine the content of customary international law concerning the protection of foreign property. The Tribunal rejected Canada’s view that under customary international law a country would violate Chapter 11’s minimum standard of treatment provision only if the treatment accorded to investors amounted to gross misconduct, an outrage, bad faith, wilful neglect of duty or to insufficiency of governmental action so far short of international standards that every reasonable and impartial person would readily recognize its insufficiency.58 According to the Tribunal, Canada’s argument was based on a view of customary international law standards from the 1920s. Since then, customary international law has evolved and the range of actions subject to international concern has broadened beyond “international delinquencies” to include the concept of fair and equitable treatment.59 Despite these findings, the Tribunal based its ruling on the fact that even if Canada’s proposed standard were adopted, there would still be a violation of Canada’s obligations as a result of the verification review. The Tribunal found that the conduct of the SLD in that episode was egregious and would shock and outrage every reasonable citizen of Canada.60

Some argue that the Tribunal’s interpretation of Article 1105 is inconsistent with the minimum standard of treatment in international law. However, one can’t help but observe that international tribunals, like domestic Courts, do not much care for high-handed and objectionable conduct on the part of litigants that appear before them, and are understandably inclined to find a remedy where the conduct in question offends the basic principles of justice and fair play. To the extent that the Chapter 11 panels have raised the bar with respect to Article 1105,61 this is arguably a positive development.62

In May 2002, the Tribunal awarded Pope & Talbot US$461,500, a relatively small award considering the original claim of US$508 million (or 0.0909 percent of the original damages claimed). Thus, only a fraction of the amount claimed was awarded. There is nothing in this case that illustrates the erosion of public interest regulation at the expense of a foreign investor.

Metalclad, a California-based corporation, developed a hazardous waste disposal facility in the Mexican state of San Luis Potosi. All the required federal and state permits for the construction and operation of the site were issued to COTERIN, which was later bought by Metalclad, by August 1993, and construction of the facility began in May 1994.

In October 1994, however, local officials ordered that construction of the facility cease due to the absence of a municipal construction permit. The Mexican federal government then told Metalclad that such a permit was not required. Relying on this assertion, Metalclad resumed construction of the facility. Work on the new facility was completed in March 1995, but at this point local authorities opposed the opening of the facility on environmental grounds. Demonstrators, sponsored by the state and local governments, abruptly interrupted the ceremony of inauguration of the landfill. After this episode, in an effort to ensure the opening of the site, Metalclad maintained constant dialogue with the federal government.

Negotiations between Metalclad and federal environmental authorities resulted in an agreement in which Metalclad agreed, inter alia, to make certain modifications to the site; take specified conservation steps; recognize the participation of a technical scientific committee and a citizen supervision committee; employ local manual labour; and make regular contributions to the social welfare of the municipality, including limited free medical advice.

Despite the agreement, and in the absence of any evidence of inadequacy of performance by Metalclad, the municipality denied Metalclad’s construction permit in a process which was closed to Metalclad. The municipal government refused to permit operation of the plant on the grounds that local geology made it likely that the waste treated at the plant would contaminate local water supplies. In addition, after Metalclad had initiated a Chapter 11 arbitration proceeding, the governor of San Luis Potosi issued, in September 1997, an ecological decree declaring the area of the landfill to be a natural area for the protection of rare cacti. The decree foreclosed any hope of operation of the facility.

In its Statement of Claim, Metalclad sought compensation of US$43 million plus damages based on the assertion that the actions of the Mexican government violated the expropriation (Article 1110) and minimum standard of treatment (Article 1105) provisions of Chapter 11.

In its Article 1105 claim, Metalclad argued that the actions of the federal, state and municipal governments, including the lack of transparency of the requirements for authorization of the site, constituted a denial of fair and equitable treatment. The Tribunal accepted Metalclad’s argument and ruled that the Mexican government had indeed violated its obligations. A significant finding, which would also play an important role on the Tribunal’s finding of expropriation, was that the claimant was entitled to rely on the representation of the federal officials who stated that a municipal construction permit was not a requirement. According to the Tribunal, Mexico failed to provide “a transparent and predictable framework for Metalclad’s planning and investments.”64 The absence of a clear rule concerning construction permit requirements in Mexico amounted, according to the Tribunal, to a “failure on the part of Mexico to ensure the transparency required by NAFTA.”65 Metalclad is the only NAFTA Chapter 11 case in which a Tribunal made a finding of expropriation. The Tribunal adopted a relatively expansive interpretation of expropriation, stating that

[E]xpropriation under NAFTA includes not only open, deliberate and acknowledged takings of property, such as outright seizure or formal or obligatory transfer of title in favour of the host State, but also incidental interference with the use of property which has the effect of depriving the owner, in whole or in significant part, of the use or reasonably-to-be-expected economic benefit of property even if not necessarily to the obvious benefit of the host State.66

The facts in this case made for an easy determination that an expropriation had taken place. The Tribunal held that the inequitable treatment of Metalclad by local Mexican authorities — with the tolerance of the federal government — the violation of representations made and the lack of basis in refusing a permit, which would bar the use of the landfill permanently, amounted to indirect expropriation.

In October 2000, Mexico filed a petition before the Supreme Court of British Columbia challenging the Tribunal’s ruling. This appeal was brought in British Columbia because the hearings had been located in Vancouver.

As noted above, Chapter 11 of NAFTA does not provide for appeal or other forms of challenging a Tribunal award. Justice Tysoe of the British Columbia Supreme Court ruled, however, that Mexico’s claim should be analyzed under the British Columbia International Commercial Arbitration Act (BCICAA). Justice Tysoe noted that, under the BCICAA, the Court was not allowed to review points of law decided by the arbitral tribunal. The issue rather was “whether the Tribunal made decisions on matters beyond the scope of the submission to arbitration by deciding upon matters outside Chapter 11.”67 In other words, the Court could set aside only the decisions of the NAFTA Tribunal which were beyond the scope of its jurisdiction.

Despite Justice Tysoe’s determination that the Court could not, under the BCICAA, review points of law, his analysis of the arbitral award essentially amounted to the same thing.

First, the Court determined that Chapter 11’s “fair and equitable treatment” requirement must be interpreted in accordance with international law. The Court found that the Tribunal erred in basing its decision on the lack of transparency in the Mexican domestic legal process for approving hazardous waste sites. Instead, the Court ruled that a lack of transparency is neither a violation of customary international law nor of Chapter 11. Accordingly, the Court determined that the Tribunal’s finding of such a violation, based on lack of transparency, was beyond the scope of the submission to arbitration.68

In addition, the Court found that the Tribunal had also improperly issued a finding of expropriation on the same mistaken basis. The finding of expropriation, however, was not totally set aside, since the Court considered that there was no error impugning the Tribunal’s finding that the state government’s Ecological Decree constituted expropriation under Article 1110.69 In the end, the Court refused to set aside the Tribunal’s award in toto, determining only that the interest portion of the award be calculated from the date of the Ecological Decree, rather than from the day of the actions which had led to the finding of unfair treatment.70

In October 1998, S.D. Myers, an Ohio-based waste disposal company, which performed PCB (polychlorinated biphenyl) remediation71 activities, claimed that Canada had breached its Chapter 11 obligations, thereby damaging S.D. Myers’ investment in Canada. S.D. Myers had no PCB remediation facilities in Canada and its investment in Canada consisted essentially of obtaining PCBs for treatment by its US facility.

S.D. Myers’ main complaint was that Canada breached its obligations under Chapter 11 as a result of a 1995 Interim Order banning the export of PCB waste to the United States. The US border had, since 1980, been closed to the import of PCBs and PCB waste for disposal; but, in October 1995, S.D. Myers received special permission from the US Environmental Protection Agency to import PCBs and PCB waste from Canada for disposal. The permission was valid from November 15, 1995 to December 31, 1997. The Interim Order was in force from November 1995 to February 1997 (at which time Canada reopened its border by an amendment to the PCB Waste Export Regulations). According to S.D. Myers, Canada acted to protect its PCB treatment facility, Chem-Securities of Swan Hills, Alberta.

S.D. Myers presented four claims. First, it asserted that the measure discriminated against US waste disposal firms that sought to operate in Canada, by preventing them from exporting PCB contaminated waste for processing in the US.72 Second, S.D. Myers alleged that Canada had failed to accord treatment in accordance with the minimum standard of international law. Third, the claimant asserted that, by requiring it to dispose of PCB contaminated waste in Canada, the Interim Order imposed performance requirements (i.e., that PCB disposal operators accord preferential treatment to Canadian goods and services and achieve a given level of domestic content). Finally, S.D. Myers claimed that Canada had indirectly expropriated its investment.

The Tribunal accepted S.D. Myers’ claim that the ban on the export of PCBs favoured Canadian nationals over non-nationals, violating Chapter 11’s national treatment obligations (Article 1102). In fact, even before examining the specific allegations against Canada, in its analysis of the legislative history of the PCB ban, the Tribunal concluded that the regulation was “intended primarily to protect the Canadian PCB disposal industry from the US competition” and that “there was no legitimate environmental reason for introducing [it].”73

According to the Tribunal, the interpretation of “like circumstances” between foreign and domestic investors and investments, that give rise to the national treatment obligation, must take into account two important factors: first, the “general principles that emerge from the legal context of NAFTA, including both its concern with the environment and the need to avoid trade distortions that are not justified by environmental concerns,” second, “the circumstances that would justify governmental regulations that treat [foreign investors] differently in order to protect the public interest.”74 With this statement the Tribunal recognized that environmental factors may provide a legitimate basis for finding circumstances to be “unlike.” The legal context for Article 1102 was determined to include the various provisions of NAFTA, its side agreement, the North American Agreement on Environmental Cooperation (NAAEC), and its principles.75 Emerging from this context are, according to the Tribunal, the following principles:

Accordingly, the Tribunal analyzed Canada’s environmental obligations and concerns and decided that the bilateral or multilateral treaties governing the disposal of hazardous waste did not justify favouring domestic suppliers over S.D. Myers. In addition, the Tribunal rejected Canada’s defence that the Order was designed to secure the economic strength of the Canadian industry in order to ensure Canada’s ability to process PCBs within its territory in the future (taking into consideration that the US could, at any time, close its border again).

The Tribunal agreed that ensuring the economic strength of the Canadian industry was a legitimate objective, but condemned Canada’s means of achieving it. It also applied a leastrestrictive-means test to determine whether the specific measure chosen by Canada to achieve that objective was, despite its adverse impact on foreign investors, consistent with NAFTA. The Tribunal found that there were several legitimate ways by which Canada could have achieved that goal, but imposing a ban on the export of PCB was not one of them.77 The Tribunal largely based its ruling on documentary and testimonial evidence that Canada’s policy was motivated by the intention to protect and promote the market share of Canadian-owned enterprises.78

In comparing like circumstances, the Tribunal went beyond comparing the S.D. Myers investment in Canada, which provided marketing services, to other Canadian-based providers of PCB marketing services.79 Instead, it applied the national treatment obligation to the full business line of S.D. Myers, including operations in the home and the host countries (the US and Canada, respectively).80

The Tribunal also accepted S.D. Myers’ claim that Canada had breached the minimum standard of treatment (Article 1105). The only reason the Tribunal presented for this finding was that on the facts of the case a “breach of Article 1102 essentially established a breach of Article 1105 as well.”81 On this point, Arbitrator Chiasson dissented, noting that the breach of another provision cannot establish a violation of Article 1105; a violation of this provision must be based on a demonstrated failure to meet the fair and equitable requirements. The Tribunal, nevertheless, made some interesting remarks on the scope of Article 1105. According to the Tribunal:

[A] breach of Article 1105 occurs only when it is shown that an investor has been treated in such an unjust or arbitrary manner that the treatment rises to the level that is unacceptable from the international perspective. That determination must be made in light of the high measure of deference that interna- tional law generally extends to the right of domestic authorities to regulate matters within their own borders.82

Regarding S.D. Myers’ claim of expropriation, the Tribunal noted that the “general body of precedent usually does not treat regulatory action as amounting to expropriation” and, therefore, regulatory action is “unlikely to be the subject of a legitimate complaint under Article 1110 of NAFTA.”83 This statement, however, was weakened by the Tribunal’s note that it did not rule out the possibility of regulatory action giving rise to a legitimate action under that article. The Tribunal also noted that, when determining whether a measure constitutes expropriation, a tribunal must look at the substance of a measure and not only at the form. In addition, tribunals “must look at the real interests involved and the purpose and effect of the government measure.”84

Under this analysis, the Tribunal noted that regulations may be found to be expropriatory. To make such a determination, both the purpose and the effects of the measure must be analyzed. As for the purpose, the Tribunal ruled that the measure was designed with the objective of preventing S.D. Myers from carrying on its business. However, the effects of the measure were found not to be expropriatory. According to the Tribunal, due to its temporality, the effect of the measure was only to delay an opportunity.

Another important finding of the S.D. Myers Tribunal was that the phrase “tantamount to expropriation” in Article 1110 did not expand the meaning of expropriation in the NAFTA beyond customary international law.85

As well, the Tribunal did not support S.D. Myers’ claim that Canada had breached the article on performance requirements. Examining its wording, the majority of the Tribunal found that the Canadian government had imposed no such requirements on S.D. Myers.

In February 2001, Canada filed an application before the Federal Court of Canada to set aside the Tribunal’s Partial Award. Canada based its application on the Commercial Arbitration Act,86 alleging that elements of the NAFTA Tribunal’s award exceeded the Tribunal’s jurisdiction and that the ruling conflicts with the public policy of Canada. As of November 2002, the Federal Court had not rendered its decision.

In October 2002, the Tribunal ruled that the damages incurred by S.D. Myers amounted to over C$6 million plus interest. These damages amount to approximately 30 percent of the damages sought by amount to S.D. Myers ($20 million).

On December 3, 1999, Methanex, a Canadian company with a US subsidiary, brought a Chapter 11 complaint against the United States, claiming that an Executive Order providing for the removal of a gasoline additive known as MTBE violates US obligations under Chapter 11. The impugned directive was based in large part on a study by the University of California which concluded that there are significant risks associated with MTBE, as it leaks into ground and surface water via leaking underground fuel tanks.87

Methanex claimed that the ban is not based on credible scientific evidence; and that the University of California report is flawed in several aspects. In addition, the claimant alleges that the ban went far beyond what was necessary to protect any legitimate public interest, and that the government failed to consider less restrictive alternative measures to mitigate the effects of gasoline releases into the environment. Methanex contends that the real problem to address is the leaking gasoline tanks.

Methanex does not manufacture MTBE, it produces and markets methanol, the principal ingredient of MTBE. Methanex fears that the measures taken by California will effectively end its methanol sales in California. Thus, Methanex argues, the California measure constitutes a substantial interference with and taking of Methanex’s US business and its investment in Methanex US, thus violating the expropriation provision of Chapter 11 (Article 1110).

Methanex has also claimed that the California measure violates the non-discrimination provision of Article 1102, as the ban was the result of a lobbying effort by the US ethanol industry, specifically by Archer Daniels Midland, an ethanol producer. Methanex asserts that the discriminatory purpose can be seen on the face of the Executive Order, which not only banned MTBE, but also sought to establish an ethanol industry in California. Moreover, the subsequent regulations that implemented the MTBE ban specifically name ethanol as the replacement product.

Methanex also has claimed that the manner in which the legislative measure was established constitutes a violation of Chapter 11’s minimum standard of treatment provisions (Article 1105). According to the company, because of the US ethanol industry’s lobbying, the California measures were arbitrary, unreasonable and not in good faith.

Between August and October of 2000, four environmental NGOs submitted petitions requesting the Tribunal’s permission to submit amicus curiae briefs, to make oral submissions and to have observer status at oral hearings. Methanex opposed any amicus participation on three grounds. First, the Tribunal had no jurisdiction to add a party to the proceedings without the agreement of the parties that already had standing. Second, Article 1128 (participation by a member-state) of NAFTA already ensured the protection of the public interest, and if the petitioners were to appear as amici curiae, the parties to the dispute would have no opportunity to cross-examine the factual basis of their contentions. Third, were the petitioners allowed to participate, there would be a breach of the privacy and confidentiality of the arbitration process. Mexico also submitted a response to the amicus application, asserting that NAFTA did not provide for the involvement of persons other than the disputing parties and the other NAFTA signatory in matters related to the interpretation of Chapter 11.

The Tribunal analyzed separately each of the requests made by the NGOs. First, it declined the request to attend oral hearings of the arbitration, since Article 25(4) of the UNCITRAL Rules provides that the oral hearings must be held in camera unless the parties agree otherwise. Second, it concluded that it had no power to accept the petitioners’ request to receive materials generated within the arbitration, since confidentiality was determined by the agreement of the parties to the dispute. Third, the Tribunal considered that allowing a third person to make an amicus written submission could fall within its procedural powers over the conduct of the arbitration, within the general scope of Article 15(1) of the UNCITRAL Arbitration Rules.88 This decision was based on the fact that there is no provision in Chapter 11 that expressly prohibits the acceptance of amicus submissions. Although the Tribunal concluded that it had the power to accept such submissions, it decided not to issue an order for the participation of the amici in its January decision.

In August 2002, the Tribunal issued a preliminary award on jurisdiction, that is, whether it was entitled to hear the case in the first place.89 This ruling did not involve a consideration of any of the merits of the substantive claims before it, but nonetheless it did not seem to offer Methanex much encouragement.

The rules of Chapter 11 apply only to measures adopted or maintained by another Party relating to investors of another Party, or investments (e.g., subsidiaries) of investors of another Party. Without establishing that a measure in question relates to either it or its investment, a foreign investor will not be able to pursue a claim under NAFTA.

In its award, the Tribunal ruled that there “was no legally significant connection between the measure [the ban on MTBE] and the investor or nature of the investment.”90 The fact that Methanex is a producer of only one component of the additive to MTBE, which was the subject of the California regulation, was viewed as too indirect a connection between the measure and the investor/investment. The scope of impact of the measure was viewed as too broad to be the subject of challenge. A measure that merely affects the investor does not automatically mean that they are necessarily “related.”

At the same time, the Tribunal ruled that to require that a measure be “primarily aimed at” a foreign investor would be too high a hurdle for a foreign investor to bring a claim under Chapter 11. The only avenue left open for Methanex to submit a claim would be to establish that the measures in question were intended to discriminate against it in favour of a domestic competitor. This would be sufficient for the Tribunal to rule that the case could proceed.

The central concern of NAFTA has been to what extent NAFTA has imposed substantive limits on the ability of governments to adopt bona fide regulatory and legislative measures taken for public welfare purposes. Do the decisions to date support the concern about these provisions, or have critics overstated the risk?

This is a critical issue because it speaks to the ability of governments to regulate in the public interest. No part of Chapter 11, and especially not the article on expropriation, was intended to subvert the ability of governments to undertake legitimate public welfare measures. However, given the potential for self-interested parties to use environmental or other measures for protectionist purposes or to transfer economic benefits for reasons not related to the common good, it is important that investors maintain the ability to protect themselves against the abuse of regulatory power. Having said that, there is a good argument that Chapter 11 does respect a state’s police powers; that is, the state’s right to protect the environment, consumers, public health, etc., and that the cases decided to date under Chapter 11 have not demonstrated a restriction on governments to act in the public interest.

Critics of NAFTA have argued that the very fact that compensation has been paid to foreign investors has resulted in “regulatory chill.”92 The meaning of the term « regulatory chill » is not clear. Does it mean that regulators are so fearful of a possible Chapter 11 challenge that they cease to adopt any new regulations and that the entire environmental regulatory framework grinds to a halt? Or does it mean, rather, that regulators must be mindful of not violating certain obligations when developing new regulations? Not only is the term regulatory chill imprecise, but it is pejorative, thereby leading one to conclude that regulatory chill exists as a negative force on regulators without any analysis or even understanding what the term means. To the extent that regulators are required to take care in designing regulation so as not to unduly discriminate against foreign investors, etc., that will not necessarily diminish the quality, quantity or effectiveness of public regulation. Indeed, such constraints are entirely consistent with a range of similar existing constraints imposed on regulators by, for example, the Government of Canada’s Regulatory Policy.93 It is hard to imagine that, based on the cases to date, regulators would be inhibited from proposing bona fide environmental regulation. The cases to date have only punished what tribunals considered to be outrageous behaviour on the part of government officials, and only three cases have resulted in awards in favour of the investor: Metalclad, S.D. Myers and Pope & Talbot. In each of these cases, the investor led significant evidence to the effect that the government had engaged in high-handed and capricious conduct to the detriment of the investor. In all three cases, the objectionable conduct was found sufficient to trigger liability on the basis of the minimum standard of treatment (and in Metalclad, liability for expropriation as well).

In examining the cases, it is important to ask what environmental regulation or value is at stake. A close examination of the cases leads to the conclusion that the so-called “environmental cases” are not really environmental cases at all. In Metalclad, for example, a Mexican state governor used a sham environmental measure to prevent a hazardous waste-disposal site from opening, despite the fact that it had been built in compliance with all applicable legal requirements.

There was significant evidence pointing to the fact that the governor was using, or rather abusing, environmental regulation as a manipulative tool for self-serving and parochial interests. This type of capricious action on the part of a subnational government is exactly the type of behaviour that NAFTA was designed to constrain.

The panel fully addressed the evidence regarding the arbitrary nature of the alleged “environmental” measure in that case. Metalclad confirms that the mistreatment of foreign investors can take many forms, including the form of an environmental regulation. It does not support the proposition that bona fide environmental regulation can form the basis of a compensation award.

Similarly, in S.D. Myers, there was much evidence presented that the Canadian measure responded to protectionist interests, rather than those of environmentalists. There was no valid environmental justification for closing the border to the export of PCB waste, but there was a valid economic reason for doing so: to eliminate the competition to less efficient Canadian businesses. Again, this type of capricious, discriminatory and high-handed behaviour is what NAFTA Chapter 11 sought to address.

And what about the precedential value of these cases? Has bona fide environmental regulation been threatened by Chapter 11? No. Rather, the cases demonstrate that discriminatory and unfairly protectionist measures are threatened by Chapter 11 — very threatened. Tribunals have not been afraid to “call it as they see it,” despite the fact that the measure in question concerns an ostensible environmental, health or safety measure. In other words, “egregious conduct begs a remedy, and that Tribunals will be inclined to find a remedy where the conduct in question offends basic principles of justice and fair play.”94

As noted above, to date there has only been one finding of expropriation since the advent of NAFTA. Tribunals have not made findings of expropriation lightly — there must be a substantial deprivation for such a finding to be made. Tribunals have stated that the diminishment of profits is not sufficient for finding expropriation, rather, there must be a measure that, in effect, renders an operating business inoperable, whatever form that measure may take. These cases have demonstrated that incidental interference with an investment is not sufficient to substantiate a claim, even where it has a negative financial impact on the investment. Rather, there must be unreasonable interference for a sustained period of time that results in a substantial and fundamental deprivation of an investor’s property rights.95

The focus on the effect of NAFTA Chapter 11 on public regulation also obscures the fact that other important values are at stake. It is important to be mindful that the ability to regulate in the public interest is not the only value important to the functioning of a democratic society. As explored above, the principles contained in Chapter 11 are not new. Arguably, it is important to consider all of the values at stake, which includes the fair treatment of investors, that governments be accountable for their actions and that a government’s discretionary powers not be abused.

Environment Canada has listed on its website all of the new federal environmental acts and regulations enacted since NAFTA was passed in 1994, it is responsible for administering. Included are 46 new acts or regulations administered by Environment Canada, eight new regulations under the Canadian Environmental Assessment Act and one regulation under the Fisheries Act. These include the Migratory Birds Convention Act (1994), the Alternative Fuels Act (1995), the Canada Marine Act (1998), the Mackenzie Valley Resource Management Act (1998) and the Oceans Act (1996).96 As the volume of new legislative instruments continues to expand, we can presume that the environmental regulatory framework continues to function in Canada (as it does in Mexico and the United States), despite the alleged “chill” that Chapter 11 has caused.

The literature supporting the contention that regulatory chill does exist is largely anecdotal and has not been adequately substantiated. Those who assert that regulatory chill is inhibiting new environmental regulation should keep in mind that more work could be usefully done on researching the degree, if any, to which Chapter 11 may have created a regulatory chill at federal, provincial or state levels in Canada and the US.

Concerns about NAFTA have also extended to “‘deregulatory chill’ — a phenomenon potentially inimical to economic efficiency and growth.”97 Schwanen posits that governments have faced increased political difficulties with deregulation and privatization politically since NAFTA, since a government’s ability to unwind, or roll back, any deregulation or privatization initiative may be seen as compromised as a result of NAFTA.98

Johnson has explored this phenomenon most recently in the context of Canada’s public healthcare system.99 While some Chapter 11 obligations are subject to reservations for the public health system,100 such as NAFTA Articles 1102, 1103, 1006 and 1107, other Chapter 11 provisions are not. The Chapter 11 provisions not subject to reservations are, most notably, the expropriation provisions (Article 1110) and the minimum standard of treatment provisions (Article 1105). While the status of measures subject to reservations is not totally clear, Johnson concludes that their potential inhibiting impact on government actions is “reduced substantially” by the reservations. On the other hand, however, with respect to those obligations that are not subject to reservations, Johnson concludes that the expropriation provisions of NAFTA would have “a major impact if the public component of the system were expanded in any way that adversely affects the business of private firms.”101 Johnson similarly concludes that the minimum standard of treatment provisions may “affect any expansion of the public component of the system that is coupled with a denial of recourse to the courts by private firms.”102

While this may seem undesirable at first glance, Chapter 11 does not really impose onerous obligations on governments wishing to deregulate. In a sense, the effect of these provisions is really just to require governments to treat foreign investors fairly and reasonably. If, by virtue of a government’s decision to deregulate or privatize, a private firm makes an investment to operate a business, that firm should be compensated in the event of a sudden reversal of policy. There is nothing in the expropriation provisions that prevents a government from taking the regulatory action it desires, but rather it must compensate a firm for that if the action is tantamount to expropriation. Similarly, the minimum standard of treatment provisions do not prevent a government from adopting any regulation or policy, but rather, require that government to treat firms with due process, e.g., a government could not deny a foreign investor access to the court system, as this would constitute a denial of justice.

Thus far this paper has mainly examined the impact of the substantive rules of Chapter 11 and resulting pressures for change. However, there is also considerable pressure for change in the area of Chapter 11 process and procedure. What has emerged from the various decisions is a rather uneven patchwork of rulings on the issues of transparency, openness, public participation and appellate review. These areas are probably most ripe for reform by NAFTA Parties.

Central among the pressures for change is the transparency of the Chapter 11 process. The lack of transparency of the panel process mandated by Chapter 11 is viewed by many as undesirable, since Chapter 11 does address issues of broad public concern. It is notable that none of the elements of a case is required to be made public, that is, there is no right of public access to the pleadings, the transcripts of the hearing or the reasons for judgment. This stands in contrast to current practice under other sections of NAFTA and the rules of the World Trade Organization (WTO). Rulings under NAFTA’s two other dispute-settlement mechanisms — Chapter 19 (for antidumping and countervailing duty challenges) and Chapter 20 (for general state-to-state breaches of NAFTA) — as well as those under the WTO, are publicly available and accessible.

To some extent, the concerns with respect to transparency have been alleviated by the Free Trade Commission’s interpretation of July 2001 (see Box 3). Therefore, the issues with respect to transparency are not as pressing as they were prior to the interpretation. However, in March 2002, the Pope & Talbot Tribunal ruled on the investor’s request that the Tribunal urge Canada not to release protected documents. Canada was seeking to make public transcripts of the hearings under the Canadian Access to Information Act. The Tribunal noted that Procedural Order on Confidentiality No. 5 prohibited Canada from disclosing transcripts of the hearings. In addition, the ruling noted that the UNCITRAL Rules require in camera hearings. The Tribunal rejected Canada’s claim that the notes of interpretation issued by the NAFTA Free Trade Commission on July 31, 2001 required such disclosure under the Access to Information Act. In the Tribunal’s view, the Commission’s Interpretation recognized the validity of Order No. 5 as binding on Canada. Accordingly, the Tribunal concluded that making the documents available violated not only Procedural Order on Confidentiality No. 5, but also NAFTA itself.104

In any event, the parties could go further in developing more precise rules which address the transparency of documents, pleadings, transcripts and hearings. This would bolster the legitimacy of the NAFTA dispute settlement process. At the same time, however, it is important to maintain certain safety valves which protect the confidentiality of sensitive business information. The demand for openness must also be balanced with protection of confidential or privileged information.

There also have been ongoing calls for other institutional reforms to Chapter 11. Most significant has been the demand for participation in the Tribunal proceedings themselves, by becoming a party to the litigation itself, and through the submission of amicus briefs and oral arguments.

NAFTA Article 1120 provides that whichever arbitral rules are chosen by the investor “shall govern the arbitration except to the extent modified” by NAFTA Chapter 11. NAFTA Article 1131(1) also provides that a tribunal “shall decide the issues in dispute in accordance with [the NAFTA] and applicable rules of international law.” Accordingly, any tribunal asked to consider participation by a non-party in a given arbitration must look first to the designated arbitration rules and then to any applicable NAFTA provisions or “rules of international law” that may be relevant to the dispute if the parties are not able to come to an agreement on such participation. To date, both the Methanex and the UPS Tribunals have ruled that they have the power to accept amicus submissions, although both Tribunals have yet to actually formally allow specific submissions to be made.

Participation by interested parties raises a number of complex issues.105 On the one hand, interested parties may possess specialized knowledge on a particular issue and, given the public nature of these disputes, the participation of certain NGOs may enhance the perceived « legitimacy » of the process. On the other hand, however, just because a certain group claims to represent broad public interests, that is not necessarily so, and arguably it is a democratically-elected government that is best equipped to represent the public interest in Chapter 11 litigation. Moreover, the addition of parties to a dispute, or the requirement to read and reply to briefs submitted, can add significantly to the time and cost of the arbitration.

However, where there is a public interest value at stake, there is no compelling reason why interested parties should not be able to, at a minimum, submit briefs for a tribunal’s consideration. This was the opinion of the Methanex Tribunal, which recently stated:

There is an undoubtedly public interest in this arbitration. The substantive issues extend far beyond those raised by the usual transnational arbitration between private parties. This is not merely because one of the Disputing Parties is a State…The public interest in this arbitration arises from its subject matter, as powerfully suggested in the Petitions. There is also a broader argument, as suggested by the [United States] and Canada: The Chapter 11 arbitral process could benefit from being perceived as more open and transparent, or conversely be harmed if seen as unduly secretive.106

However, the Tribunal also recognized that:

There are other competing factors to consider: the acceptance of amicus submissions might add significantly to the overall cost of the arbitration and, as considered above, there is a possible risk of imposing an extra burden on one or both of the Disputing Parties.107

However, attempts to make NGOs party to the actual dispute have not been successful. In October 2001, the UPS Tribunal delivered an award deciding against the Canadian Union of Postal Workers’ and the Council of Canadians’ petitions for standing as parties to the Chapter 11 proceedings. The petitioners argued that they have a direct interest in the subject matter of this claim, and it would be contrary to the principles of fairness, equality and fundamental justice to deny them the opportunity to defend their interests in the proceedings.