Le système de revenu de retraite canadien est jusqu’ici parvenu à réduire la pauvreté chez les personnes âgées et à maintenir le niveau de vie des travailleurs retraités. Mais selon Patrik Marier, des problèmes touchant la couverture et la gouvernance des régimes de retraite profes- sionnels, ainsi que le caractère facultatif et le coût élevé des autres options d’épargne, pour- raient compromettre le niveau de vie de plusieurs travailleurs à revenus moyens à l’heure de leur retraite. L’auteur analyse les réformes adoptées par la Norvège, la Suède, la Nouvelle- Zélande, le Royaume-Uni et la Saskatchewan afin d’en tirer des leçons pour le Canada, et il repère des éléments qui compléteraient les régimes de pension publics canadiens.

La Norvège, au-delà de son généreux système public, a obligé ses employeurs à offrir une modeste couverture de retraite professionnelle. Les petites entreprises ont relevé les défis liés à cette exigence en créant un partenariat entre leur association nationale et une compagnie d’assurance ; environ 600 000 salariés ont acquis une couverture de retraite professionnelle à un faible coût pour l’État. De son côté, la Suède a amélioré la couverture des pensions en intégrant à son généreux système public des comptes de pension individuels à cotisations déterminées (CD), modestes mais obligatoires.

La Nouvelle-Zélande et le Royaume-Uni ont choisi l’adhésion automatique avec option de retrait pour leurs travailleurs. Depuis 2006, la Nouvelle-Zélande inscrit chaque nouveau travailleur à un compte de pension individuel à CD, et offre des mesures incitatives et de la formation. Résultat : 1,5 million de Néo-Zélandais bénéficiaient d’une couverture à la mi-2010. Les travailleurs du Royaume-Uni, eux, participeront d’ici à 2017 soit à un régime de retraite professionnel, soit à un compte de pension individuel à CD peu coûteux, géré par une fiducie autonome.

Mais le Canada ne pourrait adapter ces modèles sans surmonter certains obstacles, notamment parce que les pensions y relèvent à la fois d’Ottawa et des provinces et que le secteur des entreprises y est moins structuré qu’ailleurs. Il serait donc nécessaire de créer une structure nationale ou de coordonner les programmes sous-nationaux pour ne pas entraver la circulation de la main- d’œuvre. Il faudrait aussi que des comptes de pension individuels viennent compléter les régimes publics, qu’ils offrent aux épargnants une option « par défaut » à faible coût et à haut rendement, et qu’ils soient uniquement obligatoires pour les travailleurs sans régime de retraite professionnel.

Le Régime de pensions de la Saskatchewan, qui est à CD, collectif et facultatif, a connu un vif succès initial en raison de ses incitations financières (ultérieurement supprimées) et de sa structure à faible coût. Il permet aux personnes au foyer, aux travailleurs et aux employeurs de cotiser de façon irrégulière à un même fonds commun, et aux retraités de toucher une rente régulière. Selon l’auteur, ce régime, auquel on ajouterait des incitations financières et un plafond de cotisations plus élevé, pourrait servir de modèle à un régime national pour les personnes sans régime de retraite professionnel.

Peu importe le modèle retenu par le Canada, ses travailleurs à revenu moyen et élevé devront disposer de meilleurs instruments privés d’épargne-retraite pour suppléer au revenu de rem- placement limité qui leur est offert par les régimes publics.

The coverage and generosity of public pension benefits increased tremendously after the Second World War, resulting in a significant reduction in the risk of poverty among the elderly. Canada was part of these trends, with the creation of Old Age Security (OAS) in 1952, the Guaranteed Income Supplement (GIS) in 1967 and the Canada Pension Plan (CPP)/Quebec Pension Plan (QPP) in 1966. The Registered Retirement Savings Plan (RRSP) and Registered Pension Plan (RPP) ensured that the public pension system would be complemented by private savings schemes. This pension mix has been highly effective in combatting poverty among seniors. As of 2006, elderly Canadians had lower poverty rates (5.4 percent) than individuals aged 18 to 64 (11.3 percent) (Statistics Canada 2008a). From an international perspective, Canada is a success story with regard to the alleviation of poverty among the elderly, ranking at the very top, alongside Nordic countries such as Sweden and Finland (Régie des rentes du Québec [RRQ] 2004).

In order to maintain this performance well into the twenty-first century, Canada will have to tackle several challenges. Socio-economic and demographic changes have triggered multiple pension reforms across member countries of the Organization for Economic Cooperation and Development (OECD). Slower economic growth, declining fertility rates and improved life expectancy are among the key factors pressing governments to alter their public pension schemes. These factors strongly affect countries that rely on pay-as-you-go (PAYGO) schemes, such as Canada (for most of the CPP/QPP), the United States (Social Security) and France (Régime général).2 They also affect programs financed through general revenues, such as the OAS and the GIS in Canada. The proportion of individuals aged 65 and over is expected to nearly double by 2031. By then, this age group will represent 23 percent to 25 percent of the Canadian population (Statistics Canada 2005). Prior to 1980, it represented less than 10 percent (OECD 2000, 142). It should be stressed that it is primarily the combination of population aging and slower economic growth that is responsible for the difficulties associated with PAYGO systems. For instance, with no changes to the contribution rate, wage growth results in additional rev- enues that could partly offset the increasing proportion of the population reaching retirement.3 The real wage growth of -0.40 percent in Quebec during 1993-2002 (RRQ 2004) is a key con- tributing factor in the actuarial difficulties currently being experienced by the QPP.

To address these issues, most countries have opted to maintain the structures of their retirement income systems while altering a few parameters, such as raising the retirement age, lengthening the contribution period, strengthening the link between contributions and benefits, and reducing the generosity of indexation mechanisms. Moreover, some countries, such as Belgium (Fonds de vieil- lissement) and France (Fonds de réserve pour les retraites), have established mechanisms to prefund PAYGO schemes. The consequences of these reforms vary greatly according to the measures employed. The 1997 reform of the CPP/QPP is a good example of an instance whereby contribution rates were raised to maintain the current level of benefits into the future. To rectify the actuarial deficit of the plans, Canadian governments opted to gradually increase contribution rates, from 5.6 percent in 1996 to 9.9 percent in 2003, and to create reserve funds using the excess contributions.

An increasing number of countries have also sought to alter the public/private balance of their pen- sion system, mainly to reduce the need for future public commitments by increasing the reliance on private savings. They have done so in a variety of ways. Sweden has increased reliance on private sav- ings by creating individual pension accounts, with a portion of the funds invested privately. It has established a special agency (Premium Pension Authority) to handle these private pensions and facili- tate the selection of investment funds. The United Kingdom is on the verge of creating a new individ- ual accounts scheme (Department for Work and Pensions 2009). In the United States, President George W. Bush’s failed 2005 plan to reform Social Security included individual pension accounts.

The adoption of individual pension accounts in some OECD countries, often within public pension programs similar to the CPP/QPP has led to debate in Canada on the merit of this policy tool. However, while this policy tool was used in most countries to adjust to population aging and to pro- tect public finances, the Canadian debate deals mainly with the social objectives of increasing pri- vate savings and providing more adequate retirement incomes. Should this type of policy tool be adopted in Canada as a complement to existing public programs — which for the most part are on a solid footing, in contrast with the situation in many other OECD countries.

The major aims of this study are to examine emerging challenges to the Canadian pension system and to analyze possible avenues for facilitating access to private pensions in light of recent experiences abroad. As a result of the limited replacement rate provided by the CPP/QPP, it is imperative that proper access to private retirement savings for middle- to high- income earners be ensured or that the replacement rate be increased. This study considers reform options of the former type.

No solutions involving the expansion of a public earnings-related pension plan (like the CPP/QPP) are presented in this study. However, the government could well raise the cur- rent CPP pensionable earnings ceiling; increase benefits by raising contribution rates; or even create a new occupational scheme, as part of the CPP, for workers who are not covered by a company plan. The Ontario Expert Commission on Pensions raised these possi- bilities in its final report and suggested that they be explored by the provinces at a national pension summit. However, due to its limited mandate and resources, the Commission did not explore these avenues (Expert Commission on Pensions 2008, 187- 88), and the third option was largely dismissed by finance ministers at their June 2010 meeting. But the Quebec pension board (RRQ) considers the first two options in its latest document on QPP reform (RRQ 2008), and the minister responsible for the RRQ and the QPP has recently put forward a proposal built around the third option.

The paper is structured in four sections. The first section is an overview of the Canadian pension system. The second contains a discussion of some of the system’s key challenges, including issues related to the maturation of RRSPs/RPPs and the shift now under way with regard to occupational pensions. The third and fourth sections are analyses of experiences abroad and in Saskatchewan, and include an assessment of the political and policy obstacles to the introduction of similar programs in Canada.

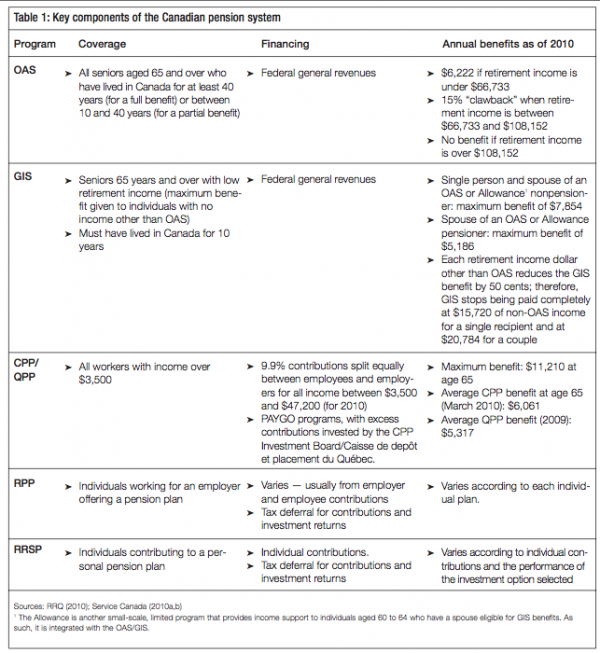

The first component of the Canadian pension system consists of noncontributory, inflation-indexed benefits issued mainly on the basis of residency (OAS) and need (GIS). In order to access these benefits, seniors must have lived in Canada for at least 10 years (table 1). The programs are financed and administered by the federal government and represent 14 percent of total yearly federal spending (Auditor General of Canada 2006).

The OAS is financed through general revenues and is provided to the vast majority of Canadians as taxable income. A full benefit is issued to individuals aged 65 or older who have resided in Canada for at least 40 years, and a partial, prorated benefit to those who have lived in Canada for 10 to 40 years. In July 2010, the full benefit came to $6,222 per year. Following the introduction of the clawback in 1989, individuals with a net income above $66,733 must reimburse a portion of their OAS pension at a rate of 15 percent for each additional dollar of income. Thus, those earning over $108,152 must reimburse the full amount. (For a broad dis- cussion of the clawback and its implications, see Marier 2008a, 424-25; Service Canada 2010b.)

The GIS is a means-tested program targeting poorer seniors. Benefits are not taxable and their level varies according to household composition and income; it is “taxed back” at a rate of 50 cents for every dollar of income other than OAS. In 2010, a single senior with no income other than OAS could receive up to $7,854, over and above OAS (Service Canada 2010b). According to the 2004 Survey of Labour and Income Dynamic, 38 percent of Canadian retirees receive some level of GIS (Marier and Skinner 2008). The GIS is completely phased out at a non-OAS income of $15,720 for a single senior.

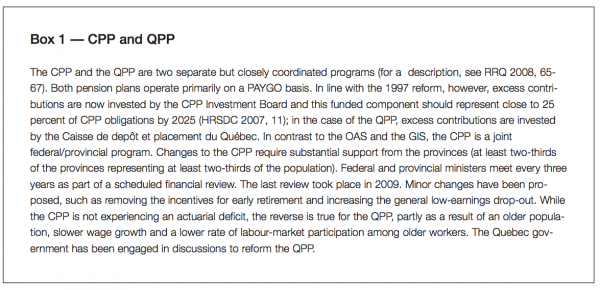

The second component of the Canadian pension system is the mandatory earnings-related pension plan, the CPP/QPP.4 Following the 1997 reform, the contribution rate for both the CPP and the QPP currently (in 2010) stands at 9.9 percent of all earnings between $3,500 and $47,200. In 2010, the average monthly CPP benefit is $505 and the maximum is almost $934 (or $11,210 per year) (Service Canada 2010a). Like most public earnings-related pension schemes, the CPP/QPP includes redistributive features such as elimination of the worst years of income (15 percent) for benefit-calculation purposes. Thus, for example, the worst seven years of a 47-year career (from 18 to 65 years of age) are expunged to calculate average earnings (see box 1) and determine benefit levels.

It should be pointed out that, unlike the public earnings-related pension schemes of many European countries, which are designed to provide an earnings-replacement rate above 50 per- cent of the average wage, the CPP/QPP aims for a modest replacement rate of 25 percent of the average wage for 40 years of contributions (i.e., 47 years minus the worst 7 years). As a result, the role of private pensions is to ensure that most retirees receive adequate replacement income, as opposed to mere subsistence income. The OECD has estimated that the average Canadian work- er needs to contribute 3.8 percent of gross earnings to private pensions annually for 45 years in order to achieve the average OECD gross replacement pension rate (OECD 2007, 84).5

The focus of this study is the privately administered portion of the Canadian pension system: company pension plans (such as RPPs), where coverage and benefit rates vary widely based on factors such as age, unionization and occupational status; and private savings, which can rely on various instruments, such as RRSPs. This study examines options for improving replacement rates for future retirees by increasing access to occupational and private pensions and by improving the management of private pensions.

Pension systems are very complex and have multiple concurrent policy goals that can be at odds with one another. These policy goals may include combatting poverty, reducing inequalities, providing universal coverage, increasing private savings, ensuring similar policy treatment or outcomes for every generation, and ensuring the good governance of pension plans at a low administrative cost. This study focuses on two key stated goals of Canadian pension policy: to ensure a minimum level of income for seniors, and to help Canadians avoid significant changes in their living standard upon retirement (Horner 2009; Task Force on Retirement Income Policy 1979).

As in many countries, in Canada the original pension legislation (in this case, the Old Age Pension Act of 1927) provided for a form of social assistance determined by a means test, with the objective of reducing poverty among the elderly. Alleviating poverty and reducing income inequalities remain important goals today,6 and Canada has been a world leader in tackling both problems among the elderly. This can be attributed to the generosity of the pension income floor, consisting of the OAS/GIS (Osberg 2001), and maturation of the CPP/QPP program (Myles 2000). However, women and immigrants continue to have a comparatively high risk of poverty. Elderly women living alone are more than twice as likely as seniors in general to be receiving the GIS (Marier and Skinner 2008). Although the increasing participation of women in the labour market is likely to generate stronger future pension rights that are independent of marital status, gender differences are not expected to disappear, because women are still more likely than men to have career interruptions and to earn lower wages. As the population ages, elderly women and immigrants will likely remain most at risk of poverty (Marier and Skinner 2008). But more Canadian seniors, both women and men, could face such a risk if the OAS and GIS continue to be indexed to inflation only, and not to standards of living. Such an indexation policy implemented in France and the United Kingdom has had a large impact on replacement rates and has produced a wide income gap between retirees and average workers as retirees grow older. For example, the Balladur Reform of 1993 in France resulted in a 12 percent decline in replacement rates, and two-thirds of this impact has been attributed to price-only indexation (Conseil d’orientation des retraites 2001).

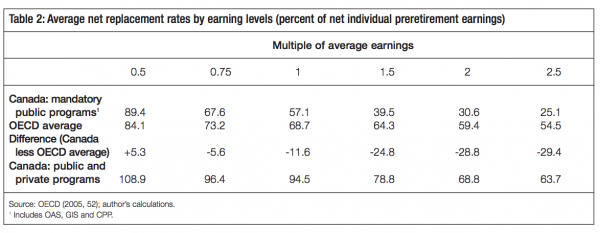

Another major objective of pension systems is to ensure an adequate replacement rate for retirees. Although various elements, such as the cost of housing (Ritakallio 2003), social benefits and the tax rate, influence the rate sought (and obtained) by workers, the general goal is that a person’s standard of living will not decline drastically once s/he retires. In Canada, public programs such as the OAS, GIS and CPP/QPP provide a high replacement rate for lowto middleincome earners (see table 2). However, individuals with above-average earnings experience a sharp drop in income if they rely exclusively on public programs.

It is in this context that the role of private pensions and their relationship with the public pension system is particularly important. Even if the OAS, GIS and CPP/QPP maintain their current level of benefits, many Canadians will still have to rely on private pensions to enjoy an adequate replacement rate. Canada’s public system provides a 57 percent net replacement rate for the average income earner, compared with an OECD average of 68 percent, and private voluntary schemes add 37.5 percent, for a grand total of 94.6 percent of average income (see table 2). The replacement rates drop considerably for those with above-average preretirement earnings.

Canadian private pensions are the weakest components of the pension system. In contrast to the OAS and the CPP/QPP, private pension plans provide uneven and unequal coverage. These plans are mostly voluntary, operate under various rules and generate a wide range of benefits. As a result, the maturity of private pension plans and current trends in their accessibility and generosity will likely have an appreciable impact on the capacity of the pension system to provide adequate replacement income for many individuals with an average or above-average income.

The state’s role in private pensions is to act primarily as a regulator, rather than as an administrator. But governments are usually not passive when it comes to private pensions; tax incentives represent a large, often underestimated, share of social expenditures. At least five OECD countries (Australia, Canada, Ireland, the United Kingdom and the United States) devote more than 1 percent of GDP to the subsidization of various pension plans (Adema and Ladaique 2005, 28).7 In Canada, private plans are regulated federally and provincially and receive preferential tax treatment from both levels of government (for an extensive review of workplace pension plans, see Baldwin 2007). Considering that in Canada direct expenditures on public pensions equalled 5.3 percent of GDP in 2001 (Baldwin 2007, 14), and government tax incentives to promote private pensions were another 1 percent (for a total of 6.3 percent of GDP), these tax incentives represent approximately 16 percent of total public expenditures on pensions.

Given that the earnings-related public plan has a replacement rate of only 25 percent for the average wage-earner, employer-sponsored plans play a vital role in the retirement income of Canadian workers. RPPs are the most common type of pension plan, but coverage is fairly narrow. In 2006 only 38.1 percent of workers participated in an RPP (Statistics Canada 2008b). The key factors associated with the likelihood of participating in a company pension plan are fulltime employment, union membership, employment by a large organization, employment in the public sector, seniority, and a high-status occupation (Lipsett and Reesor 1997). However, there has been a 7-percentage-point decline in the coverage of company plans since 1991, when 45.3 percent of paid workers were covered (Statistics Canada 2008b). Using data from 1986 and 1997, Morissette and Drolet (2001) attribute the shrinking coverage to a decline in union density and a shift away from manufacturing toward industries with low pension coverage, such as services.

Regarding these figures, two points should be made. First, there is a wide gap between pension coverage in the public and private sectors. In the public sector, coverage is widespread, with 82 percent of workers participating in a pension plan in 2006. In the private sector, coverage is much more limited, with a 2006 participation rate of 23.8 percent, and is concentrated in large enterprises (Gougeon 2009). Second, there are now more women than men with RPP coverage. In 2006, 37.5 percent of male workers were enrolled in an RPP – a 12-percentage-point decline since 1991 – whereas women’s coverage was 38.9 percent – a mere 1.9-point decline (Statistics Canada 2008b). This outcome is partly attributable to the steady rise in the number of women in the workforce; improved access to pension plans for part-timers; and employment growth in those sectors of the economy with easy access to a pension plan and where women have a strong presence, such as education and health care (Schembari 2006).

There are three types of occupational pension plans: defined benefit (DB) plans, defined contribution (DC) plans, and group registered retirement savings plans (RRSPs).8 The most common is the DB plan. DB plans usually offer pension benefits on the basis of a formula factoring the number of years worked, age and best annual earnings. Thus, retirement income is predetermined and it is the responsibility of the employer (or sponsor) to ensure that it has sufficient resources to finance pension liabilities if the accumulated contributions and the investment returns from these contributions do not cover employee pensions. It should be pointed out, however, that not all risks are assumed by the employer, even though the employer is responsible for making additional contributions when liabilities outweigh assets in a pension plan. For example, the employer can seek to increase employees’ contribution rates or alter pension indexation mechanisms in order to sustain the DB plan, depending on the nature of the difficulties associated with the plan. The worst-case scenario from the employee’s perspective may simply be termination of the plan, which is likely when a firm goes bankrupt.

Several recent studies and reports have stressed the funding deficits experienced by DB plans in Canada (Association of Canadian Pension Management 2005; Laidler and Robson 2007; RRQ 2005; Selody 2007). While the situation was considered “manageable” in 2005 (Department of Finance 2005, 3), the latest financial crisis will likely generate a different assessment.9

There are multiple reasons for the plans’ funding deficits that extend beyond the recent financial crisis. First, the decline in long-term interest rates used in actuarial valuations has significantly raised the costs of pension liabilities. Second, the decreasing returns on equities have resulted in depressed funding ratios for the many plans holding a sizable portion of assets in equity. Third, the increasing life expectancy of plan members has increased the costs of retirement. With some companies facing the prospect of having as many as one retiree per employee, their pension liabilities are likely to increase (Armstrong 2004, 46). This problem is accentuated by early retirement options (Tuer and Woodman 2005, 21-22).

Finally, many firms took a contribution holiday in the 1990s, when a number of plans experienced a sizable surplus. The Income Tax Act was partly responsible for this situation, since it limited the size of surpluses to 10 percent of liabilities (i.e., a DB plan’s funding level could not exceed 110 percent of its liabilities; this cap was recently raised to 125 percent). Moreover, recent court decisions have determined that funded pension plans are subject to classic trust legislation, meaning that a portion of surpluses must be returned to all plan members, including retirees (Armstrong and Selody 2005; Association of Canadian Pension Management 2005). Much uncertainty remains when it comes to surpluses in DB plans, which explains why this issue has received particular attention in recent provincial inquiries (Expert Commission on Pensions 2008; Joint Expert Panel on Pension Standards 2008; Pension Review Panel 2008). Plan managers continue to face strong disincentives against the accumulation of surpluses, which is counterintuitive in a volatile financial environment. According to the RRQ, a third of the firms that took a contribution holiday in 2001 and 2003 experienced a pension plan funding deficit in 2005 (RRQ 2005, 31).

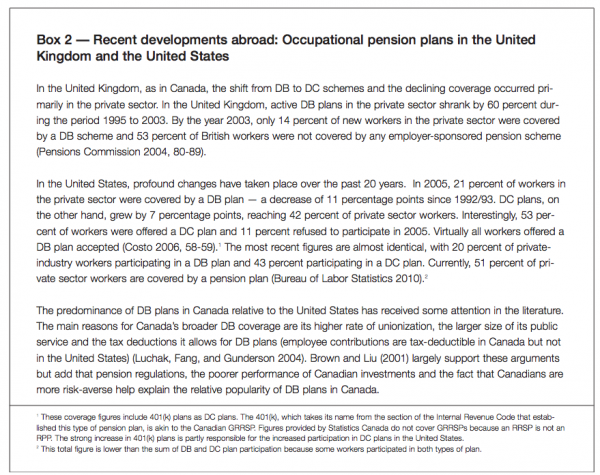

Among workers covered by an RPP, 83.6 percent are members of a DB plan (Statistics Canada 2008c). In 2004, 75.2 percent of private-sector workers with RPP coverage had a DB plan, down from 90.6 percent in 1984. Almost all civil servants (93.3 percent) continue to have DB pension coverage. While there is a discernible trend away from DB plans in favour of DC and group RRSPs (GRRSPs), the resilience of Canadian DB plans is unique relative to developments abroad (see box 2).

The second type of occupational pension plan is the DC plan. With DC plans, unlike DB plans, benefits are not set in advance, because they are based solely on the contributions made by both employee and employer and the returns earned on these contributions. Also, the risks associated with pension income are borne mostly by the employee. Each employee usually has his/her own account, and risks are not pooled within the firm. Thus, two workers with the same work history, wage and pension contributions may end up receiving very different pension incomes, depending on their investment decisions and the period during which they invested.

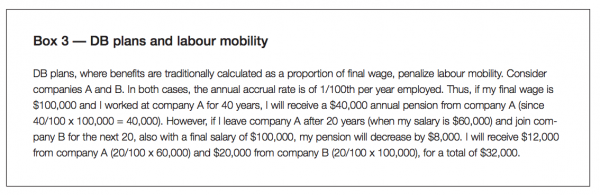

As suggested by the current trend away from DB plans, employers generally prefer DC plans, because they result in lower direct and indirect costs to them (Aaronson and Coronado 2005; Hustead 1998). DC plans also provide more cost certainty for employers, who are responsible only for making their contributions and paying their share of administration fees, whereas DB plans entail more responsibilities. According to an American study, with DC plans the employer cost per worker is reduced by 1.7 percent to 3.5 percent (Ghilarducci and Sun 2006). For example, employers do not have to make adjustments if members live longer or if equities held by their pension plan generate lower returns than expected. Workers who change employers often are also likely to prefer DC plans, because the rules associated with DB plans tend to favour individuals who have a long career with the same employer (see box 3); this explains why employees are also partly responsible for the shift towards DC plans (Aaronson and Coronado 2005). In a nutshell, DC plans offer more flexibility to both employers and employees (Mitchell and Schieber 1998).

A third option, the GRRSP, is increasing in popularity (Luchak and Fang 2005; Pozzebon 2005). This is not a registered pension plan like DC and DB plans, and thus is more flexible for the employer. In a GRRSP, the employer simply facilitates its workers’ purchase of an RRSP, which receives tax treatment similar to other RRSPs. There are no contractual obligations tying employers to their workers. The employer can add its own contribution, which it can reduce, increase or withdraw at any time. (Luchak and Fang 2005; Pozzebon 2005). The employer can even increase its contribution for some workers and not others. Also, the employer does not assume administrative responsibility beyond collecting payroll contributions – a task usually given to an outside party managing the individual funds – and, as in the case of DC plans, is not liable for guaranteeing a specific retirement income.

Few studies have captured the extent of the increase in the reach of GRRSPs, especially with respect to coverage and contribution rates. However, recent publications found a sharp rise in their popularity. Using survey data collected from more than five thousand workplaces from 1999 to 2001, Luchak and Fang (2005) found that, while the number of workplaces offering RPPs or hybrid plans (defined here as RPPs and GRRSPs concurrently)10 declined by 10.8 percent and 7.4 percent, respectively; the number of those offering only GRRSPs increased by 21.2 percent. Other sources point to significant increases as well. GRRSP deposits grew by 25 percent between 2003 and 2004 (from $82 to $102 million), and a 2003 survey found a twofold increase in GRRSP contributions between 1993 and 2003 (Sipes 2005).

Although current shifts in pension plan coverage offered by employers, mostly affecting private-sector workers, are likely to have a long-term impact on retirement income levels, the key issue remains: more than 50 percent of employed Canadian tax filers do not currently participate in either an RPP or a RRSP (Moussaly 2010). If we exclude the public sector, where coverage is nearly universal, more than 75 percent of private-sector workers are not covered by an RPP (Gougeon 2009). What is particularly alarming is that an even larger portion of the younger workforce is not covered, which could bring an end to the gains recently achieved in retirement income levels (LaRochelle-Côté, Myles, and Picot 2008); for example, between the mid-1980s and the mid-1990s, coverage actually declined slightly among women aged 25 to 34, although it rose for those aged 35 to 54 (Morissette and Drolet 2001).

In the private sector, the Canadian landscape is complicated by the presence of multiple regulatory regimes. According to the Canadian Association of Pension Supervisory Authorities (2004), this contributes to administrative complexity for companies operating in more than one province, because occupational pension plans are regulated by provincial or federal authorities that have different rules. For example, British Columbia and Quebec have clauses allowing employers to make participation compulsory (Tapia 2008), while plan membership is always compulsory in Manitoba (Hering and Kpessa 2008). The federal government regulates pensions in industries such as banking and transportation. Moreover, recent reforms have led to greater divergence across Canada, making it more difficult to integrate private pension regulations (Hering and Kpessa 2008).

The Joint Expert Panel on Pension Standards, established by the Alberta and British Columbia governments, has called for measures to facilitate harmonization across the country (2008). However, the advocates of harmonization may be facing an uphill battle. The Nova Scotia Pension Review Panel (PRP) stresses that the nonharmonization of occupational pensions is a positive factor, because it is a source of innovation; it rejects the possibility of harmonization due to the “independence of different jurisdictions” (PRP 2008).

The ability of private pension plans to safeguard prior investments (or promises) has also been questioned. Beyond cases that have attracted media attention, such as pension losses due to bankruptcy or poor stock market performance, the overall governance and management of private pension plans have also been criticized (Ambachtsheer 2004, 2007; Reynolds 2007).

The lack of extensive occupational pension coverage in the private sector means that many workers need to establish their own pension plan; they will likely face a sizable reduction in living standards if they rely on the CPP/QPP, the OAS and, potentially, the GIS. However, individual private pension coverage and benefits for many middleto high-income earners are not adequate, resulting in dramatically lower replacement rates. The findings of current studies also demonstrate that fewer young workers (aged 25 to 34) are contributing to RRSPs (41 percent in 1997, compared to 34 percent in 2008) (Moussaly 2010).

The RRSP was created in 1957 (as the registered retirement annuity) to compensate for the lack of employer-sponsored pension plan coverage for a large segment of the workforce. In the 1970s, the Registered Retirement Income Fund (RRIF) was created to allow retirees to withdraw RRSP investments gradually or transform them into annuities without the tax penalty associated with complete withdrawal. The RRSP’s status within the Canadian pension system was solidified in 1984, when the federal government explicitly stated that the CPP/QPP would not be expanded and that private pensions would provide the additional resources for retirement (Baldwin 2007; Boychuk and Banting 2008). Major changes were made in 1991, when tax deductions were equalized between RPPs and RRSPs and the contribution ceilings for both plans were raised considerably (they have since been raised again). The Conservative government recently modified the RRSP by allowing individuals to wait until 71 years of age, instead of 69, to convert their RRSPs into RRIFs.

Despite the presence of RRSPs, multiple hurdles contribute to generally lower retirement incomes for individuals who are not covered by an RPP. First, administrative costs are higher for individual investors than for group pension plans. For instance, despite the management and safeguarding issues cited above, administrative costs associated with private pension plans tend to favour workers in large firms with sizable pension assets. Ambachtsheer (2004) estimates that a tenfold difference in pension assets managed by two funds leads to a difference in annual administrative costs of 0.45 percent of assets in favour of the larger fund. Furthermore, basic computations show that charging 1 percent of assets annually to administer a pension fund depletes the fund’s accumulated balance by 20 percent over a 40-year period (OECD 2001). This issue is starting to receive the attention it deserves, figuring prominently in recent provincial commissions reports (Expert Commission on Pensions 2008; Joint Expert Panel on Pension Standards 2008; PRP 2008).

Second, unlike RRSPs, RPPs offer the opportunity to pool pension risks, thus reducing uncertainty and increasing the likelihood of higher returns and higher retirement income. Third, individual pension plans like RRSPs require that individuals be aware of the risks and uncertainties associated with retirement. The literature concludes almost unanimously that individuals, regardless of their income and for a variety of reasons, underestimate the cost of retirement. Likewise, individuals do not know how to deal with the uncertainties associated with private investments, have difficulty finding the proper information and do not make the “right” investment decisions (Bernatzi and Thaler 2001; Byrne 2004; Diamond 1977; Hey 2002). As a result, RRSPs are a poor substitute for RPPs.

While in Canada the key public pension programs (OAS, GIS and CPP/QPP) provide a solid base for the future, the shrinking coverage of private pension plans is alarming, given their role in providing adequate retirement income for a majority of people. In the following two sections, I review potential policy solutions to this problem by exploring the enactment of reforms in certain jurisdictions that have sought to extend the coverage and generosity of private pensions, I present five cases – Sweden, the United Kingdom, New Zealand, Norway and Saskatchewan – where measures have been taken to improve access to private pensions.

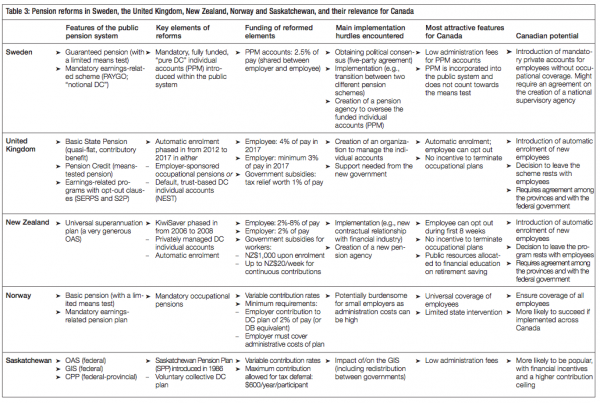

These five cases were chosen because the reforms were introduced within well-established pension systems. This matters greatly because the introduction (or the replacement) of a component in a pension system involves multiple political and administrative hurdles. Policy-makers must overcome the inertia generated by the existence of a current policy and by clientele groups with a stake in particular programs (Hogwood and Peters 1982). As a result, most of the ambitious reforms in industrialized countries have been instituted following lengthy studies, debates and negotiations. The literature is filled with examples of pension policy stressing the difficulties of introducing reforms (Béland 2001; Bonoli 2000; Marier 2008c; Pierson 1994). There is as much to be learned from the process under which reforms are introduced as from the measures implemented. For each case, a succinct assessment will be made as to how such reforms could be implemented in Canada (see table 3).

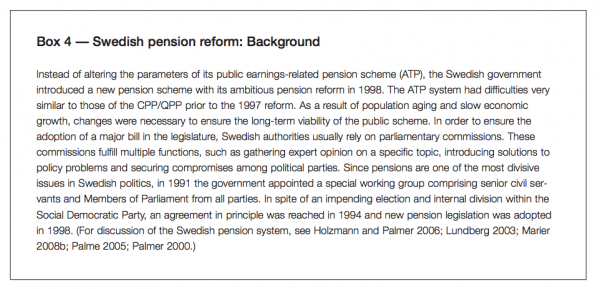

The Swedish case offers interesting lessons for Canada, for two reasons.11 First, Sweden’s new pension system includes a mandatory funded component administered and supervised by a government agency. Second, an ambitious reform was enacted in a difficult context, since it required the approval of many political parties (see box 4).

The structure of Sweden’s pension system prior to the 1994-98 reform was similar to that of Canada’s. It included a generous fundamental pension (folkpension), provided on the basis of citizenship, similar to the OAS. In 1994, a single pensioner received SEK33,116 (roughly $5,100) per year, and married pensioners SEK27,079 ($4,200) each. Low-income retirees were eligible for a means-tested supplement similar to the GIS, raising the basic pension for a single person to SEK52,261 ($8,000) (Statens offentliga utredningar 1994, 24). In the 1994-98 reform, the two benefits were amalgamated. The new, single-benefit guaranteed pension is means-tested only with respect to retirement income originating from the public earnings-related plan. In 2009 the maximum benefit for a single pensioner under the guaranteed pension was approximately $14,000. Other sources of retirement income, such as occupational pensions, are not taken into account in calculating the guaranteed pension.

Sweden’s former pension system also included a mandatory public earnings-related scheme (ATP, or National Supplementary Pension) similar to the CPP/QPP, with a contribution floor and ceiling. However, the ceiling, which was not affected by the reform, was set at a higher level than Canada’s (at roughly $51,000 in 2010). Moreover, the contribution rate was significantly higher, at 13 percent,12 which resulted in more generous benefits. In order to receive a full pension, a person had to work a minimum of 30 years. A 60 percent replacement was then calculated using the best 15 working years. Excess contributions were invested by investment agencies (the socalled AP funds, or National Pension Funds); in this respect, the ATP was similar to the CPP/QPP. Due to the generosity of the ATP scheme, occupational pensions play a minor role in Sweden.

Now, after a long transition period, the new public earnings-related pension scheme is based on the “life income principle” and relies on the principle that every Swedish crown contributed to the pension scheme (up to the ceiling) should count in the calculation of one’s public pension. Essentially, everyone who works an additional year should receive a higher pension based on the amount contributed during that year. Instead of focusing on the elimination of the worst years to achieve redistributive aims, the new system compensates for life events that prevent individuals from participating in the labour market (such as the birth of a child, unemployment or military service).

In this reformed scheme, every additional day worked generates additional pension benefits. In the previous system, by contrast, pension gains were marginal for anyone working an additional year beyond the 30 year of contribution. The contributions made for each individual, at a rate of 16 percent of pay (shared between employer and employee), are now recorded in a “notional personal account,” whose value is automatically indexed on general earnings trends each year and which serves to determine benefits upon retirement. However, this account is not funded and thus the system remains PAYGO; this type of pension scheme has been called a “notional defined contribution” (NDC) scheme (see Palmer 2006). The Swedish reform has attracted international interest and has been emulated in Latvia and Poland.

More interesting for the purpose of this study was the introduction, within the public scheme, of private individual pension accounts administered by the newly created Premium Pension Authority (PPM). In the new public pension scheme, therefore, two types of contribution are collected on earned income, up to the ceiling: a 16 percent contribution managed on a PAYGO (but NDC) basis, as described above; and an additional mandatory 2.5 percent contribution (also shared by employer and employee) invested in private individual pension accounts. In contrast to the NDC scheme, the latter are pure DC, fully funded accounts and the retirement benefits they generate will depend solely on the contributions made into them and the actual returns they earn.

In 2000, after a mass information campaign, all working Swedes received a distinctive orange envelope asking them to select investment funds for their 2.5 percent contribution. Every year since, contributors have received an orange envelope containing information on their private individual pension account, asking them to select an investment fund and explaining that they have the option of switching funds. As of 2008, 785 investment funds were registered with PPM. Individuals can opt not to select a fund, in which case their assets are managed by a publicly managed default fund called the Seventh AP Fund (which is integrated with the broader public, earnings-related NDC scheme). But once a contributor has opted to select a nondefault fund, s/he can no longer revert to the default fund. At the end of 2008, 57 percent of contributors had selected a fund (Premiepensionsmyndigheten 2009). For the past six years (including 2008, a turbulent year), the default fund has had an average annual return of 6.9 percent, compared to 5.5 percent for contributors who made a selection (Sjunde AP-Funden 2009, 11). With a steady group who continue to choose not to choose, the administrators of the default fund were mandated to create default “generational funds” (generationsfondsalternativ) in 2009, which are funds with higher risk for younger cohorts and limited risk for those nearing retirement (Sjunde AP-Funden 2009, 11).

It is worth pointing out that the long-term future of the new pension system rests on a solid political compromise involving five major parties (which represented more than 80 percent of all parliamentary seats at the time it was reached). Therefore, in contrast to the British situation (see below), policy reversal is highly unlikely. A stable pension framework is in place for years to come. This is an extremely valuable feature in a policy area that requires long-term planning and execution.

The Swedish system of mandatory individual accounts would be unlikely to succeed in Canada. The introduction of this feature into the Canadian pension system would necessitate revisiting the 1997 CPP/QPP reform agreement, a problematic endeavour since any changes must have the support of at least two-thirds of the provinces, representing at least two-thirds of the population. The idea of a private component within the CPP/QPP was briefly discussed in the 1990s but failed to garner support (see, for example, Béland 2006; Bernier 2003).

As a result, mandatory individual accounts would likely have to be introduced as a supplement to the CPP/QPP, and the contribution rates would have to be higher than Sweden’s 2.5 percent if the primary objective is to increase replacement rates substantially.13 This option poses two challenges. First, in Canada, unlike in Sweden, privately managed pensions are well organized and RPPs/RRSPs are now strongly established within the pension system. Adding a new and mandatory system of individual accounts would increase the complexity of the pension system, especially for individuals who are already covered by an RPP and contribute regularly to an RRSP. Second, it would result in higher contribution rates. Assuming that new contributions would be shared between employees and employers, as is the case for the CPP/QPP,14 employers who already have established occupational pension plans would likely terminate them or reduce their generosity to avoid contributing to three different pension schemes.

Nevertheless, mandatory pension schemes such as Sweden’s private individual accounts have clear advantages. For instance, they ensure a high level of participation and broad coverage. Moreover, the creation of the PPM in Sweden has made it easier for individuals to select and manage their private pensions and has played a role in educating the population about private pensions. In spite of these efforts, it is easy for citizens to feel confused, with more than 750 funds from which to choose – a situation that is partly responsible for the high proportion of individuals (43 percent) staying with the default fund.15 Some confusion remains with regard to the new pension system. For example, while 96 percent of Swedes are aware that they can select their own pension fund, only 29 percent know that not making a selection results in placement in the default fund. In addition, only 43 percent of Swedes know that the mandatory contributions to their private individual accounts are integrated with the universal pension system (Premiepensionsmyndigheten 2010, 47). Nonetheless, Sweden has achieved a much higher active selection rate than Australia, where close to 90 percent of individuals remain with the default option for their mandatory occupational scheme (Fear and Pace 2008). The PPM has also ensured that administrative fees are kept low. Among the most interesting features of the Swedish funded individual pension accounts are their very low management fees (0.31 percent) and administration costs (0.19 percent goes to the PPM) (Premiepensionsmyndigheten 2010) and the good financial performance of the default fund.

The most likely scenario in the Canadian context would be a modified version of the Swedish individual pension accounts, to be introduced as a mandatory measure for workers who are not covered by occupational pensions. This option would ensure that all workers are covered by either an occupational pension or individual pension accounts regulated by a new pension agency (similar to the PPM). The new agency could require that eligible investment funds meet specific criteria, such as low administration fees and a proper mix of risk. Both the pension industry and individuals could benefit from economies of scale. The creation of a good default option is also essential in this kind of initiative. However, setting up an agency to serve the needs of workers not covered by occupational pension plans might require an agreement among the provinces, which could prove difficult. Moreover, this option might generate disincentives for employers to provide an occupational plan because they would not have to contribute anything to private individual accounts. One way to resolve this situation would be to introduce mandatory contributions among employers who do not offer an occupational plan.

The introduction of automatic enrolment as a policy option to increase participation in pension plans is fairly recent. Automatic enrolment has been presented as a response to the ongoing question of whether to adopt voluntary or mandatory pension schemes. While mandatory schemes have been criticized for restricting individual choice and imposing a one-size-fits-all solution, voluntary schemes have resulted in wide gaps in both coverage and generosity.16 Although there is little opposition to mandatory public programs like the CPP/QPP, or Social Security in the United States, occupational pensions have been the subject of debate. In the United Kingdom, the mandatory/voluntary debate on occupational pensions was omnipresent in discussions leading up to an ambitious 2007/08 reform, initiated largely because of a steady decline in the coverage of occupational pensions that has not been offset by a similar rise in private savings. By 2005/06 only 42 percent of the working-age population in the United Kingdom was contributing to some type of private pension (Department for Work and Pensions 2008, 16). Similar discussions in New Zealand resulted in the creation of the KiwiSaver in 2006.

In the case of occupational pensions, automatic enrolment refers to the process by which individuals are automatically registered for a pension plan when they begin employment. In contrast to purely voluntary solutions, the default option is membership in the plan. Individuals must, then, actively choose to leave a plan, as opposed to choosing to join it. Also in contrast to mandatory solutions, individuals can choose to withdraw from the plan (opt out) at no cost. American studies have shown that if individuals are automatically enrolled in a 401(k) (similar to a GRRSP) by their employer, instead of having to actively choose to participate in the plan, participation rates will be significantly higher; moreover, individuals are likely to take the default contribution rate to be the appropriate savings rate (Madrian and Shea 2001; Thaler and Sunstein 2003). These studies suggest that, for both automatic and voluntary enrolment, “procrastination” and difficulty finding appropriate information compel individuals to avoid making a decision (in this case to opt out or to join a plan). These findings contradict key assumptions held in the economics literature about the capacity of individuals to make decisions that are in their best interests. They have led various countries to consider automatic enrolment as part of their pension reform. This is the case for both the United Kingdom and New Zealand. These two countries have recently launched programs to increase the coverage of occupational pensions, and they have introduced tax incentives to entice individuals to remain enrolled.

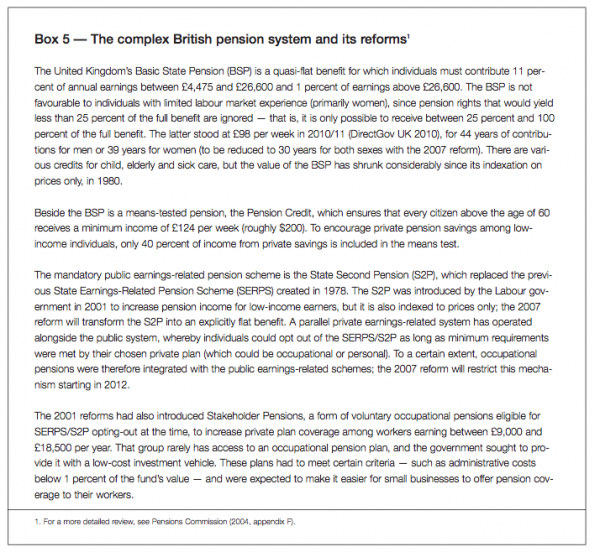

Given the more than one hundred parameters its taxpayers must consider when estimating their pension income, the United Kingdom has earned the distinction of having “the most complex pension system in the world” (Pensions Commission 2004, 210) (see box 5). While the CPP is more difficult to alter than certain elements of the Canadian Constitution, the British pension system can be changed with an Act of Parliament. This feature of British politics, combined with the fact that pensions are a highly politicized issue in the United Kingdom, has resulted in perpetual reforms – the worst-case scenario for a policy area requiring long-term horizons. Conservative and Labour governments have systematically overturned whatever changes were made to the pension system by their predecessor.

The earnings-related public pension scheme created by the Labour government in the late 1970s (SERPS) was amended in the 1980s to reduce the generosity of public benefits and to subsidize a parallel private system for workers wishing to opt out. The Labour return to power in the 1990s resulted in new reforms in 1999-2001 that introduced the S2P and voluntary Stakeholder Pensions. However, the government failed to achieve its objectives of increasing the importance of voluntary occupational pensions and easing the pressure on state pension programs. Stakeholder Pensions did not attract small businesses (less than 4 percent participated), and plans consist mostly of “empty shells with no contributing members” (Pensions Commission 2004, 92). Occupational pensions also underwent a crisis: membership in DB plans fell by 60 percent between 1995 and 2003, at which point only 14 percent of new entrants were being offered a DB plan (Pensions Commission 2004, 84). Observers forecast that up to 82 percent of pensioners would have to resort to means-tested benefits (Cohen and Hall 2004).

Consequently, the Blair government appointed the Pensions Commission in 2002. The Commission’s reports formed the basis of the pensions acts of 2007 and 2008. The 2007 Pensions Act included a shortening of the contribution period required to obtain the BSP and a change in its indexation mechanism to make it more generous; transformation of the S2P into a flat-rate benefit and elimination of the S2P opting-out arrangement for DC private plans; and an increase in the normal retirement age to 68 years between 2024 and 2046. The 2008 Pensions Act introduced automatic enrolment in either an occupational pension plan or a default individual pension account (NEST), beginning in 2012.

These reforms sought to address two problems. Measures related to the BSP and the S2P clearly sought to reduce the number of retirees relying on means-tested benefits: poverty rates among British elderly were expected to rise sharply as a result of the limited indexation and contributory nature of the BSP and the reduced generosity of the SERPS/S2P. The government addressed the decreasing coverage and generosity of occupational pension plans, also a source of future poverty among the elderly, by creating the NEST, which will provide fully funded DC individual accounts, and by introducing automatic enrolment into either the NEST or an employer-sponsored plan meeting minimum requirements.

The NEST and the automatic enrolment procedure are gradually being rolled out and implemented. Beginning in 2017, workers will contribute a minimum of 4 percent of pay; additional contributions will consist of (at least) 3 percent of pay coming from employers and a 1 percent tax relief from the state. These contributions, which cannot exceed £3,600 per year, will be collected on earnings between £5,034 and £33,540.18 The NEST will be an arm’s-length trust governed by an independent board of directors; the Pensions Regulator will enforce the automatic-enrolment provisions. No transfers in and out of the NEST will be allowed; in this respect, the NEST contrasts with earlier pension regimes.

Although the principles on which it is based are different from those underlying the Canadian public pension system, New Zealand’s superannuation plan has achieved similar policy outcomes. Poverty rates among retirees are lower in New Zealand than in any other OECD country and are substantially lower than those among the workforce (Paul, Rashbrooke, and Rea 2006). This is due to a combination of a generous universal pension, a high rate of mortgage-free home ownership among the elderly, and private savings (Periodic Report Group 2003). New Zealand does not have an earnings-related public pension scheme like the CPP. Instead, it has a superannuation plan (equivalent to a very generous OAS) for those aged 65 and over. This plan provides flat benefits to those who pass a residency test.19 Benefit rates are currently set at 66 percent of the net average wage in New Zealand for couples and at 60 percent or 65 percent for singles, depending on their living arrangements (Kritzer 2007).20 Moreover, the plan is financed not by contributions but from general revenues. Faced with an increasing proportion of individuals aged 65 and over, the government established a superannuation fund in 2001 to offset a portion of future costs. Prior to implementation of the KiwiSaver program, New Zealand had no tax incentive to bolster private savings or to favour the development of occupational pension plans. Tax concessions had been introduced in 1915 but these were eliminated in 1988 (Preston 2004, 16).

Like Canadians, New Zealanders experienced a decline in both coverage and generosity with respect to company pension plans. DB plans lost a third of their membership in the period 1990 to 2004. By 2004, the proportion of the workforce covered by a company pension plan had plummeted to 14.1 percent (Paul, Rashbrooke, and Rea 2006, 130) – much lower than the approximately 40 percent in Canada. The 2003 report of the Periodic Report Group21 stressed that pension arrangements failed to achieve an adequate replacement rate for middleincome earners, who could save more and thus be assured of a larger pension.

The government’s response was the creation of the KiwiSaver scheme, which consists of subsidized individual pension accounts. The scheme was developed in 2006 and became operational on July 1, 2007.22 New workers aged 18 to 65 are automatically enrolled in a KiwiSaver account but can opt out between the second and eighth week of employment. Their contributions are placed in one of six default funds and workers can choose to move their account to a nondefault provider at any time. Individuals were initially enrolled at a default contribution rate of 4 percent of gross earnings but could opt to increase their monthly contribution to 8 percent of gross earnings. Individuals who were already employed before the scheme was introduced can opt in, and employers can also opt in on behalf of their employees. The government has created incentives to discourage opting out. First, it provides a one-time payment of NZ$1,000 ($750), which is deposited directly into the individual’s KiwiSaver account. Second, it provides a subsidy of up to NZ$20 ($15) weekly (up to NZ$1,040 yearly) for continuous contributions; this is also deposited directly into the account (Kritzer 2007).

Since 2008, employers have been required to contribute to the individual accounts of their workers. The rate was originally expected to be increased to 4 percent of the employee’s gross salary in 2011 (up from 1 percent in 2008). Under certain conditions, employers already contributing to an occupational plan can offset their contributions to KiwiSaver against their contributions to their occupational plan.

After coming to power in 2008, the new National Party government introduced minor changes to the KiwiSaver. These were implemented in April 2009. The changes sought to reduce the costs of government subsidies – costs have been much higher than expected due to the immense popularity of the KiwiSaver; they reached NZ$1.655 billion during the first two years (Evaluation Services 2009) – and curb upcoming employer contributions. First, the minimum contribution rate for employers was set at 2 percent instead of 4 percent; any contributions made above this ceiling will not be tax exempt. Second, the original employer tax credit was discontinued. Third, the minimum worker contribution rate was reduced from 4 percent to 2 percent, with the new default contribution rate set also at 2 percent. Finally, an amendment was made ensuring that employees would not experience a decline in their gross pay as a result of their decision to join the KiwiSaver.

Though not long in place, the KiwiSaver program has been much more popular than expected. The membership was 716,637 at the end of year one (June 30, 2008), a level that was not expected to be achieved until 2011 (Evaluation Services 2008, 6). As of June 30, 2010, 1.46 million individuals had enrolled in the KiwiSaver program. Interestingly, the number who joined the program voluntarily represented 48.38 percent of members, compared to 37.11 percent who joined via automatic enrolment and 14.51 percent via their employer.23 The results of a recent government survey highlight the appeal of both incentives and automatic enrolment: 77 percent of enrolled individuals stated that the government and employer contributions/incentives were an important reason to join the KiwiSaver, while 45 percent of automatically enrolled individuals stated that they would not have participated in a pension scheme otherwise. Even more interestingly, 38 percent of households with KiwiSaver members said that they likely would not have set money aside for retirement without the KiwiSaver program (Colmar Brunton 2010).

Is automatic enrolment the best way to increase pension coverage? Although neither the British nor the New Zealand reform provides conclusive evidence concerning the impact of automatic enrolment on coverage and retirement savings, the adoption of this feature is based on substantive evidence against voluntary programs. Both countries rejected voluntary options. They also rejected mandatory options, because both countries had already established a niche for the private sector and these arrangements had to be respected. In the United Kingdom in particular, private pension funds were allowed to replace the public SERPS/S2P as long as the pension benefits they provided were as generous as those of the public plan (beginning in 2012, only certain DB plans can continue this practice). These arrangements are far more complex than those in Canada or Sweden, as they include opt-out clauses from public earnings-related pension plans similar to the CPP/QPP.

In the United Kingdom and New Zealand, the results of extensive surveys led policy-makers to believe that automatic enrolment would be successful. Moreover, in both countries, tax incentives have been introduced. Both countries have also set up an organization and a framework to facilitate investment of the funds placed in individual pension accounts. In New Zealand, this initiative has been accompanied by information campaigns to “financially educate” the public.

An interesting aspect of these reforms is the fact that employers are removed from the decision to participate in a pension plan. Previously, in both countries, an employer could simply refuse to offer retirement benefits, without penalty. The decision to remain with the KiwiSaver (or, in the United Kingdom, with the NEST or an occupational plan) now rests solely with workers. Unless their employer offers a generous pension plan, workers are unlikely to opt out of the new individual accounts scheme. However, this flexibility has a price. There is no more debate on whether occupational plans should be DB or DC, as fewer employers are offering a DB plan – a situation that predated the reforms and prompted the creation of the system of DC private individual pension accounts in the first place. Consequently, although more workers will be covered in the future, it is now an accepted fact that those covered will bear far more risks in the years to come than they have thus far.

The adoption of a similar solution in Canada could greatly improve the coverage of occupational pensions by offering an alternative for workers who lack coverage. In contrast to the Swedish scheme, both the NEST and the KiwiSaver include strong participation by employers.

Employers now have the option of either providing (or retaining) an occupational plan that meets basic requirements or simply paying into a default plan that might eventually be changed by the employee. Strong protective measures are needed to ensure that workers do not come under undue pressure by their employers to withdraw from pension schemes.

Politically, applying automatic enrolment in a default program at the national level would require the active participation of the provinces and the federal government since these entities are responsible for monitoring and supervising occupational pension plans. Coordination would be needed regardless of the extent of support for the harmonization of regulations governing occupational pension plans. On the one hand, the development of a national program – say, “LeafsSaver” or “CanuckSaver” – would demand political will on the part of Ottawa and the provinces, to ensure that all occupational plans supervised by the provinces meet the basic requirements of the default program; moreover, negotiation would be needed since the national option could result in a loss of regulatory power for the provinces in the field of pensions. On the other hand, the creation of multiple programs based on current jurisdictions, whereby each province (and the federal government for the industries it oversees) establishes its own program, would necessitate mechanisms to ensure that they do not impede the movement of labour across provinces and industries. Agreements akin to the one currently existing between the CPP and the QPP would be required.

In terms of implementation, resources and expertise would have to be pooled to ensure standardized implementation of individual pension accounts. The result would be a Canadian agency (or multiple provincial agencies with a coordinative agreement) to facilitate the purchase of private individual accounts, to ensure the availability of financial information as well as transparency among providers, and to develop new tax credits (possibly similar to those offered for RPPs). Such a reform would have several advantages. Canadians would benefit from lower administrative fees and additional resources when making decisions about their retirement plans. As a result, occupational pensions could be near universal in coverage. Ambachtsheer’s (2008, 8-10) proposal for a supplementary pension plan comes closest to describing how the KiwiSaver and the NEST would look if implemented in Canada.

The old Norwegian pension system was similar to the Swedish system. It included a universal basic pension (similar to the OAS) and an extensive PAYGO public earnings-related scheme (folketrygd) that was more expensive than the CPP/QPP (but also more generous). It provided benefits on the basis of 40 years’ worth of contributions, using the best 20 years to calculate one’s pension. In the late 1990s, authorities foresaw rising pension costs, prompting the government to launch a broad consultation process to look into possible reform.

The role of private pensions was also the subject of continuous debate in the 1990s. While DB plans benefited from tax allowances, DC plans were excluded until 2001. As in Canada, concern grew over the lack of pension coverage for many workers in the private sector. The Banking Law Commission, set up to study the possibility of introducing mandatory occupational pensions, estimated that 45 percent of workers in the private sector were not covered by an employer-sponsored pension plan (Norges offentlige utredninger 2005, 54) – this compares with approximately 75 percent in Canada.

Moreover, discriminatory practices, such as exempting newcomers and individuals below a certain income level from pension plans, were on the increase. Concerns about public sector workers had to do with the relatively generous benefits provided by their occupational plan (2.2 percent per year of service or 66 percent of final pay for 30 years of service, indexed on wage growth).24

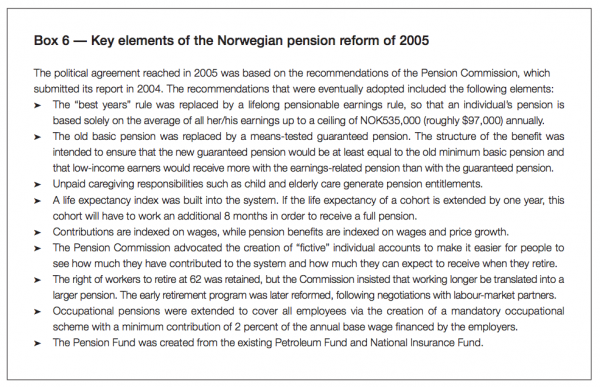

In early 2001 the Labour government opted to establish a Pension Commission with a mandate to clarify the main goals and principles of the entire pension system (Norges offentlige utredninger 2004, 38). The Pension Commission’s report was published in early 2004, followed immediately by intense political negotiations resulting in a broad agreement in 2005. Multiple elements of the Norwegian pension system were altered as a result. The changes included the introduction of a means test for the basic pension and expansion of occupational pensions (see box 6).

The government first developed a new mandatory occupational pension scheme and a new Pension Fund to prefund part of the folketrygd (both legislated in 2006). The new mandatory occupational pension legislation set minimum standards that must be met by all plans created by employers. The Banking Law Commission originally tried to set up common standards for DB and DC plans, but argued that this was virtually impossible due to their different nature. As a result, it opted to focus on contribution rates related to a DC plan. The minimum requirements include:

The authorities supervising the occupational schemes must also ensure that DB plans provide something equivalent to 2 percent employer contributions. Employers receive tax credits for their contributions. The pension schemes are expected to complement the public pension system. In October 2006, after nearly two years of negotiations based on principles adopted in 2005, the government presented a white paper addressing the other elements. The legislation was adopted in February 2009.

The interesting aspect of the reform for Canadians is the adoption of mandatory occupational pension schemes. Thus, unlike the United Kingdom and New Zealand, Norway has opted to expand occupational coverage by placing this responsibility in the hands of employers instead of workers. The Financial Supervisory Authority (Finanstilsynet, previously Kredittilsynet) is charged with the monitoring of occupational pensions. The implementation of mandatory schemes has not been well received among small businesses, since creating and administering a pension plan for as few as three workers entails considerable unit costs, which clearly advantages large enterprises. The Financial Supervisory Authority suggested that small companies pay only a portion of the administrative fees needed to run a pension plan, but this proposal was rejected by the finance ministry. Eventually, the Norwegian employers’ association entered into a partnership with an insurance company to provide this service for its members, thus allowing small companies to benefit from the economies of scale offered by the larger pension schemes. In the first year of implementation, only nine companies received advance warnings and only four received compliance orders, and all of these enterprises had established pension schemes by the end of the year (Kredittilsynet 2008, 38). There is no evidence that the reform has significantly increased the responsibilities of the Financial Supervisory Authority since only two new full-time employees have been added to the four who monitor pension funds in Norway (Finanstilsynet 2010; Kredittilsynet 2008).

The introduction of mandatory occupational pensions in Canada would require an agreement with the provinces and, based on the Norwegian experience, some input by the Office of the Superintendent of Financial Institutions. It would also provide strong incentives for employers to coordinate their efforts and create large pension schemes in order to contain administrative costs. It could be facilitated by some regulatory changes (for example, by allowing for pension plans that cut across federal/provincial jurisdictions). According to a Scandinavian investment magazine, the implementation of mandatory occupational pensions resulted in 600,000 new participants and served to “fuel competition within the [financial] industry” (“Mandatory Pensions Spark Fierce Competition” 2006). Reaching consensus among Ottawa and the provinces in favour of a mandatory solution might prove difficult because of differences in economic structure and ideological leanings, and securing the cooperation of employers might prove more difficult in Canada since employers in this country are not structured in an all-encompassing hierarchical association as they are in Norway.

Interestingly, this solution would relieve employees of occupational pension responsibilities. Workers would not have the option of declining pension coverage, as they do in the case of automatic enrolment plans, and investment decisions would be made by pension administration boards. However, all employees would be assured of coverage and replacement rates would be raised considerably for most middle-income earners.

While there has been an increased focus on learning from abroad (especially with regard to pension policy), experiences within Canada can also be instructive. The Saskatchewan Pension Plan (SPP) comes to mind. Created in 1986 to ensure that homemakers and others not covered by an RPP would have access to benefits beyond the OAS and GIS, the SPP originally provided matching government contributions of up to $300 for individuals earning less than $9,133 a year and a partial matching contribution for those earning between $9,133 and $25,800. The maximum annual contribution was – and still is – set at $600.26 It also included a guaranteed minimum pension for a low-income earner who contributed $300 for the first 10 years of operation of the plan; a $15 monthly pension for each contribution year was guaranteed. Thus, someone contributing $300 for 10 years – with a full $300 matching contribution from the province – would receive a guaranteed pension of $150 per month ($255 in 2007 dollars). It was estimated that the SPP would cost the government $20 million annually. However, a 1992 reform significantly reduced the appeal of the SPP. The matching government contribution and the guaranteed minimum pension were eliminated and members were given the choice of opting out; 45 percent of the 54,913 members did so. As a result, the SPP has since been operating as a large DC voluntary pension scheme that can also be used by employers wishing to provide a modest occupational pension to their employees. Currently, there are 165 employer plans within the SPP, representing 752 contributing members. At the end of 2009, the SPP had 31,830 members (SPP 2010), a figure that would likely increase noticeably with a contribution ceiling above $600.

The SPP is administrated by a board of trustees, in accordance with the Saskatchewan Pension Plan Act. Its day-to-day management is handled by a general manager who supervises the activities of the private firms contracted to invest member contributions, while an external pension consultant monitors the investment managers (SPP 2007). At retirement, annuities are paid out monthly. With its low administrative fees and its flexibility (individuals are not penalized for irregular and fluctuating contributions), the SPP facilitates access to the equivalent of a private pension. Employers can make payroll deductions easily on behalf of workers, free of cumbersome administrative responsibilities. The SPP’s expense ratio for the Contribution Fund27 in 2009 was slightly less than 1 percent of assets, covering all administrative expenses related to this fund within the SPP (such as salaries and benefits, investment management, advertisement, and information diffusion) (SPP 2010, 21, 31). This figure is impressive considering the administrative difficulties associated with voluntary contributions that are irregular and limited to $600. The latter features account for the high administrative fees of the SPP compared to other large DC plans such as the Co-operative Superannuation Society Pension Plan, whose assets are worth ten times those of the SPP.28

It is worth pointing out that variants of the SPP have been discussed in Nova Scotia (www.gov.ns.ca/lwd/pensionreview), Ontario (www.pensionreview.on.ca), Alberta and British Columbia (www.ab-bc-pensionreview.ca). The key difference is that these plans are unlikely to have a $600 annual contribution ceiling and may require employer participation. For example, in its position paper the Nova Scotia PRP recommended that the provincial government establish “plans available to all employers in the province, administered by an independent agency” (PRP 2008).

The SPP could serve as a model for increasing pensionable earnings among all workers – including low-income workers and even nonparticipants in the labour market if some elements of the original plan (such as matching government contributions for low-income earners and a guaranteed minimum pension) were restored and if the plan were better integrated with the GIS. As currently structured, the scheme could be of most benefit to nonparticipants in the labour market (or low-income earners) whose spouses have high earnings, resulting in a joint retirement income that disqualifies them from the GIS. Poor households are unlikely to benefit unless some measures are introduced to remove the disincentive created by the GIS, as 50 percent of investment income is considered in the calculation of the means test and therefore reduces the GIS benefit. Unless an individual is expected to receive over $15,000 in annual retirement income (the point at which s/he will stop qualifying for the GIS), it does not make financial sense to invest in the SPP (or RRSPs). The newly created Tax-Free Savings Account would be a better vehicle.

The matching contributions and the minimum pension guarantee previously offered by the Saskatchewan government made up for the GIS disincentive; the government contribution de facto provided for the GIS loss for those with lower incomes. However, this financial input by the province implied a loss of income provided by the federal government, since fewer Saskatchewan residents would have benefited from the GIS (administered and financed by Ottawa) in the long run had the original SPP been retained.

The SPP could also function as a powerful pension scheme for middleto high-income earners who are not covered by an occupational pension plan if the $600 annual contribution ceiling were to be raised substantially. In its most recent budget, the Saskatchewan government took a step in this direction via a formal request to the federal government to raise the ceiling to $2,500 (Government of Saskatchewan 2010, 71). This is necessary because the $600 contribution limit is also part of the federal Income Tax Act and SPP contributions are treated as RRSP contributions for tax purposes. Prior to the inclusion of this request in the budget, the province sought and received the support of the financial industry on raising the ceiling to $2,500. Increasing the limit even further could encourage additional employers to enrol their workers in the SPP and force private firms to offer alternative products with lower administrative charges. Other incentives could be added to encourage firms without an occupational plan to join the SPP. The key question remaining is whether a voluntary solution can be effective. The early years of the SPP demonstrated that the introduction (and subsequent removal) of incentives can have an appreciable effect on the number of individuals enrolled in a pension plan.

The Canadian pension system has produced remarkable results in terms of alleviating poverty, reducing income inequality and increasing income replacement rates among retirees. Private pensions were designed to contribute to this latter outcome. However, the current decline in RPP coverage and the inability of RRSPs to act as an alternative are worrisome. An increasing number of governments around the world are making adjustments to their pension systems to broaden coverage of occupational plans. It is time for this issue to be addressed in Canada, to ensure that future generations will be able to retire without a significant drop in their standards of living. While intergenerational issues are not addressed explicitly in this study, it remains imperative that younger cohorts endorse future reforms. Erosion of younger workers’ confidence in the current pension system could have long-term negative consequences if these workers distance themselves from their commitment to the system.

Based on the above discussion, four key questions must be answered before decision-makers can deliberate. First, which type of pension plan is preferable: voluntary, automatic enrolment or mandatory?