Au cours des dernières années, l’enfance et la famille ont occupé une place prépondérante dans le discours social sur les politiques publiques. Ottawa et les provinces ont tenté d’améliorer le devenir des enfants, notamment ceux que l’on considère comme vulnérables. Plusieurs programmes ont ainsi été modifiés et des nouveaux mis sur pied. Mais en dépit de l’importance de ces réaménagements, cette nouvelle politique familiale n’a toujours pas été examinée globalement en vue d’établir si elle offre un avenir vraiment meilleur aux enfants canadiens, les premiers visés par ces initiatives.

Cette étude tente de relever le défi. Elle décrit, analyse et évalue la politique familiale d’un bout à l’autre du pays et propose une stratégie alternative. En marge des changements survenus depuis 1996, elle soulève ainsi deux questions : quelles familles ont bénéficié des changements, et comment se distribuent les gains suivant les niveaux de revenu familial ? Des questions dont l’examen permet de conclure à l’inefficacité des changements opérés pour ce qui est de réduire la pauvreté chez les enfants, en particulier la pauvreté extrême, et d’atténuer les conséquences de la vulnérabilité socio-économique.

L’étude démontre que les récentes initiatives fédérales et provinciales ne respectent pas les critères habituels d’efficacité (bénéfice aussi élevé que possible par dollar dépensé), d’investissement social éclairé (rendement social important), d’incitation (encouragement aux comportements souhaités), d’équité (traitement égal des familles) ou de justice (égalisation des chances pour les enfants). Elles échouent à ces tests parce qu’elles reposent sur une vision à courte vue et ne considèrent pas adéquatement la nature des problèmes existants.

Pour en assurer la réussite, soutiennent les auteurs, toute politique familiale doit reposer sur deux assises complémentaires : une perspective de cycle de vie et une stratégie d’investissement dans le capital humain. Dans cette perspective, les problèmes liés à la pauvreté et à la dépendance sociale deviennent des questions de ressources humaines, alors que l’adoption du cycle vital comme cadre d’analyse implique que les politiques doivent viser la situation présente des enfants mais aussi leur situation à long terme.

Tout en proposant plusieurs réformes spécifiques, les auteurs insistent sur les éléments suivants : Ottawa doit exercer un leadership et adopter une politique qui récompense fortement les efforts de travail des parents faiblement qualifiés; la politique canadienne de prestations fiscales est un cul-de-sac et doit être remplacée par une allocation familiale universelle pour chaque enfant; et, finalement, la meilleure approche pour apporter aux enfants une aide immédiate qui les prépare à l’école consiste à fournir des services universels d’éducation préscolaire.

Après une courte introduction établissant les enjeux de la politique familiale, la partie 2 décrit les mécanismes de formation du capital humain et explique pourquoi les familles et la société devraient investir dans les enfants. La partie 3 décrit les choix récents faits par les gouvernements en matière de politique familiale et les compare aux politiques développées et mises en place en 1974 et 1985, années représentatives de périodes où des approches différentes de soutien aux familles étaient en vigueur, pour illustrer comment, historiquement, Ottawa s’est progressivement désengagé du soutien aux familles et comment le mouvement de balancier s’est renversé depuis peu.

La partie 4 évalue l’impact financier des initiatives fédérales et provinciales pour un échantillon représentatif de familles de 1996 en utilisant la banque de données associée au modèle de simulation de politique sociale de Statistique Canada. Dans la partie 5, ces résultats servent à illustrer les limites du programme canadien de prestations fiscales pour enfants par rapport à ses objectifs, qui sont de prévenir et réduire la pauvreté des enfants, de promouvoir la participation au marché du travail des familles pauvres, et de réduire le chevauchement et la duplication des programmes.

La partie 6 met en lumière les principales faiblesses de la politique fédérale et pose les assises d’une stratégie profitable de développement du capital humain. Des assises qui s’inspirent notamment d’un examen des politiques à l’égard des familles aux États-Unis et dans plusieurs pays européens, ainsi que des résultats de recherches récentes sur les programmes s’étant révélés efficaces en matière d’incitation au travail pour lutter contre la pauvreté, de traitement équitable des familles et de satisfaction des besoins des jeunes enfants.

La dernière partie présente pour le Canada une stratégie alternative détaillée s’appuyant sur trois grands axes : faire coïncider les besoins des enfants avec leur potentiel en tenant compte des circonstances propres à chacun et de leur stade de développement (nouveau-né, bébé, âge pré-scolaire ou scolaire); offrir aux parents un choix élargi en matière de conciliation travail-famille et ce, pour toutes les familles sans égard à leur revenu ou à leurs activités professionnelles; fournir une réponse au problème de la pauvreté. L’analyse s’accompagne d’une estimation raisonnée du coût de toutes les propositions et des conséquences financières de celles-ci pour Ottawa et les provinces.

Over the last two decades, children and families have become a focus of concern for governments in Canada and throughout the developed world. Though benefits such as family allowances and maternity leave have long been directed at them, only recently have children and families come to be a key focus of public policy and to occupy a prominent place in social policy discourse. In November 1989, for instance, the House of Commons adopted a unanimous all-party resolution to strive to eliminate poverty among Canadian children by the year 2000. In December 1990 the Canadian government signed the United Nations Convention on the Rights of the Child, and 12 years later it signed the UN Declaration “A World Fit for Children.” As signatory to this Declaration, Canada is obliged to develop a national plan of action to ensure that its children have first call on the public resources needed to advance their well-being. This commitment has been reiterated again and again in throne speeches, the latest occasion being September 2002 when the government vowed to “put in place a long-term investment plan to allow poor families to break out of the welfare trap so that children born into poverty do not carry the consequences of that poverty throughout their lives.”1

This interest in children on the part of the government may have come as a surprise to some, since in many respects children in Canada are better off than they have ever been. They are more likely now than ever before to have been planned by their parents and to survive infancy and childhood. They also complete more years of schooling, have more material goods, and have fewer siblings with whom to compete for the time and attention of their parents. Their parents, in turn, are better educated, work more hours and have their children later in the life cycle when their earning power is greatest.2 According to many experts, most children in Canada are physically, emotionally and socially healthy3 and a large majority perform well in school and have good academic outcomes.4

For some children, however, the trends are not so favourable. Recent reports on the well-being of Canadian children reveal some alarming statistics: child abuse and neglect have increased, as has juvenile crime. Compared with the previous generation, today’s children consume more alcohol and drugs and are more likely to commit suicide. A substantial number of children also experience emotional, behavioural, social and academic difficulties and are likely to be assessed as “developmentally delayed” in terms of motor and social skills, school readiness, and academic performance. According to one study based on Cycle 1 (1993–94) of the National Longitudinal Survey of Children and Youth (NLSCY), approximately 28 percent of Canadian children aged 0–11 can be considered “vulnerable” — that is, are likely to have poor developmental outcomes.5 These children may well remain on the negative developmental trajectories of their early years unless prolonged interventions are instituted to set them on a life course more conducive to positive outcomes.

Although poor developmental outcomes are scattered across the socio-economic spectrum, some well identified factors such as growing up in a single-parent family, having poorly educated parents or living in poverty are associated with vulnerability.6 The proportion of children living in single-parent families has markedly increased with the rise in marital disruption rates.7 In 1991, meanwhile, 37 percent of Canadian youths failed to graduate from high school at the typical age,8 while 35 percent of 16-to 25-year-olds have been found to score particularly low in terms of literacy.9 In contrast to the remarkable improvement in the status of elderly Canadians over the last 25 years, poverty among children has not been reduced. Changes in the economy have contributed to rising poverty among families with children,10 as illustrated by an increase in the proportion of families that depend on social assistance.11 Thus, despite some progress, many children are exposed to at-risk situations known to decrease their chances of realizing their full potential.

Some argue that many of the problems experienced by children and families are the result of recent transformations in the family. They contend that fundamental family mechanisms have been altered by the increased employment of women, rising separation and divorce rates, more permissive attitudes, an increased emphasis on self-fulfillment, and urbanization with its less supportive social networks. Others blame the problems on the rise in poverty that has resulted from changes in the economy. Increasing earnings inequality and greater economic insecurity have all added to the numerous stresses that society places on parents.

In and of themselves, these various factors help to explain why children and families have become a focus of public concern. But developments in the more general political, social, economic and demographic fabric have added a sense of urgency to these issues, giving them a national and very public profile. A declining birth rate, an aging population, and new educational imperatives linked to new technologies and the new labour market have all combined to bring children and the family to the top of the policy agenda. Recent research in neuroscience showing the importance of early childhood development for adult performance12 and a policy research community that is actively promoting a children’s agenda have also been instrumental in bringing these issues to the fore. Indeed the buzz around children has been such that some experts are now speaking of a new policy paradigm when it comes to family and government responsibilities toward children.13

All of these various developments raise fundamental questions. What should the response be? No government policy can undo the social changes that have, for instance, produced more single-parent families. Many argue convincingly that government has a responsibility to improve the status of children at risk for negative outcomes. But what can governments do? The current debate focuses on one proposal: providing additional income support to low-income families with children. But there appears to be a need for programs tailored specifically for children. A strategy that includes carefully designed programs can not only make a difference in the lives of children and their parents but also represent an investment in the future with high rates of social return.

Over the last decade Ottawa and the provinces have actively sought to improve the circumstances of vulnerable children. Public policy on family issues has evolved rapidly across the country. In 1993 the federal government reformed its family benefits package by replacing family allowances with the Child Tax Benefit (CTB), while 1998 saw the introduction of the National Child Benefit (NCB), an intergovernmental initiative aimed at preventing and reducing child poverty, promoting labour-market attachment, and reducing overlap and duplication across jurisdictions. These initiatives culminated in the September 2001 Early Childhood Development Agreement (ECDA), signed by all governments except that of Quebec. Many other programs have been established at both levels of government (for instance, Quebec’s $5-per-day child-care program), while existing ones have been reformed (for instance, maternity and parental leave program).

Despite this major overhaul, there has been no attempt by researchers to look globally at the newly emerging family policy and assess whether the picture looks brighter for the Canadian children who are meant to be its main beneficiaries.

This study is a first attempt at such an assessment. Its purpose is to describe, analyze and evaluate family policy across Canada while proposing an alternative strategy for public support to families with young children. While every individual in a society will value policies differently, any policy evaluation must compute the distribution of gains — if there are gains to be observed — particularly when altruistic motives are used to justify the policy. Therefore, we pose the following questions regarding the changes to family policy since 1996:

In responding to these questions, we find that the changes have not efficiently addressed the problems of child poverty, particularly extreme poverty, and the consequences for the children themselves and society at large. We also find that several types of families are not being treated fairly.

We argue that family policy should have two complementary bases: a life-cycle perspective and a human capital investment strategy. Children are poor because they live with adults who are poor. To understand child poverty, one must look at the causes of adult poverty, such as economic and demographic forces, and the factors that influence individual earning power. Thus the problems associated with poverty and welfare dependence are human resources issues. A life-cycle perspective means that policies must address not only the child’s current status but also his or her long-term outcomes.

After years of decreased social spending, more federal resources are now being devoted to programs that serve poor children and their families. However, choices still have to be made about how these resources are to be spent. We will show that recent federal and provincial initiatives, mainly those that are part of the NCB, which can be classified as human capital initiatives, do not meet the usual criteria for efficiency (the largest possible benefit for each dollar spent), sound social investment (the largest social return), providing incentives (encouraging desirable behaviours), equity (equal treatment of families) or fairness (equality of opportunities for children). The initiatives fail to meet these criteria mainly because they are based on strategies that are myopic and do not adequately consider the nature of the problems being addressed.

Although we propose several avenues of reform, we stress the following: the federal government should take the lead in setting policies that substantially reward the employment efforts of low-skilled parents while decreasing the costs of working; the CTB policy is a dead end and should be replaced by a generous universal allowance for each child in the family; and, finally, high-quality in-kind services is the best way to provide immediate assistance to young children for the purpose of preparing them for school.

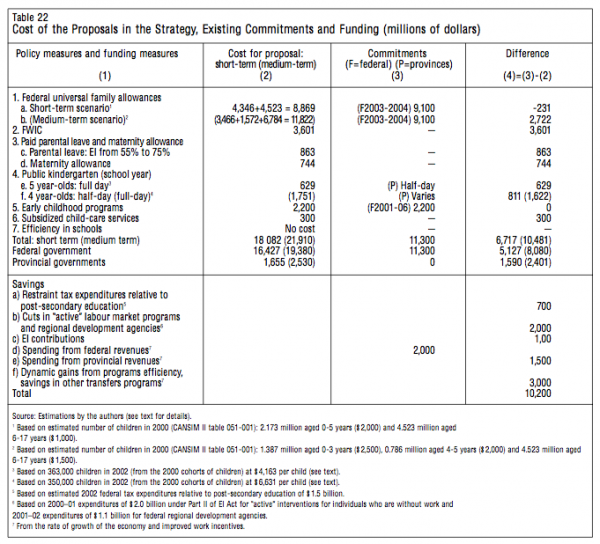

We have attempted to provide reasonable estimates of the costs for all of our proposals, as well as the financial implications for both levels of government. The results lead us to conclude that our proposals are well within the range of current budgetary constraints. We also discuss the savings that could be made through the reform of long-standing programs that are, from our point of view, inefficient.

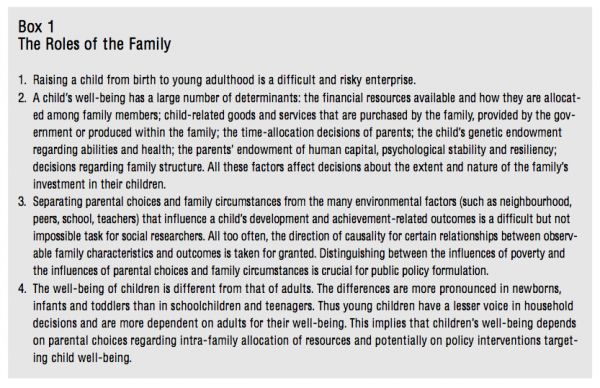

In part 2 we describe the mechanisms of human capital formation and explain why families and societies should invest in children. Here, we enunciate the roles that families must play in providing the resources for the proper development of their children and the type of investments they must make. We also discuss the trade-offs that inevitably result when parents choose to spend less time at home with their children and more time at work, or vice versa. We stress the view that although long-term investment in children is absolutely essential, each child’s immediate needs must be addressed as well.

In this section we also reflect on the role of governments and the investments that governments should make on behalf of children. This is a crucial part of the paper, because our main purpose is to evaluate family policies in Canada, particularly federal policies since 1996, and to propose an alternative strategy, including costs. Here, we establish our position with regard to why governments should support families with children and provide the basis on which family policies should be evaluated. We believe that family policies should be guided by principles of equity and efficiency. Family policies are generally designed to increase investments in children — that is, the human capital of children. These investments can be seen as annual flows that increase the stock of assets in a society’s portfolio of human capital. The return on these investments must be compared with the return on other investments, in order to determine the right mix of investments for Canada.

Part 3 is essentially descriptive. First, we put some of the recent policy choices in perspective by comparing them with policies developed and implemented in 1974 and 1985, periods representative of a different approach to family policy. We show how the federal government progressively disengaged itself from family support in historical terms and is now trying to make the pendulum swing in a more generous direction. We also discuss the distributional issues that are inherent in such changes. We then present the main features of federal family policy since the last major reform, in 1993. We explain that family support is now inextricably linked to family income. We also describe the process by which a work income supplement was established by Ottawa and then revoked, with the creation of the National Child Benefit Supplement (NCBS) in 1998, for the purpose of increasing provincial autonomy and spending in the area of family policy. We describe in detail the new provincial programs, including their budgetary requirements, as well as the particulars of the ECDA.

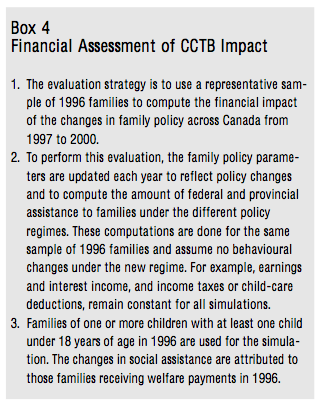

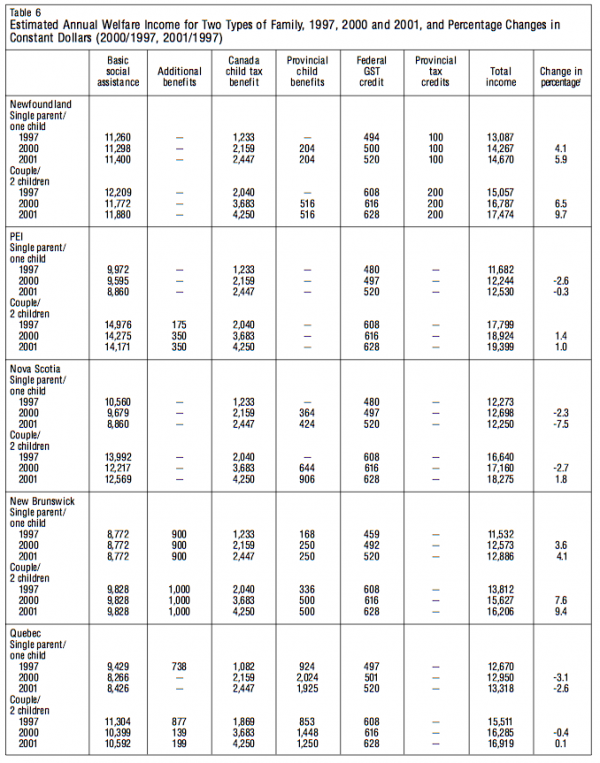

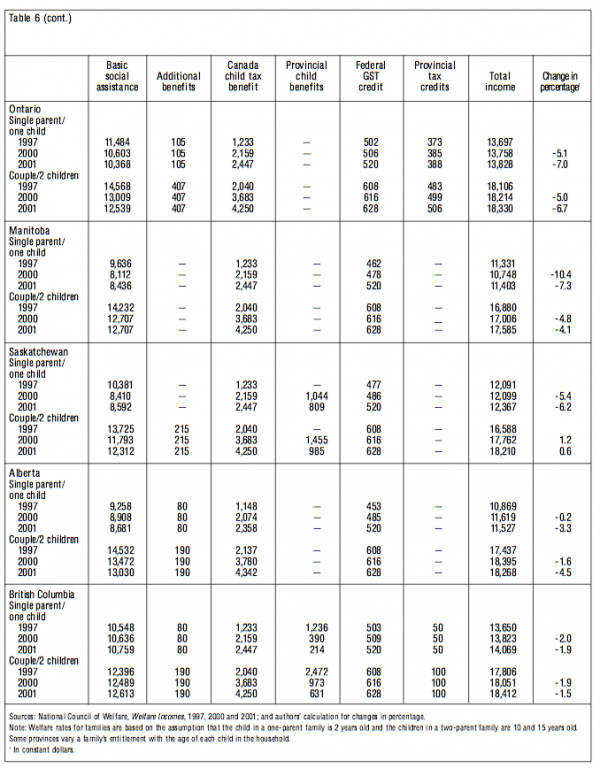

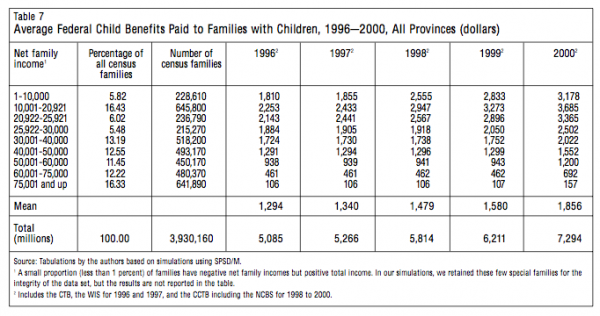

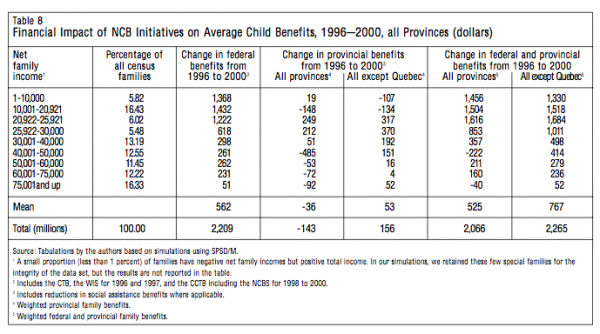

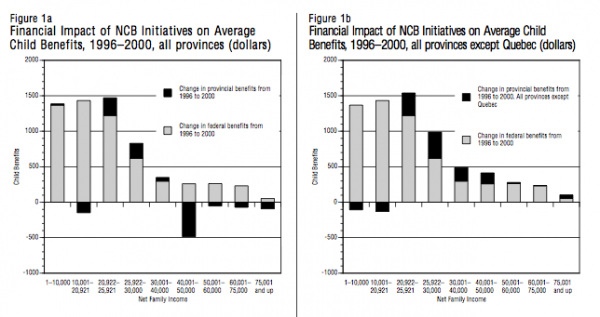

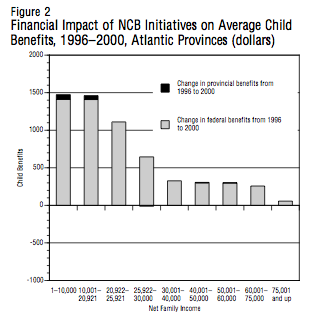

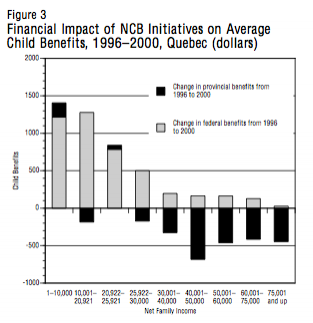

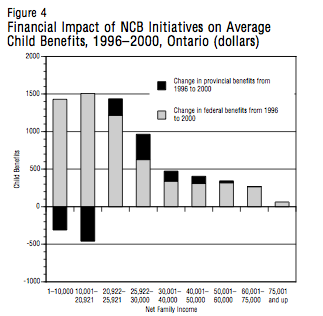

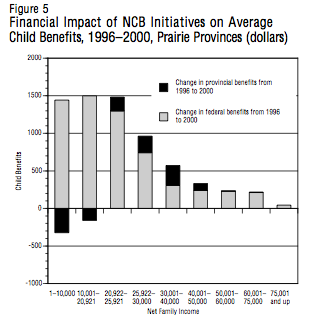

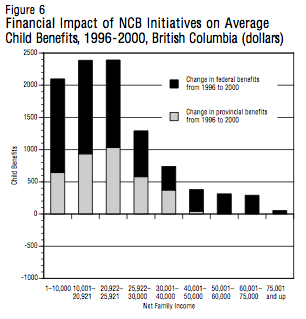

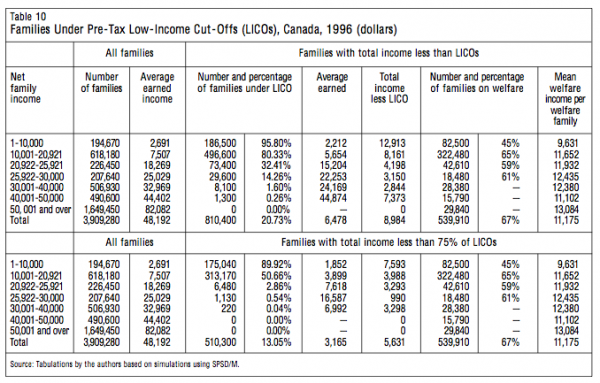

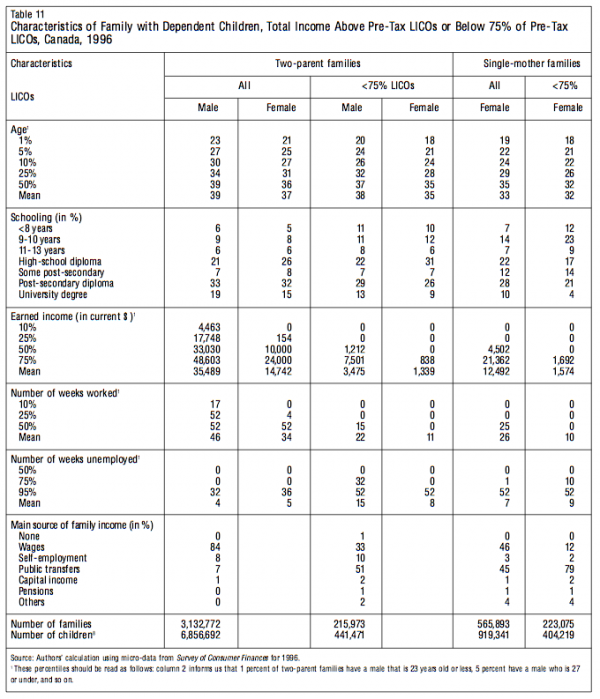

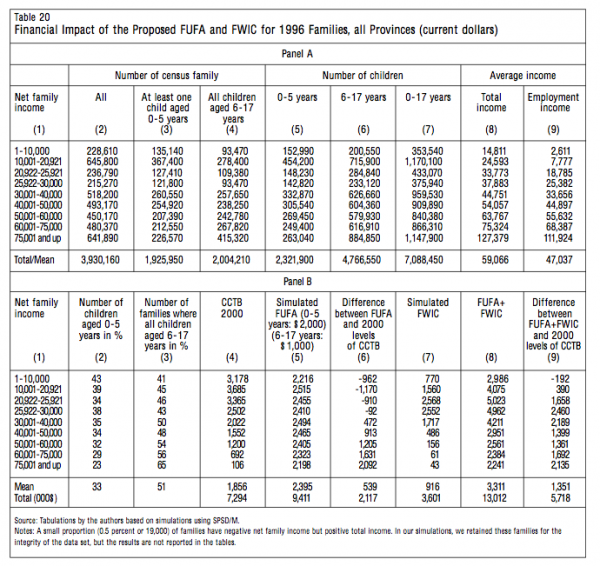

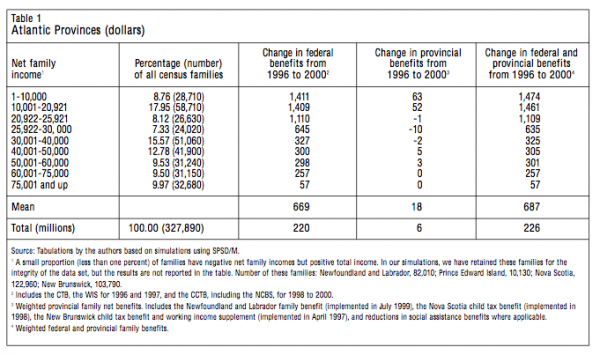

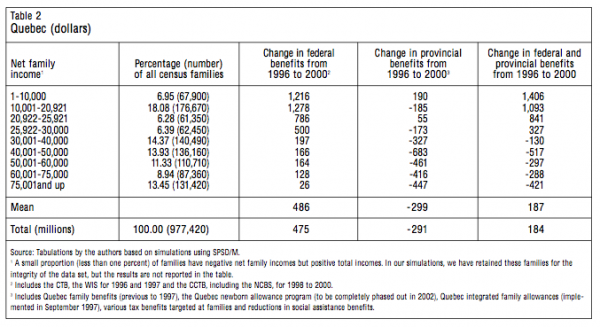

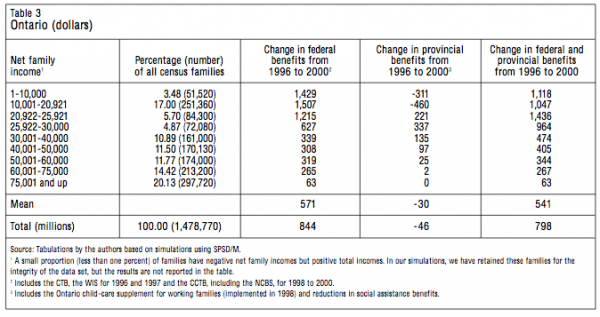

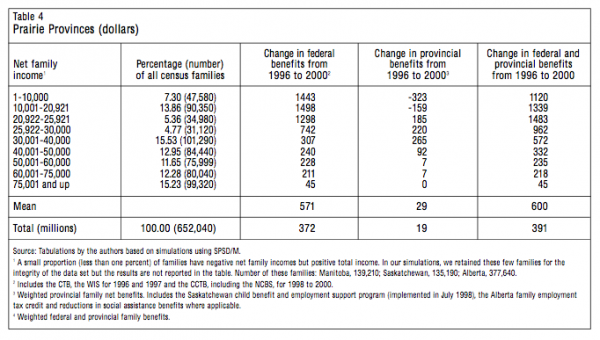

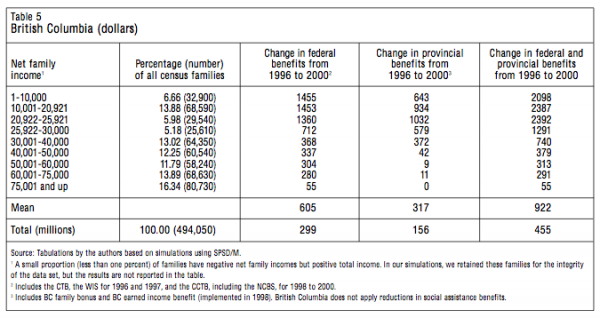

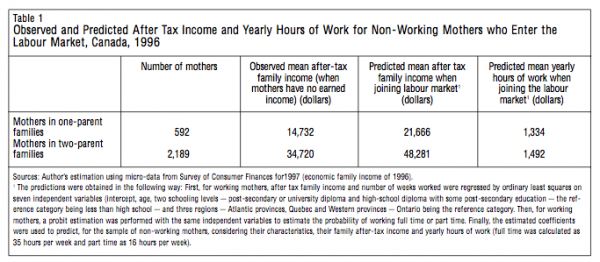

In part 4 we assess the financial impact of federal and provincial NCB initiatives on 1996 families using Statistics Canada’s Social Policy Simulation Database and Model (SPSD/M) simulation software and data-base. Using a representative sample of Canadian families with children under 18 years of age, we simulate the financial impact of the federal and provincial changes in family policy for each year from 1997 to 2000. We then compute (for Canada and each province), assuming no changes in behaviour following the changes, the average increase in family support for different income ranges.

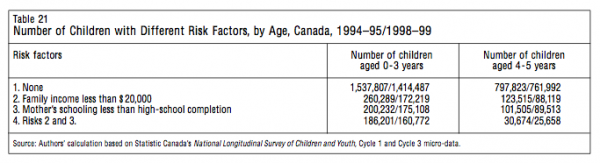

In part 5 we use these results to illustrate the limitations of the NCB in terms of the objectives set in 1997: to prevent and reduce child poverty, to promote greater incentives for labour-market participation, and to reduce overlap and duplication of programs. We show that child poverty has been reduced only negligibly, and that, given the evidence on the effects of income on child development, the increased income from the NCB cannot make a difference for impoverished children, while the additional work incentives are too weak to induce low-skilled parents, particularly welfare mothers, to enter the labour market. We conclude by discussing the inefficient and inequitable dimensions of current policies.

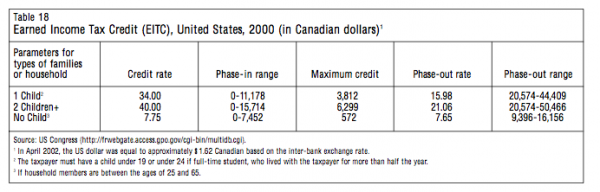

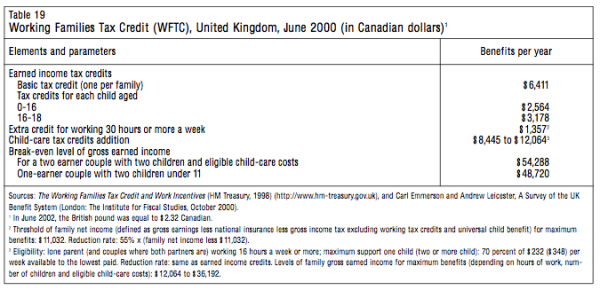

In part 6 we situate our proposed policies within a larger class of policies that, as the economist and Nobel laureate James Heckman puts it, “foster human capital.” In this section we pinpoint the major weaknesses of Ottawa’s global human capital policy. We then lay the foundations of a profitable human capital strategy for Canada that is inspired in part by a review of international policy choices and recent empirical work on programs that have been effective in providing work incentives as part of an anti-poverty strategy, treats all families equitably and addresses the needs of children.

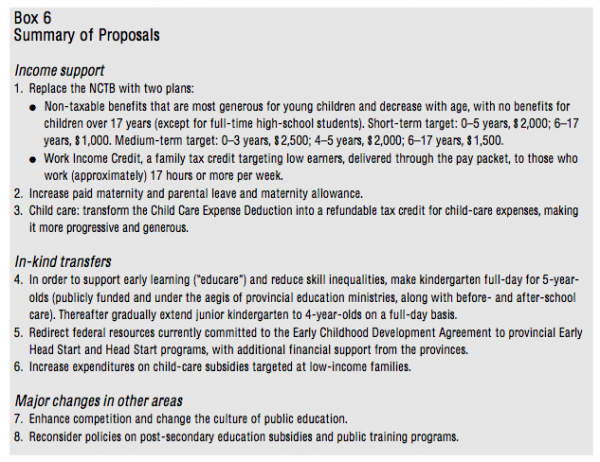

In part 7 we develop an alternative strategy for all governments, both federal and provincial. This strategy is based on the discussion in part 6 and on further research-based evidence for each program identified. Central to this strategy is the importance of matching children’s needs with their abilities, with a focus on each child’s circumstances and stage of development, whether infant, toddler, preschooler or schoolchild, and on offering parents more opportunities to balance work and family responsibilities at all income levels, while also addressing the issue of economic hardship.

Ethically and morally, our agenda is framed by the beliefs that parents should have a large set of options to respect the diversity of economic and social contexts; each child is unique; benefits of equal value to families and children is a standard of fairness; and reducing disparities in skills and outcomes among children contributes to a nation’s future well-being.

We provide elaborate details on parameters and costs for all the programs we advocate as well as the economies that can be created by the shift in strategy. We provide short-term scenarios that fall within the budgets for family expenditures and a longer-term scenario wherein economic growth will yield the modest sums necessary to implement the programs.

Finally, in the last part of the paper we sum up our strategy and offer some closing remarks.

Any assessment of policies on families and children can be cast in terms of an “investment-in-children” framework. Robert Haveman and Barbara Wolfe base their empirical analysis of children’s attainments and outcomes on a well-thought-out theoretical framework in which investments in children occur at three levels.14

First, because children develop within families, especially in their early years, their psychological and developmental outcomes are likely to be affected by family environment and functioning.15 Parents establish the environment in which their children are raised through their decisions regarding consumption and saving, work and leisure, allocation of income and time, and family structure (number of siblings, separation, remarriage). These choices determine the extent and nature of parental investments in children.

Second, parents’ choices are constrained by their financial and time resources. Parents function within a social and economic environment in which society sets constraints and restrictions and in which governments also render decisions and exert influence. By devoting resources to schooling, preschool care or family-income support, society provides for the nurture and development of children. Governments also devote resources to children in a variety of indirect ways: by ensuring that the economy performs efficiently so that parents are provided with employment opportunities, by controlling crime and drugs, and by ensuring the safety of neighbourhoods and schools. Thus, a society determines the extent and nature of its social investment in children.

Finally, in this process children are third actors. Armed with the opportunities and resources made available by their families and by society, children embark on their life course, during which they make choices about education, work and family structure, including choices regarding reproduction. As Haveman and Wolfe state, “it is the outcomes of these choices and opportunities that we observe” and that we use to assess “the extent to which children succeed or fail” and to understand the main determinants of these outcomes, in which luck also plays a role.16

A problem with the “investment framework” is that it emphasizes outcomes once children reach adulthood. It sees children not as persons in their own right but as appendages of their parents.17 Focusing on children as persons introduces two other issues. First, the well-being of a child is different from that of an adult. The differences are particularly pronounced in infants and toddlers. Very young children, being totally dependent on adults, can make known only their most primary needs and cannot assess whether their needs are adequately met. Needs evolve with age. For the very young, however, well-being implies being adequately nourished, housed and cared for, protected from undue risk of illness or injury, provided with adequate language and cognitive skills, and emotionally attached to a family and its adult members. The second issue relates to the impact of social policies on children as children now. For example, insofar as the early years of life are critical to development and form the basis for the child’s future well-being, if policy interventions are to make a difference for young children they must be effective from birth.

A person may decide to have children for any number of reasons: to perpetuate or recreate the joy of childhood, to ensure support and companionship in old age, or to produce an heir to one’s accumulated human or financial capital. One might think of children as the source of a “flow of services” that are essentially emotional in nature: their love and affection, the joy derived from their presence, their nurturance, their education, the satisfaction of seeing them succeed as adults. Success has at least three dimensions: economic (the ability to earn a steady income and thus ensure an adequate standard of living), social (the respect of peers and stable relationships with family, friends and members of the community) and psychological (self-esteem and control over one’s life).

Research in the social sciences has shown that the immediate family environment is an important determinant of children’s cognitive and social development as well as health status. Children who receive high levels of cognitive stimulation are likely to develop good language skills — a key factor in school readiness, which is the ability to fully exploit the learning opportunities available within the education system.18 The cognitive ability of young children is also a predictor of high achievement in the early and later years of schooling.19 Social development implies that children have internalized behavioural norms and accumulated social skills that will allow them to perform competently at school. Social adjustment relates to emotional health, a positive approach to new experiences, social knowledge and social competence, which are dimensions of school readiness. Children’s ability to learn in school, in turn, influences their academic performance and the likelihood of their completing high school. High-school completion is likely to be the minimum requirement for gaining entry to higher education. Furthermore, the link between high-school completion and a good living wage is well established. Economic and social success in later life is strongly linked to the ability to compete successfully in the job market. Thus educational attainment, occupational status and earnings are strongly linked.20

The familial factors that have been shown to influence children’s lives and outcomes are both direct and indirect. One direct familial factor in child well-being is socio-economic status — financial, human and social capital. Financial capital enables parents to provide adequate food, shelter and materials for cognitive stimulation. The parents’ own characteristics — especially those of the mother — such as family background, general skills and educational attainment shape the family environment in which the child is raised. Social capital refers to the relationships among parents, children, and other family members, the time and effort that parents invest in their children,21 and interactions within the local community. A strong bond between parents and children is a form of social capital that demands the attention and involvement of the parents, as well as their physical presence. Social capital can take many forms. These include obligations, expectations, information channels and norms.

Familial factors can also be indirect. Socio-economic status influences parents’ social experiences and occupations, which, in turn, influence their aspirations for their children and the values they instil in them. Parents also influence their children through the time and material resources they dedicate to them. Such familial factors as a parent’s child-rearing attitudes and practices, behaviour toward the child, and psychological and medical health can greatly affect a child’s life course. Families differ in terms of their basic parenting abilities and skills, their endowments of physical and human capital, their values and their motivations. Parents from different socio-economic situations will raise their children differently, largely because of differences in parenting values and life experiences.

Parents with meagre economic resources can still use these resources efficiently in the child-rearing process. For instance, less educated parents or those who do not possess abundant material resources can nevertheless spend time interacting with their children, be involved and affectionate with them, and devote a large proportion of their material resources on them, so that the children have access to whatever capital they do possess, including personal resources and ties to the community. In contrast, high levels of parental distress, limited material resources and low levels of human capital can hinder children’s development and decrease their chances of achieving success in young adulthood.

Obviously, employment status affects a family’s financial well-being. The employment choices of the mother can affect the family in conflicting ways. Her wages can make the difference between self-sufficiency and dependence on welfare, especially in the case of a single-parent family, or between a low-income and a middle-class standard of living. On the other hand, a poorly paid, stressful job with long hours and atypical work arrangements can place demands on parents’ time and energy and thus affect the quality of their parenting. Both the positive and negative working conditions that parents experience are reflected in the family environment they create for their children.

Family employment decisions determine not only the allocation of family members’ time between work and non-work activities, but also the allocation of time on various non-work activities such as leisure, education and household production. It is reasonable to expect that a parent’s employment will affect household-production technology and the allocation of available time. For instance, if the mother participates in the labour market, family members will generally move away from labour-intensive home-production techniques and toward goods-intensive techniques. Time given up for paid work may have low returns, and employed mothers may substitute for it other kinds of time that have higher returns. On the other hand, to spend time on a low-wage job instead of dedicating it to child care may also have low returns. We know little about parents’ time spent with children in activities not directly related to child care, and about the process by which direct or indirect time spent with children relates to child development. We do know that in the 1980s in families in which the youngest child was under five years of age the proportion of total time spent with children rose, whether or not the mother was employed.22 The increase is related to the high payoff of investing time in children, particularly when they are very young. Thus working parents who place a high value on child development are likely to allocate more of their resources to young children.

Finally, the “black box” of household decisions and resource allocation has come under increased scrutiny by economists, leading to several important theoretical and empirical contributions to the literature.23 The results of the empirical studies suggest that, ceteris paribus, as a woman’s bargaining power within the household increases, household-consumption and time-allocation patterns change for the benefit of children. For example, some researchers have found that, as the bargaining power of women within the household increases, a larger share of resources is allocated to children’s clothing, toys, furniture and health (with sons and daughters being treated more equally, according to findings for developing countries), while a smaller share is allocated to what might be considered male goods (such as alcohol, car maintenance or sports entertainment).24 To the extent that differences in preferences drive mothers and fathers to invest different amounts and types of resources in the human capital of their children, it may matter which parent (in two-parent families) controls public benefits targeted toward children. The empirical studies in this area have produced another noteworthy result: households do not pool their income for most expenditure categories. This implies that members of a family bargain for a “fair” share of the higher standard of living that is usually generated when persons form a committed partnership. However, children have a lesser voice in shaping household decisions, which makes their well-being dependent on whether their parents allocate resources in their best interests and how they share these resources.

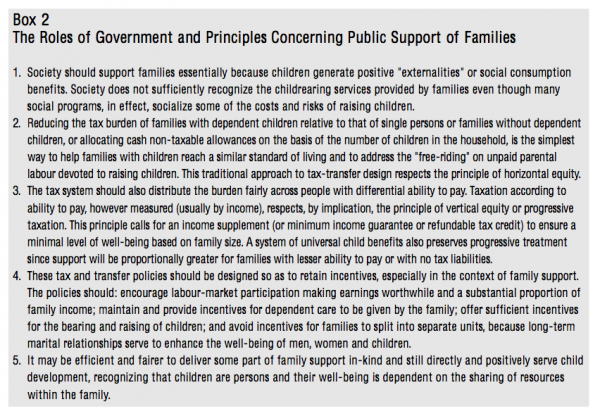

Why should governments support families? Why should childless taxpayers support those who freely choose to have children? Some would argue that the answer depends on whether such support is viewed as a consumption expenditure or an investment expenditure. Services provided to dependants, particularly children, might be considered as consumption by the dependant or investment in the dependant. If children are considered no different from any other “consumer good,” parents should not be given subsidies or tax relief for a type of consumption that they have freely chosen. However, if the care of children is considered an investment in human capital, neutrality as well as equity would argue for treatment at least similar to that provided for other types of capital investment.25

We prefer to take a social perspective and argue that the bearing and rearing of children is of tremendous importance to society. If the integrity of society depends on a stable population, children can be viewed as the source of renewal of human capital for society. From this perspective, childrearing appears less a form of private consumption and more a vital public service. In other words, children generate positive “externalities” or social-consumption benefits – that is, third-party benefits.

According to this view, members of society share in the benefits of children being brought up well. We are all, during the course of our lives, dependent upon those who rear children, for their ability to find caring friends, an affectionate spouse, trustworthy neighbours, devoted employees. This type of intergenerational dependency is not properly recognized by society, even if many social programs in effect socialize some of the costs and risks of childrearing. There are no market mechanisms for getting all the beneficiaries to pay parents or others who rear children. When a service qualifies as a public good, as for example with national defence or civilian protection, the state steps in to collectivize the costs. Since parents devote an enormous amount of time to their children, which usually results in a significant reduction in their employment hours or the withdrawal of one parent from the labour market, society, particularly non-parents who devote little or no time and energy to child-rearing, is “free-riding” on unpaid parental labour.26

The same kind of social benefits apply if we adopt the investments-in-children perspective.27 When parents spend time and money on their preschool children, the resultant “quality” (in terms of health, social development, learning and social skills, etc.) enhances the child’s chances in life as well as giving immediate satisfaction to the parents and the child. These intangible benefits, usually referred to in economics as human capital, also accrue to society as a whole. A young adult who is well adjusted and well educated is more likely to earn a good wage, which is — and this must be emphasized — mostly a private benefit but also produces public value. Through old-age security, public debt and health care, all citizens enjoy the earnings of young adults. A young adult who becomes a self-sufficient citizen generates societal benefits, and policy makers must take this into account. If families had to rely strictly on their own resources to cover all the costs of childraising, there would likely be severe under-investment in children’s human capital. This is why the two most critical functions of governments are funding health care and funding elementary and secondary education.

It is thus reasonable to assume that governments should provide families with childraising assistance. Having said that, it does not follow what the government’s role should be. Furthermore, if more public resources should be invested in children, to what areas and to which children should such investments be directed, and who should be doing the investing? Public policy on the role of government in assisting families should be influenced by a number of economic and social considerations. Although overlapping, these can be divided into two groups: equity considerations and efficiency considerations (or incentives).

Equity considerations fall into two categories: those related to the ability of different families to pay taxes, and those related to assisting families to maintain some minimum level of well-being for each dependent child. These issues include the targeting of family benefits in order to alleviate poverty — through income-tested benefits and other categorical criteria — and comparisons of inter-temporal tax burdens over the life cycle.28

A fundamental issue in public finance is how tax burdens should vary between individuals and families and how they should reflect the number of dependants within the family unit. The standard ability-to-pay principle holds that units with equal ability to maintain a standard of living before tax should have an equal ability after tax. This traditional criterion for tax design is known as “horizontal equity”: treating people in equal positions equally. Some observable index of ability to pay taxes, such as income or expenditure, can be defined. However, these measures represent outcomes of people’s choices and behaviours and thus cannot be considered exogenous indicators of ability to pay taxes. Indicators of ability to pay taxes are easily disputed. Do the Joneses who have one child have the same ability to pay taxes as the Smiths who have no children? Some would say that if the Joneses have a child, it is because they have chosen to, and that if the two families have the same level of income they have the same ability to pay taxes. This is true before the fact — that is, before the Joneses or the Smiths decided to form a couple and extend their family, considering family income to be unrelated to these decisions. But does this equality in ability to pay still hold after the fact — that is, after these decisions are made, with changes in family income caused by the emergence of a child in the household?

The answer to this classic problem has been to recognize that a family’s ability to pay taxes is lessened by the presence of a dependant. Consequently various fiscal instruments (deductions, exemptions, tax credits or non-taxable transfers conditional on presence and number of dependent children, which can be viewed as a tax credit paid in advance)29 or some form of income splitting for tax purposes are often used to lower the tax burden of families with dependants. This fiscal discrimination is based on the premise that a large family will not be able to maintain the same standard of living as a small family with the same income.30 The approaches to horizontal equity vary substantially among developed countries and have changed over time.31 A less traditional approach recognizes that public policy must reflect the fact that society (for historical, cultural or economic reasons) weights the well-being of particular groups differently. There is no consensus on the right weighting of groups in terms of their importance. In the case of families with dependants, a natural weighting is based on family size.32 Such a social judgement on the distribution of well-being would give most weight to families with the highest number of dependants, with single-parent families likely positioned between a childless couple and a couple with one or two children.

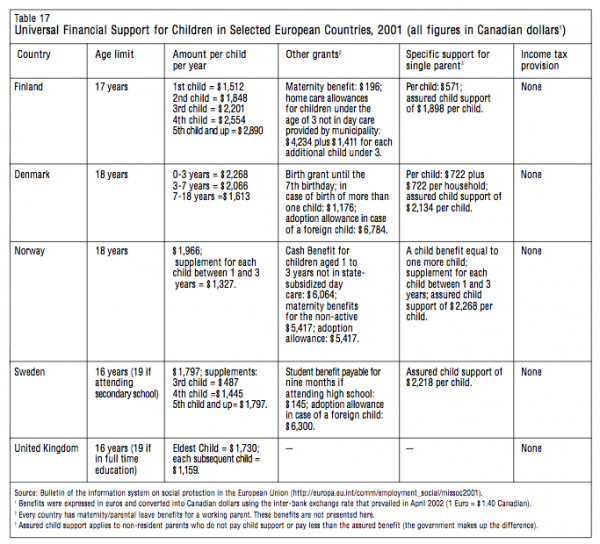

A tax system should also respect the principle of “vertical equity” — that is, it should distribute the burden fairly across taxpayers with different ability to pay. Under this principle, if ability is measured by income, some adjustment is made for subsistence costs so that taxation begins at income levels above the poverty line, however defined, and the amount of tax paid increases with income level. Under this principle also, an income supplement (or minimum income guarantee or refundable tax credit) is paid, based on family size, to ensure some minimum level of well-being. If a tax credit is provided by the tax system while a grant is provided by the welfare system, the two systems may not be well harmonized, especially with regard to those households that are in the two systems concurrently. A common goal of welfare and tax reform is to bring the two systems together in some logical fashion, such as by replacing personal and child income tax allowances with a percapita credit integrated into both systems. The same problem arises when family allowances coexist with some tax provision for dependent children. The government could take a wider view of social policy and tax policy by amalgamating child income tax allowances or credits with child benefits. This is the approach taken in some European countries — the United Kingdom, Netherlands, Sweden, Norway and Denmark — which make a more generous universal payment per child.33

A related issue is the implementation of programs directed specifically at families with children, as opposed to general welfare schemes in which payments increase with the number of dependants. In a thoughtful analysis of targeting and family benefits, Anthony Atkinson reminds us that the “argument in favour [of targeting] has to be made explicit and critically examined…and calls for greater targeting need to be treated with caution.”34 Such an approach assumes that the sole objective of programs for families is the reduction of poverty. But other objectives also merit consideration, such as the smoothing of income over the life cycle in relation to need, redistribution to favour those with dependent children, measures to improve gender equality, the encouragement of personal independence or incentives to have children. Moreover, the relative efficiency of programs that target family income is open to question, since they involve behavioural conditions (such as disincentives to work or to marry) and entail problems similar to those encountered in the tax system such as evasion and lack of compliance.

Finally, general family benefits are often viewed only on the basis of differences between households with and households without dependants over a given period. However, the treatment of dependants is a question of intertemporal distribution as well as redistribution among households of different size. At some point in their lives, most people were dependants in a family and will care for dependent children or parents. Therefore, one can argue in favour of a tax and transfer system that takes into account differences in ability to pay and needs at different stages of life. The question for family policy, then, is how to distribute the net tax burden over the life cycle.

A second group of economic considerations is based on economic efficiency, which is a catchphrase for the idea that policy decisions regarding taxes, transfers or family allowances have incentive effects — that is, they can affect decisions concerning employment, the amount of dependent care that will be provided, and whether to marry, divorce or have children. Some of these decisions can have beneficial or detrimental impacts on society. Good policy must make sure that benefits outweigh costs.

Employment and earnings From the standpoint of work incentives, the most critical income tax problem is the fact that taxpayers can alter their behaviour according to the tax-transfer system they face. Imagine an economy in which individuals have an innate ability to transform working time into a single consumer good, which is called income. But the government or tax authority does not know the ability of each individual (which depends on factors such as education, intelligence, motivation, luck) nor can it monitor the number of working hours a person chooses to work; it can only observe a person’s income. The government’s task is to choose a tax schedule (and personal deductions or credits for the taxpayer and dependants) and transfer programs into which society’s values concerning equity and fairness are embedded, taking into account the fact that most individuals will respond in terms of labour supply. Although economists cannot be expected to provide definite answers or a precise formula, economic analysis does offer some guidelines. First, the marginal tax rate at both ends of the income distribution should be “low” rather than “high.” This argument is based on the fact that tax revenue depends on the average tax rate, whereas work disincentives depend on marginal tax rates. By lowering the marginal tax rate for the highest earners, the disincentive effect is reduced without reducing the tax revenue from these earners or other taxpayers. At the low end of the income distribution, reducing the marginal rate enhances work incentives without compromising the distributional aims or tax revenue. Second, a fraction of poor individuals are unemployable either because they cannot work due to physical or social disability or because society says they should not work (such as mothers of very young children). There is much debate about what form poverty relief should take when it comes to the truly needy; if such individuals can be identified at reasonable cost, they can be “tagged” and offered more generous benefits.35 The appropriate incentives for recipients of poverty support in general is a more significant grey area.36

Caring A reliance on family is a fundamentally sound and efficient approach to the care of dependants. Most parents are dedicated and committed caretakers, providing their children with adequate nurture, discipline, moral education and motivation. Some do not meet the challenge of good parenting due to deficiencies in family functioning, which are exacerbated by lack of income and lack of social support. Although government does not provide care for all dependants through programs such as universal daycare for children of all ages or universal elder care, it does provide welfare support, training programs for parents and other kinds of support.37 To restate a previous argument, even without evaluating the time and effort devoted to children in dollars and cents, an argument can be made that public support to parents could be insufficient in terms of the economic rewards and costs to efficiency. Another pitfall of the “welfare state” is that it encourages excessive production of household services provided by public employees, to the detriment of production of other goods or services. The distorting effects of the marginal tax increases necessary to offer such services adds to the inefficiency induced by the subsidies implied by the direct public expenditures.38 A more balanced approach would be to give families greater financial support and let them decide which services to purchase.

Marriage and conjugal partnerships During the 1980s and 1990s, high-quality longitudinal surveys produced data on family structure and on the well-being of children, adolescents and young adults. These data show that growing up in a single-parent family or a stepfamily is associated with a lower level of well-being and poorer life outcomes than growing up in a family with two biological or adoptive parents or with one widowed parent.39 This is not to say that all children who are born to single mothers or who experience parental separation are likely to have difficulties. Our purpose here is to discuss the consequences of “conjugal mobility” for children, women and men, and society at large, and to reflect on the proper public response.

From the perspective of economic well-being, demographic events are one of the main pathways associated with the transition to and from poverty. The other pathways are events linked to the labour market, non-labour income and health.40 How well off we are and how our living standard changes from one year to the next also depend on our domestic partners, what we do and what happens to us — that is, on the events we experience.

The decision to marry, or to partner, to use a more modern word, is more than a lifestyle choice such as whether to live alone, form a step-family or blended family, have children within a long-term relationship or, to complete the spectrum, form a gay, lesbian or bisexual family. The empirical data on the relationship between marriage41 and longevity, health, wealth, earnings and career, children’s achievements, happiness and sex life indicate that marriage does matter.42 Marriage changes individuals’ commitments and behaviour for the benefit of themselves and society. When individuals make the decision to have a child out of wedlock, marry, cohabit or divorce, they consider the costs and benefits to themselves and their children, although the weight given to children is not clear. Only with the recent availability of longitudinal data has social research been able to identify some of the long-term negative consequences, for both men and women, of social behaviours related to conjugal mobility.

From a public policy perspective, this raises thorny questions that are neither escapable nor intractable. Health policies may offer some lessons. Health research has shown that behaviours such as smoking and sedentary lifestyle have long-term health consequences. The findings have been largely diffuse, with emphasis on the consequences for others. Due in part to increased sales tax on cigarettes, attitudes toward smoking have changed, resulting in new social norms such as the stigmatization of smoking. A case could be made for promoting healthy maternal behaviour during pregnancy in order to lower the incidence of premature births and low birth-weight. The hard evidence should be communicated to the public, and policy makers should be made aware of the stakes involved in changing the regulation of social institutions governing relationships. This is not to suggest that social policy should be less supportive of single mothers or that tax policy should favour married couples. However, all institutions are not equal in terms of their public benefits, and a case can be made for preserving marriage — whatever modern forms it may take — as a social institution.

Having children Regarding behaviour associated with fertility and population replacement, any fiscal adjustment for family size that decreases the tax burden on the family or increases family benefits lowers the net cost of bearing children. As discussed earlier, adults do not appear to have sufficient incentives to have children, considering their positive social externalities. Hence, there appears to be a presumption on efficiency grounds for public policy favouring more births.

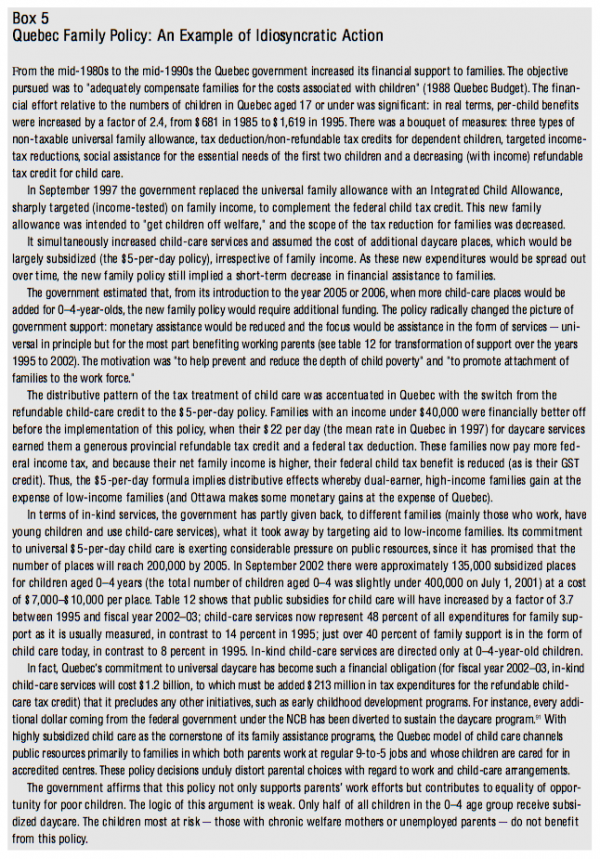

Pro-fertility policy could, in principle, encourage procreation by commencing child benefits at conception.43 To have a significant incentive effect on fertility decisions, the net costs (direct expenditures and opportunity costs in terms of forgone earnings of mothers and human capital depreciation) of raising children would have to be decreased substantially, which could amount to a fairly high percentage of income. There is some empirical evidence that public policy can raise fertility rates. For example, from 1986 to 1997 Quebec significantly increased its financial support to families. It made per-child benefits higher for low-income than high-income families, with benefits increasing sharply with each child (whatever the family’s income level).44 The 1987 total fertility rate of 1.4 (children per woman) increased rapidly, almost catching up with the rate of 1.7 for the rest of Canada by 1990. Some researchers have credited Quebec’s financial incentives for this increase (approximately 15,000 additional births per year).45

What types of families would respond to such incentives? Would the incentives result in differential fertility patterns, according to income level or family structure? This point, which was raised some years ago in the economics literature on the relative merits of a child credit versus a tax deduction for dependants,46 could also be raised in terms of the quality of the children Canadians want to raise. Are the social benefits greater when a child is raised in (a) a two-parent versus one-parent family (evidence cited earlier suggests that, on average, child outcomes are better for two-parent families); and (b) a higher-income versus lower-income family? Although the latter distinction may be contentious, it remains valid for policy discussion. If these questions seem provocative, let us add a further one: Do Canadians want to create new incentives for procreation within disadvantaged groups? Would they support a family policy that resulted in increased out-of-wedlock births?

Two factors concerning children and parental behaviour could be affected by public policy such as tax and transfer provisions for children: (a) the “quantity” of children (the number of children born), and (b) the “quality” of those children (as measured by the many criteria discussed above or simply by the amount of spending per child). It may be that enriched cash transfers or tax allowances encourage low-income families to have more children. Hence, it may be that enriched child benefits exert offsetting effects in social benefits for children in low-income families: there are more children of below-average quality in low-income than in high-income families; the benefits raise the quality of those children, but not to the level of children in high-income families.

Enriched child benefits provided to high-income families could also have positive effects on quantity of children. These effects may be relatively slight, since the benefits will amount to a smaller proportion of total income for these parents than for low-income parents. But the effects on quality may also be slight, since the cash benefit per child will be small relative to earnings. Therefore, the social benefits are still greater if child benefits are targeted to low-income parents, as the (positive) quality effects sufficiently outweigh the (adverse) quantity effects.

Cash transfers versus in-kind child benefits A different argument can be made for in-kind subsidies as opposed to cash transfers. A nurturing environment and exposure to a diversity of stimulating experiences are necessary for a child to acquire social, language and cognitive skills. These skills are sometimes described as readiness to learn. Readiness to learn, in turn, influences educational outcomes. Because high-quality daycare or early schooling can foster such readiness, it can be thought of as a “merit good” — something that all children are entitled to, whether or not their parents are willing or able to pay for it. Therefore in-kind subsidies aimed at low-income as well as middle and high-income families are justified, particularly if the positive social externalities of the educational programs are prevalent throughout the income distribution. Since children have little or no say in how their parents spend cash benefits, government, given its responsibility to ensure that children are well cared for (especially while their parents work), and given that high-quality early education produces benefits that parents may not fully consider when allocating their income, should consider in-kind subsidy programs.

The argument can be restated more generally in relation to the previous discussion on children as persons and on the sharing of resources within families. Since, presumably, society weights the well-being of children on the same basis as it weights the well-being of adults, and since the dedicated children’s share of family resources depends on adults’ decision-making processes, there is a case to be made for directing a portion of public transfers in-kind to children, instead of paying all of it in cash to the family for the benefit of children. One potential problem with this argument is that money is fungible: for example, while some of the money saved on child care will likely be used to increase the child’s well-being, a portion of it may be used to purchase a variety of household goods and services.

The decision to have children is an important one both for the individual and for society. Though the child is a person in its own right, with specific needs that must be addressed immediately by both parents and governments, we stress here the human-capital-formation aspect of raising a family. From this perspective, public policy related to family and children should be based on long-term considerations. Public support of families should be designed so as to ensure the best possible outcomes for children in terms of the life cycle. Today’s children are tomorrow’s parents, employees, taxpayers, entrepreneurs.

In the following section, we use this framework to discuss Canada’s family policy, at both federal and provincial levels, and evaluate it on the basis of two principles: equity and efficiency. We argue that, despite claims to the contrary, recent policy decisions fare poorly on both counts.

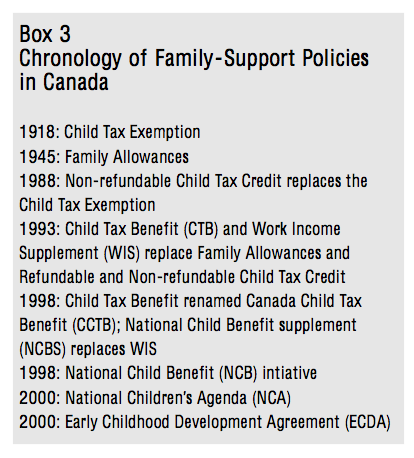

The NCB, launched as an initiative of the federal, provincial and territorial governments in 1998, is described in its third progress report as “an innovative and progressive approach to supporting Canada’s children.”47 But the authors of this report and its predecessors have a very short memory with regard to family policy in Canada, treating the NCB as if it were a completely new policy filling a void. In fact, there is a long tradition of family support in Canada. Fiscal deductions for children were introduced as early as 1918 and Family Allowances in 1945. Since then, these two measures have been the pillars of family policy. Box 3 presents the main family policy initiatives and the year of their implementation.

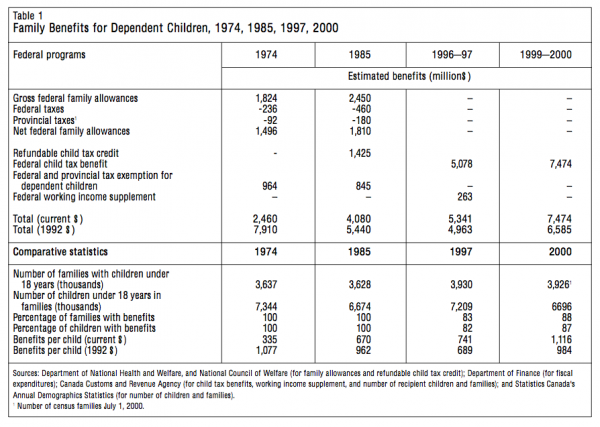

In the first part of this section we briefly describe the evolution of federal financial support for families, to remind the reader that over a period of a decade and a half cash transfers for families declined in real constant dollars while the horizon of 1997 to 2000 saw federal spending on cash benefits for children playing catch-up. We then describe the recent choices made by the federal government and the provinces and provide details on family benefits.

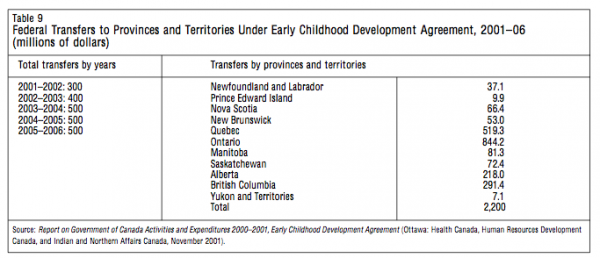

With the 1997 budget, the federal government announced its intention to increase support to families, through the CCTB, by a total of $2 billion, bringing its total annual commitment to more than $7.4 billion for fiscal year 1999—2000.48 In 2001 Ottawa announced that it would provide $2.2 billion over five years to provincial and territorial governments to support their investments in young children.

However welcome and impressive theses numbers may seem, one must step back a little to fully appreciate what these investments truly mean. It is important to remember that from the late 1970s to the mid-1990s the federal government substantially decreased its cash transfers to families with dependent children by targeting family income and not fully indexing benefits to the cost of living.

In the 1970s the Family Allowance was tripled and indexed for inflation (in addition to fiscal deductions) but made subject to personal income tax. From the mid-1970s to the mid-1980s, however, the guillotine fell on public support to families as part of the fight against inflation. In 1978 the Family Allowance was cut back to finance a refundable Child Tax Credit based on family income. Successive governments have, from time to time, frozen or cut back the Family Allowance and Child Tax Deduction while increasing the refundable Child Tax Credit. From the mid-1980s to the mid-1990s the guillotine fell a second time, as part of an offensive in the fight against the deficit. In 1988, tax deductions for children were replaced by a non-refundable child tax credit less beneficial to high-income families. From 1989 until its abolition in 1993, the Family Allowance was subject to a clawback provision, thus high-income families (those earning more than $50,000) no longer received benefits.

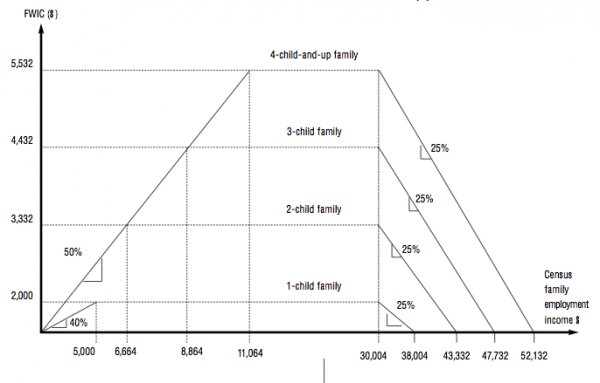

In 1993, Ottawa radically altered its benefit package to families with dependent children. The Family Allowance and the Non-refundable Tax Credit were abolished, while the Refundable Tax Credit became the Child Tax Benefit (CTB) and had its benefits increased and paid to families on a monthly basis. From its introduction until July 1998, the CTB provided the same basic benefit: $1,020 per child annually plus $75 for the third and each subsequent child. It also included a supplement of $213 for each child under the age of seven, an amount reduced by 25 percent of all child-care expenses claimed as a tax deduction. As this basic amount was income-tested, only families with a net income at or below $25,921 were entitled to the full benefit.49 For each dollar of family income in excess of $25,921, the figure was reduced by 5 percent (2.5 percent for one-child families). Therefore, one-child and two-child families with an income in excess of $66,721 received no child assistance, although they could claim child-care expenses as a tax deduction. For three-child families the income ceiling was $88,621. Since inflation, measured by the CPI, did not exceed the 3-percent mark, the benefits remained at their 1993 levels until 1997. In 1998 the government began to provide additional amounts according to the parity of the child. In 1999 and 2000 the benefits were increased, and as of January 2000 the benefits and the thresholds of family income for the purpose of calculating benefits were fully indexed.

Table 1 displays federal cash benefits. It does not show any possible offsetting of federal outlays by reduced cash-transfer spending on children by the provinces during parts of the periods covered, 1974, 1985, 1997 and 2000. These years correspond to four key periods in the history of family policy in Canada: 1974 represents the pre-targeting years, 1985 the first attempt at targeting, 1997 the era of targeting with a CTB (benefits were similar from 1993 to 1997, and 1997 precedes the conversion of the WIS50 to the NCBS in 1998, when the provinces reduced their cash spending on children through social assistance cuts), and 2000 the reinvestment period. The first panel shows the benefits paid under the programs in existence for the specific year. The last line presents the total amount of benefits in constant 1992 dollars — because 1992 is the year preceding the introduction of the CTB.

The bottom line of this brief overview is that, in real terms, the government spent almost 40 percent less in child tax and transfer benefits in 1997 than in 1974. After 1997 it did some catching up by increasing benefits by 33 percent in real terms — comparing 2000 with 1997 — but real benefits in 2000 are still 17 percent lower than in 1974. Moreover, there are fewer dependent children and far fewer families are beneficiaries, as shown in the second panel of table 1, which presents the number of families with children under 18 (and the number of those children) and the mean benefit paid per child in nominal and constant (1992) dollars. Two further observations are important. First, in nominal dollars it appears that benefits per child doubled between 1974 and 1997 and tripled between 1974 and 2000. However, in constant dollars the government decreased expenses by 36 percent on a per-child basis between 1974 and 1997 (14 percent between 1974 and 2000). The picture would be even more compelling had families not had fewer children in 1997 than in 1974 (200,000 fewer children under 18). Second, fewer families and children received some cash benefits in 1997 or 2000 than in 1985 or 1974. Around 17 percent received no benefits at all.

Although the reduction in family benefits was linked to recurrent deficits, we might ask whether the changes in family policy parameters were made in a spirit of fairness. In particular, have the changes introduced in the program over the years been conducive to more equal treatment of families of similar circumstances? This question is important, as one of the main objectives of the NCB reform was to increase benefits for low-income working families on the grounds that these families received fewer benefits than families on welfare.

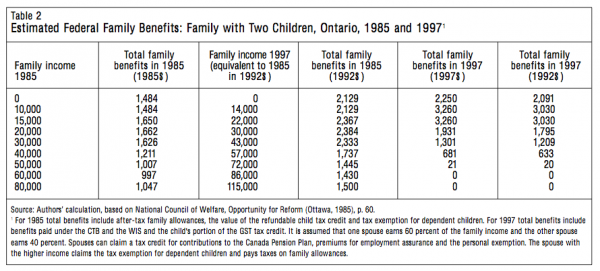

Table 2 sheds some light on this issue. It presents estimated federal family benefits by family income for a family with two children in Ontario for the years 1985 and 1997. The choice of 1997 for the “after” view of Ontario should be noted because it precedes the 1998 switch from the WIS to the NCBS and social assistance cuts. The second column presents total family benefits for a family with two children living in Ontario in 1985. A family without any earned income (a welfare-recipient family) would have received $1,484 a year, compared to $1,662 for a low-income working family with a family income of $20,000. A family with an income of $50,000 or more would have received about $1,000 in family benefits. Although the differential between families may appear justified in terms of vertical equity — less benefits to higher-income families — the programs did not draw a distinction between a welfare family with no earnings and a family with earnings of $10,000 — that is, with sufficient private income so that welfare payments are almost completely phased out.

The next columns of table 2 show the benefits during the 1997 (pre-NCB) regime for the same family-income situations — that is, assuming that family-income levels have increased at the rate of inflation. The third column shows these indexed income levels in 1992 dollars and the fourth column the indexed 1985 associated benefits — that is, the benefits had the 1985 programs been maintained. The fifth column presents the 1997 benefits associated with the income levels and the last column shows these benefits in 1992 dollars.

One striking observation is that families receiving welfare assistance would have been marginally better off had the 1985 programs been retained. Low-income working families (in the $14,000—$22,000 range) were better off, in term of benefits, with the 1997 programs. Families with an income of $30,000 or more appear to be losers with the new NCB compared to the 1985 programs. In terms of fairness, equity has clearly been reduced for two-child, two-parent working families: some families with children are being asked to pay for more generous benefits to other families with children. Meanwhile, families without dependent children have not been contributing directly to higher benefits for low-income families.

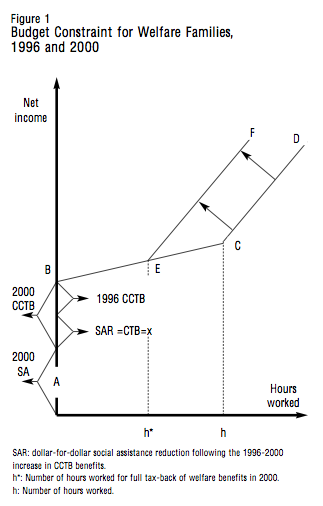

In 1998 the CTB was crafted into a new program under the NCB initiative. This new program, effective July 1998, comprises a base benefit, the CCTB, and the exact same parameters as those prevailing in 1993. The innovation is that the amount of working income supplement was converted into an income-tested National Child Benefit Supplement (NCBS), independent of the source of income. The NCBS supplemented not only income from paid employment in excess of $3,750, as was the case under the WIS program, but income from any source, including social assistance. But — and this is important — families receiving provincial social assistance (welfare) saw no increase in their public financial support. All provinces except Newfoundland and New Brunswick cut their child-related social assistance benefits dollar for dollar with the amounts provided to children in social assistance families with no earnings as the WIS was transformed into the NCBS.

For 1998, the NCBS provided the same maximum amounts as had the WIS in 1997: up to $605 for one-child families, with additional amounts for a second child (up to $405) and each subsequent child (up to $330). As with the WIS program, the NCBS was reduced by 12.1 percent of family income over $20,921 for families with one child, 20.2 percent for families with two children, and 26.8 percent for families with three or more children. The schedule of benefits was, again, such that only families with an income below $25,921 qualified for the supplement.

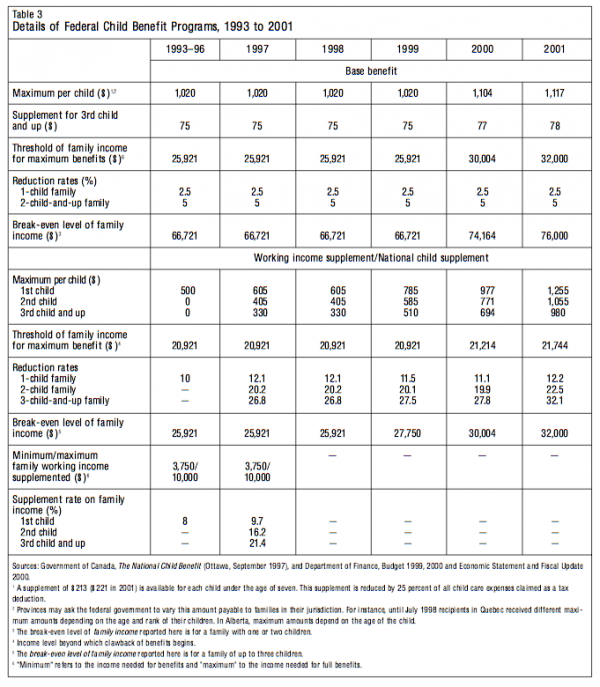

All child benefits were increased in 1999, 2000 and 2001, as shown in table 3, which provides the details on the federal programs for financial assistance to families since the introduction of the CTB in 1993. In the 2000 budget, Ottawa announced that the CCTB and the thresholds of net family income for the purpose of calculating benefits would be fully indexed as of January 2000. As of July 2001, the base benefit reached a maximum of $2,372 for the first child (with an additional benefit of up to $221 for children under the age of seven) and $2,172 for the second child if the family net income is $21,744 or less. Benefits are fully phased out at a family net income of $76,000.

Despite these improvements, prospects have not been good for all families. When the CCTB was introduced in 1998, its level of financial support to families was essentially the same as that of the CTB five years earlier. With only partial indexation of benefits in effect from 1993 to 1998 (no indexation if inflation was below 3 percent), financial support actually decreased in real dollars. Furthermore, the CCTB maintained financial support to families receiving social assistance at the level it had been 10 years earlier, in 1988, when a supplement to the refundable child tax credit was introduced for each child under the age of seven. When the CTB was implemented in 1993, the schedule of benefits was set so as to be neutral toward families receiving social assistance: no gain, no loss. The CCTB of 1998 did exactly the same: families receiving social assistance saw no increase in their government support. Also, there is still very little recognition of families that are not poor, especially upper-middle-income families who do not incur childcare expenses and high-income families. As with the CTB, the NCB provides virtually no financial support for those families: the only provision for high-income families is the tax deduction for child-care expenses. The increase in the basic CCTB benefit and in the threshold of family income for maximum benefits in 2000 and further enhancements have slightly raised the number of families receiving part of the CCTB.51 With full indexation of the basic benefit to the Consumption Price Index and threshold since the 2000 federal budget, one can predict that the number of supported families will hold steady. But in a positively growing economy, earnings and income usually increase at a higher rate than inflation. Growth and earnings increases over the life cycle of a family will likely reduce the number of families with benefits over the long term, even with full indexation for inflation.

The merit of the NCB lies in its bringing the federal and provincial and territorial governments together to design programs for low-income families with children that are inspired by three objectives:

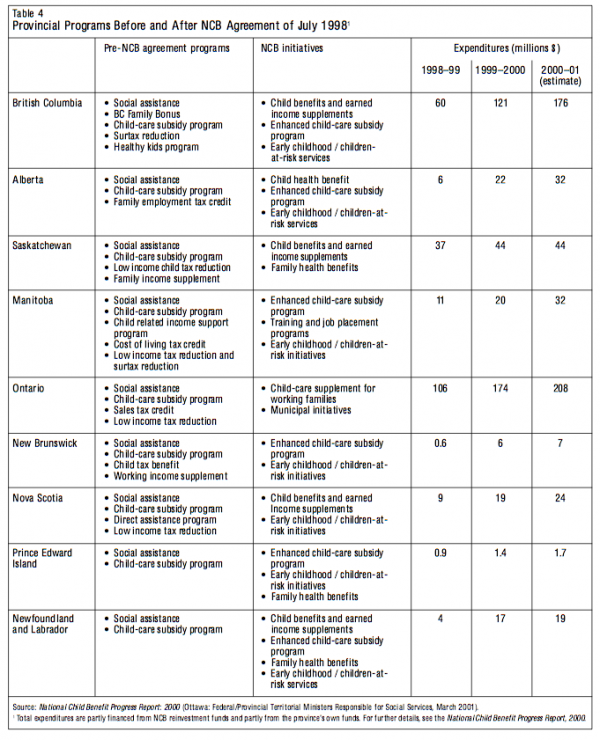

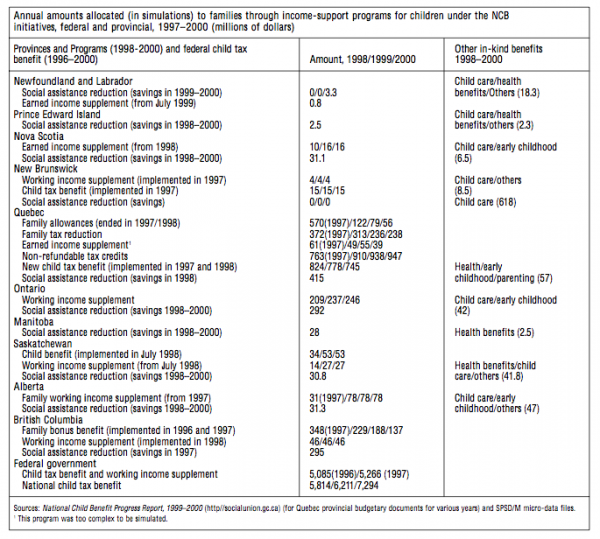

A national reinvestment plan has been developed, indicating a commitment to the enhancement of children’s well-being. The new and enhanced programs for low-income families are generally aimed at providing incentives for families to move from social assistance to employment by assisting them with the cost of raising their children, and making it easier for low-income parents to support their families through employment without resorting to welfare. Table 4 shows provincial programs for families in 1996 and 1997 and new initiatives developed under the 1998 NCB.52

Most provincial initiatives have put the emphasis on improved child-care subsidy programs: British Columbia, Alberta, Manitoba, Ontario, New Brunswick and Prince Edward Island have all committed to enhancing their existing child-care subsidy programs. In the case of Ontario, the new initiative is targeted at working families, as the Ontario Childcare Supplement program is designed predominantly as an earned-income supplement program.

British Columbia and Saskatchewan have implemented programs to supplement income from paid employment. The BC Earned Income Benefit is being implemented concurrently with the National Child Benefit and features the same parameters as the FWIC in effect before July 1998. The Saskatchewan Employment Supplement is an employment-support program providing supplemental employment, self-employment and subsistence income for low-income families with children. In addition, Saskatchewan — as well as Nova Scotia — introduced a child tax benefit. The Saskatchewan Child Benefit is delivered by the federal government as an integrated payment with the federal benefit.

All provinces have committed to some program of early intervention and prevention and child and welfare development services, contributing millions of dollars in provincial funding, in addition to the newly available funds corresponding to increases in payments made under the modified federal programs. Some programs offer basic coverage for dental and optical care, ambulance services and prescription drugs for children in low-income working families. These plans are generally modelled on the coverage provided to welfare recipients. Early-intervention programs emphasize positive parenting, healthy child development and children’s nutrition programs, including new partnerships with community groups.

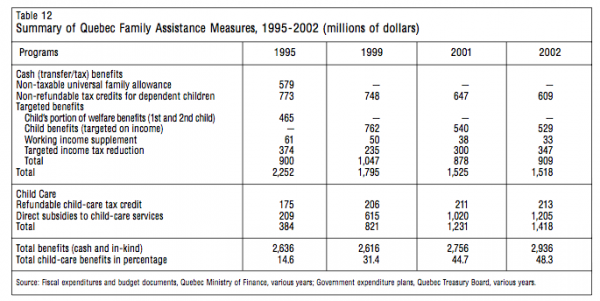

The Quebec government is not party to the NCB initiative. Its family-policy reform implemented in 1997 is, however, compatible with the main objectives and guidelines of the NCB, as financial support is targeted to low-income families and child-care subsidies have been enhanced. Quebec has chosen to move toward universality by providing daycare at a fixed subsidized price ($5 per day per child), whether or not the parents are employed and regardless of total family income. The $5-a-day program initially (in September 1997) applied to four-year-old children (five-year-olds receive full-day kindergarten) and was extended, more rapidly than planned, to include all preschool children (in September 2000). Social assistance to families with children was reduced and remodelled to exclude children as of July 1998. A new Integrated Family Allowance, targeted on income, replaced the various universal family allowances and the “child’s portion” of social assistance payments. In 1998, 1999 and 2000, increases in benefits paid to families with federal assistance were offset, dollar-for-dollar, by the Quebec family allowance.53 However, following Ottawa’s enhancements in child benefits announced in October 2000, Quebec did not reduce fully the amounts paid to families under the Integrated Family Allowance program for 2001.

Reinvestment programs under the NCB reflect each jurisdiction’s special needs and priorities. However, this also means that, nationwide, there is a large variety of programs, including numerous program parameters, various definitions of “family income” according to which benefits are calculated, and a complex schedule of rates at which benefits are reduced when income is above some thresholds. Therefore, it would appear that the third objective, to “reduce overlap and duplication between Canadian and provincial/territorial programs,” remains bureaucratic rhetoric, as the new program added another layer of complexity — the coordination of federal and provincial support levels. Many of the provincial programs do not duplicate or overlap with federal programs, especially not the provincial in-kind programs and subsidies related to child-care expenses. The cash supplements — child benefits — that some provinces offer on top of the federal cash programs for children do represent overlap with the federal transfer programs but not duplication, in that they provide cash benefits beyond those of federal programs. For policy makers, this cash transfer system may be complex, but the complexity means linking parts in a logical manner. The real drawback from the point of view of families is lack of simplicity. Families who receive provincial benefits do not understand why their monthly provincial cheque decreases when federal cash benefits increase.

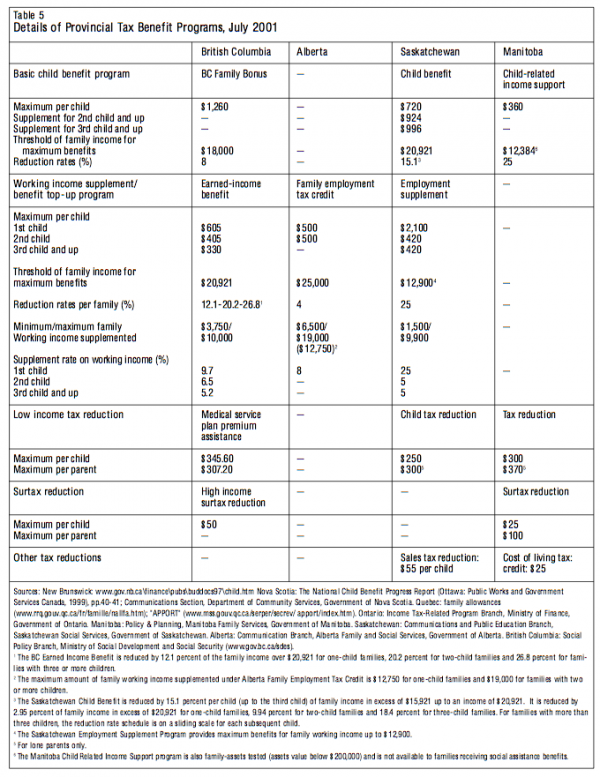

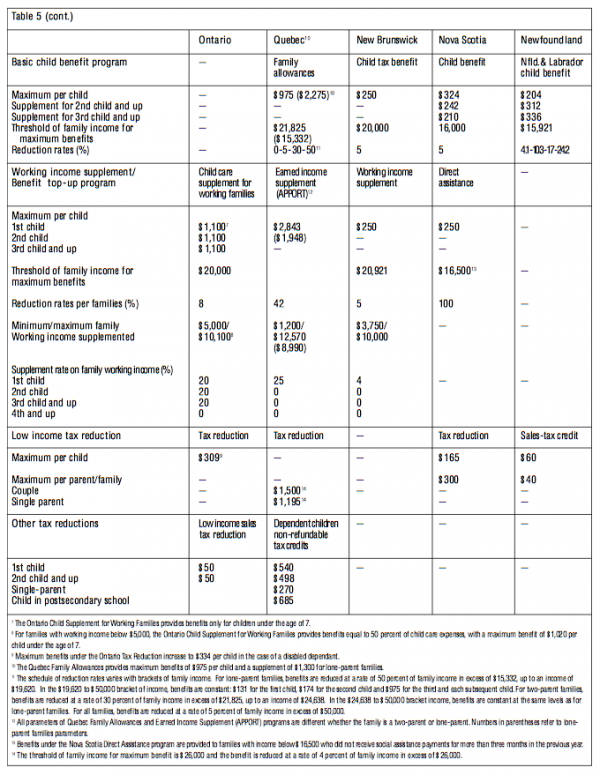

Table 5 details the specific provincial programs that assist families through the tax system, as of July 2001.54

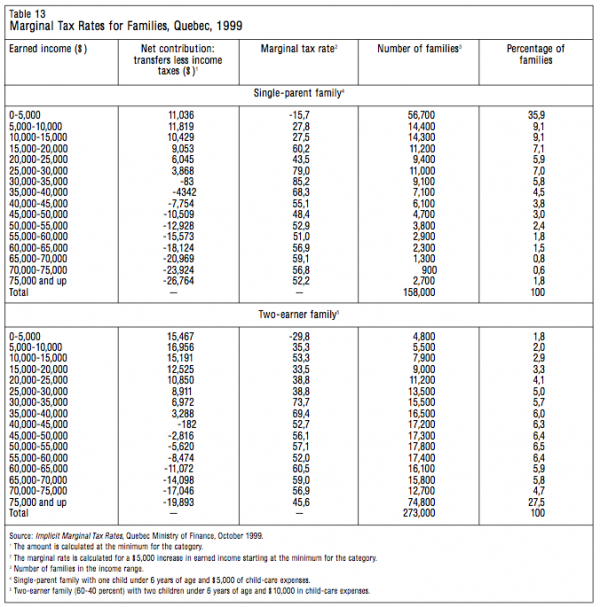

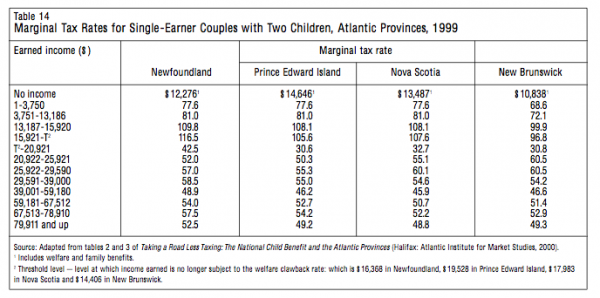

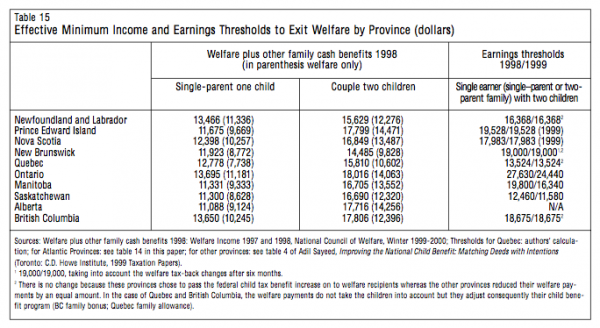

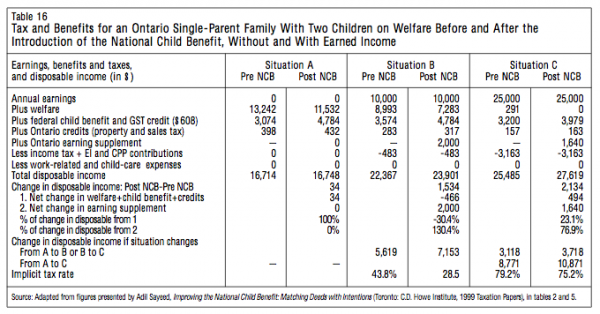

For illustrative purposes, we have placed all programs into one of three categories: basic child benefits; working-income supplements or child-benefit supplements; and tax reductions, such as for low income, and other tax credits. The table shows that assistance to families varies considerably across provinces. Also, within each province, the income tests implicit in these tax and transfer programs imply complex schedules of reduction rates, which, when combined with federal programs and with both federal and provincial personal income tax systems, can lead to numerous brackets of very steep marginal tax rates on earned income (see section Poverty Issues below). Hence, all of these additional benefit clawbacks and implicit marginal tax rates, and the associated additional benefits focused on lower-income families, augment tax-transfer progressiveness in that average tax rates are negative for those who are net beneficiaries of the tax-transfer system. On the other hand, the system imposes very high marginal tax rates (changes in net benefits and taxes when earnings and non-labour income increases). It is the marginal tax rates that matter for behavioural incentives and for the costs to the system, and that add to the complexity of government policies.